Biometrics Market Size and Growth 2025 to 2034

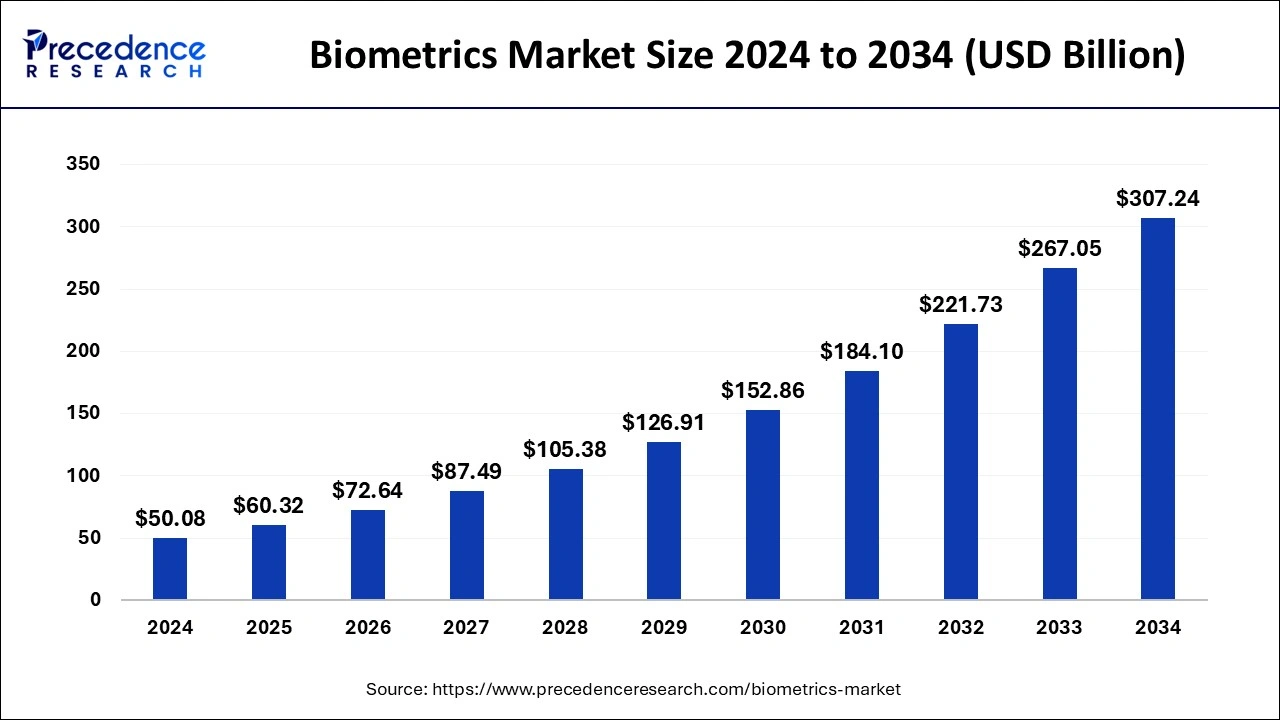

The global biometrics market size was estimated at USD 50.08 billion in 2024 and is predicted to increase from USD 60.32 billion in 2025 to approximately USD 307.24 billion by 2034, expanding at a CAGR of 19.89% from 2025 to 2034.

Biometrics MarketKey Takeaways

- In terms of revenue, the global biometrics market was valued at USD 50.08 billion in 2024.

- It is projected to reach USD 307.24 billion by 2034.

- The market is expected to grow at a CAGR of 19.89% from 2025 to 2034.

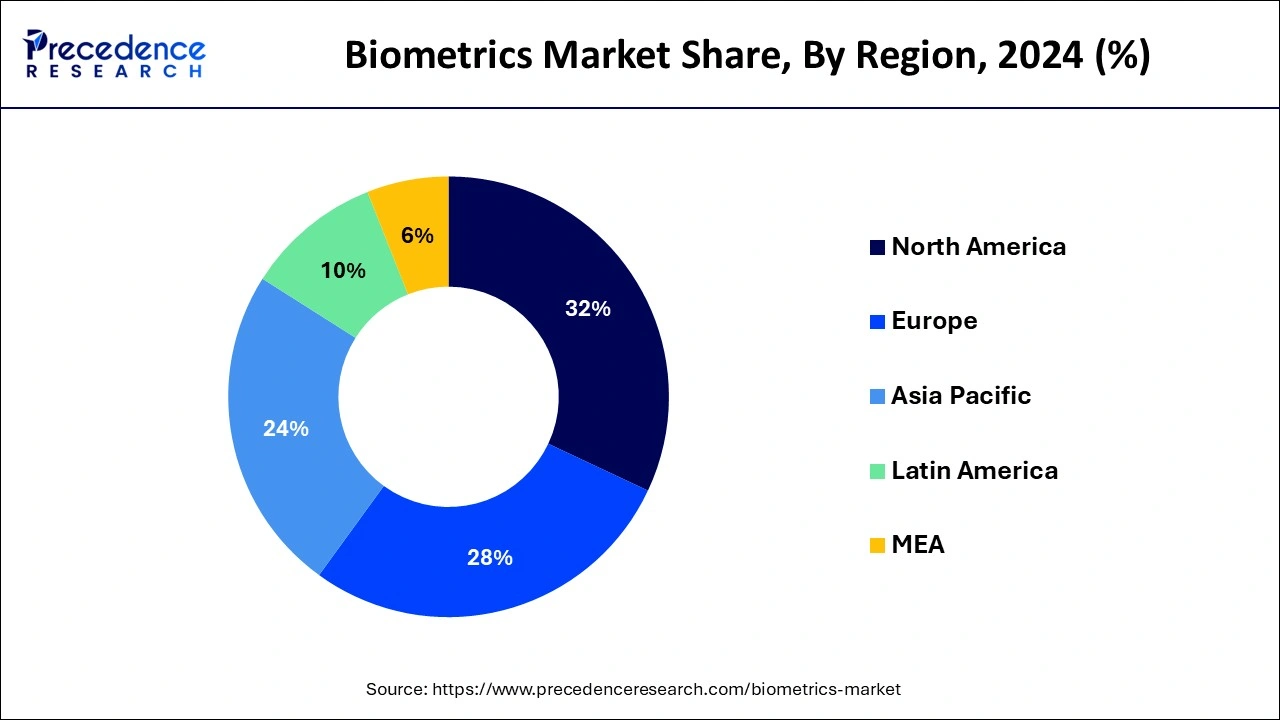

- North America dominated the market with the largest market share of 32% in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR of 22.43% during the forecast period of 2025-2034.

- By type, the hardware segment has held the largest market share in 2024.

- By type, the services segment is anticipated to grow at a remarkable CAGR during the forecast period.

- By biometric type, the fingerprint segment generated the largest share of the market in 2024.

- By biometric type, the iris recognition segment is expected to expand at the fastest CAGR over the projected period.

- By contact type, the contact-based segment generated the largest share of the market in 2024.

- By contact type, the non-contact-based segment is expected to expand at the fastest CAGR over the projected period.

U.S.Biometrics Market Size and Growth 2025 To 2034

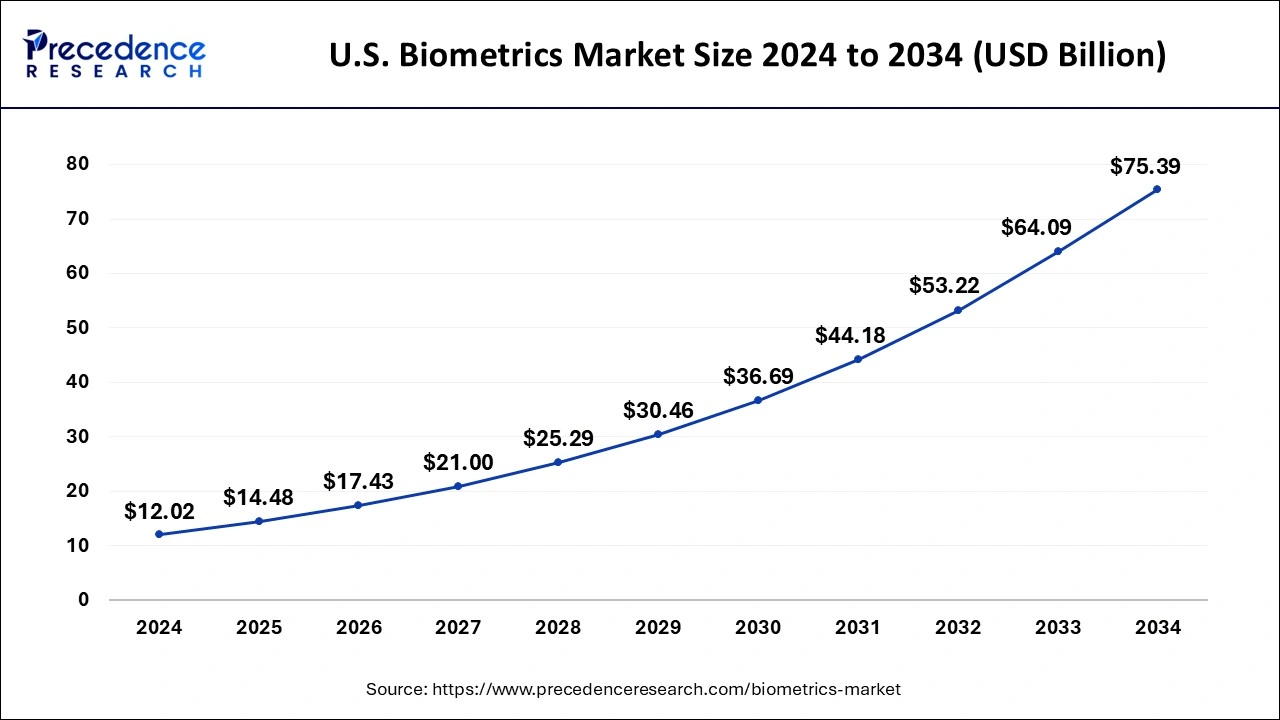

The U.S. biometrics market size was valued at USD 12.02 billion in 2024 and is anticipated to reach around USD 75.39 billion by 2034, poised to grow at a CAGR of 20.15% from 2025 to 2034.

North America led the market with the biggest market share of 32% in 2024. due to its robust technological infrastructure, high awareness and acceptance of advanced security solutions, and stringent regulatory frameworks. The region's early adoption of biometric technologies in various sectors, including government, healthcare, and finance, has contributed to its significant market share. Additionally, increased investment in research and development, coupled with a proactive approach toward cybersecurity, positions North America as a key player in driving innovation and market growth in the biometrics sector.

Asia-Pacific is poised for rapid growth in the biometrics market due to increasing government initiatives, rising security concerns, and a growing demand for advanced authentication solutions. Countries in the region are investing heavily in national ID programs and border control systems, driving the adoption of biometric technologies. Moreover, the surge in digital transformation and mobile device usage further fuels the demand for biometric solutions. With a large population and a dynamic technological landscape, the Asia-Pacific region presents significant opportunities for biometric market expansion in various sectors.

Meanwhile, Europe is experiencing notable growth in the biometrics market due to increased emphasis on security measures, digital transformation, and regulatory support. The region's stringent data protection laws, like GDPR, have fostered trust in biometric technologies. Rising awareness of identity theft and the need for secure authentication methods, especially in sectors like finance and government, has driven the adoption of biometric solutions. Additionally, advancements in technology, coupled with a push for contactless solutions, contribute to the expansion of the biometrics market across various European industries.

Market Overview

Biometrics refers to the use of unique physical or behavioral characteristics to identify and authenticate individuals. Unlike traditional methods such as passwords or ID cards, which can be lost or stolen, biometric systems rely on distinctive features like fingerprints, facial patterns, or voice recognition. These characteristics are digitally recorded and stored in a secure database. When someone needs to be identified, their biometric data is compared to the stored records to verify their identity. Biometrics enhances security by providing a more reliable and efficient way to control access to sensitive information, buildings, or electronic devices. It is widely used in various applications, including smartphone unlocking, airport security, and financial transactions, offering a convenient and robust solution for identity verification.

Biometrics Data and Statistics

- In August 2021, the European Union (EU) embraced interoperability requirements for multi-model biometric systems with the aim of enhancing data flows. The Multiple Identity Detector (MID) database assesses various databases to determine if the searched identity data is present in more than one information system.

- IntelliVision's facial recognition software, a deep learning-based solution for integrators and developers, is proficient in detecting faces across all ethnicities without displaying racial bias. Achieving a facial recognition accuracy of approximately 99.5% on standard public datasets, it can be employed on servers and in the cloud.

- September 2021 saw Gnani.ai, a player in the conversational AI and voice security domain, unveil its voice biometrics software named armour365. This biometric solution caters to industries such as Banks, Defense, Healthcare, and more.

- In February 2021, the Green Leaves+ shop-and-go store at Japan's Yokohama Techno Tower Hotel introduced a facial and palm recognition system, allowing customers to enter by verifying their identity through their faces and a swipe of their palms.

Biometrics MarketGrowth Factors

- As instances of cyber threats and identity theft increase, there is a growing demand for secure authentication methods, driving the adoption of biometrics. Individuals and organizations seek reliable solutions to protect sensitive information.

- Ongoing technological developments, especially in areas like facial recognition, fingerprint scanning, and behavioral biometrics, contribute to the growth of the biometrics market. Improved accuracy and efficiency in identification systems drive their widespread adoption.

- Governments worldwide are implementing biometric systems for various purposes, including border control, national security, and citizen identification. Regulatory support and initiatives further stimulate the adoption of biometric solutions.

- The widespread use of biometrics, such as fingerprint and facial recognition, in smartphones and other mobile devices enhances user convenience and security. This integration fuels the demand for biometric technologies.

- Biometrics find applications in healthcare for patient identification and in the financial sector for secure transactions. The expanding use of biometrics in diverse industries contributes to market growth.

- With the rise of e-commerce and online services, there is a growing need for secure and convenient authentication methods. Biometrics, offering a balance between security and user experience, becomes an attractive solution for digital transactions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.89% |

| Market Size in 2025 | USD 60.32 Billion |

| Market Size by 2034 | USD 307.24 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Biometric Type, By Contact Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government initiatives

- The Indian government's Aadhaar program, a biometric identification system, has enrolled over 1.25 billion people as of 2021.

Government initiatives play a crucial role in driving the growth of the biometrics market by fostering increased adoption and integration of these technologies. Many governments worldwide are recognizing the significance of biometrics in enhancing national security, public services, and identity management. Through initiatives like national ID programs and border control systems, governments aim to leverage biometric solutions to efficiently identify and authenticate individuals. Additionally, regulatory support and compliance requirements further contribute to the surge in demand for biometrics. Governments implementing measures to address security concerns and protect citizens' identities propel the adoption of advanced biometric technologies. As a result, the market experiences growth as businesses and individuals alike seek reliable and government-approved biometric solutions, leading to an expanding landscape for biometric applications across various sectors.

Restraint

Lack of standardization

The lack of standardization poses a significant restraint on the biometrics market, impacting its overall demand and growth. Without universally accepted standards, there is a challenge in ensuring seamless interoperability and compatibility between different biometric systems and devices. This lack of uniformity makes it difficult for organizations to integrate various biometric technologies into their existing infrastructure, leading to inefficiencies and hindering widespread adoption.

Moreover, the absence of standardization can result in complications regarding data sharing, security protocols, and overall system performance. It creates a fragmented landscape where each biometric solution may operate differently, making it challenging for users, businesses, and governments to choose and implement the most suitable and interoperable systems. Establishing common standards is essential to fostering trust in biometric technologies, encouraging broader adoption, and addressing the current obstacles associated with interoperability.

Opportunity

Increasing adoption in healthcare

The increasing adoption of biometrics in healthcare is creating substantial opportunities for biometrics market growth. Biometric solutions offer a secure and efficient means of patient identification, ensuring accurate access to medical records and enhancing overall healthcare data management. By integrating biometrics, healthcare providers can streamline processes, reduce errors, and improve patient care. Moreover, the demand for enhanced security and privacy in the healthcare sector has opened doors for biometrics to play a pivotal role in safeguarding sensitive medical information.

Biometric authentication methods, such as fingerprint or palm scanning, can be implemented for access control to restricted areas, ensuring that only authorized personnel have entry. This not only enhances data security but also contributes to the overall efficiency and reliability of healthcare services. As healthcare organizations increasingly recognize the benefits of biometrics, the market sees significant opportunities to provide tailored solutions that address the unique needs and challenges of the healthcare sector.

Type Insights

The hardware segment held the highest market share of 43% in 2024. In the biometrics market, the hardware segment refers to the physical devices used for capturing and processing biometric data, such as fingerprint scanners, facial recognition cameras, and iris scanners. The trend in the hardware segment involves continuous innovation to enhance accuracy, speed, and user experience. Manufacturers are focusing on developing compact and user-friendly biometric devices, ensuring seamless integration into various applications, ranging from access control systems to mobile devices. As demand grows, hardware advancements play a vital role in driving the overall efficiency and effectiveness of biometric solutions.

The services segment is anticipated to witness rapid growth at a significant CAGR during the projected period. In the biometrics market, the "services" segment typically encompasses a range of offerings, including system integration, consulting, maintenance, and managed services. Service providers assist clients in deploying, maintaining, and optimizing biometric solutions. Recent trends show an increasing demand for comprehensive service packages, driven by the complexity of implementing biometric technologies. As businesses and organizations seek seamless integration, services that offer expertise in system customization, training, and ongoing support are gaining prominence, reflecting a growing recognition of the value-added by service providers in maximizing the efficiency of biometric solutions.

Biometric Type Insights

The fingerprint segment held the largest share of the market in 2024. In the biometrics market, the fingerprint segment focuses on identifying individuals based on their unique fingerprint patterns. This involves capturing and analyzing distinctive features such as ridges and valleys on a person's fingertip. A significant trend in fingerprint biometrics is the widespread adoption in smartphones and other devices for secure user authentication. As technology advances, fingerprint recognition systems are becoming more sophisticated, offering faster and more accurate identification methods, further contributing to the growth of the biometrics market.

The IRIS recognition segment is anticipated to witness rapid growth over the projected period. IRIS recognition, a biometric type, involves the identification and authentication of individuals based on unique patterns in the iris of the eye. This segment is witnessing a notable trend in the biometrics market due to its high accuracy and non-intrusive nature. As organizations prioritize secure and contactless identification methods, IRIS recognition stands out for its reliability. The technology is increasingly being adopted in access control, border security, and healthcare applications, contributing to the growth of the IRIS recognition segment within the broader biometrics market.

Contact Type Insights

The contact-based segment held the dominating share in 2024. In the biometrics market, the contact-based segment refers to authentication methods that involve physical contact with the biometric sensor. This typically includes fingerprint scanning, palm recognition, and other touch-based modalities. These systems require individuals to physically interact with the sensor for identity verification. Recent trends indicate a gradual shift towards contactless biometric solutions due to hygiene concerns and the increasing demand for touchless technologies. However, contact-based biometrics continue to find applications in various sectors, particularly where a high level of accuracy and security is essential.

The non-contact based segment is anticipated to witness rapid growth over the projected period. Non-contact-based biometrics involve authentication methods that don't require physical contact with a sensor. This segment includes touchless technologies like facial recognition, iris scanning, and voice recognition. A notable trend in non-contact biometrics is the growing demand for touchless solutions due to hygiene concerns, accelerated by the COVID-19 pandemic. These technologies offer secure and convenient identification without the need for direct physical interaction, making them increasingly popular in sectors like healthcare, finance, and access control systems.

Biometrics Market Companies

- NEC Corporation

- Safran S.A.

- Thales Group

- Idemia

- Cognitec Systems GmbH

- Aware, Inc.

- BIO-key International, Inc.

- Crossmatch (acquired by HID Global)

- Fujitsu Limited

- Gemalto (acquired by Thales Group)

- HID Global Corporation

- Precise Biometrics AB

- Suprema Inc.

- Synaptics Incorporated

- Fingerprint Cards AB

Recent Developments

- August 2022 - The Minister of Finance, Economic Planning, and the Ambassador of Japan to Rwanda jointly signed the Exchange of Notes (E/N) formalizing Japan's Grant Aid totaling 550 million Yen (approximately USD 4 million). This financial assistance will be utilized by the Government of Rwanda to procure an advanced Automated Fingerprint Identification System for Criminal Investigation (Criminal AIFS), aiming to enhance Rwanda's crime investigation capacity and improve the accuracy and efficiency of investigations. The implementation of this system is anticipated to bolster Rwanda's capabilities in counter-terrorism and public security.

- August 2022 - Chile has revealed plans to implement an automated biometric identification system (ABIS) to combat organized crime. The hardware for this initiative has been provided by Idemia.

- September 2021 - Thales has entered into a partnership with Jordan Kuwait Bank to supply biometric payment cards designed for contactless EMV transactions. Customers of Jordan Kuwait Bank will be able to authorize transactions using their fingerprints, making it the first contactless biometric EMV bank card in the region.

- September 2021 - Imageware and TECH5 have joined forces as value-added resellers. This collaboration facilitates the integration of Imageware's existing product portfolio, including Imageware Proof, Imageware Authenticate, Imageware Identify, and the Imageware Biometric Engine, with all offerings from TECH5. Additionally, ImageWare will supply SISCO, Inc. with the Imageware Identity Platform, powered by TECH5 technologies, to enhance its product range in the marine and visitor management industries.

- May 2021 - Phonexia and Almawave, an AI, natural language analysis, and Big Data services vendor through its subsidiary PerVoice, have established a partnership to enhance Almawave's portfolio with Phonexia's voice biometric solution, Phonexia Voice Verify. This collaboration allows Almawave to authenticate individuals based on voice biometrics, serving as an alternative to traditional written passwords.

Segments Covered in the Report

By Type

- Hardware

- Software

- Services (Professional & Managed)

By Biometric Type

- IRIS Recognition

- Hand Geometry

- Facial Recognition

- Signature Verification

- Fingerprint

- Voice Recognition

- Palm Vein

By Contact Type

- Contact-based

- Non-contact based

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content