What is the Corporate Learning Management System (LMS) Market Size?

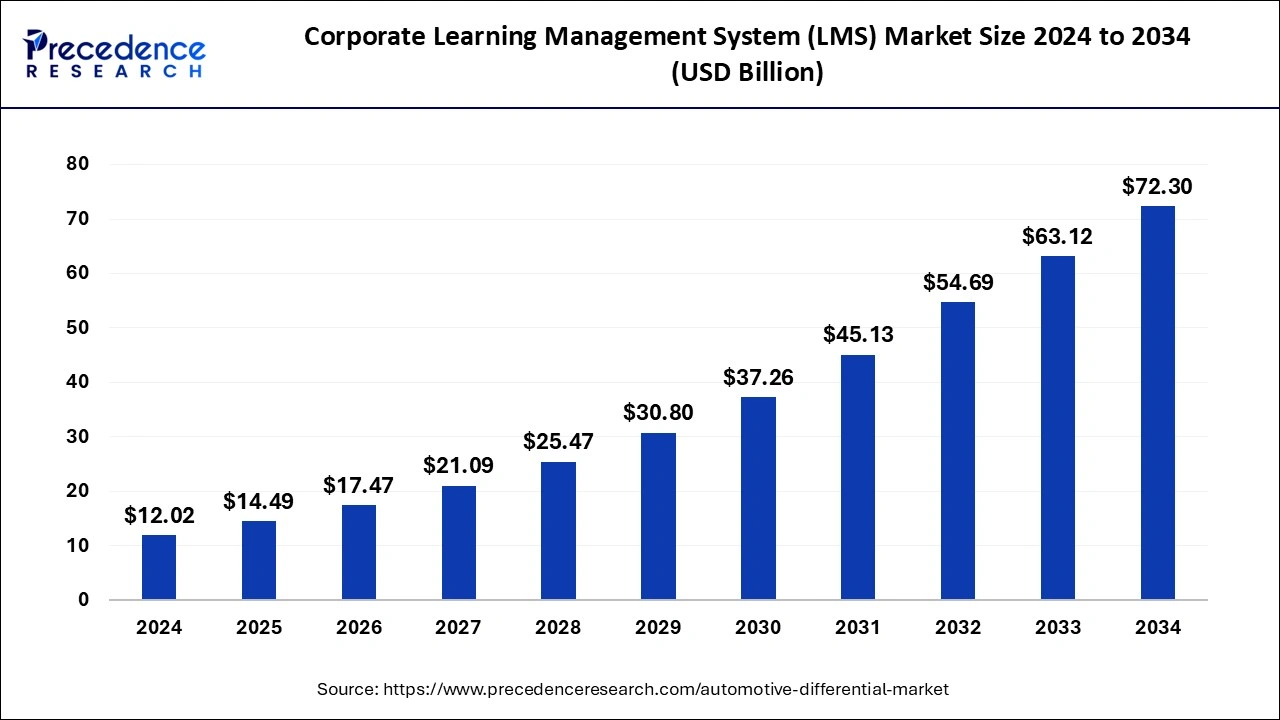

The global corporate learning management system (LMS) market size is estimated at USD 14.49 billion in 2025 and is predicted to increase from USD 17.47 billion in 2026 to approximately USD 72.30 billion by 2034, expanding at a CAGR of 19.65% from 2025 to 2034.

Corporate Learning Management System (LMS) MarketKey Takeaways

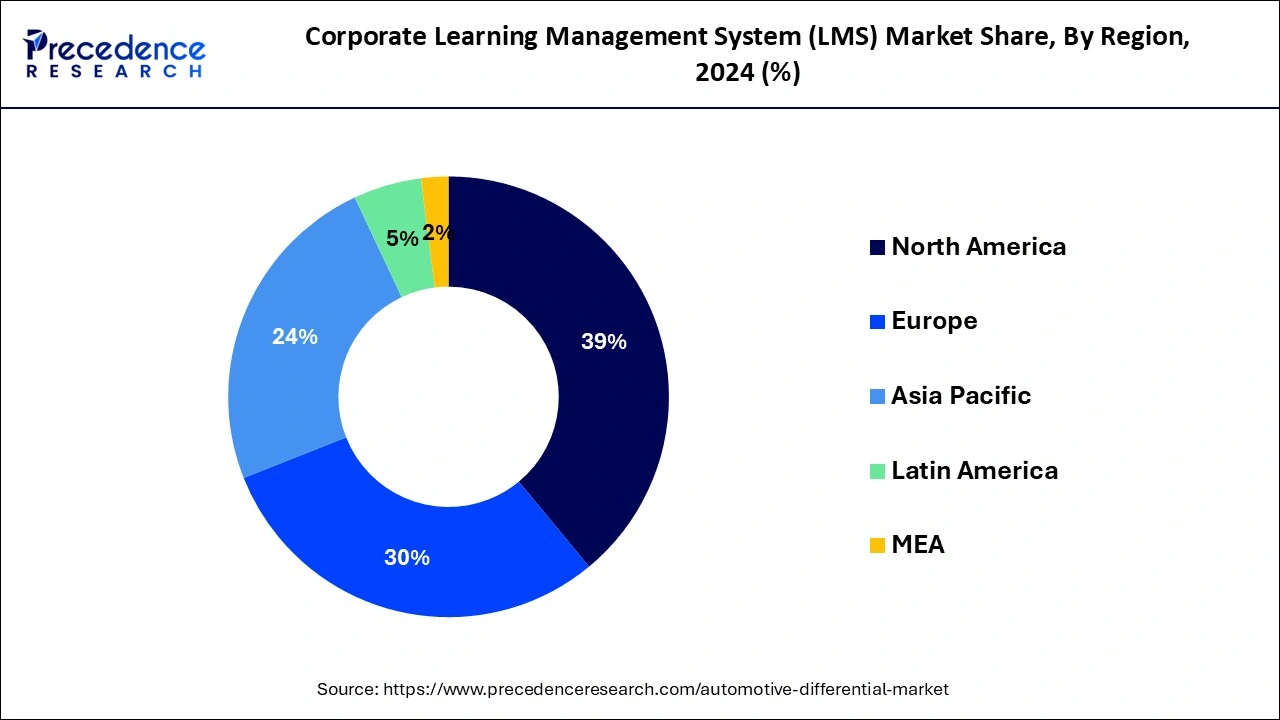

- North America dominated the market with the highest market share of 39% in 2024.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By Component, the solution segment dominated the market in 2024.

- By Component, the service segment is expected to grow at a significant rate during the forecast period.

- By Deployment, the on-premise segment dominated the market in 2024.

- By Deployment, the cloud-based deployment segment is expected to witness the fastest rate of growth throughout the forecast period.

- By Organization Type, the large-scale organization segment dominated the market in 2024.

- By Industry Vertical, the software and technology vertical segment dominated the market in 2024.

- By Industry Vertical, the retail vertical segment is expected to witness the fastest rate of growth during the forecast period.

What is a Corporate Learning Management System (LMS)?

Learning management system (LMS) software is the technology which is used for the learning process in the organization. LMS software is powered by smart technologies, they are also integrated with cloud technology and other HR and enterprise management systems. The learning management system tracks and delivers required training and learning content. Rising industrialization is driving the requirement for the learning management system applications for training and learning processes of employees. LMS software is one of the major tools for helping businesses to continue and offer personalized learning experience to both employees and enterprises.

Corporate Learning Management System (LMS) Market Outlook

- Industry Growth Overview: The Corporate LMS Market will expand rapidly between 2025 and 2030 as companies continue to invest more heavily in digital training, AI-generated learning paths, and focus on developing skills in their workforce. The increase in demand is seen in both Asia-Pacific and North America as businesses are moving away from conventional training approaches to providing scalable, tailored, and compliance-focused learning solutions.

- Global Expansion:Leading LMS vendors are increasingly expanding into Southeast Asia, Eastern Europe, and Latin America to optimize their presence to tap into the rapidly increasing remote workforce and facilitate compliance training activities due to government regulation. Corporations are developing regional data centers and multilingual platforms to enhance compliance training, improve the quality of Cybersecurity modules, and provide upskilling opportunities to the local workforce.

- Major Investors: Due to the recurring revenue streams and high retention rates, private equity and corporate investors are increasingly entering the Learning Management System (LMS) marketplace. Notable private equity investors within this space include Blackstone, TPG, and K1, who have added new products/services to their portfolios through the acquisition of, or investments in, various cloud technology-based learning and HR-teaching platforms.

- Startup Ecosystem: The LMS market is seeing rapid growth in the number of new companies leveraging technology to provide AI Tutors, Adaptive Learning Engines, and Micro-Learning Tools. Company examples such as Go1 and LearnUpon point to the attractiveness of new companies for venture-capital investors due to their ability to offer integration possibilities, Skills Intelligence, and Enterprise-Ready Learning Ecosystems built for a global hybrid workforce.

What are the Growth Factors in the Corporate Learning Management System (LMS) Market?

In the modern era of industrialization and ever-evolving technologies, the demand for skill training and learning software has increased from the corporate sector. This shift is observed to supplement the growth of corporate learning management market. Most of organizations are adopting the LMS software for training and development of the employees that gives them personalized learning experience which is benefitting the employees as well as employers.

Employee training, onboarding, professional development and continuous training, channel training and extended enterprise, and compliance training are a few applications of learning management system in the corporate sector. LMS software helps automate the Human Resource (HR) tasks like onboarding. Rising investment by private organizations for training and learning development of the employees will result in higher productivity is observed to promote the growth of corporate learning management system market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.65% |

| Market Size in 2025 | USD 14.49 Billion |

| Market Size in 2026 | USD 17.47 Billion |

| Market Size by 2034 | USD 72.30 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Deployment, By Organization Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Effortless learning

The learning management system is a modern approach of training and development programs for employees at the corporate level. Corporate learning management systems can offer effortless learning, which is observed to promote the market's growth. Learning management systems are developed in a way to resolve practical issues that arise in the corporate sector, including tome required for tasks or grading papers. As companies and organizations put emphasis on adopting advanced solutions for employee activity betterment, the adoption of LMS is observed to grow.

Restraint

Higher administrative cost and adaptability issues

Installing the learning management system in the organization results in higher administrative costs or installation costs. Installation of LMS requires considerable time and money. Many organizations are still using the traditional methods for training and development of their employees so there are adaptability issues for LMS which is also hampering the corporate learning management system market.

Opportunity

AI-based learning management system

Artificial Intelligence in learning management systems is revolutionizing the LMS program in the corporate sector. AI allows the LMS platform to assemble information about the learner, their past performance, and learning preference. All this information is beneficial for the personalized training to the learners for their better performance. For instance, if the employee is struggling with a specific concept, AI is capable of providing adequate resources or exercise. Automation and less human errors can be achieved with the deployment of artificial intelligence in learning management systems. Thereby, the factor is observed to offer opportunities for the corporate learning management systems market's expansion.

Segment Insights

Component Insights

The solution segment dominated the market in 2024. By allowing organizations to select only the components they need, solution components can potentially reduce costs, which is a significant consideration for many businesses. Solution component vendors often specialize in their respective areas, offering in-depth expertise and support, which can be more attractive to organizations seeking domain-specific solutions. Many solution components focus on enhancing the user experience, offering features like intuitive interfaces and personalized learning paths. This results in higher user engagement and adoption.

The service segment is expected to grow at a significant rate during the predicted timeframe. Substantial requirement for technical assistance and installation of learning management systems in organizations is promoting the segment's growth.

Deployment Insights

The on-premise deployment segment led the market in 2024. The growth of the segment is attributed to the higher security specification offered by on-premise deployment of corporate learning management systems. On-premise learning management system is highly beneficial for the organization who maintains the high degree of security. The on-premise deployment also offers customization and specialized integration on the organization.

The cloud-based deployment segment is expected to grow at the fastest rate during the forecast period. The easy accessibility offered by cloud-based deployment is considered a major factor for the segment's expansion. In recent times, most organizations have started preferring programs and training online, which requires cloud-based deployment. increase in knowledge retention, organizational performance and learner engagement. Cloud-based learning management is made to streamline the process of learning and development programs, it saves time, cost and effort. There are several benefits of adopting the cloud learning management system in corporate such as its adaptive design, personalized training, decreases training costs, better scalability, and low maintenance.

Organization Type Insights

The large organization segment dominated the global corporate learning management system market in 2024; the segment is expected to sustain its position throughout the forecast period. Rising demand for the learning management system from large companies or enterprises to streamline their complex learning process and modalities has propelled the segment's growth. According to research, 43% of large organizations are willing to shift or replace their learning management system software. Most of the large organizations require LMS to manage, and control and the entire organizational learning process. Large organizations have a diverse workforce, they often need LMS platforms that can seamlessly integrate with their existing HR and other software systems.

Small and medium-scale organizations segment is expected to grow at a significant rate. Technological advancement results in the growth of learning management system software in small and medium scale organizations. The learning management system is helping small and medium scale organizations in saving costs that are required to be invested in training programs.

Industry Vertical Insights

The software and technology vertical segment dominated the market in 2024. The substantial need for the continuous training of employees in the software and technology related companies is driving the growth of the learning management system in these software and technology industries. Learning management systems can collect and analyze data on learning outcomes, helping software companies assess the effectiveness of training programs and make data-driven decisions to enhance workforce productivity. The software and technology industry must adhere to strict compliance and security standards. LMS platforms provide a structured way to ensure that employees are well-informed about security protocols and compliance requirements.

The retail industry vertical segment is expected to witness the quickest rate of growth during the forecast period. The retail industry is one of the most engaged industries across the globe. Retailers can tailor learning management systems platforms to their specific needs, incorporating training on customer service, product knowledge and compliance. Retailers often have a large, diverse workforce. LMS solutions that can scale easily to accommodate this are crucial.

Regional Insights

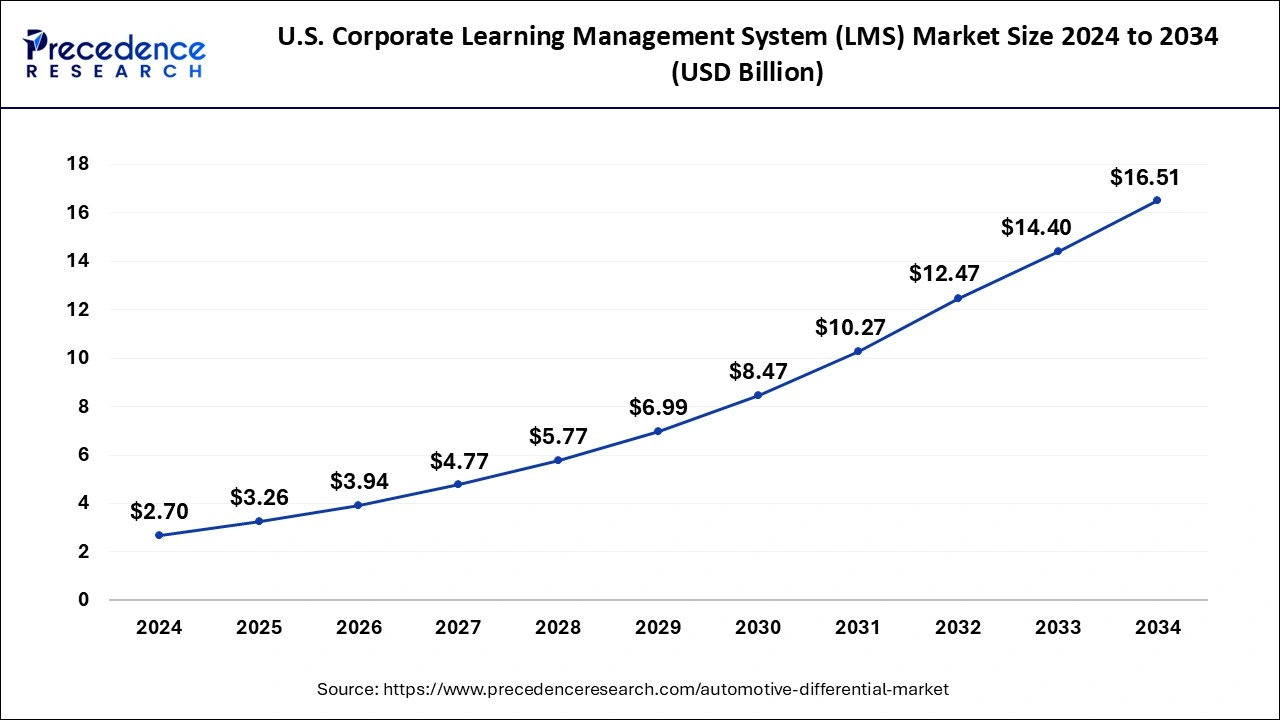

U.S. Corporate Learning Management System (LMS)Market Size and Growth 2025 to 2034

The U.S. corporate learning management system (LMS) market size is valued at USD 3.26 billion in 2025 and is estimated to reach around USD 16.51 billion by 2034, growing at a CAGR of 19.85% from 2025 to 2034.

North America dominated the corporate learning management system market in 2024. The growth of the market in the region is attributed to the industrialization and increasing demand for the training and development program for employees. The rising number of IT infrastructure in the countries like the United States, and Canada is driving the growth of the corporate learning management system market in the region. The region has a well-established ecosystem of e-learning content creators, ed-tech startups and learning technology providers, this element fosters the market's expansion in North America.

Asia Pacific is anticipated to witness the fastest rate of growth during the forecast period.The growth of industrialization in countries like India, China, and Japan.Increasing adoption of learning management systemsrather than traditional methods of training and developing skills of employees are driving the growth of the corporate learning management system market across the region. The region's commitment to research and development in multiple industries is leading to the creation of advanced e-learning technologies, further bolstering the corporate learning management system market.

Why did Europe grow at a steady rate in the Corporate Learning Management System (LMS) Market?

The development of compliance training, advanced skills development, and digital transformation in Europe has created a steady growth rate within the region, due to the increased need from companies to have a structured LMS solution, as well as due to the significant cloud adoption rates and increasing demand for remote work. Moreover, there are multiple opportunities for growth in Europe regarding GDPR-compliant systems, AI-driven skills analysis, and focused training modules related to manufacturing, healthcare, and financial services throughout the entire region.

Germany Corporate Learning Management System (LMS) Market Trends

Germany has been the leading country in the region, where its large and advanced industrial base has created an extremely high demand for technical and professional training, forcing companies to use a more advanced LMS platform to support skills related to engineering, manufacturing, and automation. The strict compliance rules within Germany have caused most companies to adopt LMS solutions as secure digital learning systems that can survive audits and regulatory scrutiny.

The opportunities that exist in Germany for AI-driven skills mapping, creating industry-focused content for particular industries, and creating analytics-driven training for mid-sized and large enterprises also serve to position Germany well into the design and creation of learning management systems.

Why did Latin America grow at a steady rate in the Corporate Learning Management System (LMS) Market?

Latin America experienced strong growth as a result of the rapid expansion of digital transformation, expanding corporate sectors, and the increased adoption of cloud platforms by both companies and institutions. Additionally, corporations invested heavily in LMS to improve efficiency and decrease costs associated with training. There was a rise in the number of businesses in Brazil, Mexico, and Chile beginning to adopt technology, which helped support LMS growth in the region.

Brazil Corporate Learning Management System (LMS) Market Trends

Brazil led the Latin American region due to both large and mid-size organizations that have embraced LMS solutions to assist in the development of digital-training programs. As such, Brazil has been a leading market in the LATAM region for cloud-based delivery of learning and compliance-focused programs. Mobile learning has been prevalent in the Brazilian market along with analytics-based LMS and localized content produced for the varying business sectors, including retail, finance, and manufacturing, that have complex workforce training requirements.

Why did the Middle East & Africa region grow at a rapid rate in the Corporate Learning Management System (LMS) Market?

Companies in the Middle East and Africa have experienced strong growth as a result of companies increasing their investments in digital transformation of their business operations, employee training opportunities, and cloud-based solutions. Government support for skill development programs in the region has also driven increased use of these products. There are numerous opportunities available in the region for companies to use Arabic language platforms, mobile learning solutions, and specific LMS modules that cater to industry needs, including oil and gas, construction, and government workforce development.

The UAE Corporate Learning Management System (LMS) Market Trends

The United Arab Emirates has been the driving force behind this growth with significant investments into technology, government-led initiatives to promote digital transformation, and significant corporate investment into upgrading their business operations. Many companies in the UAE are beginning to implement LMS systems to support upskilling their employees and for regulatory compliance purposes.

Also, companies in the UAE are being provided significant opportunities related to training solutions that leverage Artificial Intelligence (AI), multi-language learning capabilities, and advanced analytic capabilities for large enterprise customers in the finance, aviation, and hospitality sectors.

Corporate Learning Management System (LMS) Market Companies

- Cornerstone

- Blackboard Inc.

- D2L Corporation

- PowerSchool

- Instructure, Inc.

- Adobe

- Oracle

- SAP

- Moodle

- McGraw Hill

- Xerox Corporation

Recent Developments

- In October 2023, SIA the Security Industry Association introduced the latest learning system (LMS) SIAcademy. The SIAcademy is a program that is putting efforts to advance industry professionalism through premium training and education.

- In October 2023, an open learning, artificial intelligence (AI) based learning management system (LMS) which is beneficial for the learner or students of futuristic technology was about to launch in JNTUK very soon, said Vice Chancellor of Prof. Prasadaraju.

- In September 2023, Hermes Learning Management System, a digital educational and self-service tool launched by Hermes Logistics Technologies (HLT). The latest launch is to make learning about the HLT's Cargo Management System (CMS), and the air cargo process, effective and innovative.

Segments Covered in the Report

By Component

- Solution

- Services

By Deployment

- On-premise

- Cloud

By Organization Type

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- Software and Technology

- Retail

- Banking and Finance and insurance (BFSI)

- Manufacturing

- Telecommunication

- Government and Defense

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting