What is the Automated Storage and Retrieval System Market Size?

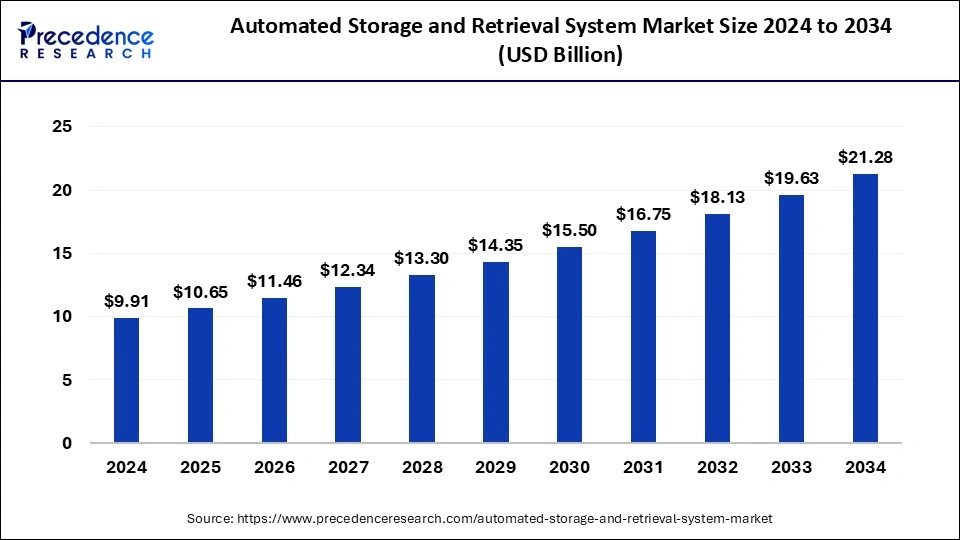

The global automated storage and retrieval system market size is calculated at USD 10.65 billion in 2025 and is predicted to increase from USD 11.46 billion in 2026 to approximately USD 22.83 billion by 2035, expanding at a CAGR of 7.92% from 2026 to 2035.

Inventory management systems with automated storage and retrieval capabilities are often employed in warehouses, distribution centers, and industrial facilities. They are made up of several computer-controlled devices for autonomously transferring cargo from one location to another. These technologies help provide rapid, dependable, precise, and affordable solutions when moving big volumes of goods from one place to another.

Automated Storage and Retrieval System Market Key Takeaways

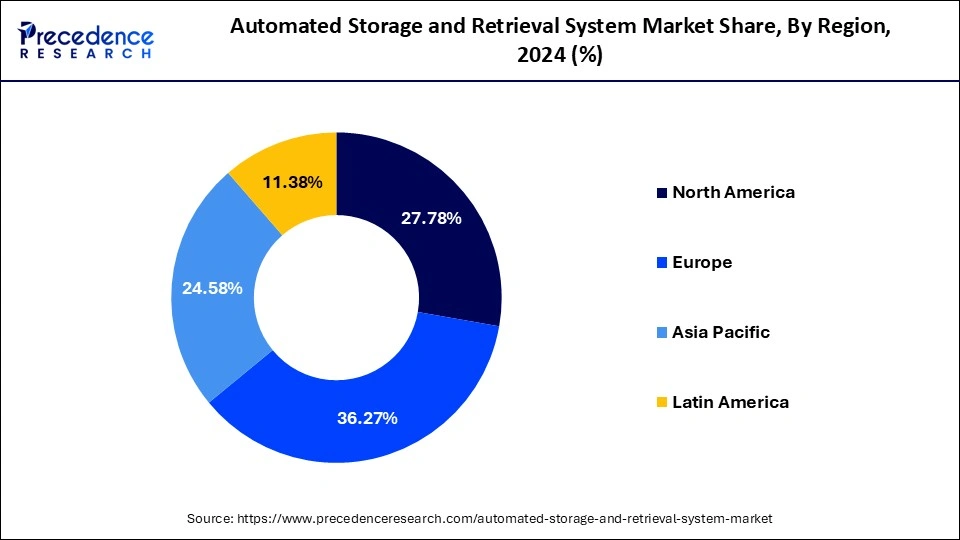

- Europe region has contributes the highest revenue share around 36.27% in 2025.

- In 2024, by end users, the automotive industry is anticipated to hold the largest market share 22.45%.

- In 2024, by type, crane based segment has held highest market share 42.49%.

- Based on load, the unit load segment has accounted 36.52% revenue share in 2025.

- By application, the storage segment has accounted 51.81% in 2025.

How Has AI Benefited the Automated Storage and Retrieval System Market?

The automated storage and retrieval system market has made significant advancements, with AI being utilized to make warehouses more intelligent and efficient. AI provides real-time knowledge of what is in store and where it is needed to move items. AI, working in conjunction with sensors and software via robotics, allows for item picking accuracy and speed that is not achievable with humans alone. AI is helping companies use their space to the fullest and improve accuracy without employing more people.

- For instance, fashion warehouses in Europe were employing RFID tags with AI to keep track of inventory around the world to lower waste and give nearly real-time visibility to their inventory globally, as well as smarter decisions that reduced overproduction. The smart warehouse demonstrated the capabilities of AI when it came to working smarter, working cheaper.

Automated Storage and Retrieval System Market Growth Factors

In order to guarantee consumer happiness around the globe, there is now a growth in the demand for quick, accurate, and effective fulfillment of in-store commerce. One of the main reasons propelling the market is this, coupled with the expanding industrial automation for enhancing productivity and quality while raising safety, lowering mistakes, and bringing flexibility to the production process. Additionally, ASRS is advancing technologically, helped by cutting-edge sensors. This is accelerating the market's growth, along with the rising need for improved storage systems across a number of industries. Additionally, many governments are making significant investments in creating digital infrastructure, which is helping the sector. In addition, the growing order volume in the e-commerce sector brought on by the ease of selling worldwide, retargeting clients, and customization of the purchasing process is providing industry investors with attractive development potential. In addition, the market is expanding because of the growing use of ASRS by small and midsize businesses (SMEs) to minimize human involvement.

Automated storage and retrieval systems allow robots and other material-handling equipment to automatically store and take items from shelves. These processes may be automated to save money on labor, quicken turnaround times, reduce human error, and increase storage capacity through vertical storage. The desire for higher productivity and efficiency throughout the supply chain, together with the rising need to use people and space as efficiently as possible, are projected to fuel market expansion. Thanks to the incorporation of cutting-edge technology, the market is benefiting from the expanded understanding of automated storage systems and inventory control.

A growing need for automation in the e-commerce sector and the advent of cutting-edge technology like shuttles and mid-load are both positive signs for the category market. Another aspect of the market's predicted strong growth in the future years is the rising usage of robotic systems in warehouses and industrial facilities to speed up procedures. As end-user demand for shelves, pallets, and racks rises, the market is projected to profit from these factors as well as from the systems' ability to reduce labor demands and increase productivity. The vehicle industry utilizes the most automated storage and retrieval systems due to their high level of automation. A lack of qualified labor and a growing focus on quality is driving the industry's demand for automated storage and retrieval solutions.

- Growing need for quick, accurate, and efficient fulfillment for in-store shopping; increasing industrial automation and investment capacities of industrial customers in emerging nations.

- Constant technical advancements in ASRS supported by state-of-the-art sensor technology

- Supportive comments from local administrations emphasizing the development of digital infrastructure

- Growing need for high-efficiency storage systems, rising order volume & order velocity in the e-commerce industry

- The increased desire to eliminate mistakes and limit human engagement

- Rapidly increasing demand for fast, highly accurate, and efficient order-picking systems is rapidly promoting the acceptance of ASRS in various industries.

- The increase in industrial automation is creating such a growth toward productivity, safety, and error minimization that ASRS becomes an indispensable component in modern facilities.

- Developments in robotics and sensor-based technologies are continuously complementing the decrease in maintenance activities and enhancing system efficiency.

- Expansion in e-commerce order volumes and demand for efficient warehouse management systems are fuelling the demand for the market.

- Widespread implementation gets supported by the growing adoption of ASRS by SMEs for curtailing labor dependence and enhancing storage efficiency.

Market Outlook

- Market Growth Overview: The market is growing rapidly due to increasing demand for warehouse automation, driven by the expansion of e-commerce, retail, and manufacturing sectors. Rising labor costs, space optimization needs, and the adoption of Industry 4.0 technologies are further accelerating market growth.

- Global Expansion: The market is expanding worldwide as companies seek faster, more accurate, and cost-efficient inventory management solutions across global supply chains. Emerging regions such as Asia Pacific, Latin America, and the Middle East offer strong opportunities due to rapid industrialization, growing logistics infrastructure, and increasing investments in smart warehouses.

- Major Investors: Major investors include global material handling and automation companies such as Daifuku Co., SSI Schaefer, Dematic (KION Group), Murata Machinery, and TGW Logistics, which invest heavily in advanced robotics and AI-driven systems. These players contribute to market growth through technological innovation, strategic partnerships, and large-scale deployment of automated warehouse solutions across industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.65Billion |

| Market Size in 2026 | USD 11.46 Billion |

| Market Size by 2035 | USD 22.83Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.92% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End Use, Type, Load, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Retail supply-chain multichannel approach

- Currently, there is a growing tendency toward multichannel supply chains, especially in the retail industry. In line with this plan, the businesses hope to develop an "in-house" distribution facility to handle order fulfillment tasks rather than contracting out to outside logistics providers (3PL). Companies want to handle both store and individual orders in a single facility by constructing their own distribution centers, which will result in considerable cost savings for distribution operations. The retail distribution centers in today's world serve as more than just a stop between storing and transporting items.

- Major changes in the retail distribution centers have already been made as a result of the growth of the retail sector, which was made possible by the explosion in electronic commerce. These changes include mass personalization and increased customer service demands, both of which have caused the number of stock-keeping units to increase exponentially (SKUs). The retail industry will experience increased demand for goods as the world economy slowly improves. In order to maintain a balance between supply and demand, new automation technologies will need to be properly integrated, which will be significant for the growth of the automated storage & retrieval systems market.

Challenges

Many systems failures

- A lot of sensors, equipment, and motors work together in synchrony as part of the complicated ASRS system, which is controlled by software. Any technical problem with the sensing component of the ASRS may halt the entire operating process, adding time and money to the company's expenses. Any programming error in the software will also result in the poor operation of the ASRS, slowing the entire manufacturing process and lengthening facility downtime. A few minutes to many days may pass during this downtime. As a result, system failures have a negative impact on the procedure and lower earnings.

Opportunities

Over the next few years, the ASRS market will have strong growth opportunities as industries choose automation to conserve space and reduce expenses. Logistics, warehouses, and others will utilize AI and robots to increase the speed of operations, reduce errors, and increase handling capacity with fewer people. Retail, healthcare, food, and e commerce will be commonplace as they upgrade existing spaces and build new smart centers. Cold chain and pharmaceutical companies will require accurate systems for properly storing products. Along with machine learning, IoT sensors will enable real-time tracking and predictive maintenance. Since sustainability is taking shape, ASRS systems help lessen energy loss and packaging waste. Third-party logistics providers can create modular designs so smaller businesses can automate their operations.

Segment Insights

End User Insights

The healthcare aspect is anticipated to grow at the fastest CAGR in the market because hospitals and laboratories need accurate, safe, and fast storage of medicines, samples, and devices. ASRS provides for these needs because it reduces human error and controls the storage of items. Hospitals began utilizing automated systems in their pharmacies and laboratories to keep stipulations they have to track of and store drugs safe with accurate dispensing and better safety conditions.

Application Insights

The order picking industry segment was the highest growth area because the retailers and logistics companies require their order fulfilment to perform faster and more accurately. Automated systems facilitate the reduction of errors, reduce labor costs, speed up e-commerce deliveries to fulfillment centers, thus being a relevant demand for ASRS usage in order picking

Type Insights

The robotic shuttles industry segment is the fastest growing type in the market as these systems provide high-density storage and fast picking with little initial labor. Reports indicated that robotic shuttle-based ASRS use was the type with the greatest profit, with increased demand to replace old ASRS technology. If the technology is employed in every warehouse, it could enhance space and speed in the warehouse with lower costs.\

Unit load cranes dominated the ASRS due to their ability to handle heavy and bulky loads with accuracy. Thus, large warehouses and cold storage facilities would implement it for their applications, making this system popular in industries where handling large-scale inventories is a matter of efficient operations and smooth production.

The robotic shuttle is the fastest-growing segment in the market due to its flexibility, scalability, and high throughput. Operating a shuttle across multiple levels on elevator support allows inventory to move seamlessly and is thus suitable for modern warehouses. With increasing e-commerce and the need for high-velocity order fulfillment, this segment is gaining traction as companies put speed, accuracy, and storage optimization at the top of their agenda.

Automated System & Retreival System Market, by Type, 2022-2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| VLM | 1,723.44 | 1,851.10 | 1,989.98 |

| Carousels | 677.04 | 720.65 | 767.75 |

| Crane-Based | 3,675.85 | 3,932.35 | 4,210.47 |

| Vertical Buffer Modules | 899.77 | 968.35 | 1,043.08 |

| Robotic Shuttles | 522.21 | 563.69 | 609.01 |

| Floor Robots | 1,101.69 | 1,191.65 | 1,289.89 |

Load Insights

According to estimates, the automated storage and retrieval system market will be dominated by the unit load ASRS category. The significant market share of this sector is mostly attributable to the increasing pressure to meet shipping deadlines during busy periods, the growing desire to improve one's business acumen, and the expanding acceptability of unit-load automated storage systems. This market's expansion is anticipated to be aided by the integration of cutting-edge technologies into process handling and shipping operations as well as the growing need for lower incineration costs.

Automated Storage And Retrieval System Market Revenue, By Load, 2022-2024 (USD Million)

| Lead Type | 2022 | 2023 | 2024 |

| Unit Load | 3,109.66 | 3,353.35 | 3,619.34 |

| Mid Load | 1,019.65 | 1,087.52 | 1,160.94 |

| VLM | 1,723.44 | 1,851.10 | 1,989.98 |

| Carousels | 677.04 | 720.65 | 767.75 |

| Mini Load | 2,070.20 | 2,215.17 | 2,372.19 |

Function Insights

Storage dominates the markets since companies consider ASRS today as long-term buffer storage for medium- and slow-moving goods. Offering compact vertical configurations, it enhances storage density and reduces expansion costs. Since it is more about safety, compliance, and efficiency, it is an indispensable function across industries, especially where goods require long-duration storage.

Order picking is the fastest-growing segment, accelerated by the boom in e-commerce retailing and omnichannel retailing. ASRS enables quick retrieval with extraordinarily high pick accuracy, and this translates into very fast fulfillment times and fewer errors. Since ASRS can quickly handle very large order volumes, it has become a pivotal technology implementing warehouses and fulfillment centers as customer expectations increase for speed and reliability.

Vertical Insights

The retail and e-commerce industry is leading the charge, supported by changes in omnichannel strategies and the proliferation of global online sales. Retailers, to remain competitive, have realized the value of automated solutions for fulfillment with complex logistics. ASRS brings the ability to process incredibly big volumes of orders very quickly and accurately, and hence becomes an integral part of any modern retail logistics network.

The healthcare segment is the fastest-growing segment, aptly meeting stringent requirements for hygiene, quality assurance, and traceability. The ASRS provides an FDA-compliant and reliable storage solution to ensure pharmaceutical handling, batch traceability, and inventory safety. ASRS is becoming a must-have for hospitals, pharmaceutical companies, and distributors handling critical supplies with increased demand for healthcare logistics to be precise, compliant, and automated.

Regional Insights

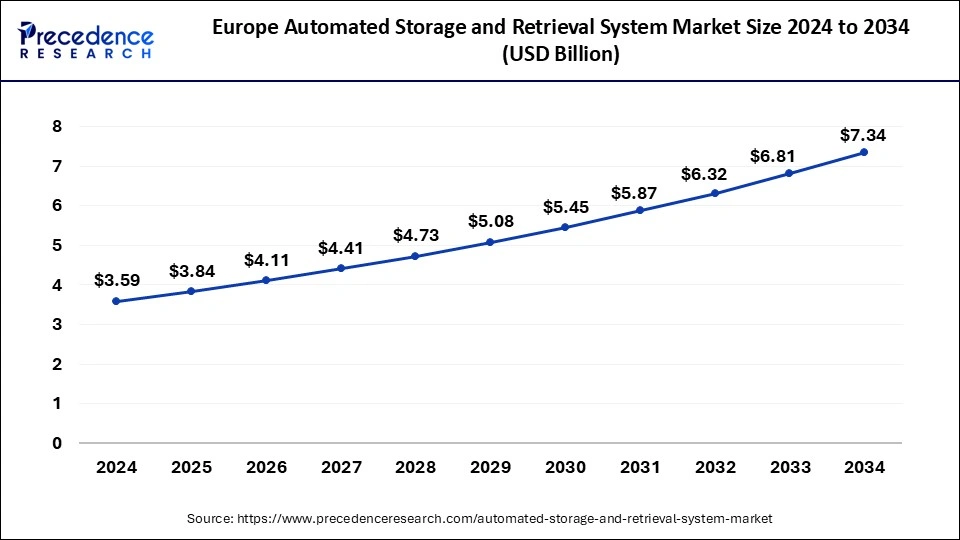

Europe Automated Storage and Retrieval System Market Size and Growth 2026 to 2035

The Europe automated storage and retrieval system market size was exhibited at USD 3.84 billion in 2025 and is projected to be worth around USD 7.84 billion by 2035, growing at a CAGR of 7.40% from 2026 to 2035.

What Influences the Market in North America?

In 2024, the North American region's market for automated storage and retrieval systems maintained a sizeable 27.83% market share. The market for automated storage and retrieval systems is anticipated to increase as a result of a rise in the use of big data technologies by businesses to improve their capacity for risk management and consumer target marketing. Additionally, the manufacturing sectors of nations like the United States and Canada have been at the forefront of automation. The expansion of the automated storage system manufacturers' market share in these nations was made possible by improvements in infrastructure and industrial growth.

The market for these systems will also be greatly boosted by the rising need for safety and control in the industrial and manufacturing sectors in the United States. Automation will become more prevalent in order to decrease worker pay as salaries continue to rise. In addition, Mexico is increasingly serving as a manufacturing base for numerous businesses, mostly due to its affordable labor prices and closeness to the United States. The majority of the top manufacturers are locating their factories in the area.

The NAFTA accords give these businesses an easier way to export their output to the United States and Canada, which encourages the use of more sophisticated manufacturing techniques in this region. The increased use of automated storage systems in Mexico is a result of the increased productivity and efficiency they offer. As a result, these factors are examined to see how they may affect market growth between 2025 and 2034.

- The North America automated storage and retrieval system market size was valued at USD 2,752.72 million in 2025 and it is expected to reach at a CAGR of 7.8% from 2026 to 2035.

- The LAMEA automated storage and retrieval system market size was estimated at USD 1,127.44 million in 2025 and it is expected to reach at a CAGR of 8.7% from 2026 to 2035.

- The Asia Pacific automated storage and retrieval system market size was valued at USD 2,436.04 million in 2025 and it is expected to reach at a CAGR of 8.6% from 2026 to 2035.

What Makes Europe a Leader in the Market for Automated Storage and Retrieval Systems?

Europe led the automated storage and retrieval system market due to a good factory automation market and large manufacturing sectors that required the means to accommodate fast and accurate material storage. European companies heavily invest in smart warehousing, and regulators encourage effective and productive use of real estate in logistics. The automated storage and retrieval system market had rapid growth across several European nations, such as Germany, Switzerland, and Austria. There are many possible opportunities in Europe to modernize existing warehouses, adopt additional automation in retail and manufacturing, and create more effective cross-border logistics networks. Furthermore, the growth of e-commerce also fuels the need for smarter systems in organizations to compete in the market.

Germany

Germany was the European leader in the automated storage and retrieval system market, with many major corporations such as Kion Group, Jungheinrich, and others growing their robotic storage solutions. The country is industrialized with advanced manufacturing plants creating demand for warehouse automation and over-the-top logistics networks, and technological adoption. Automated storage and retrieval systems (ASRS) had a high level of demand in Germany, as many factories in Germany need quick and accurate order picking and to save space. Firms in Germany would often invest in robotics, AI, and smart warehouses to increase logistics and factory efficiency, which would keep Germany at the top market in Europe.

USA

The United States of America was the leading country in North America in the automated storage and retrieval system market, where there was a strong commitment from automation to support its e-commerce, retail, and logistics companies for higher automation with the aim of improving order speed and order accuracy in processing orders from the changing needs of e-commerce. Many decision makers were adopting ASRS to support continuing labor shortages and increasing wage rates, which had been experienced across North America, especially in the urban markets, and many decision makers supported the need to invest high investment to support technological innovation toward smart infrastructure as businesses needed to switch to advanced systems. It was the prevailing belief that the use of ASRS allowed U.S. businesses to greatly improve the use of space extensively, provides protection from human error for their workplaces, and supports a positive delivery timeframe.

How is the Opportunistic Rise of Asia Pacific in the Automated Storage and Retrieval System Market?

Asia Pacific is expected to experience significant growth in the market over the forecast period. This is mainly due to the region's booming e-commerce, expanding manufacturing sector, and increasing demand for warehouse automation. Rising labor costs, the need for efficient inventory management, and technological advancements in robotics and IoT also drive adoption, enabling faster, accurate, and cost-effective storage and retrieval operations across industries. Additionally, government initiatives to modernize supply chains further accelerate market growth across the region.

India

India is a major player in the market within Asia Pacific. The market in India is growing as companies focus on reducing operational costs and optimizing space in urban warehouses. The rise of organized retail, government initiatives supporting smart logistics, and increasing adoption of AI-driven inventory management solutions are accelerating demand, enabling faster, error-free material handling and improving overall supply chain efficiency across industries.

Value Cain Analysis

- Inbound Logistics

This entails the management of materials, goods, and supplies incoming from the external world, to be received, identified, and efficiently channeled into the ASRS for storage. Then, the materials should be ready for working on or sending.

Key Players: Daifuku, Dematic (a KION Group company), SSI SCHAEFER, Kardex

- Procurement

Procurement in an ASRS context regards the events or activities of sourcing and acquiring the hardware, software, and components for the ASC itself, in addition to managing the acquisition of inventories for storage within it.

Key Players: Kardex Group, SSI SCHAEFER, Dematic

- Technology Development

This is a continual process of research, design, and development of various technologies that comprise an ASRS, including robotics, sensors, control systems, and software.

Key Players: Honeywell, KNAPP, and AutoStore

- Operations

The daily functions of the ASRS will include the automated storage of goods coming in and retrieval of goods for order picking or production, as well as management and monitoring of system performance and inventory through computer controls and software.

Key Players: Kardex, SSI SCHAEFER, Swisslog, and TGW Logistics

Automated Storage and Retrieval System Market Companies

- TGW Logistics Group GmbH – Provides fully automated warehouse solutions, including high-speed ASRS, conveyor systems, and robotics, tailored for e-commerce, retail, and manufacturing for improved efficiency and order accuracy.

- Swisslog Holding AG– Offers modular ASRS solutions, robotic picking, and warehouse automation systems that integrate with software for optimized storage, improved throughput, and scalable logistics operations.

- Daifuku Co. Ltd. – Specializes in automated material handling, including ASRS, conveyors, and sorting systems, supporting industrial, logistics, and airport operations for enhanced speed, accuracy, and space utilization.

- SSI Schaefer Group – Provides modular ASRS, automated racking, and warehouse software, offering scalable solutions for storage, order picking, and logistics efficiency across multiple industries.

- Murata Machinery – Delivers ASRS, automated storage towers, and intelligent warehouse systems, combining robotics and software to improve inventory management, reduce errors, and optimize industrial storage.

- Knapp AG – Offers robotic picking, ASRS, and automated warehouse solutions integrated with intelligent software, focusing on e-commerce, retail, and healthcare logistics to enhance throughput and accuracy.

- Mecalux SA – Provides ASRS, automated pallet and shelving systems, and warehouse management software, enabling efficient storage, space optimization, and faster order fulfillment for industrial and retail sectors.

Other Major Key Players

- Vanderlande Industries (Netherlands)

- System Logistics Corporation (Italy)

- Bastian Solution (US)

- Beumer Group (Germany)

- Dematic GmbH & Co. KG (Germany)

- Kardex Group (Switzerland)

Recent Developments

- In July 2025, Conveyco Technologies Inc. announced the first-ever addition of Hai Robotics' automated storage and retrieval systems to its integration portfolio and the partnership enabled their modular goods-to-person systems to realize operational efficiencies of up to 400%, daily throughput efficiencies of up to 300%, order picking accuracy of over 99%, while reducing storage footprint by 75%.

( Source:https://www.controldesign.com ) - In May 2025, Stellantis announced a US$388 million investment for the development of a new state-of-the-art Mopar service-parts distribution megahub located in Van Buren Township, Michigan. The facility is expected to open in 2027 with about 488 workers represented by the UAW and utilizes AutoStore automated storage and retrieval technology to improve and centralize its parts distribution network.

( Source:https://www.cbsnews.com ) - In May 2025, SoftMoc, a Canadian footwear retailer, implemented the AutoStore warehouse automation system at its fulfillment center in Ontario. The installation was integrated by Element Logic and was to feature nearly 100,000 bins, 42 R5+ Pro robots, and eight carousel ports into a 3,225-foot-long conveyor network.

( Source: https://roboticsandautomationnews.com ) - In April 2025, the City Council of Franklin, Ohio, approved a development agreement for Modula's $24 million expansion of its facility on Commerce Center Drive. The 180,000 sq ft expansion was supposed to phase in 60 new full-time jobs by 2028 over three years. It was tied to a 15-year property tax abatement program under the city's Community Reinvestment Area and New Community Authority.

( Source: https://www.daytondailynews.com )

Segment Covered in the Report

By Application

- Storage

- Order Picking

- Kitting

- Buffering

- Others

By End Use

- Automotive

- Semiconductor and Electronics

- General Manufacturing

- Retail and Warehousing or Logistics

- Aviation, Chemicals

- Rubber, and Plastics

- Healthcare

- Food and Beverage

- Postal and Parcel

By Type

- Vertical Lift Modules

- Carousels

- Crane-Based

- Vertical Buffer Modules

- Robotic Shuttles

- Floor Robots

By Load

- Unit Load

- Mid Load

- VLM

- Carousel

- Mini Load

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting