What is the Automated Data Platform Market Size?

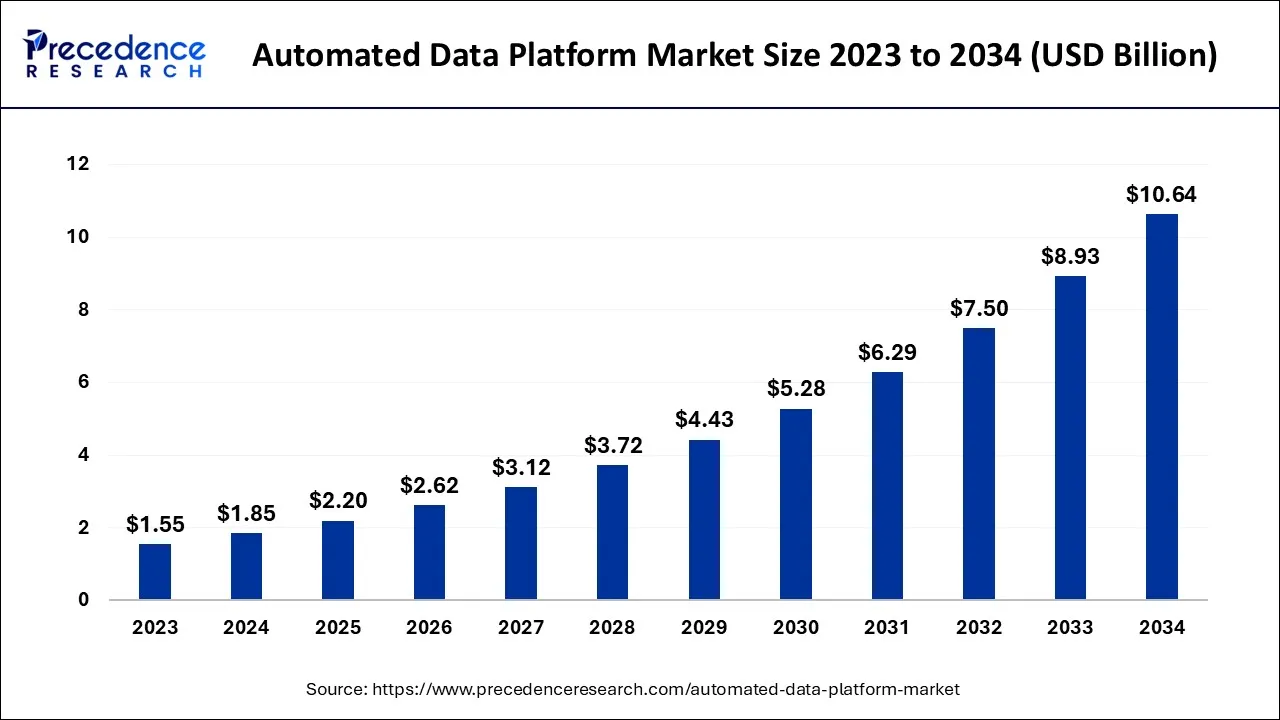

The global automated data platform market size was calculated at USD 2.20 billion in 2025 and is predicted to increase from USD 2.62 billion in 2026 to approximately USD 12.16 billion by 2035, expanding at a CAGR of 18.65% from 2026 to 2035. A technology solution known as an autonomous data platform (ADP) handles various parts of data administration and analytics duties. For the storage, processing, analysis, and management of organized, semi-structured, and unstructured data, an ADP offers a unified framework.

Automated Data Platform Market Key Takeaways

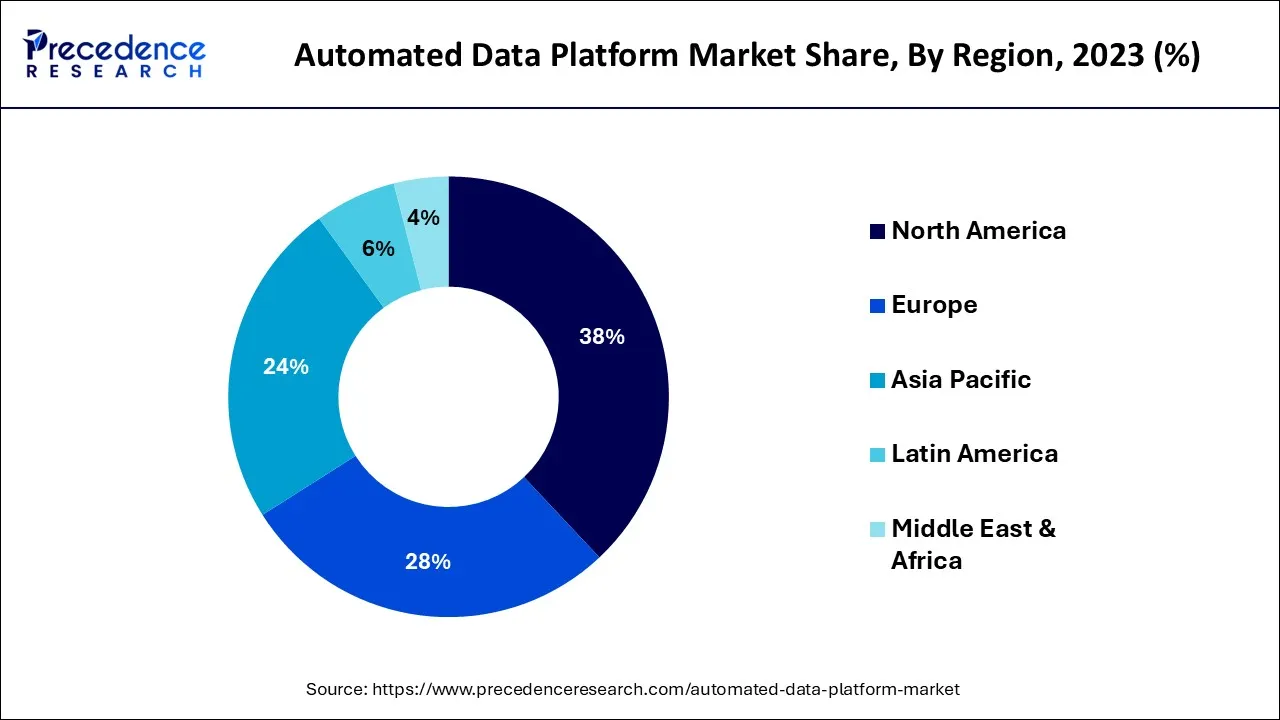

- North America led the global market with the highest market share of 38% in 2025.

- By component, the platform segment registered a maximum market share of 69% in 2025.

- By deployment, the on-premises segment has held the highest market share of 51.4% in 2025.

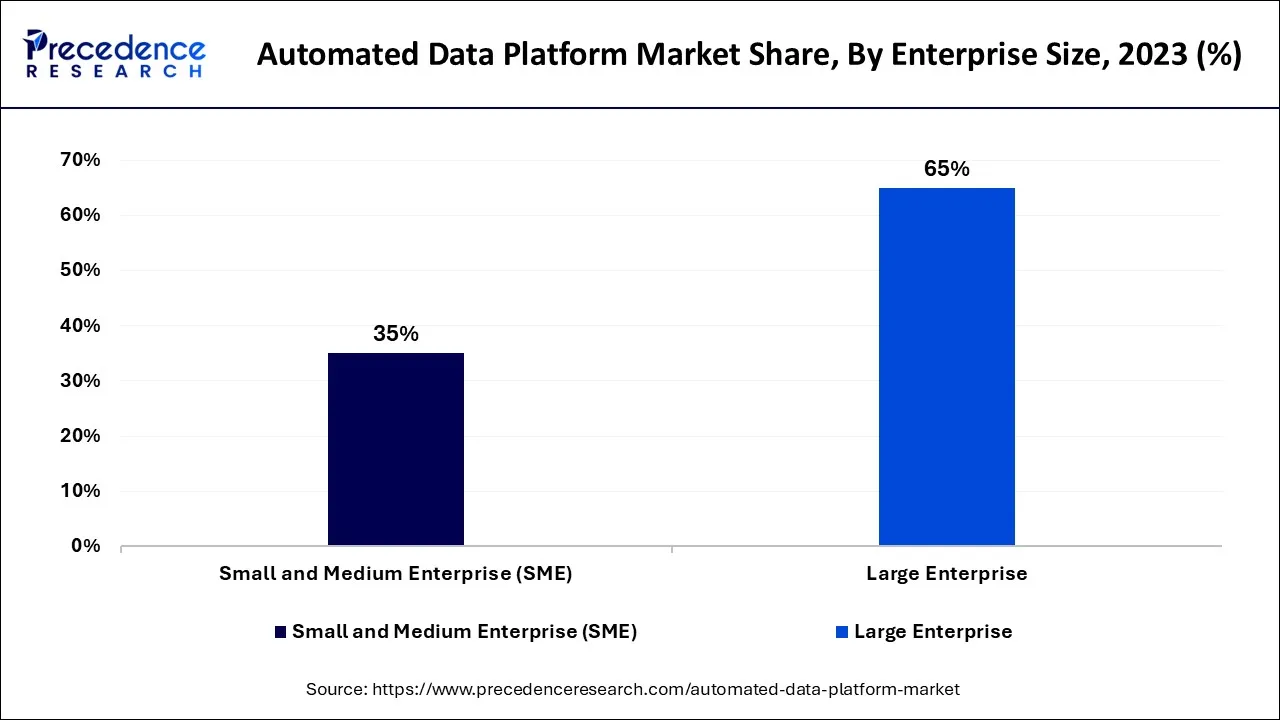

- By enterprise size, the large enterprise segment has the biggest market share of 65% in 2025.

- By end use, the BFSI segment generated over 21% of revenue share in 2025.

Automated Data Platform Market Growth Factor

The use of cutting-edge technologies like Machine Learning (ML) and Artificial Intelligence (AI), along with the rise in demand for real-time information and the increasing digitization and automation across industries, are expected to contribute to the growth of the automated data platforms industry. Autonomous data platforms are becoming increasingly applicable in cloud-based businesses, with the trend of cloud platforms in new organizations and the retention of enterprise data primarily in hybrid and public clouds.

An autonomous data platform offers exceptional flexibility, allowing companies to adjust capacity on convenience and needs. With the rapid expansion of social media and associated devices, a significant amount of unstructured information is being generated, which is expected to increase the need for autonomous database platforms from small and medium-sized businesses. Autonomous data platforms ensure that data is encrypted, workloads are tracked, and any entity attempting to access the data.

- Organizations are producing an ever-growing quantity and diversity of data. Organizations can handle and evaluate this data more effectively and efficiently with the aid of autonomous data platforms.

- The rising adoption of autonomous data platforms represents the need for more effective and efficient data management and exploitation strategies as well as the growing significance of data management and analytics in contemporary organizations.

- The rising amount of complicated and unstructured data as well as the increasing usage of advanced analytics and cognitive computing technologies all contribute to market development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.20 Billion |

| Market Size in 2026 | USD 2.62 Billion |

| Market Size by 2035 | USD 12.16 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.65% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Services, By Deployment, By Enterprise Size and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Improvements in cloud processing and artificial intelligence

The fields of artificial intelligence and cloud computing are developing quickly, and as a result, businesses have more choices to increase their productivity and effectiveness. More processes can be automated with the help from stronger artificial intelligence as automation rates can be scaled up to new levels with faster artificial intelligence skills for process and workflow.

Additionally, companies are now able to benefit from quicker, more dependable, and more effective storage and processing options thanks to increasing developments in the field of cloud computing. These developments are laying a solid basis for the global autonomous data platform industry to expand.

Key Market Challenges

High cost of autonomous data platforms

The demands of businesses increase as a result of the expanding technological advancements. In order to meet the demands of gathering, sorting and analyzing their customers' data, these businesses frequently update their cloud-based and customer-centric solutions. Additionally, businesses must make significant expenditures in order to implement cloud-based and autonomous data platforms, which could reduce demand for these platforms during the forecast period.

Key Market Opportunities

Private and mixed cloud usage is increasing among modern businesses

Due to the rising patterns of cloud application in new-age companies organizations and storing of corporate data primarily in the hybrid & public clouds, the uses of autonomous data platforms are continuously growing in cloud-based businesses. Moreover, compared to traditional business data storage solutions, autonomous data platforms are offering a variety of ways to examine, exchange, and combine crucial data more securely and quickly.

Segment Insights

Component Insights

Due to expanding technological advancements, such as the rise of digital and cloud-based platforms and an increase in the demand for analytics, which is expected to drive the sector's growth, the platform segment accounted for the biggest revenue share of 69% in 2025.

To handle significant business issues and ensure optimum database use, an autonomous data tool assesses a particular customer's big data architecture. It helps companies expand and improve their data handling capabilities. It assesses the security of a number of elements, including setup, confidential information, unusual database processes, and users.

During the projection period, the service sector is anticipated to expand at a CAGR of 21.2%. File corruption can lead to data loss because of different malware and the extremely confidential information the organization handles. The development of the database backup and restore service is being fueled by businesses' focus on having a data backup and restore tool to address this problem.

The need for very large quantities of data to be saved, backed up, and restored by a growing number of large and medium-sized companies is what is causing the services sector to grow over the course of the projected period.

Deployment Insights

In 2025, the on-premises market made for 51.4% of total income. Since on-premises implementation is thought to be safer than cloud deployment, it is used in companies where identity and secrecy are crucial components of company operations. Additionally, on-premises software is easily adaptable to specific business needs. The on-premises deployment model, which also protects IP addresses and data privacy and eliminates the need for third parties to manage and secure data, may cause businesses to avoid transferring data over the internet. Throughout the projection period, these will support the segment's development.

Over the projection period, the cloud sector is anticipated to expand at a CAGR of 25.3%. Users are more likely to favor and implement cloud-based solutions because of their flexibility and affordability. Platforms for cloud computing offer greater scalability, less expensive implementation, and continuing growth.

The use of cloud-based solutions increases the ease of service delivery because of its virtual setting, which allows businesses to access information across linked devices at any time. Users can send data to connected devices over a network as opposed to storing it directly on their own devices. These advantages of cloud implementation will accelerate the sector's development.

Enterprise Size Insights

The biggest income portion was accounted by the large enterprise's sector which was 65% in 2025. Due to the advancement toward digitalization and the effective use of technologies to automate and accelerate business processes, it is anticipated that the big firm sector will grow over the course of the projection period.

Large businesses can afford more expensive options, and as a result, these gadgets produce a lot of structured and unstructured data that needs to be handled and kept. Therefore, options for autonomous data platform will be highly esteemed in the years to come. Because of this, the big business market has embraced the autonomous data platform more quickly and will present profitable possibilities for market expansion.

During the projection period, the small and middle business companies sector is anticipated to expand at a CAGR of 24.7%. the growth of expenditures in cutting-edge methods like machine learning, the expansion of AI applications, and the acceptance of digital payment systems.

As a consequence of increased traffic, small and medium-sized companies are expected to increase their demand for self-contained data structures. The automated data platform market is expected to grow as machine learning and AI are used more frequently to enhance decision-making.

End Use Insights

The BFSI maintained the top revenue share of 21% in 2025 and is anticipated to hold this position throughout the projection period. The BFSI sector has largely adopted the autonomous data infrastructure.

Companies use analytics tools to extract information, which they then use to build tailored one-on-one client interactions. Data analytics helps banks improve their marketing skills. Risk, compliance, fraud, and determining value at risk are a few functional areas that may significantly profit from analytics to keep optimum performance and make the right choices when speed is crucial. Over the projection period, the retail sector is anticipated to expand at a CAGR of 22.5%.

Autonomous data systems are used by the retail sector for analytics in a number of areas, including CRM, product improvement, and advertising optimization. The retail industry has become more customer-focused as a consequence of the rise in the use of digital networks.

Retailers can monitor customers' purchasing behavior in real-time using the platform, which helps them better understand and meet customers' requirements. These reasons are stimulating the development of the segment over the forecast term.

Regional Insights

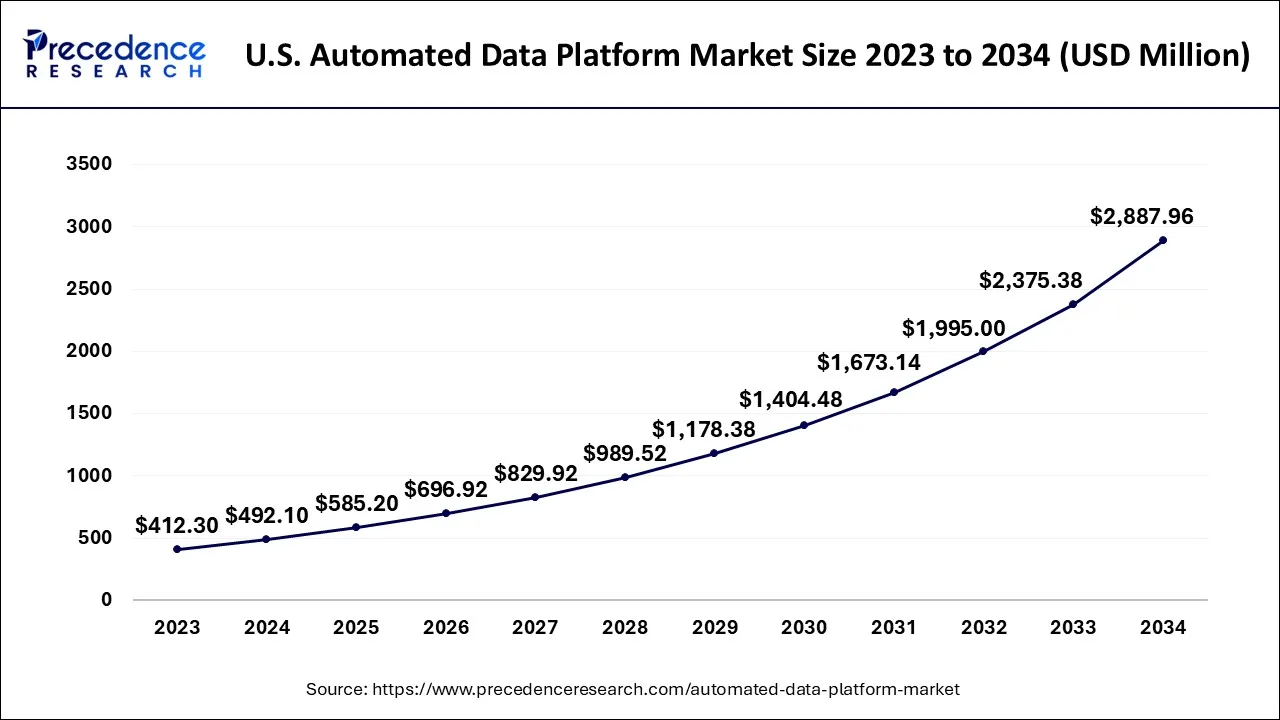

U.S. Automated Data Platform Market Size and Growth 2026 to 2035

The U.S. automated data platform market size was exhibited at USD 585.20 million in 2025 and is projected to be worth around USD 3,312.41 million by 2035, growing at a CAGR of 18.93% from 2026 to 2035.

With a 38% revenue share in 2025, North America had the highest revenue share. The region is thought to be the most evolved region in terms of embracing the newest technologies and cloud-based solutions because it is home to most established countries, including the United States and Canada. The pervasive use of mobile phones and the internet in North America is fueling the sizable market growth.

The growing use of cell phones and social networking sites to communicate with customers and business partners is another factor contributing to the market growth in the area. The regional distribution of solutions that offer clients versatile analytics on any cloud while maintaining ongoing control and security is creating strong development prospects for the autonomous data platform business in North America.

U.S.

The U.S. leads the North American automated data platform market because of the presence of major technology providers, hyperscale cloud vendors, and data-driven enterprises. Strong investments in AI, machine learning, and advanced analytics across industries such as finance, healthcare, and e-commerce are driving adoption. Regulatory focus on data security and compliance further accelerates demand for automated governance and data quality solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the automated data platform market due to rapid digital transformation, increasing adoption of cloud computing, and the proliferation of big data across industries. Strong government initiatives supporting smart cities, AI, and Industry 4.0, along with a growing number of tech startups and enterprises, further accelerate market growth. Additionally, rising demand for real-time analytics, data-driven decision-making, and advanced automation solutions drives widespread adoption in the region.

India

India's automated data platform market is growing rapidly due to widespread cloud adoption, a robust IT services ecosystem, and increasing enterprise focus on analytics-driven decision-making. The rapid expansion of the banking, telecom, healthcare, and e-governance sectors, which are major adopters, also drives the market. The rise of SaaS-based platforms and cost-effective automation solutions is supporting adoption among mid-sized enterprises and startups.

What Potentiates the Market in Europe?

The market in Europe is potentiated by advanced technological infrastructure, strong adoption of digital solutions, and stringent regulatory standards that drive innovation and quality. Additionally, increasing investments in automation, AI, and data analytics across industries, along with government initiatives supporting Industry 4.0, further accelerate growth. High awareness of data-driven decision-making and a mature enterprise ecosystem also contribute to robust market demand.

Germany

Germany is a key contributor to the European market, driven by Industry 4.0 initiatives and data-intensive manufacturing environments. Automotive, industrial automation, and engineering companies increasingly deploy automated data platforms to integrate operational and enterprise data. A strong focus on data sovereignty, security, and hybrid on-premises/cloud models influences platform selection and deployment strategies across enterprises.

How is the Opportunistic Rise of the MEA in the Automated Data Platform Market?

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the automated data platform market driven by increasing digitalization across the government, finance, and industrial sectors. Growing investments in cloud infrastructure, smart city initiatives, and AI-driven solutions are enhancing data management capabilities. Additionally, the entry of global technology providers and the rising demand for real-time analytics are accelerating market adoption in the region.

UAE

The UAE is a regional leader, driven by smart government initiatives, AI strategies, and robust cloud adoption. Enterprises and government entities deploy automated data platforms to improve data integration, governance, and real-time analytics. Investments in digital infrastructure and advanced analytics across sectors such as finance, aviation, and utilities support sustained market growth.

Automated Data Platform Market - Value Chain Analysis

Platform Development & Processing: Automated data platforms are built via data ingestion, cloud integration, AI analytics, workflow automation, APIs, and cybersecurity.

- Key Players:Snowflake Inc., Databricks, Oracle Corporation, SAP SE.

Quality Testing & Certification:These platforms require certifications in data security, system reliability, privacy compliance, and cloud infrastructure standards.

- Key Players:ISO, SOC 2, GDPR Compliance Authorities, UL Solutions.

Distribution to End-Use Industries:Automated data platforms are deployed across enterprises in BFSI, healthcare, retail, manufacturing, and IT services via SaaS and enterprise licensing models.

- Key Players:Microsoft Azure, Amazon Web Services, Google Cloud.

Automated Data Platform Market Companies

- Oracle

- Teradata

- IBM

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Development LP

- Qubole, Inc.

- Cloudera, Inc.

- Gemini Data

- Denodo Technologies

- Alteryx, Inc.

Recent Developments

- Oracle and Informatica, a provider of cloud-based corporate data management tools, partnered in May 2022. As part of this collaboration, both businesses will offer industry-leading cloud information management, connectivity, and regulation solutions along with databases, database servers, big data, data lake houses, business analytics, and data science.

Segments Covered in the Report

By Component

- Platform

- Services

By Services

- Advisory

- Integration

- Support & Maintenance

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprise

- Small and Medium Enterprise (SME)

By End-Use

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT and Telecom

- Government

- Others (Travel & Hospitality, Transportation & Logistics, and Energy & Utilities)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting