Biopharmaceutical CMO and CRO Market Size andForecast 2025 to 2034

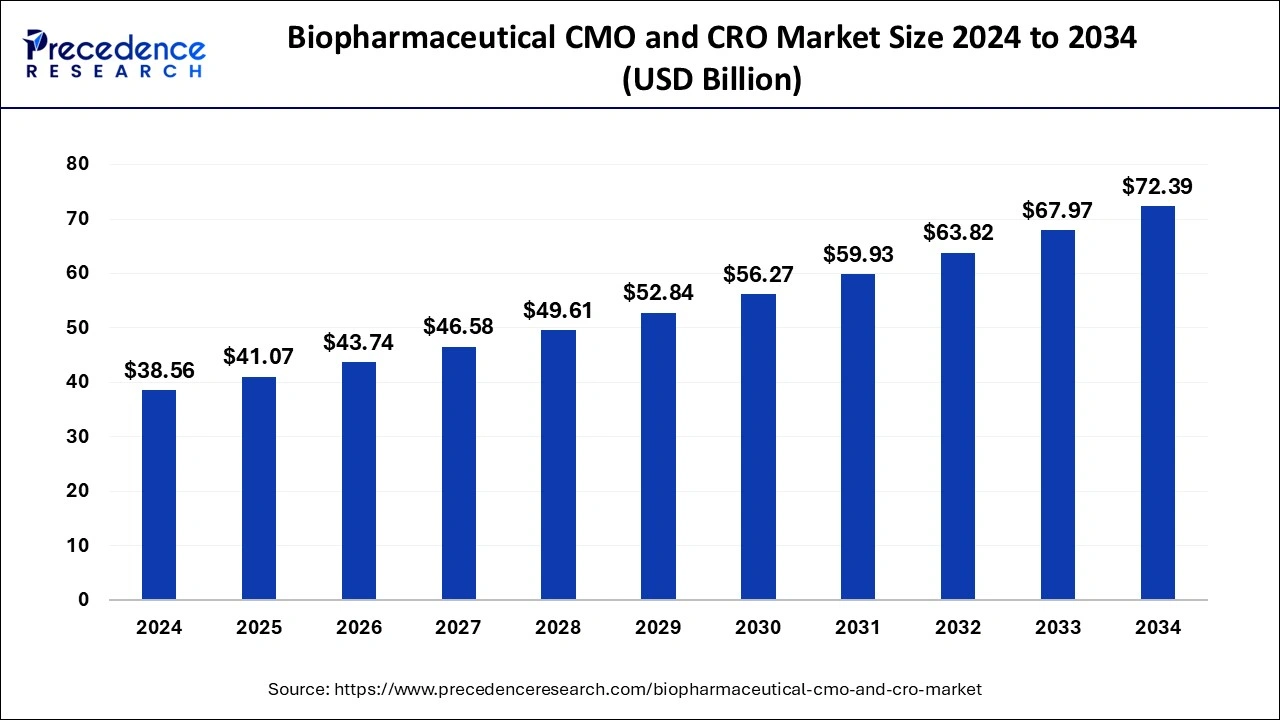

The global biopharmaceutical CMO and CRO market size accounted for USD 38.56 billion in 2024 and is expected to exceed around USD 72.39 billion by 2034, growing at a CAGR of 6.50% from 2025 to 2034.

Biopharmaceutical CMO and CRO Market Key Takeaways

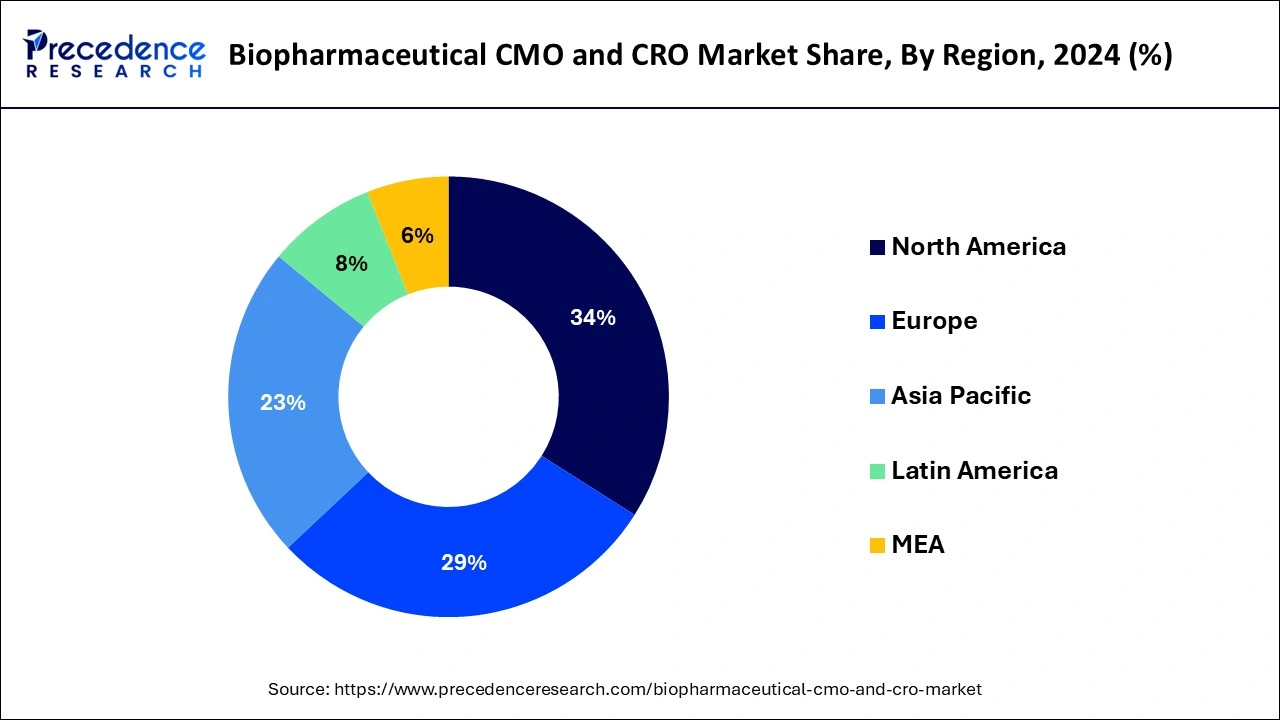

- North America led the global market with the highest market share of 34% in 2024.

- Asia-Pacific is expected to expand at the largest CAGR between 2024 and 2034.

- By Service, the contract manufacturing segment has held the highest market share of 58% in 2024.

- By Service, the contract research segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

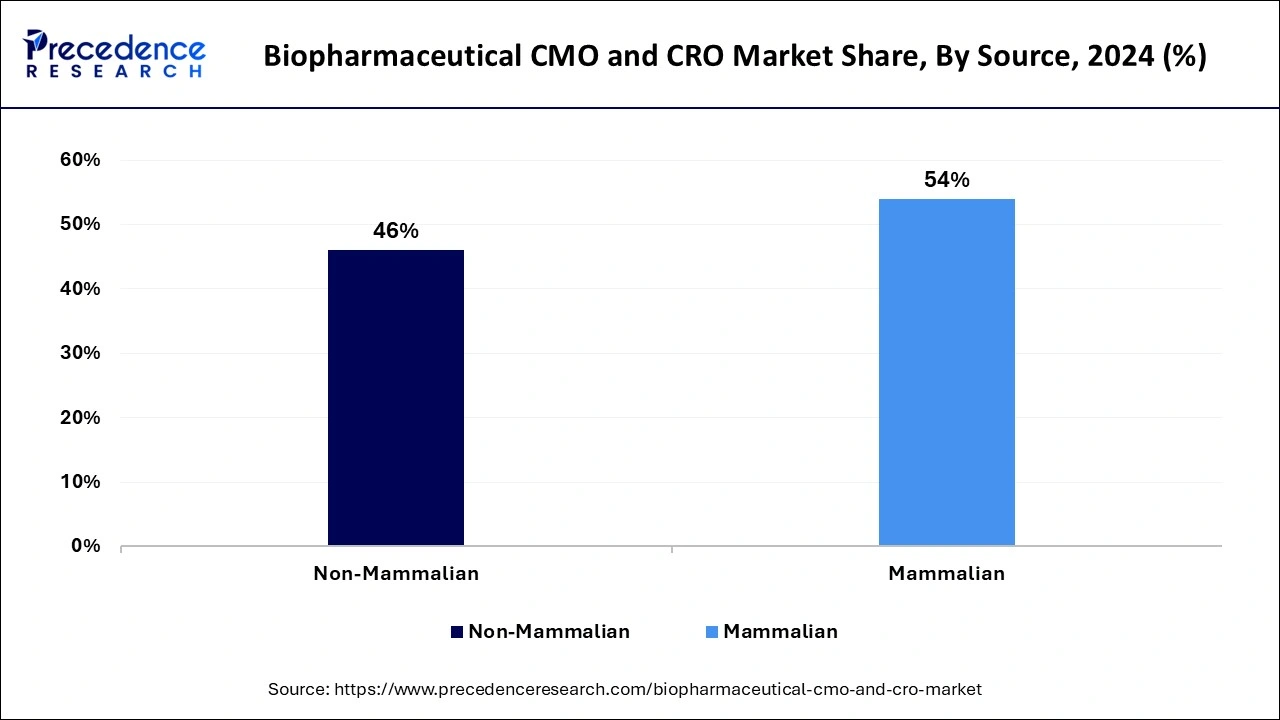

- By Source, the mammalian segment had a major market share of 54% in 2024.

- By Source, the non-mammalian segment is projected to expand at the fastest CAGR over the projected period.

- By Product Type, the biologics segment generated more than 81.5% of revenue share in 2024.

- By End-use, the biosimilars segment is estimated to grow at the fastest CAGR over the projected period.

U.S. Biopharmaceutical CMO and CRO Market Size and Growth2025 to 2034

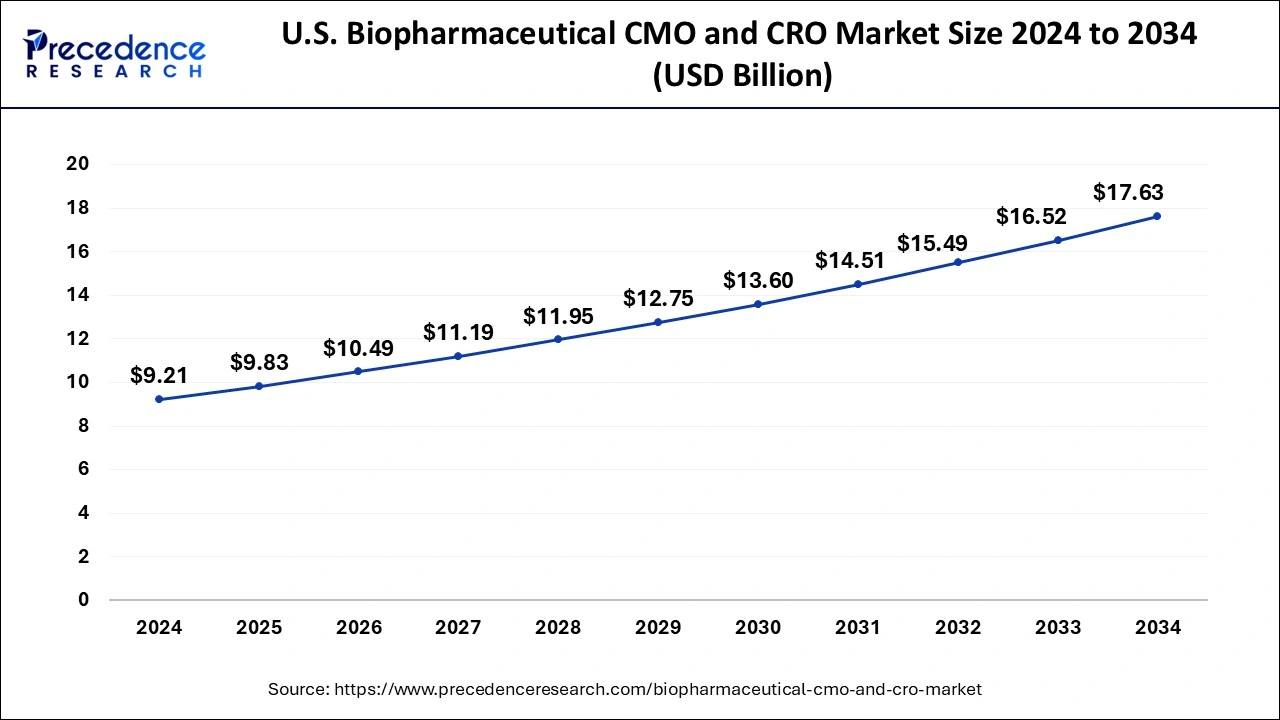

The U.S. biopharmaceutical CMO and CRO market size exhibited at USD 9.21 billion in 2024 and is projected to be worth around USD 17.63 billion by 2034, growing at a CAGR of 6.70% from 2025 to 2034.

Based on the region, the North America accounted for 34% market share in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributable to the presence of major key players in the region. Moreover, US dominate the biopharmaceutical industry due to the presence of numerous contract manufacturers and contract research organizations in the region. The various small and medium sized pharma developers are increasingly contracting the manufacturing of pharmaceuticals to the CMOs due to lack of investments. Furthermore, the growing burden of diseases in North America have resulted in the higher consumption of biopharmaceutical products, thereby fueling the growth of the biopharmaceutical CMO and CRO market in the region.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period owing to the increasing investments of the government for developing healthcare infrastructure. The presence of large population in the region coupled with growing prevalence of various diseases such as diabetes, cancer, and other chronic diseases is anticipated to offer lucrative growth opportunities to the market players in the region.

Biopharmaceutical CMO and CRO Market Growth Factors

Biopharmaceutical CMO and CRO are the abbreviations for biopharmaceutical contract manufacturing organizations and contract research organizations respectively. The market is primarily driven by the rapid growth of the biopharmaceutical industry across the globe. Biopharmaceutical industry represents around 20% of the global pharmaceutical industry. Moreover, growing demand for the biopharmaceutical products amongst the population is indirectly fueling the growth of the biopharmaceutical CMO and CRO market exponentially. CMO helps the biopharmaceutical industry by developing and manufacturing the pharmaceutical products. On the other hand, a CRO helps in the research & development activities outsourced by the biopharmaceutical industry players. Hence, the growth of the biopharmaceutical CMO and CRO market is solely dependent on the biopharmaceutical industry. Further, rising burden of diseases, growing geriatric population, increasing demand for gene therapies, and technological advancements in the field of biotechnology is significantly fueling the growth of the market across the globe.

The shifting preferences of drug developer towards biologics are pumping huge investments in the biopharmaceutical CMO and CRO industry. Moreover, the contract manufacturers are becoming popular as most of the small and medium biopharmaceutical manufacturers are opting for the CMO services in order to save costs relating to pharmaceutical manufacturing. Therefore, the growing dependence of the drug developers on contract manufacturing organizations is significantly driving the global biopharmaceutical CMO and CRO market.

Market Scope

| Report Details | Details |

| Market Size in 2025 | USD 41.07 Billion |

| Market Size by 2034 | USD 72.39 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Source, Service |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Service Insights

By service, the contract manufacturing segment led the market with a revenue share of 58% in 2024. This is attributed to the availability of numerous contract manufacturing organizations that significantly contributes in the development and production of biopharmaceuticals on large scale. Hence, this segment is estimated to remain dominant throughout the forecast period.

On the other hand, the contract research segment is expected to gain traction owing to the increasing investment by the small and big biopharma players to indulge in the research & development activities.

Source Insights

By source, the mammalian segment led the market with revenue share of 54% in 2024. This is attributed to the growing importance of the mammalian cell culture for research and development of various antibodies, vaccines, and proteins in the biopharma industry. Mammalian cell line has been extensively used for the development of viral vaccine and diagnostics in the recent years that generated huge revenue for this segment.

On the other hand, the non-mammalian segment is expected to gain considerable traction owing to its increasing use in the manufacturing of bio-therapeutics such as enzymes, hormones, cytokines, and antibodies.

Product Type Insights

By product type, the biologics segment led the market with a revenue share of 81.5% in 2024. The use of biologics is considered to be much more effective and safer. The growing interests of the pharma developers in the biologics field and rising investment towards this field has sophistically contributed in the growth of this segment.

On the other hand, the biosimilars is expected to grow at a promising rate as it provides low cost solutions and may be used as an alternative to the biologics. However, the lack of reliability and safety issues associated with this segment may restrict the growth of this segment.

Biopharmaceutical CMO and CRO Companies

- Lonza

- JRS Pharma

- Samsung Biologics

- CMC Biologics

- TOYOBO Co. Ltd.

- RentschlerBiotechnologie

- FUJIFILM Diosynth Biotechnologies

- WuXi Biologics

- Patheon

- BoehringerIngelheim

- PRA Health Sciences

- LabCorp

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved services. Moreover, they are also focusing on maintaining competitive pricing.

In May 2019, Samsung Biologics entered into a contract with GI Innovation for development of immunochemotherapy. Under this contract, Samsung Biologics will develop a new drug through a combination of protein drugs and human micro-organisms.

This strategical development will foster the market growth by introducing new drugs and encourage innovation in the field of biopharmaceutical contract manufacturing.

Segments Covered in the Report

By Service

- Contract Manufacturing

- Process Development

- Upstream

- Downstream

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

- Process Development

- Contract Research

- Inflammation & Immunology

- Cardiology

- Oncology

- Neuroscience

- Others

By Source

- Mammalian

- Non-Mammalian

By Product

- Biologics

- Vaccines

- Monoclonal antibodies (MABs)

- Recombinant Proteins

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilars

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting