Biopharmaceutical Packaging Market Size and Forecast 2025 to 2034

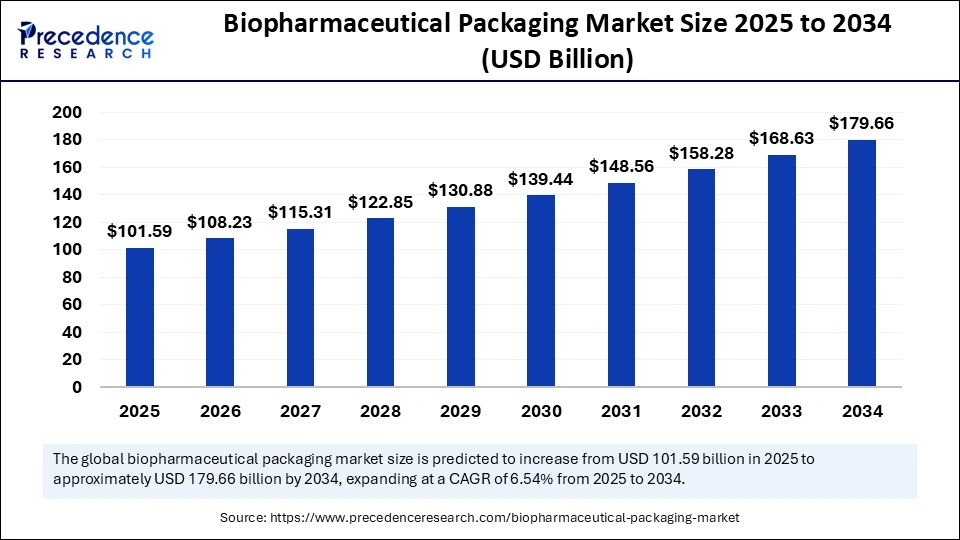

The global biopharmaceutical packaging market size was calculated at USD 95.35 billion in 2024 and is predicted to increase from USD 101.59 billion in 2025 to approximately USD 179.66 billion by 2034, expanding at a CAGR of 6.54% from 2025 to 2034. The biopharmaceutical packaging market is poised for significant growth, with projections indicating a notable increase in market size over the next decade, reflecting the growing importance of innovative packaging solutions in the biopharmaceutical industry.

Biopharmaceutical Packaging Market Key Takeaways

- In terms of revenue, the global biopharmaceutical packaging market was valued at USD 95.35 billion in 2024.

- It is projected to reach USD 179.66 billion by 2034.

- The market is expected to grow at a CAGR of 6.54 % from 2025 to 2034.

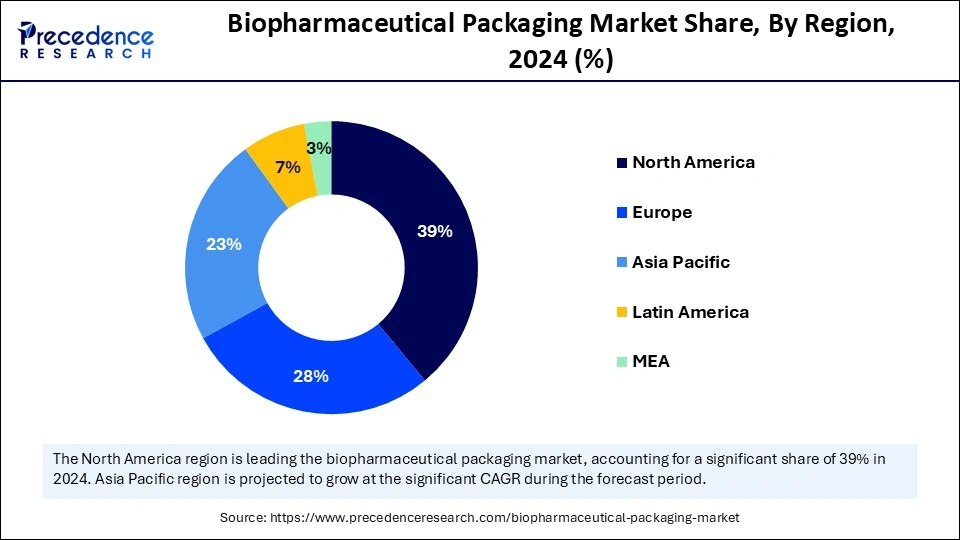

- North America dominated the Biopharmaceutical packaging market with the largest market share of 39% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By packaging level, the primary packaging segment held the biggest market share in 2024.

- By packaging level, the secondary/tertiary cold-chain shippers & specialized kit packaging segment is expected to grow at the fastest CAGR during the forecast period.

- By container/format type, the type I glass vials & prefilled syringes segment accounted for a considerable market share in 2024.

- By container/format type, the cartridges, prefilled delivery systems & single-use bioprocess bags segment is projected to experience the highest growth CAGR in between 2025 and 2034.

- By material/substrate type, the Type I borosilicate glass segment led the market in 2024.

- By material/substrate type, the COP/COC polymers and multi-layer barrier films segment is set to experience the fastest CAGR from 2025 to 2034.

- By product type/therapy type, the monoclonal antibodies & biologics segment held the largest market share in 2024.

- By product type/therapy type, the cell & gene therapy packaging is are fastest growing during the forecast period,

- By cold-chain / storage temperature, the refrigerated (2–8 °C) packaging segment contributed the highest market share in 2024.

- By cold-chain / storage temperature, the ultra-low segment is projected to expand rapidly in the coming years.

- By service/offering, the refrigerated (2–8 °C) packaging segment generated the major market share in 2024.

- By service/offering, the serialization segment is projected to expand rapidly in the coming years.

- By production mode/volume, the commercial high-volume runs (large biologics) segment captured the maximum market share in 2024.

- By production mode/volume, the on-demand / personalized small-batch segment is projected to expand rapidly in the coming years.

HowAI Is Reshaping the Biopharmaceutical Packaging Market?

Artificial Intelligence is emerging as a game-changer in the biopharmaceutical packaging market by enhancing precision, efficiency, and compliance. AI-powered quality control tools enable real-time monitoring to detect micro defects, seal integrity issues, or labelling errors that could compromise drug safety. Machine learning algorithms are being leveraged to optimize design parameters and material selection, thereby extending product shelf life. Predictive analytics are helping manufacturers forecast demand fluctuations and align their supply chains accordingly. AI is also facilitating advancements in smart packaging where embedded sensors track temperature, humidity, and shock exposure throughout the logistics cycle. By leveraging emerging automation with intelligence, AI ensures that packaging is not only robust but also adaptable to the growing complexities of biopharmaceutical delivery.

- In August 2025, Izmo's specialized division, Izmomicro, revealed that it had created a high-density silicon photonics packaging platform, signifying India's entry into the realm of next-generation semiconductor technologies. The company based in Bengaluru stated that this innovation will significantly contribute to driving advancements in artificial intelligence (AI), cloud computing, and future telecommunications networks.(Source: https://www.financialexpress.com)

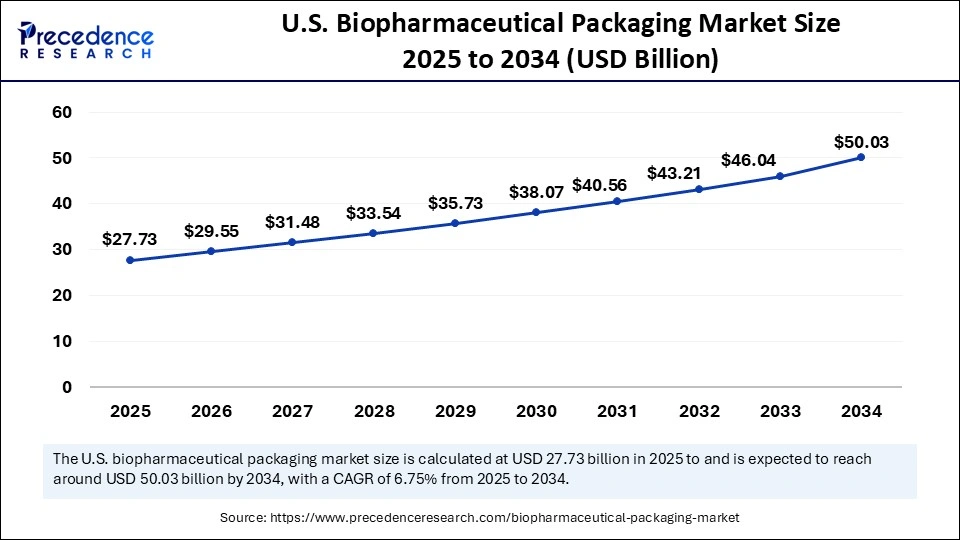

U.S. Biopharmaceutical Packaging Market Size and Growth 2025 to 2034

The U.S. biopharmaceutical packaging market size was evaluated at USD 26.03 billion in 2024 and is projected to be worth around USD 50.03 billion by 2034, growing at a CAGR of 6.75% from 2025 to 2034.

Why Does North America Lead the Biopharmaceutical Packaging Market?

The biopharmaceutical packaging market in North America is experiencing significant growth, driven by the rising demand for biologics and innovative packaging solutions. With advancements in technology, companies are increasingly adopting AI-powered systems to enhance efficiency and ensure compliance with regulations. The region is witnessing a shift towards sustainable packaging options, including recyclable materials that meet regulatory requirements. Furthermore, the emphasis on cold-chain logistics is crucial for maintaining the integrity of vaccines and biologics during transportation. Patient-friendly packaging formats, such as prefilled syringes and auto-injectors, are gaining popularity, supporting the trend towards more personalized healthcare. As the market evolves, North America is set to remain a key player in shaping the future of biopharmaceutical packaging.

Is Asia Pacific the Next Growth Frontier?

The Asia Pacific region is witnessing a rapid transformation in the biopharmaceutical packaging market, driven by significant investments in healthcare and increasing demand for biologics. As countries like China and India expand their biopharmaceutical industries, the need for advanced packaging solutions tailored to sensitive products such as vaccines and gene therapies is surging. The focus on regulatory compliance and traceability is prompting manufacturers to adopt innovative packaging technologies, including smart labels and cold chain logistics. Additionally, therising trend of sustainable packaging is gaining traction, with companies exploring recyclable and biobased materials. Collaborations between local enterprises and global players are enhancing the region's packaging capabilities and driving technological advancements. Overall, the Asia Pacific market is positioned for significant growth, reflecting the region's critical role in the global biopharmaceutical landscape.

Market Overview

Biopharmaceutical packaging systems, components, and services specifically designed for biopharmaceutical products, biologics, vaccines, cell & gene therapies, biosimilars. Covers. Covers primary packaging vials, pre-filled syringes, cartridges, IV bags, bags for single-use bioprocessing, secondary & tertiary packaging, closures & stoppers, cold-chain solutions, specialized labels/serialization, aseptic/sterile fill-finish containers, delivery devices, auto-injectors, pens, and associated services sterilization, cold-chain logistics, fill-finish contracting). Focus is on preserving biological stability, ensuring sterility/traceability, enabling cold-chain, and meeting stringent regulatory requirements.

The biopharmaceutical packaging market encompasses systems, components, and services tailored specifically for biopharmaceutical products, including biologics, vaccines, and gene therapies. Key offerings within this market include primary packaging solutions like vials, pre-filled syringes, and IV bags, as well as secondary and tertiary packaging options. Emphasis is placed on maintaining biological stability and ensuring sterility throughout the supply chain. The market also addresses critical aspects such as cold-chain logistics and specialized labelling for traceability and compliance with regulatory standards. Furthermore, services related to sterilization and fill-finish contracting are integral to supporting the packaging needs of this sector. With the increasing demand for innovative and efficient packaging solutions, the market is poised for substantial growth over the coming years.

Market Key Trends

- Growing adoption of sustainable packaging solutions with recyclable and bio-based materials.

- Rising demand for prefilled and patient-friendly formats such as syringes, cartridges, and auto-injectors.

- Increasing importance of cold-chain packaging systems for biologics and vaccines.

- Integration of track-and-trace systems for supply chain transparency and anti-counterfeiting.

- Expansion of personalized medicine and cell and gene therapies requires highly specialized packaging.

- Digital transformation with smart labels, QR codes, and connected packaging.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 179.66 Billion |

| Market Size in 2025 | USD 101.59 Billion |

| Market Size in 2024 | USD 95.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Level, Container / Format, Material / Substrate, Product Type / Therapy, Cold-Chain / Storage Temperature, Service / Offering, Production Mode / Volume, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Biologics Boom Fuels Packaging Innovation

The rapid expansion of biologics, including monoclonal antibodies, vaccines, and cell-based therapies, has created unprecedented demand for advanced packaging systems, leading to growth in the biopharmaceutical packaging market. Unlike conventional drugs, biologics are highly sensitive to environmental factors such as temperature and light, necessitating specialized solutions. This has spurred innovation in high-barrier plastics, hybrid materials, and tamper-evident closures. Governments and regulatory bodies are also driving adoption through strict guidelines on sterility and traceability. Additionally, patient-centric healthcare models are increasing their reliance on ready-to-use packaging, such as prefilled syringes and auto-injectors. Collectively, these factors are reinforcing packaging as a central pillar in the delivery of next-generation medicines.

In August 2025, the facility will be built to comply with the highest international regulatory standards, such as those set by EMA and the U.S. FDA. It will focus on monoclonal antibodies and intricate peptides. It also includes the region's inaugural in-house bioanalytical testing labs, which eliminate the need for overseas testing and accelerate the market introduction of essential treatments. This inauguration marks a significant milestone for MS Pharma and the biopharmaceutical sector in MENA, stated Ghiath Sukhtian, Chairman of MS Pharma. “We are delighted to be advancing a regional biologics platform that meets global healthcare requirements and provides high-value, complex medications in partnership with international collaborators.(Source: https://www.contractpharma.com)

Restraint

High Costs and Regulatory Complexities

Despite its rapid growth, the biopharmaceutical packaging market faces notable challenges. The cost of developing advanced packaging systems, especially cold-chain and smart packaging, remains significantly high. Many small and mid-sized biopharma companies struggle with the financial burden of adopting such solutions at scale. Furthermore, stringent regulatory compliance across multiple geographies adds complexity to manufacturing and distribution. The lack of standardization in sustainable packaging practices also creates barriers to global harmonization. These constraints, while not stalling progress, demand strategic investments and collaborations to ensure scalable, compliant, and cost-efficient adoption.

Opportunity

Smart Packaging Unlocks the Future

The evolution of smart and connected packaging presents vast opportunities for the biopharmaceutical industry. By integrating IoT-enabled sensors and RFID tags, packaging can now monitor and record data on storage conditions, authenticity, and distribution. This enables pharmaceutical companies to combat counterfeiting and improve regulatory compliance. Moreover, smart packaging enhances patient adherence by sending reminders and usage instructions through connected devices. With the expansion of personalized medicine, these intelligent systems can also be tailored for individual patient needs. As healthcare shifts toward digital ecosystems, smart packaging stands at the forefront of unlocking efficiency, safety, and patient engagement, and ultimately growth in the biopharmaceutical packaging market.

A study shows that the most recent medicine to receive this classification is the injectable solution Inhixa 12,000 IU (120 mg)/0.8 mL. On June 12, the MHRA issued a recall to the Marketing Authorization Holder (MAH), Quadrant Pharmaceuticals Limited/Maxearn Limited, due to a typographical error on the carton. According to Maxearn, two incorrectly parallel-imported batches have entered the market. Approximately 14 defective packs, each containing 10 prefilled syringes, were released to pharmacies.(source: https://www.europeanpharmaceuticalreview.com)

Packaging Level Insights

Why Primary Packaging Is Dominating the Biopharmaceutical Packaging Market?

Primary packaging continues to dominate the biopharmaceutical packaging market sector, followed by the biopharmaceutical packaging market is witnessing a paradigm shift due to the rapid growth of biologics and advanced therapies. As a result, there is a significant push towards more sustainable packaging solutions that utilize recyclable and biobased materials. Additionally, the demand for prefilled and patient-friendly options is on the rise, reflecting a broader trend towards patient-centric healthcare. Innovations such as smart packaging, which incorporates QR codes and track-and-trace systems, are enhancing supply chain transparency and addressing concerns over counterfeit products. Moreover, the integration of AI in packaging processes is improving quality control and operational efficiency. However, the increasing complexity of packaging requirements also presents challenges, particularly in terms of regulatory compliance and maintaining the integrity of sensitive biopharmaceuticals during distribution.

The biopharmaceutical packaging market is set to experience significant growth in the coming decade, driven by the increasing demand for innovative packaging solutions. Key components of this market include primary packaging systems such as vials and pre-filled syringes, which are essential for preserving the stability and sterility of biologics and vaccines. Emerging trends highlight a growing preference for sustainable packaging options, as well as a rise in patient-friendly formats like auto-injectors. Moreover, advancements in artificial intelligence are reshaping the market by enhancing quality control and optimizing packaging design. The critical nature of maintaining cold-chain logistics is further fueling the need for specialized packaging solutions. Overall, the interplay of regulatory requirements and innovations in packaging technology underscores its importance in the delivery of next-generation biopharmaceuticals.

Secondary/tertiary cold-chain shippers, as well as specialized kit packaging, are witnessing rapid growth, as they are essential for ensuring the safe transport of temperature-sensitive biopharmaceutical products. These packaging solutions provide an extra layer of protection against environmental fluctuations, maintaining the required temperature range throughout the logistics process. Specialized kit packaging is designed to securely hold and organize various components, such as vials, syringes, and other therapeutic items, ensuring they reach their destination intact and ready for use. Integrated temperature monitoring features can be included, allowing real-time tracking of conditions during transit. Additionally, these packaging systems are often designed with user-friendly features, facilitating ease of use for both healthcare professionals and patients. By combining robust design with advanced materials, secondary and tertiary packaging solutions enhance the overall efficacy and reliability of biopharmaceutical delivery systems.

Container/Format Insights

Why Are Type I Glass Vials & Prefilled Syringes Leading the Biopharmaceutical Packaging Market?

The Type I glass vials & prefilled syringes segment continues to lead the biopharmaceutical packaging market as biopharmaceutical packaging encompasses a variety of containers and formats specifically designed to meet the needs of sensitive biologics, vaccines, and gene therapies. Primary packaging options include vials, pre-filled syringes, and cartridges, which provide essential protection against environmental factors. Secondary and tertiary packaging formats are also vital for ensuring product integrity during transportation and storage. Single-use IV bags and cold-chain packaging solutions are increasingly important to maintain the required temperature and sterility. In addition, specialized closures, stoppers, and tamper-evident features enhance the safety and security of these products. The development of innovative formats is crucial for addressing the growing demand for personalized medicine and biologics.

Meanwhile, cartridges, prefilled delivery systems & single-use bioprocess bags are witnessing rapid growth as these are widely used in the biopharmaceutical industry due to their excellent resistance to heat, chemical agents, and moisture. They provide a sterile environment, ensuring the integrity of sensitive biologics and vaccines. Prefilled vials, on the other hand, offer the convenience of ready-to-use solutions, reducing the risk of contamination during the preparation process. The combination of Type I glass and prefilled technology minimizes dosing errors and enhances patient compliance. These vials are fitted with tamper-evident closures, ensuring safety and traceability throughout the supply chain. As the demand for biologics continues to rise, the adoption of Type I glass vials in prefilled formats is expected to grow significantly, driving innovation in packaging solutions.

Material / Substrate Insights

Why Is Type I Borosilicate Glass Dominating the Market?

Type I borosilicate glass continues to dominate the biopharmaceutical packaging market, due to its superior chemical resistance, durability, and ability to preserve product stability. It is the material of choice for vials, ampoules, and syringes, especially for sensitive biologics. The inert nature of borosilicate glass prevents interaction with complex formulations, ensuring safety and efficacy. Its regulatory acceptance and long-standing track record in clinical and commercial use further reinforce its dominance. Moreover, its compatibility with high-volume production lines makes it indispensable in modern biopharma packaging. As demand for biologics continues to rise, borosilicate glass is expected to maintain its strong market leadership.

COP/COC polymers and multi-layer barrier films are witnessing rapid growth owing to alternatives that offer superior break resistance, reduced extractables, and greater design flexibility compared to traditional glass. Their lightweight nature and adaptability to innovative formats like prefilled syringes and flexible containers are fueling rapid adoption. Additionally, the rise of personalized medicine and on-demand packaging formats favors these modern polymers. Increasing investments in sustainable, recyclable materials also contribute to their accelerated growth. As biologics become more diverse, COP/COC and barrier films will play an increasingly vital role in next-generation packaging.

Product Type / Therapy Insights

Why Are Monoclonal Antibodies & Biologics Dominating the Biopharmaceutical Packaging Market?

Monoclonal antibodies & biologics continue to dominate the biopharmaceutical packaging sector, driving the largest share of the packaging market, given their widespread use in treating chronic diseases such as cancer, autoimmune disorders, and infectious diseases. These therapies require specialized packaging to maintain their structural integrity and biological activity. Packaging systems for biologics focus on sterility, temperature control, and compatibility, making formats like prefilled syringes, vials, and cartridges essential. The growing approval pipeline of mAbs and other biologics underscores continued demand for advanced packaging. The combination of high therapeutic value and regulatory emphasis on safety keeps biologics packaging in a dominant position.

Cell & gene therapy packaging is witnessing rapid growth, reflecting the explosive growth of these background treatments. Unlike conventional biologics, these therapies demand highly customized, sterile, and ultra-protective packaging systems. From cryogenic storage solutions to tamper-proof containers for sensitive genetic material, the requirements are stringent and unique. Personalized and patient-specific therapies also necessitate scalable, flexible packaging approaches. The surge in global clinical trials and regulatory approvals for advanced therapies is fueling unprecedented demand. As the industry evolves, packaging for cell and gene therapies is poised to become the cornerstone of future growth.

Cold-Chain / Storage Temperature Insights

Why Is Refrigerated (2–8 °C) Dominating the Biopharmaceutical Packaging Market?

Refrigerated (2–8 °C) packaging continues to dominate the biopharmaceutical packaging market within controlled temperature ranges of 2–8 °C. This segment benefits from robust infrastructure and established logistics networks worldwide. Standardized refrigerated systems provide reliable stability while balancing costs and scalability. Prefilled syringes, vials, and cartridges are routinely stored in these conditions, making refrigerated packaging the most utilized cold-chain category. With rising global vaccination programs and biologic therapies, demand for refrigerated packaging continues to remain steady and essential.

The ultra-low/cryogenic packaging for cell & gene therapies and mRNA is witnessing rapid growth, as advanced therapies such as mRNA vaccines, cell therapies, and gene therapies require storage at –80°C or below. The complexity of maintaining such extreme conditions has spurred innovation in cryogenic containers, phase-change materials, and smart monitoring systems. Recent developments in mRNA-based vaccines and precision therapies strongly support this growth. Although infrastructure challenges exist, investment in ultra-low storage facilities is expanding globally. As therapies become more temperature-sensitive, this segment will outpace others in growth.

Service / Offering Insights

Why Fill-Finish and Aseptic Packaging Dominate the Biopharmaceutical Packaging Market?

Fill-finish & aseptic packaging continues to dominate the biopharmaceutical packaging market, thanks to the services that ensure sterility, accuracy, and safety in delivering biologics. Given the sensitivity of biopharmaceutical products, aseptic processes are crucial for preventing contamination. Automated fill-finish lines of vials, syringes, and catrifdges have become industry benchmarks. These services also integrate with cold-chain packaging and serialization to ensure full compliance with regulatory standards. The sheer volume of biologics being manufactured reinforces the necessity for fill-finish services. This dominance will continue as biologics remain central to modern therapeutics.

Serialization is experiencing rapid growth driven by the global demand for traceability, anti-counterfeiting, and compliance with stringent regulatory requirements. By embedding unique identification codes and track-and-trace systems, serialization strengthens supply chain integrity. The biopharmaceutical industry, with its high-value drugs and complex logistics, is particularly vulnerable to counterfeiting risks. Governments worldwide are implementing serialization laws, accelerating adoption across the sector. Beyond compliance, serialization enhances patient safety and strengthens brand credibility. As digital transformation sweeps through pharma, serialization is becoming an indispensable growth area.

Production Mode / Volume Insights

Why Are Commercial High-Volume Runs Dominating the Biopharmaceutical Packaging Market?

Commercial high-volume runs continue to dominate the biopharmaceutical packaging market followed by the rise in biologics and vaccines. Manufacturers are seeking efficient and reliable packaging that can accommodate large-scale production. Advanced technologies, such as automated fill-finish processes, are being implemented to enhance throughput and consistency. Companies are also focusing on sustainable materials to meet environmental regulations and consumer expectations. Additionally, high-volume packaging must ensure compliance with stringent regulatory standards to maintain product integrity and safety. As a result, the market is evolving to provide innovative and effective solutions tailored to high-volume production needs.

On-demand is witnessing rapid growth, fuelled by the rise of personalized medicine and cell and gene therapies. Unlike mass-market biologics, these therapies are often patient-specific, requiring flexible and small-batch packaging. On-demand models enable just-in-time production, reducing wastage while ensuring precise handling of sensitive formulations. Digital technologies, 3D printing, and modular packaging systems are accelerating this shift. As healthcare pivots toward customization and agility, on-demand packaging is poised to reshape the future of the industry.

Biopharmaceutical Packaging Market: Value Chain Analysis

- Raw Material Sourcing (Plastic, Paper, Glass, etc.)

Raw material sourcing in the biopharmaceutical packaging market is crucial for ensuring the quality, safety, and compliance of packaging solutions for sensitive products, such as biologics and vaccines. It involves selecting high-quality, sustainable materials while fostering strong relationships with suppliers to mitigate risks in the supply chain. Additionally, leveraging technology can enhance traceability and transparency in the sourcing process, further supporting regulatory compliance and innovation.

- Material Processing and Conversion

The processing of materials in biopharmaceutical packaging entails transforming raw substances such as bio-based polymers, glass, or metals into completed packaging components through methods like polymerization, rolling, and molding, which frequently necessitate sterilization. The conversion phase involves molding these processed materials into the ultimate product, which needs to be inert, compatible, and capable of safeguarding the biopharmaceutical formulation.

- Recycling and Waste Management

Collecting waste materials and transforming them into new, usable products through processes like mechanical recycling, chemical recycling, and composting.

Biopharmaceutical Packaging Market Companies

- Gerresheimer AG

- Schott AG

- Corning Incorporated

- West Pharmaceutical Services

- Stevanato Group

- BD (Becton, Dickinson and Company

- Amcor / Amcor Pharma

- AptarGroup

- SGD / SGD Pharma

- Nipro Corporation

- Catalent

- PCI Pharma Services

- Fisher Clinical Services / Thermo Fisher Scientific

- Schreiner MediPharm

- IMA Group

Recent Developments

- In August 2025, BirchBioMed Inc., a prominent biopharmaceutical firm specializing in the development of therapeutic solutions for scarring and fibrosis-related conditions, is pleased to announce that Hamilton Health Sciences' Centre for Burn Research in Ontario, Canada, has been selected as the inaugural clinical trial site for its Phase II/III randomized study on the naturally-derived compound FS2. This study aims to evaluate the efficacy and safety of FS2 in addressing the complex pathophysiology of scarring.(Source: https://www.einpresswire.com)

Segments Covered in this Report

By Packaging Level

- primary packaging (vials, prefilled syringes, cartridges, ampoules, IV bags, single-use bags)

- Secondary packaging (kits, cartons, trays, blister packs)

- Tertiary packaging (shipping cases, pallets, cold-chain shippers)

By Container / Format

- Type I Borosilicate Glass Vials

- Type I Tubular Glass (vials & ampoules)

- Prefilled Syringes (glass/plastic)

- Cartridges & Cassettes

- Plastic Bottles & Jars (oral biologics, excipients)

- IV/Infusion Bags (PVC, non-PVC single-use)

- Single-Use Bioprocess Bags & Containers (for upstream/downstream)

- Specialty containers (microtubes, cryovials, cryogenic storage)

By Material / Substrate

- Glass (Type I)

- Cyclic Olefin Polymer (COP) / Cyclic Olefin Copolymer (COC)

- Polyethylene (PE), Polypropylene (PP)

- PVC / non-PVC flexible films

- Elastomeric closures (butyl, bromobutyl)

- Composite / multi-layer barrier films

By Product Type / Therapy

- Monoclonal antibodies (mAbs) & biologics

- Vaccines (conventional & mRNA)

- Cell & gene therapies (vials, cryo-storage, kits)

- Biosimilars

- Peptides/oligonucleotides / RNA therapeutics

- Small-molecule injectable biologic formulations

By Cold-Chain / Storage Temperature

- Ambient stable packaging

- Refrigerated (2–8 °C) packaging

- Frozen (≤ −20 °C) packaging

- Ultra-low / cryogenic (≤ −80 °C / liquid nitrogen) packaging

By Service / Offering

- Fill-finish & aseptic packaging (in-house or CMO)

- Cold-chain logistics & controlled shipping

- Labeling & serialization (2D codes, RFID)

- Sterilization (gamma, E-beam, autoclave)

- Kit assembly & clinical packaging

- Regulatory artwork & compliance services

By Production Mode / Volume

- Clinical (small batch, nested/variable)

- Commercial (high-volume runs)

- On-demand / personalized (patient-specific, DTP for cell therapies)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting