What is the Sterile Medical Packaging Market Size?

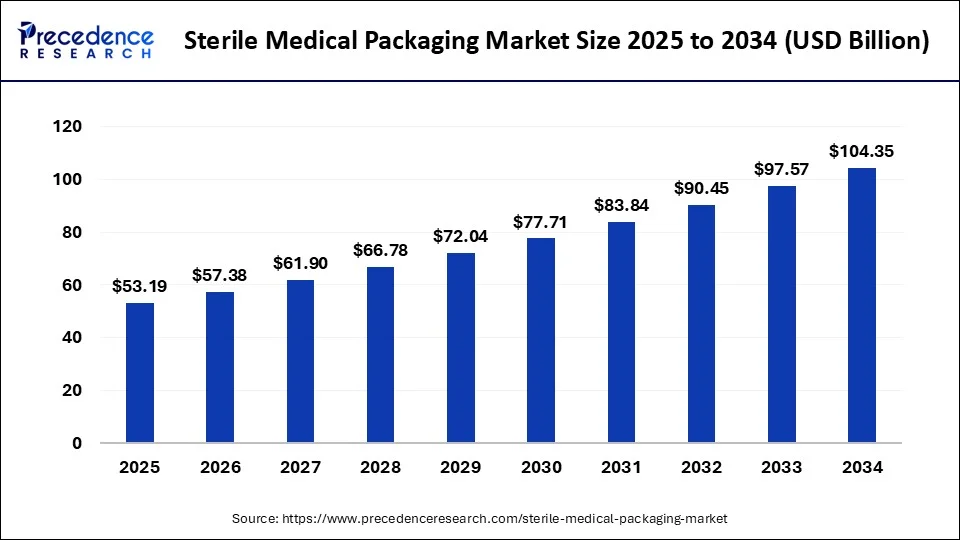

The global sterile medical packaging market size was estimated at USD 53.19 billion in 2025, and is anticipated to br worth USD 57.38 billion by 2026, and is expected to reach around USD 111.36 billion by 2035, poised to grow at a CAGR of 7.67% from 2026 to 2035.

Sterile Medical Packaging Market Key Takeaways

- In terms of revenue, the market is valued at $53.19 billion in 2025.

- It is projected to reach $111.36billion by 2035.

- The market is expected to grow at a CAGR of 7.67% from 2026 to 2035.

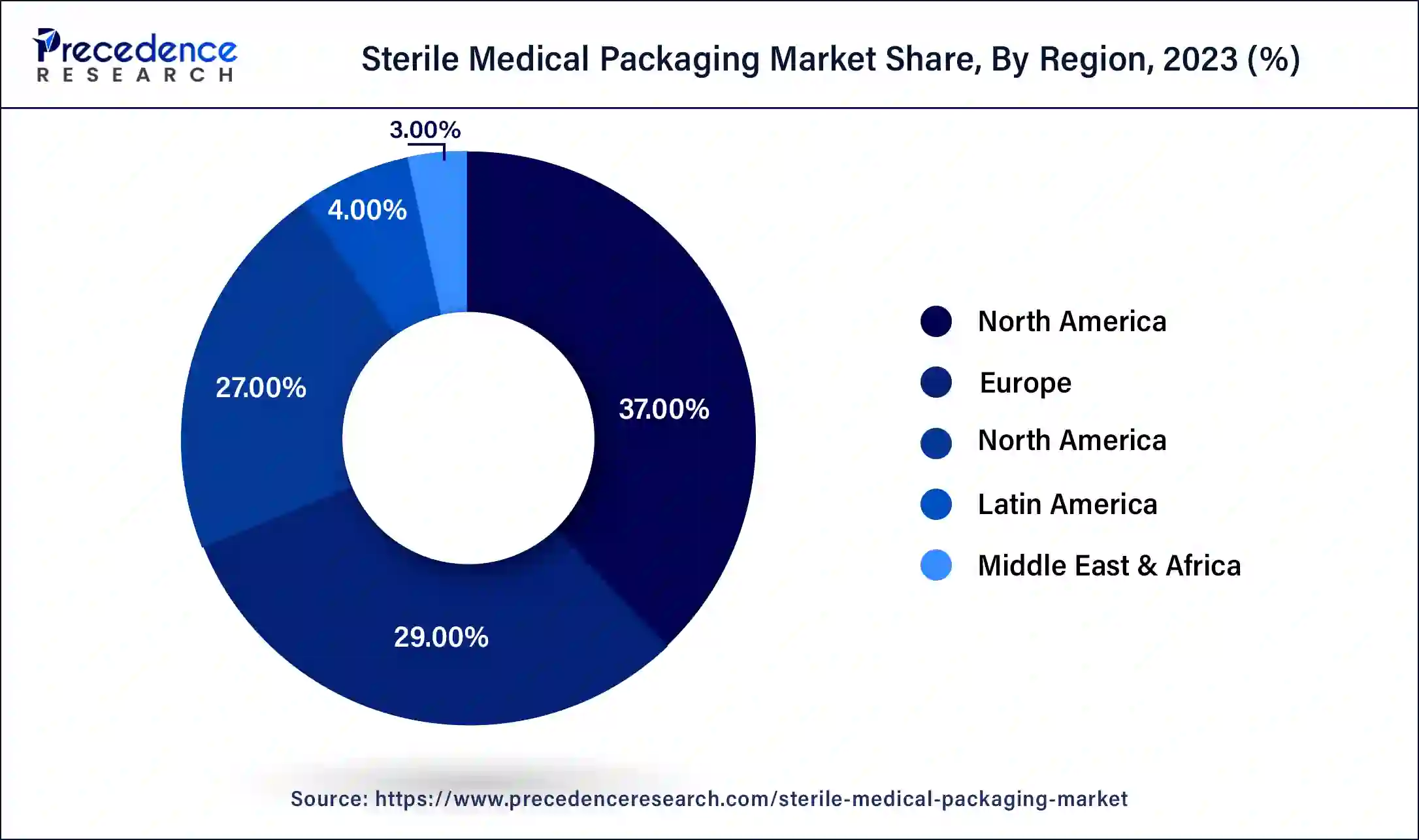

- North America led the global market with the highest market share of 37% in 2025.

- By Packaging Type, the thermoformed trays segment has held the largest market share in 2025.

- By Material, the plastic segment captured the biggest revenue share in 2025.

- By Application, the pharmaceutical and biological segment is estimated to hold the highest market share in 2025.

Market Overview

The sterile packaging market refers to the production and sale of packaging materials and containers that are designed to maintain a sterile environment for medical devices, pharmaceuticals, and other sensitive products. Sterile packaging is essential for ensuring that these products remain free of contaminants that could compromise their safety or effectiveness.

The market for sterile packaging has been growing in recent years due to the increasing demand for safe and effective medical treatments, as well as the growing prevalence of chronic diseases that require ongoing treatment. The rise of e-commerce has also contributed to the growth of the sterile packaging market, as more consumers are purchasing medical supplies and pharmaceuticals online and expecting them to be delivered in a sterile condition.

Some of the key materials used in sterile packaging include plastics, such as polyethylene, polypropylene, and polystyrene, as well as metals such as aluminum and stainless steel. These materials are often coated or treated with special coatings or films to help maintain sterility.

The global sterile packaging market is expected to continue to grow in the coming years, driven by factors such as increasing demand for medical devices and pharmaceuticals, as well as ongoing innovation in packaging materials and technologies. However, the market is also subject to various challenges, including increasing competition and regulatory requirements that must be met to ensure the safety and effectiveness of sterile packaging products.

How is AI Influencing the Sterile Medical Packaging Industry?

AI-driven vision systems manage production in real-time, instantly identifying sealing, labeling, or contamination defects that could compromise sterility. Specialized AI models help in navigating complex global regulations, decreasing human error in documentation, and ensuring compliance for faster time-to-market. By lowering material waste and optimizing production, AI encourages leaner, more cost-effective manufacturing.

Sterile Medical Packaging Market Growth Factors

There are following factors which are expected to boost the sterile packaging market growth:-

- Increasing demand for safe and effective medical treatments

- Growing prevalence of chronic diseases

- Rise of e-commerce

- Technological advancements in packaging materials

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 111.36Billion |

| Market Size in 2025 | USD 53.19 Billion |

| Market Size in 2026 | USD 57.38 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 53.19% |

| Largest Market | North America |

| Second Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Packaging Type, Material, Sterilization Method, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for safe and effective medical treatments: The global population is growing and aging, leading to an increase in demand for medical treatments and healthcare products. Sterile packaging is essential for ensuring the safety and effectiveness of medical devices, pharmaceuticals, and other healthcare products.

Growing prevalence of chronic diseases: Chronic diseases such as diabetes, cancer, and cardiovascular diseases are becoming more prevalent around the world, leading to an increased demand for ongoing treatment and management. This trend is driving the demand for sterile packaging, as many of these treatments require sterile environments.

Rise of e-commerce: The growth of e-commerce is driving demand for sterile packaging, as more consumers are purchasing medical supplies and pharmaceuticals online and expecting them to be delivered in a sterile condition.

Technological advancements in packaging materials: Advances in packaging materials and technologies are allowing for the development of more effective and efficient sterile packaging solutions, further driving the growth of the market.

Key Market Challenges

There are the following factors that can restrain the market from growing

- Stringent regulatory requirements

- Environmental concerns

Stringent regulatory requirements: While regulatory requirements for sterile packaging are driving demand for high-quality, reliable sterile packaging products, they also present a challenge for manufacturers. Compliance with these requirements can be time-consuming and expensive, and failure to comply can result in regulatory penalties and reputational damage.

Environmental concerns: Many sterile packaging products are made from plastics, which can be difficult to recycle and can contribute to environmental pollution. As environmental concerns grow, manufacturers may face pressure to develop more sustainable and environmentally friendly packaging solutions.

Key Market Opportunities:

The sterile packaging market presents several opportunities for growth and expansion in the coming years. Here are some of the key opportunities:

- Sustainability

- Growing demand for biologics

- Increasing adoption of single-use packaging

Sustainability: As environmental concerns grow, there is increasing demand for sustainable and environmentally friendly packaging solutions. Manufacturers that can develop innovative and sustainable sterile packaging products may be able to differentiate themselves in the market and capture new business.

Growing demand for biologics: Biologics is a growing area of the pharmaceutical industry, and they require specialized sterile packaging to maintain their efficacy. As the demand for biologics continues to grow, so too will the demand for sterile packaging.

Increasing adoption of single-use packaging: Single-use sterile packaging is becoming more popular in healthcare settings, as it can reduce the risk of infection and contamination. This trend is expected to drive demand for sterile packaging products.

Segment Insights

Packaging Type Insights

The most widely used sterile medical packaging among these is thermoformed trays. They feature multiple compartments to support the medical equipment and are often made of hard material. Sutures, implants, testing kits, and delicate surgical supplies are packed in these trays. In 2025, the pre-fillable syringes sector had the second-largest market share. These transparent, break-resistant, ready-to-fill syringes are lightweight.

These syringes are typically made of plastic since it has a glass-like look. Syringes' high moisture barrier capability makes it possible to store medications for a long time. It is therefore appropriate for multiple-dose injectable therapy for a variety of disorders.

Throughout the projection period, the demand for pre-fillable syringes would increase due to the increased use of multiple-dose injection therapies. Moreover, blister packs minimize the need for extra cartons and lower the cost of packaging.

As a result, the blister & clamshells industry will benefit from their growing preference. The medical sector uses a variety of bags and pouches, including bags with adhesive closures, bags for sterilization, bags for pharmacies, bags for respiratory setup, and ziplock and reclosable bags.

Material Insights

The largest and fastest-growing raw material utilised to create sterile medical packaging is plastic. Polyvinyl chloride (PVC), polyethylene terephthalate (PET), high impact polystyrene (HIPS), high-density polyethylene, polypropylene (PP), and polycarbonate (PC) are among the materials that are generally preferred for medical packaging (HDPE). These plastics are a great option for medical packaging since they are inexpensive, easy to form, and have protective qualities. They shield the medical equipment, devices, and pharmaceuticals inside from contamination and damage.

Thermoformed blister trays and packs, pouches, vials, bottles, closures, overwraps, and bags are all made of plastic. Because to its chemical and moisture resistance, glass is the second-most common material used in sterile medical packaging. It is a favoured material for making syringes, bottles, test tubes, vials, and other kinds of medical packaging, including ampoules, vials, and bottles.

Additionally, packaging for medical equipment makes extensive use of metals including lead, tin, and aluminum. Due to its numerous advantageous qualities, including high stiffness, durability, coding ability, and reliability, the paper and paperboard market is expected to expand rapidly.

Sterilization Method Insights

Based on sterilization method the sterile packaging market is further segmented into radiation sterilization, chemical sterilization, and high temperature sterilization. Ethylene oxide (ETO), hydrogen peroxide, and others make up the chemical sterilisation section. Related sub-segments include gamma radiation, e-beam radiation, and others within the radiation sterilisation segment.

The steam autoclave and dry heat are two more divisions of the high temperature/pressure sterilising segment. The market's fastest-growing approach is chemical sterilisation, where the most potent chemical utilised for sterilisation is ethylene oxide. It is an alkylating chemical that interferes with microorganisms' cellular metabolism and reproductive activities. Also, it works effectively with a variety of substances that deteriorate when exposed to radiation or heated sterilisation, such as plastics and glass.

Gamma radiation makes up the greatest sub-segment of the second-largest method of sterilisation, which uses radiation. Gamma rays destroy bacterial DNA and prevent bacterial division to eliminate the contaminating germs during the sterilising procedure. Gamma radiation is now a safe and practical method for the healthcare system as a result.

The steam autoclave is the most efficient technique for high temperature/pressure sterilisation. Using saturated steam at 121–132 °C for disinfection, it is an extremely efficient technique. It is primarily employed for medical equipment like surgical instruments. Thus, the potential expansion of the market will be boosted by the rising need for the sterilisation of packaging items.

Application Insights

In 2025, the pharmaceutical and biological industry enjoyed a hefty market share for sterile medical packaging. The prevalence of infectious and non-infectious diseases has increased, as have the number of sufferers. The demand for medications and blood tests has risen as a result of this. These favourable features are anticipated to increase demand for this type of packaging in pharmaceutical and biological applications, which will fuel market expansion.

A market category that is expanding quickly is surgical and medical instrumentation. They consist of gloves, drapes, gowns, procedure kits, urine and drainage bags, and catheters. These tools are primarily utilised during surgeries and surgical procedures. So, as the necessity for surgeries and procedures grows, so will the demand for surgical and medical equipment, which will result in market growth.

Furthermore, materials like glass and plastic are generally used in in-vitro diagnostic products. The medical implants segment is expected to grow at a significant rate during the forecast period. The demand for medical implants is related with their biocompatibility, bio functionality, corrosion resistance, availability, bio-adhesion, and processability properties.

Regional Insights

What is the U.S. Sterile Medical Packaging Market Size?

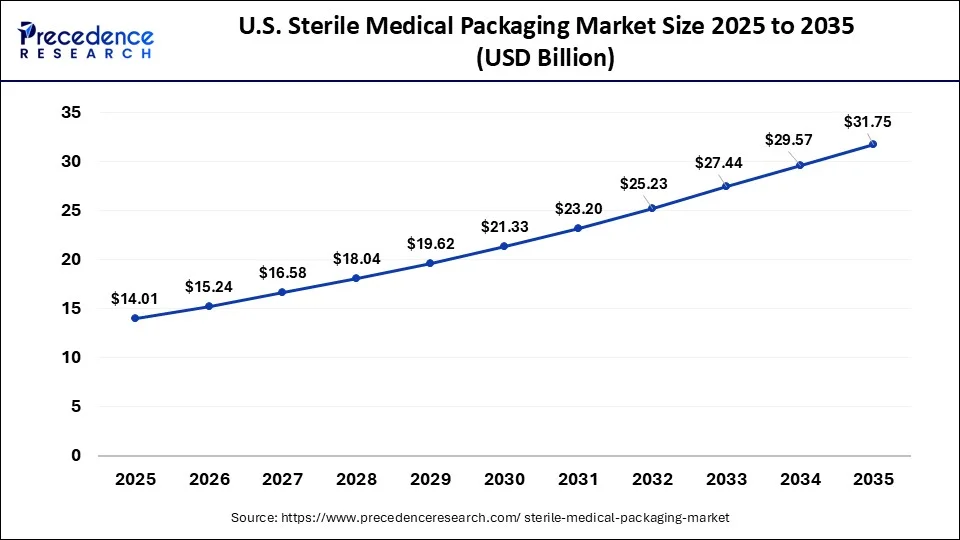

The U.S. sterile medical packaging market size was valued at USD 14.01 billion in 2025 and is predicted to be worth USD 31.75 billion by 2035, growing at a CAGR of 8.53% from 2026 to 2035.

North America dominates the market owing to the strong healthcare industry, stringent regulatory environment, and advanced technology. North America has a strong healthcare industry, driven by advanced healthcare infrastructure, high levels of healthcare spending, and a large base of pharmaceutical and medical device manufacturers. This has resulted in a significant demand for sterile packaging products in the region.

The U.S. accounted for the majority of the share in the region. The growth in the region is owing to the rise in the pharmaceutical industry and increase in the consumer healthcare spending. The surge in the number of patients, due to the rapidly spreading of contagious diseases like coronavirus, has fuel the growth of the pharmaceutical industry. These factors are expected to surge the demand for such packaging in this region. Europe accounts for the second-largest share of the market.

Asia Pacific is expected to witness the highest growth during the forecast period owing to the rising healthcare industry, large and diverse market, and increasing focus on safety and quality. The healthcare industry in Asia-Pacific is growing rapidly due to several factors, including rising disposable incomes, increasing population, and improving healthcare infrastructure. This growth is expected to drive demand for sterile packaging products in the region.

It is home to several large and diverse markets, including China, India, and Japan. These markets offer significant growth opportunities for sterile packaging manufacturers, particularly in the pharmaceutical and medical device industries.

China as a Dominating Country in the Asia Pacific:

Due to its rapidly advancing healthcare sector, large population base, and increased investment in medical infrastructure, China is a clear market leader in the Asia Pacific sterile medical packaging market. Its domestic manufacturing capacity and export capabilities further solidify its position as a regional leader.

Europe as a Notably Growing Region:

The sterile medical packaging market in Europe continues to expand; some factors driving this growth are strict regulation, an aging population, and experienced healthcare systems. The focus in Europe on sustainability and practices around assuring safe medicine has also increased demand for quality packaging solutions. In addition, countries in Europe host the majority of the large pharmaceutical and medical device manufacturers; as well, Europe is also a hub of innovation for medical device packaging. The nations experiencing the highest growth within the European sterile medical packaging market are Germany, France, and the United Kingdom; these countries drive further advances in eco-friendly and high-performing packaging formats.

Germany Sterile Medical Packaging Market Trends

Germany's market is driven by rising healthcare expenditure and a growing need for sterile and safe packaging solutions in medical settings. Moreover, stringent regulatory standards along with quality requirements for medical packaging ensure innovation and the acceptance of advanced sterile paper packaging materials.

Role of Sterile Packaging in Medical Devices and Pharmaceutical Safety in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by the growth in counterfeit products in the region, which necessitates advanced packaging with tamper-evident features to verify authenticity, along with protecting patients. Latin American healthcare systems are increasingly accepting stringent regulations, forcing producers to use advanced sterilization and even packaging methods to meet quality standards.

Brazil Sterile Medical Packaging Market Trends

It is driven by escalating need for minimally invasive procedures, expanding healthcare infrastructure, and rising regulatory standards impacting patient safety and infection control. Manufacturers are focusing on advanced materials and packaging technologies, such as high-barrier films and tamper-evident designs, to improve protection and shelf life. The increasing use of disposable medical devices in surgery, diagnostics, and wound care is further supporting market growth.

Material Innovation and Barrier Performance in the Sterile Medical Packaging Market in MEA

MEA's market shows rapid growth during the forecast period. It is driven by the booming pharmaceutical sector, mainly the rise in biopharmaceuticals, vaccines, and even injectables, which need specialized, high-integrity, and cold-chain compatible packaging. These products demand superior moisture, oxygen, and even light resistance to maintain stability

Saudi Arabia Sterile Medical Packaging Market Trends

Saudi Arabia's rising investments in healthcare infrastructure are greatly impacting the pharmaceutical packaging field. In line with its Vision 2030 initiative, the Kingdom aims to improve healthcare facilities, increase hospital capacities, and accept innovative medical technologies. Such initiatives are resulting in a few healthcare projects, catalyzing the need for pharmaceutical goods, which need sophisticated packaging options.

Value Chain Analysis for the Sterile Medical Packaging Market

- R&D: It aims on developing advanced, sustainable, and compliant solutions to ensure product integrity for biologics as well as single-use devices.

Key Players: Amcor plc, DuPont de Nemours, Inc., Berry Global, 3M Company, West Pharmaceutical Services - Clinical Trials and Regulatory Approvals: It provides validation of sterility, legal compliance, and market differentiation, allowing firms to meet the increasingly stringent requirements for patient safety and infection control.

Key Players: Piramal Pharma Solutions, Sharp Packaging Services, Catalent, Inc. - Formulation and Final Dosage Preparation: It is mainly driving innovation in the pharmaceutical and biologics sector by ensuring that drugs remain stable, safe, and thus, effective until the point of use.

Key Players: West Pharmaceutical Services, Inc., Gerresheimer AG, SCHOTT Pharma

Sterile Medical Packaging Market Companies

- Amcor Plc

- Placon

- DuPont

- Steripack Ltd.

- Wipak Group

- Nelipak Healthcare

- Tekni-Plex

- Sonoco

- BillerudKorsnäs AB

- ProAmpac

- West Pharmaceutical Services, Inc.

- Riverside Medical Packaging Company Ltd

- Oliver Healthcare Packaging

- GS Medical Packaging

- Orchid

- Technipaq Inc.

Recent Developments

- In April 2025, Global packaging solutions company Amcor opened a landmark medical packaging facility in Selangor, the first in Asia equipped with advanced air knife coating technology and to produce both top and bottom substrates for medical device packaging. Equipped with advanced technologies such as water-based coating systems, online inspection systems, and air knife technology, the facility sets new standards for precision and efficiency. (Source: https://codeblue.galencentre.org)

- In April 2025, Nelipak Corporation ("Nelipak"), a leading global manufacturer of packaging solutions for medical devices, diagnostic, pharmaceutical drug delivery, and other demanding applications, announced expansion of sterile medical packaging services across Asia-Pacific. The Nelipak medical packaging product lineup includes a comprehensive range of custom-designed sterile-barrier packaging solutions. Nelipak's flexible packaging product line includes coated roll-stock, die-cut lids and sheets, pouches, and bags. (Source: https://vir.com.vn)

- In April 2024, STEMart announced the launch of its Packaging Solutions for the pharmaceutical and medical device industries. These services are designed to ensure the quality, sterility, and regulatory compliance of medical devices throughout their lifecycle. They offer a wide variety of options for testing the physical and chemical properties of packaging materials to help manufacturers optimize packaging design and performance. (Source: https://www.industryintel.com)

Segments Covered in the Report

By Packaging Type

- Electrical & Electronics

- Transportation

- Medical

- Chemical

- Others

By Material

- Plastics

- Glass

- Metal

- Paper & Paperboard

- Others

By Sterilization Method

- Chemical Sterilization

- Ethylene Oxide (ETO)

- Hydrogen Peroxide

- Others

- Radiation Sterilization

- Gamma Radiation

- E-beam

- Others

- High Temperature/Pressure Sterilization

- Steam Autoclave

- Dry Heat

By Application

- Pharmaceutical & Biological

- Surgical & Medical Instruments

- In Vitro Diagnostic Products

- Medical Implants

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting