Sterile Injectables CDMO Market Size and Forecast 2025 to 2034

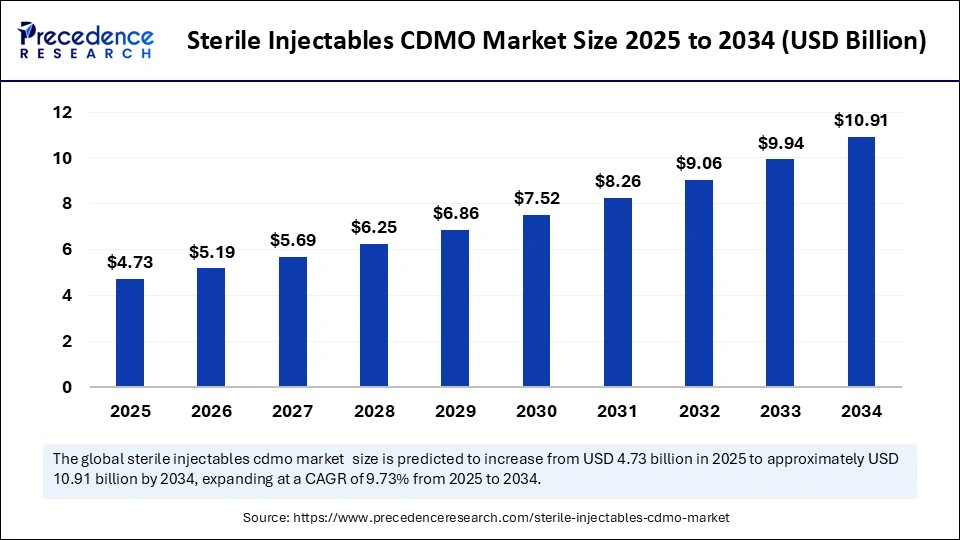

The global sterile injectables CDMO market size accounted for USD 4.31 billion in 2024 and is predicted to increase from USD 4.73 billion in 2025 to approximately USD 10.91 billion by 2034, expanding at a CAGR of 9.73% from 2025 to 2034.The market is experiencing rapid growth due to the increasing demand for outsourcing services by pharmaceutical firms, stringent sterility requirements, and rising demand for injectable drugs.

Sterile Injectables CDMO MarketKey Takeaways

- In terms of revenue, the sterile injectables CDMO market is valued at $ 4.73 billion in 2025.

- It is projected to reach $ 10.91 billion by 2034.

- The market is expected to grow at a CAGR of 9.73% from 2025 to 2034.

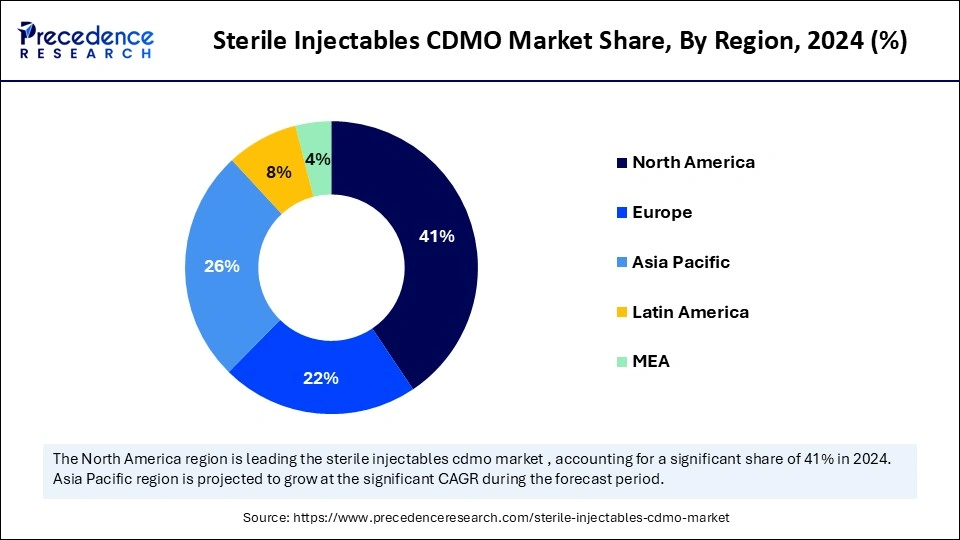

- North America accounted for the highest revenue share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 10.7% between 2025 and 2034.

- By drug type, the small molecule sterile injectables segment dominated the market by holding 61.40% in 2024.

- By drug type, the large molecule segment is expected to grow at the highest CAGR of 9.80% in 2024.

- By dosage form, the vials segment held a 42.60% market share in 2024.

- By dosage form, the prefilled syringes segment is expected to grow at the highest CAGR of 10.20% in 2024.

- By manufacturing capabilities, the aseptic fill-finish segment led the market by holding 36.80% share in 2024.

- By manufacturing capabilities, the lyophilization segment is expected to grow at the highest CAGR of 9.70% in 2024.

- By sterilization method, the Aseptic Processing segment held a 53.50% market share in 2024.

- By sterilization method, the blow-fill-seal (BFS) technology segment is expected to grow at the highest CAGR of 10.10% in 2024.

- By service type, the end-to-end CDMO services segment held a 44.10% market share in 2024.

- By service type, the fill-finish only segment is expected to grow at the highest CAGR of 9.40% in 2024.

- By the molecular stage, the commercial segment led the market by holding 54.70% share in 2024.

- By molecular stage, the clinical (Phase I–III) segment is expected to grow at the highest CAGR of 8.90% in 2024.

- By client type, the large pharma companies segment led the market by holding 48.30% share in 2024.

- By client type, the biotech companies' segment is expected to grow at the highest CAGR of 9.50% in 2024.

How is Artificial Intelligence Innovating the Sterile Injectables CDMO Sector?

Artificial Intelligence (AI) is transforming the sterile injectables contract development and manufacturing organization (CDMO) sector's landscape by increasing efficiency, accuracy, and compliance. AI-based automation and predictive analysis are optimizing the production of sterile injectables while mitigating the potential for contamination and documenting consistency in product quality. For instance, in March 2025, Delpharm's recent investment of USD 60 million in its facility located in Quebec is aimed at modernizing sterile injectable drug production, incorporating state-of-the-art technology to meet robust regulatory standards.

Globally, CDMOs are also looking to innovate through AI. AI helps in speeding up the formulation part of the drug development process, including forecasting active pharmaceutical ingredients (APIs) and excipients that will remain stable with a drug formulation. The EMA and FDA are highly recommending the use of advanced manufacturing technologies for drug regulatory submissions, opening up new avenues for AI integration. The integration of AI in sterile injectables CDMO systems is a game changer, modernizing pharmaceutical manufacturing.

U.S. Sterile Injectables CDMO Market Size and Growth 2025 to 2034

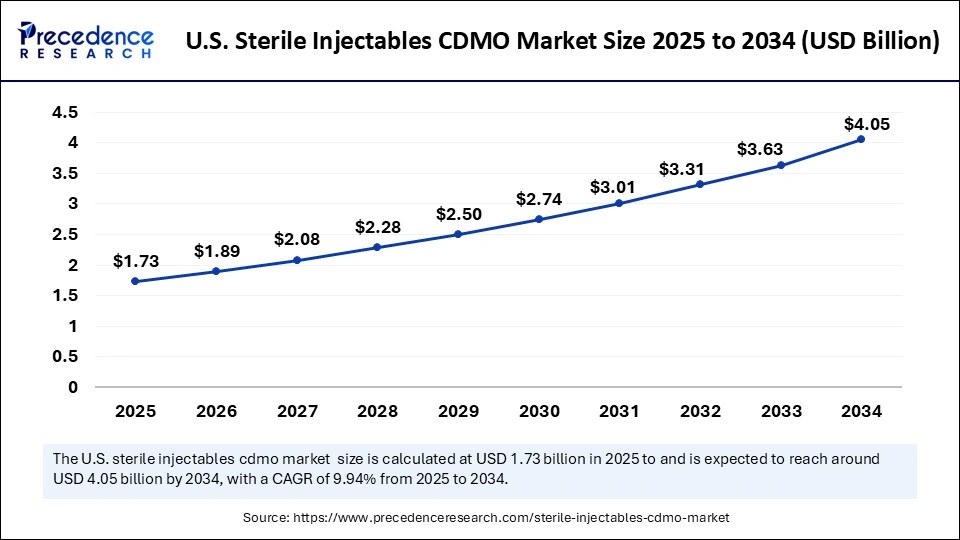

The U.S. sterile injectables CDMO market size was exhibited at USD 1.57 billion in 2024 and is projected to be worth around USD 4.05 billion by 2034, growing at a CAGR of 9.94% from 2025 to 2034.

How Does North America Dominate the Sterile Injectables CDMO Market?

North America registered dominance in the sterile injectables CDMO market in 2024 by capturing the largest revenue share of 41%. This is mainly due to the presence of leading CDMOs and a well-established integrated pharmaceutical value chain. The advanced biopharmaceutical ecosystem in North America has led to an escalating dependence on CDMO's to manage the growing complexity of injectable therapeutics (biologics, biosimilars, and high-potency drugs). A rapid increase in pressure on pharma companies to shorten time-to-market and more effectively utilize internal resources has caused a dramatic surge in outsourcing strategy, especially in sterile fill-finish services.

The U.S. is leading the charge in North America. Backed with a robust and transparent regulatory climate led by the U.S. FDA, the country is attracting more CDMOs, with no shortage of pathways for market entry and all the necessary tools for securing trust from global clients. Increasing R&D spending by pharmaceutical firms and rising clinical enrolment in injectable biologics are further fueling the growth of the market.

- In May 2025, PCI Pharma Services, a leading global contract development and manufacturing organization (CDMO), completed its acquisition of Ajinomoto Althea, Inc., a US-based sterile fill-finish CDMO and a subsidiary of Japan-based Ajinomoto Co., Inc. For PCI, the acquisition is a cornerstone of a multi-year investment strategy spanning facilities in the U.S. and Europe. The acquisition also adds highly potent vial filling with lyophilization, expanding PCI's sterile fill-finish capacity and serving as an expedient entrée into the rapidly emerging oncology modality of highly potent antibody-drug conjugates (ADCs).

(Source: https://www.businesswire.com)

What Opportunities Exist in the Asia Pacific Sterile Injectables CDMO Market?

Asia Pacific is projected to grow at a notable CAGR of 10.7% between 2025 and 2034. due to a combination of cost benefits, regulatory changes, and increasing pharmaceutical investment. Many countries are expanding their sterile manufacturing infrastructure to meet the growing demand for complex injectables, especially in oncology, immunology, and infectious diseases. In particular, the ability of the region to provide competitively priced development and manufacturing services, along with a growing base for clinical trials, has paved the way for increased outsourcing, particularly from North American and European pharmaceutical companies.

Japan is expected to have a stronghold on the market. Japan is emerging as the leading sterile injectable manufacturing hub. Japanese CDMOs are entering into partnerships with global players to expand their development and manufacturing capabilities, particularly in biologics and lyophilized injectables, which is showing the country's focus on specialty, high-margin pharmaceutical production. Furthermore, Japan's regulatory environment is aligned closely with global standards through the Pharmaceuticals and Medical Devices Agency (PMDA), which increases the ease for local Japanese CDMOs aiming to serve multinational clients. The demand for sterile injectable therapies in the country remains promoted through a rapidly aging population and increasing per capita spending on healthcare, reinforcing Japan's strategic importance in the regional CDMO market.

Market Overview

The sterile injectables CDMO market revolves around outsourcing services of sterile injectable drugs, which are produced through aseptic processing that ensures sterility. Sterile drugs are heavily utilized in treating oncological, cardiological, and infectious conditions. Contract Development and Manufacturing Organizations deliver support to pharmaceutical companies in areas such as formulation development, fill-finish operation, packaging, and regulatory assistance for a quicker and cost-effective drug commercialization process. There are various factors inciting growth in this market, such as increased requirements for injectable therapies, increased biologics development, and a growing trend for pharmaceutical companies to outsource sterile manufacturing processes.

What are the Major Growth Factors of the Sterile Injectables CDMO Market?

- Increased demand for biologics and biosimilars: The expanding pipeline of biologics and biosimilars is increasing demand for sterile injectables and subsequently, contract development and manufacturing organizations, or CDMOs, extended their capability to handle complex formulations and aseptic fill-finish services.

- Increased outsourcing by pharmaceutical companies: Pharmaceutical companies are outsourcing sterile manufacturing at a higher rate in order to minimize costs and speed up their time-to-market and in order to capitalize on defined expertise and specialized infrastructure provided by CDMOs.

- Innovation in aseptic manufacturing technologies: Innovative developments in aseptic manufacturing technologies - isolator systems, robotics, and closed-system processing - are creating improvements in sterility assurance - efficiency of production - and regulatory compliance across the other CDMO facilities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.91 Billion |

| Market Size in 2025 | USD 4.73 Billion |

| Market Size in 2024 | USD 4.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule Type, Product, Service, Therapeutic Area, Route of Administration, End-use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Shift Toward Prefilled Syringes

The increasing trend toward ready-to-use (RTU) injectables, such as prefilled syringes and single-dose vials, is driving the growth of the sterile injectables CDMO market. RTU injectables provide improved convenience, safety and accuracy over traditional vial or ampoule formats. RTU products do not require reconstitution by the clinician, which decreases the risk of a dosing error, contamination, or needle-stick injury. RTU injectables are being increasingly utilized within hospitals and home-based care environments in response to demand from patients and caregivers for easily used and convenient options to manage chronic diseases. As a result, CDMOs that can develop prefilled syringes and other RTU formats will benefit from this trend. Moreover, CDMOs are expanding their manufacturing capabilities to better meet patient demands.

- In October 2023, Vetter Pharma, a contract development and manufacturing organization (CDMO), invested about USD 243 into its new production facility in Germany to expand aseptic manufacturing capabilities.

(Source: https://www.pharmaceuticalcommerce.com)

Restraint

High Operational Costs

The sterile injectables CDMO market faces significant challenges due to high operating costs. Contract manufacturing sterile injectables require specialized facilities, equipment, and methods of quality assurance that increase the production costs of drugs. Establishing a sterile manufacturing facility requires significant investments in specialized equipment, creating barriers for new entrants. Sterile injectables manufacturing is subject to regulatory compliance, requiring significant investments in quality control measures. This further adds to operational costs and complexity. This financial burden discourages CDMOs from scaling up manufacturing.

Opportunity

Emerging Markets Open New Growth Avenues for Sterile Injectables CDMOs

Emerging markets, especially Asia Pacific and Latin America, offer major opportunities for sterile injectables CDMOs. Both regions are experiencing growth in healthcare spending, healthcare access, and prevalence of chronic diseases in exponentially higher numbers, resulting in demand for treatment products available. CDMOs with entry into these markets have an opportunity for new client bases and growth. In addition, the introduction of more sophisticated technologies, including single-use systems and advancements in digitalization, has made it possible for CDMO clients to be both more efficient and flexible, positioning the CDMO to offer the client an advantage.

Drug Type Insights

The small molecule sterile injectables segment dominated the market by holding 61.40% in 2024. The growth of the segment is attributed to the rising demand for cost-effective therapeutics. Many small-molecule-based drugs are reformulated into injectables to boost bioavailability or speed of action. The need for flexible manufacturing, especially for generic and emergency drugs, makes CDMOs important partners.

The large molecule segment is expected to grow at the highest CAGR of 9.80% in 2024. This is mainly due to the increased demand for biologics like monoclonal antibodies and recombinant proteins. Many therapies require a sterile injectable format, which drives biopharmaceutical companies to use CDMOs that possess the capabilities. As biologics continue to proliferate in therapeutic indications, CDMOs that provide support and capabilities for large molecule development and manufacturing play a crucial role in supporting the market.

Dosage Form Insights

The vials segment held a 42.60% market share in 2024. The dominance of the segment can be attributed to the surge in incidence of chronic diseases, along with the rise in demand for biosimilars and biologics in hospital settings. Countries such as China and India are witnessing increased pharmaceutical production and consumption, which leads to higher demand for vials.

The prefilled syringes segment is expected to grow at the highest CAGR of 10.20% in 2024. This is mainly due to the increased preference for ready-to-administer formats that enhance patient compliance and lower risks of contamination. Also, pre-filled syringes are useful for chronic disease management, emergency care, and self-administration, making them a favorable option for healthcare providers and patients.

Manufacturing Capabilities Insights

The aseptic fill-finish segment led the market by holding 36.80% share in 2024. The dominance of the segment can be linked to the rising demand for complex biologics, vaccines, and biosimilars, along with the innovations in fill-finish technologies. Also, Aseptic fill-finish solutions are crucial for handling smaller batch sizes required in personalized medicine.

The lyophilization segment is expected to grow at the highest CAGR of 9.70% in 2024. The growth of the segment can be driven by the rising need for complex biologics, a surge in the prevalence of chronic diseases, and innovations in lyophilization techniques. Moreover, lyophilization improves the shelf life and stability of injectable drugs, which makes them more convenient for global distribution.

Sterilization Method Insights

The Aseptic Processing segment held a 53.50% market share in 2024. The dominance of the segment is due to a rise in demand for sterile injectable drugs and innovations in biotechnology. Aseptic processing depends heavily on technologies such as single-use systems and robotics to ensure efficiency, accuracy, and safety.

The blow-fill-seal (BFS) technology segment is expected to grow at the highest CAGR of 10.10% in 2024. The growth of the segment is owing to the growing emphasis on drug quality and safety, and the growing need for sterile packaging solutions. Furthermore, advancements in BFS technology, like digitalization and automation, are improving the scalability and efficiency of the overall production process.

Service Type Insights

The end-to-end CDMO services segment held a 44.10% market share in 2024. The dominance of the segment can be attributed to the rising demand for complex biologics, gene therapies, and monoclonal antibodies. Also, a surge in the number of new drug approvals, particularly for injectables, can impact positive segment growth further.

The fill-finish only segment is expected to grow at the highest CAGR of 9.40% in 2024. The growth of the segment can be credited to the increasing incidence of chronic diseases and ongoing innovations in fill-finish technologies. The demand for faster drug action and absorption contributed to the demand for sterile injectables soon.

Molecule Stage Insights

The commercial segment led the market by holding 54.70% share in 2024. The dominance of the segment can be linked to the growing demand for injectables, especially in areas such as diabetes, oncology, and autoimmune diseases. In addition, the rise in adoption of cell and gene therapies is further boosting the segment growth.

The clinical (Phase I–III) segment is expected to grow at the highest CAGR of 8.90% in 2024. The growth of the segment can be driven by growing demand for biologics, especially in Phase I-III clinical trials. Furthermore, biologicals such as cell and gene therapies and antibody therapies are becoming rapidly prevalent in clinical development pipelines.

Client Type Insights

The large pharma companies segment led the market by holding 48.30% share in 2024. Pharmaceutical companies are actively participating in R&D activities to develop novel drugs. These companies are modernizing their portfolio and responding to the global demand for sterile injectables. By outsourcing to CDMOs, they can reduce operational costs and enhance the speed-to-market of generic and reformulation injectables.

The biotech companies' segment is expected to grow at the highest CAGR of 9.50% in 2024. This is mainly due to the increased production of biologics. Biopharmaceutical companies heavily focus on developing complex biologics, which usually require specialized sterile manufacturing. These companies typically do not have the in-house capability for aseptic processing, leading them to rely heavily on CDMOs for development. Manufacturing and regulatory compliance further encourage biopharmaceutical companies to outsource biologics manufacturing to CDMOs.

Sterile Injectables CDMO Market Companies

- Aenova Group

- Ajinomoto Bio-Pharma

- Alcami Corporation

- Baxter (Simtra BioPharma Solutions)

- Boehringer Ingelheim International GmbH

- Eurofins Scientific

- FAMAR Health Care Services

- Fareva Group

- Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG)

- IDT Biologika GmbH

- PCI Pharma Services

- Pfizer CentreOne (Pfizer Inc)

- Recipharm AB

- Siegfried AG

- Torbay Pharmaceuticals

- Unither Pharmaceuticals

- Vetter Pharma International GmbH

Latest Announcement by Industry Leader

- In July 2024, INCOG BioPharma Services, a CDMO specializing in manufacturing sterile injectables, is set to expand its production capacity. Cory Lewis, INCOG founder and chief executive, stated, “This supply chain integration is essential in accelerating a drug product to commercial launch, and even more important in today's constrained markets as the need for sterile injectable products is quickly growing to address challenging diseases and improve healthcare outcomes.”

(Source: https://www.fiercepharma.com)

Recent Development

- In January 2025, Vetter, a globally operating Contract Development and Manufacturing Organisation (CDMO), announced the development and upcoming launch of the new version of its proprietary V-OVS syringe closure system. The new closure, V-OVS next, will further advance a proprietary system with many years of proven market success supporting and differentiating a range of sterile injectables. (Source: https://pharmaceuticalmanufacturer.media)

Segments Covered in the Report

By Drug Type

- Small Molecule Sterile Injectables

- Large Molecule (Biologics/Biosimilars)

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines

- Cell & Gene Therapies

By Dosage Form

- Vials

- Liquid Vials

- Lyophilized (Freeze-dried) Vials

- Prefilled Syringes

- Ampoules

- Cartridges

- IV Bags / Infusion Bottles

- Others

By Manufacturing Capabilities

- Formulation Development

- Aseptic Fill-Finish

- Lyophilization (Freeze-Drying)

- Packaging (Primary & Secondary)

- Analytical Testing / QC / Release

- Technology Transfer & Scale-Up

By Sterilization Method

- Aseptic Processing

- Terminal Sterilization

- Blow-Fill-Seal (BFS) Technology

- Isolator Technology

- Restricted Access Barrier Systems (RABS)

By Service Type

- End-to-End CDMO Services

- Fill-Finish Only

- Formulation & Development Only

- Scale-Up & Tech Transfer

- Packaging Services

- Regulatory Support & Quality Control

By Molecule Stage

- Preclinical

- Clinical (Phase I–III)

- Commercial

By Client Type

- Large Pharma Companies

- Biotech Companies

- Generic Drug Manufacturers

- Virtual Pharma / Startups

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting