What is the Artificial Intelligence (AI) In Biopharmaceutical Market Size?

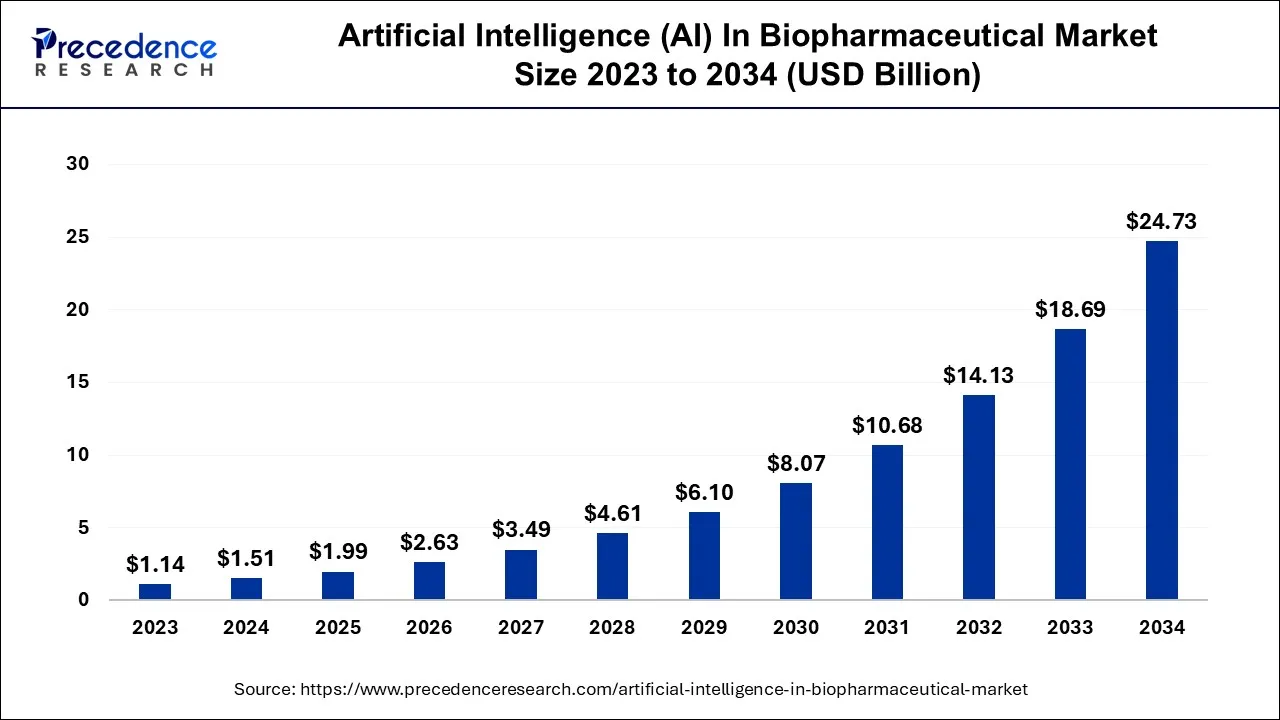

The global artificial intelligence (AI) in biopharmaceutical market size was calculated at USD 1.99 billion in 2025 and is predicted to increase from USD 2.63 billion in 2026 to approximately USD 29.78 billion by 2035, expanding at a CAGR of 31.07% from 2026 to 2035.

Artificial Intelligence (AI) In Biopharmaceutical Market Key Takeaways

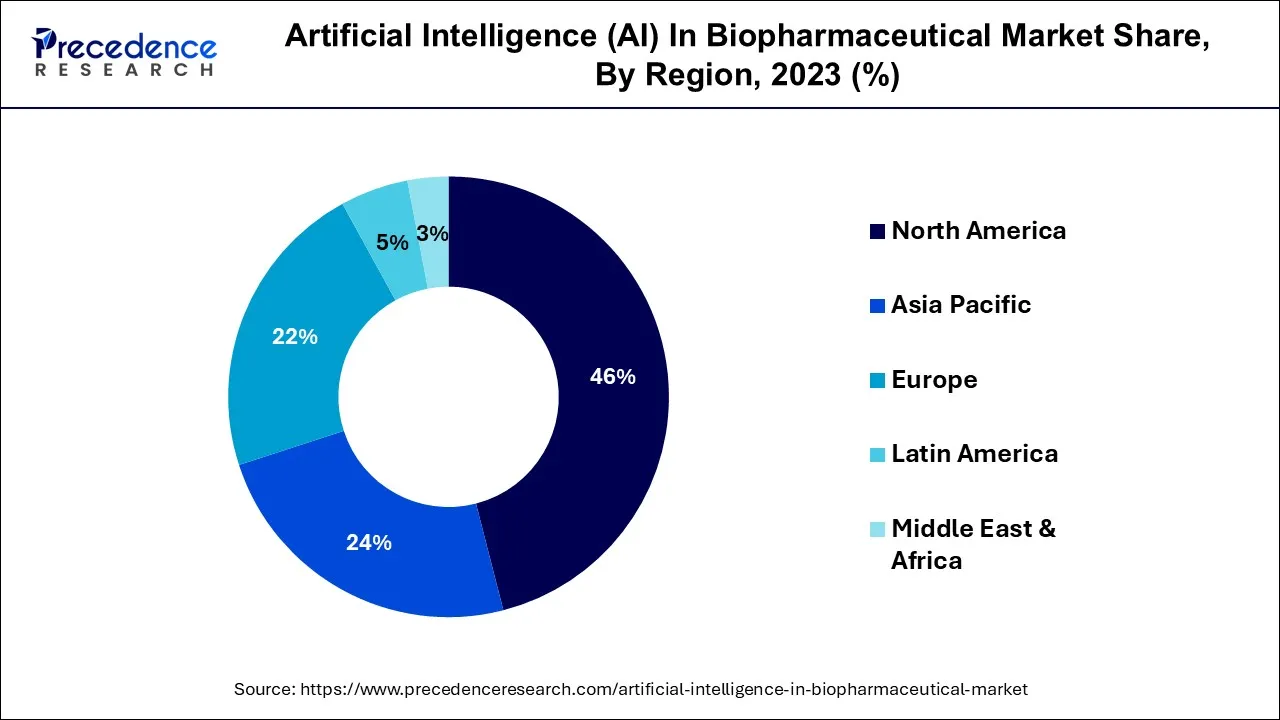

- North America contributed more than 46% of the revenue share in the artificial intelligence in the biopharmaceutical market in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By application, the drug discovery segment has held the largest market share of 35% in 2025. Whereas the research segment is anticipated to grow at a remarkable CAGR of 32.8% between 2026 and 2035.

- By technology, the natural language processing segment generated over 32% of revenue share in 2025. Meanwhile, the deep learning segment is expected to expand at the fastest CAGR over the projected period.

- By offering, the hardware segment had the largest market share of 44% in 2025. On the other hand, the service segment is expected to expand at the fastest CAGR over the projected period.

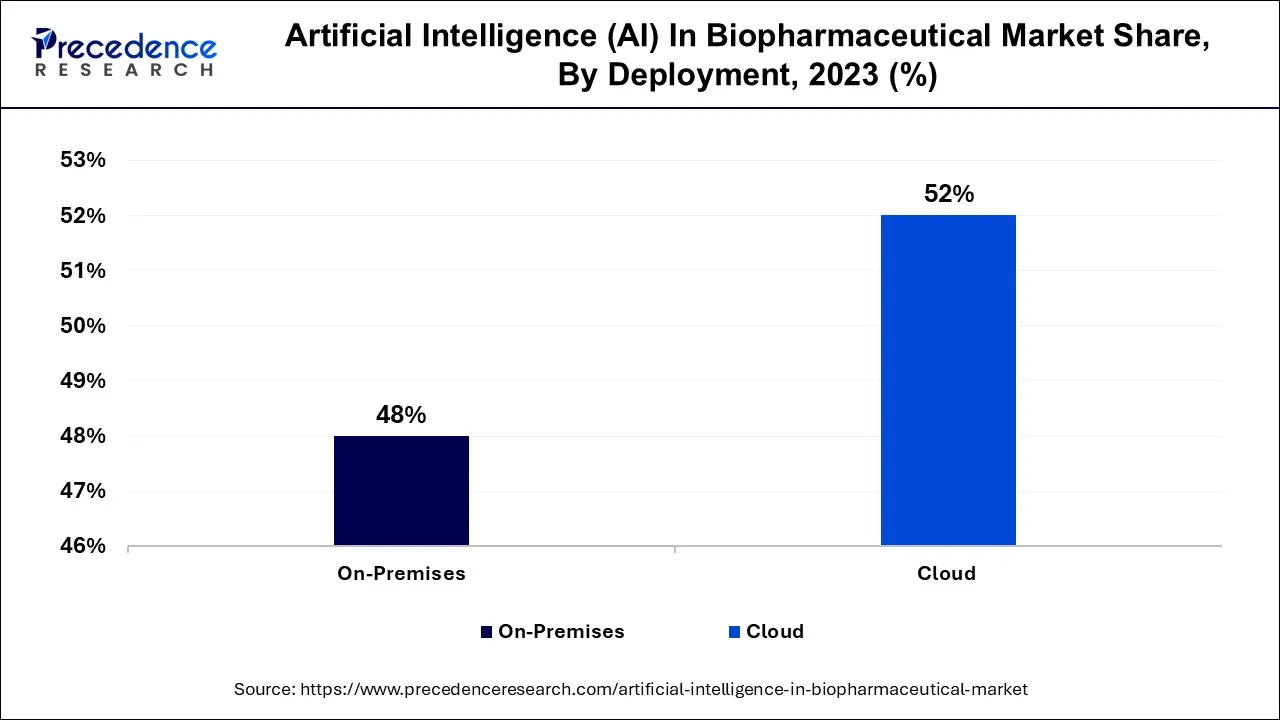

- By deployment, the cloud segment had the largest market share of 52% in 2025.

Market Overview

Artificial Intelligence (AI) within thebiopharmaceutical sectorentails the utilization of sophisticated computational methodologies and machine learning strategies to expedite the identification, development, and healthcare applications of drugs. AI facilitates the examination of extensive biological data sets, expedites the pinpointing of potential drug targets, refines the design of clinical trials, and enhances healthcare delivery by tailoring treatments to individual patients.

It enhances operational efficiency, trims expenses, and heightens the prospects for pioneering drug discoveries, ultimately resulting in more efficient treatment options, shortened developmental timelines, and improved patient outcomes in the biopharmaceutical field.

Artificial Intelligence (AI) In Biopharmaceutical Market Growth Factors

- AI orchestrates a transformation in the realm of drug discovery by swiftly processing extensive biological data sets. It enables the expeditious identification of potential drug candidates and novel molecular targets, compressing the traditional drug development timeline significantly. This acceleration is a pivotal driving force behind the pervasive adoption of AI in biopharmaceuticals. The promise of delivering life-saving treatments to patients with unprecedented celerity is a compelling motivator.

- AI empowers the creation of deeply individualized treatment strategies by leveraging genetic profiles, medical histories, and lifestyle data. This approach, coined personalized medicine, stands as a game-changing innovation. It not only amplifies treatment efficacy and minimizes adverse effects but also pioneers a new era of precision medicine. The potential to treat patients as unique entities, rather than as segments of a broader population, fuels a burgeoning demand for AI in the biopharmaceutical sector.

- AI plays an instrumental role in streamlining clinical trials. Through the enhancement of patient recruitment, real-time trial monitoring, and the prediction of patient responses, it ensures more efficient trial design and execution. Predictive analytics and data-driven insights have become indispensable tools in identifying the most promising patient subgroups, leading to substantial reductions in costs and time.

- In an era marked by stringent regulatory standards, AI helps automate data validation processes, reinforce data integrity, and elevate drug safety monitoring. Advanced machine learning algorithms excel in detecting adverse events, potential safety issues, and regulatory anomalies. This technological prowess aids biopharmaceutical companies in adhering to regulatory mandates and upholding the highest standards of patient safety.

- The escalating competition within the biopharmaceutical arena necessitates a strategic edge. AI provides a competitive advantage by augmenting R&D efficiency, truncating time-to-market, and elevating the overall quality of pharmaceutical products. Companies that invest in AI technologies position themselves to adeptly navigate the ever-evolving biopharmaceutical landscape and seize emerging opportunities. The ability to stay at the forefront of innovation and efficiency serves as the hallmark of success in this dynamic marketplace.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 31.07% |

| Market Size in 2025 | USD 1.99 Billion |

| Market Size in 2026 | USD 2.63 Billion |

| Market Size by 2035 | USD 29.78 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application, By Technology, By Offering, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Big data handling

The burgeoning volume of extensive data, commonly denoted as "big data," serves as a pivotal engine driving the impressive surge of artificial intelligence (AI) within the biopharmaceutical sphere. The inflow of copious and intricate biological and clinical datasets, encompassing genomics, proteomics, patient records, and clinical trials, has elicited a pressing demand for advanced data governance and interpretation mechanisms. AI, with its proficiency in efficiently managing, structuring, and gleaning insightful findings from these substantial and multifaceted data reservoirs, decisively meets this exigent need.

Furthermore, AI's data-guided predictions and decision support systems amplify the precision and efficiency of research and development procedures. In this data-rich landscape, AI surpasses its role as a mere tool, emerging as a transformative force that empowers biopharmaceutical entities to make data-grounded decisions, curtail expenses, hasten market penetration, and ultimately furnish more potent therapeutic solutions to patients. As the realm of big data continues its expansion, AI's significance within the biopharmaceutical sector is projected to intensify, impelling innovation and reshaping the healthcare domain.

Restraint

Regulatory hurdles and interoperability

Regulatory obstacles in the biopharmaceutical sector present a substantial impediment to the growth of Artificial Intelligence (AI). The industry's rigorous regulatory framework, particularly in pharmaceuticals, necessitates rigorous validation and the assurance of AI systems' safety, effectiveness, and adherence to regulatory standards. Demonstrating the transparency, reliability, and consistent performance of AI algorithms adds complexity to compliance endeavors. Interoperability challenges further constrain the adoption of AI in biopharmaceuticals.

Seamlessly integrating AI systems into existing infrastructure, software, and data environments proves to be a formidable task. The industry's reliance on diverse platforms and software often results in data isolation and compatibility complications. Establishing data-sharing standards and ensuring effective interfacing between AI and a variety of legacy systems are vital. These constraints collectively contribute to slower adoption, heightened compliance expenses, and difficulties in fully harnessing AI's potential to transform biopharmaceutical research, development, and patient care.

Opportunity

Enhanced drug safety

The elevation of drug safety, enabled by artificial intelligence (AI), opens an extraordinary avenue within the biopharmaceutical market. AI technologies bring a revolutionary dimension to pharmacovigilance and safety surveillance, rapidly identifying adverse events, potential safety issues, and regulatory irregularities in extensive datasets.

This proactive approach ensures the efficacy and safety of pharmaceutical products while expediting regulatory compliance and approvals. By mitigating the risks associated with drug development, AI boosts the confidence of regulatory bodies, pharmaceutical firms, and healthcare providers in the safety of new drugs, thereby expediting their market entry.

This heightened safety level also instills confidence in patients and healthcare practitioners. Consequently, AI-driven advancements in drug safety not only reduce potential liabilities but also lead to cost savings, shorter time-to-market, and the overall improvement of patient well-being, thus presenting significant prospects for AI integration in the biopharmaceutical industry.

Segment Insights

Application Insights

The drug discovery segment held 35% revenue share in 2025. The drug discovery segment commands a significant share in the artificial intelligence (AI) biopharmaceutical market due to its ability to revolutionize and expedite the drug development process. AI empowers researchers to analyze vast biological datasets, predict potential drug candidates, and optimize molecular structures, greatly reducing the time and cost involved in bringing new drugs to market.

Its precision and efficiency in target identification, hit identification, and toxicity prediction have made it an invaluable tool in biopharmaceutical research, offering the potential for breakthrough discoveries and substantial cost savings, ultimately driving its prominence in the market.

The research segment is anticipated to expand at a significantly CAGR of 32.8% during the projected period. The research segment holds a major growth in artificial intelligence (AI) in biopharmaceutical market due to its pivotal role in advancing drug discovery and development. AI empowers researchers to swiftly analyze vast biological datasets, predict drug candidates, and optimize clinical trial design.

It significantly accelerates research processes, reduces costs, and enhances the identification of potential therapeutic agents. This translates into more efficient research outcomes and, ultimately, a robust pipeline of innovative drugs. Consequently, AI's contribution to research applications remains a primary driver of its market growth in the biopharmaceutical sector.

Technology Insights

The natural language processing segment held the largest market share of 32% in 2025. The natural language processing (NLP) segment commands a significant share in the AI biopharmaceutical market due to its adaptability and broad utility. NLP excels in extracting valuable insights from vast pools of unstructured textual data, encompassing medical literature, clinical records, and research documents.

Within the biopharmaceutical realm, where data holds immense importance, NLP simplifies the process of data analysis, aids in the identification of pertinent research, and expedites the examination of scientific literature. Its contributions span drug discovery, the optimization of clinical trials, and adherence to regulatory standards. NLP's prowess in transforming textual data into actionable knowledge firmly establishes it as a cornerstone technology within the biopharmaceutical AI landscape.

On the other hand, the deep learning segment is projected to grow at the fastest rate over the projected period. Deep learning commands a significant growth in the AI biopharmaceutical market due to its exceptional ability to process and interpret intricate biological data. Its multi-layered neural networks excel at recognizing complex patterns and relationships within genomics, proteomics, and clinical data.

This technology empowers drug discovery, patient stratification, and treatment optimization by extracting actionable insights from vast datasets. Deep learning's versatility in image analysis, natural language processing, and predictive modeling further solidifies its dominance, enabling biopharmaceutical companies to make data-driven decisions, expedite research, and enhance the overall efficiency and effectiveness of drug development and patient care.

Offering Insights

In 2025, the hardware segment had the highest market share of 44% on the basis of the offering. The hardware segment holds a significant share in the artificial intelligence (AI) in biopharmaceutical market primarily due to the robust computational requirements of AI applications. AI in biopharmaceuticals demands powerful hardware infrastructure, including high-performance GPUs and processors, to handle the immense computational workloads required for data analysis, deep learning, and complex simulations.

This hardware ensures the rapid processing of extensive biological data, enabling quicker drug discovery and optimizing research efforts. Moreover, as AI continues to advance, there is a continuous need for more sophisticated hardware solutions, solidifying the hardware segment's substantial presence in the AI-driven biopharmaceutical market.

The services segment is anticipated to expand at the fastest rate over the projected period. The service segment holds a substantial growth in the artificial intelligence (AI) in biopharmaceutical market due to its essential role in providing tailored AI solutions and support to biopharmaceutical companies. AI implementation necessitates specialized expertise, data analysis, model development, and ongoing maintenance.

Service providers offer consultancy, custom AI development, and data analysis, enabling biopharmaceutical firms to harness the full potential of AI without developing these capabilities in-house. This cost-effective and efficient outsourcing of AI services empowers companies to expedite drug discovery, optimize clinical trials, and enhance patient care, driving the significant share of the service segment in the market.

Deployment Insights

In 2025, the cloud segment had the highest market share of 52% on the basis of deployment. The cloud segment commands a significant growth in the Artificial Intelligence (AI) in the biopharmaceutical market primarily due to its scalability and accessibility. Cloud-based AI solutions offer biopharmaceutical companies the flexibility to access powerful computational resources without heavy upfront investments. This scalability is crucial for handling large datasets and complex AI algorithms in drug discovery and research.

Additionally, the cloud facilitates collaborative research and data sharing among geographically dispersed teams, a vital aspect in the biopharmaceutical field. Its cost-effectiveness, ease of maintenance, and potential for real-time updates make cloud deployment the preferred choice for AI applications in biopharmaceuticals.

The on-premises segment is anticipated to expand at the fastest rate over the projected period. Data sensitivity and regulatory compliance in the biopharmaceutical sector necessitate localized data storage and control, which on-premises deployment offers. Second, the industry's longstanding emphasis on data security and privacy favors on-site solutions. Third, on-premises deployments provide greater customization and integration capabilities with existing infrastructure. Finally, they offer more control over AI algorithms and data handling, vital for addressing unique biopharmaceutical challenges. These factors make on-premises deployments the preferred choice for biopharmaceutical companies seeking to leverage AI while ensuring data security and compliance.

Regional Insights

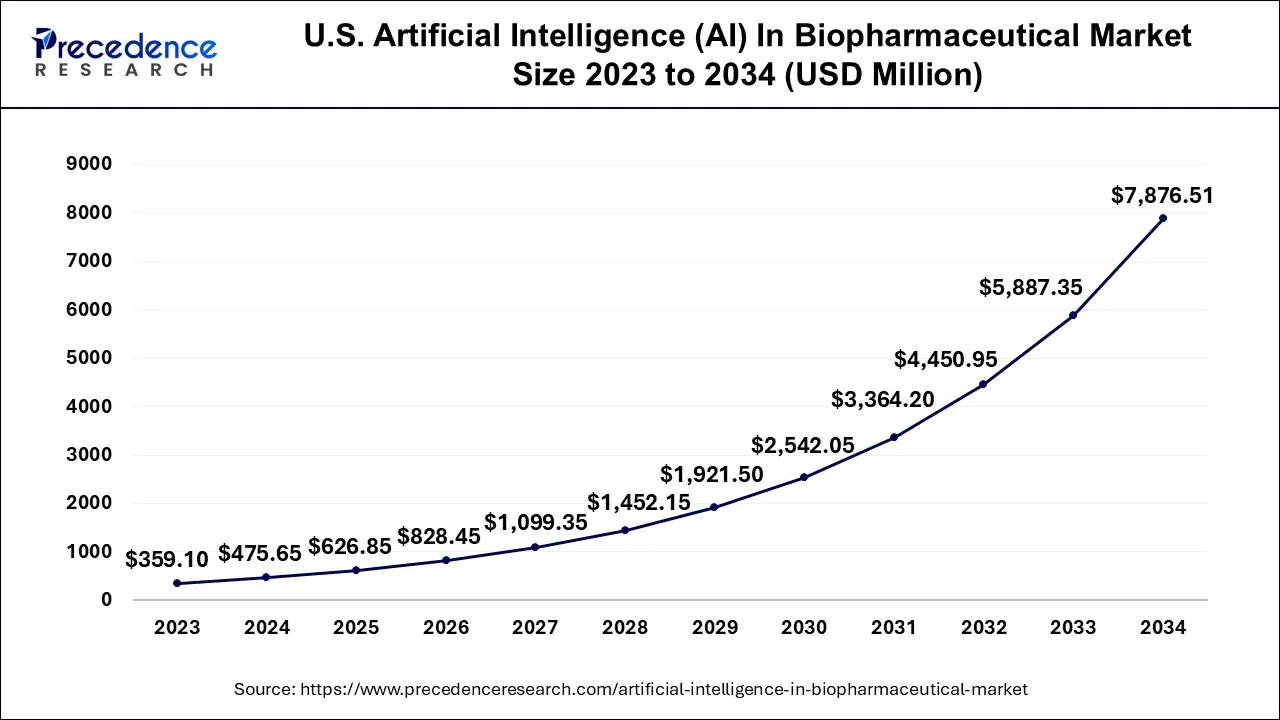

U.S. Artificial Intelligence (AI) In Biopharmaceutical Market Size and Growth 2026 to 2035

The U.S. artificial intelligence (AI) in biopharmaceutical market size accounted for USD 626.85 million in 2025 and is projected to be worth around USD 9,497.16 million by 2035, poised to grow at a CAGR of 31.23% from 2026 to 2035.

U.S. Artificial Intelligence (AI) in Biopharmaceutical Market Analysis

The market in the U.S. is growing due to increasing adoption of AI-driven solutions for drug discovery, development, and personalized medicine, which help reduce R&D costs and accelerate time-to-market. Rising demand for biologics, growing investment in advanced healthcare technologies, and the integration of AI with big data and genomics are further driving market expansion. Additionally, U.S. biopharma companies are leveraging AI for predictive analytics, clinical trial optimization, and process automation, enhancing efficiency and innovation in therapeutic development.

What Makes North America the Leading Region in the Market?

North America has held the largest revenue share 46% in 2025. North America leads theartificial intelligence (AI) in the biopharmaceutical market due to a combination of factors. Firstly, the region comprises a robust healthcare infrastructure and significant investments in AI research and development. Secondly, North America has a thriving biopharmaceutical industry, attracting both established companies and startups that are keen on integrating AI for drug discovery and personalized medicine.

Thirdly, the presence of world-renowned universities and research institutions fosters innovation and AI talent. Lastly, a supportive regulatory environment and substantial funding opportunities further drive AI adoption in the biopharmaceutical sector, solidifying North America's dominant market position.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific's significant foothold in the artificial intelligence (AI) biopharmaceutical market is underpinned by several pivotal factors. The region enjoys a swiftly expanding biopharmaceutical sector marked by increasing investments in research and development endeavors. Its sizeable patient population, coupled with growing healthcare demands, creates a robust appetite for AI-powered solutions, particularly in the realm ofpersonalized medicine.

Moreover, supportive governmental policies and a surge in collaborations with AI technology providers foster an environment of innovation and widespread adoption. Furthermore, the region's cost-effective operational environment and the thriving pool of AI and biopharmaceutical research talent consolidate its position as a key influencer in this dynamically evolving market.

India Artificial Intelligence (AI) in Biopharmaceutical Market Analysis

The market in India is growing due to increasing investments in biopharma R&D, rising demand for cost-effective drug discovery, and government initiatives supporting digital health and AI adoption. The integration of AI with big data, genomics, and predictive analytics is helping Indian companies accelerate clinical trials, optimize drug development, and improve personalized medicine. Additionally, partnerships with global AI solution providers and a growing pool of skilled tech talent are driving the adoption of AI technologies across the Indian biopharmaceutical sector.

How is the Opportunistic Rise of Europe in the Artificial Intelligence (AI) in Biopharmaceutical Market?

Europe is experiencing an opportunistic rise in the market due to strong regulatory support, robust R&D initiatives, and advanced clinical trial infrastructure that encourage the adoption of AI technologies. The region's focus on operational efficiency and innovation is further boosted by strategic investments, such as the €1 billion AI strategy launched by the European Commission in October 2025, aimed at accelerating AI adoption across industries and scientific research. These factors position Europe as a key growth hub for AI-driven drug discovery, development, and personalized medicine solutions.

What Potentiates the Artificial Intelligence (AI) in Biopharmaceutical Market within Latin America?

The market in Latin America is being potentiated by a growing demand for advanced drug discovery and personalized medicine, coupled with increasing investments in healthcare digitalization and AI technologies. Rising prevalence of chronic diseases and expanding clinical research initiatives are driving biopharma companies to adopt AI for efficient R&D, predictive analytics, and optimized clinical trials. Additionally, partnerships with global AI solution providers and improving regulatory support for innovative technologies are creating significant growth opportunities across the region.

What Opportunities Exist in the Middle East & Africa for the Artificial Intelligence (AI) in Biopharmaceutical Market?

The Middle East & Africa (MEA) presents immense opportunities in the market, driven by government-backed digital health initiatives, national AI strategies, and growing investments in healthcare innovation, particularly in the UAE, Saudi Arabia, and South Africa, which are expanding AI use in drug discovery, clinical trials, and precision medicine. Regional collaborations between biotech firms and technology partners, such as sovereign fund partnerships to accelerate AI‑based drug development, are helping build biotech hubs and research infrastructure, creating new avenues for advanced therapeutics and IP development.

Artificial Intelligence (AI) in Biopharmaceutical Market Companies

- IBM Watson Health

- Google Health

- NVIDIA Corporation

- Microsoft Healthcare

- DeepMind

- Atomwise

- Insilico Medicine

- PathAI

- Tempus

- GNS Healthcare

- OWKIN

- Cloud Pharmaceuticals

- Numerate

- Recursion Pharmaceuticals

- Healx

Recent Developments

- In March 2025, Google Health announced the launch of new AI models for drug discovery. (Source: pharmaphorum.com)

- In August of 2023, Eli Lilly and Company disclosed a collaboration with BenevolentAI with the objective of creating novel pharmaceuticals for neurodegenerative ailments. This partnership will harness BenevolentAI's advanced AI platform to sift through extensive biomedical datasets for the discovery of fresh drug targets and the formulation of innovative drug candidates.

- In July 2023, Insilico Medicine declared a groundbreaking development through its AI-driven drug discovery platform. It successfully pinpointed a new drug prospect for addressing Alzheimer's disease. Presently, this promising drug candidate is undergoing preclinical testing, raising anticipation for potential breakthroughs in Alzheimer's treatment.

Segments Covered in the Report

By Application

- Drug Discovery

- Precision Medicine

- Medical Imaging & Diagnostics

- Research

By Technology

- Machine Learning

- Natural Language Processing

- Deep Learning

- Others

By Offering

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-Premises

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting