IV Bags Market Size and Forecast 2025 to 2034

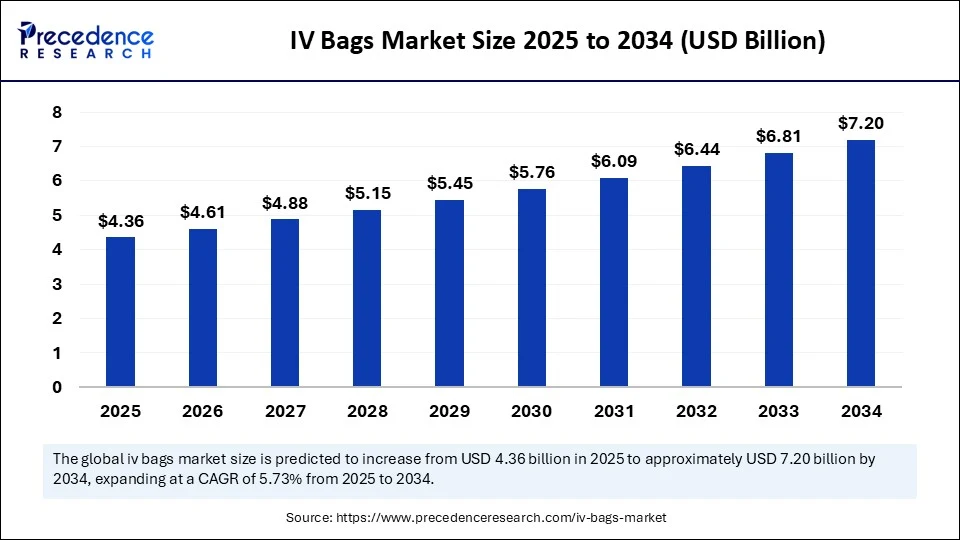

The global IV bags market size was calculated at USD 4.13 billion in 2024 and is predicted to increase from USD 4.36 billion in 2025 to approximately USD 7.20 billion by 2034, expanding at a CAGR of 5.73% from 2025 to 2034. The IV bags market is seen to reach milestones with the emergence of environmentally friendly material in the sector.

IV Bags Market Key Takeaways

- In terms of revenue, the global IV Bags market was valued at USD 4.13 billion in 2024.

- It is projected to reach USD 7.20 billion by 2034.

- The market is expected to grow at a CAGR of 5.73% from 2025 to 2034.

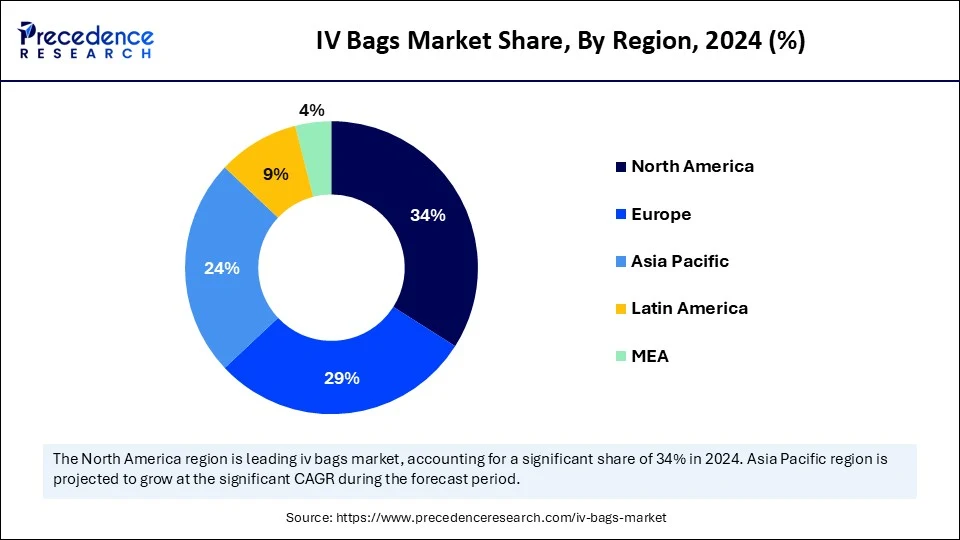

- North America dominated the global market with the largest market share of 34% market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 940% during the period.

- By material type, the PVC IV bags segment captured the biggest market share of 46% in 2024.

- By material type, the non-PVC segment is observed to experience the fastest CAGR of 11.60% during the forecast period.

- By product type, the single chamber segment held the highest market share of 72% in 2024.

- By product type, the dual chamber bags segment is expected to grow at the CAGR of 10.20% during the forecast period.

- By usage type, single use IV bags segment contributed the maximum market share of 93% in 2024.

- By end user, the public hospitals segment accounted for the major market share of 38% of market share in 2024.

- By end user, the home healthcare segments segment is expected to grow at a solid CAGR of 11.10% during the forecast period.

- By distribution channel, the government and institutional tenders segment generated the highest market share of 40% in 2024.

- By distribution channel, the online B2B medical platforms segment is projected to grow at a solid CAGR of 12.90% during the forecast period.

What is the Impact of AI in the IV Bags Sector?

Artificial intelligence continues to reshape the IV bags market in subtle yet significant ways. The biggest role of AI is the manufacturing domain, including quality control and supply chain management. AI driven predictive analytical tools are helping manufacturers optimize material selection, reduce defects and ensure the sterility standards are always met with. Since IV bags must be free from any contamination, AI powered inspection systems are now able to detect micro leaks, air bubbles or other irregularities that can potentially be invisible to the naked eye. This not only helps improve patient safety but also minimizes product recalls, which can be costly.

In the supply chain management domain, AI models are being used to forecast demand patterns depending on hospital usage rates, disease prevalence and seasonal outbreaks. This has especially become valuable after the Covid-19 outbreak as companies want to proactive manage their inventory and avoid bottlenecks. These tools also help distributers plan optimal delivery routes for IV bags, ensuring timely delivery and care, further optimizing logistics.

Another area where AI is driving innovation is the creation of smart IV bags. Several companies are investing in research and development facilities in order to embed sensors with AI integration into IV bags. This can help hospitals and healthcare establishments to monitor fluid levels, flow rate and even contaminations in real time. Such smart IV bags can transform patient monitoring and reduce the reliance on manual check. This would be highly beneficial for patients who are chronically ill and receive home based care. Based on all these factors, we can see how AI is making its mark in various sectors, becoming a critical ally of the healthcare industry.

U.S. IV Bags Market Size and Growth 2025 to 2034

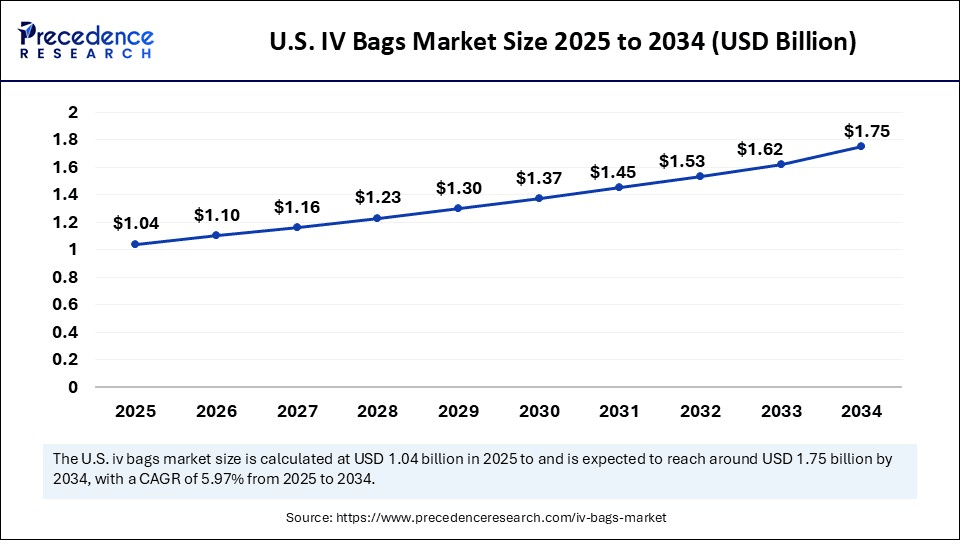

The U.S. IV bags market size was evaluated at USD 0.98 billion in 2024 and is projected to be worth around USD 1.75 billion by 2034, growing at a CAGR of 5.97% from 2025 to 2034.

The North American region commands the IV bags market with the highest share. This region also encompasses the United States, as the North American region has developed healthcare infrastructure. In addition, a huge number of chronic diseases have been increasing in this region. Moreover, their expenditure on healthcare was significant. The region is supported by well-established healthcare infrastructure, strong regulatory frameworks promoting non-PVC alternatives, and high hospital admission rates, especially in the U.S., which continues to adopt advanced medical delivery systems and eco-friendly materials.

U.S. IV Bags Market Trends

The U.S. IV bags market captured the largest revenue share in 2024 within the region of North America. This dominance is driven by the country's robust healthcare infrastructure, advanced research and development institutions and a high demand for sterile, contamination-free IV solutions. The post pandemic times have encouraged the country to optimize health systems and domestic sourcing. The FDA has also been actively monitoring the industry in order to fill up gaps.

Another important shift is the growing acceptance towards non-PVC and DEHP-free materials, supported by FDA guidelines and hospital sustainability initiatives. In addition, the rising number of chronic disease cases, surgical procedures and a growing geriatric population is further contributing to the expanded use of IV bags across all hospital and outpatient care settings. Major players like Baxter, ICU Medical and Fresenius Kabi have been strengthening their presence in the U.S by investing in new product lines and expanding collaborations with healthcare systems. Collectively, these developments highlight how the country has strategically positioned itself as a leading force in today's IV bags market.

The Asia-Pacific empty IV bags market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, due to rapid healthcare infrastructure development, rising surgical procedures, and the expansion of medical tourism. Countries such as China, India, and Japan are leading regional growth through increased public health investments and the push for domestic manufacturing. Demand is also fueled by the need for cost-effective, sterile, and safe IV solutions across both urban and rural healthcare settings. Countries like Japan and India supported by the country's large population, increasing healthcare access, and government-led initiatives to improve hospital infrastructure. The shift towards affordable, locally produced non-PVC IV bags is gaining pace, particularly in urban hospitals and clinics.

Market Overview

IV bags are medical grade products that are used to transfer liquid substances, minerals and vitamins directly into veins. These IV bags meet various medical requirements, such as preserving capacity, sterilization, transportation and handling needs. The IV Bag Market is set to witness significant growth over the forecasted years, driven by increasing demand for intravenous therapy across healthcare sectors as well as the rise in chronic diseases, growing surgical procedures, and the increasing use of IV therapy in treating dehydration, malnutrition, and electrolyte imbalances.

The IV bags industry is undergoing a transformative shift that is redefining the supply chain architectures and product design practices. Advances in manufacturing technologies have accelerated the adoption of automated sterile filling lines, which has led to decreasing contamination and increasing throughput. At the same time, regulatory bodies worldwide are tightening guidelines on plasticizers in medical plastics, compelling manufacturers to shift from PVC toward non-PVC alternatives in order to align with global environmental views.

What are the Key Trends in the IV Bags Market?

- Increasing Demand in Healthcare for IV Therapy: One of the major developments in the IV bag industry is the increase in the requirement of advanced IV therapy within hospitals, clinics and home-based healthcare. Patients with a low capability of delivering fluids, medicine or other nourishments orally find IV bags a necessity. This is mainly due to the high demand in hydrating practices, reducing pain and cancer treatment due to growing rates of conditions such as diabetes, cancer and renal disorders.

- Shifting towards Eco-Friendly IV Bags: Environmental issues and government regulations have enabled the medical sector to change their IV bag manufacturing techniques into something that is eco-friendly and safe. PVC IV bags are infused with the plasticizer DEHP, which can be a health risk via toxicity and endocrine disruption. Many drug manufacturers and hospitals are adopting non-PVC IV bags made of polypropylene, polyethylene and ethylene-vinyl acetate. These substitute frameworks possess great biocompatibility, reduce negative environmental effects and meet global health and safety regulations. Additionally, various regulatory agencies and healthcare organizations prefer the utilization of recyclable and BPA-free IV bags to further reduce medical waste.

- Rising Demand for Intravenous Therapy: The increasing prevalence of chronic diseases and health conditions such as diabetes, cancer and gastrointestinal disorders is driving the demand for IV therapy globally. With the number of hospital admissions on the rise, particularly among the aging population, healthcare facilities are increasingly relying on intravenous therapies as a critical component of patient treatment plans. Furthermore, as outpatient care becomes more prevalent and home healthcare options expand, the need for portable and efficient IV bags is likely to escalate, further accelerating market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.20 Billion |

| Market Size in 2025 | USD 4.36 Billion |

| Market Size in 2024 | USD 4.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Product Type, Usage Type, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for outpatient care services

The global shift towards outpatient care and home healthcare services is a key driver for the IV Bag Market. With more patients opting for treatments outside traditional hospital settings, the demand for portable and user-friendly IV bags is expected to rise significantly over the forecast years. This trend is further driven by lifestyle changes, advancements in technology and the desire for creating more patient-focused care solutions. The ability for patients to receive IV therapies at home not only enhances convenience but also reduces healthcare costs, pushing the market even more. As the global population is aging rapidly, it increases the chances of diseases and frequent IV treatments both in home care settings and hospitals, thus increasing the demand for IV bags.

Restraint

Concerns associated with material

Despite several growth opportunities, the market also has its fair share of challenges. Traditionally, IV bags are manufactured out of polyvinyl chloride, which is a non-biodegradable material that creates a lot of medical waste. The cost of creating high-quality, sterile IV bags is challenging as it must pass stringent safety standards. The volatility of raw material prices, especially for PVC and other polymers also impacts the market. This poses as a challenge for market growth, especially in developing and under developed countries. Additionally, regulations concerning medical devices are stringent and differ from region to region. Meeting FDA standards all over the world impacts the development cycle and often makes onboarding expensive for new entrants, thus slowing down market entry.

Opportunity

Rising investments in green product solutions

The IV bags market is full of opportunities as the global healthcare ecosystem keeps evolving every day. We can see an increased investments in green IV bags due to policies rolled out by the U.S. FDA have pushed manufacturers to seek safer alternatives. The production of multi-chamber IV bags, as well as those with better temperature controls, is now made possible by advances in technology in order to effectively enhance treatment. Manufacturers are focusing on developing advanced IV bags that offer enhanced functionality such as anti-reflux systems, smart IV bags equipped with sensors and customizable dosing options. These technological improvements not only ensure better patient safety but also allow for more efficient drug delivery methods. As the industry evolves, healthcare providers are increasingly adopting these advanced IV solutions to streamline processes and improve treatment efficacy.

Material Type Insights

The polyvinyl chloride (PVC) segment held a dominant presence in the IV bags market in 2024. PVCs are the most preferred material for manufacturing IV bags since they are proven to be the most reliable and cost-effective material. They are also free from particulate contamination, micro-organisms and pyrogens. The material is also transparent, flexible, light and impact-resistant, making it durable, water-tight and easily sterilizable.

The non-PVC segment is witnessing the fastest growth in the IV bags market over the forecast period. This is because the choice of material is highly essential as it directly impacts the health of the patient. It is important to choose a material that is lightweight, transparent and durable, facilitating easy handling, transportation and storage.

Product Type Insights

The single chamber segment held the largest share of the IV bags market in 2024. Single chamber IV bags precisely deliver a single IV fluid to the patient. Such type of chamber ensures consistent and controlled fluid delivery. It is widely preferred to store and deliver a single type of medication or fluid. It also minimizes the risk of contamination through any micro-organisms or foreign particles by providing a sterile and latex-free environment.

They are generally applied in hydration therapy, electrolyte replacement and medication administration. Single chamber bags are preferred by hospitals and healthcare institutions for their easy design, less chance of contamination and usability with various IV solutions. Moreover, companies are also innovating with PVC-free products, trying to align with environmental and safety standards while continuing to lead the market.

The dual chamber is observed to be the fastest growing segment in the IV bags market during the predicted timeframe. This growth is fueled by the rising demand for drug delivery systems, especially when talking about complex therapies that require the mixing of two components just before administration. These types of bags are especially important in oncology, parenteral nutrition and specialized treatments as maintaining drug stability is a vital factor. The surge in personalized medicine and biologics are also pushing this segment forward, allowing for more precise dosing and efficacy.

Usage Type Insights

The single use IV bags segment held the dominant share in the market in 2024; the segment is even predicted to maintain the position during the forecast period. its dominance is due to its widespread adoption across hospitals, clinics and emergency care settings. These types of bags are preferred because of their convenient nature and sterility, hence minimizing the risks of cross contamination or hospital acquired infections. They are also aligned with healthcare and safety regulations that emphasize on infection control, making them a standard choice in all global healthcare systems. Furthermore, their affordability and large-scale production processes further strengthen their position in the market.

Another segment that is growing significantly is the reusable IV bags. Although they hold a smaller market share, they are slowly gaining traction due to increasing awareness about medical waste and the environmental impact of single use plastics. Technological advancements in material sciences are also supporting the segment's growth and development as many companies have begun developing durable, sterile and biocompatible materials that can withstand repeated use.

End User Insights

The public hospitals segment led the market with the largest share in IV bags market in 2024. This is because hospitals are the primary point of care for administering IV doses. They cover everything from administering therapies to blood transfusions. They also witness the highest patient inflow, which in turn drive up the demand for IV bags. Additionally, medical treatments require close medical supervision, skilled personnel and multidisciplinary care, all of which hospitals are equipped to provide. This helps ensure a patient's safety as well as adherence to medical protocols.

The home healthcare is seen to be the fastest growing segment during the forecast period. The rising cases of diseases such as diabetes, cancer and renal disorders coupled with the growing shift towards outpatient and home-based care has accelerated the demand for IV bags outside traditional hospital environments. This is beneficial for patients who cannot travel regularly for treatment and are chronically ill. It also eases the pressure of overcrowding in hospitals for patients and families, making treatment comfortable and safe.

Distribution Channel Insights

Government and Institutional tenders dominated the IV bags market in 2024. Large scale procurement through tenders helps ensure uninterrupted supply to public hospitals, military healthcare facilities and other government run institutions. These tenders are often negotiated on a national or regional level, thus making it cost effective due to bulk purchasing. Governmental institutions also use this channel to secure critical or emergency health supplies during health crisis or natural disasters, ensuring equitable access across healthcare systems.

Online B2B medical platforms are the fastest growing segment during the predicted timeframe. Rapid digitization is reshaping how hospitals, clinics and other healthcare facilities source their IV bags. Online platforms such as MedikaBazaar, AliBaba Health and other regional B2B platforms are frequently used to purchase necessary products. These platforms also allow small scale healthcare providers and private clinics to access high quality IV bags at competitive prices. The advantage of this segment lies in its fast delivery and efficient supply chain logistics.

Value Chain Analysis

- Raw materials and suppliers

The value chain begins with the sourcing of raw materials that providers supply for IV bag production. Traditionally, IV bags are made using PVC combined with plasticizers like DEHP. However, due to growing environmental concerns and stringent regulations, there has been a major shift towards more environmentally friendly, PVC free alternatives such as Polypropylene and Polyethylene. This stage is vital because the performance, safety and flexibility of the IV bag completely depends on the composition of these raw materials.

Key players: SABIC, BASF, LG Chem, Mitsui Chemicals

- Manufacturing and Production

In this stage, raw materials are processed into sterile, ready to use IV bags. These bags go through extrusion, molding, sterilization and sealing processes. Manufacturers also innovate with multi chamber IV bags for parenteral nutrition and chemotherapy. Strict regulatory bodies such as the FDA and EMA govern this stage as quality control is critical. In addition to this, manufacturers are also investing in automation and regional production hubs in order to reduce costs and minimize disruptions.

Key players: Pfizer, Baxter International, ICU Medical, Fresenius Kabi

- Distribution and Logistics

In this stage, IV bags are distributed through specialized healthcare logistics networks. This stage is sensitive as IV bags must remain sterile, safe and even temperature controlled in some cases. Distributers are increasingly adopting digital supply chain tools, AI based demand forecasting and blockchain tracking to ensure uninterrupted availability. This in turn, helps manufacturers secure government contracts with large hospital tenders.

Key players: Cardinal Health, McKesson, Medline Industries

IV Bags Market Companies

- Medline Industries

- Eastman Kodak

- Baxter International

- Fresenius Kabi

- B. Braun Melsungen

- McKesson

- IVEN Pharmatech

- Cardinal Health

- Terumo Corporation

- Sutron

- Kanghong Pharmaceutical

- Mountainside Medical Equipment

- Renolit, Angiplast Pvt. Ltd

- Sippex IV Bag

- ICU Medical, Inc.

Recent Developments

- Freeflex has introduced a line of IV bags that are made entirely without PVC or DEHP. These bags are highlighted for minimizing patient exposure to toxic plasticizers and offer a versatile clinical use across hospital care. These bags are made from a low density polyethlene (LDPE), made from medical grade imported granules.

- In May 2024, India Life Sciences Fund and Morgan Stanley PE contributed over Rs 1,000 crore to Maiva Pharma. This was Maiva's first private equity fundraising campaign and was utilized to establish a new manufacturing facility close to Hosur, Karnataka, which will produce sterile dosage forms, including bags, pre-filled syringes, oncology and even hormonal injectables.

Segments Covered in the Report

By Material Type

- PVC (Polyvinyl Chloride) IV Bags

- Non-PVC IV Bags

- Polypropylene (PP) IV Bags

- Ethylene Vinyl Acetate (EVA) IV Bags

- Polyethylene (PE) IV Bags

- Polyolefin IV Bags

By Product Type

- Single Chamber IV Bags

- Dual Chamber IV Bags

- Triple/Multi-Chamber IV Bags

By Usage Type

- Single-Use (Disposable) IV Bags

- Reusable IV Bags

By End User

- Public Hospitals

- Private Hospitals

- Clinics & Physician Offices

- Ambulatory Surgical Centers (ASCs)

- Long-Term Care Centers

- Home Healthcare Settings

- Military & Field Emergency Units

By Distribution Channel

- Government & Institutional Tenders

- Group Purchasing Organizations (GPOs)

- Pharmaceutical & Medical Distributors

- Direct Hospital Supply Contracts

- Online B2B Medical Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting