Cardiac Biomarkers Market Size and Forecast 2025 to 2034

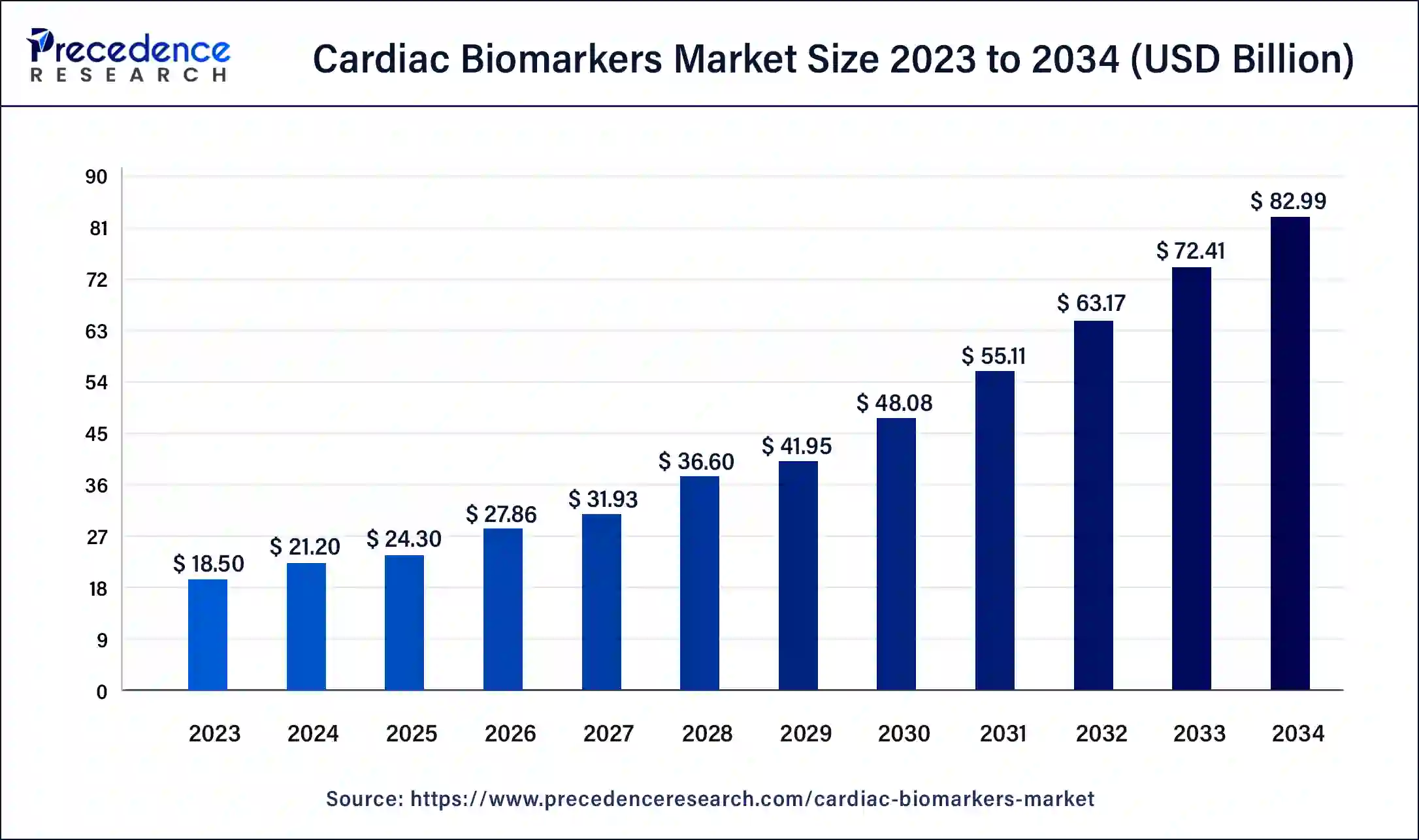

The global cardiac biomarkers market size was estimated at USD 21.20 billion in 2024 and is predicted to increase from USD 24.30 billion in 2025 to approximately USD 82.99 billion by 2034, expanding at a CAGR of 14.62% from 2025 to 2034. The rising demand for adequate diagnosis and monitoring of heart attack, stroke, or any heart disease is projected to accelerate the growth of the cardiac biomarkers market.

Cardiac Biomarkers Market Key Takeaways

- In terms of revenue, the market is valued at $24.30 billion in 2025.

- It is projected to reach $82.99 billion by 2034.

- The market is expected to grow at a CAGR of 14.62% from 2025 to 2034.

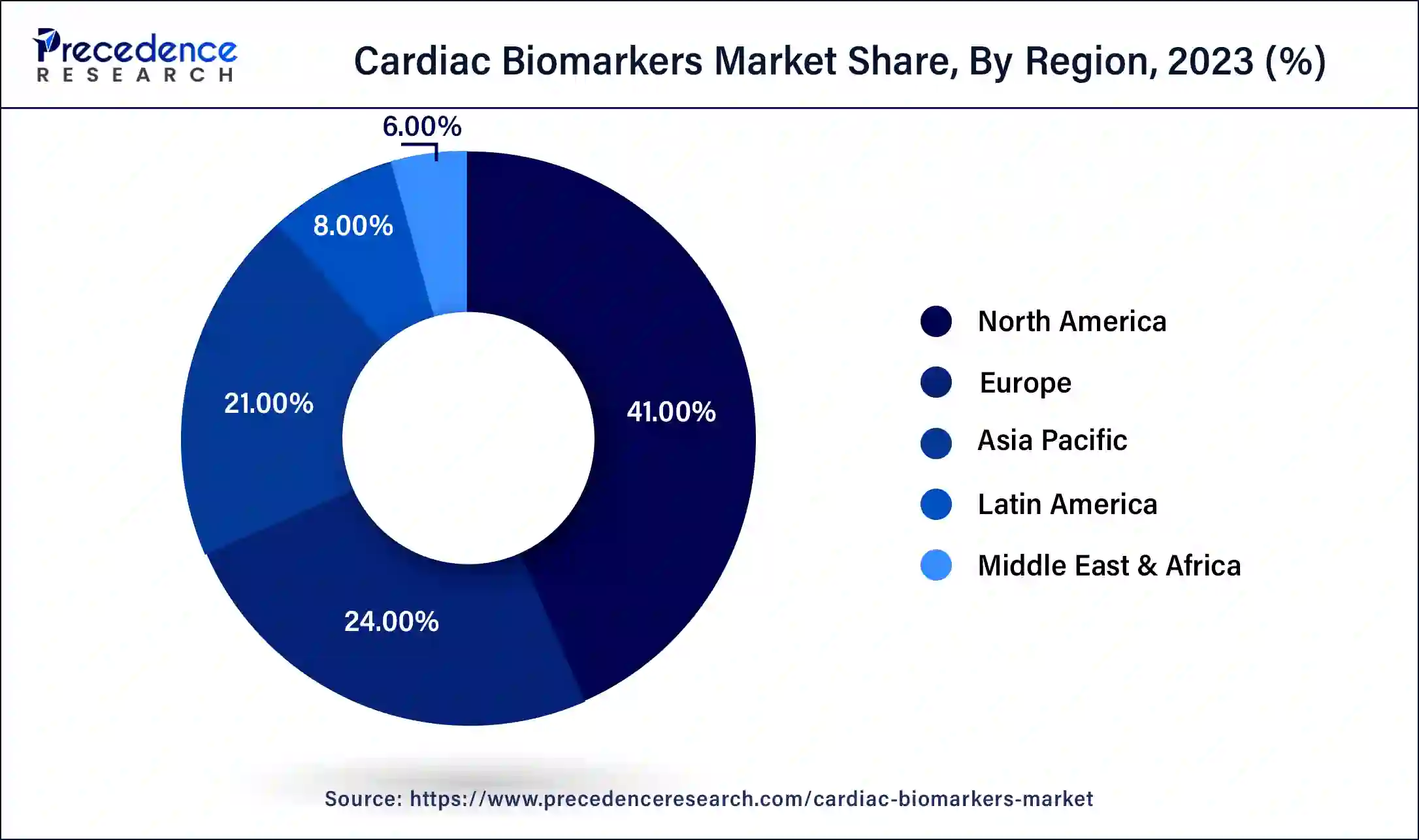

- North America dominated the cardiac biomarkers market with the largest market share of 41% in 2024.

- Asia Pacific is expected to grow at a double digit CAGR of 16.02% during the forecasted years.

- By type, the troponin segment contributed the biggest market share of 34% in 2024.

- By type, the BNP and NT-proBNP segment is expected to grow at the fastest rate in the market over the forecast period.

- By application, the acute coronary syndrome segment accounted for the largest market share of 56% in 2024.

- By application, the other segment is expected to grow at a notable CAGR of 15.52% during the forecasted years.

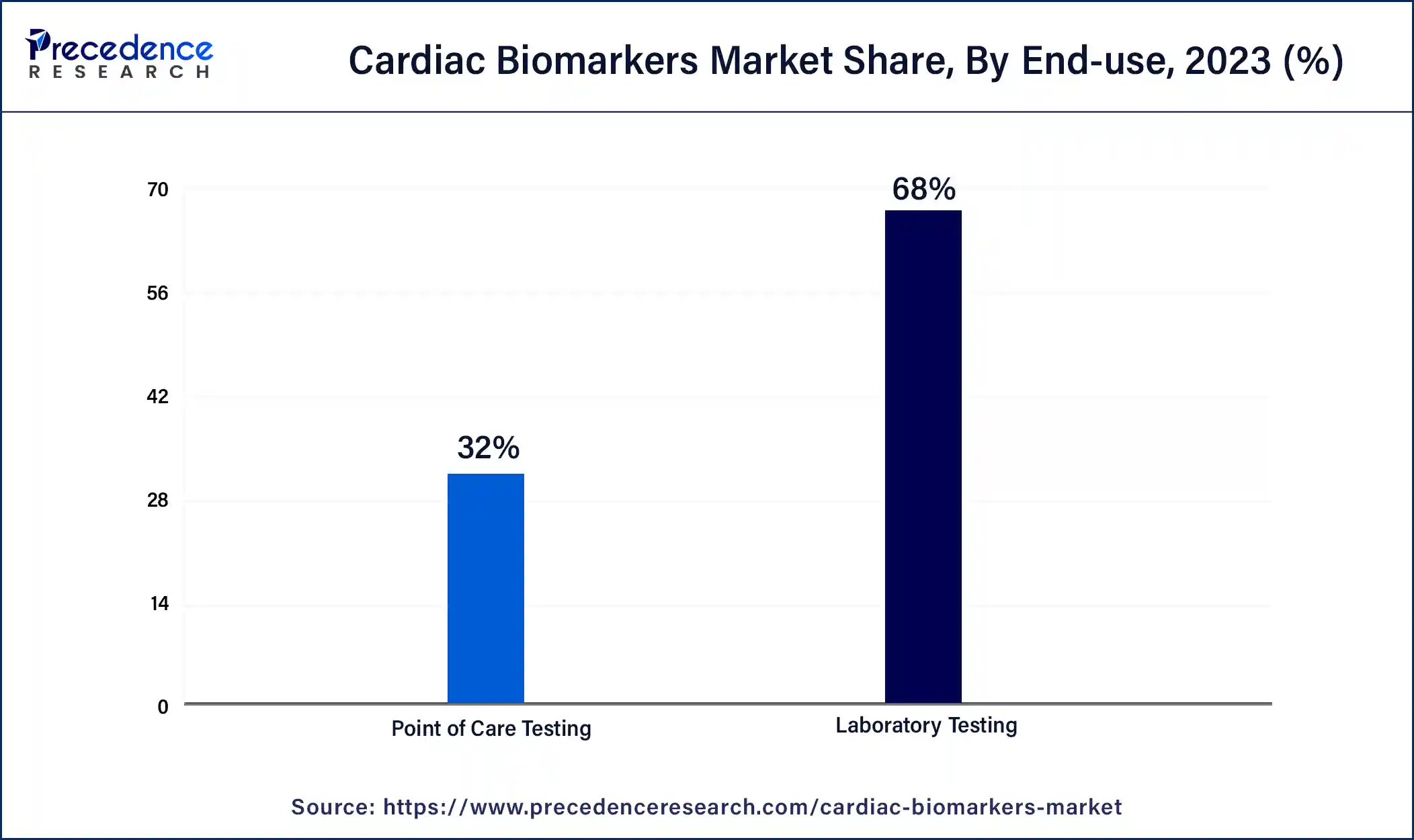

- By end-use, the laboratory testing segment contributed the biggest market share of 68% in 2024.

- By end-use, the point-of-care testing segment is projected to expand at a solid CAGR of 14.93% during the forecasted years.

How is AI changing the Cardiac Biomarkers Market?

The evolution of the cardiac biomarkers market and the result of prediction has integrated several multi-omics such as genomics, metabolomics, proteomics, and other omics technologies. The primary application of AI in multi-omics is to identify the biomarkers for cardiovascular risk, integrate multi-omics data to depict patient subsets with molecular characteristics and prepare for personalized medicine.

This personalized solution is a promising step towards improving the accuracy of cardiovascular risk prediction and developing precision medicine in the cardiac biomarkers market. By incorporating such innovative approaches and continuous expansion of the potential genomics and AI, the future is anticipated to have a proactive, personalized approach to CVD management, resulting in improving patient outcomes globally.

- In a recent study, researchers discovered the importance of personalized medicine. The aim is to understand each patient's genetic characteristics and design the required medicine for CVD using cutting-edge AI/ML techniques.

- RCEE Technologies, Inc., is an artificial intelligence (AI) based medical technology company that detects heart attacks early. An announcement was made at the annual meeting of the American College of Cardiology (ACC.24) regarding the first-ever continuous monitoring of cardiac biomarkers on the skin.

U.S. Cardiac Biomarkers Market Size and Growth 2025 to 2034

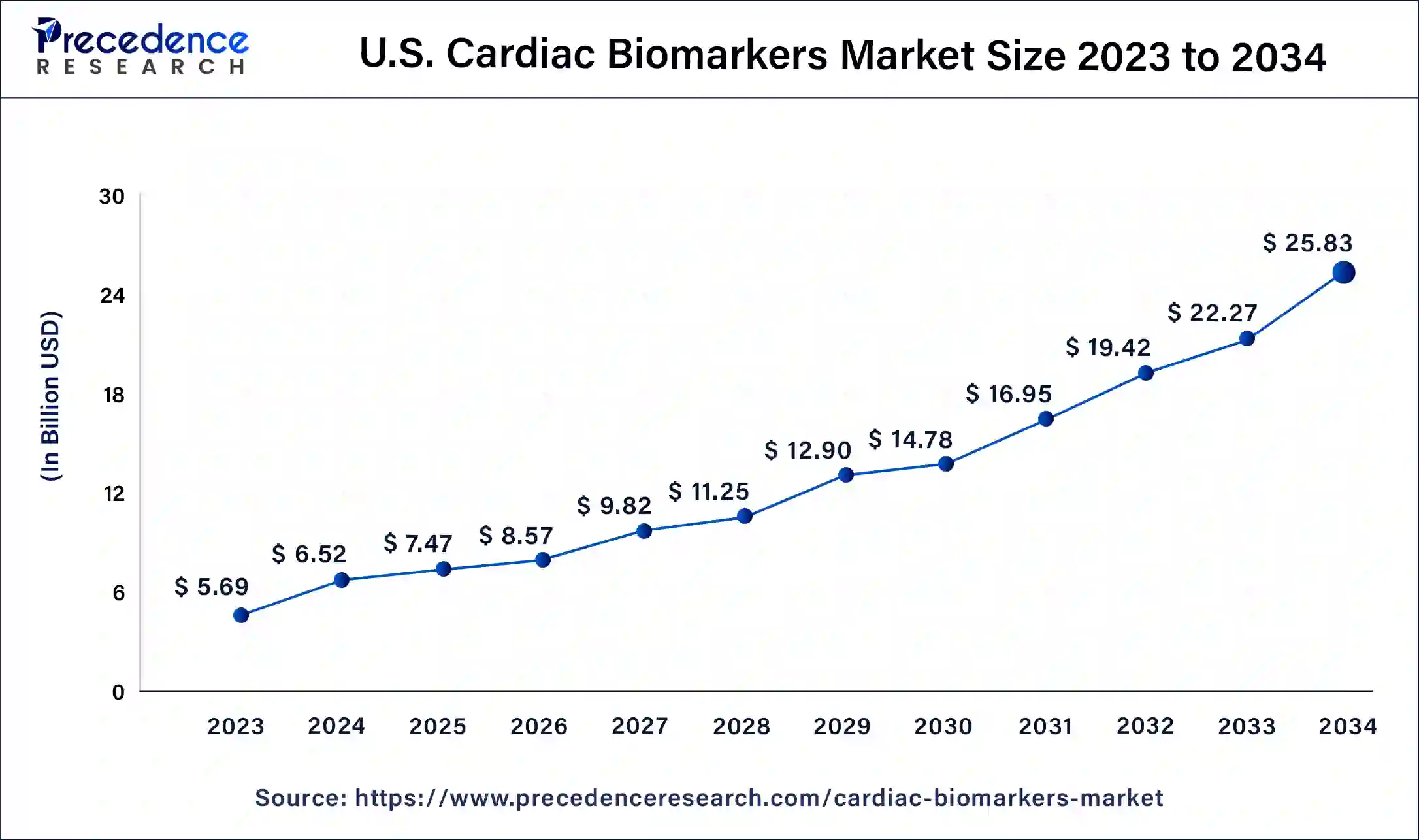

The U.S. cardiac biomarkers market size was exhibited at USD 6.52 billion in 2024 and is projected to be worth around USD 25.83 billion by 2034, poised to grow at a CAGR of 14.74% from 2025 to 2034.

North America dominated the cardiac biomarkers market in 2024. The main reason for market growth is the increasing number of heart disease cases in this region. But at the same time, North America has developed healthcare facilities and demandable biomarkers to treat, monitor, and diagnose heart conditions.

- According to the Centers for Disease Control and Prevention (CDC), 702,880 people died from heart disease in 2022, which is 1 in every 5 deaths. Furthermore, proving the United States is the leading country in North America.

- The United States has all major facilities or sites to conduct diagnostic testing or medical treatment using human specimens under the regulation of Clinical Laboratory Improvement Amendments.

Asia Pacific is expected to witness the fastest growth in the cardiac biomarkers market during the forecasted years. Asia Pacific is known for its extensive laboratory and advanced research and development program. APFCLM (Asia-Pacific Federation for Clinical Biochemistry and Laboratory Medicine) is an Asian-Pacific association of 18 member countries that promotes a variety of scientific/educational activities. Most cardiac tests are ordered in emerging countries, such as India, China, Vietnam, and Indonesia.

Europe is expected to grow significantly in the cardiac biomarkers market during the forecast period. The increasing cardiac diseases in Europe are increasing the use of cardiac biomarkers for their early detection. At the same time, the presence of a robust healthcare sector is using cardiac biomarkers to develop new diagnostic solutions. Moreover, the use of point-of-care testing kits is also contributing to the same. Thus, this is promoting the market growth.

UK

The industries in the UK are focusing on the development of new diagnostic approaches to tackle the growing cardiac diseases. Moreover, their development is enhanced with the use of advanced technologies. These are further supported by the funding provided by the government.

Germany

The use of point-of-care testing kits in Germany is increasing, which in turn is increasing the demand for cardiac biomarkers. Moreover, various policies are also being introduced for the early detection of cardiac diseases, which is promoting the use of cardiac biomarkers.

Market Overview

Cardiac biomarkers are intracellular macromolecules released into the bloodstream when the heart is damaged or under stress. Rising heart enzyme levels help to reveal acute coronary syndrome or ischemia. The use of the cardiac biomarkers market services has extensively increased in the past decade and provides more successful results in the diagnosis of myocardial cell injury or heart failure.

The biomarkers used in the mid-20th century (Aspartate transaminase (AST) and Lactate dehydrogenase) are not clinically suitable in present days however, they are now replaced with more sensitive and specific biomarkers. It is expected for biomarkers to evolve to provide a substantial understanding of the pathogenesis of cardiac diseases.

- According to the World Health Organization (WHO), 10,000 people in WHO Europe are dying every day due to cardiovascular disease. The death of men in the region is 2.5 times more than that of women.

Cardiac Biomarkers Market Growth Factors

- Reduces mortality rate: The demand for reducing mortality rate with the help of biomarkers that diagnose and monitor cardiovascular disease increases the market growth.

- Risk prediction: Cardiac biomarkers can improve cardiovascular risk prediction for early prevention, thus boosting the market.

- Rise in heart attacks: The rise in the number of heart attacks or any heart diseases caused by excess salt consumption, hypertension, or diabetes, which can be treated by cardiac biomarkers.

- The severity of heart failure: Cardiac biomarkers allow quick detection of the size and severity of heart attack and the damage caused, hence increasing the market demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 82.99 Billion |

| Market Size in 2025 | USD 24.30 Billion |

| Market Size in 2024 | USD 21.20 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.62% |

| Largest Market | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising heart disease cases

The primary causes of heart disease are genetics, unhealthy lifestyle, high blood pressure, high cholesterol, smoking, and many more. Cardiac biomarker provides numerous advantages in lowering the occurring cases by screening the damaged heart and other problems, predicting the result for various heart conditions, monitoring the efficiency of heart medications and heart surgery process, and diagnosis of heart conditions led by symptoms such as chest pain and shortness of breath.

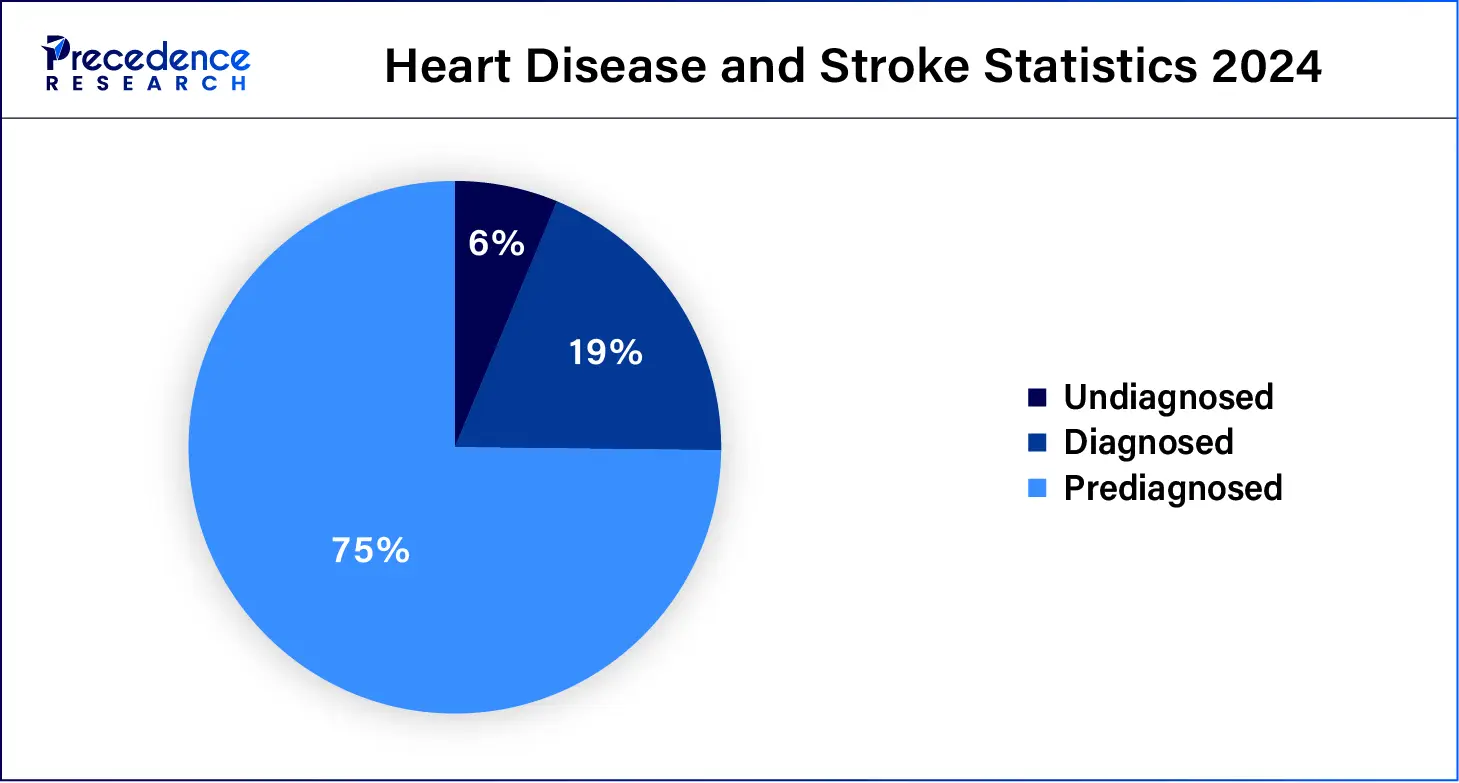

- Recently, a study published in JAMA Cardiology states that global diabetes, obesity, and hypertension are putting the heart at risk. It is estimated that over 6.7 million Americans aged 20 years have heart failure due to consumption of poor-quality food such as processed food, sugary drinks, and fast food, and the growth is anticipated to rise to 8.5 million by 2023.

- In February 2024, at Uppsala University in Sweden, a researcher published a scientific study that identified 90 molecules that may function as biomarkers of a cardiac event, also providing an early detection warning that may avail time for preventive measures before the first heart attack hits.

Restraints

Lack of standardisation

The main drawback of cardiac biomarkers market is the lack of standardization. Different laboratories are using different methodologies for the measurement of biomarkers, which is leading to inconsistent results. Currently, there is a lack of standardization between different assays and variations of concentration. Therefore, it is hard to compare. The hindrance in comparing the study's data and the institution's complex is impacting the worldwide adoption of cardiac biomarkers in clinical application.

Price structure and availability

In the healthcare setting, biomarker assays are extremely expensive and not feasible for routine use. The availability and ease of access depend on different regions and healthcare facilities in the cardiac biomarkers market. This causes social inequality among patients and their diagnosis.

- A study published in the Journal of the National Comprehensive Cancer Network claims that Medicaid insurance coverage beneficiaries are less likely to undergo biomarker testing or receive any top-quality biomarker-driven therapy.

Opportunity

In the future, sensitivity and specificity will no longer be an issue when diagnosing heart disease. The increased sensitivity by assays is costly, which decreases the diagnostic specificity. Therefore, that problem is expected to be resolved in the future. New biomarker identifications will be implemented to understand the complex cardiac pathophysiology. The cardiac biomarkers market will be enhanced in the foreseeable future as it is not specific enough to be a cardiac biomarker. Multi-biomarker approaches, such as tissue-specific markers, will be added for diagnosis, which will be helpful.

Type Insights

The Troponin segment dominated the cardiac biomarkers market in 2024. Troponin protein is the most used biomarker. It is highly sensitive compared to the other protein biomarkers. The sensitivity is useful for diagnosis, monitoring, and prediction of heart attacks. Current American Heart Association (AHA) guidelines state that troponin is the best biomarker for finding a heart attack. It also warns against using other biomarkers such as CK, CK-MB, and myoglobin. Due to their being less specific for the heart, it may cause complicacy with skeletal muscle injury. The extensive use of troponin is observed in hospitals, emergency rooms, and similar healthcare settings.

The BNP and NT-proBNP segment is expected to grow at the fastest rate in the cardiac biomarkers market over the forecast period. BNP and NT-proBNP are natriuretic peptide proteins that are produced by the heart. They are commonly used to confirm or eliminate heart failure. Although they are usually used to recognize heart failure, an increased number of people with ACS has indicated an increased risk of recurrence in the symptoms. If the result of Brain Natriuretic Peptide (BNP) is greater than 100 pg/mL, it indicates abnormality and the presence of heart failure. The higher the result, the greater the severity.

- Pathkind Labs in Mumbai collaborated with Roche Diagnostics and released the cardiac biomarker NTProBNP to detect heart failure in patients, and is also used in the management of Type 2 Diabetes (T2DM).

Application Insights

The acute coronary syndrome segment accounted for the largest share of the cardiac biomarkers market in 2024. It is a collaborative condition that either immediately stops or severely slows down the blood flow to the heart muscle. Due to the hindrance in blood flow to the heart, the heart muscles become damaged, causing heart attacks and angina. ACS requires emergency medical care at the healthcare facility. Some primary tests for ACS are an electrocardiogram (ECG or EKG) and blood test with the help of a cardiac biomarker. The testing helps the healthcare professional to provide the patient with the right diagnosis.

The other segment is expected to grow rapidly in the cardiac biomarkers market during the forecasted years. The other segment includes myocardial infarction, congestive heart failure, pulmonary embolism, and non-ST non-ST-elevation myocardial infarction (NSTEMI). Among all, myocardial infarction is expected to grow at the fastest rate. Myocardial infarction is silent and undetected; the events may lead to hemodynamic deterioration and sudden death. For instance, In the United States, the majority of myocardial infarctions are due to underlying coronary artery disease.

End-use Insights

The laboratory testing segment contributed the biggest share of the cardiac biomarkers market in 2024. The laboratory testing is either performed at the hospital facility or a private laboratory. These places can test a high volume of samples in one sitting. Laboratory testing provides a reliable and precise result of the health problem while other tests provide a general idea. It takes up to 24 hours or more to show results. These tests are conducted considering federal regulatory standards and go through strict criteria before presenting them to the physician.

The point-of-care testing segment is anticipated to have the fastest growth rate in the cardiac biomarkers market during the forecasted years. A point-of-care test is also known as near-patient resting; it provides doctors with accurate, real-time, and quick laboratory-quality diagnostic results. In POCT, portable analyzers simplify the diagnostic process to ensure that patients receive the care they need. This test is not always accurate. They frequently show errors depending on the testing device used. As these tests can be conducted one test at a time, this method is suitable for at-home service.

Cardiac Biomarkers Market Companies

- Abbott Laboratories

- Beckman Coulter, Inc

- BioMérieux

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- Mindray

- Randox Laboratories Ltd

- Roche Diagnostics Ltd.

- Siemens Healthineers

Recent Development

- In July 2025, the new trial results of Ifetroban, which is an investigational oral therapy, showed improvement in heart function along with decreased damaged cardiac biomarkers, in people suffering from Duchenne muscular dystrophy (DMD), which was developed by Cumerland Pharmaceuticals. Moreover, at the Parent Project Muscular Dystrophy (PPMD), these observations of the phase 2 fight DMD trial (NCT033400675) were presented by the company, which was held in Las Vegas. (Source: https://musculardystrophynews.com)

- In June 2025, the UP STEMI Care Program was launched by the government to enhance emergency heart care in rural and semi-urban areas in SGPGIMS. To decrease the ST-Elevation Myocardial Infarction (STEMI) death rates, which is one of the most lethal and time-sensitive types of heart attack, is the main goal of this initiative, and will detect heart attacks with the help of tele-ECG technology in remote regions within minutes. (Source: https://www.msn.com)

- In October 2023, Mindray, a medical device company, launched two new highly sensitive troponin I (hs-cTnI) and NT-proBNP cardiac biomarkers. This act is achieved in collaboration with HyTest, a biotechnology company in Finland. HyTest brought together their antibodies and research on cardiac biomarkers combined with Mindray's technology and delivered this innovation.

Segments Covered in this Report

By Type

- Troponin

- CK-MB

- Myoglobin

- BNP And NT-Probnp

- Others

By Application

- Acute Coronary Syndrome

- Myocardial Infarction

- Congestive Heart Failure

- Others

By End-use

- Laboratory Testing

- Point Of Care Testing

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting