What is the Cardiac Pacemaker Market Size?

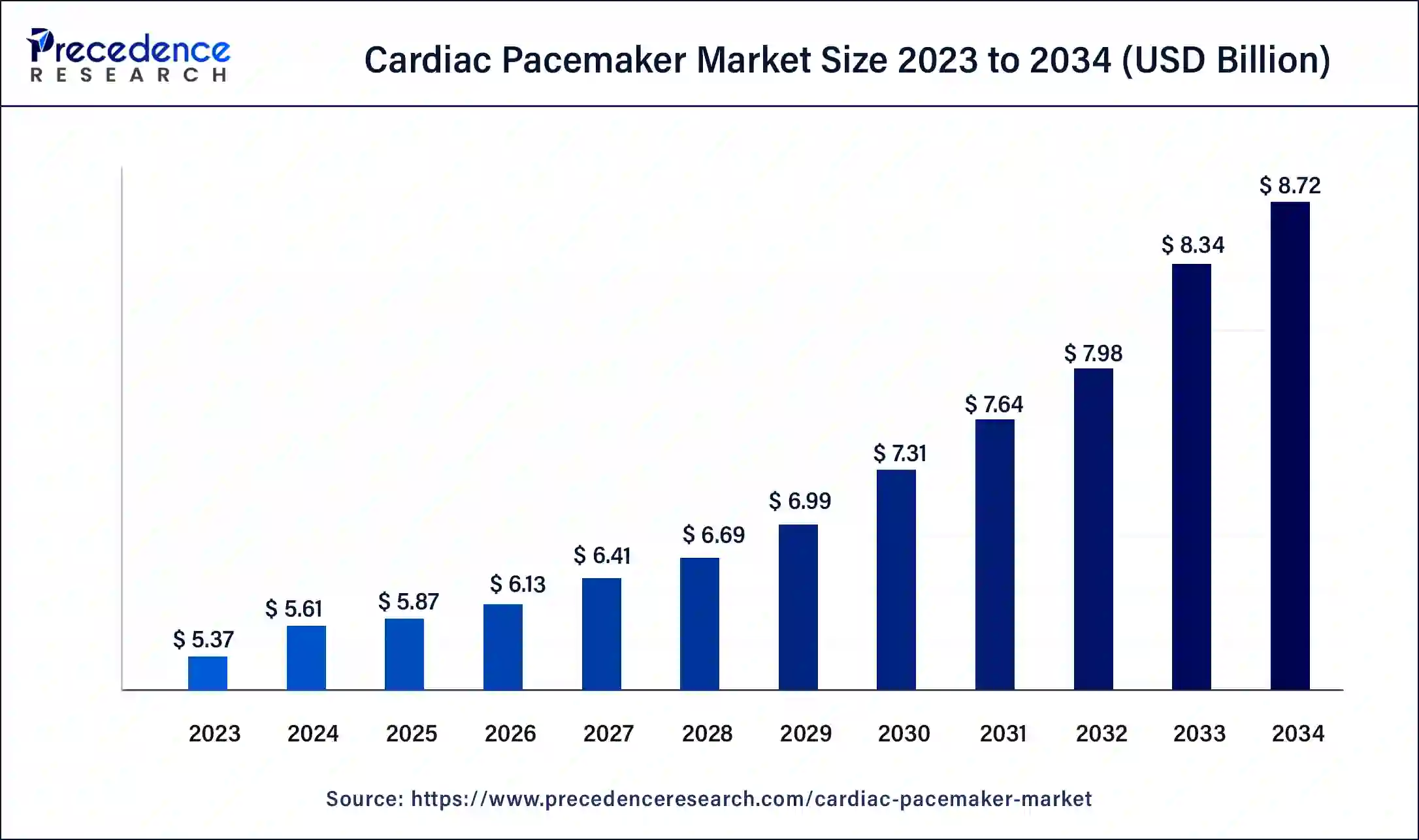

The global cardiac pacemaker market size is valued at USD 5.87 billion in 2025 and is predicted to increase from USD 6.14 billion in 2026 to approximately USD 10.10 billion by 2035, expanding at a CAGR of 5.58% from 2026 to 2035.

Cardiac Pacemaker Market Key Takeaways

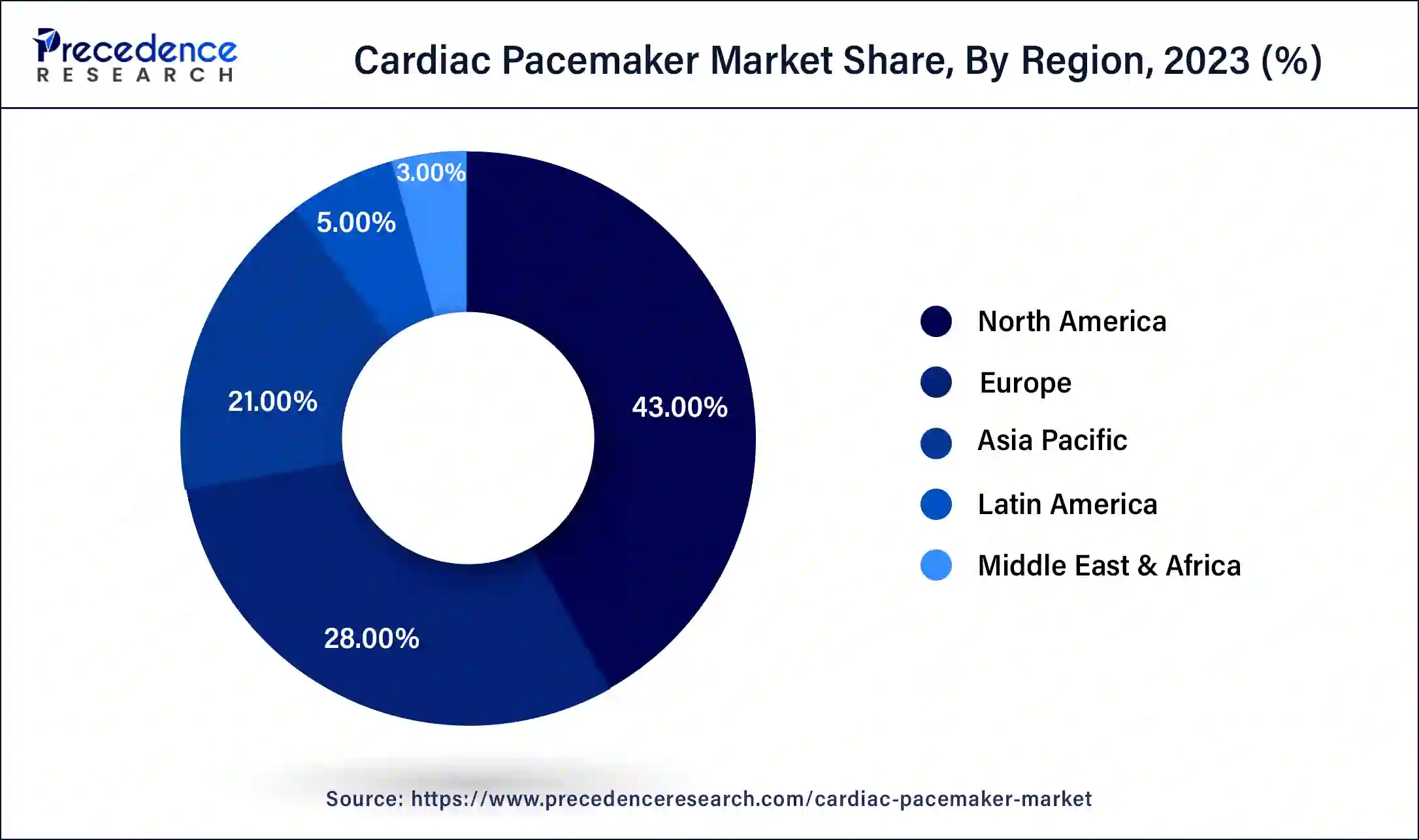

- By geography, North America dominates the market and accounted for more than 43% of revenue share in 2025, In terms of revenue.

- By product type, the implanted pacemaker segment captured more than 61% of revenue share in 2025.

- By type, the conventional pacemakers segment generated more than 52% of the revenue share in 2025.

- By application, the arrhythmia segments accounted for 38% of all pacemaker sales in 2025.

- By end-use, the hospitals & cardiac centers contributed more than 70% of revenue share in 2025.

What is a Cardiac Pacemaker?

An artificial cardiac pacemaker, often known as a pacemaker, is amedical devicethat produces electrical impulses and delivers them via electrodes to the heart's upper or lower ventricles to force the targeted chambers to contract and pump blood. The development of advancedpacemakers, like leadless pacemakers as well as pacemakers that are MRI safe, as well as rising CVD incidences, rising cardiac disease management expenses, and supportive government policies are the main drivers for the expansion of the market.

How is AI contributing to the Cardiac Pacemaker Industry?

AI improves pacemakers in the heart by performing three key functions: optimizing the performance, improving the monitoring, and then making the diagnostics more accurate through the intelligent evaluation of extensive patient data. It dials down the problem of data overload, spots the early signs of device or heart issues, and also fine-tunes the pacing strategies, making them suitable for the individual in the process of the patient's care.

Moreover, AI takes part in risk assessment for prediction, consulting procedural decisions, battery lifetime, and thus, these features when combined lead to the improvement in the patient's outcome, less frequent interventions, and longer durability of the device.

Cardiac Pacemaker Market Growth Factors

- Rising prevalence of cardiovascular diseases

- Increasing acceptance of implanted pacemakers will hasten commercial development

- Public funding for healthcare interoperability

The burden of cardiovascular disease, which is increasing, is also another key factor driving the market's expansion. Coronary heart disease is one of the leading causes of CVD mortality globally. The predicted $1,044 billion cost of these diseases by 2030 highlights the urgent demand for cardiac pacing equipment. Patients benefit from the new products that medical device businesses like Boston Scientific Corporation and Medtronic are now selling that are covered by reimbursement plans. Additionally, companies are concentrating more on making advanced pacemakers that support individualized care. These advancements include enhancing precision, introducing new tools to enhance workflow, and encouraging error minimization. For instance, at the Large Multi-Centre Study in May 2020, the home monitoring system from BIOTRONIK provided secure and affordable remote supervision of pacemaker patients. During COVID-19, this was a crucial step for routine remote follow-ups.

Market Outlook

- Industry Growth Overview:

The market is slowly expanding because of the rising number of cardiac cases, the continuous development of technology, and the increased demand for management of long-term rhythms. - Sustainability Trends:

The attention has been switched to leadless pacing and energy-efficient innovations that are not only improving the longevity of devices but also reducing the need for repeat surgical procedures. - Global Expansion:

North America is at the forefront of growth, and while Asia-Pacific is progressively gaining strength with the availability of healthcare and the introduction of new technologies in the cardiac area. - Major Investors:

Medtronic, Abbott, Boston Scientific, BIOTRONIK, and MicroPort Scientific are the leading firms constantly pushing for development and investment in the area of cardiac pacing. - Startup Ecosystem:

Startups are working on biodegradable leads, AI diagnostic tools, and advanced pacing interfaces that would make it possible to have a patient-centered, futuristic cardiac rhythm management.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.87 Billion |

| Market Size in 2026 | USD 6.14 Billion |

| Market Size by 2035 | USD 10.10 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.5% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By Type, By Application, By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Key Market Drivers

- Rising prevalence of cardiovascular diseases - The need for pacemakers is expected to increase due to the rising prevalence of cardiovascular diseases, which will increase industry revenue. The worldwide illness burden is being exacerbated by the higher prevalence of various cardiovascular diseases like congenital heart disease, rheumatic heart disease, coronary heart disease, and cerebrovascular disease. The biggest cause of death worldwide is cardiovascular disease. The significant increase in the prevalence and incidence of cardiovascular illnesses is attributable to behavioral risk factors, including heavy alcohol and cigarette use, obesity, poor diet, and inactivity. Cardiac arrests and strokes account for about 85% of deaths from cardiovascular illnesses. In the upcoming years, these numbers are expected to rise much further.

- Congestive heart failure is becoming more common - The rising frequency of congestive heart failure and related fatalities helped the congestive heart failure category to account for 35% of the market share in 2021. According to the Radcliffe Cardiology 2017 article, heart failure is a complex clinical illness that affects over 26 million people worldwide and is predicted to grow in prevalence over the next few years. It is characterized by the heart's impaired ability to pump blood. Heart failure currently affects about 5.7 million Americans, and predictions show that number will increase by 46% by 2030 to more than 8 million Americans. The need for these devices to regulate cardiac rhythm is expected to increase due to the increasing prevalence of heart failure.

Key Market Challenges

- Lack of knowledge regarding CVD among the population in developing countries - The growth in the market is anticipated to be constrained by factors such as low awareness of cardiovascular illnesses among the population in developing nations, expensive treatment costs, and a high rate of product recalls because of defective devices. The future landscape of the cardiac pacemaker industry will be shaped by a focus on new device launch strategies and the development of quick, accurate, and affordable diagnostic techniques.

Key Market Opportunities

- High rates of sickness in poor nations – High rates of sickness in poor nations, numerous government programs to assist those efforts, and financing for non-governmental organizations. The cardiac pacemaker market is also being driven by improved diagnostics, favoring reimbursement policies for treatment, and policies that are cost-effective and are implemented by governments of different nations. Focusing on innovative device launch strategies and the creation of quick, accurate, and affordable diagnostic techniques will shape the future of the cardiac pacemaker business.

Product Type Insights

In 2025, more than 61% of the cardiac pacemaker market was accounted for by the implanted pacemaker segment. Biventricular pacemakers, dual-chamber pacemakers, and single-chamber pacemakers are categorized as implantable pacemakers. The increasing need for these devices to treat failure of heart and arrhythmias, together with current clinical trials, are two major factors propelling market expansion. According to the CDC, atrial fibrillation, which affects between 2.9 and 6.5 million people in the U.S. alone, was the most prevalent kind of arrhythmia in 2017. As a result, the market is growing as CVDs are becoming more common.

The market for external pacemakers is predicted to experience encouraging growth over the projection period because of the segment's straightforward configuration, improved user interface, and improved indicator for low battery. Outside pacemakers are noninvasive, therefore there is a lower chance of problems following surgery. The devices also let patients monitor and record their everyday heart functioning. Additionally, outside pacemakers are the quickest cardiac rhythm synchronization devices currently on the market, which is also anticipated to drive category growth. Market participants who deal in external pacemakers, like Medtronic, Oscor Inc., and Pacetronix, are projected to have a beneficial impact on segment growth.

Type Insights

In terms of revenue in 2025, the market category for traditional pacemakers held a dominant share of almost 52% of the market. This growth is brought about by continual advancements, affordability, compactness, and long shelf life. Based on type, the market is split into MRI-compatible and conventional pacemakers. The MRI-compatible pacemaker segment is expected to grow profitably during the forecast period. The high rate can be attributed to the rising use of MRI-based diagnoses. The Mayo Foundation for Medical Education and Research estimates that in 2018, more than 75% of patients with pacemaker implants will eventually need an MRI. As a result, the market is growing at a rapid pace.

Application Insights

Arrhythmias accounted for 38% of all dominating the industry. The part is further divided into three categories: long QT syndrome, heart block, and atrial fibrillation. Pacemaker sales in 2023, several factors, including lifestyle disorders, excessive alcohol consumption, smoking, and obesity, have an impact on the prevalence of cardiac arrhythmia. In the UK, there were 12,33,140 cases of atrial fibrillation and atrial flutter combined in 2019, according to the European Medical Group LTD. The second-fastest predicted growth will occur in the congestive heart failure market. As of December 2018, the CDC estimates more than 6.5 million adults in the U.S. had heart failure. As a result, there will be a greater need for pacemakers with Innovative technology during the anticipated timeframe.

End Use Insights

Hospitals and cardiac centers had a dominant share of over 70% in 2025. Hospitals and cardiac centers offer the greatest care while a patient is admitted. The fact that these facilities additionally offer procedure reimbursements is what is causing the category to grow. The American Heart Association estimates that by 2030, there will have been an additional 23.8 million hospital admissions for cardiac arrest. The end-user category includes hospitals, cardiac centers, ambulatory surgery centers, and other facilities.

Due to its extensive market reach, particularly in rural areas, and convenience of treatment, the ambulatory surgery center category is predicted to rise at a promising rate during the projection period. In this situation, ambulatory surgery facilities have shown to be a reliable approach. The increasing need to reduce surgery and post-surgical costs as well as the rising prevalence of CVDs are two additional factors that are projected to have a significant impact on the ambulatory surgical centers market. Another factor driving the industry is the need to lower healthcare costs while also enhancing patient satisfaction.

Regional Insights

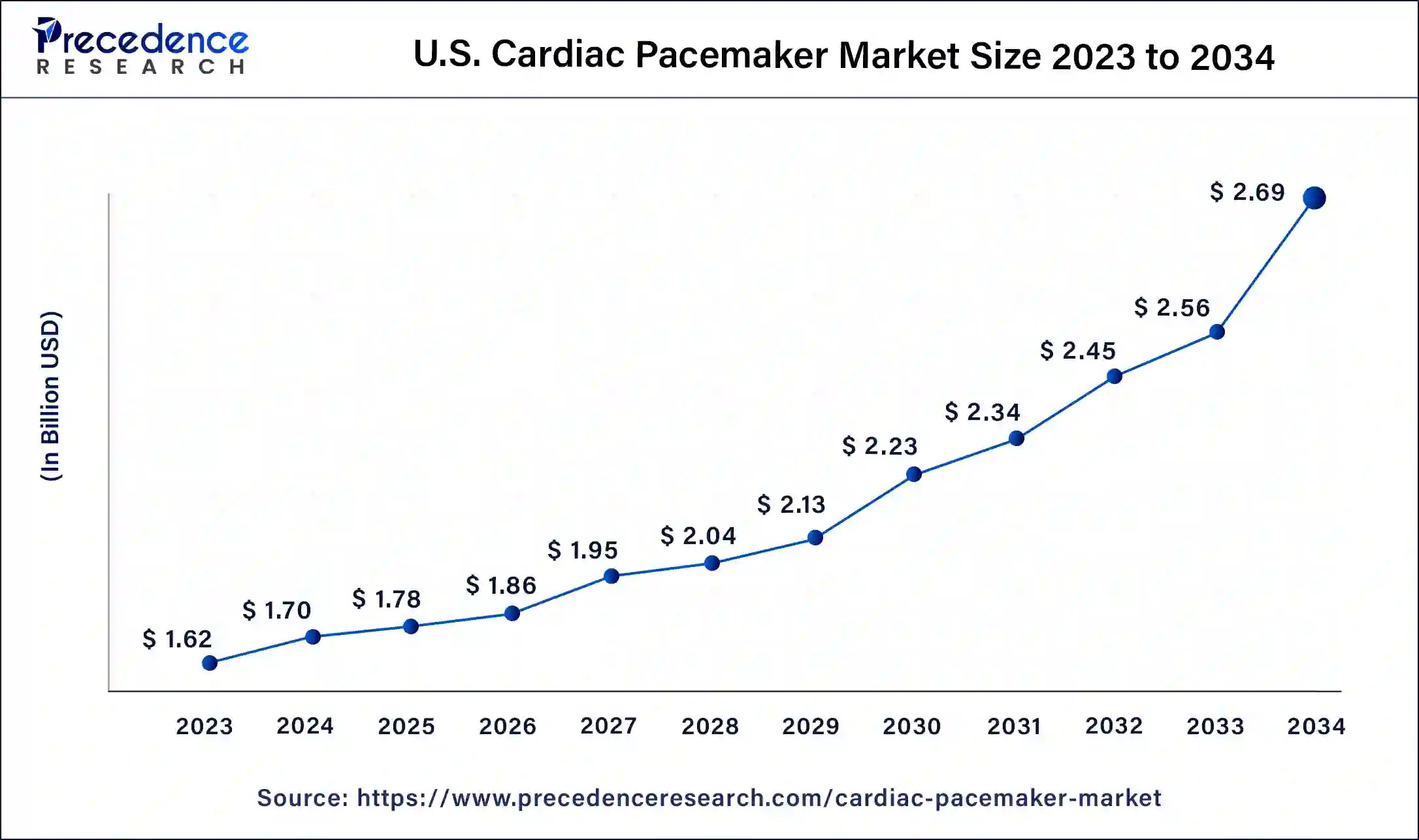

U.S. Cardiac Pacemaker Market Size and Growth 2026 to 2035

The U.S. cardiac pacemaker market size is estimated at USD 1.78 billion in 2025 and is predicted to be worth around USD 3.02 billion by 2035, at a CAGR of 5.43% from 2026 to 2035.

In terms of revenue, North America dominates the global cardiac pacemakers market and generated more than 43% revenue share in 2025.Its enormous market size is mostly due to the high prevalence of cardiovascular illness, high cases of obesity, and favorable revenues. The report "There is the number of elderly people that will strike U.S. economy apparently" like a" brick"—USA trade secretary" published on April 2021 estimates that 54 million people, or 16.5% population in the U.S., were above 65 years of age by 2020 and by the year 2030, this number is expected to grow to 74 million. There is the proportion of people aged over 85 who are at risk of heart disease is projected to significantly increase.

How is North America leading in the Cardiac Pacemaker Market?

North America is the foremost region in demand for pacemakers because of its high-level healthcare systems. The integration of digital health, artificial intelligence in next-generation pacemakers, and enhanced access to care are the areas that will drive future growth.

U.S. Cardiac Pacemaker Market Trends:

The U.S. is leading the way with a fast adoption of advanced pacemaker technologies, a vast population of the elderly, and well-structured reimbursement systems. The rapid upgrading of technologies, the growth of remote monitoring, and the acceptance of new pacing systems in clinics as a means of achieving better therapeutic outcomes and managing cardiac diseases in the long run are some of the prospects.

Additionally, nearly half of Americans, including those with high blood pressure, have some sort of heart disease, according to statistics from the American Heart Association that were released in January 2019. The prevalence of cardiac problems has increased the demand for cardiovascular equipment, equipment used for monitoring, and equipment used for diagnostics, as a result, there has been a critical demand for better medical technology, which could drive the market under study.

Every age range is affected by arrhythmia, although as people get older, they are more likely to get atrial fibrillation. According to Heart Disease and Stroke Statistics 2019, 1 in 3 white Americans is thought to be at risk for atrial fibrillation which could be long-term. Alcohol, sedentary, tobacco habits, and several over-the-counter medications may further raise the possibility of arrhythmia. As a result of these factors, the North American cardiac pacemakers market is anticipated to increase significantly during the projected period.

What are the driving factors of the Cardiac Pacemaker Market in Europe?

Europe is the continent that enjoys very active health systems, the highest clinical standards, and the largest number of people suffering from heart diseases. The area not only presents advanced devices for patient care but also integrates them into structured health programs with the aim of improving access, efficiency in care, and the attuning of pacemaker technologies to patient needs and public health priorities.

Germany Cardiac Pacemaker Market Trends:

Germany is on top of the list thanks to the fact that its strong health insurance coverage facilitates the clinical adoption of pacemakers and elderly patients' consistent demand. The rapid acceptance of MRI-compatible systems and the continuous progress in cardiac care, which is backed by a systematic infrastructure and established pathways for medical technology, are the opportunities available.

How is Asia-Pacific performing in the Cardiac Pacemaker Market?

The Asia-Pacific region is growing fast, with awareness of cardiac diseases, better health infrastructures, and access to advanced health care being some of the contributing factors. Modern pacemaker solutions, which are under the government and rising tech adoption, are the opportunities that come with such growth, despite the challenges of cost and differences between the urban and rural healthcare environments.

China Cardiac Pacemaker Market Trends:

China is moving ahead with the increasing burden of cardiovascular diseases, co-funded hospital treatment by the government, and the gradual growth of manufacturing technology in-house. The main opportunities that will come with wider access to modern pacemaker tech are healthcare expansion in different regions, along with the big demand for cardiac devices that include features for long-term patient outcome improvement.

Cardiac Pacemaker Market-Value Chain Analysis

- R&D: The support activity is arranging and altering the pacemaker technology so that it has product features or production costs.

Key players: Medtronic, Abbott Laboratories, and Boston Scientific - Clinical Trials and Regulatory Approvals: The activities are directed at ensuring the product is safe and effective, and at the same time, acquiring the necessary certifications.

Key Players: (Medtronic, Abbott - Formulation and Final Dosage Preparation: The operation takes care of the exact assembly and quality check of the inner parts into the final device.

Key Players: Boston Scientific and Biotronik. - Packaging and Serialization: The outbound logistics step consists of making the finished sterile product ready for shipment and putting a unique label on it.

Key Players: (Medtronic, Boston Scientific - Distribution: The last outbound logistics activity is about making the device's delivery to the medical facility reliable and done promptly.

Key players: Medtronic, Boston Scientific, Abbott

Top Companies in the Cardiac Pacemaker Market & Their Offerings:

- OSYPKA MEDICAL: Delivers external pacemakers and pacing leads as temporaries, which are meant for surgical and acute uses, thereby relying on the cardiac rhythm management of clinical environments reliably.

- Boston Scientific Corporation: Presents a complete range of implantable pacemaker systems consisting of MRI-conditional technology, remote monitoring, and battery innovations that offer long-term cardiac therapy support.

- Zoll Medical Corporation: Market items that are mainly made to monitor the heart, resuscitate, and help circulation, but those implantable pacemakers are not the focus of the emphasis, as cardiac care is very wide beyond that.

Cardiac Pacemaker Market Companies

- OSYPKA MEDICAL

- Boston Scientific Corporation

- Zoll Medical Corporation

- Asahi Kasei Group Company

- Medtronic

- BIOTRONIK SE & Co. KG

- MicroPort Scientific Corporation

- MEDICO S.R.L.

- Shree Pacetronix Ltd.

- Abbott

- OSCOR Inc

- Lepu Medical Technology (Beijing) Co., Ltd.

Recent Developments

- In February 2022 – Abbott made history by implanting the first dual-chamber leadless pacemaker in a patient as part of its significant clinical research project, AVEIR DR i2i. The pivotal study's first global implant of Abbott's innovative Aveir dual-chamber leadless pacemaker represents a significant advancement in leadless pacing technology.

- In 2021 June – India Medtronic Private Limited unveiled the Micra AV which is a tiny, entirely self-contained type of pacemaker that employs a minimally invasive technique to give patients with atrioventricular (AV) blocks with innovative pacing technology. The apparatus is the first pacemaker to be able to detect atrial activity even when there is no lead or other device in the heart's upper chamber.

- In January 2020- Micra AV, an atrioventricular (AV) synchronization integrated pacemaker from Medtronic, has FDA certification. It is suggested to treat AV block, a condition marked by impairment of electrical communication between the ventricle and the atria. The portfolio of pacemaker products became stronger because to this product's higher safety and efficacy.

- In 2018 in the month of March – In order to optimize the production of therapeutic antibodies, ambr 250 HT which is a system for perfusion bioreactor was introduced by Sartorius AG for development process of cell culture. This system offers a computerized parallel bioreactor system that is specially designed for quick cell culture perfusion process development.

- In December 2025, SSB Hospital Faridabad successfully implanted a newly launched leadless atrial pacemaker, marking its first use in the region. This nonsurgical device provides a safer alternative for elderly patients, offering them a new option amidst limited safe choices, especially considering the procedure's technical complexity and significance. (https://www.hindustantimes.com)

- In October 2025, Abbott launched a dual-chamber leadless pacemaker system, improving heart rhythm management without wires. This implant-to-implant technology allows wireless communication between two miniature pacemakers, providing a solution for bradycardia and enhancing patient care. (https://www.business-standard.com)

Segments Covered in the Report

By Product Type

- Implantable pacemakers

- Single Chamber

- Dual Chamber

- Biventricular Chamber

- External pacemakers

By Type

- MRI Compatible Pacemakers

- Conventional Pacemakers

By Application

- Arrhythmias

- Atrial Fibrillation

- Heart Block

- Long QT Syndrome

- Congestive Heart Failure

- Others

By End-Use

- Hospitals & Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting