Disposable Urine Bags Market Size and Forecast 2025 to 2034

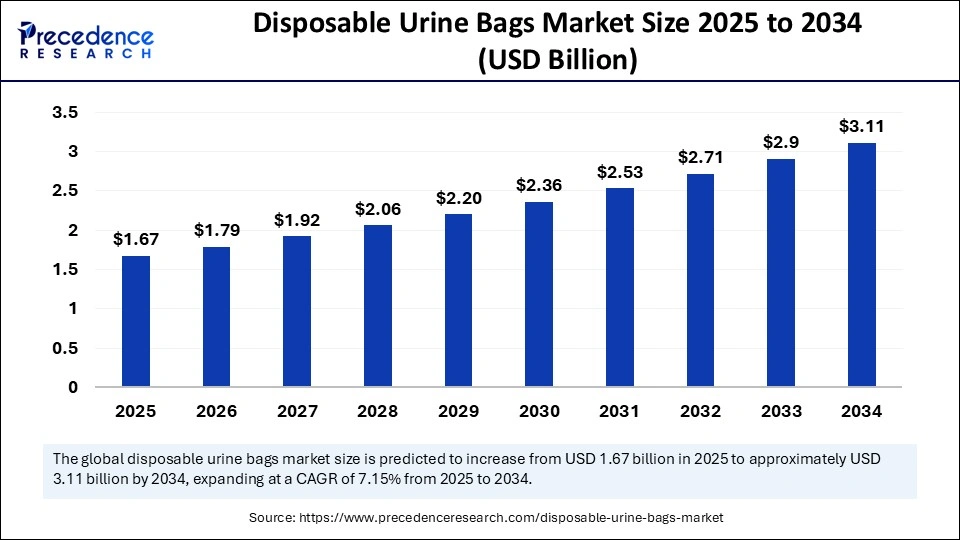

The global disposable urine bags market size accounted for USD 1.56 billion in 2024 and is predicted to increase from USD 1.67 billion in 2025 to approximately USD 3.11 billion by 2034, expanding at a CAGR of 7.15% from 2025 to 2034.The market is growing due to rising awareness about hygiene and increasing demand for convenient, portable sanitation solutions in the healthcare sector.

Disposable Urine Bags Market Key Takeaways

- In terms of revenue, the global disposable urine bags market was valued at USD 1.56 billion in 2024.

- It is projected to reach USD 3.11 billion by 2034.

- The market is expected to grow at a CAGR of 7.15% from 2025 to 2034.

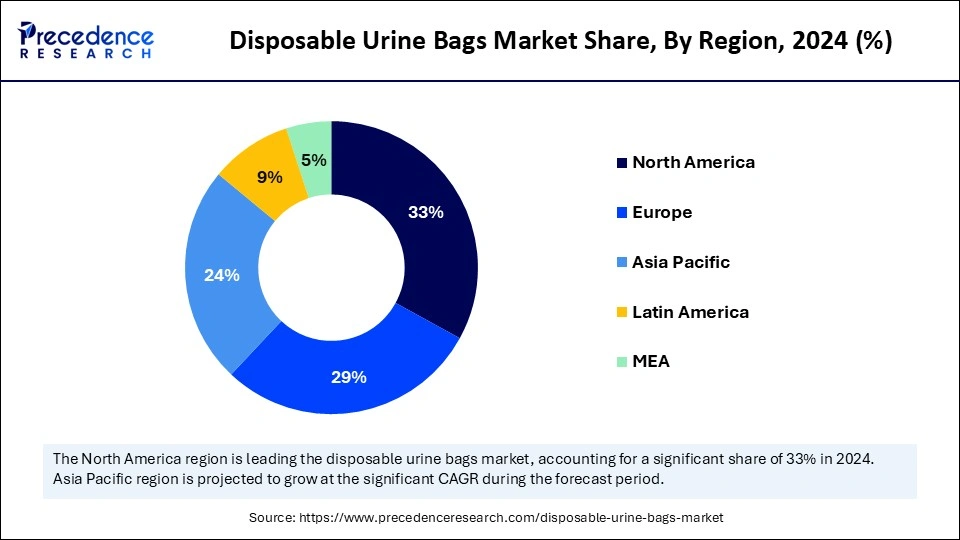

- North America dominated the market with the largest market share of 33% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming period.

- By product type, the bedside urine bags segment held the biggest market share of 35% in 2024.

- By product, the leg bags segment is expected to grow at the fastest CAGR during the forecast period.

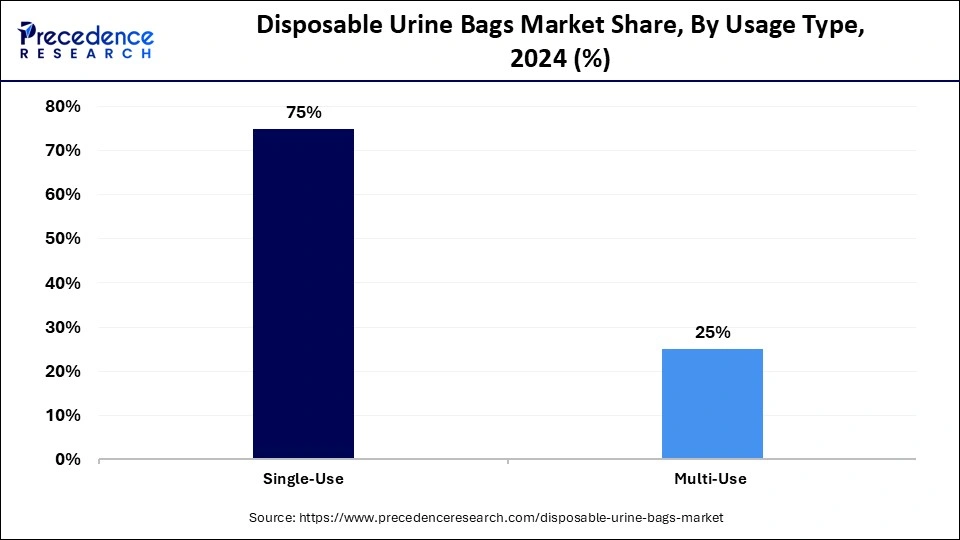

- By usage type, the single-use segment captured the highest market share of 75% in 2024.

- By usage type, the multi-use (short-term

- ) segment is projected to grow at the fastest CAGR during the forecast period.

- By capacity, the 1000–2000 mL segment contributed the major market share of 48% in 2024.

- By capacity, the above 2000 mL segment is emerging as the fastest growing during the forecast period.

- By material, the polyvinyl chloride (PVC) segment generated the major market share of 60% in 2024.

- By material, the silicone segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the hospitals segment held the largest share of 40% in 2024.

- By end user, the home care settings segment is expected to grow at the fastest CAGR during the forecast period.

- By distribution channel, the direct tenders segment accounted for the significant market share of 50% in 2024.

- By distribution channel, the online pharmacies/e-commerce segment is expected to grow at the fastest rate over the projection period.

How is artificial intelligence transforming product innovation in the disposable urine bags market?

By facilitating smarter design, better usability, and increased performance, Artificial Intelligence (AI) is revolutionizing product innovation in the market for disposable urine bags. By using AI-powered simulation tools, manufacturers can minimize material waste and prototyping time by optimizing the ergonomics of the urine bag, material efficiency, and leakage control during the design phase. Through the analysis of patient data, machine learning algorithms also assist in the identification of user pain points and unmet needs, facilitating the creation of more functional, discrete, and comfortable products, especially for elderly and immobile patients.

Furthermore, AI is driving innovation by facilitating the integration of smart sensors in urine bags, allowing real-time monitoring of urine output and flow for better clinical decision-making. These advancements not only improve patient care but also offer healthcare professionals data-driven insights into hydration levels, infection risks, and early warning signs of complications. As hospitals and home care providers increasingly demand intelligent, user-friendly solutions, AI continues to push the boundaries of traditional product development in the disposable urine bags market.

U.S. Disposable Urine Bags Market Size and Growth 2025 to 2034

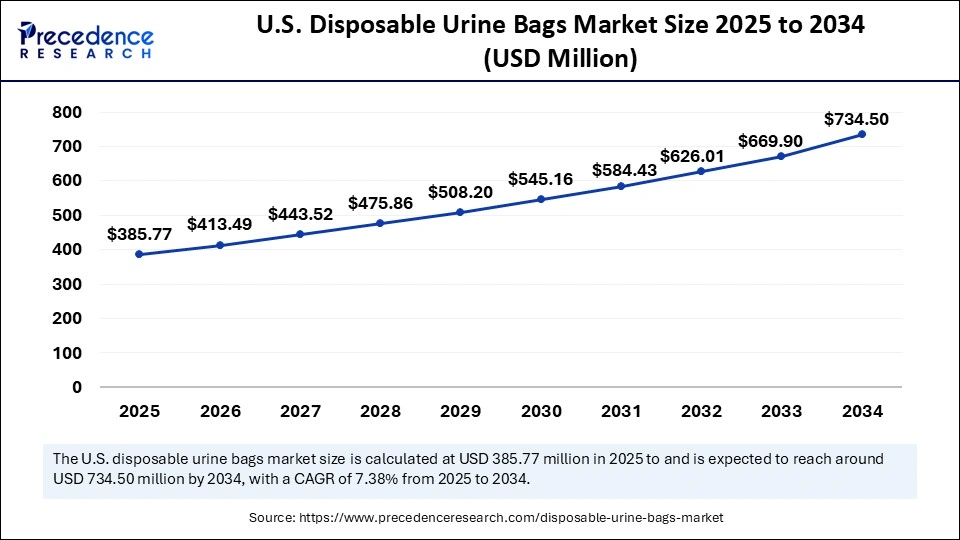

The U.S. disposable urine bags market size was exhibited at USD 734.50 million in 2024 and is projected to be worth around USD 360.36 million by 2034, growing at a CAGR of 7.38% from 2025 to 2034.

What made North America the dominant region in the disposable urine bags market in 2024?

North America registered dominance in the disposable urine bags market in 2024. This is mainly due to the presence of top manufacturers, high surgical volumes, and sophisticated healthcare infrastructure. Favorable reimbursement policies for novel and smart healthcare products and widespread awareness about the benefits of urine bags in elderly care also support market dominance. Chronic illnesses like urinary incontinence and prostate disorders are very common in the area, which boosts the demand for urine bags. In addition to frequent bag replacement brought in by technological advancements and stringent infection control procedures, hospitals and assisted living facilities are using more bags overall. Rising development of smart urine bags further supports regional market growth.

What makes Asia Pacific the fastest-growing region in the market?

Asia Pacific is expected to expand at the fastest rate in the upcoming period, owing to a rising geriatric population, increasing healthcare spending, and improving access to medical products. The growing home healthcare trend is also driving market expansion. Governments are focusing on strengthening healthcare infrastructure and post-acute care services, which is likely to boost the demand for disposable urine bags. The growing availability of affordable urine bag options from local manufacturers is expanding access in rural and semi-urban areas. Moreover, the rise of e-commerce and the rising number of surgical procedures contribute to regional market expansion.

Market Overview

The disposable urine bags market refers to the global market for single-use urine collection bags used for the hygienic and convenient collection of urine in patients with mobility issues, incontinence, or those undergoing surgical procedures. These bags are typically made of medical-grade plastic and are commonly used in hospitals, clinics, nursing homes, and home healthcare settings. They include features such as anti-reflux valves, graduated markings, and drain outlets, and may be attached to beds, chairs, or legs, depending on the type. The market is driven by an increasing geriatric population, a rise in urinary incontinence disorders, post-operative recovery needs, and advancements in home healthcare and ambulatory care.

What trends are shaping the future of the global disposable urine bags market?

The incorporation of antimicrobial features to reduce the risk of infection, the development of smart urine bags with real-time monitoring sensors, and the growing demand for environmentally friendly biodegradable materials are some of the major trends influencing the future of the global disposable urine bag market. Particularly in home care and post-operative settings, advancements in lightweight leak leak-proof, and odor-controlling designs are enhancing patient comfort and usability. In addition, the market is seeing a rise in the use of travel-friendly and unisex options, and manufacturers are concentrating on accessibility and sustainability to satisfy changing consumer and healthcare demands.

Disposable Urine Bags Market Growth Factors

- Growing demand for home healthcare and post-operative care: Patients recovering at home require portable and hygienic urine disposal solutions for better comfort and convenience.

- Increased awareness of hygiene and sanitation: People are becoming more conscious about preventing infections, especially in hospitals and elderly care homes.

- Expanding healthcare infrastructure, especially in emerging markets: Governments and private players are investing in medical facilities, creating higher demand for basic hygiene products.

- Technological innovations like leak-proof and sensor-enabled bags: Smart features enhance monitoring and reduce risks, attracting healthcare providers seeking efficiency.

- Preference for disposable over reusable options due to convenience and infection control: Disposable bags reduce cleaning efforts and minimize the chance of cross-contamination.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.11 Billion |

| Market Size in 2025 | USD 1.67 Billion |

| Market Size in 2024 | USD 1.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Usage Type, Capacity, Material, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing geriatric population and prevalence of urinary incontinence

Urinary incontinence and mobility issues are becoming more common as the world's population ages. Disposable urine bags are convenient for elderly patients who frequently need help with waste management. These products are becoming increasingly necessary for comfort and infection control in hospital-assisted living facilities and home care arrangements. They are preferred over reusable options due to their convenience and lower risk of cross-contamination. Sustained market growth is still primarily driven by these expanding domestic needs.

Growing awareness about hygiene and patient care

Rising awareness about hygiene and infection control is pushing both institutions and consumers toward single-use products, which is likely to drive the growth of the disposable urine bags market. Post-operative and bedridden patients benefit from sanitary, disposable options that lower hospital-acquired infection risks. Government campaigns and health organizations are promoting better hygiene practices in both urban and rural areas. Especially in developing countries, improving literacy and media exposure are helping spread awareness. This rising hygiene consciousness is directly impacting the sales of disposable urine bags in medical and personal use settings.

Restraints

Environmental concerns due to plastic waste

Most disposable urine bags are made from PVC or other non-biodegradable plastics, contributing significantly to medical waste. With the increasing global focus on sustainability and climate change, these products are under scrutiny for their ecological impact. Many countries are tightening regulations on single-use plastics, especially in the healthcare sector. The lack of cost-effective, biodegradable alternatives poses a challenge for manufacturers trying to meet environmental standards. Hospitals and care centers aiming for green certifications are beginning to favor sustainable alternatives, potentially limiting demand for traditional bags. If the industry fails to innovate toward eco-friendly designs, regulatory pressure could restrain the growth of the disposable urine bags market.

Lack of awareness and access in rural or underdeveloped regions

In many developing nations, especially in rural areas, awareness about the benefits of disposable urine bags is limited. Cultural taboos, lack of healthcare education, and poor medical outreach limit the adoption of these products. Additionally, uneven distribution networks make it difficult for suppliers to penetrate remote markets effectively. Cost sensitivity also plays a role reusable options or traditional practices may be favored due to financial constraints. Government support for hygiene products in these areas is often minimal, leaving a large potential user base untapped. Without targeted awareness campaigns and improved accessibility, market expansion in these regions remains restricted.

Opportunities

Development of biodegradable and eco-friendly urine bags

The creation of biodegradable and environmentally friendly disposable urine bags offers manufacturers a significant opportunity as pressure mounts to reduce plastic waste in the healthcare industry. To replace conventional PVC-based designs, businesses are actively investigating sustainable materials such as plant-based substitutes and compostable bioplastics. Consumers who care about the environment and businesses aiming to obtain green certifications are increasingly choosing these eco-friendly options. This change is also being accelerated by favorable government regulations and incentives that support sustainable medical products, especially in Europe and some parts of Asia. Companies that invest early in sustainable product innovation may gain a competitive advantage in a market where environmental impact is increasingly a major factor in consumer decisions.

Integration of smart features for real-time patient monitoring

Disposable urine bags with intelligent features like fluid sensors and connectivity modules are becoming more popular as digital health technologies gain traction. In addition to monitoring urine output and detecting anomalies like blood or infection, these smart urine bags can also automatically send data to electronic health record (EHR) systems or caregivers. These advancements are particularly beneficial in in-home healthcare, critical care units, and senior care settings where real-time data improves treatment accuracy and decreases manual monitoring. This technological breakthrough provides a high-margin growth path for businesses wishing to branch out from conventional bag designs and focus on individualized preventive care.

Product Type Insights

Why did the bedside urine bags segment dominate the disposable urine bags in 2024?

Bedside urine bags, especially with drainage taps, dominated the market in 2024. The dominance of these bags stems from their high usage in clinical and hospital settings, particularly for patients who are immobile or have had surgery. Higher demand from healthcare facilities is a result of their greater capacity and simplicity of emptying, which makes them perfect for continuous overnight use. These bags also reduce the need for frequent caregiver intervention and increase patient comfort. They are widely used in intensive care units and inpatient wards because of their clinical effectiveness, which is further increased by the presence of graduated volume markings and anti-reflux valves.

The leg bags with anti-reflux valve segment is expected to grow at the fastest rate in the coming years, driven by rising adoption among ambulatory patients for daytime use. Their discreet design and improved valve technology that prevents backflow make them increasingly preferred for home care and travel purposes. These bags are especially popular among patients managing chronic urinary issues, like incontinence or post-surgical recovery. With increasing focus on patient mobility and quality of life, leg bags are gaining popularity due to their comfort, strap-based fittings, and compatibility with catheters.

Usage Type Insights

What made single-use the dominant segment in the disposable urine bags market in 2024?

The single-use segment dominated the disposable urine bags market in 2024, driven by the growing emphasis on infection control, particularly in hospital settings. Single-use urine bags are a convenient solution during surgical emergencies and travel, and they lower the chance of cross-contamination. In most healthcare settings, they are the preferred option due to their affordability and hygienic advantages. Rapid patient turnover and operational efficiency are supported by their sterile packaging and ease of disposal in emergency rooms and field hospitals.

The multi-use (short-term disposable) segment is growing rapidly in the market because it offers a balance between convenience and cost-effectiveness. They are gaining traction in home care settings, where patients may reuse them for a limited period under hygienic conditions, especially in low-resource regions. These bags are made with more durable materials and designed for 1–3-day use, reducing frequent replacement costs. With rising out-of-pocket healthcare expenditure, many patients prefer multi-use options that do not compromise hygiene but are more economical in the long run.

Capacity Insights

How does the 1000-2000 mL segment lead the market in 2024?

The 1000-2000 mL segment dominated the disposable urine bags market in 2024 because disposable urine bags of this capacity provide the ideal volume for the majority of post-operative and clinical requirements. By supporting prolonged use, this capacity lowers the frequency of emptying and increases patient comfort. They provide a good balance between bulkiness and holding capacity, making them popular in both hospital and home care settings. To make these bedside and portable bags even more useful, the majority of them have graduated markings, anti-spill features, and secure drainage options.

The above 2000 mL segment is likely to grow at the fastest CAGR during the forecast period. Urine bags with a capacity of more than 2000 mL are particularly used in critical care or long-term hospitalization. These high-capacity bags reduce the need for frequent changes, which is beneficial for bedridden patients and nighttime usage. They are often used in urology departments and ICUs for patients on long-term catheterization. Their ability to hold large volumes makes them especially suitable for elderly patients or those with urinary retention issues, reducing nursing workloads and patient discomfort.

MaterialInsights

What made polyvinyl chloride (PVC) the dominant segment in the disposable urine bags market in 2024?

The polyvinyl chloride (PVC) segment dominated the market in 2024 owing to its affordability, adaptability, and durability. Because of its strong resistance to leaks, PVC is the material of choice for healthcare facilities. PVC bags work with different kinds of catheters and can be heat-sealed to guarantee sterility. Their transparent design makes it simple to monitor urine output, which is essential in intensive care units or post-operative settings. Because of its demonstrated dependability and affordability, PVC is still preferred despite environmental concerns.

The silicone segment is expected to expand at the highest CAGR in the upcoming period, driven by its hypoallergenic, soft, and biocompatible qualities. Patients with sensitive skin who are using it long-term are using it more frequently, particularly in pediatric and home care settings. Silicon urine bags are ideal for prolonged use because they are odor-resistant, easy to clean, and less likely to irritate skin. Non-PVC, environmentally friendly, and reusable silicone are becoming more popular as patient comfort becomes a major consideration when choosing a product, particularly in developed nations.

End User Insights

Why did the hospitals segments dominate the disposable urine bags market in 2024?

The hospitals segment led the market in 2024, as these facilities routinely require urine bags for surgeries, ICU care, and inpatient recovery. The high patient turnover and need for infection control contribute significantly to market demand. Additionally, hospitals benefit from bulk procurement via tenders, ensuring a consistent supply of high-quality, sterile bags. Given their wide usage across departments, urology, orthopedics, emergency, and more, urine bags have become essential consumables in hospital supply chains.

The home care settings segment is expected to grow at the fastest rate throughout the forecast period, owing to the growing trend of patient management at home. The need for easy and sanitary urine disposal solutions is being driven by the growing number of elderly people and the desire for at-home post-operative care. With the advent of portable medical equipment and home healthcare providers, many patients now choose to receive chronic or rehabilitation care at home. Sales of urine bags designed for non-clinical settings that are easy to use, portable, and disposable have increased as a result.

Distribution Channel Insights

How does the direct tenders segment dominate the market in 2024?

The direct tenders segment dominated the disposable urine bags market in 2024, driven by the bulk purchasing from large medical facilities and public hospitals. In many countries, bulk purchasing through tenders is the main procurement method because it guarantees cost savings and continues supply. Tenders are usually used by governments and health organizations to standardize product types, ensuring uniformity among hospitals. Large orders are frequently involved in these contracts, and suppliers offer value-added services like training, prompt delivery, and product customization to win bids.

The online pharmacies/e-commerce segment is expected to grow at the fastest rate in the upcoming period. Online platforms offer easy access, discreet delivery, and competitive pricing. Increased digitalization and awareness are pushing more consumers to buy urine bags online, particularly for home care use. These platforms allow customers to compare brands, read reviews, and choose bags based on their comfort and budget. Subscription models, quick reordering features, and bundled offers are also boosting sales through online channels, especially among elderly caregivers.

Disposable Urine Bags MarketCompanies

- B. Braun Melsungen AG

- Coloplast A/S

- Cardinal Health

- Teleflex Incorporated

- BD (Becton, Dickinson and Company)

- ConvaTec Group PLC

- Flexicare Medical Limited

- McKesson Medical-Surgical

- Romsons Group of Industries

- Manfred Sauer GmbH

- Hollister Incorporated

- Medline Industries LP

- Medtronic plc

- GPC Medical Ltd

- Apexmed International B.V.

- Urocare Products Inc.

- Covalon Technologies Ltd.

- Plasti-med

- Well Lead Medical Co., Ltd.

- Forlong Medical Co., Ltd.

Recent Developments

- In June 2024, ConvaTec Group received a grant to develop an improved urine collection bag featuring a catheter insertion notch, one-way valve, and tear-resistant zones to enhance comfort and efficiency for both medical professionals and patients.(Source: https://www.globenewswire.com)

- On 4 June 2025, King's George's Medical University (KGMU) received a design registration patent for a newly developed IFT uro bag connector, a device that allows standard adult uro bags to be connected to infant feeding tubes, improving sterile urine collection in babies, particularly in resource-limited settings.

(Source: https://timesofindia.indiatimes.com) - In 2025, Genesis Plastics was appointed to produce the iBag system, a sensor-enabled disposable urine collection bag paired with wireless monitoring software and a thermistor-equipped Foley catheter for continuous urine and temperature tracking.(Source: https://www.nsmedicaldevices.com)

Segments Covered in the Report

By Product Type

- Leg Bags

- With Anti-Reflux Valve

- Without an Anti-Reflux Valve

- Bedside Bags

- With Drainage Tap

- Without Drainage Tap

- Pediatric Urine Bags

- Adhesive Pediatric Bags

- Non-Adhesive Pediatric Bags

- Others

- Urostomy Bags

- Night Drainage Bags

By Usage Type

- Single-Use

- Multi-Use (Disposable After a Few Uses)

By Capacity

- Below 500 mL

- 500–1000 mL

- 1000–2000 mL

- Above 2000 mL

By Material

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Silicone

- Others

- Thermoplastic Elastomers (TPE)

- Polyurethane

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Nursing Homes / Long-Term Care Facilities

- Rehabilitation Centers

- Others

By Distribution Channel

- Direct Tenders

- Retail Pharmacies

- Online Pharmacies / E-commerce

- Distributors / Wholesalers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting