What is the Blood Preparation Market Size?

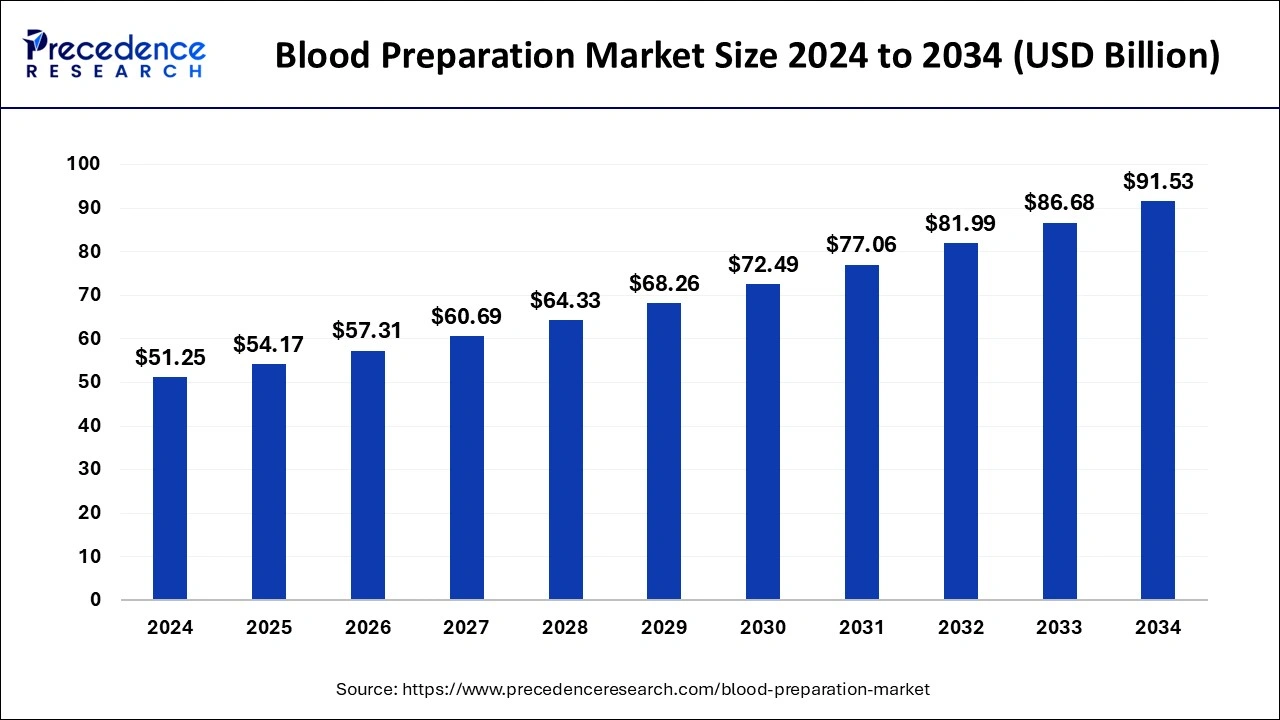

The global blood preparation market size is accounted at USD 54.17 billion in 2025 and predicted to increase from USD 57.31 billion in 2026 to approximately USD 91.53 billion by 2034, expanding at a CAGR of 5.97% from 2025 to 2034.

Blood Preparation Market Key Takeaways

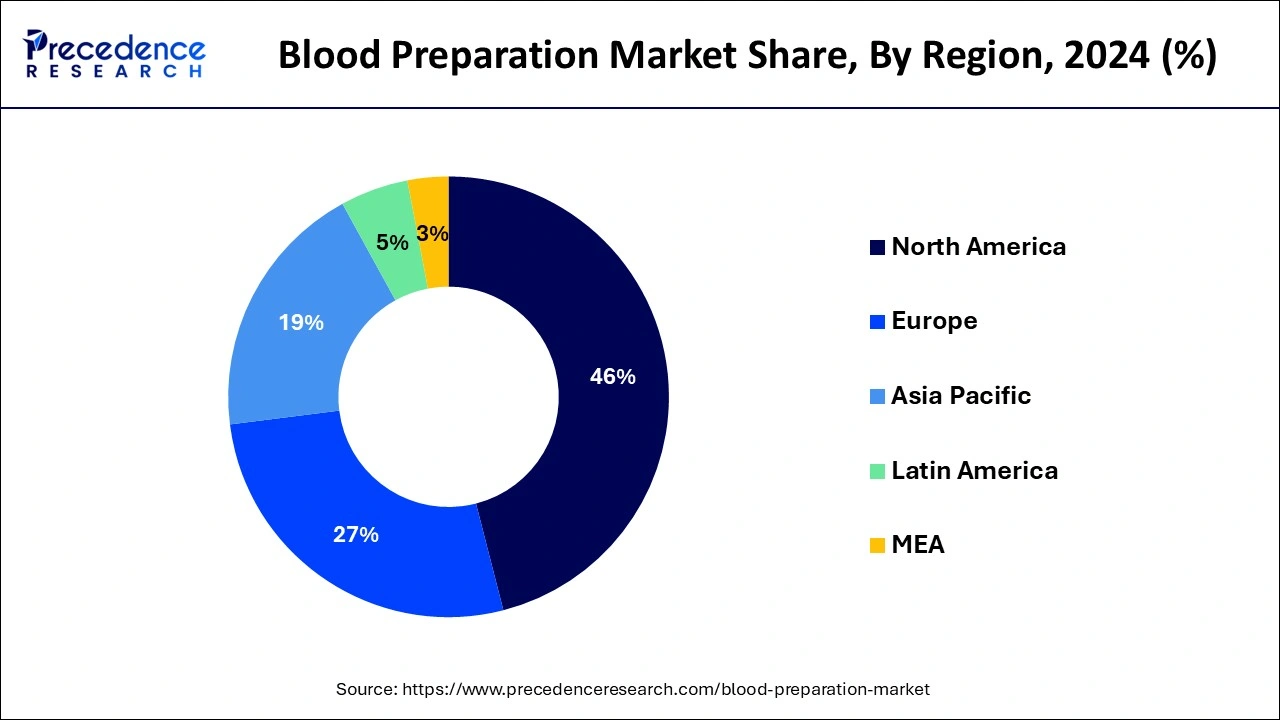

- North America contributed more than 46% of the revenue share in 2024.

- Asia Pacific is expected to witness the fastest growth rate in the blood preparation market during the forecast period.

- By product, the whole blood segment held the largest share of the blood preparation market in 2024.

- The blood derivatives segment is expected to grow at a significant compounded annual growth (CAGR) rate during the forecast period.

- By application, the thrombocytosis segment accounted for a larger share in 2024.

- The angina blood vessel complications segment is estimated to grow with a notable CAGR during the study period till 2034.

What is blood preparation?

The growing number of transfusion procedures, rising incidence of blood-related disorders, and increasing blood donations are majorly driving the blood preparation market growth across the world. Additionally, the growing incidence of road accidents is also expected to fuel the market growth over the study period. In June 2023, the WHO stated that in total, 79 nations collect more than 90% of their blood supply from voluntary unpaid blood donors and 54 nations collect over 50% of their blood supply from family/replacement or paid donors. As per The American National Red Cross, nearly 6.8 million people donate blood in the U.S. every year. The American National Red Cross also mentioned that around 13.6 million units of whole blood and red blood cells are collected every year in the United States. The high donation of blood and its components supports the blood preparation market growth remarkably.

Blood Preparation Market Growth Factors

- An increasing number of transfusion-based therapies drives the growth of the blood preparation market. Each year in the U.S., around 21 million blood components like platelets, red blood cells, and plasma are transfused. These transfusions help in improving the lives of more than 4 million Americans. As per an article shared by Springer Nature, 1.13 million blood transfusions are performed in Japan each year. Thus, the high requirement for transfusions is majorly driving the blood preparation market growth worldwide.

- The rising incidence of blood-related disorders has a significant impact on the growth of the blood preparation market. Conditions like leukaemia, anaemia, and other genetic anomalies related to the blood or bone marrow are generally treated by procedures including several components of the human body. Plasma therapies, blood and bone marrow replacement procedures, etc., promote the growth of the therapeutic segment of the market.

Blood Preparation Market Outlook

- Industry Growth Overview: From 2025 to 2030, the blood preparation market experienced gradual growth fueled by the increasing incidence of chronic diseases, trauma incidents, and surgeries. As plasma-derived products and sophisticated treatment for coagulopathies gained traction, North America and the Asia Pacific were well-positioned to deliver growing value to the market.

- Global Expansion: As major companies continued to expand into growing markets such as India, Brazil, and Southeast Asia, this promotes accessibility to blood components and modern blood transfusion technologies. Partners with hospitals or local biomedical companies will assist in the new healthcare infrastructure demand for regional medical economies. In addition, global supply chains will be further strengthened through these partnerships.

- Major Investors: Interest in investment increased as the sector offered reliable returns and strong social impact alignment. Private equity and funds that focus on health care deployed capital into biopharma firms, making plasma derivatives and recombinant therapies. This increased investment accelerated R&D in the development of infection-free and high-yield blood processing systems.

- Startup Ecosystem: A new crop of startups entered the blood tech space, with the focus on synthetic substitutes for blood, donor-matching through AI, and innovations to cold chain logistics. Many organizations, including Hemarina (France) and Erytech Pharma (France), attracted attention for their work related to oxygen-carrying biotherapies and red cell-based biotherapies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.97% |

| Market Size in 2025 | USD 54.17 Billion |

| Market Size in 2026 | USD 57.31 Billion |

| Market Size by 2034 | USD 91.53 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Antithrombotic and Anticoagulants Type, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

The growing blood donations in various countries are driving the blood preparation market growth remarkably. As per an analysis of Increasing blood donation

mentioned by the National Library of Medicine, the blood donation rate in Japan in FY 2020 increased and accounted for 6.0% (5.04 million). While addressing ‘National Voluntary Blood Donation Day' in October 2022, the Indian Union Health Minister stated that over 250,000 people donated blood under ‘Raktdaan Amrit Mahotsav' in India.

Restraint

Complications associated with blood transfusion

Inappropriate handling of blood products during processes such as blood transfusion can probably lead to various blood-borne infections. Transfusion-transmitted infections (TTIs) refer to infections that originate from the introduction of a pathogen into a person's body through blood transfusion. A broad range of organisms, including viruses, bacteria, parasites, and prions can be transmitted through blood transfusions. Transfusion–transmitted sepsis can cause severe illness. More common reactions with blood transfusion include allergic reactions. These allergic reactions may cause fever, hives, and itching. The risk of respective infections associated with blood transfusion tends to restrain the blood preparation market growth to a certain extent.

Opportunity

New research initiatives

Several new initiatives supporting the research and awareness of blood transfusions have been observed in the past few decades. The policies support business to develop a better understanding regarding blood and its components. In January 2023, it was announced that a scientist from the University of Maryland School of Medicine (UMSOM) will lead a new research program for developing and testing a whole blood product.

This whole blood product will be storable at room temperature and useful to transfuse wounded soldiers within 30 minutes of injury. With $46.4 million in Federal funding, UMSOM will manage this whole blood product project. The growing research and development activities for blood products are anticipated to create promising opportunities for the blood preparation market growth.

Products Insights

The whole blood segment held the largest market share in 2024. Whole blood is used in the treatments of cases that require large amounts of all blood components. Majorly individuals who have sustained significant blood loss due to major surgeries or massive trauma need substantial quantities of whole blood. As per the German Heart Surgery Report 2022, the total number of heart surgical procedures increased from 92,838 in 2021 to 93,913 in 2022. The growing number of heart surgeries is contributing to the enormous growth of the whole blood segment.

The blood derivatives segment is predicted to grow at a notable compounded annual growth rate (CAGR) during the study period. The increasing requirement for the development of plasma-derived proteins, such as coagulation factor products, immunoglobulins, dried human plasma, human fibrin foam, and human thrombin, is expected to cater to the growth of the blood derivatives segment during the forecast period.

Applications Insights

The thrombocytosis segment had a higher revenue share in 2024. The National Library of Medicine mentions that in a retrospective study involving 801 adult patients, primary thrombocytosis was observed in 5.2% of cases. Thus, the high prevalence of thrombocytosis, increasing awareness, and advancements in diagnostic techniques contribute to the growth of the thrombocytosis segment.

The angina blood vessel complications segment is anticipated to grow with a significant compounded annual growth (CAGR) during the forecast period. Angina is generally caused by a reduction in blood flow to the heart muscle, which is commonly observed in coronary artery disease (CAD). As per the Centers for Disease Control (CDC), about 1 in 20 adults (nearly 5%) aged 20 years and older have coronary artery disease (CAD) in the U.S. The high prevalence of coronary artery disease is estimated to contribute to the angina blood vessel complications segment growth.

Regional Insights

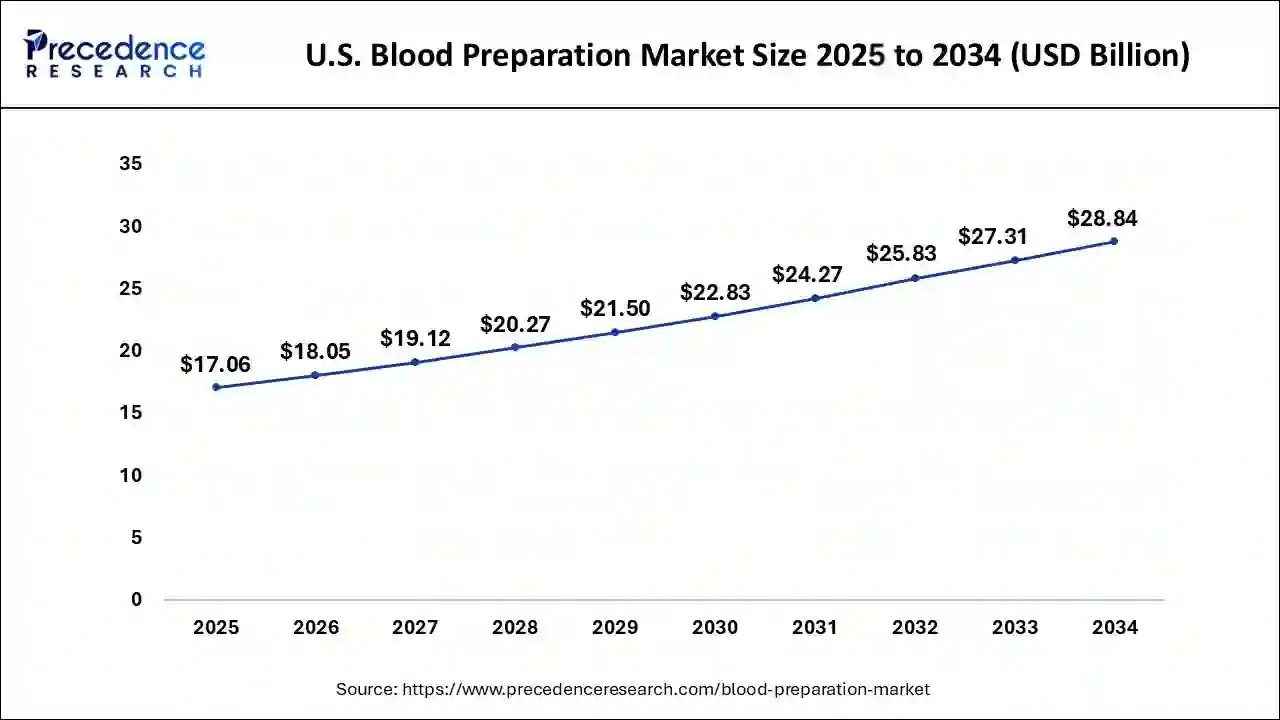

U.S.Blood Preparation Market Size and Growth 2025 to 2034

The U.S. blood preparation market size is evaluated at USD 17.06 billion in 2025 and is projected to be worth around USD 28.84 billion by 2034, growing at a CAGR of 6.00% from 2025 to 2034.

As per the American National Red Cross, someone in the United States requires blood and/or platelets every 2 seconds. Around 29,000 units of red blood cells are needed each day in the United States. About 6,500 units of plasma and 5,000 units of platelets are required every day in the U.S. Approximately 16 million blood components are transfused every year in the United States. Thus, the high demand for blood components is driving the blood preparation market growth in the North American region.

In April 2024, fifty community groups and organizations across Wales and England received £685,000 ($856,983) in funding. This financial support was provided as part of the Government's commitment to tackle health inequalities by promoting blood donation among Asian and Black communities. German Red Cross has 6 blood transfusion services including 28 donation centres and institutes. Some of these institutes and donation centers also offer an opportunity for plasmapheresis. The presence of a significant number of blood transfusion and donation centers is strengthening the European blood preparation market from the supply side.

In June 2024, the Indian Health Ministry reported that India needs an average of 14.6 million blood units every year. As per the Press Information Bureau (PIB), someone in India requires blood every 2 seconds, and 1 out of every 3 Indians will need blood in their lifetime. Thus, the high demand for blood is expected to drive the blood preparation market in the Asia Pacific (APAC) region in the coming years.

Why was Asia-Pacific the fastest-growing region in the blood preparation market?

Asia-Pacific was the fastest-growing region in the blood preparation market due to increased population, healthcare awareness, and chronic disease incidences. Governments of countries in the region have contributed heavily to basic healthcare infrastructure and are encouraging general voluntary blood donations. Countries such as China and India have improved their plasma collection systems and their blood and blood product storage facilities.

China Blood Preparation Market Trends

China dominated the region's market due to its significant government initiatives to develop biopharmaceutical products. In addition, growing funding into healthcare and an improvement in awareness of blood donation further improved blood product supply chains. As China continues to develop domestic plasma fractionation facilities and more advanced disease screening technologies, its market share will likely continue to grow. Further, expanding reform regarding healthcare and partnering with global biopharmaceutical companies to improve product technologies and the blood product manufacturing sector as a whole will also continue to lead to growth in blood products.

What made Europe grow steadily in the global blood preparation market?

Europe was predicted to experience slow and continuous growth in the blood preparation market, supported by stable healthcare systems, world-class research programs, and policy frameworks. Countries were advancing products to improve plasma fractionation, minimize transfusion injuries, and adhere to ethical standards. There were growth opportunities as rates of rare blood conditions escalated, and governments invested in blood safety technologies and cold chain systems to store blood better.

Germany Blood Preparation Market Trends

Germany was the leading country in the European blood preparation market due to its high-capacity medical infrastructure and strict regulations. The advanced state of plasma fractionation facilities, coupled with ongoing research and development programs into biopharmaceutical products, enhanced production efficiencies.

Why was Latin America a rapidly growing region in the blood preparation market?

Latin America anticipated progressive growth in the blood preparation market due to improvements in healthcare systems and increasing awareness regarding the importance of safe transfusion of blood. Governments initiated donation campaigns and utilized their resources to invest in expanding national blood services. Brazil and Mexico made concentrated efforts to modernize blood collection infrastructure and enhance their plasma fractionation capabilities. In addition, the markets in Latin America are positioned to capitalize on public-private partnerships, as well as introduce more advanced specimen testing equipment, and collaborate within local regions to strengthen transfusion safety standards.

Brazil Blood Preparation Market Trends

Brazil captured the largest share in the blood preparation market as a result of increasing funding and investment from the government. Outreach efforts by the government improved awareness about the importance of donation and built on existing plasma processing capacity. Additionally, Brazil encouraged private investments in the manufacturing of blood products. Public healthcare service expansions and disease screening technologies enhanced the market prospects for blood and plasma products in Brazil, as a leading jurisdiction in Latin America.

What made the blood preparation market in the Middle East & Africa region grow at a rapid rate?

The blood preparation market in the Middle East & Africa region was projected to grow at a robust rate. The growth of the market is attributed to the investment in healthcare, improved disease awareness, and the expansion of hospital facilities. New blood donation initiatives were initiated by governments, and healthcare logistics improvements were made. A public-private partnership, along with advances in cold storage and screening technology, created opportunities in Saudi Arabia and South Africa for upgrading plasma collections and transfusion infrastructure.

Saudi Arabia Blood Preparation Market Trends

Saudi Arabia dominates the Middle East blood preparation market, primarily due to its significantly increased investments in healthcare and government-backed awareness programs. The demand specifically drove the establishment of modern blood bank infrastructure, while introducing advanced testing technology for donated blood products to support the country's new focus on producing plasma locally and partnering with international biotechnology firms to further enhance local medical capacity.

Recent Developments

- In May 2023, with $50 million from the New York Blood Center, NYBC Ventures was unveiled as one of the first venture funds focusing exclusively on advancing new blood and cell-based therapies. Thus, increasing funds for new blood and cell-based therapies is expected to contribute to the promising growth of the blood preparation market.

- In February 2023, Terumo Blood and Cell Technologies announced the FDA clearance and official launch of its IMUGARD WB Platelet Pooling Set. This new platelet pooling set supports extended shelf life of whole blood-derived platelets from 5 to 7 days. IMUGARD is the first platelet pooling set approved for 7-day storage in the United States.

- In November 2022, the RESTORE clinical trial (REcovery and survival of STem cell Originated REd cells) was initiated by the NIHR Blood and Transplant Research Unit. Researchers stated that if this clinical trial of lab-grown red blood cells is proven effective and safe, it can revolutionize treatments for people with rare blood types.

Blood Preparation Market Companies

- AstraZeneca plc

- Baxter International Inc

- Bristol-Myers Squibb Company

- Celgene Corp.

- GlaxoSmithKline PLC

- Leo Pharma A/S

- Pfizer, Inc.

- Portola Pharmaceuticals, Inc.

- Sanofi

- Shandong East Chemical Industry Co.

- Xiamen Hisunny Chemical Co., LTD

Segments Covered in the Report

By Product

- Whole blood

- Granulocytes

- Red blood cells

- Plasma

- Platelets

- Blood components

- Leukocyte reduced red blood cells

- Packed red blood cells

- Frozen plasma

- Platelet concentrates

- Cryoprecipitate

- Blood derivatives

By Antithrombotic and Anticoagulants Type

- Platelet aggregation inhibitors

- Glycoprotein inhibitors

- ADP antagonists

- COX inhibitors

- Others

- Fibrinolytics

- Streptokinase

- Tissue plasminogen activator (tPA)

- Urokinase

- Anticoagulants

- Heparins

- Low molecular weight heparin (LMWH)

- Unfractionated heparin

- Ultra-low molecular weight heparin

- Direct thrombin inhibitors

- Vitamin K antagonists

- Direct factor Xa inhibitors

- Heparins

By Application

- Thrombocytosis

- Renal impairment

- Pulmonary embolism

- Angina blood vessel complications

- Others

By End User

- Clinics

- Hospitals

- Diagnostic centers

- Research labs

- Blood banks

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting