Bovine Artificial Insemination Market Size and Forecast 2025 to 2034

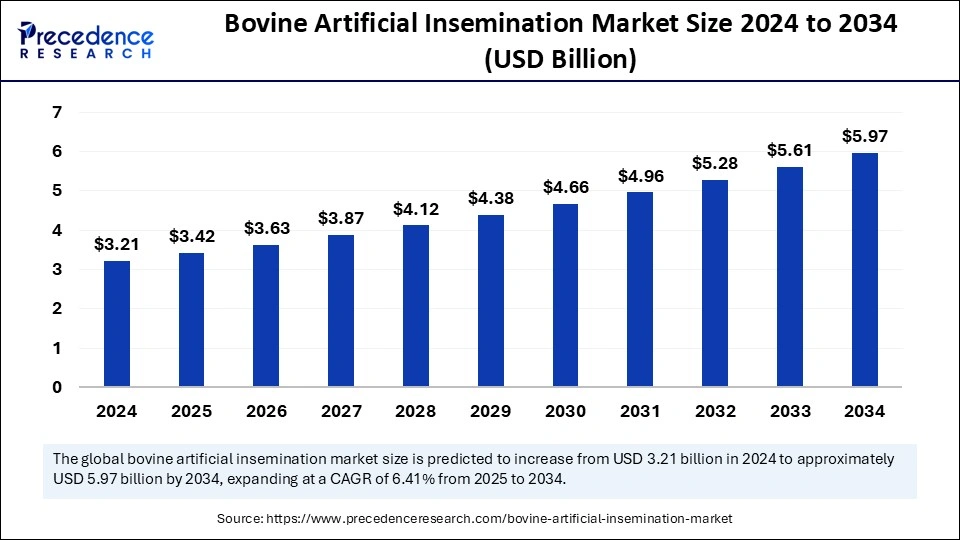

The global bovine artificial insemination market size accounted for USD 3.21 billion in 2024 and is predicted to increase from USD 3.42 billion in 2025 to approximately USD 5.97 billion by 2034, expanding at a CAGR of 6.41% from 2025 to 2034. The market is growing due to the increasing demand for genetic improvement, enhanced reproductive efficiency, and advancements in breeding technologies.

Bovine Artificial Insemination Market Key Takeaways

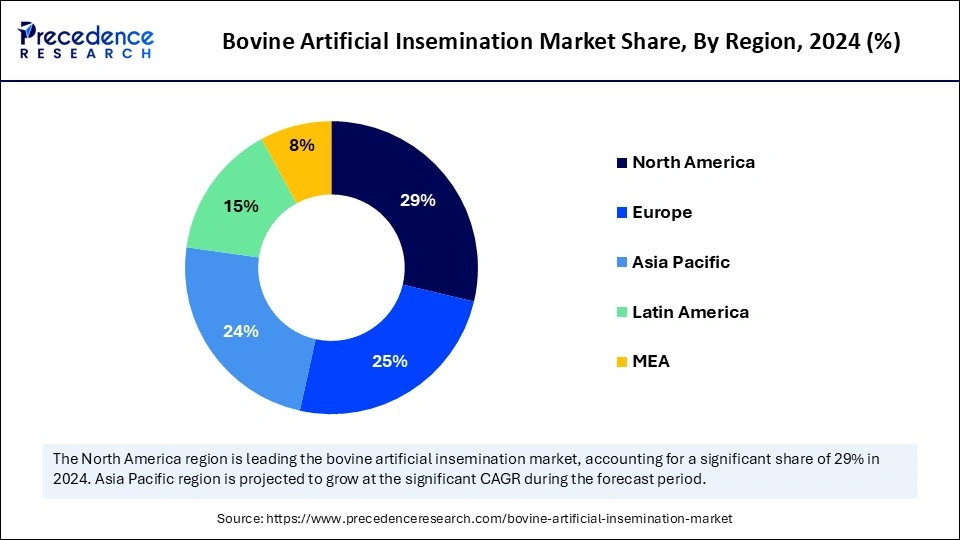

- North America dominated the bovine artificial insemination market with the largest share of 29% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 7.3% during the forecast period.

- By solution, the service segment held the biggest market share of 40% in 2024.

- By solution, the semen segment is expected to witness the fastest growth during the projected timeframe.

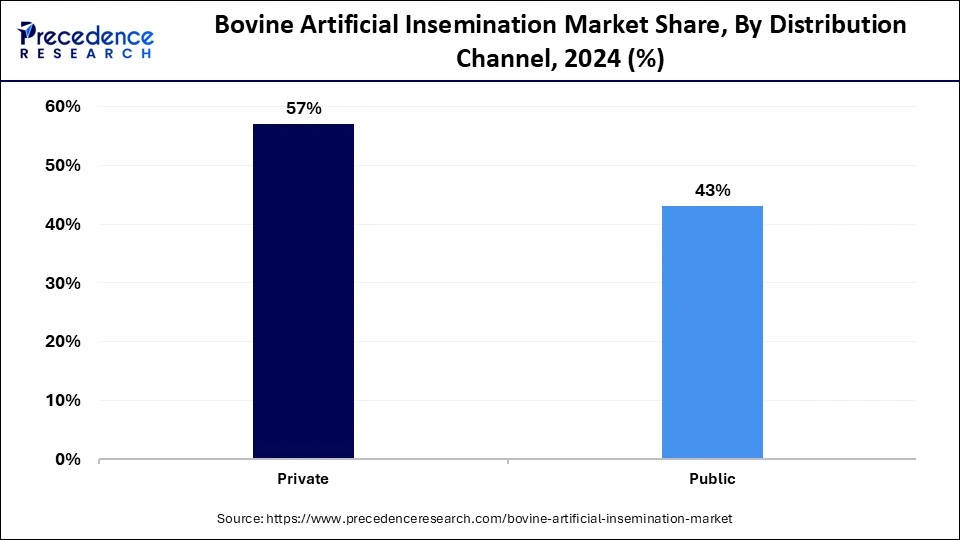

- By distribution channel, the private segment contributed the biggest market share of 56% in 2024.

- By distribution channel, the public segment is projected to grow at a significant rate in the coming years.

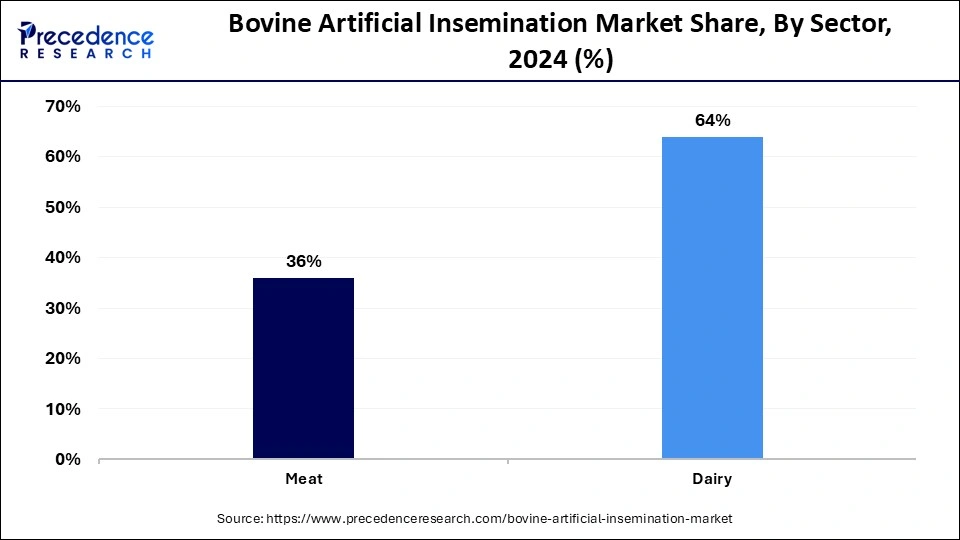

- By sector, the dairy segment held the major market share of 64% in 2024.

- By sector, the meat segment is expected to grow at the fastest rate between 2025 and 2034.

Is AI the Game Changer in Bovine Reproduction?

Artificial intelligence (AI) is transforming bovine reproduction by enhancing efficiency, accuracy, and genetic advancements in breeding programs. AI algorithms analyze large datasets to improve breeding techniques, semen quality, and estrus detection. High-merit bulls can be precisely selected with the help of machine learning models, increasing conception rates and reducing reproductive waste. Automation reduces human error and streamlines processes in herd management, embryo transfer, and semen sorting. Farmers can make data-driven breeding choices with real-time monitoring and sophisticated analytics, which ultimately increases the production of meat and dairy products. As AI technology advances, the future of bovine reproduction is becoming more innovative, profitable, and sustainable.

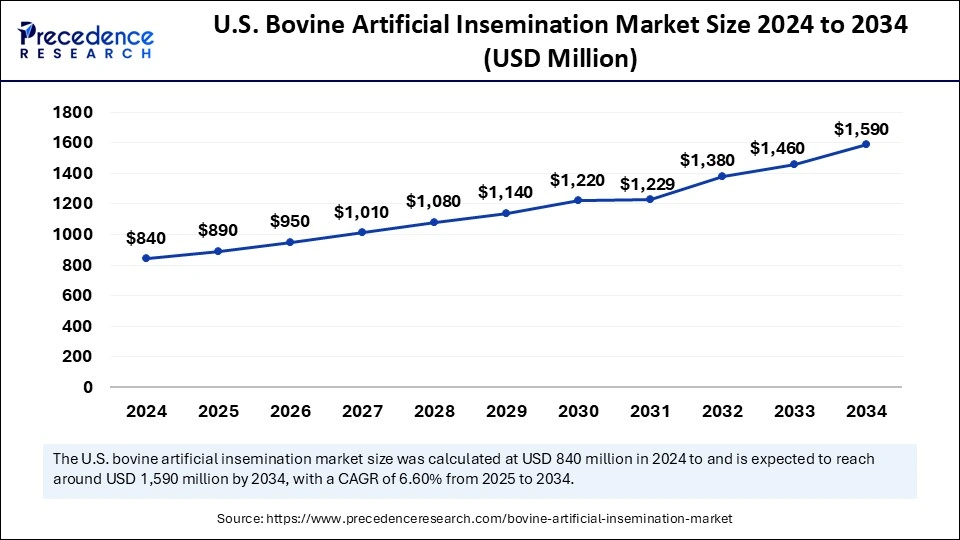

U.S. Bovine Artificial Insemination Market Size and Growth 2025 to 2034

The U.S. bovine artificial insemination market size was exhibited at USD 840 million in 2024 and is projected to be worth around USD 1.590 million by 2034, growing at a CAGR of 6.60% from 2025 to 2034.

North America dominated the bovine artificial insemination market by capturing the largest share in 2024. This is mainly due to the high investments in precision breeding, widespread adoption of veterinary reproductive technologies, and increased demand for improved livestock genetics. The high consumption of dairy and beef products further bolstered the regional market growth. Businesses like Select Sires Inc. and ABS Global are leading the way in herd performance optimization by providing sexed semen embryo transfer and genomic selection. There is a strong focus on productivity improvement and sustainability in farming practices, which prompted partnerships between dairy cooperatives and genetic companies, solidifying North America's market leadership. Government-supported breeding initiatives and research facilities have also accelerated the development of disease-resistant cattle breeds and fertility management techniques. The region's market is expanding thanks to the growing trend of combining artificial insemination methods with digital herd management solutions.

The Asia Pacific bovine artificial insemination market is expected to expand at the fastest CAGR during the forecast period. This is mainly due to the rising government-sponsored genetic improvement initiatives, growing awareness among farmers about the benefits of artificial insemination, and rising demand for high-quality dairy products. China and India are making significant investments in breed improvement to increase meat quality and milk yield. Large-scale artificial insemination efforts are being supported by programs like the China Dairy Herd Genetic Improvement Plan and India's Rashtriya Gokul Mission. To meet the rising demands of livestock, farming businesses like STgenetics and CRV are expanding their footprints in the region by implementing cutting-edge semen processing methods and AI-integrated fertility management solutions. The rising adoption of genetic selection technologies among large-scale dairy cooperatives and the high focus on boosting milk production further contribute to regional market growth. Artificial insemination is also becoming more widespread in rural areas in the region due to government subsidies and farmer education programs.

Europe is observed to grow at a considerable growth rate in the upcoming period. The rising innovations in breeding technologies are a key factor supporting the growth of the market. There is high adoption of precision breeding techniques due to its stringent animal welfare laws and emphasis on producing high-quality dairy and beef products. Organizations such as Topigs Norsvin are presently engaged in genetic refinement initiatives aimed at improving cattle reproductive performance, feed efficiency, and disease resistance. Furthermore, the future of artificial insemination in the European market is being shaped by continuous research into low-emission livestock farming and climate-resilient breeds. In line with its sustainability objectives, the area is also seeing a rise in investments in environmentally friendly breeding practices. Furthermore, the growing focus on boosting livestock production to meet the demands for meat and dairy products supports regional market growth.

Market Overview

The bovine artificial insemination market is experiencing significant growth due to increasing demand for high-yield dairy and beef cattle, advancements in veterinary reproductive technologies, and growing awareness among farmers about the importance of genetic improvement. Artificial insemination is favored over natural mating because it provides advantages like disease control, cost-effectiveness, and improved breeding efficiency. Prominent market participants are offering premium semen, sexed semen technology, and artificial intelligence tools to increase the rate of conception. Accessibility issues in remote locations and the requirement for qualified technicians are obstacles. The market is anticipated to grow because of ongoing technological advancements and the growing global adoption of artificial insemination.

Bovine Artificial Insemination Market Growth Factors

- The rising demand for high quality dairy and meat products is expected to boost the growth of the market. Increasing global consumption of dairy and beef fuels the need for efficient breeding methods.

- Innovations such as sexed semen, embryo transfer, and genomics enhance artificial insemination's success rates, supporting market growth.

- The rising focus on disease prevention among cattle boosts the growth of the market. Artificial insemination minimizes the risk of sexually transmitted diseases in cattle compared to natural mating.

- Farmers are becoming more aware of the benefits of artificial insemination, leading to higher adoption rates.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.97 Billion |

| Market Size in 2025 | USD 3.42 Billion |

| Market Size in 2024 | USD 3.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.41% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Distribution Channel, Sector and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Need for Genetic Improvements & Selective Breeding

The rising need for genetic improvements is a key factor boosting the growth of the bovine artificial insemination market. Artificial insemination is a technique used to achieve pregnancy in cattle without breeding. Artificial insemination speeds up herd improvement, improves disease resistance, and maximizes production efficiency by enabling the selection of superior genetics. This method guarantees consistency in livestock performance, increases feed conversion ratios, and reduces the risk of inbreeding. Breeding programs are further improved by the incorporation of genomic selection, which makes data-driven choices that optimize potential yield and sustainability in cattle operations. Artificial insemination enables selective breeding, improving milk yield, meat quality, and overall cattle productivity.

- In 2022, Select Sires Inc. Implemented advanced pathogen screening for artificial insemination bulls, reducing disease risks in breeding programs and ensuring semen is free from pathogens.

Biosecurity & Disease Prevention

Artificial insemination procedure plays a key role in reducing the biosecurity threats related to reproductive illnesses and sexually transmitted infections, which result in large financial losses. Producers can guarantee controlled breeding conditions and lessen the need for expensive disease management interventions by utilizing artificial insemination. It further enhances overall productivity and longevity by fostering genetic resistance to common livestock diseases, which promotes herd health.

Restraints

High Costs

Significant investments in cryopreservation restrains the growth of the bovine artificial insemination market. Proper handling, storage, and processing of semen require substantial investments in adequate infrastructure. The high costs of semen and liquid nitrogen storage tanks make artificial insemination services unaffordable for many farmers, especially those with low-income groups. Artificial insemination techniques also incurred the costs of ongoing veterinary consultations, hormone treatments, and specialized kits. The financial burden is exacerbated in areas with inadequate infrastructure because of import taxes on artificial insemination-related goods.

Regulatory Barriers & Compliance Costs

Artificial insemination operations must adhere to stringent laws governing the handling of genetic material, the transportation of semen, and biosecurity protocols. Operational costs for artificial insemination service providers are raised by adherence to sanitary regulations, traceability standards, and animal welfare laws. Genetic material import/export restrictions cause supply chain disruption in some nations, hampering the growth of the market.

Opportunities

Government Support & Incentives

Governments around the world are promoting advanced breeding techniques through training programs, research grants, and financial incentives. Farmers now have easier access to reproductive technologies thanks to tax breaks, rural development initiatives, and subsidized artificial insemination services. Regulatory agencies are also putting traceability initiatives into place to guarantee the moral use of genetic resources. These programs are essential for increasing local dairy and meat industries' competitiveness, decreasing dependency on imports, and improving food security. Expanding the use of artificial insemination is also being greatly aided by public-private partnerships. Partnerships between government agencies and breeding businesses are producing more potent genetic solutions. To guarantee quality-controlled breeding and disease prevention, some nations are expanding the use of artificial insemination in government-supported dairy cooperatives.

In 2024, the U.S. Department of Agriculture launched a USD 20 million grant program to support reproductive research, improve artificial insemination adoption, and enhance genetic resilience in cattle herds across rural areas.

Advancements in Sexed Semen Technology

Advancements in sexed semen technology create immense opportunities in the bovine artificial insemination market. Artificial insemination's ability to control offspring's gender is becoming a game changer, particularly in the dairy sector, where female calves are more desirable for milk production. Accessibility for farmers has expanded due to advancements in sperm sorting efficiency. Additionally, improved sperm viability and quicker sorting speeds are increasing the rate of conception, which increases the commercial viability of gender selection.

In 2024, STgenetics launched a next-generation sorting method with a 96% accuracy rate, allowing farmers to optimize herd composition while reducing breeding costs and increasing profitability.

Solution Insights

The services segment dominated the bovine artificial insemination market with the largest share in 2024 because of the increased need for specialized reproductive solutions, such as fertility monitoring, embryo transfer, and artificial insemination. To improve herd genetics and maximize breeding cycles, farmers and breeding facilities depend more on professional advice. Renowned businesses like Select Sires Inc. and Genus ABS provide customized fertility plans, artificial insemination services, fertility monitoring, and sophisticated synchronization strategies to guarantee greater profitability and conception rates. Developments in on-site genetic testing and mobile veterinary services further bolstered the segment.

The semen segment is expected to witness the fastest growth during the forecast period. The segment can be attributed to advancements in sexed semen technologies and the growing need for high-merit bulls. Genetically improved semen is being chosen by farmers to increase herd productivity, overall disease resistance, and milk yield. Businesses like CRV and STgenetics have led the way in sexed semen innovations, which enable farmers to predict the gender of their offspring, maximizing herd composition to produce either beef or dairy. The increasing emphasis on genomic selection and tailored breeding strategies further contributes to segmental growth.

Distribution Channel Insights

The private segment dominated the bovine artificial insemination market in 2024 as industry-leading companies consistently improve their product offerings and broaden their distribution networks. Precision breeding and increased success rates in artificial insemination are guaranteed by the introduction of AI-driven herd monitoring systems by private companies. Businesses like Alta Genetics and URUS Group have forged strategic alliances with dairy farms across the globe by offering creative breeding and integrated genetic solutions. Furthermore, the introduction of direct-to-farm delivery services augmented the segment.

The public segment is projected to grow at a significant rate in the coming years. To increase access to high-quality semen and cutting-edge reproductive technologies, public institutions are funding the genetic advancement of native breeds. Rural farmers now have easier access to high-quality bovine genetics thanks to government initiatives such as the Rashtriya Gokul Mission in India and genetic enhancement projects in Europe and North America. These programs are essential for raising milk production and strengthening livestock farming's financial viability.

Sector Insights

The dairy segment held the largest share of the bovine artificial insemination market in 2024. Artificial insemination is essential for increasing milk yield, herd longevity, and disease resistance. The increase in demand for dairy cows with high yields encouraged investments in reproductive technologies. By creating exceptional breeding programs that concentrate on enhancing milk and fertility rates, businesses like LIC (Livestock Improvement Corporation) and Semex are advancing the genetics of dairy cattle. Furthermore, the incorporation of genetic analysis driven by AI is improving breeding results and raising the overall profitability of dairy farms.

The meat segment is expected to grow at the fastest rate during the forecast period. The segment growth is attributed to the rising demand for high-quality meat worldwide. Breeding programs are emphasizing more on characteristics like muscle growth and feed efficiency to improve meat quality. Leaders in the industry, including Topigs Norsvin and Beef Genetics Australia, are investing in advanced reproductive technologies and genomic selection to enhance carcass traits. Farmers are also adopting precision breeding methods to increase productivity and lessen their environmental impact because of growing awareness of sustainable beef production.

Bovine Artificial Insemination Market Companies

- Genus Plc

- IMV Technologies

- SEMEX

- Jorgensen Laboratories

- URUS Group

- STgenetics

- National Dairy Development Board

- Munster Bovine

- World Wide Sires, Ltd

- CRV

Recent Developments

- In March 2025, the Rajasthan government, in collaboration with the National Dairy Development Board (NDDB), launched a sex-sorted semen scheme, aiming to increase female calf births to 90%. The state procured 100,000 doses of sex-sorted semen to be produced within Rajasthan. This initiative is expected to enhance milk productivity, reduce unproductive male calves, and provide economic benefits to small dairy farmers by ensuring more productive female livestock.

- In 2024, Amul and Verka invested into new state markets, focusing on artificial insemination-based dairy farms, improved breed genetics, and cold chain infrastructure. This expansion aims to optimize milk supply, boost productivity, and enhance national dairy self-sufficiency.

- In 2023, Genus plc (ABS Global) launched an affordable artificial insemination service package to support small-scale dairy farmers, reducing costs by optimizing semen storage and insemination efficiency.

- In 2023, IMV Technologies enhanced its semen tracking and compliance solutions, ensuring artificial insemination service providers meet strict regulatory standards without compromising efficiency.

Segments Covered in the Report

By Solution

- Equipment & Consumables

- Semen

- Normal (Conventional)

- Sexed

- Services

By Distribution Channel

- Private

- Public

By Sector

- Meat

- Dairy

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting