What is the Fetal Bovine Serum Market Size?

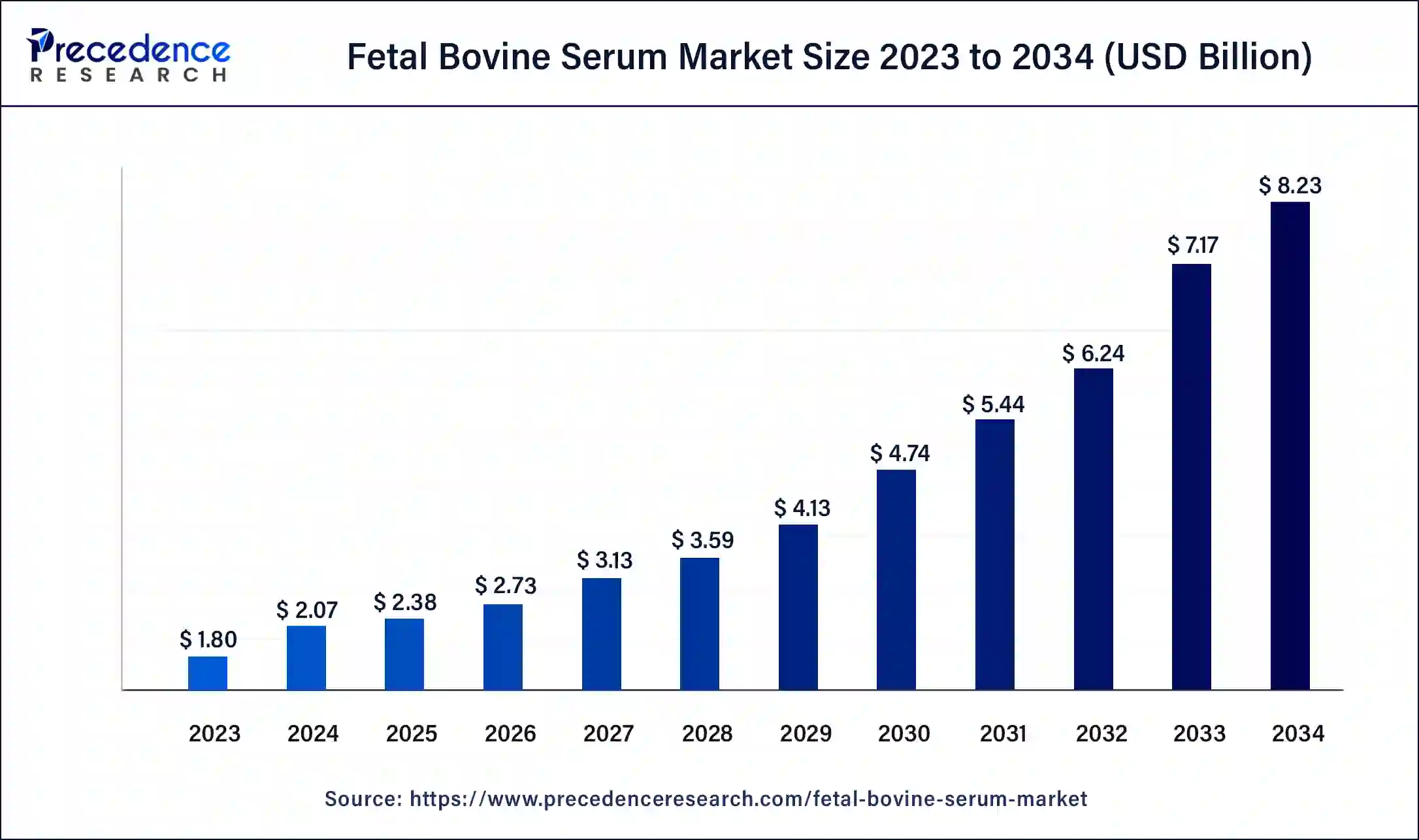

The global fetal bovine serum market size is accounted at USD 2.38 billion in 2025 and predicted to increase from USD 2.73 billion in 2026 to approximately USD 9.20 billion by 2035, representing a CAGR of 14.48% from 2026 to 2035. The market is expanding at a solid CAGR of 14.8% over the forecast period 2026 to 2035.

Fetal Bovine Serum Market Key Takeaways

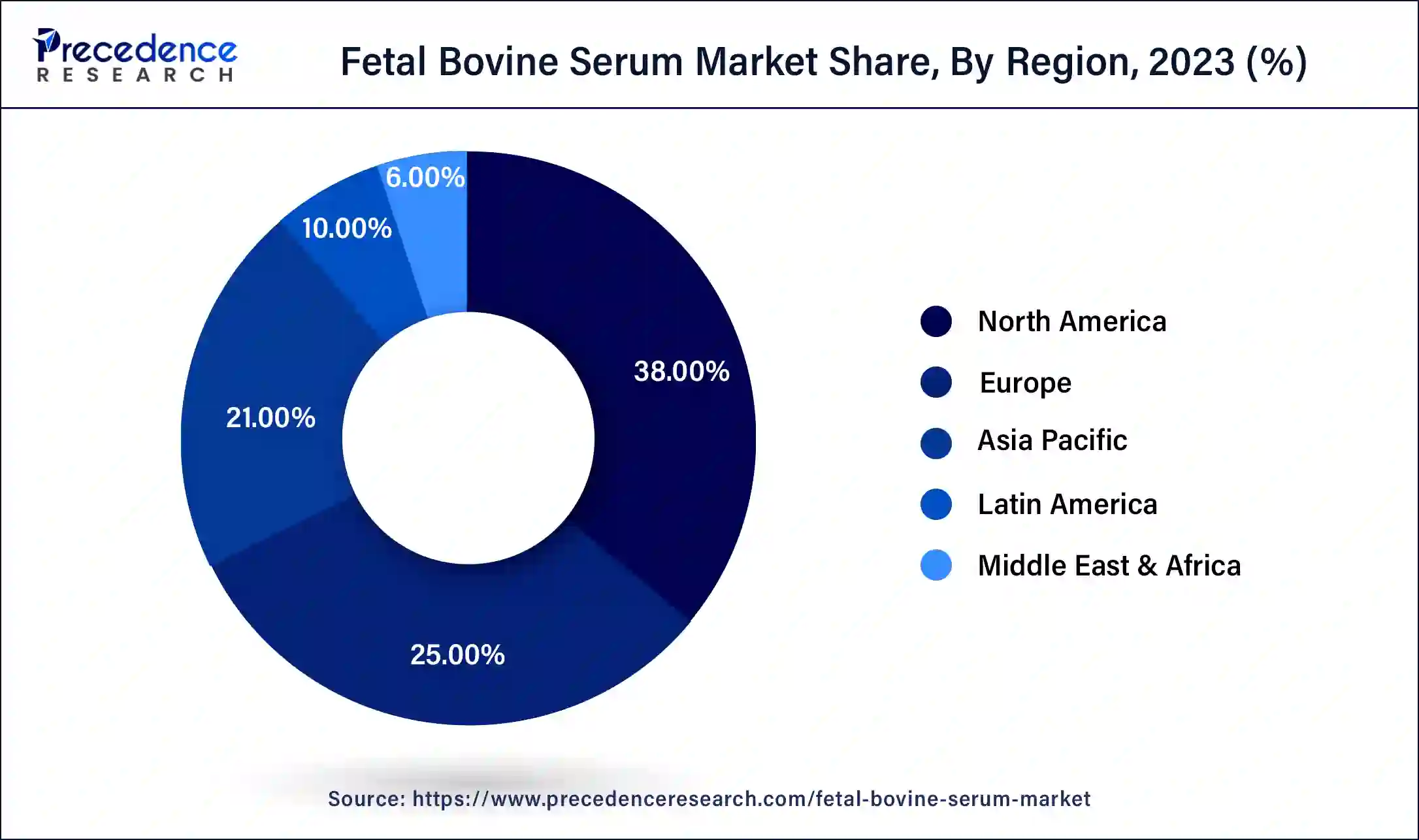

- North America dominated the market in 2025 with a revenue share of 38% and is anticipated to sustain its dominance throughout the forecast period.

- The Asia-Pacific region is expected to record a stable CAGR throughout the estimated period.

- By Application, the vaccine production segment had the largest share during the projection period.

- By Application, the drug discovery segment is assumed to grow a steady CAGR during the predicted period.

- By End-User, the pharmaceuticals and biotechnology industries segment anticipated the dominating spot worldwide.

- By End-User, the research labs segment is predicted to record a constant CAGR during the forecast period.

What is Fetal Bovine Serum?

Fetal bovine serum (FBS) is a nutrient-rich mixture derived from the fetal blood of bovine (cattle) fetuses during the processing of pregnant cows. It is a commonly used supplement in cell culture media to support the growth and survival of many types of cells, including primary cells, mammalian cells, and stem cells. FBS aids drug discovery, production, and development as it prevails in growth properties. It is used for cell attachment to buffer against disruptions such as endotoxins and pH changes. The addition of FBS in the freezing media prevents oxidative stress. Gene and cell therapies rely on many of the same manufacturing approaches, creating a looming possibility in the supply chain of raw materials as recombinant vaccine production. It provides hormones, proteins, vitamins, growth factors, limited antibodies, trace elements, attachment factors, and sheer force of protection.

Fetal Bovine Serum Market Growth Factors

Fetal bovine serum is compatible with a wide range of cell types and can support the growth of both adherent and suspension cultures. It is mainly helpful in cell development, multiplication, and survival. It is extensively utilized in the life science industry, mainly for conducting research. The rapid increase in culture media in developing countries, growth in vaccine production, and increasing product approvals by the regulatory authorities, for instance, Gennova Pharmaceutical's mRNA testing for the Omicron variant, is subjected to regulatory approvals.

Further, in-vitro cell culture in healthcare sectors and the rise in stem cell applications, for example, in treating cancer in the early stage, are responsible for the growth of the fetal bovine serum market. Several events, workshops, and annual meet are organized across the globe to spread awareness about the cell- culture-based vaccine.

The cell culture based vaccine is termed as the vaccine produced from a mammalian cell line rather than embryonic eggs due to their potential benefits in terms of safety, efficacy, and scalability, growing adoption of cell-based therapies, including stem cell therapy and gene therapy, which require fetal bovine serum for cell culture, propelling the market demand. Moreover, cell culture aims to diagnose prevailing infections, conduct research and discover and test new drugs. As the focus on animal cell-based vaccines increases, the demand for FBS also rises, and there is rapid in-vitro production. This factor assists as the trending opportunity for expanding the fetal bovine serum market.

Market Outlook

- Industry Growth Overview: The fetal bovine serum market is experiencing significant growth, driven by fetal bovine serum remains the most versatile and widely used growth supplement in life science labs. Growing R&D in drug discovery, targeted medicine, and cell and gene therapies (like CAR-T) drives demand for high-quality FBS.

- Global Expansion: The market is experiencing significant global expansion, driven by the growing worldwide demand, production, and market for this critical cell culture supplement, driven by biotech research, vaccines, and diagnostics. North America is dominated by strong biotech/pharma industries and advanced research infrastructure.

- Major investors: Major investors in the market are large life science companies such as Thermo Fisher Scientific, Merck KGaA, Danaher (Cytiva/GE Healthcare), and Bio-Techne, alongside specialized suppliers such as HiMedia, Biowest, PAN-Biotech, and Rocky Mountain Biologicals (RMBIO)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.38 Billion |

| Market Size in 2026 | USD 2.73 Billion |

| Market Size by 2035 | USD 9.20 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.48% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing investments by market players in the life science sector

Soaring research and development activities in the life science industry are determined as the driving factor for the fetal bovine serum market. Regenerative medicine, which involves repairing, replacing, or regenerating damaged tissues or organs, is an emerging field in the life science sector. Fetal bovine serum is commonly used in cell-based therapies and tissue engineering, critical areas of regenerative medicine research. As market players invest more in regenerative medicine research and clinical trials, the demand for FBS as a vital

component in these therapies also increases, driving the FBS market and raising venture capital investment, robust workforce, escalating growth of pharmaceutical industries, and government initiatives to bolster the research in life science.

Restraints:

Rise in FBS price while a decrease in its production

Change in variation is a significant concern because of different economic factors but is majorly affected by unreliable sources. Firms need a fixed reference to keep varying prices as there is no regular supply. This leads to some cases of contamination of products where adult bovine serum is blended in to cut the expense. Due to the biochemical contrast that can emerge in FBS due to origin, breed, feed, etc., these variances could be better for scientists who rely entirely on consistency for results.

It has been acknowledged that cattle usage for FBS production has raised the price of FBS in the market. A higher number of cattle are being slaughtered for producing FBS, which according to PETA, has been considered a crime, and the manufacturers are imposed with huge fines, which reduces their production in the market. This price increase is attributed to the substantial surge in demand for FBS and decreased production.

Opportunities:

Rising demand for FBS due to the supply gap

FBS is widely available from commercial suppliers and is relatively inexpensive compared to other growth supplements. When the demand for FBS exceeds the available supply, it can lead to an increase in prices. This presents an opportunity for FBS producers and suppliers to capitalize on the price differential and generate higher revenues and profits. Producers may also invest in expanding their production capacity to meet the increased demand and take advantage of favorable market conditions.

The demand and supply gap can stimulate innovation and diversification in the FBS market. Producers may invest in research and development to develop alternative sources of FBS or explore other cell culture media and supplements that can serve as substitutes for FBS. This can create opportunities for new product development and differentiation, leading to a competitive advantage in the market.

Application Insights:

The vaccine production segment is the major revenue contributor and is projected to grow significantly; owing to the rising production of the novel vaccine, FBS provides a rich source of nutrients, hormones, and growth factors essential for cell growth and proliferation. FBS is a vital ingredient in the culture medium that aids in manufacturing vaccines. The introduction of proteomics, genetic engineering, and artificial intelligence in vaccine research propels fetal bovine serum market growth. For instance, according to an article published in AAMC, in March 2021, mRNA technology obliges the reorganization of future vaccines and treatments for infectious diseases and cancer. It can be used to build a diversity of vaccines and therapeutics and is more transient and cost-effective than conventional approaches.

The drug discovery segment is expected to register the fastest growth during the forecast period, owing to the discovery of novel drugs for oncology by using technological advancements such as next-generation proteomics and cell-free DNA for drug discovery and development. For instance, FDA accepted cell-based gene therapy to medicate subjects with Beta-thalassemia that require a regular blood transfusion in August 2022. Further, basic research application is anticipated to garner a significant industry share over the predicted period. Cell-based assays act as the core of life sciences research to better understanding of different cellular events in health and disorders.

End-User Insights:

The pharmaceuticals and biotechnology industries segment is the dominant segment in the fetal bovine serum market; the increase in populations across the world dealing with hypertension and diabetes has expanded the growth of a more significant number of pharmaceuticals and biotechnology industries that assign medications for the respective diseases making it to contribute for the highest revenue share in the fetal bovine serum leading to the maximum growth.

The research labs segment held the fastest growing part of the fetal bovine serum market; the growing demand for cell and gene-based research, mainly to oncology and neurodegenerative disorders such as Alzheimer's and Parkinson's disease, aid for the fastest growing segment in the fetal bovine serum market. For instance, the National Institute of Mental Health and Neurosciences (NIMHANS) provides research facilities such as neuro-oncology, cell culture, advanced flow cytometry, etc.

Regional Insights

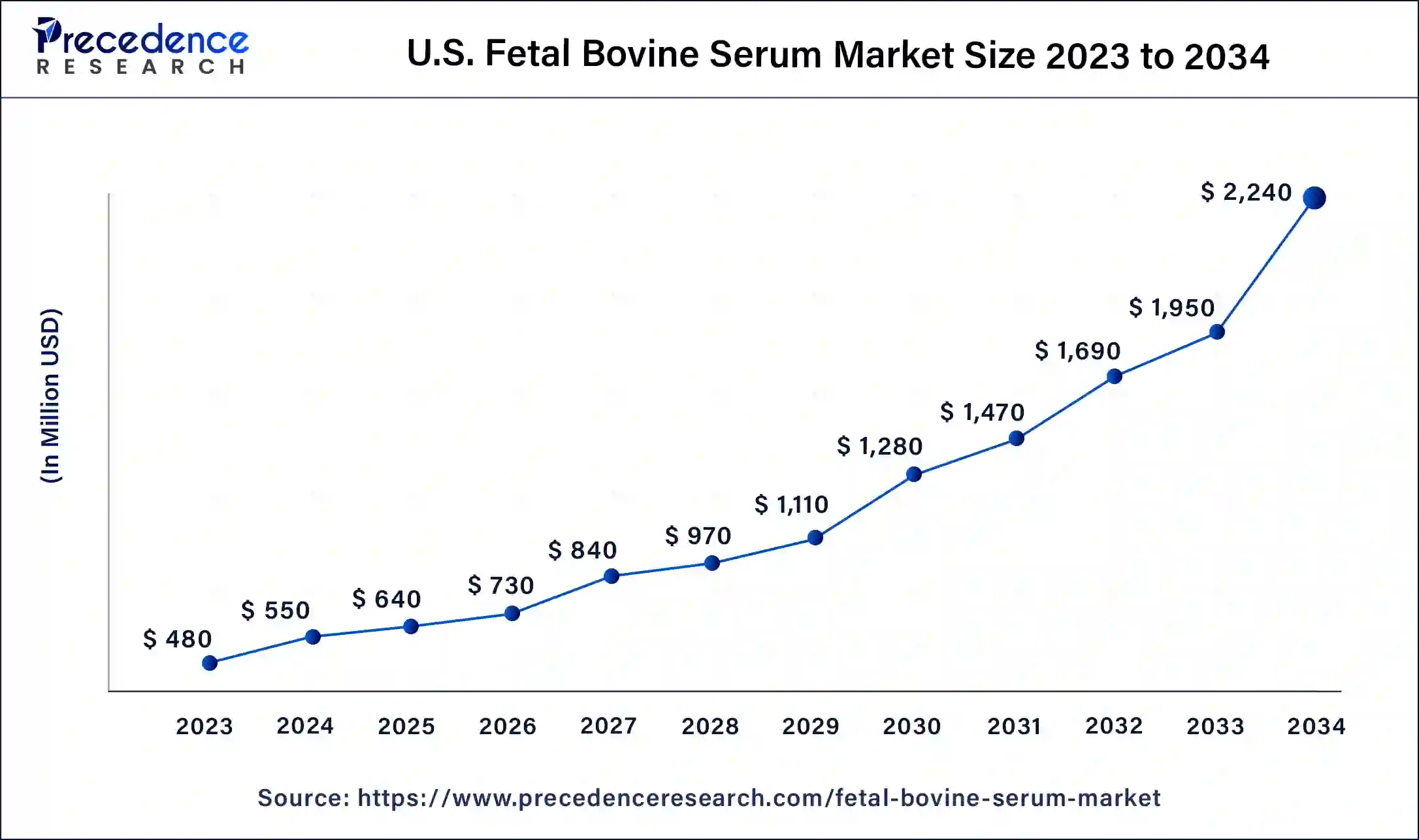

U.S. Fetal Bovine Serum Market Size and Growth 2026 to 2035

The U.S. fetal bovine serum market size is estimated at USD 640 million in 2025 and is predicted to be worth around USD 2,510 million by 2035, at a CAGR of 14.64% from 2026 to 2035.

North America: High investment and innovation

North America held the largest share of the fetal bovine serum market in 2025, the region is expected to maintain its dominance in the fetal bovine serum market during the predicted period. The presence of maximum leading vital players and a more significant number of private research labs and universities that conduct extensive research and development activities require fetal bovine serum as a crucial component in North America, influencing it to be the dominating region in the world. The United States has better funding facilities, well-established instrumentations, and skilled laborers. Also, it has strict regulations and standards for fetal bovine serum production, ensuring high quality and safety. This has led to the adoption of premium-priced serum products, propelling market growth worldwide.

U.S. Fetal Bovine Serum Market Trends

In the U.S., the presence of well-developed medical care, biotech, and cold-chain distribution networks ensures high-quality FBS supply and consistent delivery. Extensive cattle farming offers a consistent, large-scale source of high-quality bovine blood for serum extraction. Strict quality control and adherence to standards increase trust in North American-sourced FBS.

Europe is anticipating lucrative fetal bovine serum market growth during the predicted period. With emerging cell culture technologies and government initiatives in life science, Europe is home to numerous research institutions and academic centers conducting extensive life science research. Increasing focus on regenerative medicine is promoting the Europe market in fetal bovine serum.

Asia Pacific: Increasing pharmaceutical and biotech growth

The fetal bovine serum market in Asia-Pacific is thriving at a special rate. The increasing usage of fetal bovine serum market in the emerging market is expanding the growth. India is considered the most extensive cattle record after China. With more cattle in the country, the production for FBS margin has increased. Asia-Pacific has a large population, leading to a high demand for vaccines. Fetal bovine serum is extensively used in vaccine production, which is intended to drive the market.

The Latin America- the Middle East & Africa is growing due to increasing demand for vaccines, drugs, and favorable government policies to enhance the industry's development in the fetal bovine serum market. Many countries in Latin America are focusing on improving their healthcare infrastructure, including research and development capabilities, which is expected to boost the demand for fetal bovine serum in the region.

India Fetal Bovine Serum Market Trends

India serves as a key center for biomedical research, particularly in personalized medicine, cell-based therapies, and regenerative medicine, all of which depend heavily on FBS. Robust government support for the life sciences and biotech sectors enhances funding and infrastructure, promoting the adoption of FBS. The presence of major pharmaceutical companies and a growing diagnostics industry spurs high demand for FBS in drug discovery and vaccine development.

Europe: Advanced Research & Development

Europe shows significant growth in the Fetal Bovine Serum Market, driven by strong research infrastructure and an expanding biotech industry. The increasing use of cell-based therapies and the strong demand for fetal bovine serum across drug discovery and R&D, from basic research to specialized assays, further fuel this growth. To specialty assays

The UK Fetal Bovine Serum Market Trends

The UK regulatory system actively funds biomedical research, particularly in areas such as cell therapies, gene therapy, and tissue engineering, which all need significant FBS. The presence of major pharmaceutical organizations and an increasing startup scene in biotech increases the demand for novel drug discovery and clinical trials.

Value Chain Analysis - Fetal Bovine Serum Market

- R&D:

The R&D and manufacturing process for fetal bovine serum (FBS) involves stringent controls from collection to final testing to ensure a high-quality, consistent product suitable for cell culture.

Key Players: Thermo Fisher Scientific and Merck KGaA - Clinical Trials:

In clinical research and pharmaceutical manufacturing, fetal bovine serum (FBS) is significantly applied as a cell culture supplement to increase and maintain human cells, like stem or immune cells, intended for therapeutic applications.

Key Players: Bio-Techne - Manufacturing:

FBS manufacturing includes rigorous quality control and processing processes to confirm safety and consistency for research and manufacturing applications. These manufacturing and quality assurance processes are crucial because the end products are used by patients.

Key Players: PAN-Biotech and Corning Incorporated

Top Companies in the Fetal Bovine Serum Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

TCS Biosciences Ltd |

UK |

reliable manufacturer and distributor |

TCS Biosciences Ltd is pleased to incorporate Fetal (Foetal) Bovine Serum (FBS) of Australian and New Zealand Origin |

|

Merck KGaA |

Germany |

Deep scientific expertise and R&D investment, |

In 2025, Merck KGaA (through its MilliporeSigma/Sigma-Aldrich brand) remains a major supplier of Fetal Bovine Serum (FBS) for research, offering diverse grades like EmbryoMax. |

|

Gemini Bio-Products |

California |

Comprehensive automation portfolio |

In November 2024, Gemini Bioproducts, LLC, Acquires Selected Fetal Bovine Serum (FBS) Product Rights and Inventory from Bio-Techne |

|

Thermo Fischer Scientific Inc. |

United States |

diversified customer base |

Fetal bovine serum (FBS) offers essential nutrients and growth factors for the maintenance and growth of cultured cells. |

|

Moregate Biotech |

Australia |

Production of high-quality animal sera and proteins |

Moregate Biotech complements ANZCO's Melbourne-based Bovogen Biologicals, creating a stronger presence in the bioscience sector. |

Fetal Bovine Serum Market Companies

- TCS Biosciences Ltd

- Merck KGaA

- Gemini Bio-Products

- Thermo Fischer Scientific Inc.

- Moregate Biotech

- Bovogen Biologicals Pvt Ltd

- General Electric

- Atlanta Biologicals Inc.

- HiMedia Laboratories

- PAN-Biotech

- R&D Systems Inc.

Recent Developments

- In September 2022, scientists developed a new technique for growing meat in-vitro using FBS for cell growth and multiplication by applying a magnetic field which can later be used in regenerative medicine.

- In February 2022, CellMEAT, a South Korean startup, scooped $4.5 million to scale its program to reduce cultivated product expense. The results were revealed in December, which states that the company was the first to hit a milestone as it disclosed its FBS-free cell culture media that eventually will be able to support domestically cultivated companies, including its manufacturing branch, alongside global players.

Segments Covered in the Report

By Application

- Cell-based research

- Vaccine production

- Diagnostics

- Drug discovery

- Toxicity testing

- In-vitro fertilization

- Cell therapy

By End-User

- Academic Institutes

- Pharmaceuticals and Biotechnology Industries

- Research labs

- Diagnostic labs

- IVF centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content