What is the Cell Culture Media Market Size?

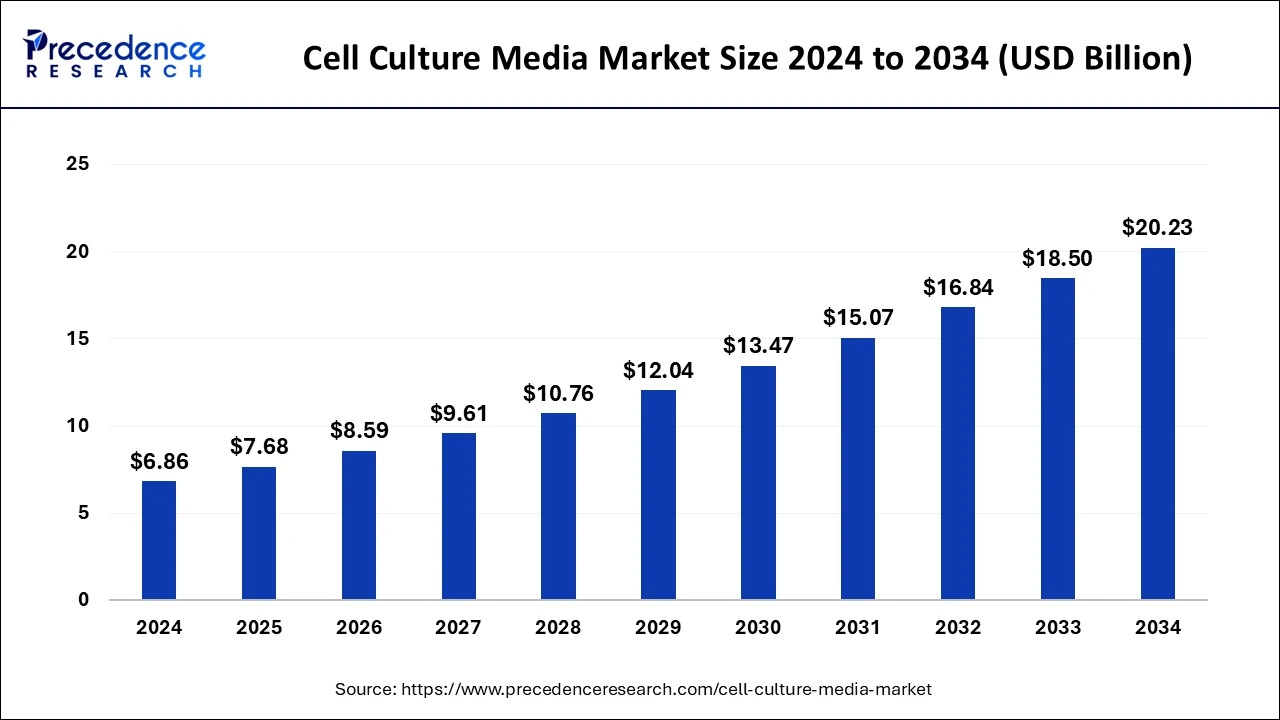

The global cell culture media market size accounted for USD 7.68 billion in 2025 and is predicted to increase from USD 8.59 billion in 2026 to approximately USD 21.91 billion by 2035, growing at a CAGR of 11.05% from 2026 to 2035.

Cell Culture Media Market Key Takeaways

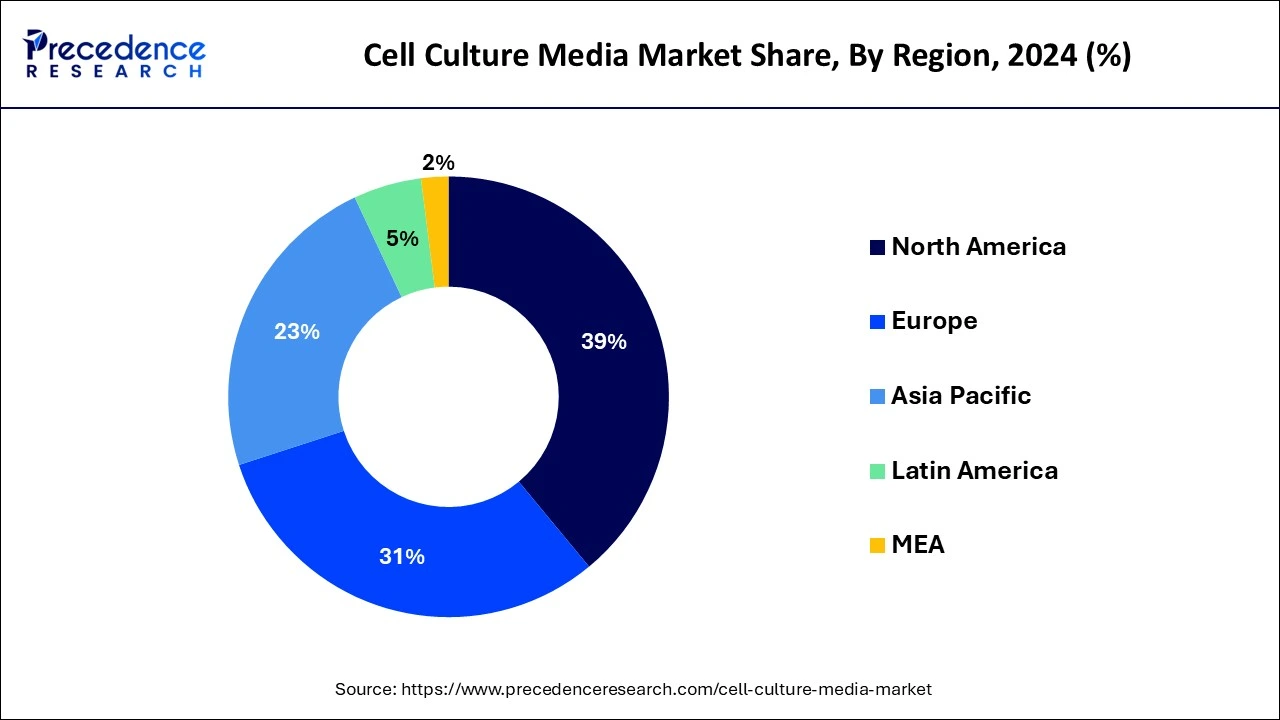

- North America has dominated the cell culture media market with a revenue share of 38.14% in 2025.

- By Product, the serum-free media segment has recorded the largest revenue share of 36% in 2025.

- By Application, the biopharmaceutical production segment has held the highest revenue share 43.7% in 2025.

- By Type, the liquid media segment is projected to capture a maximum market share of over 63% in 2025.

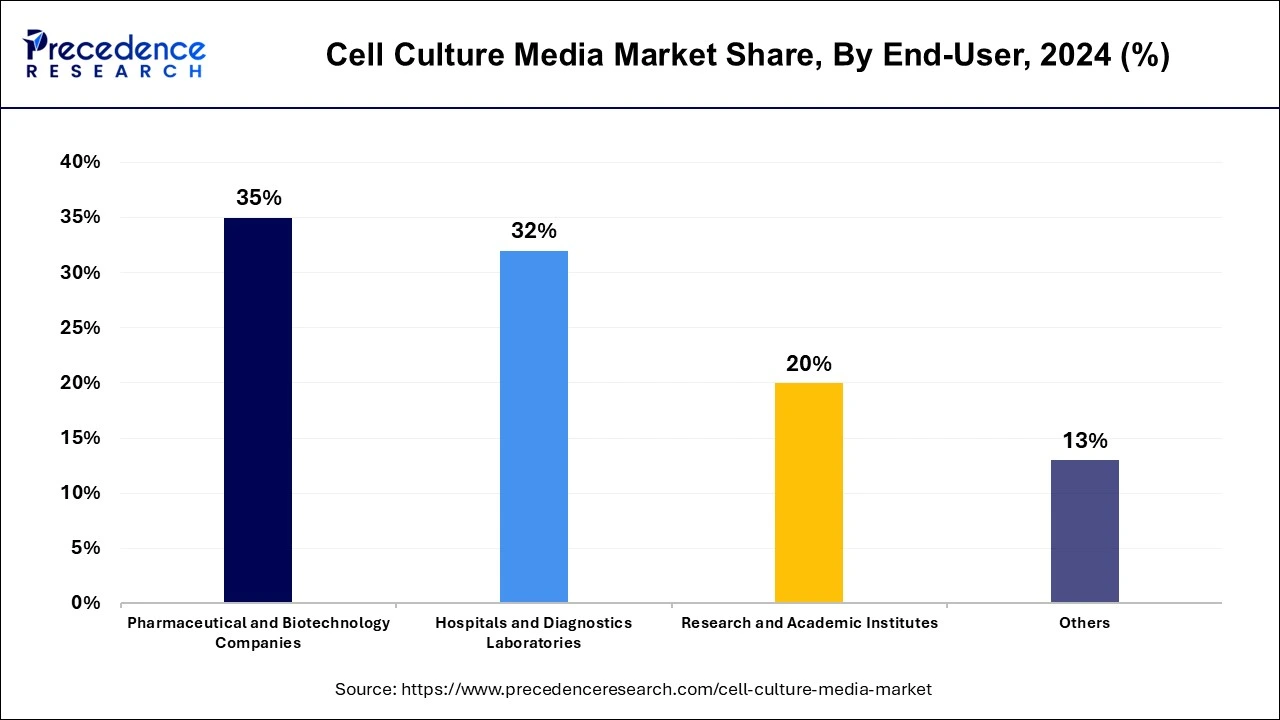

- By End-user, the pharmaceutical and biotechnology segment has contributed the largest revenue share of 35% in 2025.

Market Overview

One of the most significant techniques in the life sciences is cell culture. It is a broad term used to describe the removal of cells, tissues, or organs from an animal or plant and the subsequent transplantation of those tissues or organs into an environment created artificially to support their survival or proliferation. Controlled temperature, a surface on which cells may attach, a growth medium that is suited for the cells, and an incubator that maintains the correct PH and osmolality are the basic environmental needs for cells to develop optimally.

The most fundamental and significant stage in cell culture is choosing the right growth media for in vitro cultivation. A liquid or gel known as a “growth medium” or “culture medium” is used to support the growth of microbes, cells, or small plants. The majority of cell culture mediums contain a substance that controls the cell cycle and is a suitable source of energy. Amino acids, inorganic salts, vitamins, serum and glucose, a source of growth factors, hormones, and attachment factors make up the majority of a standard culture media. The medium aids in maintaining PH and osmolality in addition to providing nutrients.

Artificial Intelligence: The Next Growth Catalyst in Cell Culture Media

AI is significantly transforming the cell culture media industry by introducing data-driven precision, automation, and efficiency into what was traditionally a subjective and labor-intensive process. Machine learning algorithms analyze vast datasets to optimize media formulations, identifying the ideal combination of nutrition's and growth factors for specific cell lines and applications which significantly reduces the need for trial- and -error experimentation.

Market Outlook

- Market Growth Overview: The cell culture media market is expected to grow significantly between 2025 and 2034, driven by the rising biopharmaceutical demand, higher investment in biotech and pharma, and innovation in 3D cell culture, and focus on personalized and precision medicine drives the market growth.

- Sustainability Trends: Sustainability trends involve chemically defined and animal-component-free media, reduced plastic waste, and implementation automation for higher throughput and reproducibility, reducing manual labor and labor errors.

- Major Investors: Major investors in the market include Thermo Fisher Scientific, Merck KGaA, Danaher Corporation, and Sartorius AG.

- Startup Economy: Startup economy focuses on tissue engineering and regenerative medicine, cellular agriculture, and advanced media and consumables.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 11.05% |

| Market Size in 2025 | USD 7.68 Billion |

| Market Size by 2035 | USD 21.91 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Type, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing use of regenerative medicine

A new area of medicine called “regenerative medicine” claims to have treatments for replacing organ and tissue system in patients. Regenerative medicine uses cells, biomaterials and chemicals to repair body tissue that have been harmed by disease or injury. Nearly 30 different bodily parts are being studied by the Wake Forest Institute for Regenerative Medicine in the US, including skin, bladder, and liver.

Numerous individuals with chronic disease have a great deal of optimism about an improvement in their health owing to cell therapy and regenerative medicine. The makers are being encouraged to create cutting-edge cell culture systems by the urgent and growing need for breakthrough medicines to treat crippling medical disorders. Thus, this is expected to drive market growth over the forecast period.

Restraints

Optimization of cell culture media

It can be difficult to adjust individual components because of the complicated composition of cell culture media. The majority of traditional culture media were developed for low-density, small-scale cultures and frequently demand serum a crucial component. However, research and optimization of culture media are essential in the biotechnology sector where there is a requirement to maintain high cell densities and boost cellular productivity. Media used in the biotechnology sector are often serum-free and substantially richer in nutrients than conventional media. Thus, this is expected to be a major restraint for the market growth over the forecast period.

Opportunities

Increasing pharmaceutical and biotechnology industry

The increasing biotechnology and pharmaceutical industry is expected to provide a lucrative opportunity for market expansion over the forecast period. For instance, according to Invest India, by 2024 and 2030, respectively, the Indian pharmaceutical market is projected to grow to $65 billion and $130 billion. With over 200 nations receiving Indian pharmaceutical exports, India is a significant pharmaceutical exporter. India meets over 50% of Africa's demand for generic drugs, about 40% of the US's demand for generics, and about 25% of the UK's total demand for drugs. India is a major supplier of the DPT, BCG, and measles vaccines and provides for about 60% of the world's vaccine demand.

According to the WHO's recommended vaccination plan, 70% of the organization's vaccines come from India. Thus, the increasing pharmaceutical and biotechnology industry is expected to provide an attractive opportunity for market growth.

Impact of COVID-19:

The COVID-19 pandemic positively impacted the growth of the market. The COVID-19 pandemic has increased the demand for tried-and-true cell-based vaccine manufacturing technologies. Additionally, it has sparked a few scientific breakthroughs, especially in the development and testing of vaccination technologies.

For instance, the VERO cell line, which was derived from the kidney of an African green monkey, has been widely applied to the production of viral vaccines. Furthermore, it has been utilized to create several SARS-CoV subtypes. Lonza Bioscience ProVeroTM1 serum-free medium is a protein-free, non-animal origin medium created to assist the development of Vero cells and MDCK.

Segment Insights

Product Insights

Based on the product, the global cell culture media market is segmented into serum-free media, classical media, stem cell culture media, specialty media, chemically defined media, and others. The serum-free media is expected to dominate the market over the forecast period. A cell can be cultivated without the need for animal sera using a serum-free medium, which includes the proper nutritional and hormonal compositions. Serum-free mediums have various benefits for cell culture, including improved productivity and consistency, simpler purification, and downstream processing.

Furthermore, a combination of growth factors that are selective for particular cell types can be added to serum-free media to make them more potent. Many primary cultures and cell lines including hybridoma cell lines, Chinese hamster ovary (CHO) lines that produce recombinant proteins, and cell lines that serve as hosts for virus generation, are amenable to serum-free medium formulations such as 293, VERO, MDCK and MDBK. Thereby, driving the market expansion during the forecast period.

Application Insights

Based on the application, the market is bifurcated into biopharmaceutical production, diagnostics, drug screening and development, tissue engineering and regenerative medicine, and others. Biopharmaceutical production is expected to capture the largest market share during the forecast period owing to the increasing demand for cell culture media in this industry. The demand for cell culture media is growing in the biopharmaceutical industry owing to the need for more consistent and better-defined media to match the escalating production levels by decreasing the risk of contamination in the downstream procedures.

Type Insights

Based on the type, the market is segmented into liquid media semi-solid and solid media. The liquid media segment is expected to hold a significant market share over the forecast period. These media don't have any traces of solidifying agents like agar or gelatin and substantial bacterial development of colonies is visible there. When incubated at 37C for 24hrs, liquid media, commonly known as broths, enable bacterial strains to develop uniformly and turbidly. The media is utilized for experiments on fermentation and the voluminous development of microorganisms.

End-User Insights

Based on the end-user, the market is segmented into pharmaceutical and biotechnology companies, hospitals and diagnostic laboratories, research and academic institutes, and others. The pharmaceutical and biotechnology company is expected to dominate the market over the forecast period. The growth in the segment is attributed to the growing biopharmaceutical manufacturing. Moreover, the key players investing heavily to expand their biomanufacturing capabilities are expected to drive segment growth. For instance, in July 2021, to fulfil the rising demand for biotechnology solutions, Cytiva and Pall Corporation announced an investment of USD 1.5 billion over two years. This investment also expands manufacturing capacity for life sciences products at 13 Cytiva and Pall Corporation sites to meet customer demand. Thus, the growing investment by the key players helps to drive the market expansion over the forecast period.

Regional Insights

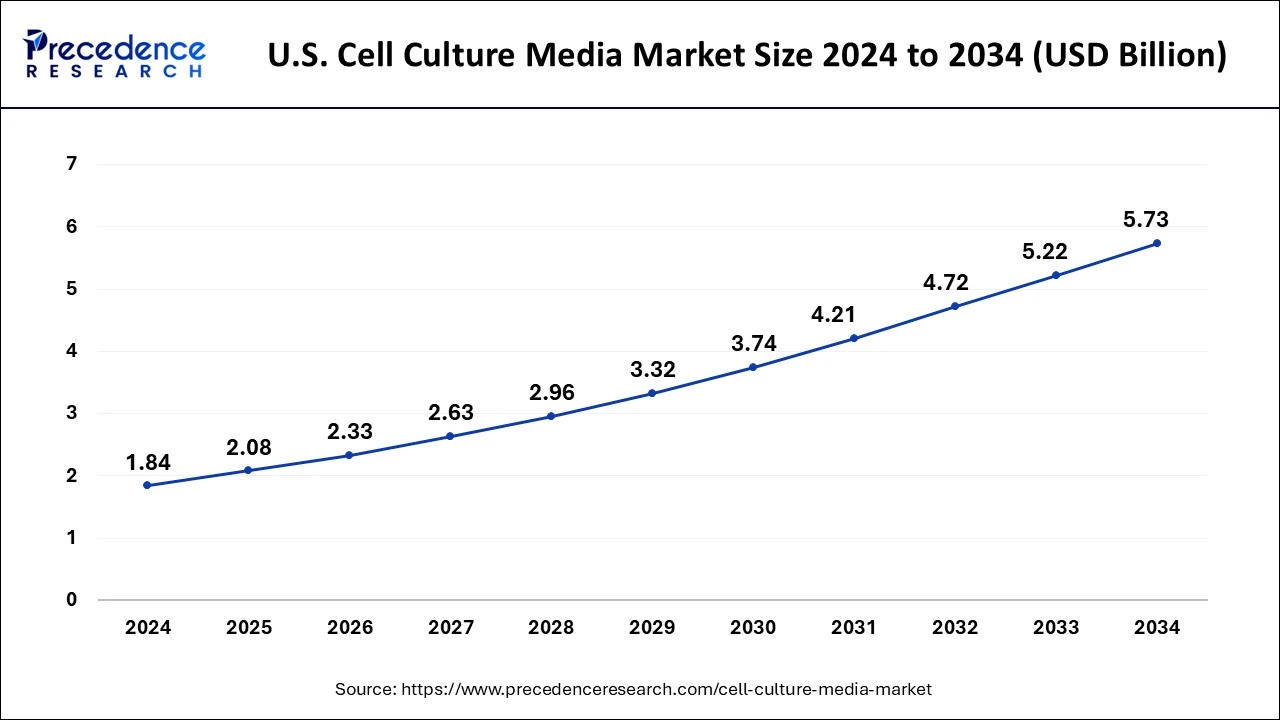

What is the U.S. Cell Culture Media Market Size?

The U.S. cell culture media market size was evaluated at USD 2.08 billion in 2025 and is projected to be worth around USD 6.23 billion by 2035, growing at a CAGR of 11.59% from 2026 to 2035.

North America is expected to dominate the market during the forecast period. The growth in the region is attributed to the robust presence of prominent players including Thermofisher Scientific Inc, Cytiva and Others. These players constantly launch innovative products and draw strategies to remain competitive in the field of life sciences. For instance, in October 2022, the leading provider of high-performance cell line development and viral vector manufacturing technology in Germany and the world, CVEC Pharmaceuticals, was acquired by Cytiva, a pioneer in the life sciences industry. Cytiva's position as the industry leader in biomanufacturing solutions will be strengthened by CEVEC.

U.S. Cell Culture Media Market Trends

U.S.'s shift toward high-yield, chemically defined media to support the mass production of biologics and cell therapies. As the industry moves away from animal-derived components, the integration of custom, "ready-to-use" formulations is drastically reducing R&D timelines.

In addition, an increase indrug discoveryand laboratories is expected to provide enormous opportunities for the market in the North American region. Moreover, the growth of the market in this region is anticipated to be aided by several factors such as governmental initiatives for biotechnology research, increasing acceptance ofpersonalized medicines, rising academic and governmental investments in diagnostic research and increasing emphasis on drug discovery and development. For instance, in September 2022, the United States declared new investments and resources to progress the national biotechnology and biomanufacturing initiative.The Department of Health and human services will spend USD 40 million on this project to increase its biomanufacturing position in society. Thus, the aforementioned facts support the market growth during the forecast period.

The Asia Pacific is growing at the highest CAGR during the forecast period. The growing prevalence of cancer in countries like India and China is expected to drive market expansion in the region. For instance, as per the US Department of Health and Human Services (HHS), 14,61,427 incident cases of cancer were determined to be the projected total in India for 2022.In India 1 out of 9 people has a lifelong risk of developing cancer. The most common cancer in men and women were lung andbreast cancer. According to the estimates, there will be 12.8% more cancer instances in 2025 than there were in 2020. Moreover, the growing investment in healthcare infrastructure is among the key factor that propels the market growth.

China Cell Culture Media Market Trends

China's growing domestic production capacity for media and reagents, rising adoption for convenience and efficiency, and strong demand from research institutes, pharma/biotech, and hospitals, fuel the market growth.

How did Europe experience notable growth in the Cell Culture Media Market?

Europe's strong demand for biologics, biosimilars, gene therapies, rising investment in research and development in biopharmaceutical research, and rising adoption of single-use systems, automation, and development of xeno-free media, enhances efficiency, fueling the market growth.

Germany Cell Culture Media Market Trends

Germany's dominance of serum-free media, growing research, and clinical trials in regenerative medicine and cell therapy, rising adoption of advanced technology, and government initiatives promote R&D and innovation in life science, and rising adoption of advanced cell culture technology fuels the market growth.

Value Chain Analysis of the Cell Culture Media Market

- Raw Material & Component Sourcing

This initial stage involves the procurement of high-quality base components such as amino acids, vitamins, minerals, salts, and other essential nutrients.

Key Players: Avantor, Thermo Fisher Scientific, Merck KGaA, FUJIFILM Irvine Scientific. - Media Formulation and Development

In this stage, companies leverage R&D to develop and optimize proprietary and custom media formulations tailored for specific cell lines and applications.

Key Players: Thermo Fisher Scientific, Merck KGaA, Lonza Group, Sartorius AG, FUJIFILM Irvine Scientific, STEMCELL Technologies. - Manufacturing and Quality Control

Manufacturing involves the large-scale production of media under strict quality control standards, such as Good Manufacturing Practices (GMP), to maintain sterility and batch-to-batch consistency.

Key Players: Merck KGaA, Thermo Fisher Scientific, Sartorius AG, Lonza, Danaher (Cytiva), Corning Incorporated.

Recent Developments

- In June 2022, to increase the output of cell-culture-based biopharmaceuticals, Evonik introduced a novel peptide. It is the most recent addition to the cQrex product line of cell culture components, which boosts productivity and efficiency in bioprocesses for the production of monoclonal antibodies, vaccines, viral vectors, and therapeutic cells.

- In September 2022, the Thermofisher Scientific Dynaspin Single-use centrifuge was recently introduced by Thermofisher Scientific Inc. at the Bioprocess International annual conference in Boston, Massachusetts. The technology is especially created to offer the best single-use solution for extensive cell culture collection. By lowering the quantity of depth filtration cartridges needed to finish the harvest process, the DynaSpin technology enhances and streamlines harvesting for cell culture separation in single-use.

- In July 2021, through its division, Sartorius Stedim Biotech, the German Company Xell AG, a leader in cell culture, was acquired by the life science companies Sartorius. The company expanding their current media offering particularly by specialized media for producing viral vectors and media analytics.

- In January 2022, Thermofisher Scientific acquired PeproTech, a pioneer in recombinant proteins. Through this acquisition, Thermofisher Scientific Inc. added new capabilities to its existing offering to serve the high growth cell and gene therapy market.

Cell Culture Media Market Companies

- Merck KGaA: A leading provider with a strong, high-quality product range and significant R&D, focusing on innovative media and bioprocessing solutions for consistent experimental results and market expansion.

- Thermo Fisher Scientific Inc.: Dominates with a vast portfolio including sera, media, and cultureware, leveraging a strong distribution network for research and large-scale GMP manufacturing of customizable media.

- CYTIVA(Danaher): Strengthens its position through investment in biomanufacturing, offering advanced media and fermentation solutions, especially for cell-based therapies and bioprocessing.

- FUJIFILM Irvine Scientific, Inc.: Contributes specialized, high-quality media, particularly for cell and gene therapy, stem cell research, and regenerative medicine applications, focusing on defined, animal-component-free options.

- Sartorius AG: Rapidly growing with bioreactor systems and media, emphasizing automation and single-use technologies to provide efficient and scalable cell culture solutions.

- Lonza Group AG: A key player known for innovation, providing critical media and services that support the growth of biopharmaceuticals, cell therapies, and vaccines.

Other Major Key Players

- STEMCELL Technologies Inc.

- InvivoGen

- PromoCell GmbH

- Cell Biologics, Inc.

Segments Covered in the Report

By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Others

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Others

By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Others Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Others

By Type

- Liquid Media

- Semi-solid and Solid Media

By End-User

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostics Laboratories

- Research and Academic Institutes

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content