Butyric Acid Market Size and Forecast 2025 to 2034

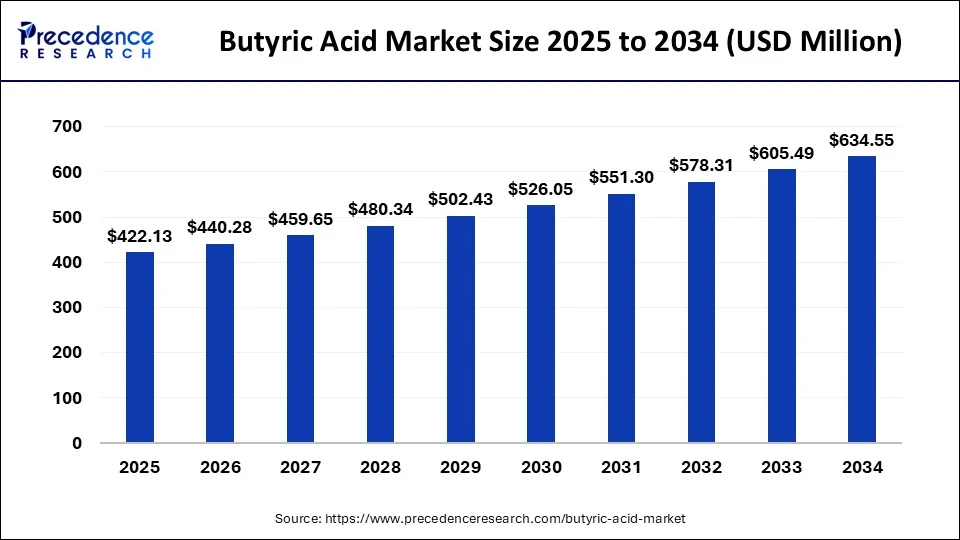

The global butyric acid market size was estimated at USD 405.11 million in 2024 and is predicted to increase from USD 422.13 million in 2025 to approximately USD 634.55 million by 2034, expanding at a CAGR of 4.60% from 2025 to 2034.

Butyric Acid Market Key Takeaways

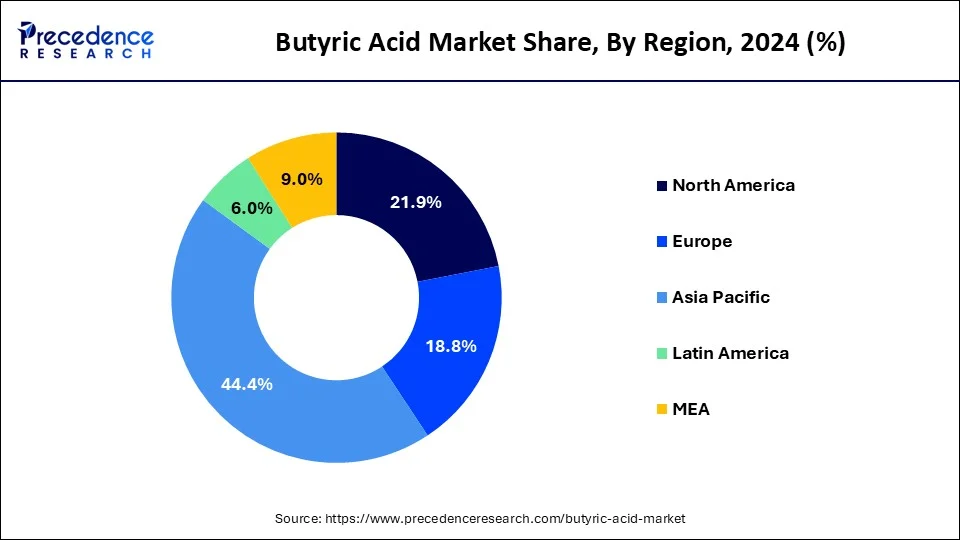

- Asia Pacific dominated the global market with the largest market share of 44.4% in 2024.

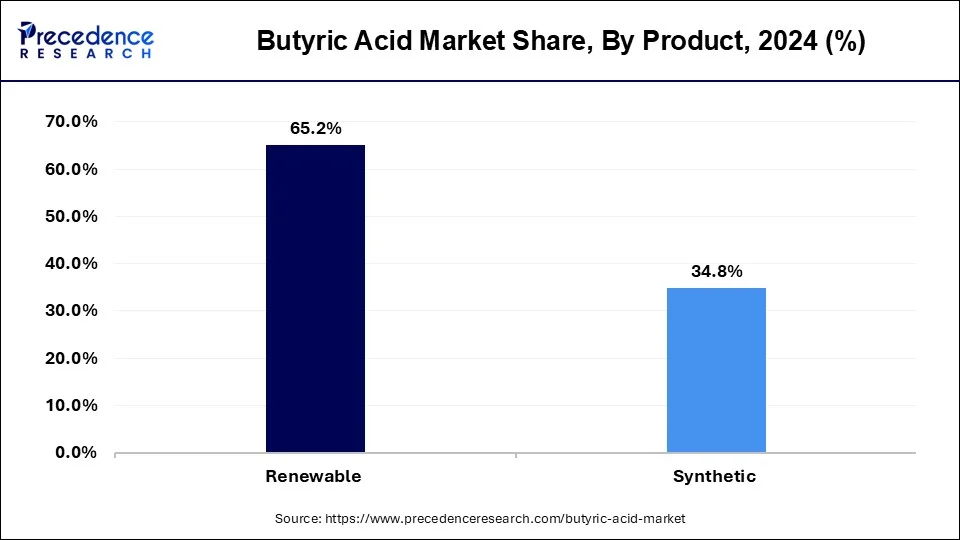

- By product, the renewable segment captured the biggest market share of 65.2% in 2024.

- By application, the animal feed segment contributed the highest market share of 54.22% in 2024.

- By darivatives, the calcium butyrate segment generated the major market share of 45.1% in 2024.

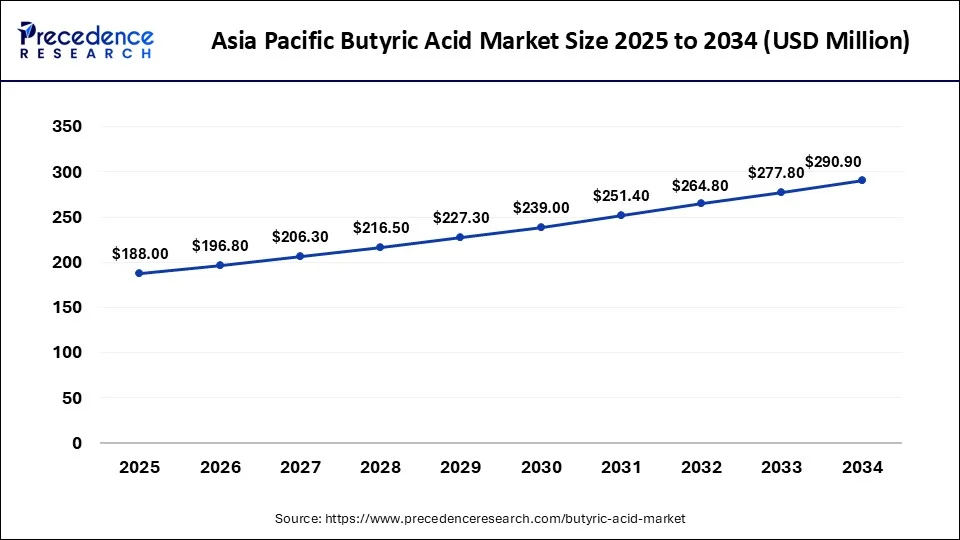

Asia Pacific Butyric Acid Market Size and Growth 2025 to 2024

The Asia Pacific butyric acid market size was valued at USD 179.7 million in 2024 and is estimated to reach around USD 290.9 million by 2034, growing at a CAGR of 5% from 2025 to 2034.

Due to the fast-growing pharmaceutical and agricultural industries, where butyric acid is used in animal feed, Asia Pacific will likely become the region with the greatest market for butyric acid. During the forecast period, agro-based economies like India will likely hold a sizable market share.

The Asia Pacific butyric acid market, will likely increase due to several important players in the area and quickly growing end-use industries. The need for butyric acid to manufacture biofuels in North America and Europe will be facilitated by strict regulations by environmental regulators against antibiotics in animal feed.

Asia Pacific is dominating the butyric acid market. The region holds an increased demand for animal feed additives as well as the food and beverage industries. Within Asia Pacific, China shares the largest share of this market. The advantage of this region is its key manufacturers.

Market Overview

When bacteria ferment carbohydrates and dietary fibre, a colourless carboxylic acid known as butyric or butanoic acid is produced. It can also be found in milk, butter, cheese, vegetable oils, and animal fats. It can also be used as a precursor to creating different biofuels. It is produced industrially through the chemical synthesis of feedstocks derived from petroleum and through the fermentation of starch or sugar in a solution of calcium carbonate and putrefying cheese.

As a result, it demonstrates several positive traits like affordability, sustainability, and low greenhouse gas emissions. Because of these, butyric acid is widely used in various businesses, including those that produce animal feed, medications, chemical intermediates, perfume goods, and food and beverages.

The enormous worldwide pharmaceutical business growth is one of the key factors supporting a positive outlook for the market. Pharmaceutical companies employ butyric acid to create medications to treat cancer, irritable bowel syndrome, and obesity (IBS). Additionally, market growth is being boosted by the growing use of butyric acid to improve the nutritional value of animal feed.

It helps to prevent microbial infections and diseases in pigs, poultry, fish, and cattle, as well as to improve digestive health. Additionally, the industry is expanding as more products are being employed in creating biofuels, quickly replacing conventional gasoline and other fuel substitutes.

The demand for animal feed is rising, especially for swine and poultry, propelling the butyric acid market's expansion. Furthermore, renewable butyric acid demand is rising in the food, flavour, and pharmaceutical industries.

The emphasis on R and D activities has turned to alternative fuel sources due to the rise in petroleum prices and the ongoing decline in petroleum availability, combined with the rising need for clean energy sources. Security of supply, a reduction in greenhouse gas emissions, and long-term viability are just a few of the many environmental advantages of biofuels.

Technological Advancement

Technological advancements in the butyric acid market feature the fermentation process, synthetic production, biocatalysts, and microbial strains. Bio-based production methods are adopted by most companies, like renewable biomass feedstocks, to encourage an environmentally friendly production process. The fermentation techniques reduce cost, deliver better quality, and enhance butyric acid production yields. Advances in synthetic production help in balancing appropriate consistency, scalability, and purity level. This method is a popular choice for several industries. The biocatalyst and microbial strains are important for the improvement of yields to reduce environmental impact through the production process.

Cell and process engineering allow effective and efficient production of butyric acid, utilizing several biomass sources. The technological advancement in science will be a popular record in the history of various sectors acquiring technological science. The study and advancements accelerate the butyric acid market globally. The sustainable factor is successfully achieved with the support of technologies.

Growth Factors

The main drivers of the butyric acid market's expansion are the increasing demand from various end-user sectors and the prohibition of antibiotic usage in animal feed in some nations. However, the smell of butyric acid is a significant barrier to market expansion. The food and flavour sectors' renewable butyric acid rising demand may create a sizable business opportunity in the years to come.

The rising demand for packaged foods due to shifting customer preferences is a key driver of industry expansion. The market is driven by butyric acid, and as meat consumption rises, so does butyric acid production in finished goods.

One of the main reasons influencing the market's optimistic outlook is the substantial growth of the pharmaceutical business globally. Pharmaceutical companies employ butyric acid to create medications that help with weight management, cancer treatment, and irritable bowel syndrome (IBS).

The expanding prevalence of animal diseases has led to a rise in the usage of butyric acid in feed for animals across several geographical markets. Asia has very low per capita meat consumption compared to industrialised nations like Europe and North America. However, meat consumption in the area will likely soar due to increased earnings and urbanisation.

One of the main reasons influencing the market's optimistic outlook is the substantial growth of the pharmaceutical business globally. Pharmaceutical companies employ butyric acid to create medications that help with weight management, cancer treatment, and irritable bowel syndrome (IBS).

The expanding prevalence of animal diseases has led to a rise in the usage of butyric acid in feed for animals across several geographical markets. Asia has very low per capita meat consumption compared to industrialised nations like Europe and North America. However, meat consumption in the area will likely soar due to increased earnings and urbanisation.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 405.11 Million |

| Market Size in 2025 | USD 422.13 Million |

| Market Size by 2034 | USD 634.55 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Derivatives, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Butyric Acid Market Dynamics:

Drivers

The Increasing use of butyric acid to prevent CVS disorders

The increasing use of butyric acid to prevent extensive cardiovascular diseases, including Heart failure, Atherosclerosis, High blood pressure, and stroke, significantly drives the growth of the butyric acid market.

According to the National library of medicine, Oral butyrate can inhibit the development of atherosclerosis by lowering macrophage adhesion and migration and boosting plaque stability. These processes are related to reduced pro-inflammatory cytokines, decreased CD36 in macrophages and endothelial cells, and decreased NF-B activation. Such as, a metabolite produced by gut bacteria called butyric acid reduces arterial blood pressure by activating the GPR41/43 receptors and the colon-vagus nerve.

In addition, the gut microbiota impacted butyric acid production, which altered the acetylation level and tissue healing after myocardial infarction. Furthermore, Butyric acid is used to treat and prevent the development of various gastrointestinal disorders, including diarrhoea, intestinal inflammations, functional abnormalities, dysbiosis, and symptoms that arise after surgery or chemotherapy. The standard butyric acid doses (150–300 mg) range between 1.5–3% and 15–30% of the average daily demand.

The rising number of oncology patients

Short-chain fatty acid sodium butyrate (NaB), created by bacterial fermentation of indigestible dietary fibre, has been shown to have anti-tumour effects in several tumour types, including colorectal cancer (CRC). According to the National Center of Biotechnology Information, phenyl butyric acid (PBA) has a growth-inhibitory impact on gastric cancer cells related to cell cycle changes.

The cell cycle was stopped in moderately differentiated gastric cancer (Adenocarcinomas) cells at the G0/G1 and G2/M stages. The cell cycle was stopped in low-differentiated gastric cancer cells at the G0/G1 and S phases. In addition,

According to the American Society of Clinical Oncology, India is anticipated to have 1,392,179 cancer patients, In 2020. Breast (57.0%), cervix uteri (60.0%), head and neck (66.6%), and stomach (50.8%) cancer were among the most commonly diagnosed tumours at a locally advanced stage.

However, lung cancer was more commonly identified with distant metastasis in men (44.0%) and females (47.6%). Furthermore, according to the World Cancer Research Fund International, there were 18.1 million new cancer cases worldwide. 9.3 million of these cases included men, while 8.8 million were women in 2020.

The flourishing use of ethyl butyrate for synthetic flavours, perfumes and cosmetics is continuously driving the growth of the butyric acid market.

Ethyl butyrate is a versatile, very affordable flavouring ingredient that is frequently used in the production of food and nutrition products. Apricots, bubble gum, cherry, fig, guava, mango, orange, peach, pineapple, and plum are some of their flavouring agents.

According to the Penta International Corporation, ethyl butyrate is used to produce BUTYL-2-METHYL BUTYRATE, BUTYL-2-METHYL BUTYRATE NATURAL, ETHYL BUTYRATE FCC, ETHYL BUTYRATE NATURAL, ISOAMYL-2-METHYL BUTYRATE NATURAL among others. These apply to manufacturing flavouring used in food or perfume and as a solvent.

In addition, In the fragrance industry, ethyl butyrate is frequently used to provide products such as Lotions and creams for antiperspirants, deodorants and lipsticks. It is profoundly used as a Bath and Shower Gel, Shampoo and Conditioner, Soap (both solid and liquid), and Talcum Powder.

Opportunity

Stringent guidelines for the use of antibiotics in animal feed

Antibiotics can no longer be added to feed to stimulate the development of animals and poultry, according to FDA regulations. It was also vital to look at alternatives because the European Union has banned antibiotics. Thus, it is anticipated that such strict rules would open up opportunities for butyric acid to replace antibiotics in animal feed.

In addition, the butyric acid market is growing due to demand from several end-use industries, VirtualExpo Group, Kemin Industries Inc., Thermo Fisher Scientific, and many other industries that use butyric acid for animal feed. The food and flavour industries' increasing demand for renewable butyric acid provides a considerable market opportunity in the years ahead.

Restrains

The odour of butyric acid is a significant barrier to the market.

The butyric acid odour is a significant barrier to market expansion. Inhaling butyric acid can have adverse effects and be absorbed through the skin, and contact can cause serious skin and eye burns and severe eye damage.

The nose, throat, and lungs might get irritated while inhaling butyric acid. 3-4% of the fat molecules in butter are made from butyric acid. In addition, it is a by-product of anaerobic fermentation and is typically found in dairy products. Thus, the references to parmesan cheese and butter. Butyric acid is just what gives vomit its distinctive odour smell.

The hazardous impact of butyric acid on human health and the environment

The respiratory tract and mucous membranes are irritated by inhalation, which increases the risk of nausea and vomiting. Mouth and stomach discomfort occur from eating. Eye contact may result in severe harm. Burns might result from skin contact; the chemical is readily absorbed through the skin and could cause damage in this manner.

A headache, nausea, vomiting, and light-headedness from overexposure are all possible side effects. Higher doses may cause unconsciousness. In addition, several medical professionals advise against taking butyric acid supplements if the user is pregnant or breastfeeding. Butyrate has also been reported to cause symptoms in those who need different fibre levels, such as those with bloating or a sensitive stomach (food intolerance).

Impact of Covid-19

The COVID-19 pandemic has impacted the global market for butyric acid in three key ways: directly affecting supply and demand, disrupting the market and supply chain, and having an economic impact on businesses and financial markets. Flight cancellations, restaurant closures, travel bans, and prohibitions on all indoor events are just a few of the many effects of the outbreak.

Other effects include the declaration of a state of emergency in more than 40 countries, a significant slowdown in the supply chain, stock market volatility, declining business confidence, rising public panic, and uncertainty regarding the future.

Before the COVID-19 outbreak, the food and beverage, animal feed, pulp and paper, and pharmaceutical industries were the key growth drivers of the natural butyric acid industry. However, in 2020, these businesses had to scale back their activities due to value chain disruptions brought on by closing domestic and international borders.

Due to limitations put in place by government agencies in several nations, the COVID-19 epidemic hindered the main supply networks for raw materials and disrupted production processes. However, economies began to gradually restart their activities in 2021, which benefited the world economy.

Manufacturers were able to work at full capacity by the end of 2021. Many individuals from different countries will have received all recommended vaccinations, allowing them to focus on bridging the supply and demand gap. Additionally, the pharmaceutical industry's increased need for natural butyric acid during the COVID-19 epidemic favoured the market.

Product Insights

Based on Product, the market is divided into renewable and synthetic. The market share will likely be dominated by renewable butyric acid. The synthetic segment is estimated to observe the fastest expansion. The factors can be ascribed to the rising synthetic butyric acid usage in APAC nations and its attractiveness as a raw material in many sectors due to its inexpensive and effective fermentation technique.

The natural butyric acid segment will likely dominate the market due to the increasing demand for natural ingredients in food and beverage products and the growing awareness about the health benefits of natural butyric acid. The synthetic butyric acid segment will likely grow at a moderate rate, driven by the increasing demand for industrial chemicals and pharmaceutical products.

Global Butyric Acid Market Revenue, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Renewable | 243.2 | 253.3 | 264.1 |

| Synthetic | 131.0 | 135.8 | 141.0 |

Application Insights

Based on application, the market is divided into animal feed, chemical intermediate, perfume, pharmaceuticals, food and flavors, and others. The segment for animal feed will likely have the greatest CAGR during the foreseeable time. These factors can be linked to the sharp rise in interest in high-quality animal feed.

The animal feed segment is the largest application for butyric acid, followed by the food and beverages and pharmaceuticals segment.

- Pharmaceuticals – Butyric acid is actively used in the pharmaceutical sector, with applications that help in treating conditions such as inflammatory bowel diseases.

Animal Feed – Butyric acid is also used in animal feed in the form of a natural gut health additive, which helps in the improvement of nutrient absorption.

Global Butyric Acid Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Chemical Intermediates | 59.9 | 62.5 | 65.3 |

| Animal Feed | 203.9 | 211.5 | 219.6 |

| Pharmaceuticals | 43.0 | 44.8 | 46.7 |

| Food & Flavors | 44.9 | 47.0 | 49.2 |

| Others | 22.5 | 23.3 | 24.2 |

Butyric Acid Market Companies

- Eastman Chemical Company

- Blue Marble Biomaterials LLC

- Oxea GmbH

- Tokyo Chemical Industry Co. Ltd.

- Perstorp Holding AB

- Snowco Industrial Co. Ltd

- Beijing Huamaoyuan Fragrance Flavor Co. Ltd.

Recent Developments

- In May 2024, NutraShure launched BIOMEnd, a form of butyrate designed to help solve palatability and solubility issues found with traditional butyrate ingredients. BIOMEnd contains L-Lysine Butyrate, the L-Lysine salt of butyric acid, which allows for complete solubility in a liquid solution, according to the company.

- In March 2025, METEX NØØVISTA, a subsidiary of METABOLIC EXPLORER, and ALINOVA announced an agreement for the marketing of the first 100% bio-based butyric acid for animal nutrition in France. This partnership enables ALINOVA to expand its portfolio of performance-enhancing products to meet its customers' needs for natural and sustainable ingredients.

- In May 2024, NutraShure Distribution, LLC. launched BIOMEnd, a new butyrate formulation designed to address solubility and palatability issues with traditional butyrate ingredients. BIOMEnd contains L-Lysine Butyrate, the l-lysine salt of butyric acid, which is superior in form and completely soluble in liquid solution, making it suitable for various supplement formats.

Segments Covered in the Report:

By Product

- Renewable

- Synthetic

By Application

- Chemical Intermediates

- Animal Feed

- Pharmaceuticals

- Perfumes

- Food and Flavors

By Derivatives

- Sodium Butyrate

- Calcium Butyrate

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting