What is Polylactic Acid Market Size?

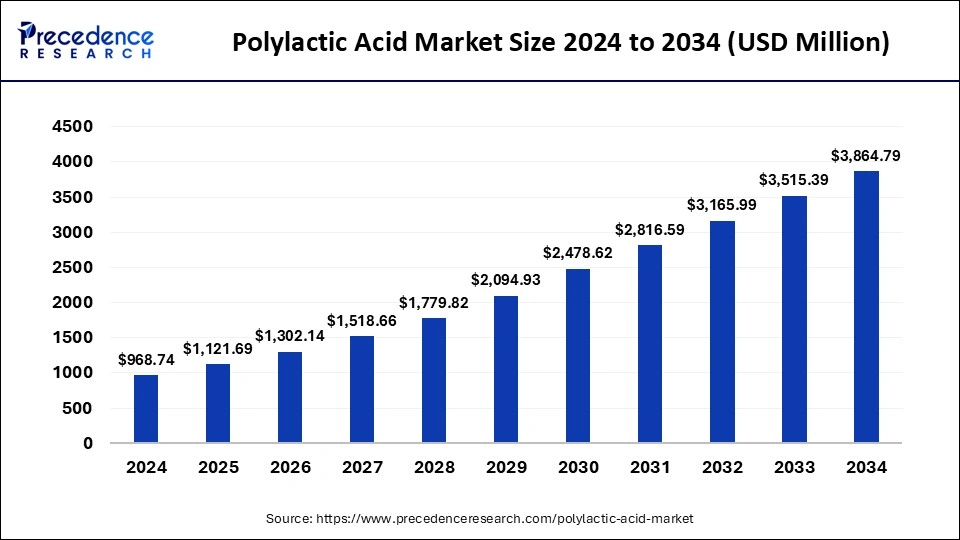

The global polylactic acid market size is calculated at USD 1121.69 million in 2025 and is predicted to increase from USD 1,302.14 million in 2026 to approximately USD 4214.19 million by 2035, expanding at a CAGR of 14.15% from 2026 to 2035.

Market Highlights

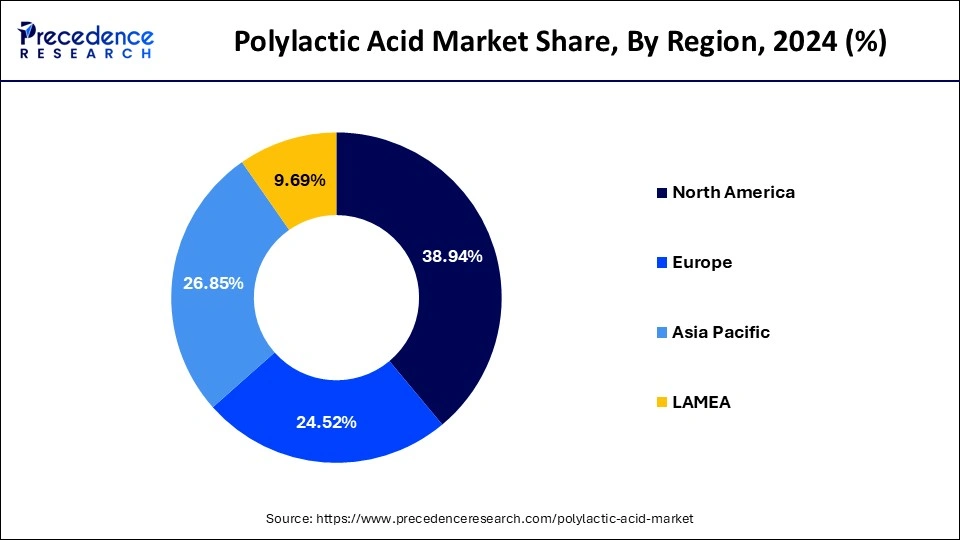

- North America led the global market with the highest market share of 38.94% in 2025.

- By region, the Asia Pacific segment is predicted to witness significant growth over the forecast period of 2026 to 2035

- By Raw Material, the sugarcane/ sugar beet segment is anticipated to expand rapidly in the market in the coming years.

- By application, the packaging segment is set to experience the fastest rate of market growth from 2026 to 2035

- By grade, the corn starch segment accounted for a considerable share of the market in 2025

- By grade, the corn starch segment experienced notable growth in the market from 2026 to 2035

- By end-use industry, the packaging segment dominated the market in 2025

- By end-use industry, the packaging segment is also expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035

Role of AI in the Polylactic Acid(PLA) Market

Artificial intelligence (AI) is beginning to play a transformative role in the Polylactic Acid (PLA) market, particularly in enhancing the efficiency, scalability, and sustainability of bioplastic production. In manufacturing, AI-powered process optimization tools are being used to fine-tune fermentation and polymerization parameters reducing tools are being used to fine tune fermentation and polymerization parameters reducing energy consumption and improving PLA yield from renewable feedstocks like corn, sugarcane, or beet.

AI is also helping predict the biodegradation behaviour of PLA in different environmental conditions, which is crucial for product design in packaging and medical applications. Moreover, AI-driven material discovery platforms are accelerating the development of new PLA blends with between-strength, thermal resistance, or transparency, enabling broader industrial usage. In the supply chain, machine learning models are optimizinglogistics for sourcing raw materials and distributing finished PLA products, especially in regions transitioning away from petroleum-based plastics.

Polylactic Acid Market Growth Factors

- Governments initiatives for the production and use of biodegradable products.

- Increasing preferences for the bioplastic over conventional plastic.

- Growing demand for the polylactic acid from the cosmetic industry.

- Easy availability of raw materials for the production of PLA.

- Growing awareness among the consumers regarding green packaging and sustainability.

- Capacity addition by the major players operating in the target industry.

Market Trends

- Brands across food, cosmetics, and consumer goods are increasingly adopting PLA-based packaging to meet sustainability mandates and reduce plastic pollution.

- Companies like Nature Works and Futerro are setting up large-scale PLA plants in the U.S., Europe, and Asia to meet growing global demand.

- Ongoing research is focusing on improving PLA's thermal and mechanical properties to expand its use in automotive, electronics, and textile sectors.

- Policies banning single-use plastics and promoting eco-friendly alternatives are accelerating PLA adoption worldwide.

- Companies are investing in closed-loop systems for PLA recycling and composting, enhancing the material's appeal for sustainable applications.

- AI-driven tools are being used to improve fermentation and polymerization processes, enabling more efficient PLA production.

- PLA is gaining traction in medical uses such as sutures, drug delivery, and tissue engineering due to its biocompatibility and biodegradability.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 1,121.69 Million |

| Market Size in 2026 | USD 1,121.69 Million |

| Market Size by 2035 | USD 4,214.19 Million |

| Growth Rate from 2026 to 2035 | CAGR of 14.15% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Growing demand from the flexible packaging industry

The polylactic acid market is showing a strong and positive growth trend, mainly due to increasing demand for flexible packaging andsustainable packaging systems. Alternative polymer materials to conventional petroleum-derived plastics include the use of biodegradable and compostable polymer materials, PLA, aimed at mitigating the impact that conventional plastics have on the environment. The PLA packaging has also become more popular in the food and beverage industry, where it is characterized by its eco-friendly nature, its capability to promote the aesthetic appeal of products, and its capacity to replace plastic-based packaging.

The pharmaceutical industry is also gaining prominence as a market growth driver of the PLA besides food packaging. A significant improvement has been experienced in the global pharmaceutical industry as a result of research, technologies that are more profound, and a heightened level of healthcare awareness. Such trends have increased the demand for safe, hygienic, sustainable packaging solutions. PLA is very strong, transparent, and moisture resistant, which is highly essential to maintain pharma products.

Restraint

High Production Costs

The high cost of production of polylactic acid is one of the major limitations in market growth in relation to the conventional petroleum-based polymers. The manufacture of PLA is done by new technologies, the manufacturing process of which is based on renewable resources like corn, maize, or sugarcane. Though environmentally friendly, they end up costing more because of the cost of acquiring the raw materials and conducting the complicated processes of fermentation and polymerization of lactic acid, an important constituent of PLA. Such increased cost of production may pose a challenge to most industries, particularly those whose activities run on a strict budget or on price-sensitive markets.

Opportunity

Growing demand for bioplastics

There is an increasing trend in bioplastics, such as PLA and polyhydroxyalkanoates (PHA), because they are renewable sources, such as corn, sugarcane, algae, and starch, and are compostable or biodegradable. The materials represent an eco-friendly alternative to traditional plastics, particularly in the fields of flexible and rigid packaging. Their smaller carbon footprint and faster biodegradability make them very attractive at a time when fears are growing over the problem of plastic pollution.

The increased awareness among consumers and regulatory agencies against fossil-fuel-based plastics, more industries are shifting their focus to Bioplastics, which is helping them achieve their environmental targets. This change is being sped up by government incentives, tighter restrictions on single-use plastics, and growing demand for green packaging in food, beverage, and personal care markets.

- In May 2023, Sulzer agreed with China-based Jindan New Biomaterials to manufacture polylactic acid (PLA), a biobased plastic. Jindan obtains a licensed PLA technology offered by the Sulzer company with the help of which it is going to build a new manufacturing plant in the Henan Province where it is going to produce up to 750,000 tonnes of PLA annually, which will be used mainly in the food packaging industry and in making molded goods as well as making fibers.

Segment Insights

Raw Material Insights

The corn starch segment maintained a leading position in the PLA market, supported by its abundant availability, ease of processing, and established agricultural infrastructure, which makes it a popular choice for cost-effective production. By Raw material, the sugarcane/sugar beet segment is projected to expand rapidly due to growing interest in renewable and low-carbon raw materials. Countries with strong sugar industries are leveraging this feedstock to boost sustainable PLA production.

Grade Insights

The corn starch segment captured a significant portion of the market, attributed to its flexibility, low environmental footprint, and strong alignment with sustainability trends in PLA manufacturing. By grade, the corn starch segment also underwent notable growth in the market, driven by innovation in PLA processing and increasing use in thermoformed products.

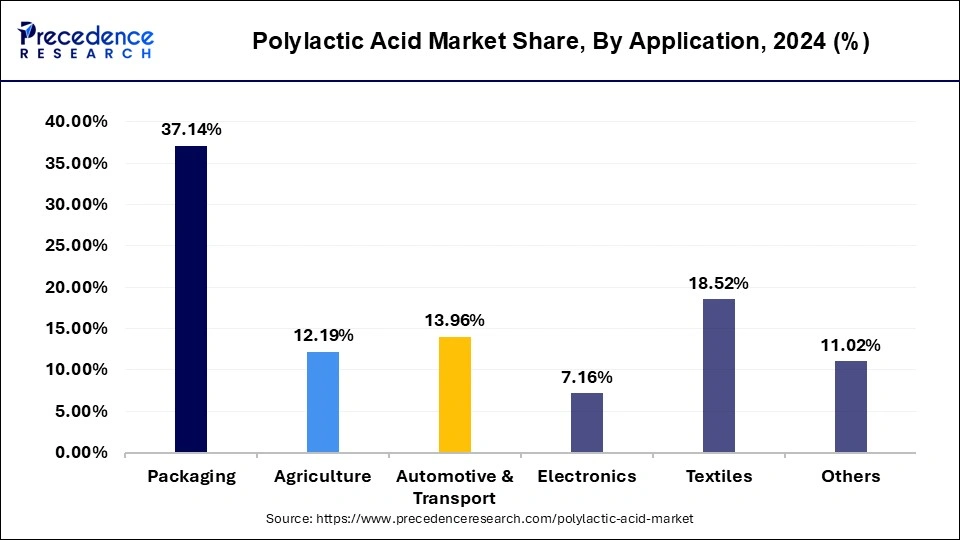

Application Insights

The packaging segment dominated the market as industries increasingly shifted toward biodegradable alternatives to conventional plastics, particularly in food, beverage, and personal care sectors. By application, the packaging segment is also set to experience the fastest growth over the coming years, driven by rising global regulations on single-use plastics and heightened consumer demand for eco-friendly and compostable packaging.

Polylactic Acid Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Packaging | 269.00 | 309.84 | 359.84 |

| Agriculture | 90.10 | 103.25 | 118.06 |

| Automotive & Transport | 102.25 | 117.31 | 135.27 |

| Electronics | 52.57 | 60.24 | 69.35 |

| Textiles | 134.16 | 154.77 | 179.45 |

| Others | 80.86 | 93.28 | 106.77 |

End Use Insights

The packaging segment dominated the market, reflecting strong demand across consumer goods, service, and logistics industries seeking compostable alternatives. By end use industry, the packaging segment is also expected to grow at the fastest rate during the forecast period, supported by tightening regulations on petrochemical plastics and growing consumer inclination toward eco-packaging.

Regional Insights

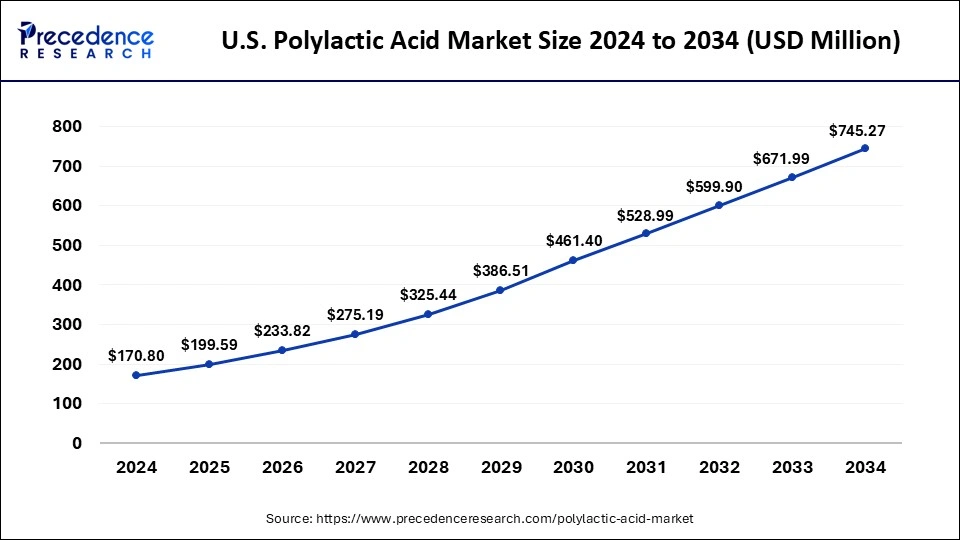

U.S. Polylactic Acid Market Size and Growth 2026 to 2035

The U.S. polylactic acid market size is exhibited at USD 199.59 million in 2025 and is projected to be worth around USD 817.75 million by 2035, growing at a CAGR of 15.15% from 2026 to 2035.

North America is estimated to be the largest Market for Polylactic Acid. Geographically, the polylactic acid market is dominated by North America owing to favorable government mandates for the production of polylactic acid, coupled with easy availability of the raw materials for the production of polylactic acid in the countries of this region, especially in the United States.

Asia-Pacific is expected to register the fast growth rate, on account of increasing research and development investment by key market players and increasing awareness regarding use of bioplastics in the region. Also, governments in the region are offering subsidiaries for the production of biodegradable products in order to reduce the environmental concerns which is another factor anticipated to propel growth of the target industry in the countries of Asia Pacific region.

Europe

Europe remains a prominent region in the global polylactic acid (PLA) market, driven by robust environmental regulations, circular economy policies, and a strong commitment to bio-based materials. Countries like Germany, France, the UK, Italy, and the Netherlands are at the forefront of sustainable packaging innovation, supported by EI-wide directives targeting single-use plastics and carbon emissions. Germany leads in terms of PLA consumption, particularly in packaging and automotive applications, due to its large industrial base and recycling infrastructure.

Meanwhile, the Netherlands is projected to exhibit the highest growth rate in the region, fuelled by aggressive sustainability targets and government-backed research and development of compostable bioplastics. France and Italy are also expanding PLA adoption in textiles and agriculture. However, countries like Poland, Sweden, and Belgium, while included in the broader European analysis, currently lack country-specific segmental insights, indicating untapped opportunities for market expansion. Europe's strong regulatory push and consumer preference for eco-friendly products continue to make it a vital region for PLA growth across applications and end-use sectors.

Polylactic Acid Market Companies

- NatureWorks LLC

- Corbion Purac

- Chongqing bofei biochemical products co., ltd.

- Synbra

- Futerro

- Nantong Jiuding Biological Engineering Co. Ltd

- Hisun Biomaterials

In order to better recognize the current status of polylactic acid, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the polylactic acid market. This research study bids qualitative and quantitative insights on polylactic acid market and assessment of market size and growth trend for potential global market segments.

Recent Developments

- India has rolled out Bioyug on Wheel, the country's first mobile initiative dedicated to raising awareness about polylactic acid (PLA) biopolymers. Unveiled in Mumbai by Chief Minister Devendra Fadnavis in mid-2025, the program aims to engage consumers directly through workshops, displays, and interactive events demonstrating PLA's potential as a sustainable alternative to single-use plastics. The campaign is expected to increase adoption at the grassroots level and support broader waste reduction goals while elevating PLA viability beyond industrial and B2B channels. The initiative underscores India's strategic push for eco-friendly materials.

- In a strategic move toward green industrialization, Balrampur Chini Mills has signed a memorandum of understanding with the government of Uttar Pradesh to construct one of India's first large-scale PLA production facilities. The investment exceeds Rs. 2,000 crore, and the plant will be located adjacent to an existing sugar mill in Lakhimpur Kheri. Scheduled to begin operations imminently, the facility is expected to boost local employment and position India as a key player in Asia's sustainable polylactic acid landscape, leveraging domestic sugarcane as feedstock and supporting circular economy goals.

(Source: https://www.sulzer.com), (Source:https://totalenergies-corbion.com), (Source:https://totalenergies-corbion.com)

Segments Covered in the Report

By Raw Material

- Corn Starch

- Sugarcane & Sugar Beet

- Cassava

- Others

By Application

- Packaging

- Agriculture

- Transport

- Electronics

- Textiles

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting