What is the Carbamazepine Market Size in 2026?

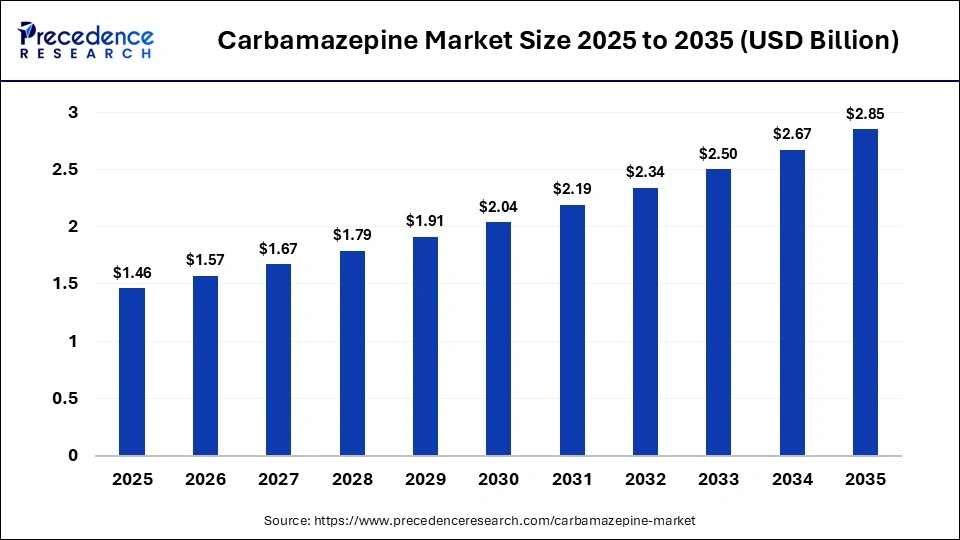

The global carbamazepine market size was calculated at USD 1.46 billion in 2025 and is predicted to increase from USD 1.57 billion in 2026 to approximately USD 2.85 billion by 2035, expanding at a CAGR of 6.90% from 2026 to 2035.Demand for cost-effective treatment for epilepsy and bipolar disorder, particularly in developing countries, is driving the market expansion. The growth is fueled by a rise in the incidence of neurological disorders, increased adoption of generics, and growing demand in emerging markets.

Key Takeaways

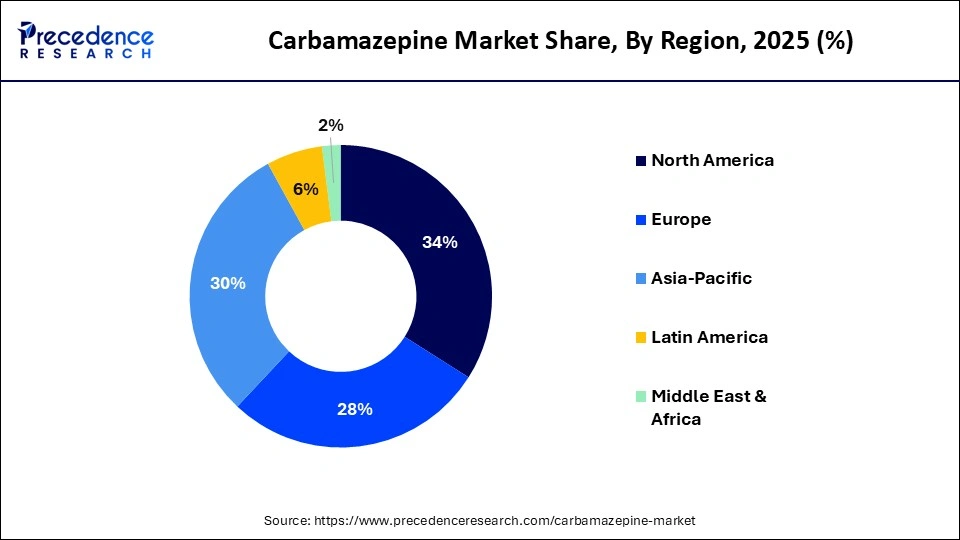

- North America dominated the market, holding a share of approximately 34% in 2025.

- Asia-Pacific is expected to expand with the highest CAGR of approximately 7.2% during the forecast period.

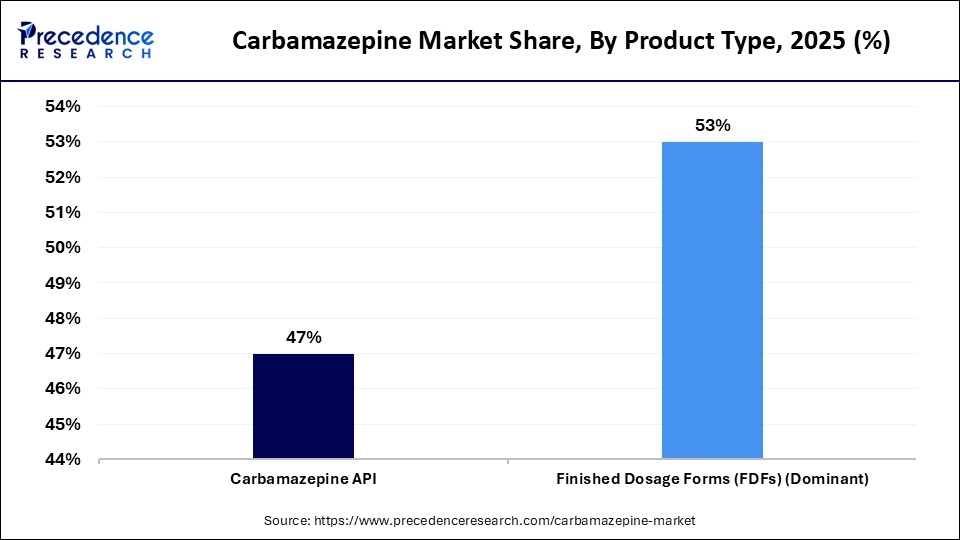

- By product type, the finished dosage forms (FDFs) segment held the largest carbamazepine market share, accounting for approximately 53% in 2025.

- By product type, the extended-release tablets sub-segment is expected to grow at a remarkable CAGR between 2026 and 2035.

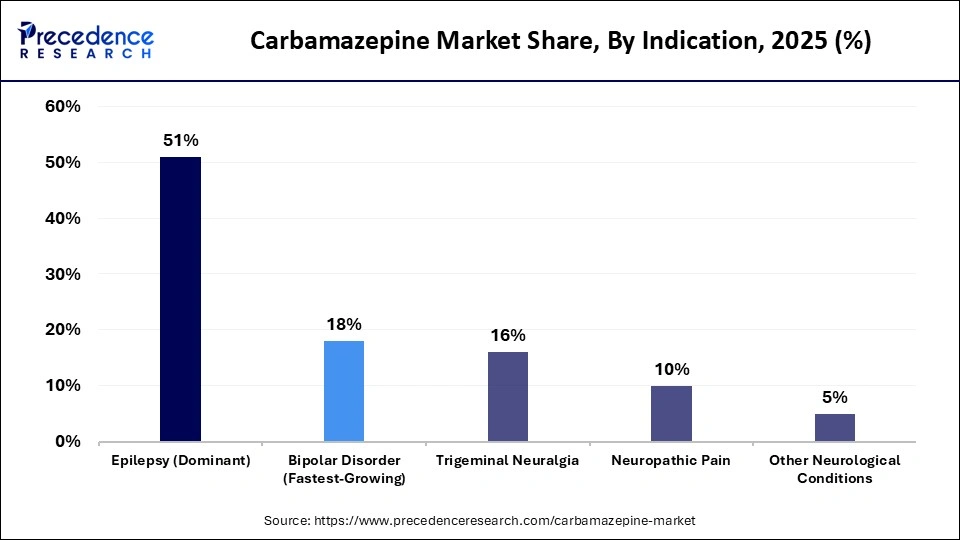

- By indication, the epilepsy segment held a major market share of approximately 51% in 2025.

- By indication, the bipolar disorder segment is expected to be the fastest-growing segment between 2026 and 2032.

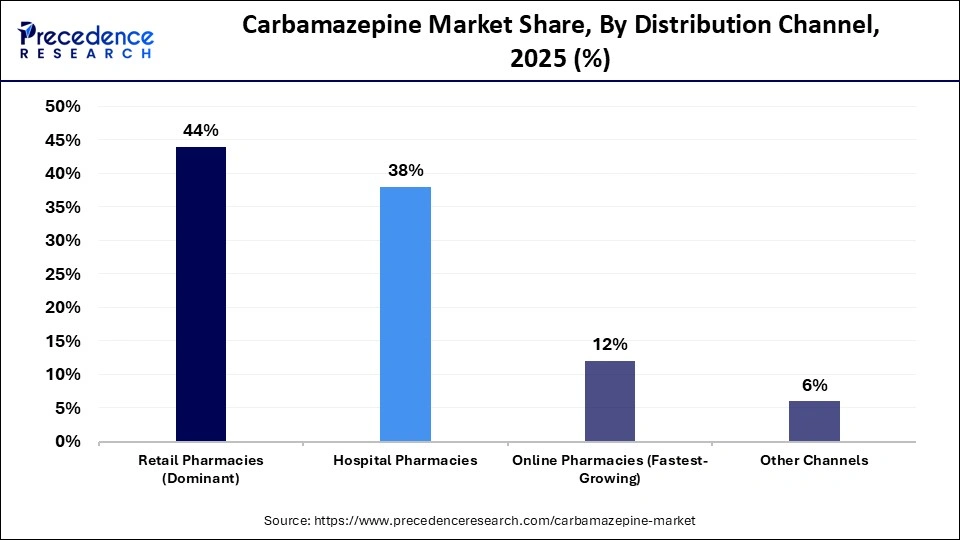

- By distribution channel, the retail pharmacies segment dominated the market with a share of approximately 44% in 2025.

- By distribution channel, the online pharmacies segment is expected to grow at the highest CAGR between 2026 and 2035.

- By drug type, the generic carbamazepine segment led the market with a share of approximately 71% in 2025.

- By drug type, the branded carbamazepine segment is expected to show the fastest growth in the forecast period.

What is the Overview and Outlook for the Carbamazepine Market?

The carbamazepine industry is expanding due to the growing demand for well-established, cost-efficient, first-line anticonvulsant and mood-stabilizing drugs. This market is propelled by the rising incidence of neurological disorders and demand for affordable treatment solutions. The market is further driven by advancements in pharmaceutical production, heightened consciousness of mental health issues, and innovation in extended-release formulation. Manufacturers focus on producing an advanced, high-purity API by relying on eco-friendly synthesis and adherence to high-quality compliance. Proven efficacy and affordability of carbamazepine solidify its position in the market.

How is AI Transforming the Carbamazepine Market?

Artificial Intelligence (AI) is transforming the market by streamlining production processes, enhancing drug delivery formulation, and improving patient safety and predictive modelling in clinical pharmacology. AI helps in enhancing the manufacturing quality and efficiency of carbamazepine by reducing waste and ensuring high-purity API production. It helps in improving the solubility, stability, and bioavailability of carbamazepine. AI analyzes genetic and patient-specific data to predict toxicity risk, such as skin reactions caused by carbamazepine, thereby improving patient safety.

Moreover, AI and ML play a vital role in streamlining the supply chain of carbamazepine, facilitating its accessibility across diverse geographical locations. They can analyze vast amounts of patient data and suggest appropriate dosages based on disease severity. They can also predict potential adverse effects of carbamazepine, allowing healthcare providers to make effective clinical decisions.

Carbamazepine Market Trends

- Increasing incidence of disease: The market is expanding due to a rise in the prevalence of epilepsy, bipolar disorder, and neuropathic pain, paired with an aging demographic that is vulnerable to neurologic conditions.

- Rising Demand for Extended Release: The surge in demand for extended-release formulations is to improve patient compliance and reduce side effects of conventional rapid-release dosage, which expands the market.

- Dominance of Generics: It is growing rapidly in the market due to a surge in demand for affordable epilepsy and neuropathic treatment, being fueled by widespread patent expirations and notable expense reduction.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.46 Billion |

| Market Size in 2026 | USD 1.57 Billion |

| Market Size by 2035 | USD 2.85 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Indication, Distribution Channel, Drug Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Carbamazepine Market?

The finished dosage forms (FDFs) segment held a dominant market share of approximately 53% in 2025 due to improved water solubility and the requirement for precisely controlled-release dosing in treating chronic conditions. An advanced finished dosage form is essential for integrating excipients that improve dissolution and bioavailability of the drug, which boosts its market. Long-term treatment is required for this condition, wherein finished dosage forms are a convenient and common form of administration, with the market showing a high demand.

The extended-release tablets sub-segment is expected to grow at the highest CAGR over the studied period due to its ability to improve tolerance, reduce adverse effects, increase patient compliance, and enhance the quality of life. The market is also expanding due to a surge in the incidence of neurological disorders paired with an aging population, which needs effective and chronic management.

Indication Insights

Why Did the Epilepsy Segment Dominate the Carbamazepine Market?

The epilepsy segment dominated the market with a share of approximately 51% in 2025, as it is established as the first-line drug for the onset of seizures, coupled with a proven safety record, affordability, and accessibility. Carbamazepine is more effective compared to other expensive antiepileptic drugs, hence expanding its market. The surge in global pressure of neurological disorders demands reliable, established therapies like carbamazepine, which further boost its market.

The bipolar disorder segment is expected to rise at a remarkable CAGR in the forecast period due to its established efficacy in acute mania, the development of an enhanced extended-release formulation, and its role as an affordable alternative for patients resistant to lithium. The carbamazepine has proven its efficacy and affordability in managing complex, chronic bipolar cases, ensuring its rapid market growth.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Carbamazepine Market?

The retail pharmacies segment held the largest market share of approximately 44% in 2025, as it addresses the high long-term demand for chronic disease management and provides access to affordable, generic, and long-term outpatient therapy. Retail pharmacies make them accessible to a broader patient population. Patients with neurological disorders often favor ease and regular access to medication, making retail pharmacies more appealing than hospital settings, hence boosting the segment's growth.

The online pharmacies segment is expected to witness the fastest growth between 2026 and 2035, as it addresses the needs of patients, such as regular, long-term, discreet access to medication and the convenience of digital health services. Improved digital infrastructure allows for increased patient compliance through app-based medication reminders and easier access to pharmacy services.

Drug Type Insights

Why Did the Generic Carbamazepine Segment Dominate the Carbamazepine Market?

The generic carbamazepine segment held the largest revenue share of approximately 71% in the market in 2025, due to its cost-effectiveness, long-standing off-patent status, and proven efficacy for neurological conditions. High demand, particularly in cost-conscious markets, drives massive consumption, while strict regulatory standards ensure bioequivalence. The market is fueled by cost, accessibility, and proven high-standard performance.

The branded carbamazepine segment is expected to expand rapidly in the forecast period, driven by the need for high-quality, consistent, and stable formulations, particularly in treating complicated neurological disorders. Branded carbamazepine is gaining popularity due to its high patient adherence, superior quality manufacturing standards, and clinical efficacy.

Regional Insights

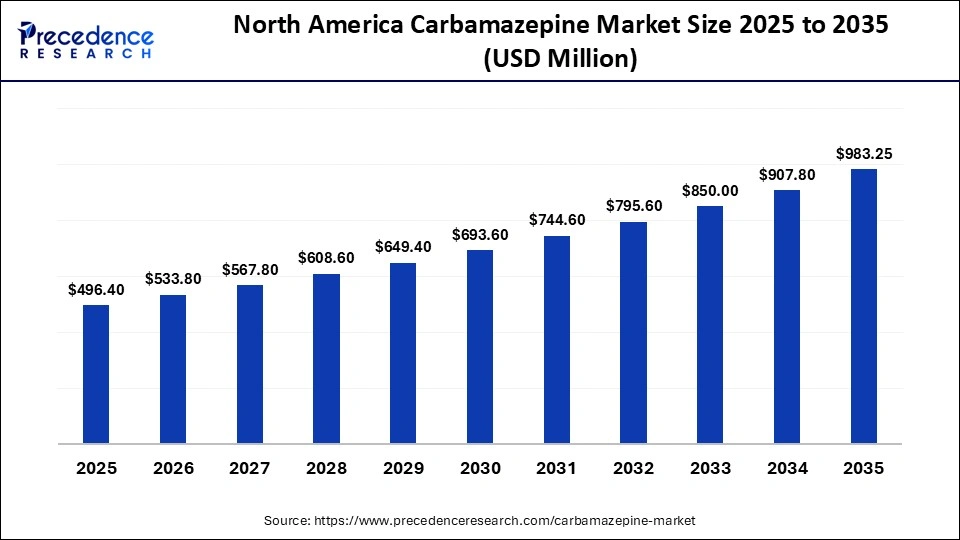

How Big is the North America Carbamazepine Market Size?

The North America carbamazepine market size is estimated at USD 496.40 million in 2025 and is projected to reach approximately USD 983.25 million by 2035, with a 7.07% CAGR from 2026 to 2035.

What are the Key Drivers for the North American Carbamazepine Market?

North America dominated the market with a share of approximately 34% in 2025. The major factors that contribute to market growth in North America include the presence of an advanced healthcare ecosystem, high healthcare expenditure, and advanced diagnostic capabilities. This market is further boosted by the presence of major pharmaceutical companies, an aging demographic needing chronic care, and high adoption of extended-release formulations. Due to the high incidence of age-related neurological disorders, the need for reliable therapeutics like carbamazepine is boosted, which further expands its market.

Easy accessibility to specialists and advanced diagnostic tools for neurological conditions propels the market. The robust government support and favorable reimbursement policies that facilitate access to both branded and generic versions of the medication significantly expand the market in this region.

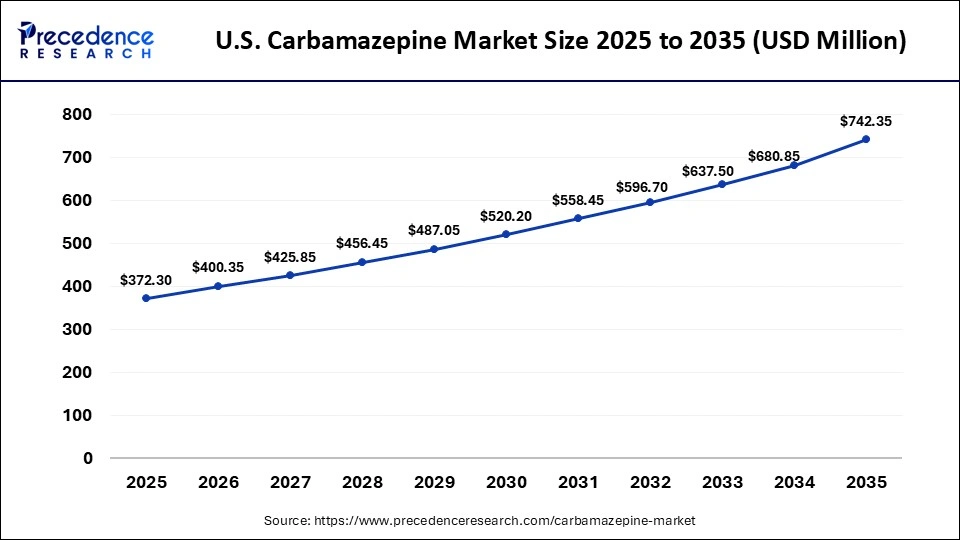

What is the Size of the U.S. Carbamazepine Market?

The U.S. carbamazepine market size is calculated at USD 372.30 million in 2025 and is expected to reach nearly USD 742.45 million in 2035, accelerating at a strong CAGR of 7.14% between 2026 and 2035.

U.S. Market Trends

The U.S. leads the market in North America due to its high incidence of epilepsy and bipolar disorder, paired with a well-established healthcare infrastructure and high healthcare expenditure. The market is propelled by early adoption of new branded and generic pharmaceutical formulations. The market is further expanded by high volume, a competitive generic market, massive R&D investments, and an enormous hospital pharmacy distribution channel. The U.S. market is backed by continuous improvements in drug delivery systems and robust R&D, maintaining market dominance.

How Will Asia Pacific Grow in the Carbamazepine Market?

Asia-Pacific is expected to host the fastest-growing market with a CAGR of approximately 7.2% in the coming years, due to a surge in the prevalence of neurological disorders, enhanced healthcare infrastructure, and accessibility to affordable generic drugs. The market is driven by growing pharmaceutical production, public awareness of neurological disorders, and government-supported healthcare initiatives. The increasing collaboration among intergovernmental organizations are further boosting this market. Massive investment in health and higher awareness of mental and neurological conditions are accelerating market growth.

China Market Trends

China is dominating this market mainly due to its huge low-cost manufacturing infrastructure. The dominance is driven by economic scale, massive vertical integration of manufacturing, and a surge in demand for generic drugs for neurological and mental disorders. China is the leading supplier of active pharmaceutical ingredients and key starting materials, which are essential for the production of affordable drugs like carbamazepine.

Government support and cost-effective solutions for generic production further boost its market leadership. China has a strong chemical industry, which reduces import dependency. China is experiencing immense market growth due to a surge in healthcare requirements and better access to medical facilities.

Will Europe Grow in the Carbamazepine Market?

Europe is expected to grow at a notable CAGR in the foreseeable future. It has experienced tremendous growth due to the rise in prevalence of epilepsy and bipolar disorder, heightened awareness of neurological conditions, and robust healthcare infrastructure. The growth is further boosted by the accessibility of affordable generic drugs, increased R&D in pharmaceuticals, and a surge in demand for effective treatment options for neurological conditions. Advanced healthcare facilities and government programs aimed at improving mental health care are boosting the market.

Germany Market Trends

Germany is the dominant country in the European market, as it leads in industrial development, technical production standards, and large-scale commercial deployment of drugs. This market is fueled by well-established healthcare infrastructure, high prevalence of neurological disorders, and robust pharmaceutical R&D.

The country's leadership in the market is boosted by easy access to generic medication, strong government support for mental health, and major hubs of pharmaceutical exports. The presence of leading pharmaceutical companies and persistent advancement in drug delivery technologies solidifies Germany's status as a top-tier industry leader.

Carbamazepine MarketValue Chain Analysis

- R&D

It focuses on streamlining standard, genericized drugs to improve therapeutic outcomes, enhance patient compliance, and boost manufacturing efficiency.

Key Players: Novartis AG, Alembic Pharmaceuticals, Teva Pharmaceutical Industries Ltd.

- Clinical Trials and Regulatory Approvals

It hinges on optimizing the path from API procurement to final market approval, mainly for generic drugs.

Key Players: Alembic Pharmaceuticals Ltd., Novartis AG, Teva Pharmaceutical Industries Ltd.

- Formulation and Final Dosage Preparation

It aims to convert poor API drugs into stable, bioavailable, and effective final products.

Key Players: Novartis AG, Teva Pharmaceutical Industries Ltd., Alembic Pharmaceuticals

- Patient Support & Services

Patient support refers to guiding patients about the dosage and delivery of carbamazepine. It also involves providing financial assistance to enhance treatment affordability.

CarbamazepineMarket Companies

- Novartis AG

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc. (formerly Mylan N.V.)

- Taro Pharmaceutical Industries

- Zydus Lifesciences Ltd. (formerly Cadila Healthcare)

- Alembic Pharmaceuticals Ltd

- Lupin Limited

- Torrent Pharmaceuticals Ltd.

- Cipla Inc.

- Dr. Reddy's Laboratories Ltd.

- Hikma Pharmaceuticals PLC

- Amoli Organics Pvt Ltd

- CTX Life Sciences

- Apotex Corp.

Recent Developments

- In October 2025, Pfizer, Inc. announced the conduction of its Phase I clinical trial to investigate the effect of Carbamazepine on PF-07248144 pharmacokinetics. The study aims to understand the safety, tolerability, and pharmacokinetics when PF-07248144 is taken alone and with carbamazepine. (Source: https://www.tipranks.com)

- In July 2025, Alembic Pharmaceuticals Limited received an FDA approval for Carbamazepine Extended-Release Tablets. This tablet is indicated for use as an anticonvulsant and for treating pain associated with trigeminal neuralgia. The drug is therapeutically equivalent to Novartis' Tegretol-XR and is available in three strengths: 100 mg, 200 mg, and 400 mg. (Source: https://scanx.trade)

Segments Covered in the Report

By Product Type

- Carbamazepine API

- Finished Dosage Forms (FDFs)

- Standard tablets

- Extended-release tablets

- Capsules

By Indication

- Epilepsy

- Bipolar Disorder

- Trigeminal Neuralgia

- Neuropathic Pain

- Other Neurological Conditions

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Other Channels

By Drug Type

- Branded Carbamazepine

- Generic Carbamazepine

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting