What is the Carbohydrates Market Size?

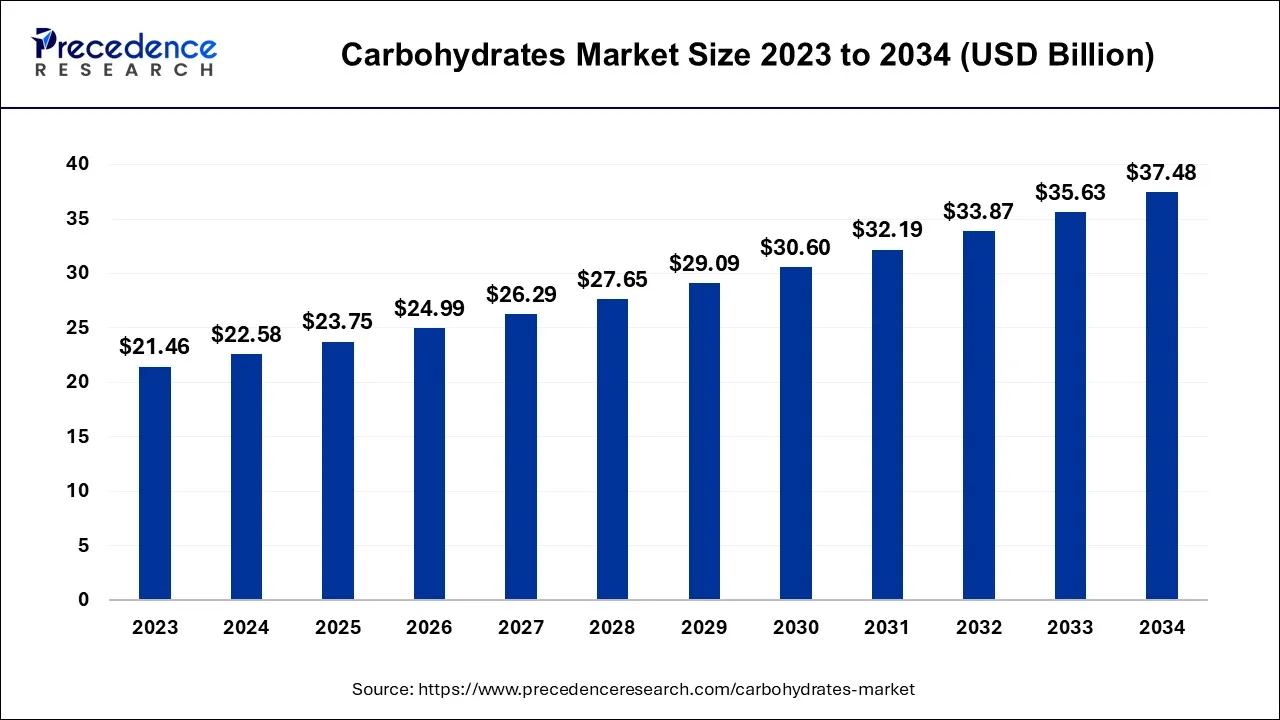

The global carbohydrates market size was calculated at USD 23.75 billion in 2025 and is predicted to increase from USD 24.99 billion in 2026 to approximately USD 39.27 billion by 2035, expanding at a CAGR of 5.16% from 2026 to 2035.

Carbohydrates Market Key Takeaways

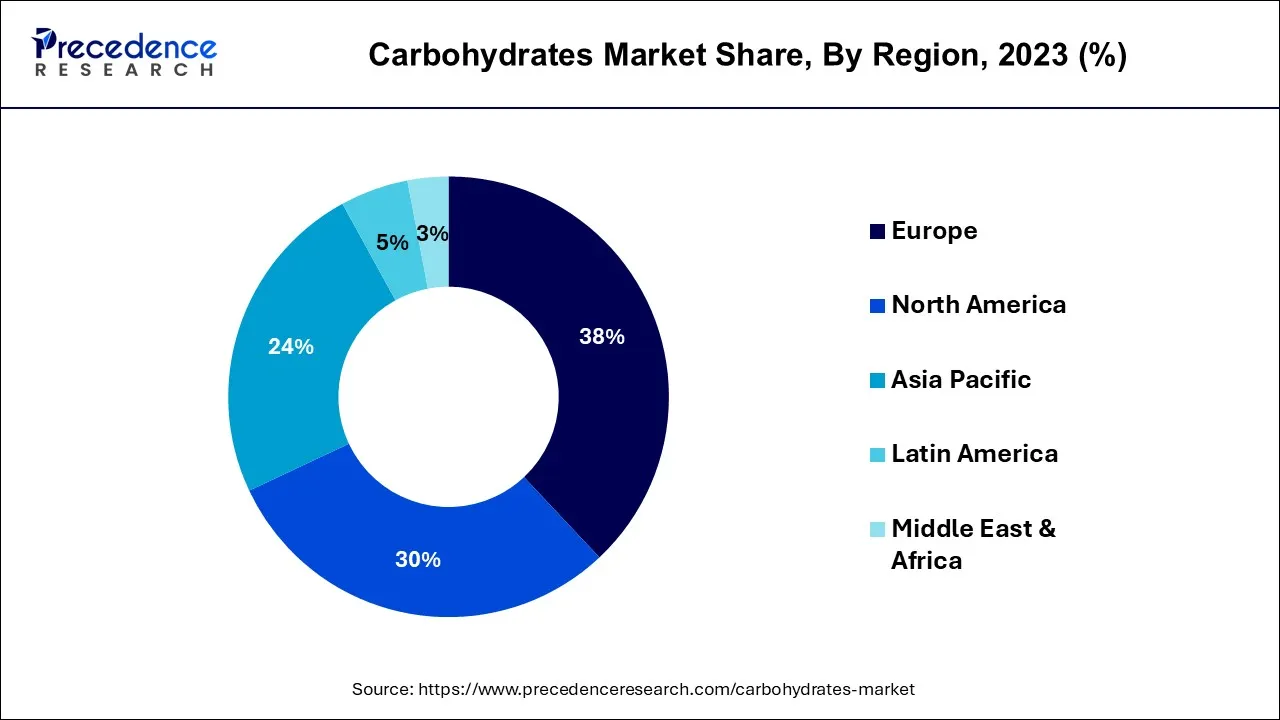

- Europe contributed more than 38% of the revenue share in the carbohydrates market. Whereas North America is estimated to expand the fastest CAGR between 2026 and 2035.

- By Type, the Isomalt segment has held the largest market share of 34% in 2025. On the other hand, the other segment is anticipated to grow at a remarkable CAGR of 6.5% between 2026 and 2035.

- By Application, the food & beverages segment had the largest market share of 31% in 2025. Whereas the other segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The carbohydrates market represents a multifaceted arena, enshrining a plethora of products and industries, spanning domains like consumables, pharmaceuticals, and the biofuel sector. Carbohydrates, predominantly constituted by saccharides, polysaccharides, and dietary cellulose, stand as quintessential reservoirs of energy and nourishment. The market's vitality is driven by an escalating consumer demand for nutritionally conscious and health-empowering comestibles, which, in turn, spurs the innovation of low-glycemic and fiber-enriched commodities.

Furthermore, the biofuel industry heavily relies upon carbohydrates as the cardinal raw material for ethanol generation. Present trends orbit around sustainable sourcing, epitomized by plant-derived carbohydrates, and pioneering breakthroughs in carbohydrate refinement. The global carbohydrates market remains in perpetual flux, molded by ever-evolving dietary inclinations and industrial progress.

Carbohydrates Market Growth Factors

- A pivotal catalyst for the carbohydrates market's surge is the ever-evolving landscape of consumer dietary preferences. This transformation is characterized by a rising demand for carbohydrate products tailored to contemporary health and wellness paradigms. Consumers are increasingly gravitating towards low-carbohydrate and low-sugar alternatives, spurring the innovation of novel carbohydrate-based offerings. Manufacturers are seizing the opportunity by introducing products like low-glycemic selections and high-fiber choices, custom-tailored to the evolving dietary inclinations. The market's adaptability to changing consumer habits unveils a treasure trove of prospects for companies to craft and market carbohydrate products uniquely suited to these discerning preferences.

- Another compelling factor propelling the carbohydrates market is the proliferation of functional gastronomy and nutraceuticals. These delectables transcend basic nourishment, bestowing health benefits beyond sustenance, frequently by incorporating specific carbohydrate constituents such as dietary fibers, prebiotics, or resistant starches. As consumers grow more cognizant of the correlation between their dietary choices and well-being, they actively seek out products offering added functional value. These benefits may encompass enhanced gastrointestinal health, glycemic control, and weight management. The integration of distinct carbohydrates into these products augments not only their nutritional appeal but also amplifies their utility, rendering them more appealing to health-conscious epicures.

- The burgeoning prevalence of plant-centric diets and burgeoning ecological concerns are reshaping the carbohydrates market, elevating the prominence of plant-derived sources. Many carbohydrates naturally originate from botanical sources, cementing their position as a pivotal constituent of vegetarian and vegan dietary patterns. In parallel, the quest for sustainability in sourcing and production practices is taking center stage. Consumers display heightened awareness regarding the environmental footprint of their culinary choices, compelling the food industry to adopt eco-conscious methodologies. This encompasses the judicious sourcing of carbohydrates from ecologically sound agricultural practices, the curbing of food wastage, and steadfast adherence to clean-label initiatives. The market's transformation towards plant-based and eco-friendly options is fomenting an escalating demand for carbohydrate-rich products that resonate with these principles, including those crafted from heirloom grains and alternative flours.

- Carbohydrates find application across diverse industrial domains, transcending the confines of nutrition. The biofuel sector, for instance, leans heavily on carbohydrates as the fundamental feedstock for ethanol production. The burgeoning biofuel industry, driven by stringent environmental mandates and the urgency to mitigate greenhouse gas emissions, is stoking a significant market for carbohydrates. Moreover, the pharmaceutical industry employs carbohydrates as excipients, binders, and fillers in the formulation of medicinal compounds. As the pharmaceutical sector continues to expand, the demand for carbohydrates in these applications is poised for an upsurge. The gamut of industrial applications serves as a multitude of revenue streams for carbohydrate producers and processors, thus contributing to the overarching expansion of the market.

- Strides in carbohydrate processing and manufacturing technologies stand as a major impetus for market growth. These breakthroughs translate into heightened efficiency, product excellence, and economic viability. Innovative techniques such as precision engineering and enzymatic enhancements empower the production of carbohydrates boasting bespoke characteristics, including modified starches that proffer augmented functionality.

- Furthermore, these technological advancements facilitate the extraction of carbohydrates from unconventional sources, broadening the repertoire of carbohydrate-based commodities. This augmented innovation and efficiency foster competitiveness within the carbohydrates market while concurrently nurturing the development of fresh and specialized carbohydrate offerings, meticulously aligned with the evolving demands of consumers and industries. As technology persists in its progression, it is poised to further propel the market by enabling amplified adaptability and sustainability in carbohydrate production.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.16% |

| Market Size in 2025 | USD 23.75 Billion |

| Market Size in 2026 | USD 24.99 Billion |

| Market Size by 2035 | USD 39.27 Billion |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Diverse dietary preferences

The carbohydrates market is witnessing robust expansion, propelled by the multifaceted nature of consumer dietary inclinations. In an era marked by heightened health consciousness and the recognition of the need for personalized dietary regimens, the market has evolved to introduce a plethora of carbohydrate-based offerings that cater to this wide-ranging spectrum of dietary choices.

The surge in popularity of low-carb diets, for instance, has given rise to specialized products with diminished carbohydrate content, precisely tailored to meet the demands of individuals seeking to curtail their carb intake. These include low-carb bread, alternative pasta, and innovative snacks. Conversely, health-conscious consumers are proactively in pursuit of sources rich in high-fiber and complex carbohydrates, accentuating products like whole grains, legumes, and vegetable-based options, brimming with these nutritionally beneficial carbohydrates.

This diversification of dietary preferences has ignited the development of an assortment of innovative products, finely attuned to specific dietary niches within the market. Examples include products meticulously fashioned for paleo, keto, and gluten-free diets, all of which have garnered significant traction. The carbohydrates market's adeptness at adaptation, coupled with its ability to offer a diverse array of choices, underscores its ongoing expansion and ability to cater to consumers who prioritize their distinct dietary requisites and health goals.

Restraint

Health concerns and diet trends

Health-related apprehensions and the ongoing shifts in dietary trends are imposing a substantial constraint on the carbohydrates market. The growing awareness of potential health risks associated with excessive carbohydrate intake, particularly focusing on sugars and refined carbohydrates, has propelled the rise of low-carb and keto dietary preferences. This alteration in dietary choices, driven by concerns about weight control, blood sugar management, and overall metabolic health, has propelled the expansion of a market niche centered on low-carb products.

Simultaneously, it has precipitated a decline in the demand for traditional carbohydrate-rich options. As consumers increasingly explore substitutes to products high in sugar and carbohydrates, the food industry confronts the formidable task of overhauling its product offerings to align with these evolving dietary patterns. This entails the formulation of products with reduced sugar content and an amplified emphasis on low-carb choices, frequently involving substantial investments and innovative endeavors.

Consequently, conventional carbohydrate-rich products are grappling with a dwindling consumer base, presenting a hurdle to their market growth. The carbohydrates market must adeptly navigate these health-related concerns and the perpetually shifting dietary landscape to uphold its competitiveness and significance amidst evolving consumer preferences.

Opportunity

Functional and nutraceutical products

The realm of functional and nutraceutical products holds a distinct and promising realm of opportunities within the carbohydrates market. These specialized products are meticulously crafted to go beyond basic nutrition, focusing on delivering tangible health benefits, often harnessing specific carbohydrate components like dietary fibers, prebiotics, and resistant starches. This particular niche responds to the escalating consumer appetite for health-conscious comestibles that can effectively address a gamut of wellness-related concerns.

For instance, dietary fibers are renowned for their role in bolstering digestive health and supporting weight management, while prebiotics are recognized for their ability to cultivate a robust gut microbiome. These functional carbohydrates are progressively being integrated into a wide spectrum of food and beverage offerings, ranging from fortified cereals to probiotic-enriched yogurt. Furthermore, the potential for functional and nutraceutical products extends to dietary supplements, providing consumers with convenient means to incorporate health-enhancing carbohydrates into their daily regimen.

As consumer understanding of the interplay between dietary choices and well-being continues to burgeon, the creation of inventive functional and nutraceutical carbohydrate goods presents a lucrative opportunity for companies to meet the evolving demands of health-conscious consumers, delivering solutions tailored to address specific health needs.

Segment Insights

Type Insights

The Isomalt segment has held 34% revenue share in 2025. The dominance of the Isomalt segment in the carbohydrates market is primarily attributed to its exceptional attributes and adaptability. Isomalt stands out as a low-calorie sugar substitute sourced from beet sugar, a choice highly favored by health-conscious consumers. What sets Isomalt apart is its remarkable ability to replicate the taste and texture of sugar while minimizing calorie intake and its impact on blood glucose levels. This unique feature has catapulted Isomalt into a prominent position across a spectrum of food and beverage applications.

It is widely embraced in the production of sugar-free and diabetes-friendly products, confectionery items, and pharmaceuticals. Isomalt's capacity to reduce sugar content without compromising taste has turned it into a prized resource for food manufacturers responding to the surging demand for healthier, sugar-reduced options.

The other segment is anticipated to expand at a significantly CAGR of 6.5% during the projected period. The other segment, in the carbohydrates market, predominantly includes a diverse range of carbohydrate sources that don't fit into conventional categories like sugars, starches, or fibers. This segment holds a significant share due to the growing popularity of alternative and specialty carbohydrate sources, including novel grains, ancient grains, and non-traditional flours.

These products are sought after by health-conscious consumers and those with dietary restrictions, as they offer unique nutritional profiles and often cater to specific dietary preferences. As dietary diversity and innovation continue to gain traction, the others category serves as a hub for unconventional and specialty carbohydrates, contributing to its major share in the market.

Application Insights

The food & beverages segment is anticipated to hold the largest market share of 31% in 2025. The dominance of the food and beverages segment in the carbohydrates market can be attributed to its pivotal role in providing essential sustenance. Carbohydrates serve as foundational elements in an extensive array of food and beverage products, encompassing staples like bread, pasta, cereals, and snacks. Their primary function lies in supplying vital energy and enhancing the flavor profile of diverse food offerings.

Furthermore, carbohydrates play a multifaceted role in food processing, acting as vital thickeners, stabilizers, and sweetening agents. This profound versatility within the food and beverages sector underscores its supremacy in the carbohydrates market, underscoring its indispensable significance in the global food industry.

On the other hand, the others segment is projected to grow at the fastest rate over the projected period. The other segment in the carbohydrates market encompasses a diverse array of applications, including industrial uses like biofuel production, pharmaceuticals, and non-food applications. These applications collectively hold a significant share due to the versatile nature of carbohydrates.

Biofuel production, driven by environmental concerns, relies on carbohydrates as a primary feedstock for ethanol. In the pharmaceutical industry, carbohydrates serve as excipients, binders, and fillers in drug formulations. Non-food applications, such as textiles and adhesives, also rely on carbohydrates. This multifaceted use of carbohydrates across various industries contributes to the prominence of the "others" segment in the carbohydrates market.

Regional Insights

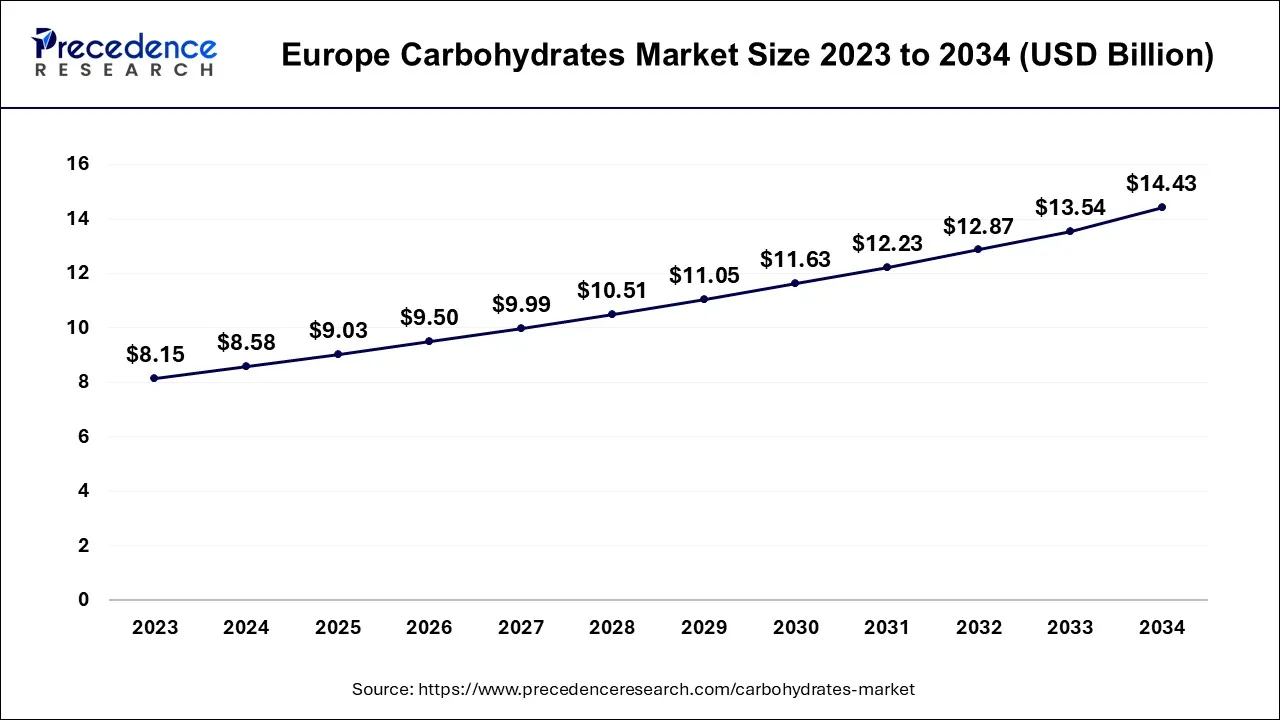

Europe Carbohydrates Market Size and Growth 2026 to 2035

The Europe carbohydrates market size was accounted at USD 9.03 billion in 2025 and is projected to be worth around USD 15.17 billion by 2035, poised to grow at a CAGR of 5.32% from 2026 to 2035.

Europe held the largest revenue share 38% in 2025. Europe holds a substantial share in the carbohydrate market due to several factors. Firstly, there's a strong emphasis on healthy and sustainable eating in European consumer culture, which drives demand for carbohydrate-rich products with natural and whole ingredients. Moreover, Europe boasts a well-established food processing and production industry, enabling efficient manufacturing of carbohydrate-based foods. Additionally, the region's robust agricultural sector provides a consistent supply of raw materials. Stringent regulations and consumer preferences for transparent labeling also promote high-quality carbohydrate products. All these factors collectively contribute to Europe's significant share in the carbohydrates market.

Germany Carbohydrates Market Analysis

The market in Germany is expanding due to the rising health awareness, the growing demand for functional foods, and supportive government policies. Additionally, increasing consumer preference for natural sweeteners, clean-label ingredients, and innovation in food processing and biotechnology is driving market expansion.

Why is North America Considered the Fastest-Growing Region in the Carbohydrates Market?

North America is estimated to observe the fastest expansion. North America commands substantial growth in the carbohydrates market due to a combination of factors. The region's diverse consumer preferences drive demand for a wide range of carbohydrate-rich products. Moreover, the presence of prominent food and beverage manufacturers continually innovates to meet evolving consumer needs. Additionally, the region'sfocus on health and wellness trends has led to the development of functional carbohydrate products. High disposable incomes and busy lifestyles have spurred the demand for convenient carbohydrate-based snacks. Lastly, the biofuel industry, which relies on carbohydrates for ethanol production, further bolsters North America's dominant position in the carbohydrates market.

U.S. Carbohydrates Market Analysis

The carbohydrates market in the U.S. is growing due to strong consumer demand for clean-label and plant-based products, as well as advancements in animal and personalized nutrition. Supportive government initiatives, such as the U.S. FDA's $7.2 billion investment in food safety, nutrition, and public health, are further driving innovation and market expansion.

How is the Opportunistic Rise of Asia Pacific in the Carbohydrates Market?

Asia Pacific is expected to grow at a notable rate in the market, owing to growing demand for functional foods, beverages, and nutraceuticals driven by health-conscious consumers. Rapid urbanization, increasing disposable incomes, and the expansion of the food processing and animal nutrition sectors are further fueling market growth. Additionally, government support, investment in R&D, and adoption of innovative carbohydrate-based ingredients are creating long-term opportunities across the region.

What Potentiates the Market within Latin America?

The carbohydrates market in Latin America is potentiated by rising demand for functional foods, beverages, and animal feed driven by growing health awareness and urbanization. Expansion of the food processing industry, increasing disposable incomes, and supportive government initiatives for agricultural and nutritional development further boost market growth. Additionally, investments in R&D and the adoption of innovative carbohydrate-based ingredients are creating long-term opportunities across the region.

What Opportunities Exist in the Middle East & Africa for the Carbohydrates Market?

The Middle East & Africa (MEA) presents significant opportunities for the market due to growing demand for functional foods, beverages, and animal nutrition products amid rising health awareness. Investments in food processing, expanding urban populations, and government initiatives to improve nutrition and food security are further driving growth. Additionally, the adoption of innovative carbohydrate-based ingredients and fortification solutions presents significant potential for market expansion in the region.

Carbohydrates Market Companies

- Archer Daniels Midland Company

- Cargill, Incorporated

- Ingredion Incorporated

- Bunge Limited

- Tate & Lyle PLC

- Grain Processing Corporation

- Roquette Frères

- Emsland Group

- AGRANA Beteiligungs-AG

- Associated British Foods plc

- Sudzucker AG

- The Scoular Company

- AVEBE

- SÜDSTÄRKE GmbH

- BENEO GmbH

Recent Developments

- In July 2024, Ingredion launched SUSTRA 2434, a clean-label, slowly digestible starch designed for energy-focused nutrition products such as bars, shakes, mixes, snacks, and supplements. (Source: nutraceuticalsworld.com)

- In 2023, Ingredion Incorporated unveiled an innovative starch named NOVATION 4300, strategically crafted to enhance the texture and stability of plant-based food products. This groundbreaking development signifies a commitment to elevating the quality of plant-based foods.

- In 2023, Archer Daniels Midland Company and Cargill Incorporated forged a dynamic partnership aimed at pioneering sustainable carbohydrate solutions. Leveraging their combined knowledge and capabilities, these two industry leaders are embarking on a journey to create novel carbohydrate products with a significantly reduced environmental footprint.

- In 2023, Bunge Limited introduced a fresh range of organic rice offerings, encompassing a diverse selection of rice varieties, including white rice, brown rice, and fragrant jasmine rice. This innovative line of products is a testament to their dedication to offering high-quality organic rice options to consumers.

Segments Covered in the Report

By Type

- Isomalt

- Palatinose

- Curdlan

- Cyclodextrin

- Others

By Application

- Food & Beverages

- Pharmaceutical/Nutraceutical

- Cosmetics & Personal Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting