What is the Cloud Analytics Market Size?

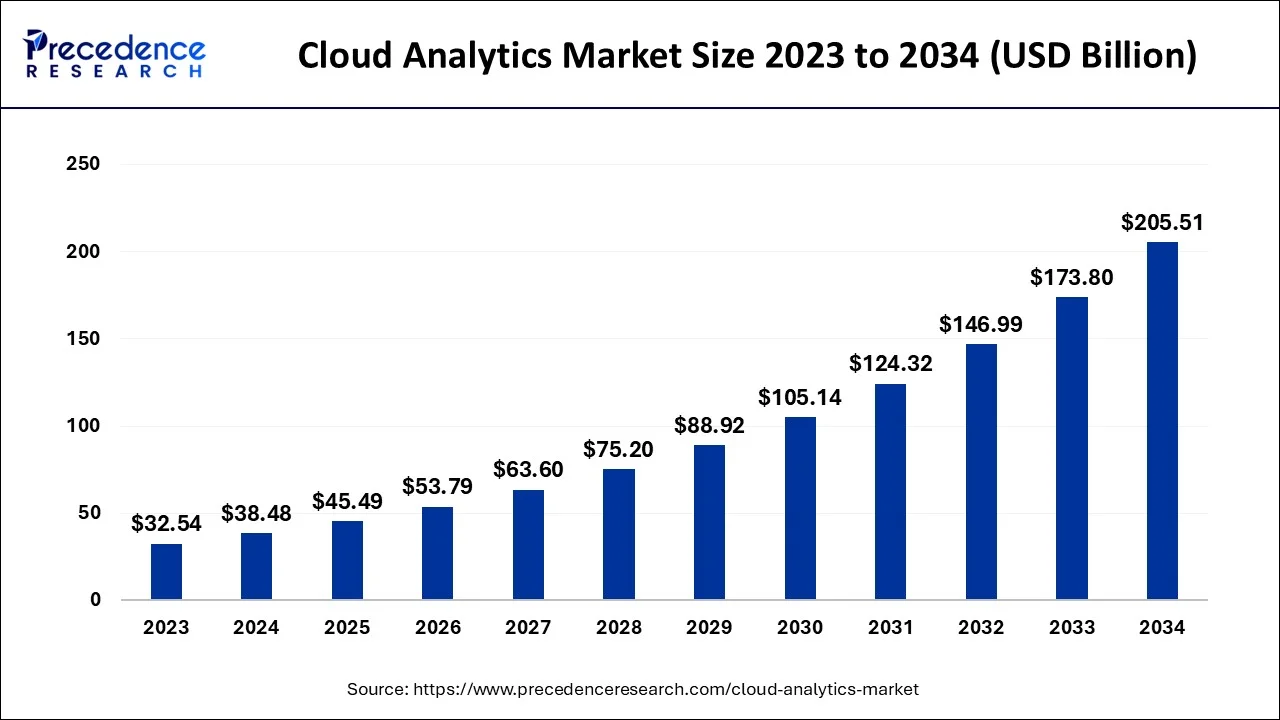

The global cloud analytics market size was calculated at USD 45.49 billion in 2025 and is predicted to increase from USD 53.79 billion in 2026 to approximately USD 233.95 billion by 2035, expanding at a CAGR of 17.79% from 2026 to 2035.

Cloud Analytics Market Key Takeaways

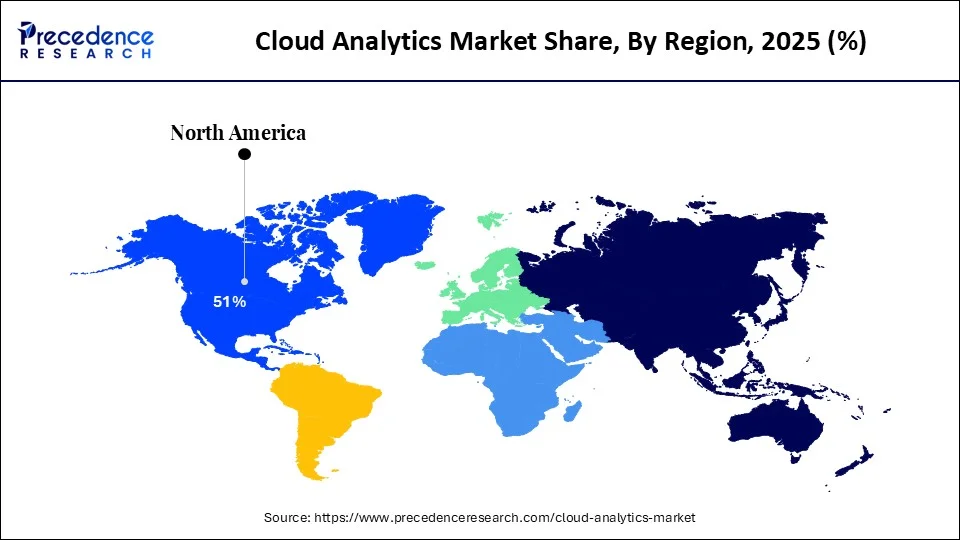

- North America generated more than 51% of total sales in 2025.

- Asia Pacific region is anticipated to have the largest CAGR at a13% from 2026 to 2035.

- By component, the solutions segment generated more than 72% of the total revenue share in 2025.

- By deployment, the private segment captured more than 30% of the revenue share in 2025.

- By organization size, the SME segment accounted for more than 45% of revenue share in 2025.

- By industry vertical, the BFSI segment generated more than 35% of the total share in 2025.

- By industry vertical, the healthcare and life sciences segment accounted for over 10% of revenue share in 2025.

- By application, the sales and marketing segment generated more than 38% of the revenue share in 2025.

- By application, the customer service segment contributed more than 13% of revenue share in 2025.

Strategic Overview of the Global Cloud Analytics Industry

Cloud analytics continues to be well-liked as a better alternative to on-premises analytics. On-premises analytics are complicated and expensive to manage, whereas cloud analytics enables customers to scale up and promote cost reductions inside the firm. Due to the requirement for handling big data sets for businesses, the market for cloud analytics has also shown to be a reliable option for processing these enormous data volumes and producing meaningful information. Future occurrences can be predicted with it, and it can also produce meaningful data that is helpful to decision-makers. The user also benefits from not having to pay upfront for infrastructure thanks to pay-as-you-go pricing and the use of data connectivity in hybrid and multi-cloud models. The cloud platform, however, provides the benefit of public clouds with the potential for automatic, infinite scaling.

Recent assessments show that the majority of corporate firms in a variety of non-IT and non-telecommunications industries lack the IT personnel required to manage the complexity of the cloud computing environment. Additionally, because of the significant financial investment required, they do not want to purchase expensive hardware equipment and other hardware-related instruments. The cloud is these firms' greatest option for managing enormous amounts of data without requiring a lot of specialized IT staff, tools, or processes. The primary driver currently driving increasing public cloud computing contact or adoption is enterprises that are digitally transitioning (63%). Security is the main issue, according to 66% of IT experts, when it comes to creating a business cloud computing strategy.

Artificial Intelligence: The Next Growth Catalyst in Cloud Analytics

AI is profoundly transforming the cloud analytics industry by enabling advanced capabilities that move beyond traditional business intelligence to predictive and prescriptive insights. Machine learning algorithms automate much of the data preparation, cleansing, and modeling process, significantly reducing the time and human effort required for analysis.

Furthermore, AI-driven solutions enhance data interpretation by identifying complex patterns and anomalies that human analysts might miss, providing deeper, more actionable intelligence for strategic decision-making. The technology also personalizes the user experience, offering natural language query interfaces and automated report generation, making sophisticated analytics tools accessible to a wider range of business users.

Cloud Analytics Market Growth

The cloud analytics market has not been significantly impacted by the COVID-19 outbreak. This can be ascribed to the rising use of big data technologies, increased reliance on the culture of working from home, the boom in social media usage, and the acceptance of mobile applications. In addition, several industries have seen the advantages of cloud services to improve their capabilities, including healthcare, BFSI, and media & entertainment. Healthcare firms were compelled to swiftly reevaluate their technology and advance preparations for digital transformation as COVID-19 started to proliferate.

Accelerating the implementation of cloud technologies was one of the top priorities for healthcare firms in order to better manage the flood of patient data, assure faster workplace procedures, and make information sharing easier. The cloud's predictive analytics can help those managing the supply chain better understand where shortages exist and where they will soon be so that they can allocate before there is a problem. As organizations look to provide essential healthcare equipment to those in need, such as PPE and ventilators, the cloud's predictive analytics can help. Predictive services can be easily combined with matching algorithms to cut down on waste in the supply chain while giving suppliers and procurers real-time visibility.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 45.49 Billion |

| Market Size in 2026 | USD 53.79 Billion |

| Market Size by 2035 | USD 233.95 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 17.79% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Deployment. By Organization Size, By Industry Vertical, and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The advent of cloud computing environments, where data is remotely stored in distributed storage systems, has made it possible to quickly scale up or scale down the IT infrastructure. These ecosystems also make pay-as-you-go arrangements possible. Because of this, companies that need to process enormous amounts of data and have high storage and processing requirements can do so without having to make a significant investment in building out their IT infrastructure. A better option would be for businesses to license the storage and processing power they need and only pay for what they really use. Because of this, most significant organizations that handle vast volumes of data are making use of cloud computing to offer their goods to enterprises.

However, a corporation must go through a challenging and time-consuming process to move data from an on-premises solution to the cloud. The companies must take several weeks or months to synchronize their data sources and systems before the relocation is finished. These factors aren't putting people off from embracing cloud-based solutions; rather, they're accelerating the growth of hybrid and multi-cloud deployments. Early adopters are leveraging their cloud storage for dynamic workloads, while on-premises solutions are still highly useful for steady workloads. Businesses are developing multi-cloud strategies to take advantage of the many best-suited technologies and solutions that are accessible in a variety of deployment options.

Market Restraints

Corporate organizations worldwide working in and across a number of industries are growing more concerned about data security risks as cloud technology is embraced (such as data theft and loss of industry-specific information). The multi-tenancy infrastructure of cloud analytics allows a variety of different commercial companies to share data that is transported from various cloud providers. The cloud infrastructure servers are virtually accessible and shared across numerous lines in an organization rather of being used by just one line. Throughout this procedure, numerous data security issues are brought up. Breach of cyber security is the main concern for cloud-based environments. Cyberattacks might lead to customer churn and the eventual extinction of well-known brands if consumers decide to shop at other companies.

Market Opportunities

In February 2022, Teradata and Microsoft joined up to connect Microsoft Azure with the Teradata Vantage data platform. The partnership aims to carry out cloud activities, update business data analytics workloads, and collaborate on data analytics issues. Additionally, in November 2021, the industry-leading supplier of cloud data management, Informatics, unveiled its cutting-edge cloud analytics software on Microsoft Azure. The platform is available to customers who need to migrate their on-premise data warehouse and ETL workloads to IDMC on Azure and Azure Synapse Analytics and who have a combined Microsoft and Informatics PowerCenter.

Segment Insights

Component Insights

In 2025, the category for cloud analytics solutions will account for roughly 72% of total revenue. The demand for cloud analytics solutions is rising. These include cloud BI tools, enterprise information management, governance, risk, and compliance, enterprise performance management, and analytics solutions. The enterprise performance management solution aids businesses in gaining insights, improving agility and planning across HR, finance, sales, and supply chain, streamlining financial techniques, and producing better results and decisions.

The service industry has a market share of about 45% in 2025. The businesses that provide cloud analytics services provide managed and professional services. The service providers provide services for data management, analysis, and organization that give clients information for making business decisions. Over the course of the forecast period, market growth is anticipated to be driven by the growing demand of SMEs and large enterprises to manage data and quality insights.

Deployment Insights

In 2025, the private cloud segment's revenue share was close to 30%. The advantages, particularly for large businesses, include service customization and greater control due to the cloud infrastructure being dedicated to a single-user organization, enabling privacy and increased security. About 42% of income in 2025 will come from the hybrid cloud. By combining the deployment of private and public clouds, the hybrid cloud offers services.

Based on changes in demand for process computing, users of a hybrid analytics cloud solution can seamlessly transition resources from on-premises private infrastructure to public cloud. To address short-term demand without investing in cloud infrastructure, businesses are implementing hybrid cloud architecture. The advantages provided by the hybrid cloud, such as low-risk exposure, cost-efficiency, and scalability, are anticipated to increase demand for hybrid cloud platforms during the projected period.

Organizational Size Insight

The SMEs market was responsible for over 45% of total revenue in 2025. Due to its scalability and ability to support both online and regional development without having an adverse financial impact, SMEs are embracing public and hybrid clouds. It decreases or eliminates downtime while allowing organizations to operate more efficiently without spending money on infrastructure. Large companies accounted for over 69% of the revenue share in 2025.

Businesses are implementing cloud analytics to boost profitability and pinpoint areas that are operating well and poorly in order to inform their future business plans. Data is password-protected and routinely backed up by cloud analytics systems on servers spread across various locations, improving security. Additionally, it is projected that the advantages, such as enhanced collaboration and sharing, will accelerate industry growth during the forecast period.

Industry Vertical Insights

The BFSI sector contributed over 35% of total income in 2025. Businesses are using cloud analytics to enhance user experience as a result of the fiercer competition in the BFSI sector. Businesses use cloud analytics to improve customer acquisition, engagement, and targeting. To enhance the user experience and achieve a competitive edge, the BFSI sector is implementing cloud analytics solutions such as sales analytics, website analytics, performance analytics, and financial analytics. The healthcare and life sciences sector controlled over 10% of the market in 2025.

Cloud analytics tools assist the healthcare and life sciences industries in using gathered healthcare data to make critical choices. It enables management and healthcare teams to quickly evaluate personnel, financial, and operational performance in any area of a healthcare company, taking into account variations, trends, and potential future effects. Analytics tools make it possible for medical staff to quickly combine data from many sources, reducing the amount of time required for analysis and reporting and improving patient care.

Application Insights

Nearly 38% of the revenue share in the application segment in 2025 was accounted for by sales and marketing. The market is expanding as a result of new trends like text analytics and social analytics as well as an increase in demand for information to help with better company planning. The platform is tailored for manufacturing, health & life sciences, financial services, retail & consumer products. It offers artificial intelligence (A) driven insights to improve visibility and forecast correct pipeline information.

In 2025, the customer service segment's revenue share was close to 13%. The increase in demand for individualized services by the client and key performance measures like total time resolution (TTR), first reaction time (FRT), and customer satisfaction (CSAT) by the client are credited with the growth. The segment is expanding as a result of the growing use of customer journey analytics, customer retention analytics, and customer engagement analytics to comprehend different facets of customers.

Regional Insights

U.S. Cloud Analytics Market Size and Growth 2026 to 2035

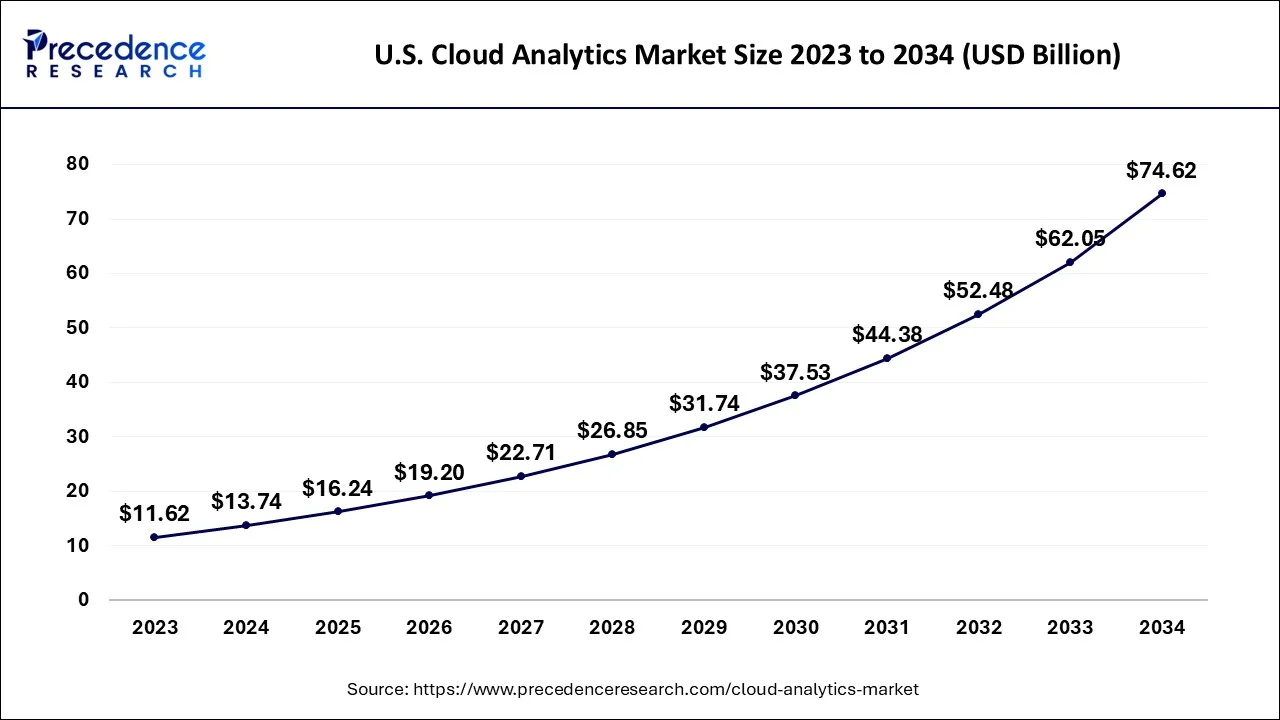

The U.S. cloud analytics market size was estimated at USD 16.24 billion in 2025 and is expected to be worth around USD 85.19 billion by 2035, rising at a CAGR of 18.03% from 2026 to 2035.

In 2025, North America accounted for over 51% of total sales. The expansion is credited to the greater use of the most recent technologies in postal services and the presence of important firms in the area. Additionally, businesses are adopting automation due to growing labor costs and a lack of workers, which is fueling the market's expansion. Government, BFSI, and other sectors are increasingly in need of postal automation services, which is boosting the sector's expansion in the area.

U.S. Cloud Analytics Market Trends

The U.S. market, a deep integration of AI/ML technologies and the widespread adoption of hybrid and multi-cloud strategies. The expansion into high-value professional sectors like healthcare emphasizes data security and compliance measures. The market's infrastructure is dominated by public cloud platforms, with strong growth in Platform-as-a-Service (PaaS) for AI development.

The highest CAGR, at about 13%, is anticipated in Asia Pacific throughout the anticipated period. A highly advanced e-commerce logistics sector is now necessary due to the rapid growth of the e-commerce sector in nations like Japan, China, and India. Additionally, there are several potential for postal automation systems to flourish in the Asia Pacific region due to rising BFSI sector demand.

China Cloud Analytics Market Trends

China's market is experiencing robust growth driven by heavy government investment and a significant focus on developing advanced AI infrastructure. Key growth is concentrated in the industrial manufacturing sector, which is leveraging AI and IoT for smart-factory initiatives. The market balances the scalability of public cloud models with the flexibility of the rapidly growing hybrid cloud segment.

How did Europe gain a notable share in the Cloud Analytics Market?

Europe's widespread digital transformation across business, including SMEs, drives demand for scalable cloud services. Stringent data privacy regulations like GDPR have created a unique demand for secure, compliant, and sovereign cloud solutions, which domestic and international providers are rapidly meeting. The region's focus on Industry 4.0 initiatives in manufacturing and the healthcare sector provides high-value application areas for cloud analytics.

Germany Cloud Analytics Market Trends

Germany's market is experiencing substantial growth driven by strong adoption in the manufacturing sector for Industry 4.0 initiatives and a boom in AI/ML workloads. A key characteristic is the demand for data sovereignty and compliance with strict GDPR regulations, fostering the rise of hybrid and sovereign cloud solutions.

Value Chain Analysis of the Cloud Analytics Market

Cloud Infrastructure & Platform Provisioning: This foundational stage involves providing the core hardware (data centers, servers, networking) and the foundational software platform (IaaS, PaaS) upon which analytics solutions run.

- Key Players: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

Software Development and Solution Provision: This stage focuses on creating the specific analytics software, tools, and platforms that run on the cloud infrastructure, including business intelligence (BI), data warehousing, and machine learning tools.

- Key Players: SAP SE, Salesforce (Tableau), Microsoft Power BI, Snowflake Inc., and Databricks

Managed Services & Integration:Third-party service providers and consultancies manage the implementation, integration, and ongoing operation of cloud analytics platforms for clients, especially for small to medium-sized enterprises (SMEs).

- Key Players: Major IT consulting firms like Accenture, Deloitte, and IBM

Distribution and Sales: This stage involves the channels through which cloud analytics solutions reach end-users, including direct sales from vendors, online marketplaces, and channel partners/resellers.

End-User Applications and Value Creation: The final stage involves enterprises and organizations across various industries utilizing cloud analytics to gain insights, optimize operations, and make strategic decisions.

- Key Players: J.P. Morgan, Goldman Sachs

Top Companies in the Cloud Analytics Market & Their Offerings

- Microsoft Corporation:Microsoft contributes heavily through its Azure cloud platform, offering a comprehensive suite of analytics tools like Azure Synapse Analytics and Power BI for data processing, visualization, and AI integration

- IBM Corporation: IBM provides hybrid cloud analytics solutions, including the IBM Cloud Pak for Data, which helps enterprises manage data across multi-cloud environments and leverage AI for deeper insights and automation.

- Oracle Corporation: Oracle offers a range of cloud analytics services that are deeply integrated with its database and enterprise resource planning (ERP) systems, providing high-performance data warehousing and business intelligence tools for corporate clients.

- Google, LLC: Google Cloud Platform contributes with a strong focus on AI/ML and big data services like BigQuery and Looker, enabling advanced analytics, real-time data processing, and user-friendly natural language interfaces.

- SAP SE (Germany): SAP focuses on real-time business analytics through its S/4HANA and SAP Analytics Cloud platforms, providing integrated solutions that help businesses manage complex data and make informed decisions directly within their enterprise workflows.

- TIBCO Software, Inc.: TIBCO contributes by providing a broad platform for data integration and visual analytics, helping companies connect data from various sources and derive actionable insights using tools like TIBCO Spotfire.

- Salesforce.com: Salesforce leverages its dominant position in CRM by integrating analytics capabilities (through Tableau and Einstein Analytics) to help sales and marketing teams make data-driven decisions and personalize customer interactions.

- SAS Institute, Inc.: A long-standing leader in advanced analytics, SAS provides cloud-based platforms and services that enable complex statistical analysis, data mining, and predictive modeling for a wide range of industries.

- AWS (Amazon Web Services): AWS is the leading cloud infrastructure provider, offering a vast array of analytics services like Amazon Redshift and Amazon SageMaker that provide scalable and cost-effective solutions for data storage, processing, and AI development.

- MicroStrategy: MicroStrategy offers a leading enterprise analytics platform that helps organizations embed analytics into their applications and build powerful, data-driven dashboards and mobile intelligence applications within cloud environments.

- Cloudera: Cloudera provides a hybrid data cloud platform that enables businesses to manage and analyze massive amounts of data efficiently and securely across multi-cloud and on-premise environments.

- Alteryx, Inc.: Alteryx contributes by offering a data science and analytics automation platform that allows analysts to easily prepare, blend, and analyze data without extensive coding skills, primarily within cloud-based workflows.

- Sisense (U.S.): Sisense provides an AI-driven analytics platform that simplifies complex data analysis and helps companies embed actionable insights into their workflows and applications, focusing on rapid time-to-insight.

- Atos (France): Atos provides a range of digital services, including hybrid cloud and big data analytics consulting, helping European enterprises manage data sovereignty and leverage analytics for Industry 4.0 initiatives and other specialized applications.

- Qlik (U.S.): Qlik specializes in cloud-based data integration and analytics platforms, focusing on visual insights, data literacy, and a unique associative engine that allows for flexible and interactive data exploration.

Recent Developments in the Cloud Analytics Industry

- In January 2025, Renesas and Honda agreed to develop a high-performance system-on-chip (SoC) for software-defined vehicles, enhancing future analytics capabilities. The novel SoC is developed for delivering leading-edge AI performance of 2,000 TOPS combined with a world-class power efficiency of 20 TOPS/W. (Source: renesas.com)

- In December 2024, Amazon SageMaker Lakehouse solution, launched, combining data lakes (Amazon S3) and data warehouses (Amazon Redshift) for AI/ML tasks. It uses open Apache Iceberg tables and integrates with applications like Salesforce and SAP. (Source: amazon.com)

- In January 2021, Data Analyzer, Plan Process Management with flexible modeling of calendar activities and processes, Story Exploration with improved View Time Story Tool Bar, Smart Discovery, and Voice to Insight are some of the new features added to SAP Analytics Cloud. The Voice to Insight function allows you to use Natural Language Query to ask business-related inquiries about the data.

- In June 2020, Microsoft Corp. and SAS announced their strategic alliance. They will give clients the tools they need to quickly operate their SAS workload in the cloud, expand their business solutions, and unlock significant value from their efforts to engage in digital transformation. As part of their partnership, the companies will move their industrial and analytical applications from SAS to Microsoft Azure as their chosen cloud provider for the SAS Cloud. SAS' business solutions and expertise will benefit Microsoft customers more in the financial, healthcare, and other industries.

- In November 2020, IBM recently released a number of data and automation upgrades for its Hybrid Cloud software portfolio that would help company's foster innovation and quicken the digital transformation process.

- In February 2021, With Ford Motor Co., Google has a six-year agreement that will add cloud services to the Ford manufacturing floor and Android technology to Ford cars.

- In June 2019, to increase its client base, Google paid $ 2.6 billion to purchase Looker Data Sciences Inc. With this deal, Google will be able to offer its clients more cloud storage and software.

Segments Covered in the Report

By Component

- Solutions

- Services

By Deployment

- Public

- Private

- Hybrid

By Organization Size

- SME

- Large Organizations

By Industry Vertical

- BFSI

- IT & Telecommunication

- Manufacturing

- Healthcare & Life Sciences

- Government

- Energy & Utilities

- Others

By Application

- Sales and Marketing

- Research & Development

- Customer Service

- Accounting & Finance

- Human Resource

- Others

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting