Composable Applications Market Size and Forecast 2025 to 2034

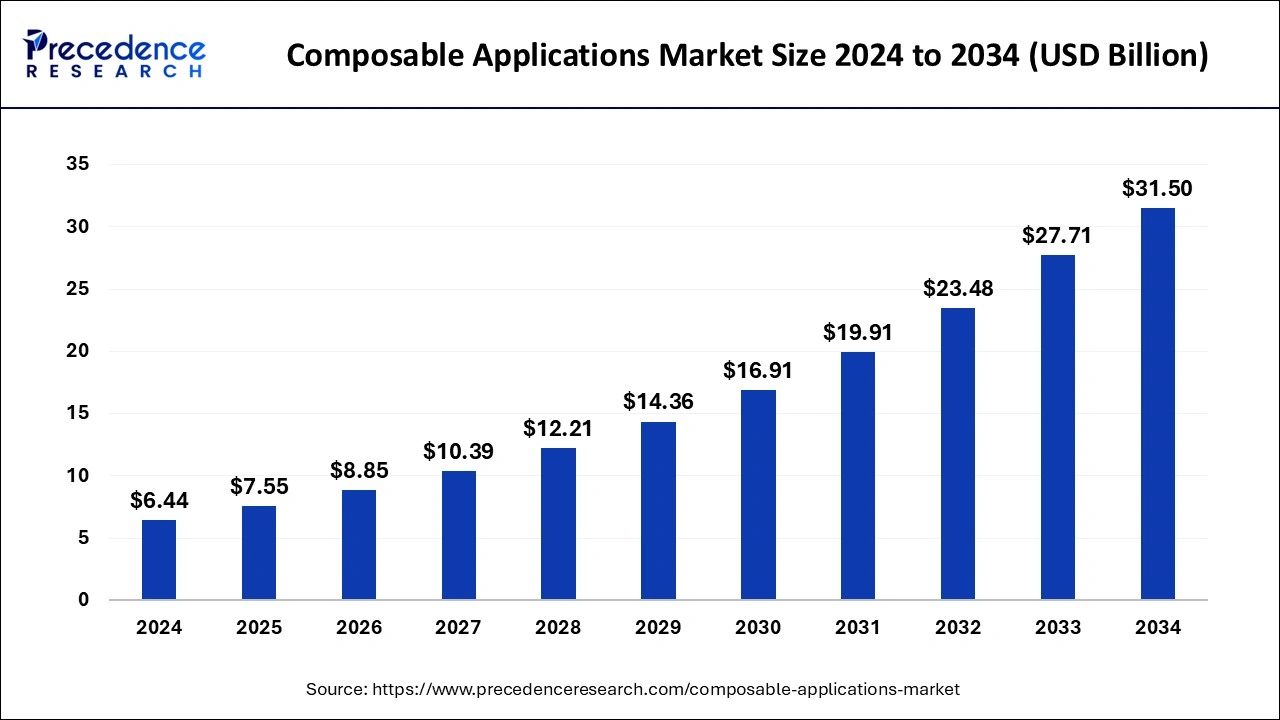

The global composable applications market size was estimated at USD 6.44 billion in 2024 and is predicted to increase from USD 7.55 billion in 2025 to approximately USD 31.50 billion by 2034, expanding at a CAGR of 17.20% from 2025 to 2034.

Composable Applications MarketKey Takeaways

- In terms of revenue, the global AA market was valued at USD AA billion in 2024.

- It is projected to reach USD 20.07 billion by 2034.

- The market is expected to grow at a CAGR of 8.87% from 2025 to 2034.

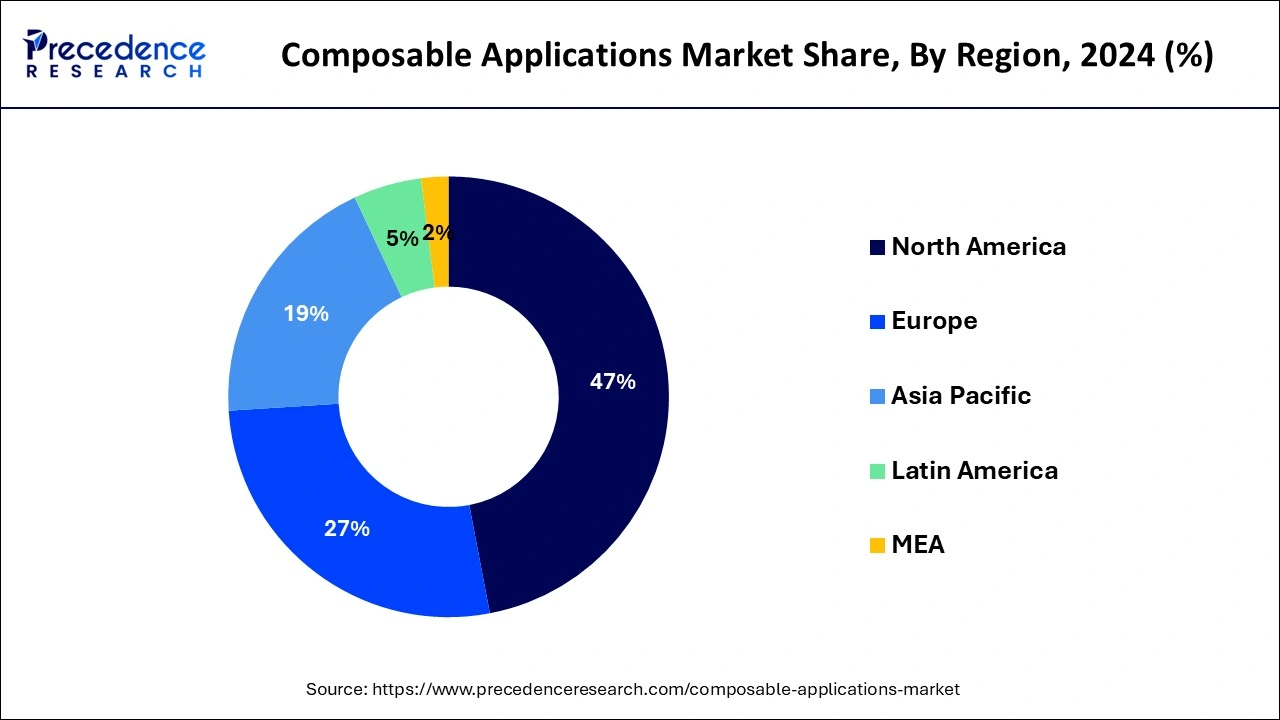

- North America dominated the market with the largest share of 47% in 2024.

- Asia Pacific is expected to exhibit the highest CAGR of 19.5% during the forecast period of 2025-2034.

- By offering, the platform segment dominated the market while carrying a 73% market share in 2024.

- On the other hand, the services segment is projected to experience the highest CAGR of 19.9% during the forecast period in the composable applications market.

- By vertical, The BFSI segment held the largest share of 29% in 2024.

- On the other hand, the retail & e-commerce sector is projected to experience the highest CAGR of 18.9% during the forecast period.

U.S.Composable Applications Market Size and Growth 2025 to 2034

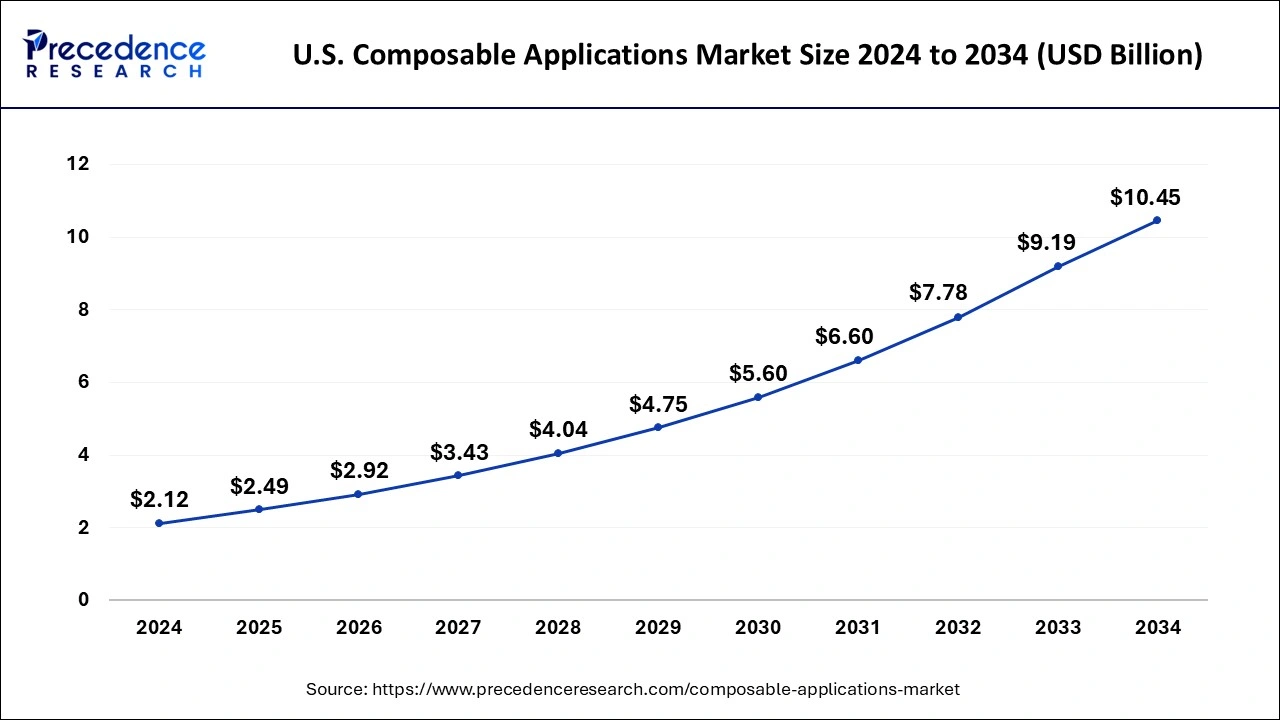

The U.S. composable applications market size was estimated at USD 2.12 billion in 2024 and is anticipated to reach around USD 10.45 billion by 2034, growing at a CAGR of 17.29% from 2025 to 2034.

North America held the largest share of 47% in 2024. The region boasts remarkable adoption rates of composable applications, underpinned by its robust and sustainable economies that enable substantial investments in Research and Development (R&D) initiatives, fostering the creation of innovative technologies. The widespread adoption of advanced technologies and the proliferation of mobile and web applications are pivotal drivers propelling the composable applications market in North America. With a significant concentration of vendors operating in the composable applications market, the United States leads with the highest number of market players. The presence of key players in the application platform market within the US significantly contributes to the expansion of the overall market size in the region.

Asia Pacific is expected to exhibit the highest CAGR of 19.5% during the forecast period in the composable applications market. Known for its rapid adoption of new technologies, Asia Pacific has consistently been an attractive region for market growth. It encompasses major economies like Japan, China, Australia, New Zealand, India, and Singapore. The drive to enhance organizational operational efficiency and reduce costs is expected to fuel the overall expansion of the composable applications market in Asia Pacific.

The region is characterized by its entrepreneurial culture, continuous technological innovation, and rapid development. Despite the challenges posed by the global health crisis, digitalization has continued to proliferate across various industries such as healthcare, finance, and construction in Asia Pacific over the last decade. This ongoing digital transformation makes the region a fertile ground for the adoption of composable applications. With their adaptability, scalability, and agility, composable applications are increasingly gaining traction in the IT sector across Asia Pacific. As organizations strive to innovate and stay competitive in a rapidly evolving market, composable apps are likely to play a crucial role in supporting their digital transformation initiatives.

Market Overview

The composable applications market refers to software applications that are built from modular, interchangeable components or micro services. These components are designed to perform specific functions or tasks and can be assembled and reconfigured dynamically to meet changing business needs. Composable applications are characterized by their flexibility, scalability, and agility, allowing organizations to rapidly develop, deploy, and update applications in response to evolving requirements and market conditions. The concept of composable applications aligns with the broader trend of composability in IT infrastructure, where resources such as compute, storage, and networking are abstracted and pooled together, allowing them to be dynamically allocated and reallocated based on demand.

The global composable applications market leverages technologies such as containerization, microservices architecture, and application programming interfaces (APIs) to enable seamless integration and interoperability between different components. This modular approach to application development and deployment enables organizations to achieve greater agility, innovation, and efficiency in their software development lifecycle.

Factors driving the market growth of composable applications include the increasing demand for rapid customization and scalability in software development. As businesses strive to adapt to evolving market dynamics and customer preferences, the ability to quickly customize and scale applications according to specific requirements becomes essential. Composable applications enable organizations to achieve this agility by leveraging modular components that can be easily assembled, modified, and scaled as needed.

Furthermore, the rise of digital transformation initiatives and the adoption of cloud-native architectures have fueled the demand for composable applications. These applications offer greater flexibility and resilience compared to traditional monolithic software architectures, allowing businesses to innovate more rapidly and respond to market changes effectively.

Composable Applications Market Data and Statistics

- According to the findings from Harvard Business Review, indicating that Omni channel strategies increase average order value (AOV) by 10% and lifetime value (LTV) by 30% compared to single-channel commerce. As companies prioritize Omni channel experiences to meet customer expectations for seamless interactions across multiple channels, the demand for composable applications is expected to rise. These applications offer the agility and scalability necessary to adapt to evolving Omni channel requirements while facilitating integration with diverse systems and data sources. The proven impact of Omni channel strategies on AOV and LTV underscores the growing significance of composable applications in supporting businesses' Omni channel initiatives, driving demand and growth in the composable applications market.

- With 70% of retailers considering composable commerce a top priority and 85% believing it will enhance the customer experience, the demand for composable applications is poised for growth. The increasing adoption and priority placed on composable storefronts by retailers reflect a significant trend in the composable applications market. Composable storefronts offer retailers the flexibility and agility to adapt to evolving consumer needs and preferences in today's dynamic marketplace. By leveraging composable architecture, retailers can create customizable and scalable storefronts that cater to unique customer journeys and experiences across various channels.

Composable Applications MarketGrowth Factors

- Composable applications offer businesses the ability to adapt and respond quickly to changing market demands and technological advancements. Their modular architecture allows for easy integration, updates, and customization, enabling organizations to stay agile in a rapidly evolving digital landscape.

- Composable applications can scale according to the needs of the business. As companies grow and their requirements evolve, composable architectures provide the flexibility to scale up or down without significant disruption or additional infrastructure investment.

- Composable applications enable businesses to create highly personalized and engaging customer experiences across various touchpoints. By leveraging modular components and APIs, organizations can deliver seamless and cohesive experiences that cater to individual customer preferences and behaviors.

- Composable applications facilitate seamless integration with existing systems, third-party services, and emerging technologies. This interoperability enables businesses to leverage their existing investments while adopting new capabilities and expanding their digital ecosystem.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.20% |

| Market Size in 2025 | USD 7.55 Billion |

| Market Size by 2034 | USD 31.50 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Offering and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand for app development

The surge in application development, witnessing a growth of over 20%, marked a significant acceleration in the digital transformation landscape. Additionally, around 35% of new applications are projected to embrace composable architecture, leveraging Packaged Business Capabilities (PBCs). In a bid to outperform competitors, over 75% of small-to-medium-sized SaaS companies are anticipated to integrate bundled business capability architecture.

Traditional monolithic structures are gradually being replaced by adaptable compositions, reflecting the evolving needs of enterprises. Composable applications empower developers to innovate by repurposing existing code or applications, streamlining the installation and management of workload-specific configurations. This trend is particularly evident in the retail and e-commerce sectors, where composable commerce enables the assembly of tailored solutions to address diverse business requirements. Leveraging advanced methodologies like MACH (Micro services, API, Cloud, and Headless), composable commerce ensures adaptability to dynamic market dynamics, underscoring its relevance and demand in contemporary app development paradigms.

Restraint

Reliance on custom solutions provided by vendors

In the contemporary digital landscape, the rapid delivery of applications stands as a paramount priority, given its pivotal role in ensuring business success. While vendor-supplied software presents a convenient and fully integrated solution tailored to meet specific business needs, it often comes with drawbacks such as increased costs and prolonged delivery timelines for custom software. Moreover, off-the-shelf solutions may not always align perfectly with the unique requirements of enterprises, leading to potential mismatches.

Despite the advantages offered by in-house software development, many organizations remain unaware of its benefits, contributing to a prevalent reliance on vendor-supplied software solutions. This dependency poses a significant challenge to the growth trajectory of the composable application development platform market, inhibiting broader adoption and innovation in the realm of custom application development.

Opportunity

Expanding digital transformation within the IT industry

The emphasis placed by organizations on enhancing productivity stands as a significant catalyst for the embrace of digital transformation. The integration of cutting-edge technologies like cloud computing, Internet of Things (IoT), big data analytics, mobility, and social media has spurred innovation and revolutionized business operations, fostering positive growth for the composable applications market. These digital advancements have revolutionized traditional business paradigms, with online services now firmly entrenched in sectors like banking and finance, fueling a surge in online activities and platforms. Organizations seek to enhance their operational efficiency through digital transformation initiatives, thereby fueling the demand for composable application platforms and services across diverse industries.

Offering Insights

The platform segment held the largest share of 73% in 2024. This trend is propelled by the growing usage of cloud applications, which is fueling the demand for application integration solutions, APIs, and micro services, consequently driving the adoption of composable application architecture. Organizations are leveraging these platforms to streamline development processes, automate procedures, and enable developers to visually model business logic through drag-and-drop features.

Enterprise low-code applications are particularly instrumental in this regard, offering ready-made Packaged Business Capabilities (PBCs) that adhere to the composability principle. The primary goal of integrating low-code development platforms is to diminish the reliance on native programming languages and facilitate application assembly using graphical elements and reusable code blocks. Furthermore, these platforms empower organizations to scale up applications in response to evolving needs without necessitating the creation of entirely new applications.

The services segment is projected to experience the highest CAGR of 19.9% during the forecast period in the composable applications market. These services encompass a range of offerings crucial for the implementation and deployment of composable applications within an enterprise. Professional services form a fundamental component, of supporting day-to-day business operations. They encompass integration and implementation, consulting and training, as well as support and maintenance. Companies providing these services boast skilled consultants and solution architects, specialized professionals dedicated to facilitating the design and delivery of composable application architecture, ensuring seamless integration and optimal performance within the enterprise ecosystem.

Vertical Insights

The BFSI segment held the largest share of 29% in the composable applications market in 2024. Composable banking represents a significant shift in the operational paradigm of financial institutions, characterized by modularity, reusability, and adaptability. In today's competitive landscape, banks and financial institutions recognize that application development is a cornerstone of digital transformation. Consequently, there is a rapid uptake of low-code and API integration solutions within the sector, offering unprecedented opportunities for digital advancement.

API integration empowers banking customers to perform various tasks such as checking balances, paying bills, exploring loan options, and initiating transfers, thereby enhancing convenience and accessibility. For instance, the integration of PayPal with Siri enables customers to execute transactions using voice commands. This burgeoning digital transformation within the banking industry is expected to drive the adoption of composable applications, platforms, and services, further solidifying the sector's leadership in the market.

The retail & e-commerce segment is projected to experience the highest CAGR of 18.9% during the forecast period in the composable applications market. Retail organizations prioritize the automation and digitization of their business operations to stay competitive in today's dynamic retail landscape. The COVID-19 pandemic has prompted retailers to adapt their sales models to meet evolving customer preferences and safety protocols. Notably, the adoption of Buy Online, Pick-Up in Store (BOPIS) models has surged, necessitating retailers to automate end-to-end supply chain processes effectively. Investing in unified application integration solutions holds significant promise for retailers, enabling streamlined operations and enhanced customer experiences.

Shopify revealed that 42% of companies aim to offer personalized product recommendations to consumers, leveraging tools like quizzes, dedicated mobile applications, and behavioral data analysis. For instance, Off-Limits, a plant-based cereal company, redesigned its purchasing process akin to a vending machine, enhancing customer engagement through gamified checkout experiences.

Allbird's smartphone app employs augmented reality to enable customers to virtually try on shoes, illustrating the potential of composable commerce solutions in enhancing customer engagement and satisfaction in the retail & e-commerce industry.

Composable Applications Market Companies

- Salesforce (US)

- Dell Boomi (US)

- MuleSoft (US)

- Informatica (US)

- Software AG (Germany)

- TIBCO Software (US)

- Mendix (US)

- OutSystems (US)

- SnapLogic (US)

- OpenLegacy (US)

- AgilePoint (US)

- IBM (US)

- Shopify (Canada)

- Akinon (Turkey)

- Infosys Equinox (US)

- Contentstack (US)

- WaveMaker (US)

- Virtusa (US)

- SymphonyAI (US)

- L7 Informatics (US)

- Scheer PAS (Germany)

- Michaels, Ross, and Cole (US)

Recent Developments

- In August 2022, the company introduced Composable Storefront, a customizable headless storefront designed to enhance e-commerce websites' agility and flexibility. This solution enables users to make rapid changes to their online stores, catering to evolving customer needs and market trends effectively.

- In April 2021, Informatica unveiled a cloud platform leveraging micro services and an AI engine to integrate data management capabilities and facilitate seamless data and application programming interface (API) integration. The Informatica Intelligent Data Management Cloud (IDMC) represents a significant upgrade to the Informatica platform, leveraging the CLAIRE AI engine to deliver advanced data management functionalities.

- In April 2021, Software AG announced innovations to its webMethods platform for APIs, integration, and micro services. These enhancements empower companies to streamline and expedite their digital transformation endeavors while accelerating their transition to the cloud. The updated webMethods platform offers comprehensive capabilities to support organizations' evolving needs in the rapidly changing digital landscape.

Segments Covered in the Report

By Offering

- Platform

- Service

By Vertical

- BFSI

- Retail & e-commerce

- Government

- Healthcare and life sciences

- Manufacturing

- IT and ITeS

- Energy and Utilities

- Other Verticals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content