What is the Controlled Release Drug Delivery Market Size?

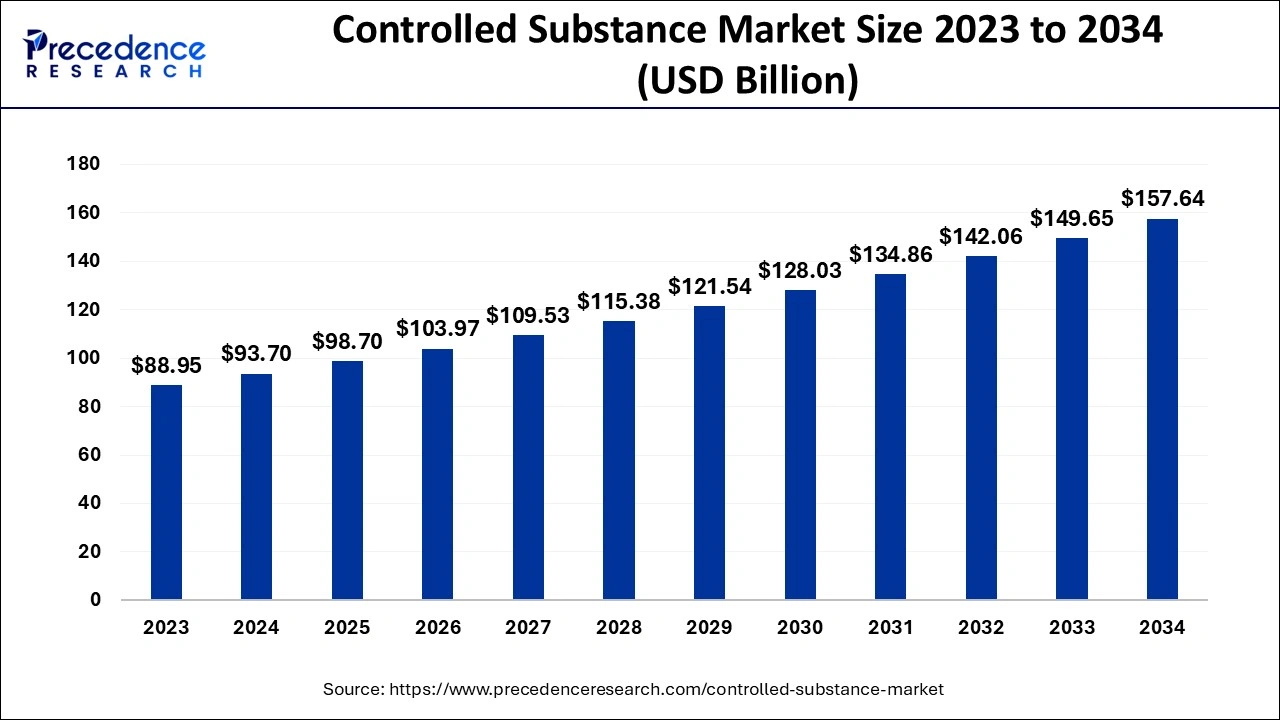

The global controlled release drug delivery market size is calculated at USD 66.80 billion in 2025 and is predicted to increase from USD 72.99 billion in 2026 to approximately USD 160.09 billion by 2035, expanding at a CAGR of 9.13% from 2026 to 2035.

Controlled Release Drug Delivery Market Key Takeaways

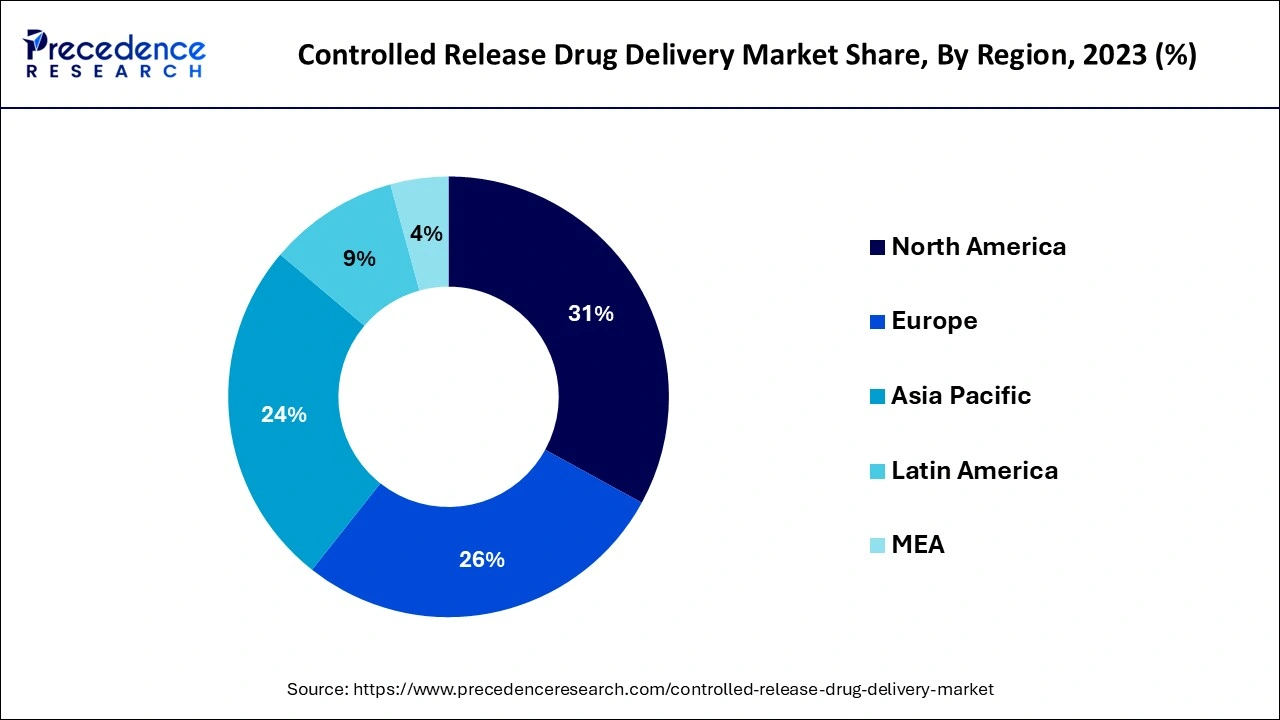

- North America captured more than 43% of the revenue share in 2025.

- By technology, the targeted delivery segment captured more than 24% of revenue share in 2025.

- By release mechanism, the feedback-regulated drug delivery systems segment contributed more than 27% of revenue share in 2025.

- By application, the oral-controlled segment generated more than 37% of total revenue in 2025.

What is a Controlled-Release Drug Delivery?

Throughout the projection period, predictably, changing prescription patterns would result from doctors choosing controlled-release medication delivery over conventional systems due to advantages such as better patient compliance, greater therapeutic efficacy, and lower treatment costs. Additionally, due to their aggressive response to the shifting market demands and ongoing investments in developing controlled-release drug delivery systems, pharmaceutical companies, who operate in a fiercely competitive and fragmented industry, have significantly increased demand.

For the forecast period, pharmaceutical development businesses' consistently expanding R&D spending, which aims at creating effective treatments for chronic and non-communicable problems like cancer, diabetes, and hypertension, is anticipated to drive market expansion. For instance, the pipeline medicine TAR-200 (Gemcitabine) from Taris, a biomedical business focused on research and development, has a controlled-release drug delivery system and is recommended for the treatment of bladder cancer. Johnson & Johnson also finalized the acquisition of Taris Biomedical in 2019. One of the primary drivers behind the purchase is reportedly its lead experimental product, TAR-200.

One of the main drivers of market expansion is the growing worldwide elderly and pediatric population, partly attributable to the high rate of non-adherence to prescription regimens in these age groups. The impaired mental, physical, and biological processes that plague geriatric populations impact how they take their medications. Additionally, their bodies cannot handle excessive dosages and adverse side effects. Consequently, as the patient population rapidly increases, demand for controlled-release drug delivery devices will increase.

Controlled-release drug administration enables a significant decrease in dose and dosing frequency, minimizes aberrant variations in plasma drug levels, increases efficacy, boosts patient compliance, and provides uniform medication effects. Drugs are delivered at the target site at predetermined times with predictable drug release kinetics using control releases drug delivery systems, which, in contrast to conventional administration methods, offer a prolonged therapeutic impact. As a result of the controlled release delivery system's additional advantages, their use will likely grow significantly during the forecast period.

How is AI contributing to the Controlled Release Drug Delivery Industry?

Artificial Intelligence revolutionizes the way drugs are released, developing methods that adapt to patients' situations, which solves the problem of releasing through controlled systems that people have to connect with.

Market Outlook

- Industry Growth Overview: Market conditions are favorable due to the chronic diseases that require more treatment, the aging population, and the continuous technological innovations in the delivery systems.

- Sustainability Trends:The use of biodegradable polymers, green chemistry, and eco-friendly manufacturing practices on delivery platforms is part of the sustainability movement.

- Global Expansion:The global presence grows with North America being the front-runner in the adoption of new technologies, while Asia-Pacific is catching up through healthcare investments and population increase.

- Major investors:The companies of Johnson & Johnson, Pfizer, Merck, Novartis, and AstraZeneca remain the main players whose funds support delivery control research projects.

- Startup Ecosystem:Startups are getting involved in the innovation process by merging nanotechnology with smart partnerships to create patient-centered controlled release platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 66.80 Billion |

| Market Size in 2026 | USD 72.99 Billion |

| Market Size by 2035 | USD 160.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.13% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Release Mechanism and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Technology Insights

Because a sizable number of market participants have a robust portfolio for the technology, targeted delivery held the most significant market share of more than 24% in 2025. Targeted delivery allows placing medications away from areas where they can cause drug toxicity and offers the intended site of action. It is a frequently selected drug delivery technology because these systems boost bioavailability and localize the medication, which improves absorption, reduces fluctuations in circulating drug levels, and lowers the risk of side effects.

Over the forecast period, the microencapsulation market is anticipated to expand because of the growing desire to extend the shelf life and achieve controlled medication release of unstable and highly complex compounds such as proteins, vitamins, and antioxidants. For instance, vitamin A has poor chemical stability and water solubility; nevertheless, when it is microencapsulated, the product's shelf life rises, contributing to controlled drug release.

Implantable devices guarantee linear medication delivery over a predetermined duration while improving efficiency, reducing adverse effects, and providing convenience. As carriers of proteins and small molecule medications, coacervates represent a novel drug delivery system. Coacervates, made of heparin, hold artificial polycations for the regulated release of growth factors. Due to their rising utilization, these systems will likely command a sizeable portion of the controlled-release medication delivery market soon.

Release Mechanism Insights

The feedback-regulated drug delivery systems segment generated more than 27% of revenue share in 2025 due to their effectiveness in treating diseases, including diabetes. Additionally, rising R&D efforts to take advantage of the potential of the controlled methods of drug delivery that are feedback-regulated as countermeasures will support market expansion.

Hydrolysis-activated, pH-activated, and enzyme-activated systems are all examples of chemically activated systems. The ability to quickly and precisely react to the target metabolite, leading to enhanced pharmacological therapy, is causing the segment to flourish. For instance, an enzyme-activated release mechanism achieves optimal and controlled insulin release in hyperglycemic patients.

Chemically activated delivery systems have become extremely popular in recent years, and market participants are also investing in the industry to bolster their portfolios. For instance, chemically triggered delivery systems with the controlled release are used in QuilliChew ER chewable tablets and Pfizer, Inc.'s LYRICA Pregabalin. The category will likely have a sizable market share throughout the projection period.

Application Insights

Due to its availability and frequent use, the oral-controlled segment had a share of more than 37% of total revenue in 2025. Another attractive market that will likely expand significantly throughout the predicted period is meter dose inhalers. The rising frequency of respiratory illnesses, regular product innovation, and technological improvements will fuel long-term market growth. For instance, in 2019, the medical technology company Gofire Inc. Unveiled a metered dose inhaler with a unique dose completion alarm signal to ensure precise administration.

In addition, three medications in Aradigm Corporation's current development pipeline use metered dosage inhalers, a reasonably simple drug administration method, to treat cystic fibrosis, bronchiectasis, and smoking cessation.

Due to the extensive product diversity and utilization in treating numerous ailments, the injectable category will likely develop at the quickest rate throughout the projection period. Long-acting injectables are preferred to conventional delivery forms. They offer several benefits, such as a predictable drug release profile over a specific period, improved patient compliance, ease of application, enhanced systemic availability of drugs, and a consequent overall decrease in medical costs.

Regional Insights

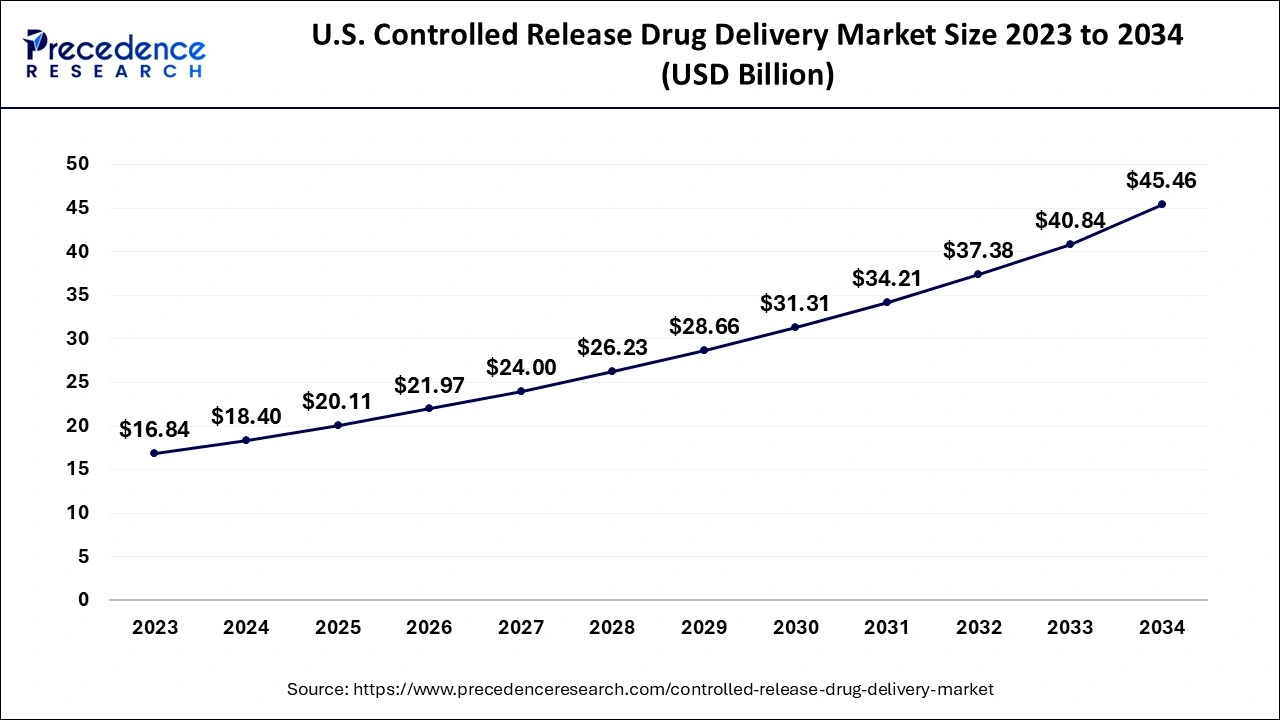

U.S. Controlled Release Drug Delivery Market Size and Growth 2026 to 2035

The U.S. controlled-release drug delivery market size accounted for USD 20.11 billion in 2025 and is expected to be worth around USD 49.31 billion by 2035, growing at a CAGR of 9.38% from 2026 to 2035.

How is North America leading in the Controlled Release Drug Delivery Market?

North America was the most important regional market globally, with a market share of more than 43% in 2025. Government programs that encourage the development of controlled-release drug delivery and rising R&D spending will likely fuel market expansion in the area. In addition, the presence of significant market participants helps to encourage the use of controlled-release medication delivery systems.

The burden of chronic illnesses like cancer, diabetes, and heart ailments is rising, fostering market expansion. One of the major factors driving the growth of the regional market is the spiraling use of controlled-release medication delivery systems for hypertension treatment.

The market in North America is led by the region itself, which is backed by an excellent healthcare infrastructure, high research investments, and a considerable burden of chronic diseases. The presence of the main pharmaceutical manufacturers and the supportive policies further increases the adoption of technologically advanced controlled-release drugs.

U.S. Controlled Release Drug Delivery Market Trends

The U.S. is in the region leading the drive for growth, grounded on the demand for more patient-centric therapies and better adherence. The combination of an old population, a pharmaceutical ecosystem focused on innovation, and a highly effective regulatory system contributes to the rapid uptake of the latest generations of controlled release delivery systems in the treatment of chronic diseases and specialty segments of therapy.

What are the driving factors of the Controlled Release Drug Delivery Market in Europe?

Europe is a major market where the aging population, high prevalence of chronic diseases, and technological innovations are the main factors driving the market. Patients' preferences are increasingly leaning towards long-acting and convenient therapies, which in turn increases the need for solutions that would reduce the dosage frequency and lead to the treatment continuity across the healthcare systems.

Due to increased research and development activities and significant regional pharmaceutical businesses, Europe accounted for the second-largest share in 2019. With the considerable increase in patients with chronic illnesses like diabetes, cancer, and COPD, the local market will likely experience substantial expansion during the ensuing years. The predicted period is likely to have the greatest CAGR in Asia Pacific.

Germany Controlled Release Drug Delivery Market Trends

Germany is in the spotlight because of its good pharmaceutical infrastructure and the increasing number of elderly people. The changing population patterns are raising the demand for controlled-release drugs that make it easier to comply with the treatment, reduce the number of doses, and facilitate the long-term management of chronic diseases in structured healthcare delivery systems.

How is Asia-Pacific performing in the Controlled Release Drug Delivery Market?

The region has been attracting attention worldwide as the pharmaceutical industry continues to grow. The market in the area is benefiting from the pharmaceutical industries' rapid expansion in China and India. Another significant element driving product acceptance in Japan is the country's sizable elderly population.

Asia-Pacific is the region that is experiencing the fastest growth, and this is backed up by better healthcare infrastructure, increased healthcare spending, and large patient populations. The rise in the number of chronic diseases across the region is forcing the demand for the slow release of drugs that are cheap and easy to access, with improved therapeutic effectiveness.

India Controlled Release Drug Delivery Market Trends

India is the country that has the strongest market growth and is supported by the high prevalence of diseases, developing healthcare systems, and technology advancements. The government initiatives that help the local production and the regulations that simplify access to drugs are driving the development and uptake of controlled-release drug delivery systems across different therapeutic categories.

Controlled Release Drug Delivery Market-Value Chain Analysis

1.R&D: R&D is the priority area for the company, where it is focused on the development and protection of its patented controlled release technology through scientific research investments that are strategic and thus yielding good returns.

- Key Players: Pfizer Inc., Johnson & Johnson, and Novartis AG

2. Clinical trials and regulatory approvals:Clinical trials and regulatory approvals, which consist of conducting efficient studies and navigating regulatory pathways, thereby obtaining market entry.

- Key Players: PAREXEL International Corporation and IQVIA

3. Formulation and final dosage: Formulation and final dosage preparation activities include the development of controlled release formulations and then turning the APIs into final delivery systems.

- Key players: Catalent Inc., Lonza Group, and Evonik Industries

4. Packaging and serialization:Packaging and serialization activities involve the enclosing of the finished products, and also the implementation of the traceability systems that ensure compliance with the safety regulations.

- Key Players: Gerresheimer AG, Amcor plc, and Becton Dickinson & Company

5. Distribution to hospitals, pharmacies: Distribution to hospitals, pharmacies of controlled release drug delivery system entails managing secure logistics, which ensures timely delivery not only for the providers but also for the patients.

- Key players:McKesson Corporation, Cardinal Health, and AmerisourceBergen

Top Companies in the Controlled Release Drug Delivery Market & Their Offering

- Merck and Co., Inc.: Merck is utilizing delivery technologies for injectable therapies to create and release the time-controlled versions of top-selling pharmaceuticals.

- Orbis Biosciences, Inc.: Orbis Biosciences invents microparticle delivery systems with the capability of dual-release as well as long-lasting erosion performance.

- Johnson and Johnson: Johnson & Johnson creates and sells drug variants that are time-controlled in order to tolerate better and keep patients hooked.

Other Major Companies

- Alkermes plc

- Corium International, Inc.

- Coating Place, Inc.

- Pfizer, Inc.

- Depomed, Inc.

- Capsugel

- Aradigm Corporation

Recent Developments in the Controlled Release Drug Delivery Industry

- In August 2025, N-Power Medicine launched the first Prospective External Control Arm platform for oncology. The platform aims to reduce patient enrollment by NUM0, shorten trial timelines by NUM1 months, and significantly lower development costs while enhancing patient participation. (Source: businesswire.com)

- In March 2025, MIT engineers created an innovative drug delivery method using tiny crystals in a solution, injected under the skin. These crystals form a depot that gradually releases medication, reducing the need for frequent injections and minimizing discomfort. (Source: openaccessgovernment.org)

Segments Covered in the Report

By Technology

- Coacervation

- Wurster Technique

- Implants

- Micro Encapsulation

- Targeted Delivery

- Transdermal

- Others (Liposomes, Microelectromechanical Technology)

By Release Mechanism

- Partition Controlled Micro Reservoir Drug Delivery Systems

- Polymer Based Systems

- Drug Delivery Systems, which are Feedback Regulated

- Drug Delivery Systems that are Activation-modulated

- Hydrodynamic Pressure Activated

- Osmotic Pressure Activated

- Magnetically Activated

- Vapor Pressure Activated

- Mechanically Activated

- Chemically Activated

- Hydrolysis Activated

- pH Activated

- Enzyme Activated

By Application

- Injectable

- Metered Dose Inhalers

- Infusion Pumps

- Ocular and Transdermal Patches

- Oral Controlled-drug Delivery Systems

- Eluting Drug Stents

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting