Corrosion Inhibitors Market Size and Forecast 2025 to 2034

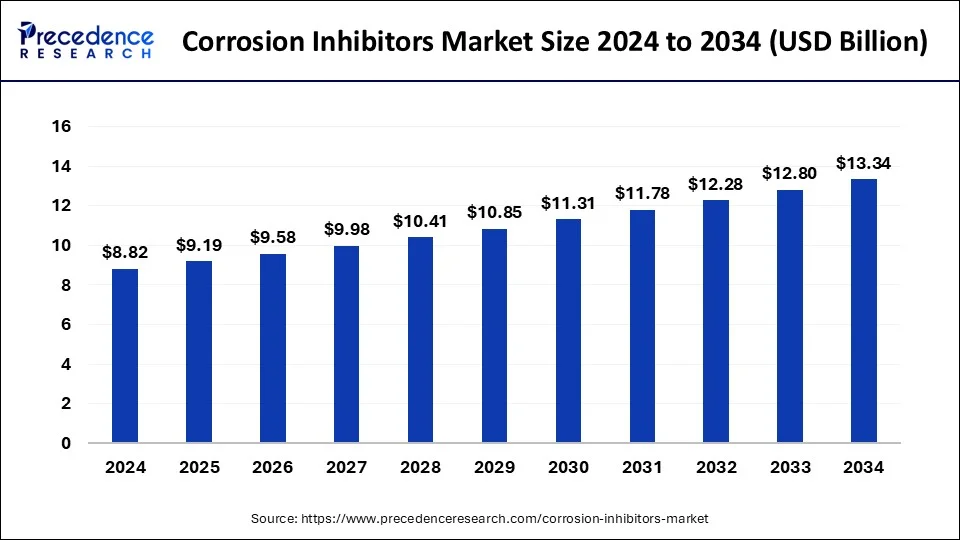

The global Corrosion Inhibitors market size was estimated at USD 8.82 million in 2024 and is predicted to increase from USD 9.19 million in 2025 to approximately USD 13.34 million by 2034, expanding at a CAGR of 4.22% from 2025 to 2034. The corrosion inhibitors market growth is attributed to the increasing demand for effective corrosion control solutions across various industries.

Corrosion Inhibitors Market Key Takeaways

- In terms of revenue, the global corrosion Inhibitors market was valued at USD 8.82 million in 2024.

- It is projected to reach USD 13.34 million by 2034.

- The market is expected to grow at a CAGR of 4.22% from 2025 to 2034.

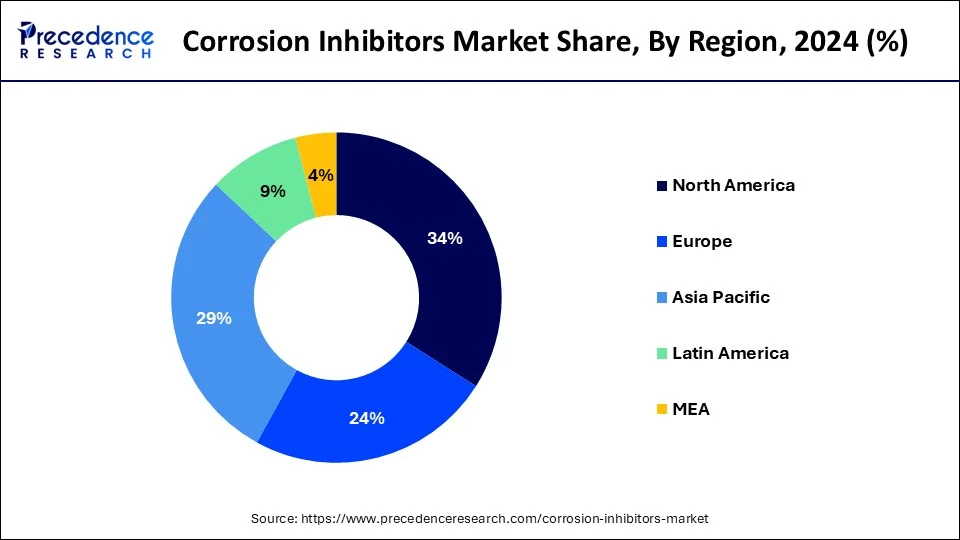

- North America dominated the corrosion inhibitors market with the largest market share of 34% in 2024.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By compound, the organic segment held a dominant presence in the market in 2024.

- By compound, the inorganic segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By type, in 2024, the water-based segment led the global market.

- By type, the oil-based segment is projected to expand rapidly in the market in the coming years.

- By end-user, the oil & gas segment dominated the global market in 2024.

- By end-user, the power generation segment is projected to grow at the fastest rate in the market in the future years.

Impact of Artificial Intelligence on the Corrosion Inhibitors Market

AI makes corrosion monitoring systems accurate and faster, which helps predict the problem before it becomes a major one in terms of analytics. Companies gain improved control of their processes and increase the durability of exposed materials to harsh conditions by utilizing artificial intelligence. Analysis of large data sets also enables business entities to come up with superior inhibitors for designated applications, hence evolving corrosion prevention technologies. Furthermore, the increase in the use of AI is attributed to its role in enhancing productive operations and quality decision-making and to future advancements in the field.

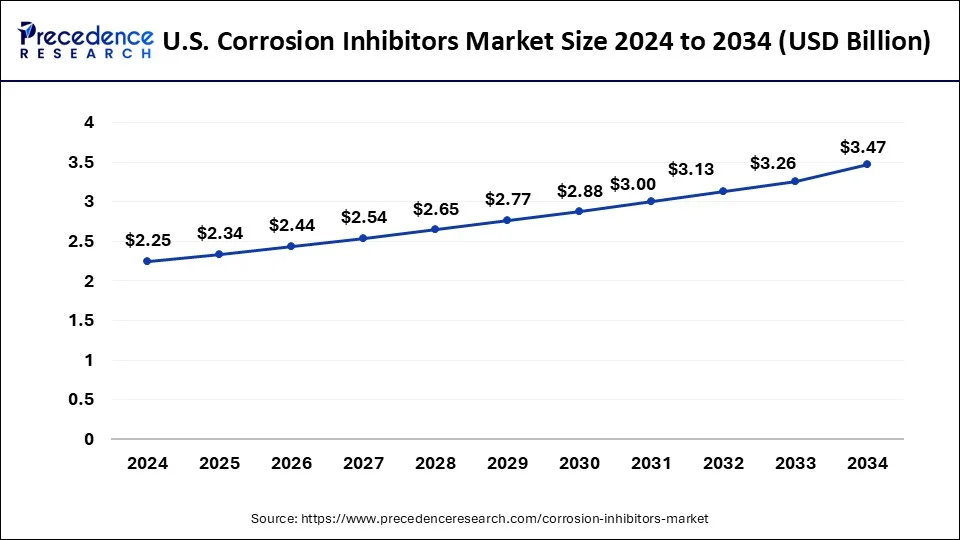

U.S. Corrosion Inhibitors Market Size and Growth 2025 to 2034

The U.S. Corrosion Inhibitors market size was exhibited at USD 2.25 billion in 2024 and is projected to be worth around USD 3.47 billion by 2034, poised to grow at a CAGR of 4.43% from 2025 to 2034.

North America dominated the corrosion inhibitors market in 2024 due to the presence of large industrial coverage, especially in the oil & gas, power, and chemicals industries. Corrosion inhibitors are widely used in these industries to protect infrastructures and equipment from corrosion. Technologically developed North America, along with the stringent regulatory norms in the fields of environment and safety, has led to the extensive application of corrosion inhibitors. Furthermore, the North American Free Trade Agreement (NAFTA) has facilitated cross-border industrial operations, boosting the demand for corrosion inhibitors across the continent.

- According to the report by the U.S. Environmental Protection Agency (EPA) in 2023, industrial sectors in North America spend over USD 20 billion annually on corrosion prevention and control measures, reflecting the critical importance of these solutions.

Asia Pacific is projected to host the fastest-growing corrosion inhibitors market in the coming years, owing to the increasing rate of industrialization, urbanization, and infrastructural developments in countries such as China, India, and Japan. The growth of the oil & gas, power generation, and chemical industries in the region is likely to boost the demand for corrosion inhibitors. The increasing concern of the company towards raising environmental standards and industrial efficiency is also expected to boost the growth of the market in Asia Pacific.

Moreover, the International Energy Agency (IEA) highlights that Asia's energy demand accounts for more than half of the global increase in energy consumption over the next decade, further driving the need for advanced corrosion control technologies.

- The Asian Development Bank (ADB) reports that infrastructure investment in Asia is projected to reach USD 26 trillion by 2030, underscoring the substantial growth potential for corrosion inhibitors in the region.

Market Overview

Growing at a very healthy rate, especially as there is a rising demand to protect vital assets in different industries, boosts the market in the coming years. Industrialization is increasing around the world, creating the need to protect structures and equipment from corrosion as industrial development advances. The use of sophisticated corrosion control technologies alongside the continuous rise in environmental standards is expected to fuel the corrosion inhibitors market. Corrosion inhibitors are special chemicals that slow the rate of metal surface deterioration in a variety of hostile environments, including the oil and gas, power generation, and chemical processing industries.

- The International Energy Agency (IEA) reports that global investments in oil and gas infrastructure are expected to exceed USD 1 trillion by 2025.

Corrosion Inhibitors Market Growth Factors

- Technological advancements in corrosion inhibitor formulations are enhancing effectiveness and application versatility.

- Rising industrialization and infrastructure development globally are increasing the demand for corrosion control solutions.

- Growing investments in the oil and gas sector are driving the need for robust corrosion inhibitors.

- The expansion of the power generation sector is boosting the demand for corrosion protection in high-temperature environments.

- Increasing environmental regulations are promoting the adoption of eco-friendly corrosion inhibitors.

- Emergence of new manufacturing processes and materials requiring specialized corrosion control solutions.

- A surge in maintenance and repair activities across aging industrial infrastructure is driving the need for effective corrosion inhibitors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.34 Billion |

| Market Size in 2025 | USD 9.19 Billion |

| Market Size in 2024 | USD 8.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Compound, Application, Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing demand from the oil and gas industry

The growing demand for corrosion inhibitors from the oil and gas sector is expected to drive the market. Corrosion of pipeline, rig, and drill equipment is always at risk due to the harsh natural environment encountered by the equipment, which leads to a short life of such equipment and, hence, poor efficiency. Corrosion inhibitors are crucial in reducing these risks, as they offer a very important form of protection from corrosion.

According to Zerust Oil & Gas, the cost of corrosion for oil and gas production globally is valued at approximately a billion per annual rate. Expenses incurred in offshore drilling and deepwater exploration are also on the rise, and companies are seeking corrosion-resistant solutions to avoid failures of equipment. These inhibitors help to minimize unplanned shutdowns and also to avoid having to deal with any environmental disasters.

Restraint

Stringent environmental regulations

The high stringency of environmental laws is anticipated to hinder the market in the coming years. Governments around the world, such as North America and European countries, have set strict laws concerning chemical discharge and the use of dangerous chemicals in industrial processes. This has led to restrictions on some forms of poisonous corrosion inhibitors, such as chromium and phosphates, or forms that are toxic to the environment. This escalates costs of compliance and increases research costs for implementing environmentally amiable corrosion inhibitors. The U.S. Environmental Protection Agency (EPA) has set new lower limits for chemicals, such as hexavalent chromium, that are used as corrosion inhibitors as they cause cancers.

Opportunity

Growing demand for eco-friendly corrosion inhibitors

The growing demand for eco-friendly corrosion inhibitors is expected to create immense opportunities for the players competing in the market. Industries are searching for better products that decrease the impact on the environment without having to compromise the efficacy of the merchandise. Environmentally friendly or green corrosion inhibitors obtained from natural sources are increasingly being used due to the harm they cause to the environment.

High demand for such sustainable solutions is expected to favor firms that invest in research and development specializing in these products, especially in regions such as Europe and North America, where regulatory standards are stricter. The European Union's REACH regulation and the U.S Environmental Protection Agency's high standards regarding hazardous chemicals provide the momentum towards green options.

- In June 2024, the European Chemical Agency (ECHA) announced updated regulations aimed at reducing the environmental impact of chemical products, including corrosion inhibitors. The new regulations mandate stricter safety and environmental criteria for chemical substances used in various industrial applications. This regulatory shift is prompting manufacturers to accelerate the development and adoption of eco-friendly corrosion inhibitors.

Compound Insights

The organic segment held a dominant presence in the corrosion inhibitors market in 2024 due to their use across numerous end-user sectors, such as oil and gas, water treatment, and chemical manufacturing. These inhibitors, generally produced from different natural products comprising amines, carboxylates, and aldehydes, are famous for the formation of a protective layer on metal surfaces to avoid corrosion. They have the capability to perform their operations between a wide range of pH levels.

Organic inhibitors are also less dangerous in comparison with inorganic ones, which is more suitable with the tendencies of stricter environmental legislation in regions such as Europe and North America, where the utilization of green technologies has increased. The REACH regulations of the European Union have put pressure on the industries to seek organic, non-hazardous inhibitors. Organic inhibitors were also relatively more popular in the oil and gas industry, leading to growing demand for corrosion inhibitors, which further boosted the segment in the coming years.

The inorganic segment is expected to grow at the fastest rate in the corrosion inhibitors market during the forecast period of 2024 to 2034, as various industry-specific inorganic corrosion inhibitors, such as chromates, nitrates, phosphates, and so on. These inhibitors work very well in areas where metals are prone to harsh conditions that include high temperature and pressure. They are commonly used in infrastructure development, electricity generation, and production plants. Phosphate-based inhibitors are commonly used in water treatment facilities and cooling systems to avoid scaling and corrosion of the equipment.

The increasing numbers of infrastructure projects undertaken in the developing economies within the Asia-Pacific are expected to increase the demand for these compounds. Moreover, developments in secondary zinc-based and silicate-based inhibitors that provide comparative protection to the primary inhibitors, which are moderately less environmentally friendly, further fuelling the segment.

Type Insights

The water-based segment led the global corrosion inhibitors market in 2024, as they are used in almost all fields ranging from water treatment to manufacturing industries. They are environmentally friendly and can easily be applied to steel. Water-based corrosion inhibitors are especially suitable for protecting equipment and structures located in aqueous conditions, such as cooling systems and pipelines. Moreover, the shift in regulatory frameworks that supports environmental safety and concerns in searching for improved, safer, and non-toxic chemicals is expected to continue to fuel the market for water-based corrosion inhibitors.

The oil-based segment is projected to expand rapidly in the corrosion inhibitors market in the coming years. Corrosion inhibitors are used in this sector to offer better protection to metal surfaces exposed to such conditions as those in the oil & gas industry. Organic inhibitors offer much better protection to a substrate than aqueous inhibitors, especially in regions where waterborne inhibitors do not yield good results. Furthermore, the ongoing production activities and the need for crude corrosion inhibitors, especially oil-based inhibitors, boost the market.

End-user Insights

The oil & gas segment dominated the global corrosion inhibitors market in 2024 because the industry requires rigorous corrosion control in the course of exploration, extraction, and transportation of crude. Anti-corrosion products are essential for safeguarding pipelines/ storage tanks/ and other related apparatus from the negative impacts of hydrocarbons/ acids and other chemicals in usage within the oil and gas industry. The ability to minimize downtime and maintenance expenses is the critical factor that will create the demand for corrosion inhibitors within this sector in the future. Furthermore, the increase in activities related to oil and gas exploration across the world is expected to drive market growth.

- The International Energy Agency (IEA) reports that global oil and gas investments are projected to exceed USD 1 trillion by 2025, highlighting the substantial and ongoing need for effective corrosion management solutions.

The power generation segment is projected to grow at the fastest rate in the corrosion inhibitors market in the future years, owing to the rising demand for power plant efficiency and reliability. This creates the need for corrosion inhibitors to safeguard critical parts, including turbines, boilers, and cooling systems, from the highly charged HTHP environment. Existing power generation facilities continue to be upgraded, and new capacity is added to meet increasing energy requirements in various parts of the globe; the need for robust forms of anti-corrosion measures is likely to grow.

The U. S. Energy Information Administration (EIA) forecasts in 2024 that global power generation capacity will grow significantly over the next decade, further driving the demand for corrosion control technologies. Additionally, the International Energy Agency's report on power generation outlines the increasing emphasis on maintaining infrastructure integrity and efficiency, which is expected to propel the growth of the corrosion inhibitors market within this segment.

Corrosion inhibitors market Companies

- Nouryon

- Cortec Corporation

- Ashland

- Ecolab

- Henkel Ibérica, S.A.

- The Lubrizol Company

- BASF SE

- Dow

- DuPont de Nemours, Inc.

- Baker Hughes

Recent Development

- In July 2024, CorroTech Solutions, a leading chemical technology company, announced the launch of a groundbreaking corrosion inhibitor specifically designed for marine environments. This new technology aims to address the persistent challenges of corrosion faced by marine infrastructure, including ships, offshore platforms, and port facilities.

Segments Covered in the Report

By Compound

- Inorganic Corrosion Inhibitors

- Organic Corrosion Inhibitors

By Application

- Process & Product Additive

- Water Treatment

- Oil & Gas Production

By Type

- Volatile Corrosion Inhibitors

- Water-Based Corrosion Inhibitors

- Oil-Based Corrosion Inhibitors

By End-User

- Power Generation

- Chemicals

- Oil & Gas

- Metals Processing

- Pulp & Paper

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting