Cryogenic Tanks Market Size and Forecast 2025 to 2034

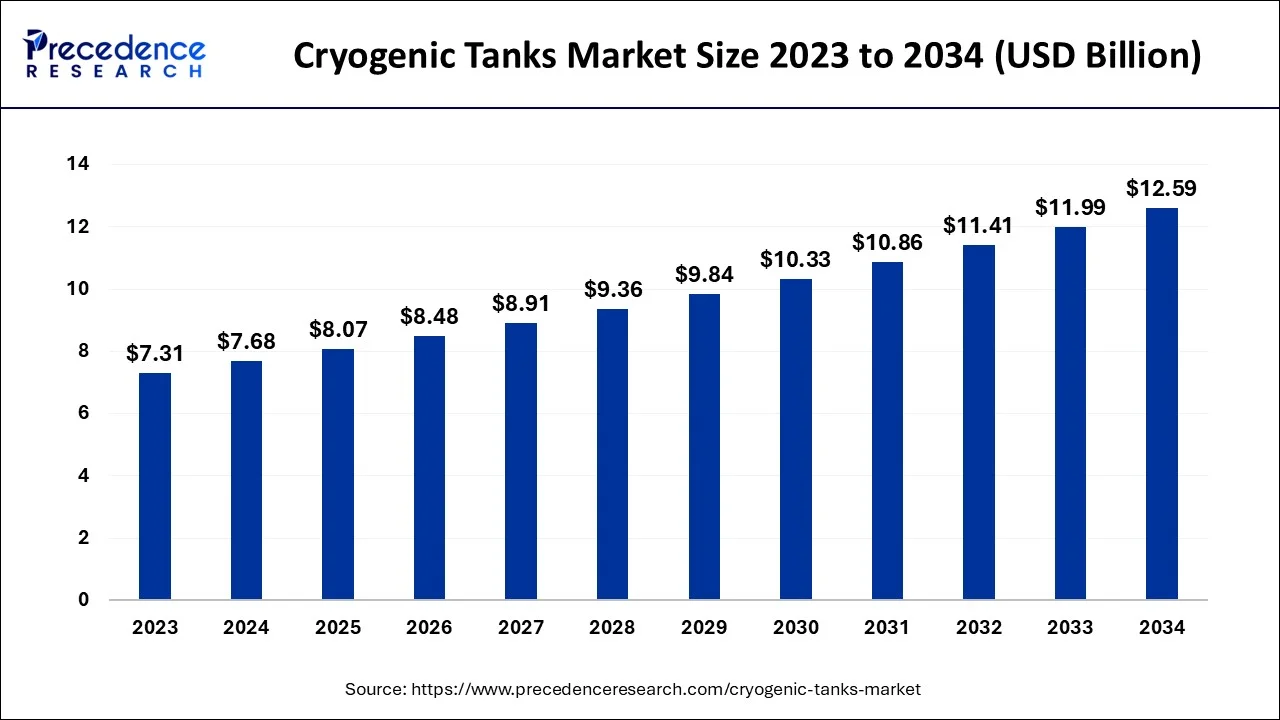

The global cryogenic tanks market size was estimated at USD 7.68 billion in 2024 and is anticipated to reach around USD 12.59 billion by 2034, expanding at a CAGR of 5.07% between 2025 and 2034. The improving healthcare infrastructure and rising pharmaceutical industry is expected to boost the demand for the cryogenic tanks market.

Cryogenic Tanks Market Key Takeaways

- In terms of revenue, the market is valued at $8.07 billion in 2025.

- It is projected to reach $12.59 billion by 2034.

- The market is expected to grow at a CAGR of 5.06% from 2025 to 2034.

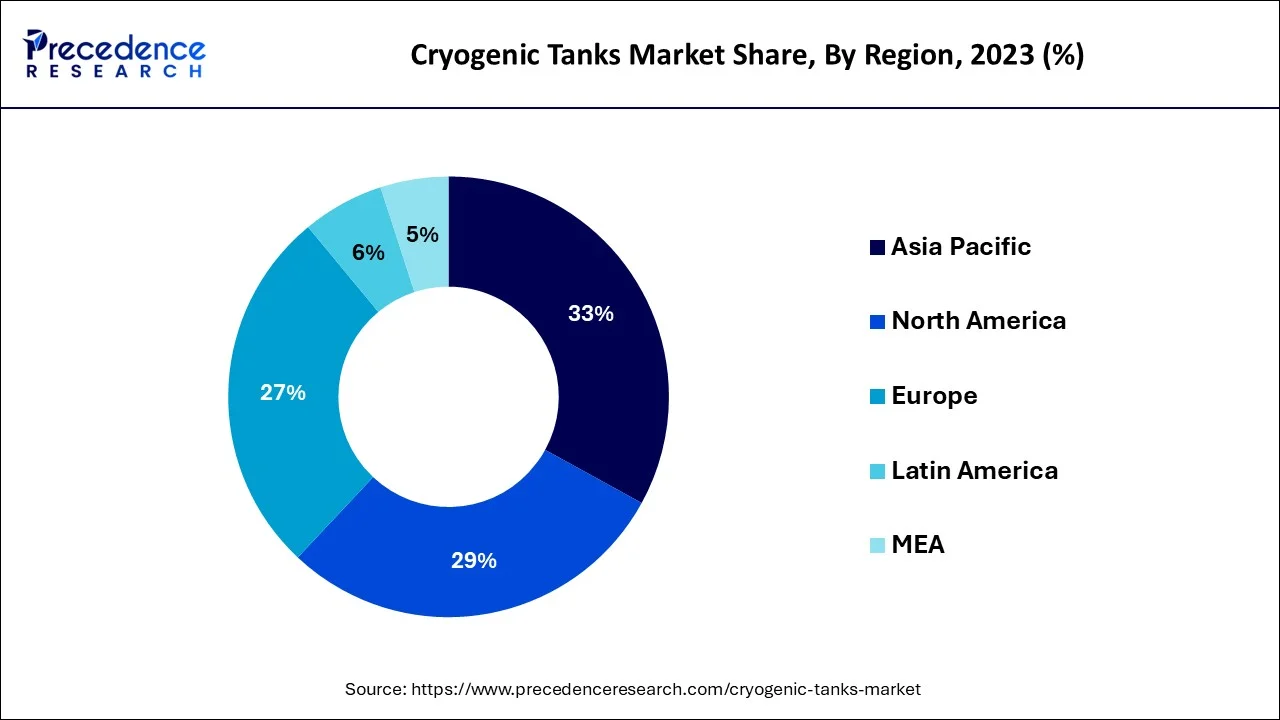

- Asia Pacific holds the maximum share of the cryogenic tank market.

- North America is expected to expand at a CAGR of 5% between 2024 and 2034.

- By Raw Material, the nickel alloy segment is predicted to grow at a CAGR remarkable of 5.5% between 2025 and 2034.

- By Cryogenic Liquid, the nitrogen segment contributed to the maximum share of the global market.

- By Cryogenic Liquid, the natural gas segment is expected to expand at a significant CAGR between 2025 and 2034.

- By Application, the storage segment led the global market in 2024.

- By Application, the transportation segment is expected to expand at a significant CAGR between 2025 and 2034.

- By End-user, the healthcare segment led the global market in 2024.

U.S. Cryogenic Tanks Market Size and Growth 2025 to 2034

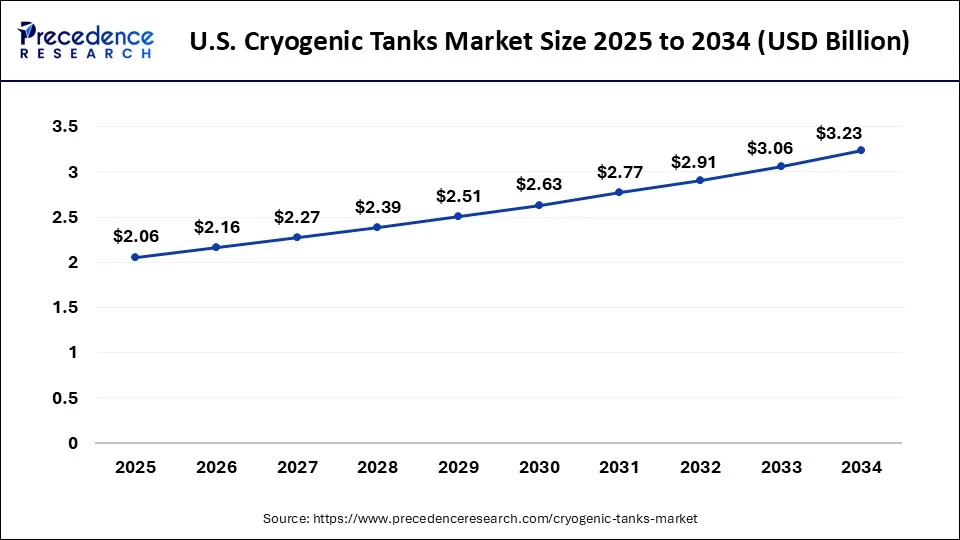

The U.S. cryogenic tanks market size accounted for USD 2.53 billion in 2024 and is expected to be worth around USD 4.15 billion by 2034, growing at a CAGR of 5.10% from 2024 to 2034.

Asia Pacific holds the largest share of the cryogenic tanks market.The Asia Pacific region is expected to experience significant growth in the cryogenic tanks market due to the increasing demand for industrial gases such as nitrogen and oxygen in countries such as China, India, and Japan. These gases are widely used in industries such as healthcare, food and beverage, electronics, and metallurgy.

Additionally, the region is experiencing a surge in the demand for LNG, which is being used as a cleaner alternative to fossil fuels. This is driving the demand for cryogenic tanks for LNG storage and transportation. The key players operating in the Asia Pacific cryogenic tanks market include Chart Industries, Inc., Cryofab Inc., Linde plc, INOX India Pvt. Ltd., and Air Water Inc.

Asia Pacific is home to the world's largest population, which provides a large and growing consumer base for industrial products and services. The rising industrialization in developing countries of Asia Pacific presents lucrative opportunities for the cryogenic tank market in the region.

The report published by the analysts of Reuters in March 2024 predicted the industrial output of India would increase by 5% for March 2024. The country is witnessing a significant increase in manufacturing processes and electricity generation.

There is a significant demand for cryogenic tanks in China due to its growing industrial sector and reliance on industrial gases. Moreover, China is one of the largest consumers of LNG in the world, which is driving the demand for cryogenic tanks for LNG storage and transportation. The country is investing heavily in LNG infrastructure to reduce its reliance on coal and other fossil fuels and to reduce its carbon emissions.

The cryogenic tanks market in North America is expected to grow at a CAGR of 5% during the forecast period.Well-established manufacturing industries, advanced healthcare infrastructure, and stricter energy efficiency policies are significant factors for market growth in North America. Moreover, the immediate product and design development and the presence of major key players in the region fuel the market's growth in North America.

The government initiatives and programs for promoting cleaner energy solutions for manufacturing industries present a plethora of opportunities for the cryogenic market to grow. The US government has been actively promoting cleaner energy solutions for manufacturing industries through a range of policies and programs; for example, the Environmental Protection Agency (EPA) has implemented regulations aimed at reducing emissions of greenhouse gases from industrial facilities and has also established the ENERGY STAR program, which provides certifications for energy-efficient products and buildings. The rising importance of energy efficiency and increasing awareness about carbon emissions will boost the demand for cryogenic tanks across the globe.

North America is currently dominating the cryogenic tanks market. North America pushes the limit to introduce cleaner energy solutions, especially in liquified natural gas (LNG). The other factors helping the growth of the market in the region are regulatory energy efficiency policies and manufacturing industries.

Market Overview

Cryogenic tanks are specialized storage vessels designed to store and transport cryogenic fluids, which are liquids that are extremely cold, typically below -150°C (-238°F). These tanks are used in a range of industries and applications, including the storage and transport of liquefied natural gas (LNG), medical gases, and other cryogenic materials used in chemical manufacturing, semiconductor production, and other industrial processes.

Cryogenic tanks play a crucial role in developing cleaner energy solutions, particularly in liquefied natural gas (LNG) transportation. LNG is a cleaner-burning alternative to traditional fossil fuels such as oil and coal, and its use is rapidly expanding as more countries seek to reduce their greenhouse gas emissions. Overall, cryogenic tanks offer a range of benefits as a cleaner energy solution, including reduced greenhouse gas emissions and improved environmental performance.

As the demand for cleaner energy solutions continues to grow, the use of cryogenic tanks is expected to expand, driving the growth of the cryogenic tanks market. The ongoing efforts by the government and other organizations to switch industries to cleaner energy solutions are observed as one of the major factors in boosting the growth of the global cryogenic tanks market.

Technological Advancement

Technological advancements in the cryogenic tanks market feature IoT, insulation, smart technologies, automation, and vacuum jacketed piping. The insulation materials have seen the advancement of composite materials and vacuum insulation. It decreases heat transfer and performs at a stable liquid temperature, which reduces energy consumption. These technologies have encouraged to implementation of more innovative initiatives contributing to the environment and businesses of various sectors.

Smart technologies and automation systems help the operational process, enabling remote monitoring and safety. The Internet of Things in the market supports controlling and monitoring temperature and ensures safety. Vacuum jacketed piping (VJP) is a system used for traction, holding the potential to reduce heat transfer in the transportation of cryogens. The technologies and innovations have introduced lightweight materials, enhancements, reliability, durability, and energy-saving designs to the cryogenic tanks market.

Cryogenic Tanks Market Growth Factors

The development of alternative energy sources, such as hydrogen fuel cells, is driving the demand for cryogenic tanks for the storage and transport of cryogenic liquids, such as liquid hydrogen. Moreover, the growing focus on safety and efficiency in industrial processes and transportation is driving the demand for cryogenic tanks, as they provide a safe and efficient means of storing and transporting cryogenic materials.

Researchers and market players are focused on developing advanced technologies for the storage and application of cryogenic liquid; the increasing research and development activities in the industry highlight a noticeable growth for the global cryogenic tank market. Moreover, the expansion of industrial facilities with the deployment of on-site storage for cryogenic liquids is another factor to fuel the growth of the cryogenic tanks market.

In January 2024, a researcher's team at Pusan National University, South Korea, found that hydrogen vaporization increases significantly as cryogenic tanks become empty. The research by this team sheds light on new technology to transport hydrogen.

Overall, the drivers for the cryogenic tank market are diverse and reflect the increasing demand for cryogenic storage and transportation solutions across a range of industries and applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.59 Billion |

| Market Size in 2025 | USD 8.07 Billion |

| Market Size in 2024 | USD 7.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Cryogenic Liquid, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for cryogenic tanks from the healthcare sector

The increasing demand for cryogenic tanks in the healthcare sector is a significant driver of the growth of the cryogenic tank market. Cryogenic tanks store and transport medical gases such as oxygen, nitrogen, and argon, which are essential for various medical applications, including respiratory therapy, anesthesia, and other medical procedures.

The healthcare sector is growing globally due to factors such as an aging population, the increasing prevalence of chronic diseases, and the need for more advanced medical technologies and treatments. As a result, the demand for medical gases is also increasing, driving the demand for cryogenic tanks.

Cryogenic tanks are used to store and transport medical gases safely and efficiently, ensuring they are readily available in medical facilities such as hospitals and clinics. Manufacturers and suppliers of cryogenic tanks are experiencing increased demand, and the market is expected to continue to grow as the healthcare sector continues to expand globally.

Restraint

High maintenance requirements

Cryogenic tanks are designed to store and transport materials at extremely low temperatures, typically below -150°C (-238°F), which can result in significant thermal stresses and other performance challenges. As a result, cryogenic tanks require high maintenance levels to ensure their safe and reliable operation over their lifespan. Some cryogenic fluids, such as liquid oxygen, can be highly corrosive to specific materials, which can cause damage to the tank over time.

Cryogenic tanks are designed to withstand high pressures from the stored material and external environment. However, these increased pressures can cause wear and tear on the tank over time, leading to cracks, leaks, or other issues. Such regular maintenance and servicing can be time-consuming and costly, which is considered a restraining factor for the market's growth.

Opportunity

Increasing adoption of cryotherapy

The rising demand for cryotherapy presents a significant opportunity for the cryogenic tank market. Cryotherapy involves exposing the body to extremely cold temperatures for a short period, typically using liquid nitrogen or other cryogenic gases. Cryogenic tanks are used to store and transport these gases, making them a crucial component of the cryotherapy supply chain. Cryogenic tanks used for cryotherapy applications are typically smaller and are designed to withstand the extreme cold and pressure conditions of cryogenic gases and are usually made of materials such as stainless steel or aluminum.

The increasing adoption of cryotherapy to treat various conditions, including sports injuries, chronic pain, and skin conditions, is driving growth and innovation in the cryogenic tanks market, creating opportunities for companies across the supply chain.

Raw Material Insights

The nickel alloy segment is expected to grow at a CAGR of 5.5% during the forecast period. Nickel alloy is a significant raw material in cryogenic tank construction, as they offer the necessary strength, flexibility, and corrosion resistance to ensure safe and reliable storage of cryogenic fluids at low temperatures. Nickel alloys such as Inconel, Incoloy, and Monel are often used in cryogenic tank construction because they can maintain their strength and flexibility even at shallow temperatures.

The steel segment is expected to remain the most lucrative segment of the global cryogenic tanks market; steel is another most common raw material used in the construction of cryogenic tanks. Steel is readily available and makes the most cost-effective choice for manufacturers. Additionally, steel is commonly used as a raw material for cryogenic tanks due to its high strength and durability.

Cryogenic Liquid Insights

The nitrogen segment accounts for the largest share of the global cryogenic tanks market; liquified nitrogen has an extremely low boiling point at atmospheric pressure. Cryogenic tanks are designed to maintain a low boiling point by using vacuum insulation. The rising consumption of liquified nitrogen from multiple industries, including cryogenics, HVAC, beer production, food storage, and preservation, and the healthcare sector, is supplementing the demand for cryogenic tanks for nitrogen storage and transportation.

At the same time, the natural gas segment is expected to witness a noticeable increase during the forecast period. Governments across the world are focusing on the reduction of greenhouse gas emissions. This factor will boost the consumption of natural gas in multiple manufacturing industries, including chemical industries and oil & gas industries. Natural gas requires cryogenic tanks for storage and transportation purposes, and the rising consumption of cryogenic natural gas will enhance the segment's growth.

Application Insights

The storage segment dominated the global cryogenic tank market in 2022; the segment is expected to maintain substantial growth during the forecast period. Cryogenic tanks are used for storage because they are designed to maintain extremely low temperatures, typically below -150°C, which is necessary for storing materials in a liquid or gas state at average temperatures and pressures. Cryogenic tanks are also used to store other materials, including biological samples, vaccines, and other temperature-sensitive materials, especially in the healthcare and pharmaceutical industries. The purity and stability of cryogenic tanks make them an ideal material for storage applications.

Additionally, many manufacturing industries are focused on developing cryogenic liquid storage facilities on-site; this factor is observed to maintain the dominance of the storage segment during the forecast period.

The transportation segment is expected to witness a significant increase during the forecast period; cryogenic tanks are widely used to deliver oxygen liquid, nitrogen liquid, and other cryogenic liquids to the desired sites. The tanks are designed to minimize the loss of cryogenic liquid during transportation, which is essential as the cost of these gases is relatively high. Cryogenic tanks are also designed to withstand the high pressures generated during transport, and this ensures that the tanks are safe to use and that the contents are not at risk of leaking or exploding. These advantages of cryogenic tanks are predicted to highlight their importance for transportation applications.

End-User Insights

The healthcare segment dominated the global cryogenic tanks market in 2024; the Covid-19 pandemic boosted the demand for cryogenic tanks from the healthcare sector in the last several years. Hospitals require cryogenic tanks to store and transport medical gases that are used for a variety of purposes in patient care. The enormous requirement for oxygen for patients with respiratory issues such as asthma, COPD, and pneumonia in hospitals and critical care centers fueled the demand for cryogenic tanks.

The manufacturing industries segment holds another largest share of the global cryogenic tanks market; the rising demand for cryogenic tanks from manufacturing industries that need extremely low temperatures has boosted the growth of the manufacturing industries segment. Manufacturing industries require cryogenic liquids such as oxygen and nitrogen liquid that are often used in the manufacturing of materials such as metals, plastics, and rubber, where the extremely cold temperature can be used to improve their properties.

Cryogenic Tanks Market Companies

The cryogenic tanks market includes a wide range of market players, including manufacturers, suppliers, and distributors of cryogenic tanks and related equipment. Some of the major market players in the cryogenic tanks market include:

- Wessington Cryogenics

- Eden Cryogenic LLC

- INOX India Limited

- Linde Plc

- Auguste Cryogenics

- Suretanks Group Limited

- Cryogas Equipment Private Limited

- Chart Industries

Recent Developments

- In May 2025, GreenFuel Energy Solutions partnered with Advanced Cryomotive Systems (ACS) to supply liquefied natural gas (LNG) tanks for the Indian OEM market. The collaboration will meet a range of mobility and transportation needs.

- In November 2024, Smallcap, which offers solutions across the value chain of design, manufacturing, engineering, and installation of systems and equipment for cryogenic conditions, went up 7% in the day's trade after receiving the order to supply cryogenic tanks from Highview Power (UK).

- In November 2024, INOX India Ltd. (INOXCVA), a global leader in cryogenic technology solutions, secured a major contract with Highview Power, UK, for their upcoming liquid air energy storage (LAES) facility in Carrington, Manchester.

- In December 2022, Babcock and Wilcox announced that the company has entered into a strategic agreement with Chart industries to collaborate on hydrogen generation technology. Babcock and Wilcox will be utilizing Chart's integrated hydrogen liquefaction and cryogenic carbon capture equipment and expertise. Both companies will be working together on marketing and sales, capturing consumers and projects.

- In December 2022,headquartered in New Zealand, Fabrum announced it supplies its first lightweight composite liquid hydrogen tank for the aviation industry. The tank is designed to maximize storage efficiency and reduce boil-off gases during warm refueling.

- In November 2022,Airbus announced to develop of a cryogenic hydrogen storage tank in order to support future aircraft fueled by hydrogen liquid. The designs for cryogenic hydrogen tanks are passed onto to teams in Nantes and Bremen to explore the process of manufacturing. The company has already built a cryogenic nitrogen tank on the same passed design.

- In February 2022, a globally leading aircraft company, Boeing, announced that it had successfully tested all fully composite and liner less cryogenic tanks at NASA's Marshall Space Flight Center in Alabama. The company has stated that it will be using this advanced technology for future aerospace vehicles, including NASA's space launch system. The composite technology in the tank will contribute to an increase of 30% in payload mass compared to the traditional metal structures.

Segments Covered in the Report

By Raw Material

- Steel

- Nickel alloy

- Aluminum alloy

- Others

By Cryogenic Liquid

- Nitrogen

- Argon

- Natural gas

- Oxygen

- Others

By Application

- Storage

- Transportation

By End-User

- Manufacturing industries

- Oil & gas industry

- Power

- Metallurgy

- Healthcare

- Shipping

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting