What is the Data Catalog Market Size?

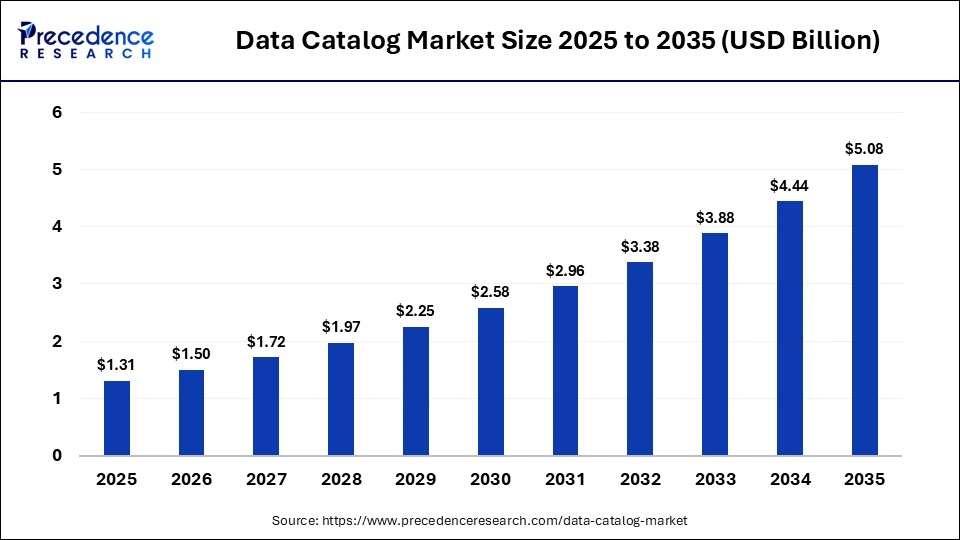

The global data catalog market size was calculated at USD 1.31 billion in 2025 and is predicted to increase from USD 1.5 billion in 2026 to approximately USD 5.08 billion by 2035, expanding at a CAGR of 14.52% from 2026 to 2035. The market growth is attributed to the increasing demand for centralized metadata management and enhanced governance frameworks across enterprises and public sector organizations.

Market Highlights

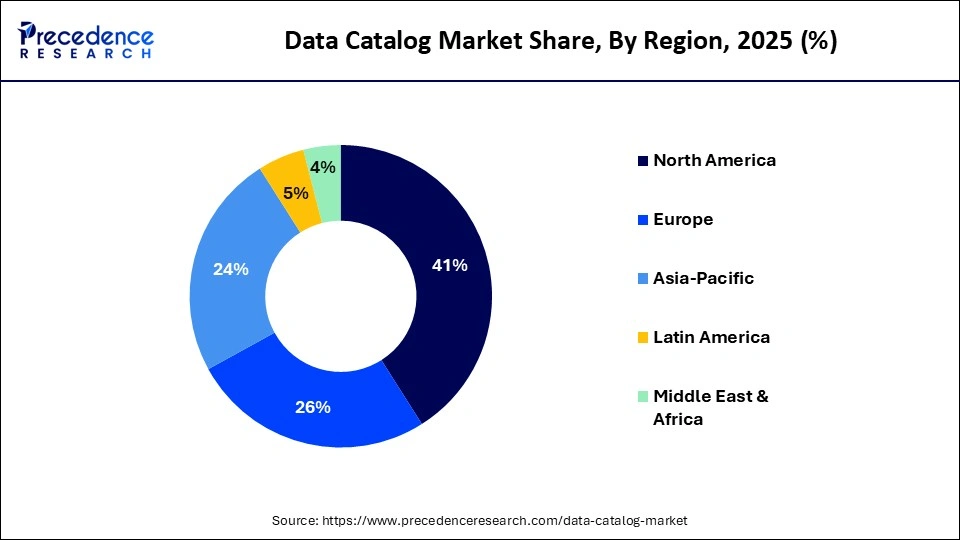

- North America dominated the market with 41% of the market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

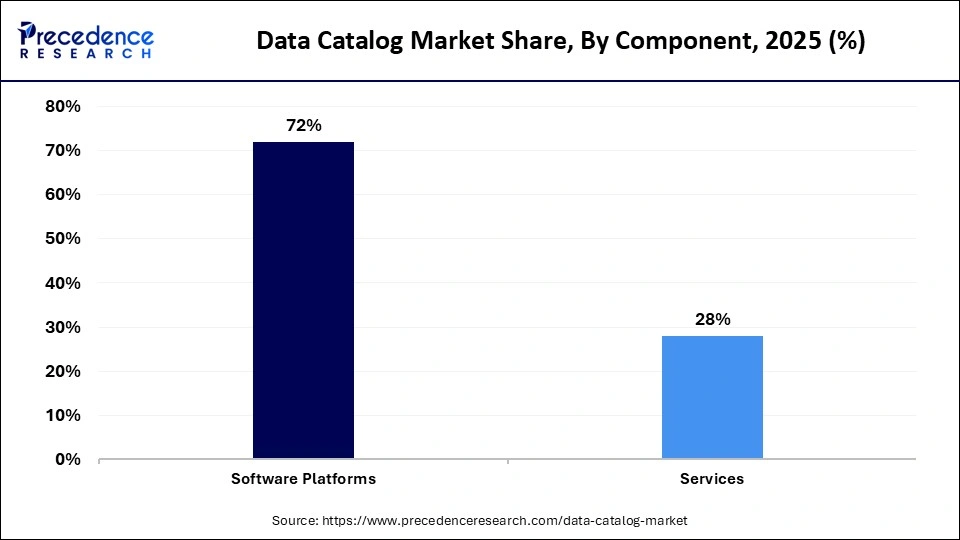

- By component, the software platforms segment contributed the highest market share of 72% in 2025.

- By component, the services segment is growing at a strong CAGR between 2026 and 2035.

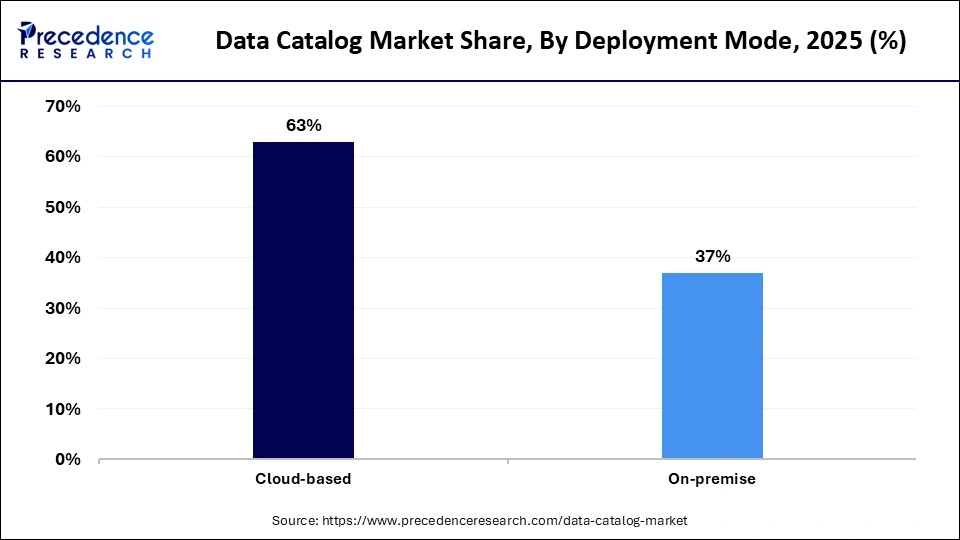

- By deployment mode, the cloud-based segment held the largest revenue share of about 63% in the data catalog market in 2025 and is expected to sustain the position between 2026 and 2035.

- By catalog type, the enterprise data catalogs segment led the data catalog market with a 46% share in 2025.

- By catalog type, the AI-enabled/active data catalogs segment is expected to grow at the highest CAGR between 2026 and 2035.

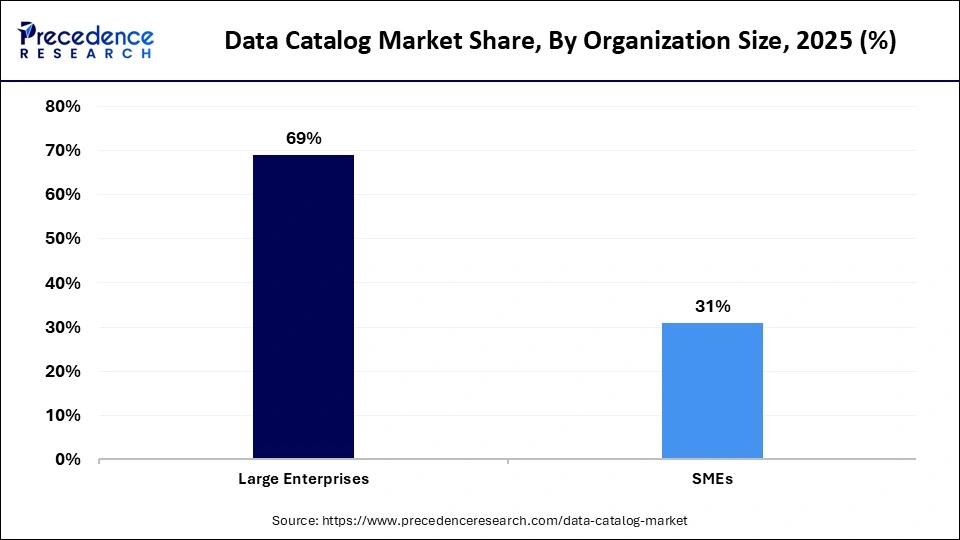

- By organization size, the large enterprises segment captured the highest market share of 69% in 2025.

- By organization size, the SMEs segment is poised to grow at the highest CAGR between 2026 and 2035.

Data CatalogMarket Overview

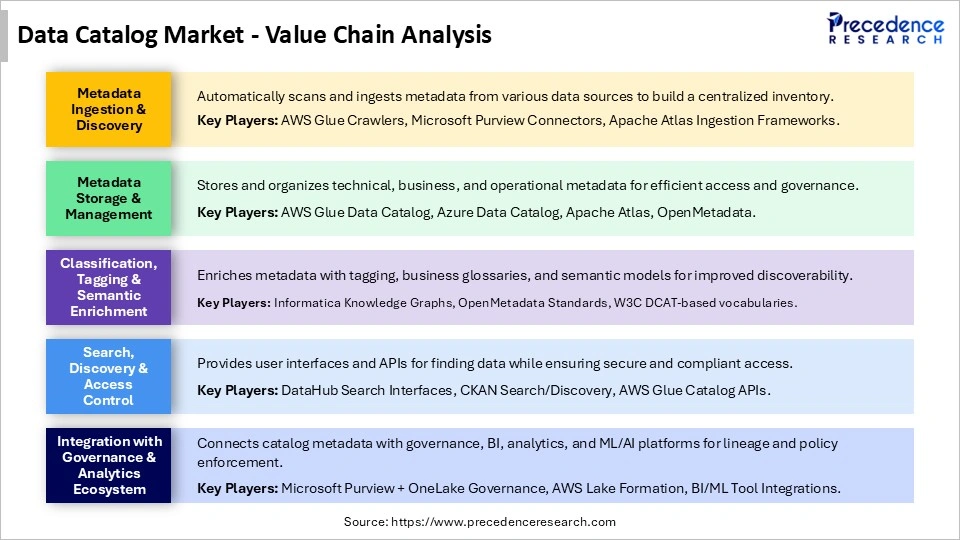

Data cataloging technology drives findability, accessibility, interoperability, and reuse of metadata across enterprise ecosystems, making standardized metadata practices essential for unlocking data value while ensuring privacy and trust. The Organisation for Economic Co-operation and Development Government at a Glance 2025 report highlights that formal open data policies increasingly mandate machine-readable, reusable data with rich metadata and API access, capabilities directly enabled by enterprise catalog tools to support analytics and governance. Furthermore, the UNESCO Data Governance Toolkit released in 2025 underscores global emphasis on ethical, interoperable data practices and responsible catalog implementation.

Growing adoption of data mesh and domain-oriented architectures is increasing reliance on federated catalogs to maintain consistency across decentralized data estates. Integration of catalogs with data quality, lineage, and access control tools is strengthening regulatory compliance and audit readiness. In parallel, AI-assisted metadata discovery and classification are reducing manual effort and accelerating enterprise-wide data utilization.

Impact of Artificial Intelligence on the Data Catalog Market

The future of the data catalog market is being transformed by AI that is now providing the ability to manage enterprise metadata in a faster and more precise manner. The automated ingestion, classification, and enrichment of metadata is the automation of metadata ingestion and classification functions across a variety of systems. This saves human effort and enhances the completeness of a catalog. Furthermore, theartificial intelligence integration improves adoption speed, operational efficiency, and strategic importance of enterprise data catalogs.

Data Catalog Market Growth Factors

- Driving AI and ML Integration: The rising use of AI-assisted metadata discovery is fueling advanced analytics and machine learning capabilities across industries.

- Expansion of Multi-Cloud and Hybrid Data Environments: The growing complexity of distributed data estates is driving adoption of unified catalog solutions.

- Boosting Data Democratization Initiatives: Enterprises focusing on self-service analytics are propelling metadata catalog usage among business and technical teams.

- Increasing Collaboration Across Global Teams: Rising remote work and cross-border data operations are fueling the need for centralized, accessible metadata repositories.

Global Adoption Signals Shaping the Data Catalog Ecosystem

- The U.S. public sector data catalog (Data.gov) hosts at least 440000 open datasets indexed by metadata catalogs maintained across federal agencies as part of open government transparency and metadata requirements.

- Singapore's national open data portal provides access to 5,000+ government datasets from over 65 public agencies, each cataloged with metadata and APIs for public use.

- Across OECD countries, metadata coverage of datasets in government open data portals shows that at least 16 out of 27 countries provide detailed metadata on dataset registration and purpose, reflecting catalog usage maturity in public administrations.

- In 2025, 94% of enterprises globally use cloud services in some form, with the majority of modern data management tools, including data catalogs, deployed on cloud infrastructure rather than on-premise servers, indicating cloud data catalog preference.

- Approximately 60% of corporate data is stored in the cloud as of 2024, reflecting a strong shift toward cloud environments for data management workloads where data catalogs are typically hosted.

- Global IT spending reached ~USD 5.3 trillion in 2024 and is projected to grow to approximately USD 5.74 trillion in 2025, indicating strong ongoing investment in technologies, including data management, governance, discovery, and AI-powered tools that encompass data catalogs.

- Among CIOs surveyed globally, 52% expect their IT budgets to increase in 2026, with priorities including cloud platforms, automation, and analytics tools, categories under which enterprise data discovery and cataloging tools fall.

Data CatalogMarket Trends

- Real-Time Metadata Streaming and Change Capture: Enterprises increasingly adopt technologies that support real-time metadata streaming to instantly capture changes across dynamic data sources. This tendency is pushing catalog systems to consume, process, and reconcile metadata in real-time, improving quality and responsiveness.

- Generative AI-Driven Metadata Synthesis: Generative AI models are now being embedded into catalog workflows to synthesize metadata descriptions, semantic tags, and relationship graphs at scale. This speeds the process of onboarding the new data assets and manual enrichment.

- Federated Metadata Sharing Across Ecosystems: Cross-organization and cross-platform metadata federation is becoming mainstream, driven by interoperability frameworks and secure data exchange protocols. Such a trend will drive catalog platforms to facilitate standard metadata exchange and shared vocabularies between partners and data spaces.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.31Billion |

| Market Size in 2026 | USD 1.5 Billion |

| Market Size by 2035 | USD 5.08 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Organization Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Did Software Platforms Drive the Largest Share of Component Revenue?

The software segment dominated the data catalog market in 2025, accounting for an estimated 72% market share, due to the higher emphasis of enterprises on end-to-end, scalable catalog products. This provides automated metadata discovery, advanced governance, and embedded artificial intelligence features. Modern software solutions allowed companies to bring together divergent metadata sources, provide self-service discovery, and externalize lineage tracking in a hybrid cloud environment. They are vital components of enterprise data management strategies, thus fueling segment market growth.

The service segment is expected to grow at the fastest rate in the coming years, accounting for the highest CAGR, as organizations face more challenging metadata environments and need professional advice to implement and optimize the use of catalog solutions appropriately. Companies that lack the internal skills tend to seek the services of professional service businesses to customize catalog deployments and construct metadata processes into more extensive data management plans. Furthermore, the enterprises without in-house expertise often turn to professional service firms, further propelling the segment in the coming years.

Deployment Mode Insights

Why Are Cloud-Based Deployments Dominating in the Data Catalog Market?

Cloud-based segment held the largest revenue share in the data catalog market in 2025, holding a market share of about 63%, and is expected to sustain the position during the forecast period. Organizations pursued flexibility, rapid scalability, and reduced infrastructure overhead that traditional on-premises models could not match. Growing adoption of hybrid and multi-cloud data architectures is further strengthening demand for cloud-native catalog solutions. In addition, seamless integration with cloud analytics, data governance, and security platforms is improving operational efficiency and accelerating enterprise-wide data discovery.

Enterprises are moving towards cloud-native catalog architecture that scans and controls metadata across hybrid storage environments, allowing metadata visibility to be visible to teams working globally. Organizations reported that comprehensive cataloging accelerated data discovery up to 4.7 times faster and improved reuse rates by 63% compared with traditional catalog approaches. Moreover, the ongoing innovation in cloud service offerings is shortening deployment cycles compared with local systems, thus boosting the segment in the coming years.

Catalog Type Insights

Why Do Enterprise Data Catalogs Dominate the Global Data Catalog Market?

The enterprise data catalogs segment dominated the data catalog market in 2025, accounting for an estimated 46% market share, as they manage vast, complex data ecosystems that demand centralized discovery, governance, and compliance tooling across numerous departments and business units.

Over 70% of businesses in 2025 said they had increased attention to metadata and governance structures for regulatory demands, including GDPR and data sovereignty programs. Additionally, the large enterprises are maintaining investments in thorough metadata infrastructures of enterprise data catalogs, thus fueling the segment growth.

The AI-enabled/active data catalogs segment is expected to grow at the fastest rate in the coming years, accounting for the highest CAGR, owing to the cloud-native, subscription-based catalog offerings that have lowered barriers to entry. This made powerful capabilities accessible without high upfront costs or extensive in-house expertise. Moreover, the open policy and standardization efforts, including those followed in the 2025 Open Data Maturity Report, also favored smaller businesses, further propelling the market in the SMEs.

Organization Size Insights

Why Do Large Enterprises Lead the Global Data Catalog Market?

The large enterprises segment held the largest revenue share in the data catalog market in 2025, holding a market share of about 69%, due to the strict regulatory requirements and increasingly tight compliance requirements that make robust data governance essential. Metadata catalogs also served to consolidate various data resources into executable inventories so that they become more precise and audit-ready.

The large organizations also relied on the catalog characteristics to improve cross-teaming between the compliance, analytics, and product teams. This saves time otherwise attributed to manual data discovery and standardizing semantics across business lines. Furthermore, the Innovative AI driven catalog capabilities helped classify and govern sensitive data automatically, further boosting the market in this sector.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest rate in the coming years, accounting for 14% CAGR, as these two areas are confronted with a skyrocketing amount of data and significant demands to secure and control access to clinical, operational, and research data.

- In 2025, metadata catalogs were more widely used by providers and research institutions to store patient records, lab data, and image repositories. Moreover, the catalog tools were useful in establishing stringent access controls and lineage monitoring required to comply with HIPAA and other privacy regimes, thus fueling the market in the coming years.

Regional Insights

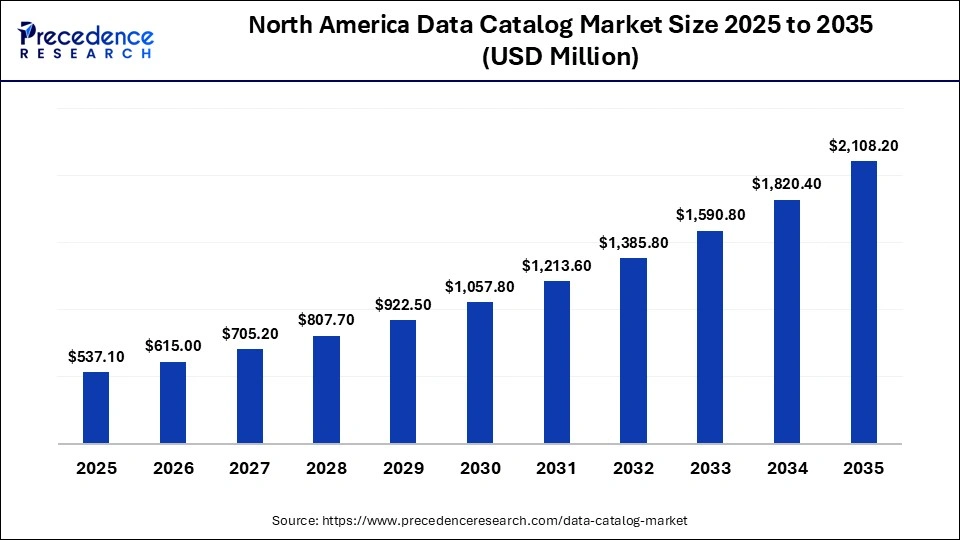

How Big is the North America Data Catalog Market Size?

The North America data catalog market size is estimated at USD 537.10 billion in 2025 and is projected to reach approximately USD 2,108.20 billion by 2035, with a 14.65% CAGR from 2026 to 2035.

Why Is North America Dominating the Data Catalog Market Space?

North America led the data catalog market, capturing the largest revenue share in 2025, accounting for an estimated 41% market share, due to the fact that the region had an advanced digital public infrastructure and data governance maturity. This environment drives comprehensive metadata management and cataloging implementation.

In 2025, the OECD Government at a Glance report showed that 22 out of 36 OECD countries (61%) made more than half of their high-value datasets fully accessible. North American leaders like Canada and the U.S. are leading the way in providing machine-readable and API available metadata, which indicates enterprise trust in structured catalogs. Furthermore, the cloud provider and the research and governance ecosystem in the region also promoted open data standards, further increasing the need for metadata services in this service.

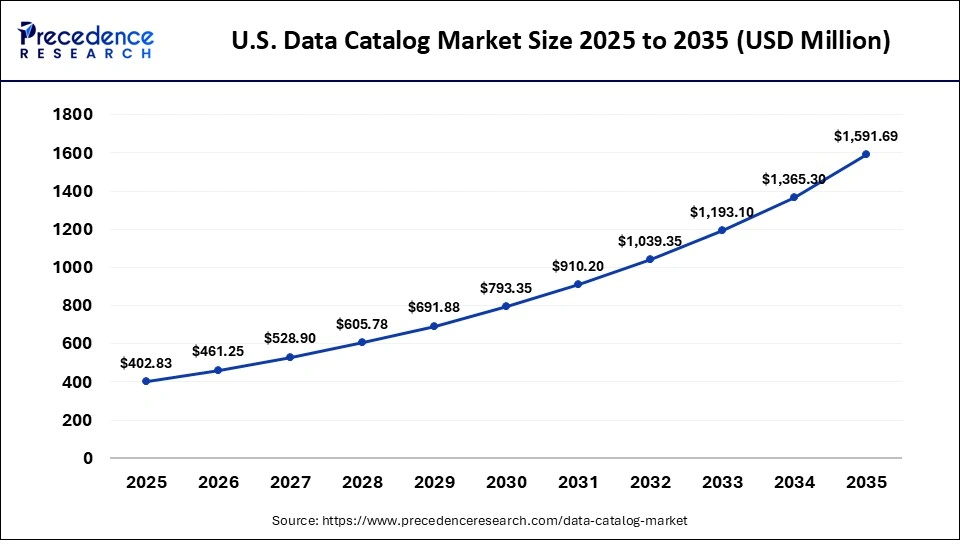

What is the Size of the U.S. Data Catalog Market?

The U.S. data catalog market size is calculated at USD 402.83 billion in 2025 and is expected to reach nearly USD 1,591.69 billion in 2035, accelerating at a strong CAGR of 14.73% between 2026 and 2035.

United States: Leading the North American Metadata and Data Catalog Revolution

The U.S. leads the data catalog market due to one of the world's largest collections of open, machine-readable public datasets. Platforms such as Data.gov have made an effort to capture over 291,000 cataloged datasets by 2025, which are a rich source of discovery and reuse. Advanced implementations of catalogs are frequently connected to federal open data inventories. This allows analytics teams to look up and correlate both internal and external data effectively. Furthermore, the collaboration between open data infrastructure and enterprise metadata strategies has assisted U.S. organizations in expanding catalog utilization in the coming years.

Why Is Asia Pacific Growing Fast in Regional Metadata & Catalog Adoption?

Asia Pacific is anticipated to grow at the fastest rate in the data catalog market during the forecast period, accounting for 35% of CAGR, owing to the governments and enterprises in China, India, Japan, and Southeast Asia doubling their efforts to utilize data catalog technologies. The Asia Pacific companies broadened catalog deployments to enable hybrid analytics and data sharing requirements. Additionally, the extension of metadata efforts to larger data governance models promotes the adaptation of catalog technologies in new markets.

Singapore: Driving Rapid Data Catalog Growth Across Asia Pacific

Singapore is leading the charge in the Asia Pacific data catalog market, with high demand for real-time, programmatic access to structured data across sectors. The Singapore government platform generates 13 million API calls monthly, demonstrating high demand for data catalog technology across sectors. Furthermore, the capacity building and quality governance forums throughout 2025 further enhanced Singapore's role as a growth anchor in the Asia Pacific's metadata and catalog ecosystem.

Data Catalog Market Value Chain Analysis

Who are the Major Players in the Global Data Catalog Market?

The major players in the data catalog market include Zaloni, Inc, Talend Inc., Precisely Inc., Oracle Corporation, Microsoft Corporation, Informatica Inc., IBM Corporation, Hitachi Vantara Corporation, Apache Software Foundation, Alation Inc.

Recent Developments

- In September 2025, Rivvit, a leading provider of data management and reporting software for financial services and investment management firms, announced the launch of its data catalog module, offering full visibility into data lineage and flow across enterprise systems. Tailored for investment managers and financial institutions, the module is now available to all Rivvit clients, enabling improved transparency, governance, and compliance.(Source:https://www.prnewswire.com)

- In February 2025, DataGalaxy, a collaborative data and analytics (D&A) governance SaaS provider, acquired YOOI, a platform that helps enterprises define, monitor, and manage their data and AI investment portfolios. YOOI delivers a 360° cockpit to track the full lifecycle of D&A and AI initiatives, allowing organizations to optimize value, control risks, ensure compliance, and consistently track ROI.(Source: https://www.datagalaxy.com)

- In July 2023, RightData, the Data Products Company, introduced DataMarket, a unified platform for accessing and managing organizational data. Users can explore definitions, view metadata, control permissions, and directly connect to APIs, connectors, and natural language data queries. DataMarket supports any data source, store, or analytics tool, simplifying enterprise data discovery and operationalization.(Source: https://www.getrightdata.com)

Segments Covered in the Report

By Component

- Software Platforms

- Services

- Consulting & implementation

- Support & maintenance

- Managed services

By Deployment Mode

- Cloud-based

- On-premise

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting