What is the Data de-identification Market Size?

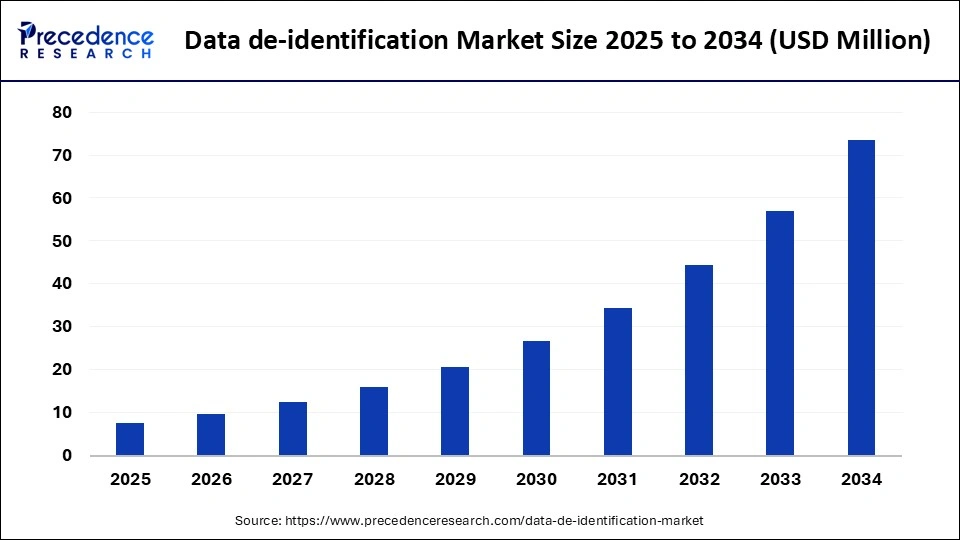

The global data de-identification market analysis covers market size, segmentation, growth drivers, and leading players in privacy-preserving technologies. The market growth is attributed to increasing regulatory requirements, rising data privacy concerns, and the expanding adoption of advanced analytics across industries.

Market Highlights

- By region, the North America segment held a dominant presence in the data de-identification market in 2024.

- By region, the Asia Pacific segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By solution type, the data masking segment accounted for a considerable share of the market in 2024.

- By solution type, the tokenisation & differential privacy segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By deployment model, the on-premises segment led the data de-identification market.

- By deployment model, the cloud (SaaS) and hybrid segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By data type supported, the structured data segment registered its dominance over the data de-identification market in 2024.

- By data type supported, the unstructured data and streaming segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By use case/application, the test data management & analytics segment dominated the market.

- By use case/application, the data sharing for collaborations and research segment is projected to expand rapidly in the market in the coming years.

- By industry vertical, the BFSI & healthcare segment maintained a leading position in the data de-identification market in 2024.

- By industry vertical, the retail/ e-commerce and public sector analytics segment is predicted to witness significant growth in the market over the forecast period.

Market Overview

What Is Data De-identification?

The data-de-identification market in 2024 has grown due to the strictness of data privacy laws and the increasing necessity to share data safely across various industries. Considering the importance of protecting personal information, governments worldwide have introduced and strengthened policies requiring the de-identification of valuable data.

The U.S. Department of HHS 2024 report highlighted the need to improve the practice of de-identification to protect Protected Health Information (PHI) to support research and analytics. The National Institute of Standards and Technology (NIST) has published new recommendations that recommend the use of strong de-identification methods to reduce the risk of privacy breaches related to the sharing of data. Furthermore, the de-identification solution has become an important part of industries such as healthcare, finance, and retail.

Impact of Artificial Intelligence on the Data De-identification Market

The data de-identification industry is being transformed by artificial intelligence (AI), which increases the speed, accuracy, and intelligence of privacy protection. Organisations also use AI-based software to automatically detect sensitive information in both structured and unstructured data, and to create synthetic data with the same analytical utility as real data without compromising privacy. Furthermore, privacy engineering is an ever-growing source of demand, and data de-identification is becoming a pivotal pillar of responsible digital transformation on a global scale.

Data de-identification Market Growth Factors

- Rising Data Privacy Regulations Worldwide: Growing implementation of laws such as GDPR, HIPAA, and PIPL is driving enterprises to adopt robust data de-identification solutions.

- Boosting Adoption of AI and Machine Learning: Increasing reliance on AI for analytics and automation is propelling demand for secure anonymised datasets to train models effectively.

- Driving Demand for Cross-Border Data Collaboration: Expanding global research collaborations and data sharing projects are fuelling the need for advanced de-identification technologies.

- Growing Healthcare Digitalisation: The rising digitisation of patient records and telehealth services is accelerating the need for privacy-preserving data solutions.

Enterprise Adoption & Regional Investment Stats

- In 2024, over 90% of hospitals in the U.S. used electronic health records (EHRs), increasing the need for secure data de-identification solutions.

- A 2024 survey reported that 74% of EU organizations identified data privacy and security as their top IT investment priority.

- In 2024, Asia-Pacific countries invested over USD 12 billion in AI and cloud infrastructure projects, driving demand for privacy-preserving technologies.

- By 2024, 52% of Asia-Pacific enterprises had adopted cloud-based privacy solutions, fueling de-identification adoption.

- A 2024 survey found that 68% of Canadian organisations planned to scale up privacy-enhancing technology investments in the next three years.

- UNCTAD data in 2024 shows that international cross-border data flows increased, driving privacy concerns and the adoption of de-identification solutions.

- In 2023, global private investment in infrastructure projects in primary markets increased by 10%, reaching US$380 billion, indicating a strong investment trend in sectors related to data infrastructure

(Source: https://pmc.ncbi.nlm.nih.gov)

(Source: https://www.cisco.com)

(Source: https://press.aboutamazon.com)

(Source: https://my.idc.com)

(Source: https://www.ey.com)

(Source: https://documents1.worldbank.org)

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution Type,Deployment Model,Data Type Supported,Application,Industry Vertical , and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Demand for Regulatory Compliance Shaping the Future of the Data De-identification Market?

Increasing focus on regulatory compliance is expected to drive the data de-identification market in the coming years. There are healthcare, banking, and insurance companies that use AI-based anonymisation methods to enforce strict data protection laws, including the GDPR, the HIPAA, and the CCPA. Such laws provide strict rules for collecting, storing, and processing personal information, and enterprises should invest in technologies that ensure compliance while keeping the data usable.

Companies are incorporating privacy auto-protective mechanisms to avoid litigation and build consumer confidence. In 2024, the European Union Agency for Cybersecurity (ENISA) announced that more than three-quarters of enterprises based in the European Union had modified their privacy models to comply with the GDPR, compared to 58% in 2022. Furthermore, the growing digital transformation initiatives are anticipated to fuel the demand for de-identification tools that secure enterprise data during modernisation efforts.

Restraint

High Implementation Costs Hamper Adoption of De-identification Solutions

The major restraint in the data de-identification market is the high implementation costs are expected to slow the deployment of advanced de-identification solutions, thus hindering the market. Businesses are characterised by budget limitations that reduce their capacity to embrace the state-of-the-art privacy-saving instruments. Moreover, the restrained growth due to a lack of standardised de-identification frameworks is projected to impact the interoperability and adoption rate of privacy-preserving technologies.

Opportunity

To What Extent Are Increasing Cyber Threats Fuelling the Expansion of the Data De-identification Market?

Surging data breaches and cyber threats are likely to intensify the need for robust data anonymisation technologies, further creating immense opportunities for the market. The 2024 global data breach cost was the highest in history at 4.88 million, marking a 10% increase over the previous year. The healthcare industry incurred even greater expenses, whose an average breach is 9.77 million.

Growing Boardroom Commitment to Cybersecurity Strengthens Market Opportunities Across Sectors

| Year | Businesses (%) | Charities (%) |

| 2021 | 77% | 68% |

| 2022 | 82% | 72% |

| 2023 | 71% | 62% |

| 2024 | 75% | 63% |

| 2025 | 72% | 68% |

(Source:https://www.gov.uk)

These growing costs highlight the economic cost of data breaches and the need to implement advanced security. Organizations across diverse industries are adopting anonymization solutions powered by AI to reduce the risks associated with data breaches. In 2024, there were over 5.5 billion account breaches around the world, which is nearly eight times more than in 2023. Furthermore, the high demand for secure data sharing and collaboration is estimated to accelerate the deployment of privacy-preserving technologies, including data de-identification. (Source: https://surfshark.com)

Segment Insights

Solution Type Insights

Why Did Data Masking Dominate the Data De-identification Market in 2024?

The data masking segment dominated the data de-identification market in 2024, due to its ability to secure sensitive data without distorting the original data format. The method was widely implemented in different industries, such as healthcare, banking, and IT services.

They protect personal and confidential information throughout the development, testing, and analytics procedures. Furthermore, the increasing sophistication of cyber threats and the necessity of strict privacy rules have further increased the use of data masking solutions.

The tokenisation & differential privacy segment is expected to grow at the fastest rate in the coming years, owing to its sophisticated privacy protection features. The process of tokenisation substitutes sensitive data with globally unique tokens, providing high levels of protection without affecting usability, which is critical to real-time transactions and analytics.

The EU Agency on Cybersecurity (ENISA) has promoted the concept of differential privacy as a best practice of GDPR-compliant data sharing in 2025. They increased their awareness among the international business community, which will further contribute to the faster promotion of such innovative solutions in the future.

(Source: https://privacymatters.dlapiper.com)

Deployment Model Insights

What Made On-Premises Deployments the Leading Segment in the Data De-identification Market in 2024?

The on-premises segment held the largest revenue share in the data de-identification market in 2024, due to its high compliance and data security requirements. These solutions were enabling strong security systems such as firewalls, encryption. Furthermore, the on-premises solution was greatly preferred among enterprises in the Asia-Pacific region due to strict cross-border data transfer limitations.

The cloud (SaaS) and hybrid segment is expected to grow at the fastest rate in the coming years, owing to its flexibility, scalability, and affordability. According to the CSA 2024 report, more than 48% of enterprises had implemented cloud-based tools to support data privacy and speed up analytics, and remain in compliance. Moreover, the growing need to use AI-driven analytics and dynamic workload processing is expected to fuel the demand for cloud data de-identification solutions.

Data Type Supported Insights

Why Was Structured Data the Dominant Segment in the Data De-identification Market in 2024?

Structured data segment dominated the data de-identification market in 2024, due to its standardisation and wide range of use in enterprise systems. Organisations in industries, including healthcare, financial, and government sectors, prefer structured data to be de-identified. Furthermore, its suitability for essential business functions, where data integrity and access are important elements, also contributed to the preference for structured data.

The unstructured data and streaming segment is expected to grow at the fastest CAGR in the coming years, as text, images, and sounds become more common with the rise of digital content. Real-time data produced by the IoT devices and social media is anticipated to increase considerably in the future. The growth of the Internet of Things and the necessity of real-time analytics further boost the segment growth in the coming years.

Use Case / Application Insights

What Factors Drove Test Data Management & Analytics to Lead the Data De-identification Market in 2024?

The test data management & analytics segment held the largest revenue share in the data de-identification market in 2024. The demand to create, test, and validate applications without disclosing sensitive information continues to grow, highlighting the need for a secure environment.

Companies in other industries focused on de-identifying production data to develop realistic data for testing, without violating regulations. Furthermore, these forces cumulatively contributed to the significance of test data management and analytics as an essential application of data de-identification technology.

Data sharing for collaborations and research segment is expected to grow at the fastest rate in the coming years, owing to the growing significance of the cross-institutional and cross-border collaboration. The European Union Agency for Cybersecurity (ENISA) released guidelines in 2024 proposing privacy-preserving data sharing as research in 2024 as a strategic demand to comply and be innovative.

Various healthcare organisations use de-identification solutions to safely share datasets, enhancing innovation without compromising the privacy of individuals. Additionally, the exchange of anonymised datasets without losing confidentiality makes this application a significant driver of growth for the segment in the coming years.(Source: (https://www.diva-portal.org)

Industry Vertical Insights

Why Did BFSI & Healthcare Lead the Data De-identification Market in 2024?

The BFSI & healthcare segment dominated the data de-identification market in 2024, due to the increased regulation and rising cybersecurity threats. The EDPB reported more than 1,500 cases of data breaches in financial institutions in 2024, with a significant number of them related to unsecured sensitive data. Compelling BFSI businesses to implement effective mechanisms of de-identification.

A report by HIPAA in 2024 indicated that in 2023, healthcare organisations reported a 23% higher patient information data breach than in 2023. Furthermore, the anonymised patient data is essential for advancing public health research without violating confidentiality, which will drive the market in the coming years

(Source: https://www.hipaajournal.com)

The retail/e-commerce and Public Sector analytics segment is expected to grow at the fastest rate in the coming years, as data-based strategies are growing tremendously. As reported by the IAPP in its 2024 privacy trends report, more than 78% of retail organisations listed data privacy compliance among their most important operational priorities, driving the adoption of de-identification.

Rising demand for analytics is also applied in the context of the public sector to enhance citizen services. Additionally, retail/e-commerce and public sector analytics are expected to become sources of growth, as de-identification is used to personalize experiences, introduce policies, and even collaborate with other sectors.

Regional Insights

Why Was North America the Dominant Region in the Data De-identification Market in 2024?

North America led the data de-identification market, capturing the largest revenue share in 2024, due to strict data privacy laws, the development of the advanced digital infrastructure, and the orientations towards healthcare innovation. The compliance with CCPA and HIPAA influenced the implementation of effective de-identification systems to ensure the safety of sensitive datasets.

U.S. Department of HHS found that more than 80% of care providers accessed patient records through research and analytics by de-identifying records in 2024. The ethical nature of data use led to the development of industry norms through the FPF, prompting organizations to invest heavily in scalable anonymization solutions. Furthermore, the industry partnerships among companies, such as IBM, Google Cloud, and Microsoft Azure, have solidified North America's market leadership in the global market.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the growing digital infrastructure, changing privacy policy, and an increased number of developing data-oriented studies. Providers in the region began massive projects with de-identified patient data to enable research and policy-making.

China has encouraged the use of privacy-preserving analytics with the Personal Information Protection Law (PIPL). Cloud providers in the region had added de-identification services to their offerings by the year 2024. Alibaba Cloud also reported that data anonymisation usage increased significantly in the Asia Pacific, particularly in retail and e-commerce. They are enhancing the adoption of data anonymisation to ensure personalised shopping within privacy legislation, thus further propelling the market in the coming years.

Top Vendors in the Data De-identification Market & Their Offerings

- Amazon Web Services (AWS)

AWS leads in secure cloud infrastructure, offering comprehensive privacy and encryption solutions like AWS Macie, KMS, and PrivateLink to safeguard sensitive data at scale. Its data privacy tools enable organizations to automate data classification, enforce fine-grained access control, and maintain compliance with global regulations such as GDPR and HIPAA.

- Google Cloud

Google Cloud integrates privacy-by-design principles across its data ecosystem, with key solutions including Confidential Computing, Cloud DLP APIs, and Encryption at Rest and in Transit.Its platform helps enterprises analyze and manage sensitive data securely while preserving utility for AI and analytics workloads.

- IBM

IBM provides enterprise-grade data security through its IBM Guardium and IBM Security portfolio, delivering real-time data monitoring, masking, and encryption.

Leveraging AI and automation, IBM enables dynamic risk detection, regulatory compliance, and privacy management across hybrid and multi-cloud environments.

- Informatica

Informatica's Intelligent Data Management Cloud (IDMC) platform includes advanced data masking, anonymization, and privacy governance tools.

Its solutions empower businesses to manage sensitive information responsibly while enabling safe data sharing, analytics, and modernization initiatives in cloud environments.

- Protegrity

Protegrity specializes in enterprise-wide tokenization and encryption frameworks that protect data across storage, analytics, and AI applications.

Its Data Protection Platform allows organizations to use sensitive data safely while maintaining compliance and performance, supporting hybrid and multi-cloud deployments.

Other Companies in the Data De-identification Market

- Anonos: Specializes in data privacy and pseudonymization solutions that enable lawful data use under GDPR and global privacy laws through its Data Embassy platform.

- BigID: Offers AI-driven data discovery, classification, and privacy management software that helps enterprises identify and protect sensitive data across hybrid and multi-cloud systems.

- Datavant: Focuses on privacy-preserving data connectivity, helping organizations securely link and share health and life sciences data while maintaining compliance with HIPAA and GDPR.

- Delphix: Provides data masking and virtualization solutions that enable secure, compliant data delivery for testing, analytics, and cloud migration without exposing real customer data.

- Microsoft:Embeds privacy and data protection features across Azure Purview and Microsoft Security, providing end-to-end compliance, discovery, and governance for enterprise data.

- Oracle: Offers integrated data masking, redaction, and encryption tools within its database security suite, supporting regulatory compliance for financial, healthcare, and government sectors.

- Privitar: A leader in privacy engineering, Privitar provides data anonymization and access control tools that help enterprises manage sensitive data safely for analytics and AI development.

- Spirion: Focuses on sensitive data discovery and classification across structured and unstructured environments, helping organizations meet compliance and data minimization standards.

- TokenEx:A cloud-based data protection company offering tokenization-as-a-service to secure payment and personal data without storing it on internal systems.

- Very Good Security (VGS): Delivers Data Alias and Vaultless Tokenization solutions that allow businesses to operate on sensitive data without ever directly accessing it, reducing compliance risk

Recent Developments

- In June 2025, HealthVerity, a leader in privacy-protecting technologies and the nation's largest verified healthcare and consumer data ecosystem, unveiled HealthVerity Notes. This new modular, de-identified dataset is built from over 2.5 billion unstructured clinical EHR notes and employs innovative methodologies to preserve full contextual detail. The solution is designed to enhance real-world data strategies across life sciences research, commercial pharma, and analytics applications, offering critical context for improved decision-making while safeguarding privacy.

- In March 2025, Atropos Health, a pioneer in automating high-quality real-world evidence (RWE) generation, announced the launch of Nodal Patient Deidentification and Query Time Interval Encoding (Nodal Deid) within the GENEVA OS platform for Atropos Evidence Network members. This advancement allows members to address gaps in longitudinal patient records by leveraging robust de-identified data mapped to HIPAA's Safe Harbour standard. Crucially, the linkage occurs only at query time, ensuring that control over and possession of source data remain with the owner while enhancing data privacy and utility.

- In May 2025, Topcon Healthcare, Inc., a global leader in robotic diagnostics and digital health solutions, launched the Institute of Digital Health (IDHea™), an ocular data-as-a-service platform aimed at accelerating AI research and innovation in digital health. IDHea offers secure and rapid access to unique real-world and clinical trial datasets, fostering advancements in ocular and systemic disease research. The platform empowers researchers and innovators to develop cutting-edge healthcare applications that improve patient outcomes.

(Source: https://www.digitalhealth.net)

(Source:https://healthverity.com)

(Source:https://www.businesswire.com)

(Source: https://topconhealthcare.com)

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Solution Type

- Data Masking (static masking, dynamic masking)

- Tokenization (format-preserving tokenization)

- Pseudonymization / Anonymization (k-anonymity, differential privacy, generalization)

- Data Redaction (field-level removal)

- Data Perturbation / Noise Injection

- Encryption for de-identified data (selective encryption)

By Deployment Model

- On-premises (appliance/software)

- Cloud (SaaS / managed)

- Hybrid (cloud + on-prem orchestration)

By Data Type Supported

- Structured data (databases, data warehouses)

- Semi-structured data (JSON, XML, logs)

- Unstructured data (documents, images, free text)

- Streaming / real-time data

By Use Case / Application

- Test data management/development & QA

- Analytics & BI (safe analytics)

- Data sharing / collaborations & research (including healthcare)

- Regulatory compliance & reporting (GDPR, HIPAA)

- Customer privacy (marketing, 3rd-party sharing)

- SaaS enablement/vendor integrations

By Industry Vertical

- BFSI (banking, financial services)

- Healthcare & Life Sciences

- Retail & E-commerce

- Telecom & Media

- Public Sector / Government

- Manufacturing & Automotive

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting