What is the Dehumidifier Market Size?

The global dehumidifier market size was estimated at USD 4.44 billion in 2025 and is predicted to increase from USD 4.73 billion in 2026 to approximately USD 8.31 billion by 2035, expanding at a CAGR of 6.47% from 2026 to 2035. The rising adoption of dehumidifiers in commercial spaces due to the increasing concerns about climate change is a major factor boosting the growth of the market.

Dehumidifier Market Key Takeaways

- In terms of revenue, the dehumidifier market is valued at 4.44 billion in 2025.

- It is projected to reach 8.31billion by 2035.

- The market is expected to grow at a CAGR of 6.47% from 2026 to 2035.

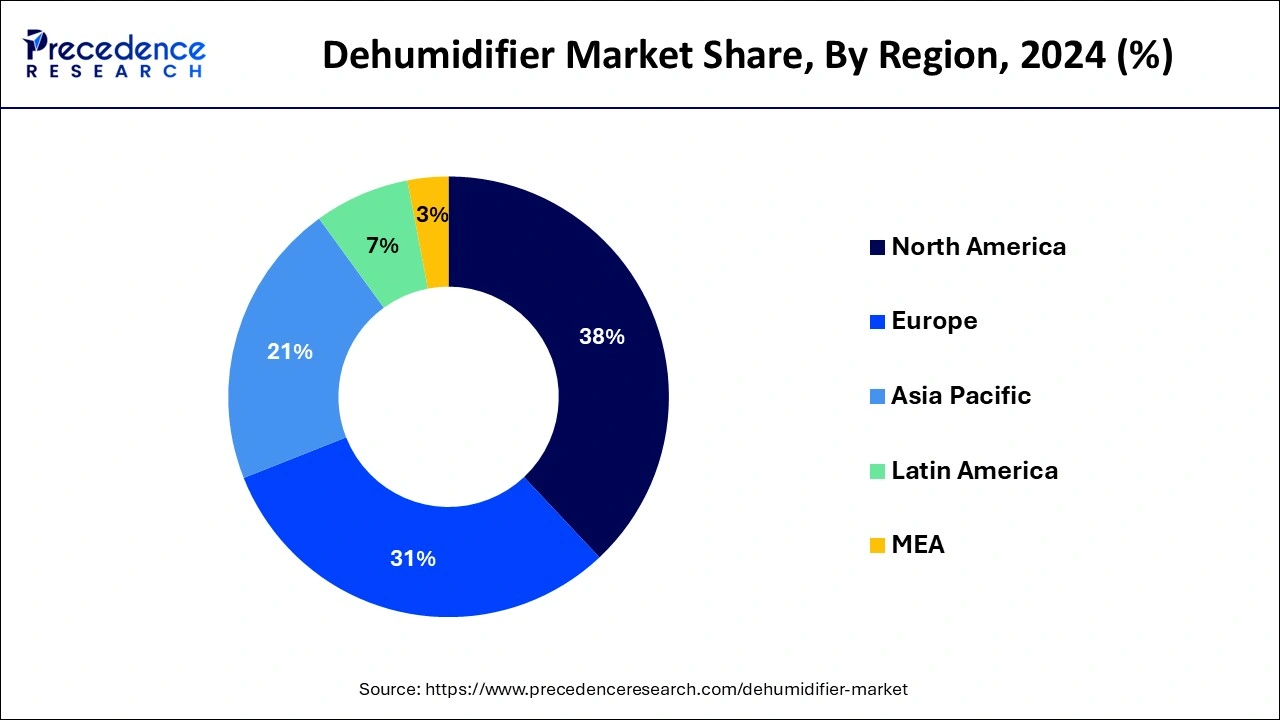

- North America dominated the global market with the largest market share of 48.92% in 2025.

- Asia Pacific is expected to witness the fastest CAGR of growth of 7.21% during the forecast period.

- By technology, the desiccant humidifier segment held the biggest market share of 77.51% in 2025.

- By technology, the thermoelectric dehumidifiers segment is expected to grow at a significant CAGR of 7.95% during the forecast period.

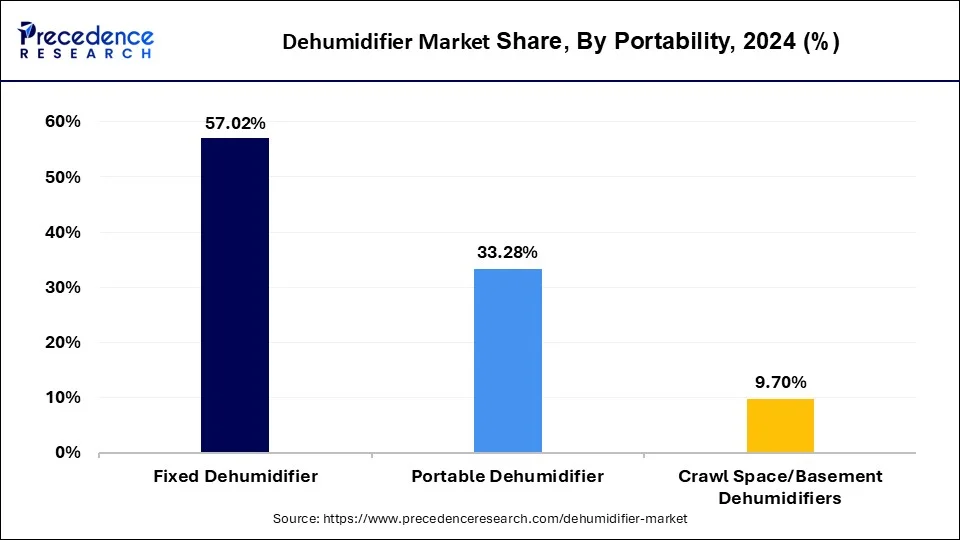

- By portability, the fixed dehumidifier segment captured the highest market share of 57.02% in 2025.

- By portability, the portable dehumidifier segment is expected to grow at a CAGR of 7.18% during the forecast period.

- By application, the industrial segment generated the major market share of 41.65% in 2025.

- By application, the residential segment is expected to grow at a CAGR of 7.02% during the forecast period.

- By capacity, the 30–70 pints segment contributed the biggest market share of 47.02% in 2025.

- By capacity, the Above 70 pints segment is expected to grow at a solid CAGR of 7.03% during the forecast period

- By distribution channel, the offline segment accounted for the biggest market share of 64.06% in 2025.

- By distribution channel, the offline segment is expected to expand at a solid CAGR of 7.81% during the forecast period.

What is a dehumidifier?

Dehumidifiers are appliances designed to reduce and maintain the level of humidity in the air within a specific space. These devices are commonly used in homes, commercial buildings, industrial facilities, and other environments to prevent issues such as mold growth, musty odors, and damage to sensitive materials. The market for dehumidifiers encompasses various types and sizes of these devices, catering to different needs and applications. Some common types of dehumidifiers include refrigerative dehumidifiers, desiccant dehumidifiers, and whole-house dehumidification systems. The market is influenced by factors such as climate conditions, geographical locations, construction trends, and awareness about indoor air quality.

Role of AI in Dehumidifiers

The incorporation of artificial intelligence (AI) algorithms in dehumidifiers enhances their efficiency. AI algorithms automatically adjust the operation of dehumidifiers by monitoring humidity levels, temperature, and airflow in real-time. This automation is important in various sectors where controlling humidity is of utmost priority. Furthermore, AI's predictive maintenance capability helps predict potential failures in dehumidifiers before they arise, which further helps reduce downtime and maintenance costs. The emergence of AI and ML technologies has also paved the way for the development of smart and energy-efficient dehumidifiers.

Dehumidifier Market Data and Statistics

- In September 2023, Quest Climate launched its new dehumidifier created with a small greenhouse, Quest 100.

Dehumidifier Market Growth Factors

- Growing awareness among consumers about the importance of maintaining good indoor air quality, and the potential health risks associated with high humidity levels, drives the demand for dehumidifiers.

- The construction industry's growth, especially in residential and commercial sectors, leads to an increased demand for dehumidifiers. New buildings may require effective humidity control to prevent issues such as mold growth and structural damage.

- Changes in climate patterns and an increase in extreme weather events can contribute to higher humidity levels. As a result, regions experiencing more frequent and intense humidity may see a greater demand for dehumidifiers.

- Ongoing advancements in dehumidifier technology, such as energy-efficient models, smart controls, and integration with home automation systems, attract consumers looking for modern and efficient solutions.

- Concerns related to respiratory health and allergies due to mold, mildew, and dust mites thrive in humid environments. This drives individuals to invest in dehumidifiers to create healthier living spaces.

- Industries such as pharmaceuticals, food and beverage, electronics, and manufacturing often require precise humidity control for production processes. This industrial demand contributes to the growth of the dehumidifier market.

Market Outlook

- Industry Growth Overview: Multi-sector market growth is high due to the demand for health awareness, data centers, and moisture control.

- Sustainability Trends: Refrigerants that are eco-friendly, efficient designs, and intelligent integration minimize the environmental impact of operations.

- Major Investors: LG Electronics, Honeywell International, Munters Group, De Longhi, Haier, Frigidaire, and Electrolux are active investors.

- Startup Ecosystem: Innovators are aimed at small designs, smart systems, and hybrid solutions to niche applications.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.47% |

| Market Size in 2025 | USD 4.44 Billion |

| Market Size by 2035 | USD 8.31Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Portability, Capacity, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increased awareness of the health risks

Growing awareness of health risks associated with high humidity levels is fueling a robust demand for dehumidifiers. As people become more conscious of the impact of indoor air quality on their well-being, the need for effective humidity control solutions is on the rise. High humidity can contribute to the growth of mold, dust mites, and other allergens, leading to respiratory issues and exacerbating allergies. Recognizing these health risks, consumers are increasingly turning to dehumidifiers to create healthier living spaces. The awareness of the link between indoor air quality and various health problems is not only driving demand in residential settings but also in commercial and industrial sectors.

Businesses, healthcare facilities, and educational institutions are investing in dehumidification solutions to maintain optimal indoor conditions, safeguarding the health of occupants and preserving sensitive equipment or materials. This heightened awareness is reshaping consumer priorities, making dehumidifiers a sought-after solution for those seeking to proactively address and mitigate the health risks associated with elevated humidity levels.

Restraint

High initial cost

The high initial cost of dehumidifiers stands as a potential constraint, potentially impeding the widespread adoption of these devices. As consumers increasingly prioritize indoor air quality, the financial barrier posed by the upfront investment in dehumidifiers may hinder their widespread acceptance. In a market where cost considerations play a pivotal role in purchasing decisions, the perceived expense of acquiring a dehumidifier could deter some prospective buyers, particularly in price-sensitive segments.

Moreover, the initial investment may be perceived as disproportionate to the perceived benefits, especially in regions where humidity levels are not consistently high. Potential customers might weigh the cost against alternative solutions or choose to address humidity issues through less expensive means, such as natural ventilation or passive methods.

Opportunity

Advancements in energy-efficient technologies

The ongoing advancements in energy-efficient technologies within the dehumidifier market open up promising opportunities for sustainable growth. As environmental concerns and energy conservation become increasingly integral to consumer choices, the demand for energy-efficient dehumidifiers gains substantial traction. Manufacturers investing in research and development to create innovative, eco-friendly models are well-positioned to capitalize on this emerging market niche.

Moreover, energy-efficient dehumidifiers not only align with the growing global focus on sustainability but also address the longstanding concern of high energy consumption associated with traditional models. Consumers are becoming more discerning, seeking products that not only deliver optimal performance but also contribute to reduced energy consumption, translating into cost savings and environmental benefits.

Technology Insights

The desiccant dehumidifier segment dominated the dehumidifier market with 77.51% in 2025. The segment is observed to continue the trend throughout the forecast period. Desiccant dehumidifiers employ a desiccant material, often silica gel, to absorb moisture from the air. The desiccant material attracts and holds moisture, and the process involves the rotation of a wheel or drum containing the desiccant. Desiccant dehumidifiers are particularly effective in low-temperature environments and are suitable for industrial applications, storage facilities, and areas with specific humidity control requirements.

The electronic/heat pump dehumidifier segment is expected to grow at a significant CAGR throughout the forecast period. Electronic orheat pump dehumidifiers function similarly to air conditioners. They pull in moist air, cool it to condense the moisture, and then reheat the air before releasing it back into the environment. This technology is versatile and suitable for various humidity levels, making it a popular choice for both residential and commercial use.

Global Dehumidifier Market Market Revenue, By Technology2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Refrigerant Dehumidifiers | 788.32 | 836.86 | 886.57 |

| Desiccant Dehumidifiers | 2826.92 | 3021.83 | 3227.82 |

| Thermoelectric Dehumidifiers | 43.50 | 46.71 | 50.09 |

Portability Insights

The fixed dehumidifier segment dominated the market with 57.02% in 2025. Fixed dehumidifiers, also known as whole-house or built-in dehumidifiers, are designed for permanent installation within a building's HVAC (Heating, Ventilation, and Air Conditioning) system. These units are typically larger and more powerful, providing comprehensive dehumidification for an entire home, office, or commercial space. Fixed dehumidifiers offer a centralized solution, integrated into the building's infrastructure to maintain consistent humidity levels throughout the structure. They are ideal for larger spaces or areas where continuous and efficient moisture control is essential.

The portable dehumidifier segment is expected to grow at a CAGR of 7.18% during the forecast period. Portable dehumidifiers are compact, mobile units designed for easy movement from one room to another. They are suitable for smaller spaces, such as bedrooms, offices, or specific areas where temporary dehumidification is required. These units often feature wheels and a handle for convenient transportation. Portable dehumidifiers are popular among homeowners who want flexibility in targeting areas with high humidity levels or dealing with localized moisture issues. They are generally more affordable and offer a plug-and-play solution for on-the-go humidity control.

Global Dehumidifier Market Market Revenue, By Portability2022-2024 (USD Million)

| Portability | 2022 | 2023 | 2024 |

| Portable Dehumidifier | 1203.01 | 1291.91 | 1385.95 |

| Fixed Dehumidifier | 2103.25 | 2235.95 | 2374.58 |

| Crawl Space/Basement Dehumidifiers | 352.48 | 377.53 | 403.95 |

Application Insights

The industrial segment dominated the market with a share of 41.65% in 2025. The industrial segment focuses on dehumidifiers designed for heavy-duty applications in industrial settings. Industries such as manufacturing, pharmaceuticals, food processing, and warehouses often require precise humidity control for production processes, storage of materials, and preservation of products. Industrial dehumidifiers are robust, high-capacity units capable of handling large volumes of air and effectively controlling humidity in challenging industrial environments.

The residential segment is expected to grow at a CAGR of 7.02% during the forecast period. The residential segment encompasses dehumidifiers designed for use in homes and apartments. These dehumidifiers are typically smaller in size and are geared towards maintaining comfortable and healthy indoor environments for individuals and families. Residential dehumidifiers are commonly used in basements, bedrooms, living rooms, and other areas where excess humidity can lead to issues such as mold growth, musty odors, and discomfort.

Global Dehumidifier Market Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Residential | 900.84 | 965.89 | 1034.57 |

| Commercial | 1219.36 | 1305.09 | 1395.45 |

| Industrial | 1538.54 | 1634.41 | 1734.46 |

Capacity Insights

30-70 pints capacity range dominates the dehumidifier market providing outstanding performance in living areas, laundry rooms, and basements in residential and light commercial settings. These units usually remove a large amount of moisture without using excessive amounts of power because they perfectly balance energy efficiency and dehumidification capacity. Homeowners like them because of their Energy Star certification and portable designs which include handles, wheels, and small profiles. Additionally, they are widely accessible through physical stores where customers can compare models and get professional advice.

- On 4 June 2025, Frigidaire announced the release of its new 35-pint Wi-Fi-enabled dehumidifier (FFAD3533), featuring smart humidity control and real-time alerts via mobile app.

Above 70 pins dehumidifier segment is currently the fastest growing, driven by the demands of the large commercial industrial and restoration markets. To control high humidity levels, safeguard delicate equipment, and avoid structural damage, these high-capacity units are being used more and more in data centers, manufacturing facilities, warehouses, and disaster recovery sites. Improved usability and dependability are being brought about by technological advancements such as integrated pumps, auto defrost, and strong digital controls. Additional factors driving demand include improvements in energy efficiency and closer integration with building automation systems.

- On 12 May 2025, BaseAire released their 70-pint commercial dehumidifier with an integrated pump and auto defrost optimized for data center and warehouse environments.

Global Dehumidifier Market Market Revenue, By Capacity, 2022-2024 (USD Million)

| Capacity | 2022 | 2023 | 2024 |

| Below 30 Pints | 1410.17 | 1496.54 | 1586.55 |

| 30–70 Pints | 1711.24 | 1832.83 | 1961.06 |

| Above 70 Pints | 537.33 | 576.02 | 616.87 |

Distribution Channel Insights

Offline retail remains the dominant distribution channel for dehumidifiers motivated by consumers' desire to examine units, evaluate noise levels, and speak with in-store professionals. Stores usually provide live demonstrations, help with installation, and post-purchase support, which is essential for larger units. When choosing models for areas or contrasting technical specifications side by side, this face-to-face integration fosters trust. By bundling installation services alliances with HVAC contractors also increase offline sales.

Online sale is the fastest-growing channel in the dehumidifier driven by consumer demand for convenience, variety, and competitive pricing. E-commerce platforms feature extensive model comparisons, verified reviews, and bundled shipping or installation deals. Smart home-enabled units (with Wi-Fi control, app integration, and Alexa/Google support) are particularly successful online, where tech-savvy buyers seek seamless compatibility and remote monitoring.

- On 18 April 2025, Honeywell launched its 50-pint smart dehumidifier with Amazon for exclusive pricing, featuring Alexa integration and auto restart remote monitoring via the Honeywell home app.

Global Dehumidifier Market Market Revenue, By Distribution Channel, 2022-2024 (USD Million)

| Distribution Channel | 2022 | 2023 | 2024 |

| Online | 1281.88 | 1385.90 | 1496.60 |

| Offline | 2376.86 | 2519.50 | 2667.88 |

Regional Insights

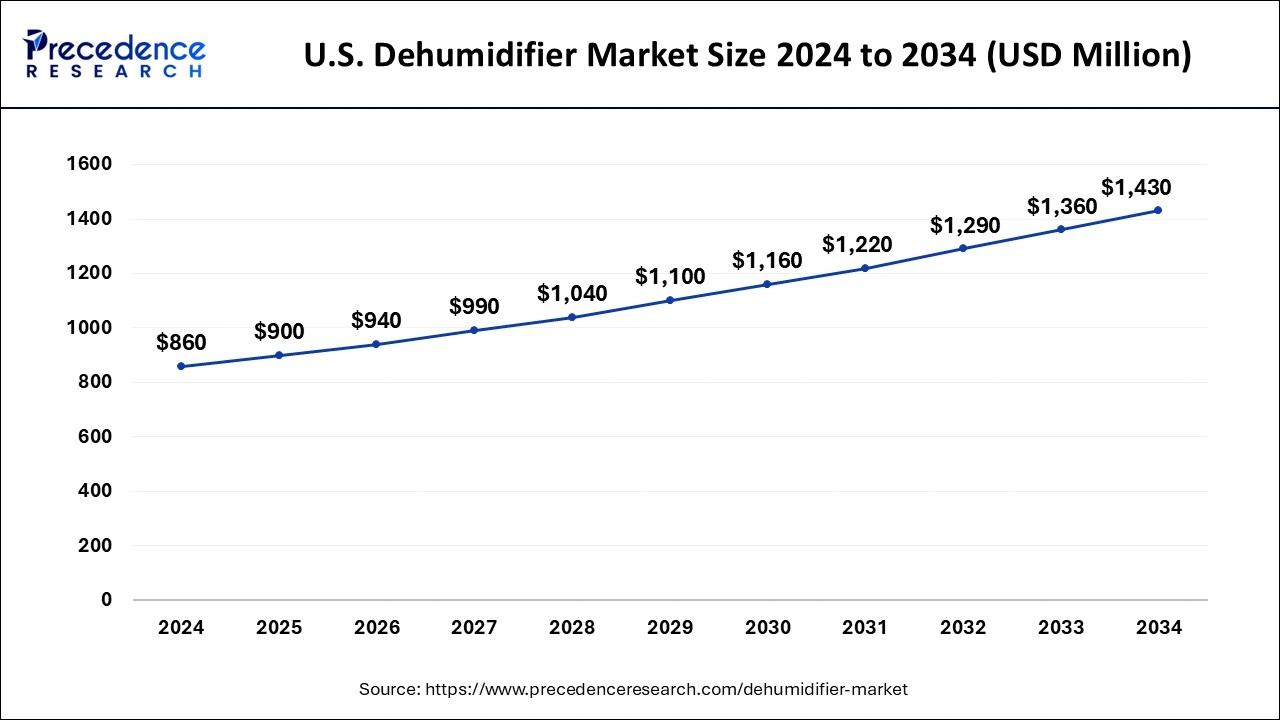

What is the U.S. Dehumidifier Market Size?

The U.S. dehumidifier market size was valued at USD 1.79 billion in 2025 and is expected to reach around USD 3.29 billion by 2035, growing at a CAGR of 6.28% from 2026 to 2035.

North America dominated the market with a 48.92% market share in 2025. particularly in the southern and coastal areas, experience high humidity levels. This creates a consistent demand for dehumidifiers, especially during the warm and humid seasons, to enhance indoor comfort and prevent issues like mold growth. Dehumidifiers are commonly used in residential settings to address moisture-related problems in basements, crawl spaces, and other areas of homes. Consumers are increasingly recognizing the importance of maintaining healthy indoor air quality, which has contributed to the demand for residential dehumidification solutions, which further drives demand for the market across the region.

U.S. Dehumidifier Market Trends

The U.S. is the leader in regional demand with smart connectivity and whole-home systems. Customers desire certified units that are energy efficient. HVAC systems with built-in dehumidifiers are becoming popular. Mobile heavy load units are used in disaster recovery. Indoor air quality standards and residential renovations bring about faster adoption in the country.

Asia-Pacific is poised for rapid growth of 7.21% in 2025 in the dehumidifier market due to many countries in the Asia-Pacific region experiencing high humidity levels due to their climate. This creates a demand for dehumidifiers in residential, commercial, and industrial applications to maintain comfortable and healthy indoor environments. Also, rapid urbanization and ongoing construction activities in the region contribute to the demand for dehumidifiers.

China Dehumidifier Market Trends

China is the fastest emerging manufacturing centre of dehumidifiers. Lithium batteries and electronics are produced mostly by industrial demand. The high-rise building within cities enhances the adoption of housing. Ceiling-mounted and compact designs have become popular. Intelligent inverter models are compatible with the growing smart home systems.

Meanwhile, Europe is growing at a notable rate in the dehumidifier. Europe experiences diverse climates, ranging from humid coastal regions to continental and northern climates. This diversity contributes to varying humidity levels in different parts of the continent, influencing the demand for dehumidifiers. The European market has shown an increased focus on energy efficiency, and this is reflected in the dehumidifier sector. Consumers and businesses alike are inclined toward energy-efficient appliances to reduce environmental impact and operational costs.

What Are the Driving Factors of The Dehumidifier Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. The sustainability requirements and the energy efficiency regulations influence the market of dehumidifiers in Europe. The rate of adoption increases in airtight buildings. Connected systems with smartness are becoming popular. The application extends into pharmaceuticals, data centers, and museum preservation centers.

Germany Dehumidifier Market Trends

Germany focuses on quality-controlled dehumidification of airtight standards of construction. An incorporated ventilation system eliminates mould growth. The industrial industries are emphasizing on energy efficient desiccant solutions. The consumers seek silent high-end portable units. Sustainability objectives promote the use of the same in the automotive, pharmaceutical, and electronics production setups.

Value Chain Analysis of the Dehumidifier Market

- Raw Material Sourcing: Acquires metals, compressors, and electronics that are durable, cost-effective, and reliable production chain supply.

Key Players: Rio Tinto, NLMK, TSMC, Samsung - Component Fabrication and Machining: Transfers metals and circuits into heat exchangers, sensors, and casings using engineering.

Key Players: LG Electronics, Danfoss - Testing and Certification: The safety, efficiency, and regulatory compliance are proven, which enhances reliability, trust, and the ability to be accepted in the market in the long term.

Key Players: UL Solutions, Intertek, SGS, and the Bureau of Energy Efficiency - Installation and Commissioning: Makes sure that things are in place, performance is checked, and that the customers are more than satisfied with the operational deployment being reliable.

Key Players: Johnson Controls, Munters, Honeywell - Distribution and Sales of Dehumidifier: Organizes the logistics, warehousing, and sales channels to achieve the maximum coverage, availability, and maximization of profit.

Key Players: Amazon, Home Depot, Grainger

Dehumidifier Market Companies

- LG Electronics Inc.: Promotes PuriCare dehumidifiers to include Dual Inverter compressors, Wi-Fi control, UVnano technology, and laundry drying attachments.

- Honeywell International Inc.: Offers power-efficient portable dehumidifiers with Smart Dry modes, continuous drainage, timers, and basement-targeted moisture control.

- Haier company: Supplies offer affordable portable dehumidifiers featuring Smart Dry, digital controls, silent running, and safety alarms to residential houses.

Other Major Key Players

- De'Longhi Appliances S.r.l.

- Whirlpool Corporation

- Munters Group

- CondAir Group

- Bry-Air Inc.

- Stulz GmbH

- Danby Products Ltd.

Recent Developments

- In January 2026, Xiaomi launched the Mijia Inverter Purifying Dehumidifier Max in China, aimed at large homes and high-humidity areas. Priced at 3,799 yuan ($544), it offers a dehumidification capacity of 60 liters per day with a dual-rotor inverter compressor. (Source:https://www.gizmochina.com )

- In November 2025, Bry-Air launches the P80x dehumidifier for the pharmaceutical industry, featuring the MIRACLE Next-Gen Rotor powered by MOF technology. This innovation revolutionizes dehumidification, surpassing the 35-year reliance on Silica Gel with ultra-porous materials that enhance drying performance and sustainability. MOFs represent the future of desiccants. (Source:https://www.expresspharma.in )

- In May 2024, Nature's Miracle Holdings Inc. announced the launch of the Company's efinity brand name dehumidifier. The initial roll out of the efinity dehumidifier includes two models: the 345-pint-per-day SJD-07EG model and the 506-pint-per-day SJD-10EG model while the company is working on the even more powerful 876-pint-per-day model.

Segments Covered in the Report

By Technology

- Refrigerant Dehumidifiers

- Desiccant Dehumidifiers

- Thermoelectric Dehumidifiers

By Portability

- Portable Dehumidifier

Fixed Dehumidifier - Crawl Space/Basement Dehumidifies

By Capacity

- Below 30 Pints

- 30–70 Pints

- Above 70 Pints

By Application

- Residential

- Commercial

- Offices

- Schools & Educational Institute

- Hotels & Resorts

- Retail Stores & Supermarkets

- Others (Gyms, Healthcare Facilities, etc.)

- Industrial

- Warehouses

- Manufacturing Plants

- Laboratory

- Printing & Packaging Units

- Shipyards

- Mining Sites

- Others (Data Centers, etc.)

By Distribution Channel

- Online

- Offline

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting