What is the Heat Pump Market Size?

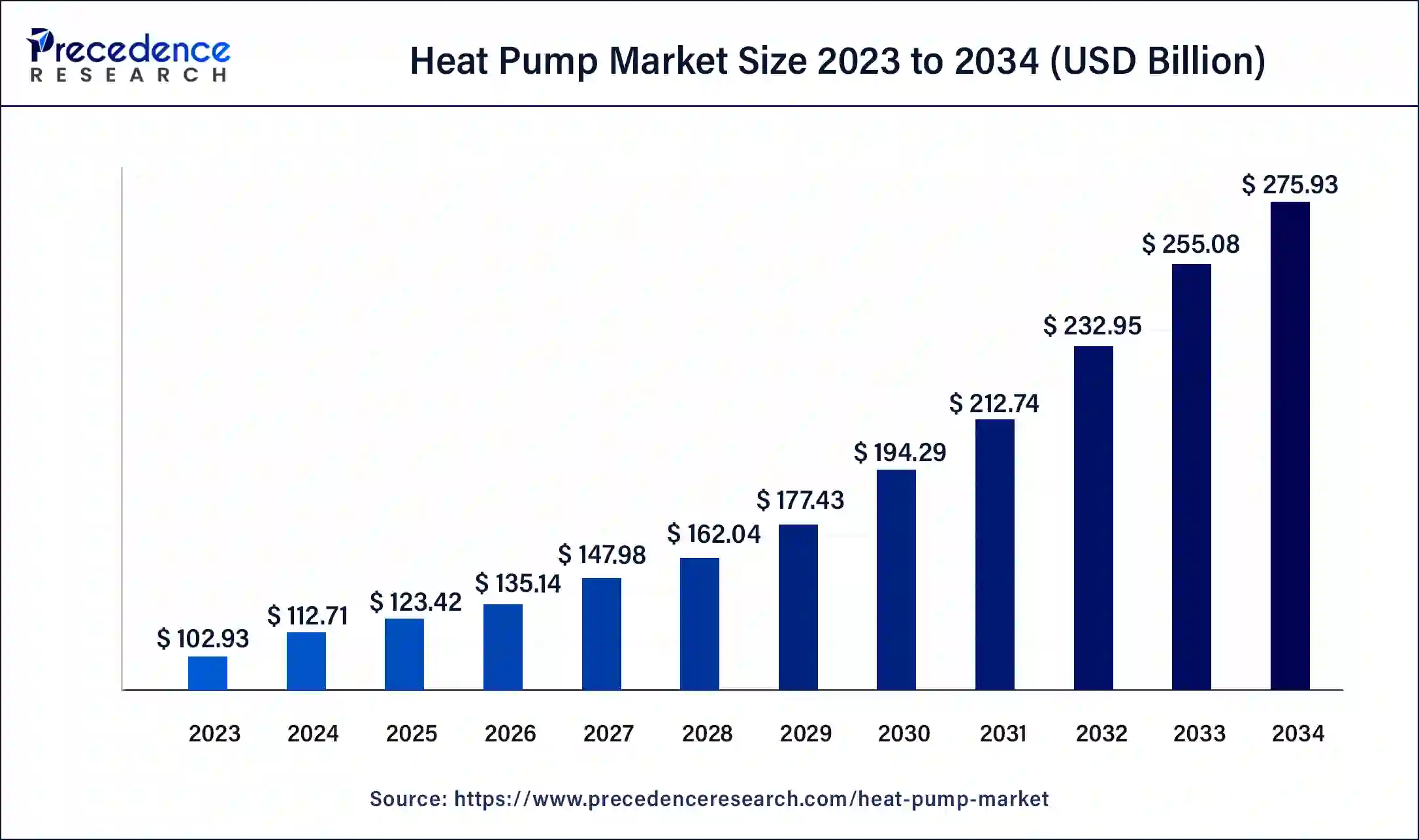

The global heat pump market size is valued at USD 123.42 billion in 2025 and is predicted to increase from USD 135.14 billion in 2026 to approximately USD 297.63 billion by 2035, expanding at a CAGR of 9.2% from 2026 to 2035. The global heat pump market is driven by the rising demand for renewable sources which is aligned with environmental concerns.

Market Highlights

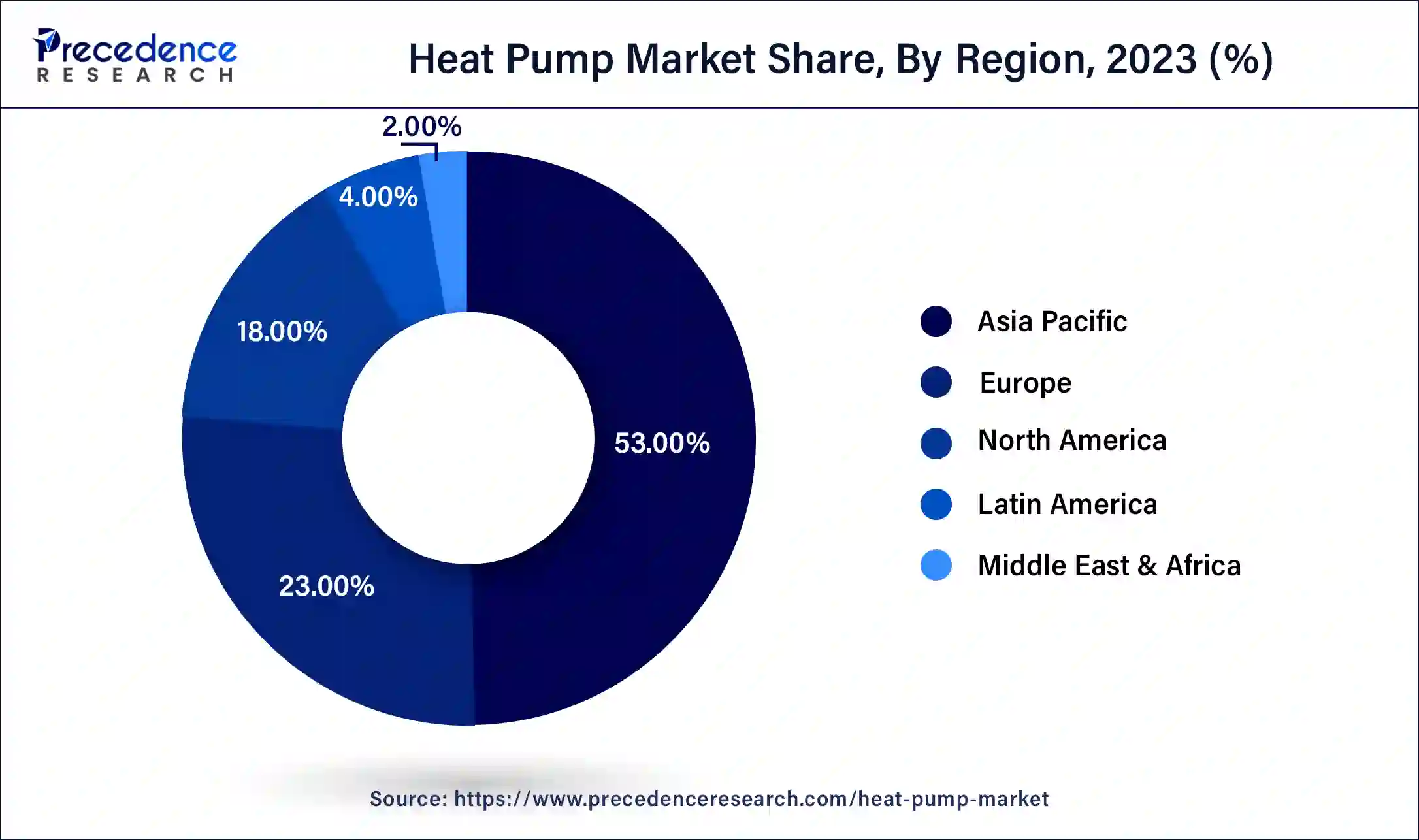

- Asia-Pacific dominated the market with a 53% market share in 2025.

- By technology, the air-source technology segment held the largest market share of 83% in 2025.

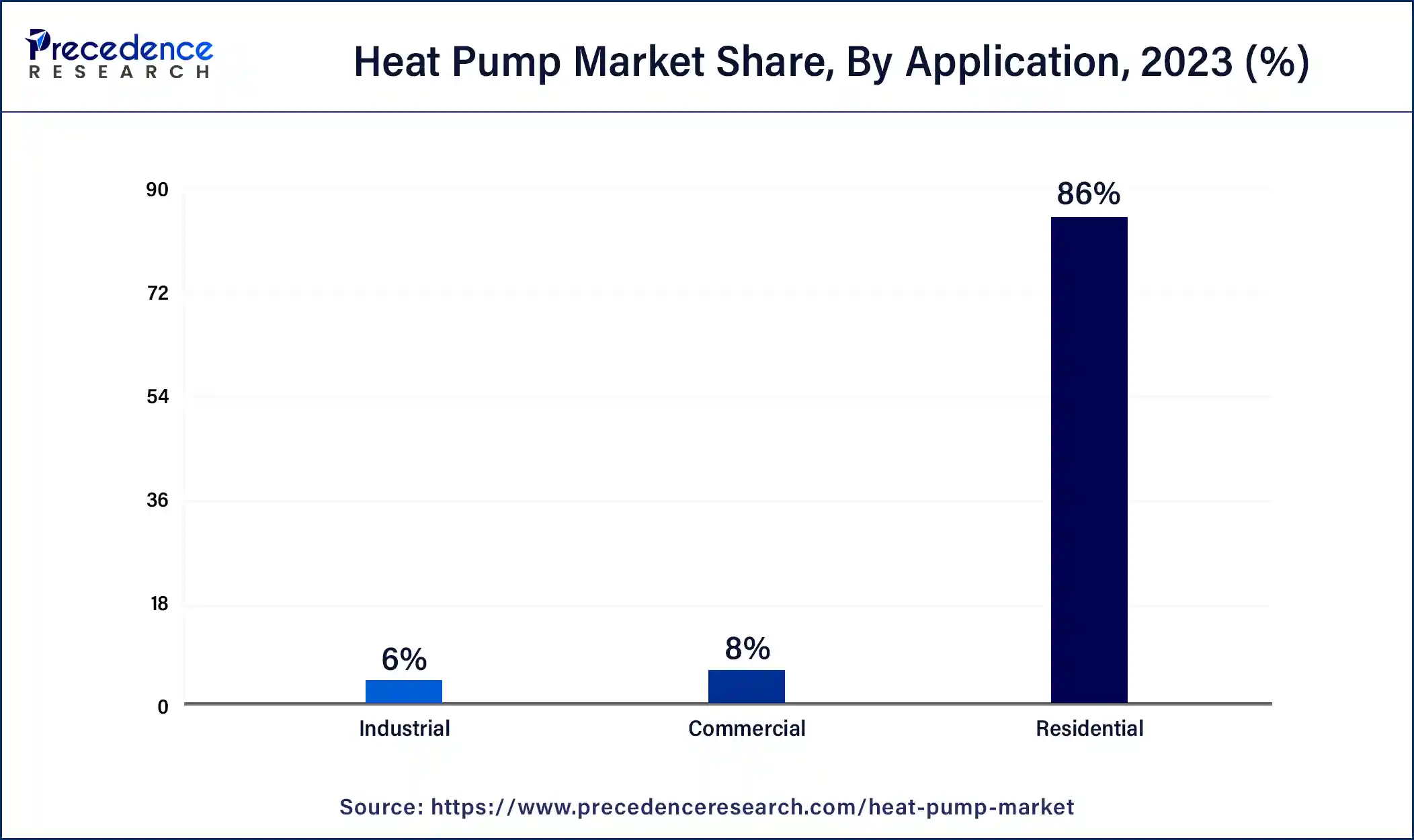

- By application, the residential segment held the dominating share of 86% in 2025.

- By rated capacity, the 10-20 kW segment held the largest market share over 23% in the heat pump market.

Market Overview: Strategic Overview of the Global Heat Pump Industry

The market for heat pumps has expanded significantly in recent years due to the growing focus on sustainable heating solutions and energy efficiency. Heat pumps are becoming increasingly well-liked as adaptable and environmentally responsible replacements for conventional heating systems. Heat pumps draw heat from the air, earth, or water. The market is growing due to factors such as increasing public awareness of environmental issues, government subsidies encouraging the use of renewable energy, and developments in heat pump technology. With an emphasis on lowering carbon footprints, the market for heat pumps is expected to grow further because it is essential to shift to more sustainable and environmentally friendly heating options.

- In November 2023, Bosch has stated that it intends to invest more than €100 million in its Portuguese heat pump manufacturing. The German manufacturer plans to expand two production buildings, additional heat-pump production lines, and new labs in Aveiro, south of Porto. The investment is expected to generate several hundred other jobs over the medium future. Along with Eibelshausen in Germany and Tranas in Sweden, Bosch views Aveiro as a critical location in the European heat pump research and production network. Bosch intends to have invested over €1 billion in the network's development by the end of the decade.

- In September 2023, Rendesco invested £150 million in ground-source heat pumps for new development in the UK. The housing industry will be able to install 600,000 heat pumps annually by 2028, as per the UK government's goal.

- In December 2022, Ground source heat pump (GSHP) and geothermal heating and cooling services provider GEOptimize, Inc. was successfully acquired by Endurant Energy, an innovator of distributed energy resources (DERs).

Artificial Intelligence: The Next Growth Catalyst in Skilled Nursing Facilities

Artificial intelligence increases the efficiency and sustainability of full heat pump realization through intelligent control and optimization. Machine learning is utilized to analyze data for design and sizing optimization, while the control system performs real-time monitoring, linking performance with prevailing conditions. Predictive maintenance reduces downtime by anticipating fault occurrences and responding before they occur, while enhancing comfort in regard to adjusting to user preferences. Additionally, the supports from AI in integration with renewable energy systems and smart grid promote energy management. In general, AI historically provides a range of adaptive solutions towards energy efficiency objectives within the heat pump market.

Heat Pump Market Growth Factors

Numerous reasons have contributed to the notable expansion of the heat pump market. The growing emphasis on sustainability and energy efficiency is one important factor. Heat pumps are a more energy-efficient option to conventional heating systems for individuals and governments looking for ecologically friendly heating and cooling solutions. Technological developments are also a significant factor in the expansion of the heat pump industry. Consumer interest in heat pump systems has increased due to ongoing research and development efforts producing more dependable and efficient models. The market for heat pumps has increased even further thanks to government policies and incentives that support the use of renewable energy sources. Financial incentives, tax credits, and rebates are frequently provided to promote the use of heat pump systems and lower their cost to consumers.

As consumers become more conscious of the environmental effects of traditional HVAC systems, such as those that run on fossil fuels, their tastes are shifting in favor of more environmentally friendly options like heat pumps. Customers prioritize eco-friendly products, fueling market expansion due to the increased environmental consciousness. Furthermore, the growing building sector, particularly in areas with severe weather, fuels the need for more effective heating and cooling options, which boosts the market for heat pumps. Heat pumps are incredibly versatile since they can both cool and heat subjects.

- Energy Efficiency Focus: The increasing importance assigned to energy conservation at a global level is driving the demand for heat pumps as environmentally sustainable heating and cooling alternatives.

- Governmental Policy Support: Government incentives, rebates, and tax credits are promoting the installation of green heat pump systems in residential and commercial sectors.

- Technological Advancements: R&D continuation is producing newer heat pump models that are smarter, efficient, and reliable.

- Environmentalism: Consumers are increasingly considering preventing pollution through carbon emissions to reduce dependency on fossil fuels, hence drifting towards green HVAC options.

- Expansion in Construction Activities: Rapid expansion of residential and commercial construction, elite climate regions in particular, is creating a demand for efficient thermal systems.

Market Outlook

- Market Growth Overview: The heat pump market is expected to grow significantly between 2026 and 2035, driven by the stringent environmental regulations, energy efficiency and cost savings, and technological advancement.

- Sustainability Trends: Sustainability trends involve refrigerant phase-down and low-GWP alternatives, extreme energy efficiency & decarbonization, and integration with smart technology & grid flexibility.

- Major Investors: Major investors in the market include Daikin Industries Ltd., Johnson Controls, Mitsubishi Electric Corporation, Robert Bosch GmbH, and NIBE Industries AB.

- Startup Economy: The startup economy is focused on smart technology & IoT integration, installation & workforce solutions, and high-temperature & industrial applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 123.42 Billion |

| Market Size in 2026 | USD 135.14 Billion |

| Market Size by 2035 | USD 297.63 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.37% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, Rated Capacity, Refrigerant, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Improved safety and eco-friendliness

Demand for heat pumps is surging, mainly due to the increased focus on increased safety and environmental friendliness. When heat pumps are used instead of conventional heating systems, they drastically lower greenhouse gas emissions. Their effectiveness in removing heat from the ground, the air, or water sources helps reduce energy use, which aligns with international efforts to mitigate climate change. Enhanced safety features primarily drive the adoption of heat pumps. Unlike combustion-based heating systems, heat pumps function without open flames, which lowers the possibility of mishaps involving gas leaks or combustion-related catastrophes. This addresses the issues of indoor air quality and fire threats, making them a safer solution for both commercial and residential applications.

Furthermore, technical developments have resulted in the creation of intelligent and automated heat pump control systems, which improve safety by including functions like automatic shutdown in the event of a malfunction or unusual operating circumstances. This keeps the equipment safer for longer and extends its lifespan. Manufacturers must create heat pumps with the least amount of environmental impact possible as environmental regulations throughout the world become stricter. This covers the use of refrigerants that adhere to stringent efficiency criteria and have a lower global warming potential (GWP). As more people become aware of the long-term advantages of purchasing environmentally friendly heating solutions, the market for heat pumps is expanding.

Restraint

- Higher installation cost

For various reasons, higher installation costs are a significant barrier in the heat pump business. First off, installing heat pump systems typically calls for specific knowledge, which raises labor expenses. The overall cost of installation is further increased by the requirement for qualified specialists to evaluate the location, make the required adjustments, and guarantee correct sizing. Additionally, heat pumps can require particular infrastructure changes, such as ductwork or electrical upgrades, which would raise the installation cost. Potential customers may be turned off by the difficulty of integrating heat pump technology with current HVAC systems, which can increase costs.

Permit requirements and adhering to building rules may occasionally result in more extended installation periods and higher expenses. Potential consumers are discouraged from implementing heat pump solutions because of this and the need for high-quality components and sophisticated controls, which raises the total cost of ownership. The increased initial installation costs ultimately deter consumers and businesses from switching to heat pumps, which hinders the general uptake of this energy-saving innovation.

Opportunity

- Better humidity control and air quality

Heat pumps with built-in humidity control features create a more comfortable interior atmosphere by controlling moisture levels, which is especially helpful in areas with different humidity levels. Effective humidity management lessens the heat pump's workload, increasing energy efficiency. Users will benefit from decreased energy use and operating expenses as a result.

Ventilation can be added to advanced heat pump systems to bring fresh outdoor air. Better air quality is maintained, and indoor contaminants are lessened. Certain heat pump types have advanced air filtration systems capable of removing pollutants, dust, and allergies, creating a better living environment and enhancing indoor air quality.

Segment Insights

Technology Insights

In 2025, the air-source technology segment held the dominating share of 83% in the heat pump market. Many significant benefits are causing air source heat pump technology to become more and more dominant in the market. First, it is more affordable than other options like ground source heat pumps. Because air source heat pumps typically have cheaper installation and operating costs, they are desirable for residential and commercial applications. Furthermore, the fact that air source heat pumps don't need significant drilling or ground excavation makes them more straightforward to install and less expensive overall. They are, therefore, a sensible option for adding heating systems to older buildings.

Another reason for the widespread use of air-source heat pumps is their adaptability. They can function well in various weather conditions, even in colder areas. Due to technological developments, they now work better even in cold weather, making them appropriate for multiple climates. Furthermore, air-source heat pumps are more space-efficient because they require less installation area than ground-source heat pumps. Because of this, they are a better choice in confined urban spaces.

- For instance, In July 2023, Guildford-based boiler maker Navien UK introduced a monobloc heat pump. The device is the first monobloc air source heat pump from Navien, and it comes alongside its latest H2 100% hydrogen boiler. It is the most current in a string of creative initiatives that give locals other ways to heat their homes ahead of the government's objective of reaching net zero emissions by 2050.

The water-source technology segment shows significant growth in the heat pump market during the predicted period. Because water source technology is sustainable and efficient, its market share in the heat pump industry has increased significantly. The constant temperature of water sources, like lakes, rivers, or subterranean aquifers, is tapped into by heat pumps that use water as its source. Because water has a higher thermal conductivity than air, this technology uses this property to enable more effective heat exchange.

The increased emphasis on renewable energy solutions and the demand for environmentally friendly substitutes are significant factors propelling this expansion. By utilizing the inherent heat found in water bodies, water source heat pumps help reduce carbon footprints by lowering dependency on fossil fuels.

Water-source heat pumps are more efficient and have lower running costs and environmental advantages than air-source equivalents. Due to its affordability, businesses and consumers have noticed, creating a favorable market trend.

Application Insights

The residential segment held the largest share of 86% in 2025. Residential applications, for several reasons, dominate the market for heat pumps. First, households are looking for alternative heating and cooling options due to the increased focus on sustainability and energy efficiency, making heat pumps a desirable choice. These systems use the ground's temperature or the ambient air to heat and cool, which uses less energy overall.

Technological developments have also improved residential heat pumps' cost-effectiveness, dependability, and efficiency. Improved designs, variable-speed compressors, and smart controls make better efficiency and energy savings possible, which appeal to households looking for cost-effective and ecologically friendly options.

- For instance, In November 2023, LG introduced a propane heat pump for homes that uses air to water. The new product has a seasonal coefficient of efficiency (SCOP) of greater than five and uses propane refrigerant, which has a lower global warming potential. The manufacturer claims that even at -15 C outside, it can reach flow temperatures of 75 C and a 100% heating output.

The industrial segment shows significant growth in the heat pump market during the forecast period. The industrial sector has witnessed substantial growth in the heat pump market due to several key factors. Firstly, the increasing global emphasis on sustainable and energy-efficient technologies has driven industries to adopt heat pumps as an eco-friendly alternative for heating, ventilation, and air conditioning (HVAC) systems. These pumps utilize renewable energy sources, such as air or water, to transfer heat, reducing carbon emissions and operating costs.

Moreover, advancements in heat pump technology have enhanced their efficiency, making them more attractive to industries looking to optimize energy consumption. Heat pumps' ability to provide heating and cooling solutions adds versatility to their applications, addressing the diverse needs of industrial processes. Government incentives and regulations promoting energy efficiency and environmental responsibility have further incentivized industrial players to invest in heat pump systems. Financial benefits, such as tax credits or subsidies for adopting sustainable technologies, have encouraged industries to transition.

Additionally, industries are starting to see heat pumps as strategic investments due to a rising knowledge of the long-term financial benefits of lower operational costs and energy usage. This is especially important for industries like manufacturing and processing facilities with high energy requirements.

Rated Capacity Insights

In 2025, the 10 – 20 kW segment held the largest share of over 23% in the heat pump market. Several causes are responsible for the rise of the 10-20kW segment in the heat pump market. First, this line fits nicely with the growing need for small-scale commercial and residential applications, where efficiency and capacity must be balanced. As energy efficiency gains traction, consumers choose heat pumps in this power range because they minimize energy use while providing necessary heating and cooling. Technological developments have also been crucial. Higher efficiency levels in the 10–20kW range result from improved compressors, heat exchange systems, and componentry, which appeals to consumers more. Manufacturers also create intelligent and networked products that enable customers to optimize energy using remote control and monitoring.

Enhanced awareness and education are further factors driving the market's expansion. The market for these systems is growing as more people become aware of the advantages of 10–20kW heat pumps, such as decreased energy costs and less of an impact on the environment. This positive feedback loop in the heat pump business drives the 10–20kW category to new heights through awareness, technological breakthroughs, and government backing.

Regional Insights

Asia Pacific Heat Pump Market Size and Growth 2026 to 2035

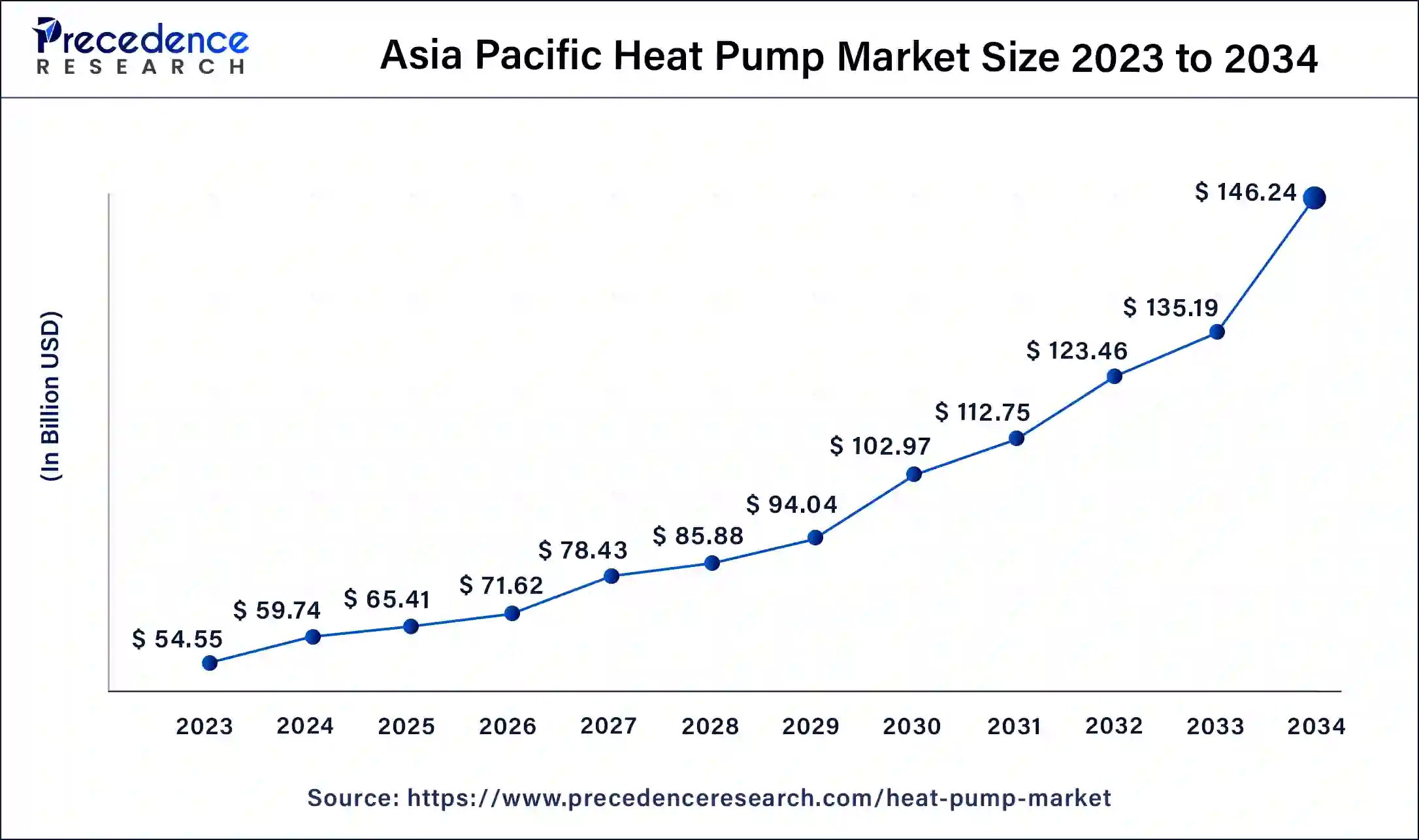

The Asia Pacific heat pump market size is estimated at USD 65.41 billion in 2025 and is predicted to be worth around USD 159.58 billion by 2035, at a CAGR of 9.33% from 2026 to 2035.

Asia-Pacific had the largest market share of 53% in the heat pump market in 2025. The Asia-Pacific region firmly leads the global heat pump market, primarily due to a blend of pivotal factors such as rapid urbanization, robust economic growth, rising disposable incomes, and an increasing focus on energy efficiency and sustainability. Governments in this region have enacted policies that strongly support renewable energy initiatives and environmental conservation, further amplifying the demand for heat pumps across both residential and commercial sectors.

China Heat Pump Market Trends

The Chinese market is growing due to strong government decarbonization policies and increasing urbanization. The dominance of highly effective air-source heat pumps and the adoption of advanced technologies capable of operating in extreme cold. The industry is moving towards low-GWP refrigerants and expanding applications in the industrial sector.

The burgeoning populations and swift urban development in countries like China and India have resulted in a significant rise in residential construction projects, thereby intensifying the demand for energy-efficient heating and cooling solutions, with heat pumps at the forefront. These versatile systems are being widely adopted in residential buildings and various commercial facilities for essential functions such as heating, cooling, and providing hot water.

In North America, the heat pump market is witnessing dynamic growth fueled by several key factors, including a concentrated commitment to energy efficiency, proactive government initiatives that promote the adoption of sustainable heating technologies, and notable technological advancements particularly tailored for cold-climate applications. The region's dedication to diminishing carbon emissions, coupled with a rising demand for efficient heating and cooling systems, serves as the bedrock for this market's expansion. Furthermore, North America is focusing heavily on incorporating energy-efficient products like heat pumps to meet ambitious carbon reduction goals.

The ongoing innovations in heat pump technology have led to the development of remarkably efficient systems, even in challenging cold climates. This increasing necessity for effective heating and cooling solutions within both residential and commercial environments is propelling the growth trajectory of the heat pump market in North America.

- For instance, In November 2023, with $169 million from the previous year's climate bill, the United States will fund nine projects to accelerate the development of heat pumps and other systems that can cool and heat homes and buildings more efficiently. Additionally, the Defense Production Act (DPA) dates to the Cold War and will boost spending on clean energy technologies.

U.S. Heat Pump Market Trends

The U.S. market is experiencing a significant surge driven by powerful federal and state incentives, notably the Inflation Reduction Act. Technological advancements, including the development of high-efficiency, cold-climate heat pumps, are expanding, and the industry is moving towards more sustainable refrigerants and expanding into industrial applications.

Value Chain Analysis of the Heat Pump Market

- Raw Material & Component Manufacturing

This initial stage involves the production and sourcing of essential raw materials and core components, such as compressors, coils (heat exchangers), refrigerants, and electronic controls.

Key Players: Danfoss A/S (compressors and controls), Emerson Electric Co. (compressors), Chemours Company, and Honeywell International Inc. - Product Manufacturing & Assembly

In this core stage, manufacturers assemble the components into finished heat pump units, specializing in various types like air-source, ground-source, and water-source systems.

Key Players: Daikin Industries, Ltd., Mitsubishi Electric Corporation, Carrier Global Corporation, Gree Electric Appliances Inc., and Midea Group Co., Ltd. - Distribution & Installation

After manufacturing, units are distributed through wholesalers, specialized HVAC distributors, and retailers.

Key Players: Ferguson plc., Watsco, Inc., and HVAC contractors - After-Sales Services & Maintenance

This final stage involves providing ongoing maintenance, repairs, and warranty services throughout the product's lifecycle.

Key Players: HVAC contractors, Daikin, and Carrier

Top Companies in the Heat Pump Market & Their Offerings:

- Daikin Industries Ltd.: A global market leader in heating, ventilation, and air conditioning (HVAC) systems, Daikin drives the market by investing heavily in R&D and expanding its European production capacity for residential, commercial, and industrial heat pumps.

- Glen Dimplex Group: As a major European player, Glen Dimplex Group contributes with its portfolio of heat pumps and electric heating solutions, which are well-aligned with the decarbonization efforts in Europe and other regions.

- Ingersoll Rand Plc:While its portfolio extends beyond heat pumps, Ingersoll Rand contributes through its climate solutions business and ongoing investment in energy efficiency and low global warming potential (GWP) alternatives.

- Melrose Industries PLC: Melrose is an industrial investor that previously owned heating and cooling companies, though its focus has since shifted significantly toward aerospace technology.

- Mitsubishi Electric Corporation: A global manufacturer, Mitsubishi Electric contributes by expanding its heat pump production and offering a diverse lineup of high-efficiency systems for both residential and commercial buildings.

- NIBE Industrier AB: A European market leader, NIBE contributes by offering an extensive product range for heating, cooling, and heat recovery, with a particular focus on ground-source heat pumps and integrated systems. They grow their market presence through strategic acquisitions, including entering the North American market through Enertech Global.

- Stiebel Eltron: Stiebel Eltron contributes as a German manufacturer specializing in high-efficiency heating systems, including a strong portfolio of heat pump hot water systems and other electric solutions for indoor climate comfort. Their focus is on high-quality, reliable products and promoting clean, energy-efficient heating technologies.

- Vaillant Group:This major European player contributes by heavily investing in expanding its heat pump portfolio and manufacturing capacity, particularly in Germany, to become a market leader in climate solutions.

- Viessmann Werke GmbH & Co. KG:A leading provider of climate solutions, Viessmann contributes by investing heavily in heat pump technology and providing integrated systems for heating, cooling, and ventilation.

- Panasonic Corporation: Panasonic contributes significantly, especially in the European market, by expanding its production capacity and investing in R&D for air-to-water (A2W) heat pumps.

Recent Developments

- TCL

In March 2025, TCL unveiled a groundbreaking propane heat pump designed specifically for residential applications, marking a significant innovation in the field.

- Ariston

In May 2025, Ariston introduced the NUOS PLUS S2, a smart and energy-efficient heat pump water heater that aims to revolutionize energy consumption in households.

- Mitsubishi Electric Trane HVAC US

In April 2025, Mitsubishi Electric Trane HVAC US launched a novel collection of low Global Warming Potential (GWP) all-electric heat pumps, optimized for performance across diverse climate conditions.

Segments Covered in the Report

By Technology

- Water Source

- Air Source

- Ground Source

- Hybrid Heat Pump

By Application

- Industrial

- Commercial

- Educational Institutes

- Healthcare

- Retail

- Logistics & Transportation

- Offices

- Hospitality

- Residential

- Single Family

- Multi Family

By Rated Capacity

- Up to 10 kW

- 10 – 20 kW

- 20 – 30 kW

- Above 30 kW

By Refrigerant

- R410A

- R407C

- R744

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting