What is the Dental Consumables Market Size?

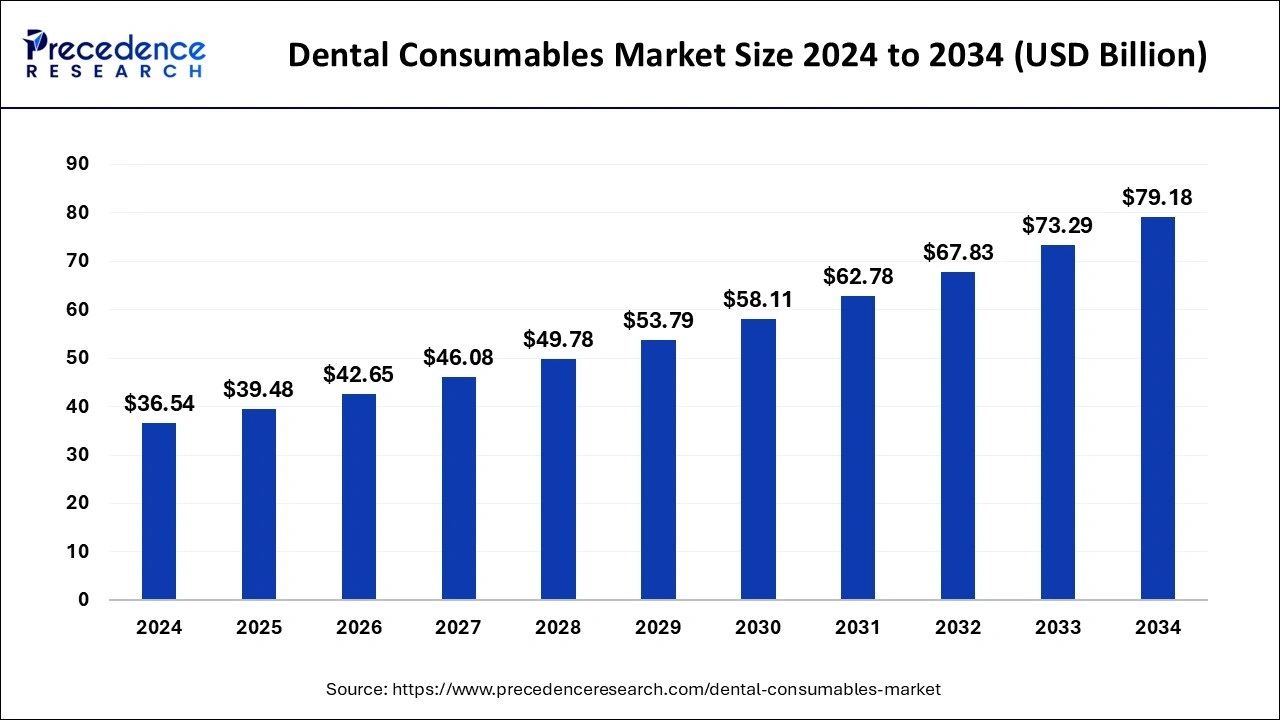

The global dental consumables market size is calculated at USD 39.48 billion in 2025 and is predicted to increase from USD 42.65 billion in 2026 to approximately USD 79.18 billion by 2034, expanding at a CAGR of 8.04% from 2025 to 2034.

Dental Consumables Market Key Takeaways

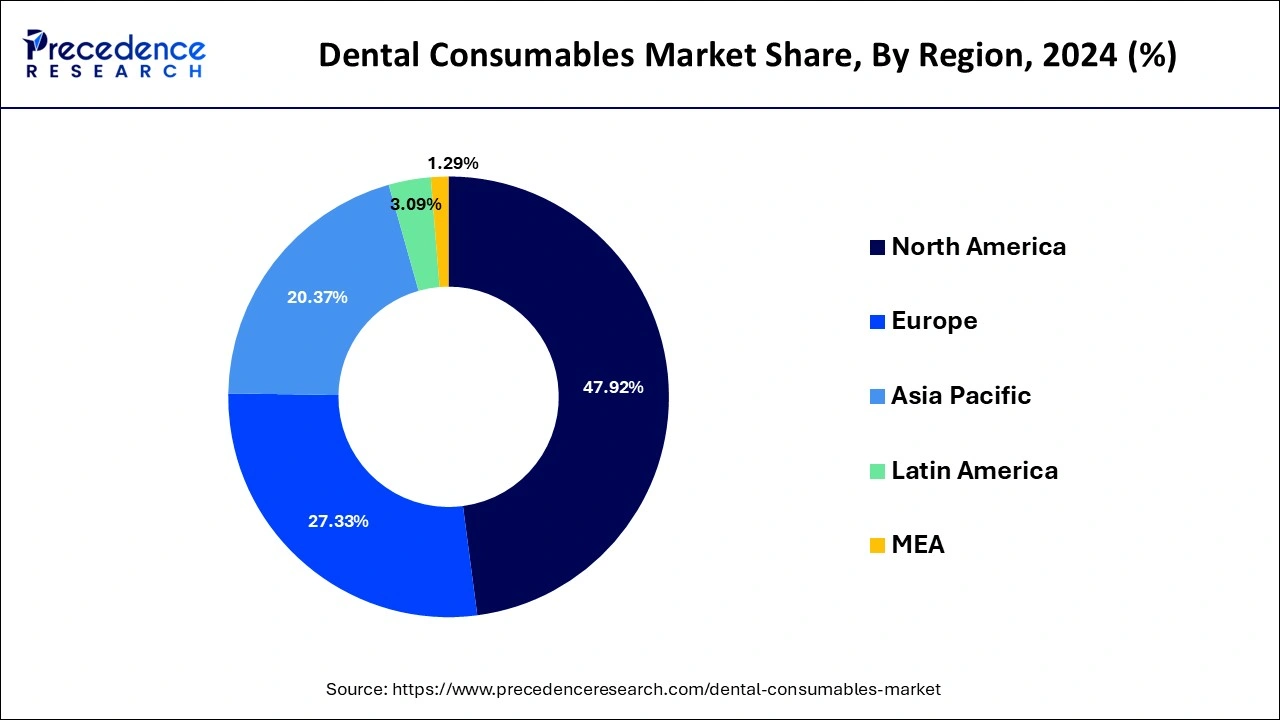

- North America dominated the global market with the largest market share of 47.92% in 2024.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By product, the dental implants segment contributed the highest market share in 2024.

- By end-user, the dental hospitals and clinic segment captured the biggest market share in 2024.

What are dental consumables?

Braces, dental impression materials, prosthetics, implants, and other dental consumables are all examples of dental consumables. They are utilized to treat dental difficulties like tissue problems, tooth restoration, dental caries, periodontal diseases, and dental impairments.

How is AI improving dental industry?

AI in dentistry is composed to alter several aspects of the industry, marking a shift of profound significance. AI algorithms help in the generation of personalized treatment plans by analyzing patient data, including genetic predispositions and medical histories. The application of artificial intelligence AI extends beyond diagnostics and treatment planning to optimize administrative tasks within dental practices. Automated appointment scheduling, electronic health record management systems, and billing processes powered by AI technologies increase operational efficiency, allowing dental professionals to focus more on patient care.

Dental Consumables Market Growth Factors

- An increase in the prevalence of dental illnesses and conditions, as well as an increase in the geriatric population, who are more susceptible to dental disorders and tooth loss.

- Furthermore, in emerging nations, increased dental tourism, increased awareness of oral hygiene, and government support to enhance awareness of dental problems all contribute to the growth of the dental consumables market.

Market Outlook

- Industry Growth Overview:

The dental consumables market is growing, driven by an expansion of the aging global population, rising awareness of oral medical care, an increase in cosmetic dentistry, and the rising prevalence of dental diseases such as caries and periodontal disease. - Global Expansion:

The dental consumables market is experiencing global expansion, as rising awareness in public campaigns and enhanced educational programs are causing people to seek more proactive and consistent dental care, increasing demand for defensive consumables. North America is dominant in the market due to the presence of an advanced healthcare infrastructure and extensive dental insurance coverage. - Major investors:

Major investors in the dental consumables market containing a combination of large, publicly traded companies, private equity organizations, and asset management companies. It includes Dentsply Sirona, Straumann Group, Envista Holdings Corporation, Henry Schein, Inc., and many other companies

Market Scope

| Report Coverage | Details |

| Market Size in 2034 | USD 79.18 Billion |

| Market Size in 2025 | USD 39.48 Billion |

| Market Size in 2026 | USD 42.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.04% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, nad Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Severe periodontal disease, which can lead to tooth decay or loss, is also highly frequent, affecting about 10% of the world's population. In several Asia-Pacific countries, oral cancer is one of the three most frequent cancers. All these factors are driving up the demand for dental consumables in the global market.

The increased use of dental implants in various therapeutic areas, as well as rising demand for prosthetics, are likely to drive the dental consumables market expansion. Oral rehabilitation, which aids in the restoration of a patient's oral function and face form, is a primary driver of demand for dental consumables.

Due to the limitations of detachable prosthesis, such as lack of natural appearance, discomfort, and the necessity of maintenance, the acceptance level of dental implants is increasing among patients and dental surgeons. Prosthetics attached to dental implants doe not impact directly on sensitive tissues and improve aesthetics, which is projected to fuel the growth of the dental consumables market during the forecast period.

The widespread use of computer-aided design or computer aided manufacturing in dental consumables market has resulted in the fabrication of long lasting and precise implant components that is cost effective in nature. Furthermore, this technology allows for non-invasive operations, which reduce recovery time and discomfort while protecting the soft tissues of the teeth.

As a result, growing public knowledge about oral health, economic growth, and the increasing relevance of aesthetic restoration of tooth implants are all expected to propel the dental consumables market forward throughout the forecast period.

Product Insights

The dental implants had the highest revenue share in 2024. This could be due to technological advancements and increased awareness of the benefits of clear aligners and detachable braces, such as easier tooth cleaning compared to fixed braces, lower risk of future gum disease, and improved oral hygiene.

The retail dental care essentials segment is fastest growing segment of the dental consumables market in 2020. The increased knowledge of oral health, an increase in the frequency of dental caries and other periodontal disorders, and an increase in the number of awareness campaigns, undertaken by key companies and the government agencies all contribute to the growth of the segment.

End User Insights

The dental hospitals and clinic had the highest revenue share in 2024. The growing number of dental clinics and hospitals around the world, the rapid adoption of modern technology by small and major dental clinics and hospitals, and expanding dental tourism in emerging economies all contribute to the growth of the segment.

The laboratory segment is fastest growing segment of the dental consumables market in 2020. The dental consumables are used in laboratories on a large scale to discover and develop new products in the market. The extensive research is carried out for the launch of new products in the dental consumables market.

Regional Insights

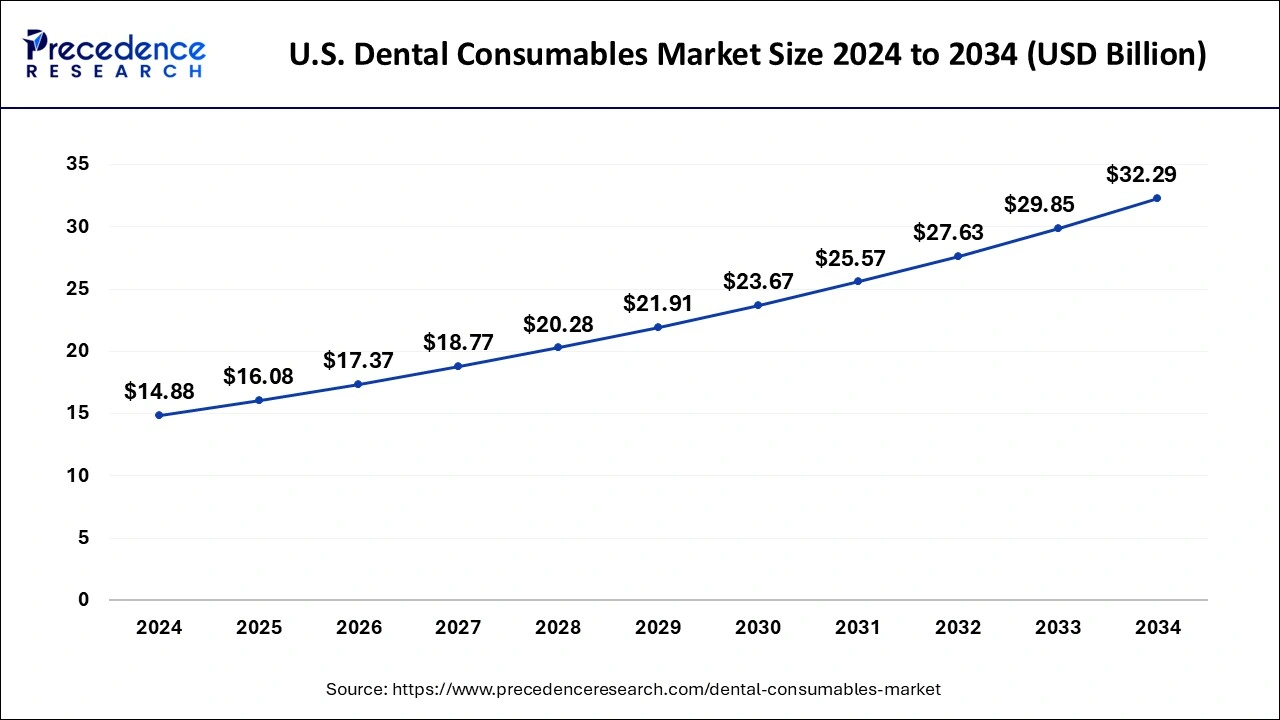

U.S. Dental Consumables Market Size and Growth 2025 to 2034

The U.S. dental consumables market size is exhibited at USD 16.08 billion in 2025 and is projected to be worth around USD 32.29 billion by 2034, growing at a CAGR of 8.06% from 2025 to 2034.

North America dominated the dental consumables market in 2022. The U.S. is predicted to grow during the forecast period, as government healthcare spending rises in relation to people's disposable income.

- In March 2025, Patterson Companies, Inc., a value-added specialty distributor serving the U.S. and Canadian dental supply markets and the U.S., Canadian, and U.K. animal health supply markets, today that its shareholders approved at a special meeting the acquisition of Patterson by Patient Square Capital, a dedicated medical care investment firm. (Source: https://investor.pattersoncompanies.com)

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The Asia-Pacific region's dental consumables market is expanding due to an increase in the number of dental clinics.

Europe is expected to grow significantly in the dental consumables market during the forecast period. The use of dental consumables in the aging population is increasing in Europe. Furthermore, the rising dental awareness and disorders are also increasing the use of dental consumables such as implants, fillings, adhesives, etc. Thus, this in turn promotes the market growth.

UK & Germany Dental Consumables Market Trends

The rising dental awareness in the UK is increasing the use of dental consumables. At the same time, to make the dental services more accessible, various policies, investments, as well as reimbursement are also being provided by the government as well as the private sectors.

The industries in Germany are adopting various advanced technologies for enhancing production as well as new developments. Additionally, various durable and aesthetic materials are being used, as well as the use of 3D printing in the development of dental implants is also increasing. Furthermore, the growing attraction for aesthetic dentistry is also driving the market.

How is North America leading in the Dental Consumables Market?

North America is the largest region in the dental consumables market, mainly because dental problems are very common and the population is aging. Moreover, the area has a great dental care infrastructure, and almost everyone has insurance, plus the incomes are also quite high. The demand for aesthetic dentistry is climbing, and the presence of major manufacturers supports the growth of the region. A top-of-the-line innovation, the early reception of the new products keeps the region ahead in the global market and, as such, the market leader.

United States Dental Consumables Market Trends:

The U.S. is at the forefront of the North American market for dental consumables, thanks to advanced dental technologies and a high concentration of industry players. The rising popularity of cosmetic and restorative procedures is one of the main factors contributing to the growth of the market.

How is Asia-Pacific performing in the Dental Consumables Market?

Asia-Pacific is the region with the highest growth rate, and this is due to the fact that people are becoming more aware of oral health, and their incomes are going up. The government support, the growth of dental tourism, which is particularly noticeable in countries like India, China, and Thailand, is making dental care more accessible to more people. A large number of people moving to towns and cities, along with changes in their lifestyle habits, have resulted in oral diseases being more prevalent, thus making dental consumables more sought after. And the healthcare infrastructure being improved has also made the market potential better.

China Dental Consumables Market Trends:

China is being regarded as one of the fastest-growing markets for dental consumables in the world. An increasing concern for oral health, higher disposable incomes, and various government policies promoting dental hygiene are the main drivers behind the growth.

What are the driving factors of the Dental Consumables Market in Europe?

Europe is still a stronghold in the dental market due to its developed health care system and its legislative backing of the dental industry. The demand for aesthetic and restorative dental procedures has greatly increased as a result of the popularity of these procedures. The main reasons for the market growth are the patient comfort focus, the technological adoption, and the very high-quality care standards. Moreover, the successful implementation of oral health programs supported by the government and trained manpower is are favorable conditions that keep the market stable and mature.

Germany Dental Consumables Market Trends:

Germany is one of Europe's premier dental consumables markets, predominantly due to its sophisticated dental health care infrastructure and strong preventive oral care policies. The country not only has a huge global dental products manufacturing base but also research institutions, which help in the innovation of materials and technologies.

South America: Rising middle class and disposable incomes

South America is experiencing substantial growth in the market because this region is quickly adopting modern dental technologies like digital impressions, 3D printing, and CAD/CAM systems, which surges the demand for associated high-quality consumable products and enhances the effectiveness and accuracy of processes. Economic growth in numerous South American nations has led to an increasing middle class with more disposable spending, which contributes to the growth of the market.

Brazil: Strong Dental Infrastructure

Brazil has a highly advanced dental care technology with a massive number of dental doctors per capita and top-ranking dental schools worldwide. This vigorous professional base helps a vigorous market for dental products and the acceptance of the recently developed technologies.

MEA: High prevalence of dental diseases

MEA is experiencing substantial growth in the market due to in this region rising burden of oral health challenges, including high rates of periodontal diseases, tooth decay, and tooth loss (edentulism). This creates an increased demand for efficient restorative and treatment applications of dental consumables such as implants and prosthetics.

South Africa: Growing awareness and demand for cosmetic dentistry

In South Africa, growing public awareness of oral hygiene and an increasing demand for aesthetic dental procedures like teeth whitening, orthodontics, and veneers. This trend, driven by changing lifestyles and increasing disposable incomes in the middle class, enhancements the demand for associated consumables.

Value Chain Analysis – Drive by Wire Market

R&D:

- The research and development (R&D) process for dental consumables is an organized, many-stage process that generally includes materials science investigation, prototyping, rigorous testing, regulatory approval, and production validation.

- Key Players: Dentsply Sirona, Envista Holdings

Clinical Trials:

- The clinical trial process for dental consumables involves severe preclinical testing (biocompatibility, risk assessment), followed by an organized series of clinical trial phases (I-IV), adhering to particular government policies.

Key Players:Henry Schein, Straumann GroupPatient Services:

- These services allow a broad range of diagnostic, restorative, preventive, and health treatments. They play a significant role in confirming patient safety through infection control and improving patient comfort.

Key Players: Ivoclar Vivadent and ZimVie

Top Vendors in the Dental Consumables Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Myriad Genetics Inc. |

Utah |

strategic collaborations with industry leaders. |

In May 2025, Myriad Genetics, Inc., a leader in molecular diagnostic testing and precision medicine, announced it would share data from seven new research studies. |

|

Guardant Health Inc. |

California |

Innovative Liquid Biopsy Technology |

In November 2025, Guardant Health, Inc., a leading precision oncology company, announced the public launch of the Single Namespace Working Group (SNS), a 34-member, cross-industry consortium that has drafted the first open standard for exabyte-scale data interoperability. |

|

Exact Sciences Corporation |

Madison, Wisconsin |

Precision oncology diagnostics. |

In November 2025, Abbott and Exact Sciences announced a definitive agreement for Abbott to acquire Exact Sciences, which will enable it to enter and lead in fast-growing cancer diagnostics segments, serving millions more people. |

|

Bio-Rad Laboratories Inc. |

United States |

Strong life science research |

Bio-Rad continues to expand diagnostics company partnerships by providing InteliQ products, a range of barcoded, load-and-go quality control tubes. |

Dental Consumables Market Companies

- Agena Bioscience Inc.

- Personal Genome Diagnostics Inc.

- Exosome Diagnostics Inc.

- ANGLE Plc.

- F. Hoffmann-La Roche Ltd.

- Myriad Genetics Inc.

Recent Developments

- In May 2025, a major step forward in the healthcare sector of Nagaland was achieved by the inauguration of the first 3D dental laboratory in the state, which is situated at the Naga Hospital Authority, Kohima (NHAK). To revolutionize the dental treatment by providing affordable, fast, and more accurate solutions is the main goal of this facility. (Source: https://www.msn.com)

- In June 2025, as per the latest announcement on developing the ADA Living Guideline Program, frequent and evidence-based informed recommendations will be provided for oral as well as overall health to the oral healthcare providers and patients. Moreover, it is the first and only known living guideline program devoted to oral health, and is formed by the collaboration between the Center for Integrative Global Oral Health and the American Dental Association (ADA). (Source: https://finance.yahoo.com)

- In January 2024, Dr. Dento, an emerging name in the oral care sector, is proud to launch a new product range just in time for the festive season, marking an exciting step towards well-rounded oral hygiene. The new range focuses on natural ingredients blending in with the magic and spirit of the holiday season to offer professional-grade results while being gentle on gums and teeth. (Source: https://www.business-standard.com)

- March 2025, Mikrona Group AG, a leading Swiss manufacturer, service provider, and distributor of orthodontic products and equipment, has acquired Dental Axess AG, a specialist in digital dentistry operating in Switzerland. Mikrona Group is part of Healthcare Holding Schweiz AG, which is managed by Winterberg Advisory GmbH. (Source: https://dentalaxess.com)

- In March 2025, Solventum partnered with SprintRay to disrupt the digital dentistry market with high-quality, permanent, same-day restorations. In this first-of-its-kind partnership for its Dental Solutions business, Solventum, formerly 3M Health Care, is striving to focus on longevity and durability of permanent same-day restorative dental offerings, reaffirming its commitment to solving the industry's toughest challenges.

- In February 2025, Premier Dental Products Company, a leading developer and manufacturer of consumable dental products, announced its new partnership with Radial Equity Partners. Premier's leading portfolio contains products like Traxodent hemostatic retraction paste, Hemodent hemostatic liquid, and Triple Tray impression trays.

(Source: https://www.businesswire.com) - In May 2023, T-Plus declared that its ST implant system had been made available for sale in the Chinese market after an 8-year NMPA registration procedure.

- In May 2023, Straumann declared the acquisition of GalvoSurge, a manufacturer of dental medical devices based in Switzerland. The firm specializes in implant care and maintenance solutions, with its concept for supporting peri-implantitis treatment, the GalvoSurge Dental Implant Cleaning System GS 1000 - holding a CE mark and has been in the market since 2020.

Segments Covered in the Report

By Product

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Dental Prosthetics

- Three-unit Bridges

- Four-unit Bridges

- Maryland Bridges

- Cantilever Bridges

- Complete Dentures

- Partial Dentures

- Temporary Abutments

- Definitive Abutments

- Crowns

- Bridges

- Dentures

- Abutments

- Veneers

- Inlays & Onlays

- Endodontics

- Endodontic Files (Root Canal Treatment)

- Obturators

- Permanent Endodontic Sealers

- Orthodontics

- Fixed

- Removable

- Bands & Buccal Tubes

- Miniscrews

- Elastomeric Ligatures

- Wire Ligatures

- Brackets

- Archwires

- Anchorage Appliances

- Ligatures

- Periodontics

- Dental Sutures

- Dental Hemostats

- Retail Dental Care Essentials

- Dental Brushes

- Dental Floss

- Specialized Dental Pastes

- Dental Wash Solutions

- Dental Whitening Agents

- Other Dental Consumables

- Straight Handpiece Shank

- Latch Type Angle Handpiece Shank

- Friction Grip Angle Handpiece Shank

- Dental Splints

- Dental Sealants

- Dental Burs

- Dental Impression Materials

- Dental Disposables

- Bonding Agents

- Patient Bibs

- Aspirator Tubes and Saliva Ejectors

By End User

- Dental Hospitals and Clinic

- Dental Laboratory

- Others

By Material

- Metals

- Polymers

- Ceramics

- Biomaterials

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting