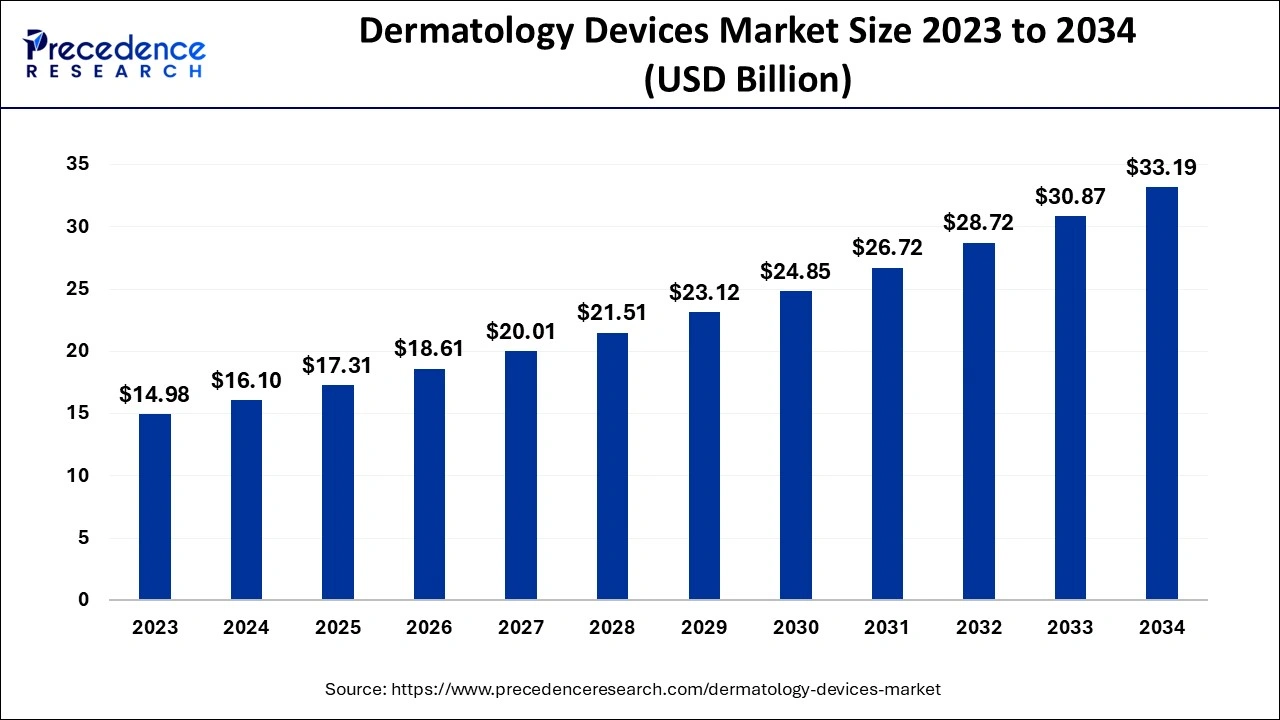

What is the Dermatology Devices Market Size?

The global Dermatology Devices Market size is estimated at USD 16.10 billion in 2024 and is anticipated to reach around USD 33.19 billion by 2034, expanding at a CAGR of 7.50% from 2024 to 2034.

Dermatology Devices Market Key Takeaways

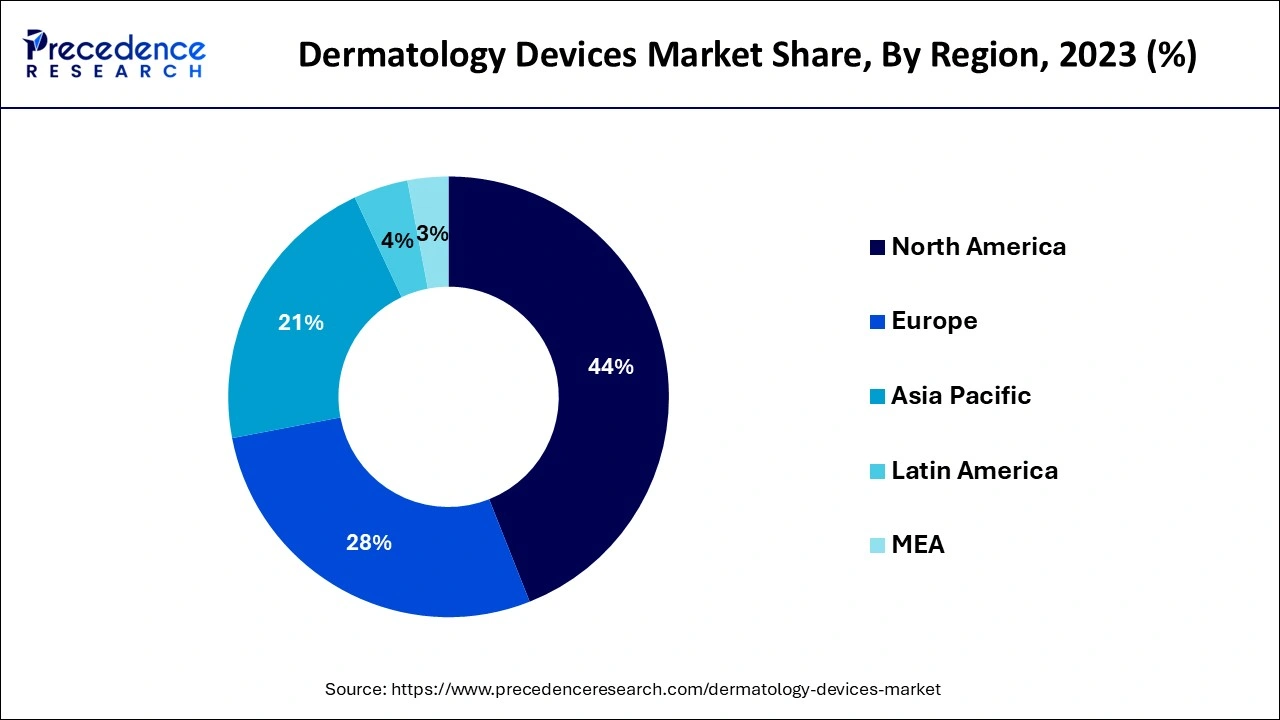

- North America dominated the global market with the largest market share of 40% in 2024.

- Asia Pacific is observed to be the fastest growing during the forecast period.

- By product type, the laser-based devices segment captured the biggest market share of 45% in 2024.

- By product type, the microneedling devices segment is observed to be the fastest growing segment during the forecast period.

- By end-use the dermatology clinics segment contributed the highest market share of 50% in 2024.

- By end-use, the cosmetic surgery centers segment is observed to be the fastest growing during the forecast period.

- By technology, laser technology segment generated the major market share of 50% share in 2024.

- By technology, the radiofrequency technology segment is observed to be the fastest growing during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 17.28 Billion

- Market Size in 2025: USD 19.46 Billion

- Forecasted Market Size by 2034: USD 56.81 Billion

- CAGR (2025-2034): 12.64%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The dermatology devices market is experiencing significant growth driven by increasing prevalence of skin disorders, rising awareness of skin health and aesthetics, and technological advancements that provide minimally invasive and effective treatment options. With the expansion of the cosmetic dermatology segment, demand for devices that can perform skin rejuvenation, scar treatment, and pigmentation correction has surged. Additionally, rising adoption of teledermatology and AI-powered diagnostics is revolutionizing patient care by enabling early detection and remote monitoring. Market growth is further supported by an aging global population seeking solutions for age-related skin conditions, and growing disposable incomes, particularly in emerging economies.

Role of AI in Dermatology Devices Market:

Artificial Intelligence is playing a transformative role in the dermatology devices market by enhancing diagnostic precision, enabling automated image analysis, and supporting decision-making processes. AI algorithms analyze large datasets of skin images to identify patterns and anomalies that may be missed by human eyes, thereby increasing early detection rates of skin cancers and other dermatological conditions. Furthermore, AI integration with imaging devices facilitates personalized treatment planning by evaluating skin type, lesion characteristics, and patient history.

What are Latest Trends in Dermatology Devices Market:

- Integration of Artificial Intelligence (AI) for Enhanced Diagnostics: AI-enabled imaging and diagnostic tools are improving accuracy and reducing diagnostic times for skin cancers and other disorders.

- Rising Adoption of Non-Invasive and Minimally Invasive Technologies: Technologies such as fractional lasers, radiofrequency microneedling, and light-based therapies are preferred due to reduced downtime and fewer side effects.

- Expansion of Teledermatology Services: Remote consultation platforms are growing, enabling patients in remote areas to access specialist care and imaging services.

- Growth in Combination and Hybrid Devices: Devices combining laser, RF, and microneedling technologies to offer synergistic benefits are gaining popularity.

- Increasing Demand for Personalized Skin Treatments: Customizable device settings and AI-driven analysis allow for treatments tailored to individual skin types and conditions.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 17.28 Billion |

| Market Size in 2025 | USD 19.46 Billion |

| Market Size by 2034 | USD 56.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-Use, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East |

Market Dynamics

Market Driver:

Increasing Prevalence of Skin Diseases and Cosmetic Procedures

The rising incidence of skin diseases such as psoriasis, eczema, acne, and particularly skin cancers, is significantly driving the demand for dermatology devices. Moreover, there is an increasing awareness and demand for cosmetic dermatology procedures aimed at improving skin aesthetics, such as laser treatments, microneedling, and phototherapy.

Advancements in minimally invasive technologies have also encouraged more patients to seek treatments with reduced downtime and enhanced safety profiles. For instance, the growing number of patients undergoing treatments for acne scarring or pigmentation issues directly boosts demand for devices like laser systems, cryotherapy units, and light therapy devices, underpinning robust market growth.

Market Restraint

High Cost of Advanced Dermatology Devices

Despite growing demand, the high initial investment and maintenance costs of advanced dermatology devices act as a significant barrier to market expansion, especially in emerging economies. Cutting-edge technologies like fractional lasers, radiofrequency systems, and confocal microscopes involve expensive components, software, and specialized training for healthcare providers. Small clinics and individual practitioners may find it difficult to afford these costs, limiting adoption. Additionally, lack of adequate insurance reimbursement for cosmetic procedures in many regions further restricts patient access, dampening overall market potential.

Market Opportunity

Integration of Artificial Intelligence and Teledermatology

The integration of Artificial Intelligence (AI) and teledermatology in dermatology devices presents a transformative opportunity for this market. AI-powered imaging systems improve diagnostic accuracy, automate lesion detection, and provide risk stratification, enabling early and precise treatment decisions. Simultaneously, teledermatology platforms allow remote patient consultations, expanding access to dermatological care in underserved and rural areas. For example, AI-enabled smartphone dermatoscopes can facilitate rapid screening and triage, reducing the need for in-person visits.

Segmental Insights

Product Type Insights

By product type, the laser-based devices segment led the market with 45% market share in 2024.Laser-based skin rejuvenation devices are the most widely used due to their effectiveness in treating a range of conditions such as wrinkles, sun damage, hyperpigmentation, and acne scars. Their precision, versatility, and consistent clinical results make them a staple in both medical and aesthetic dermatology. The availability of fractional and non-ablative laser technologies has further increased patient preference for these devices, especially those seeking visible improvements with minimal downtime.

By product type, the microneedling devices segment is observed to be the fastest growing segment during the forecast period.Microneedling devices are gaining popularity due to their ability to stimulate collagen production with minimal invasiveness. Often combined with radiofrequency (RF) or serums for enhanced results, these devices are preferred for treating fine lines, acne scars, and skin texture issues. The growing trend toward natural, regenerative aesthetics and the relatively lower cost of microneedling treatments compared to laser therapies contribute to the segment's rapid expansion across both clinical and medspa settings.

End-Use Insights

By end-use, the dermatology clinics segment led the market with 50% share in 2024. Dermatology clinics are the primary providers of skin rejuvenation treatments, given their access to skilled medical professionals and advanced equipment. These clinics offer a wide variety of energy-based and non-energy-based rejuvenation procedures, including laser therapy, microneedling, IPL, and chemical peels. The credibility and trust associated with dermatologist-supervised treatments drive patient preference, contributing significantly to this segment's market leadership.

By end-use, the cosmetic surgery centers segment is observed to be the fastest growing segment during the forecast period.Cosmetic surgery centers are increasingly expanding their offerings beyond surgical procedures to include non-invasive and minimally invasive skin rejuvenation services. These centers often invest in the latest technologies and cater to a clientele seeking comprehensive aesthetic solutions. As consumer interest grows in combination therapies, like pairing laser resurfacing with injectables or skin tightening—cosmetic centers are well-positioned to meet this demand, driving rapid growth in this segment.

Technology Analysis

By technology, the laser technology segment led the market with 50% share in 2024.Laser technology continues to dominate the skin rejuvenation space due to its wide-ranging applications and proven clinical efficacy. From ablative COâ‚‚ lasers to non-ablative fractional lasers, this technology allows for precise treatment of various skin concerns with adjustable intensity and minimal downtime. Laser-based devices are widely adopted in both clinical and aesthetic practices, reinforcing their dominant market share.

By technology, the radiofrequency technology segment is observed to be the fastest growing during the forecast period. Radiofrequency (RF) technology is becoming increasingly popular for non-surgical skin tightening and collagen stimulation. RF devices are safe for all skin types and involve no downtime, making them highly attractive to patients seeking gradual, natural-looking results. The rise of RF microneedling and RF-based combination therapies is expanding the application range of this technology, particularly among younger demographics and those seeking preventive aesthetics, thus fueling its accelerated market growth.

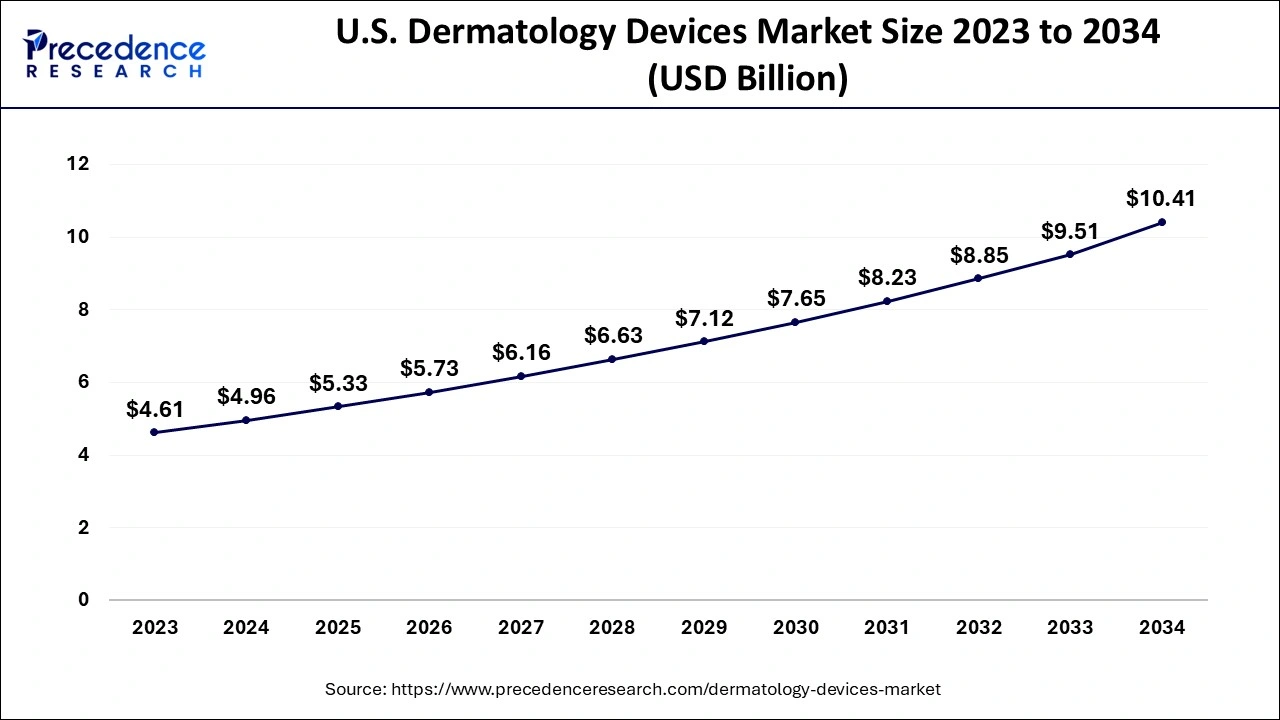

U.S. Dermatology Devices Market Size and Growth 2025 to 2034

The U.S. dermatology devices market size was evaluated at USD17.28 billion in 2024 and is predicted to be worth around USD16.22 billion by 2034, rising at a CAGR of 12.85% from 2024 to 2034.

North America led the market while holding 40% of market share in 2024.This dominance is driven by high consumer demand for aesthetic treatments, advanced healthcare infrastructure, and the widespread availability of technologically sophisticated skin rejuvenation devices. The U.S. in particular has a large base of dermatology clinics, medspas, and cosmetic surgery centers offering laser, RF, and microneedling procedures. Additionally, a strong presence of key industry players and favorable reimbursement policies for dermatologic procedures in certain cases further strengthen the region's leading position

Asia Pacific is observed to be the fastest growing during the forecast period. Asia Pacific's growth is fueled by increasing aesthetic awareness, a rising middle-class population, and growing medical tourism across countries like South Korea, India, and Thailand. The region also benefits from a booming beauty and skincare industry, where skin rejuvenation is seen as both a health and beauty practice. Increasing investments in dermatology clinics, government support for aesthetic innovation, and the adoption of non-invasive treatments are expected to accelerate market growth in the coming years.

Dermatology Devices Market Companies

- Lumenis Ltd.

- Candela Corporation

- Syneron Medical Ltd.

- Cutera, Inc.

- Hologic, Inc.

- Alma Lasers

- Sciton, Inc.

- Zimmer MedizinSysteme GmbH

- El.En. S.p.A.

- Cynosure, Inc.

- Abbott Laboratories

- Merz Pharmaceuticals

- Solta Medical

- Revance Therapeutics, Inc.

- Johnson & Johnson

- Bausch Health Companies

- L'Oreal

- Integra LifeSciences Corporation

- Strata Skin Sciences, Inc.

- BTL Industries

Recent Developments

- Cynosure Elite+ Laser System – Launched March 2025: An advanced dual-wavelength laser platform offering both Alexandrite and Nd:YAG lasers, optimized for various dermatological treatments including hair removal, pigmentation, and vascular lesions. The system includes AI-powered skin analysis software to customize treatment protocols.

- Cutera Secret RF Microneedling Device – Launched January 2025: A hybrid device combining radiofrequency and microneedling technologies designed for skin tightening, scar remodeling, and wrinkle reduction with minimal downtime.

- FotoFinder AI Skin Analysis Tool – Launched June 2024: An AI-powered imaging software integrated with dermatoscopes, enabling real-time lesion detection and risk assessment, improving early skin cancer diagnosis and patient monitoring.

Segments covered in the report

By Product Type

- Laser-based Devices

- Fractional CO2 Lasers

- Diode Lasers

- Pulsed Dye Lasers

- Alexandrite Lasers

- Energy-based Devices

- Radiofrequency Devices

- Ultrasound Devices

- Electrosurgical Devices

- Light Therapy Devices

- LED Therapy Devices

- Intense Pulsed Light (IPL) Devices

- Microneedling Devices

- Motorized Microneedles

- Manual Microneedles

- Cryotherapy Devices

- Cryosurgery Systems

- Dermatome Devices

- Injectable Devices

- Botulinum Toxin

- Hyaluronic Acid Fillers

- Collagen Fillers

- Calcium Hydroxylapatite Fillers

By End-Use

- Hospitals

- Dermatology Clinics

- Cosmetic Surgery Centers

- Medical Aesthetic Centers

- Homecare Settings

By Technology

- Laser Technology

- Non-ablative Lasers

- Ablative Lasers

- Radiofrequency Technology

- Monopolar Radiofrequency

- Bipolar Radiofrequency

- Ultrasound Technology

- High Intensity Focused Ultrasound (HIFU)

- Cryotherapy Technology

- LED & Light Therapy Technology

- Microneedling Technology

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content