What is the Dermatology Diagnostic Devices and Therapeutics Market Size?

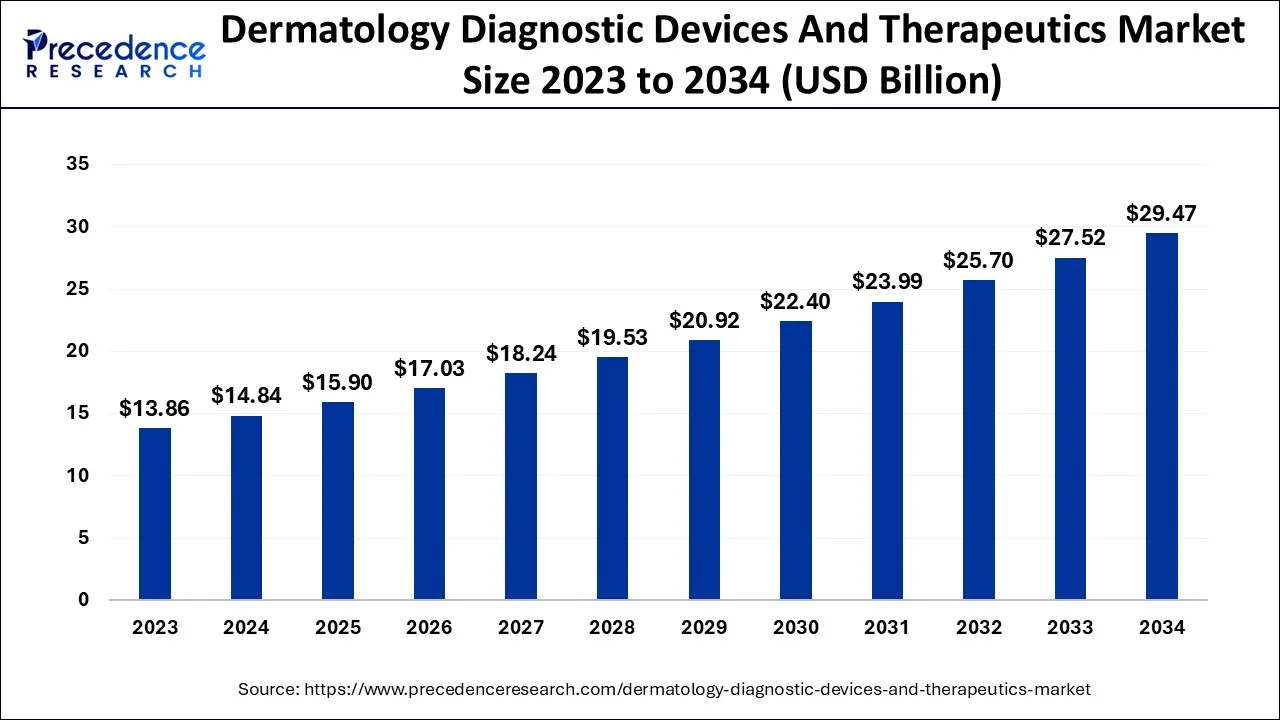

The global dermatology diagnostic devices and therapeutics market size is calculated at USD 15.90 billion in 2025 and is predicted to increase from USD 17.03 billion in 2026 to approximately USD 31.33 billion by 2035, expanding at a CAGR of 7.02% from 2026 to 2035. Dermatology diagnostic devices and therapeutics are used for diagnosing skin wounds, skin-related disorders, pigmentation, acne, and assisting in the diagnosis of skin cancer.

Dermatology Diagnostic Devices and Therapeutics Market Key Takeaways

- The North America region contributed 45% of the revenue share in 2025.

- By diagnostic devices, the imaging equipment segment had the highest revenues in 2025 and is expected to see above-average CAGR growth of 7.96% from 2026 to 2035.

- By application, the hair removal segment has captured a market share of 15% in 2025.

- By end use, the hospitals' segment accounted for a market share of 54.60% in 2025.

Dermatology Diagnostic Devices and Therapeutics Market Growth Factor

The market growth for dermatological diagnostic equipment would be greatly impacted by the rising incidence of skin cancer. UV radiation exposure is a cause of skin cancer. According to the American Academy of Dermatology, 1.9 million individuals were expected to have melanoma in 2019. Additionally, the Skin Cancer Foundation predicts a 2% increase in new melanoma occurrences in 2020. The demand for dermatological devices will also increase during the next years due to the increasing requirement for quick diagnostics of skin cancer and other associated skin problems. The size of the market for dermatological diagnostic equipment will increase over the future years due to technological developments in the field of dermatology. Manufacturers should benefit from these technical developments in order to preserve their place in the market. The adoption of dermatological diagnostic devices will also be influenced by the development of diagnostic tools for treating malignant skin cancer and other conditions like squamous cell carcinoma. Similarly to this, as dermatological diagnostic gadgets become more digitalized, more people will use them, increasing the market's growth. Therefore, the industry of dermatological diagnostic devices will have the potential for significant growth due to ongoing improvements in dermatology equipment. The market for dermatological diagnostic equipment and therapies is gaining momentum due to the proliferation of specialist clinics, in addition to the rise in cases of hair loss and skin illnesses and technological advances in the industry. Additionally, the development of e-commerce and the rise of the cosmetics industry are anticipated to have a beneficial impact on this market. On the other hand, high prices for dermatological diagnostic tools and associated treatments prevent the market from growing more profitably.

- An increase in occurrences of hair loss, skin conditions, and scientific developments

- An increase in patients with skin allergies, fungus infections, and skin cancer due to pollution and environmental changes.

- A high incidence of acne and psoriasis has also been caused by rising pollution, changing lifestyles, and more cosmetic use, which has positively impacted the worldwide market.

- The expansion of the overall market has been attributed to rising healthcare costs as well as the development of new and improved dermatological diagnostic tools, treatments, and equipment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.90 Billion |

| Market Size in 2026 | USD 17.03 Billion |

| Market Size by 2035 | USD 31.33 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.02% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Diagnostic Devices, Application Class, End Use |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America andMiddle East & Africa |

Market Dynamics

Key Market Drivers

Geriatric people are using aesthetic operations more frequently

- The number of people 60 and older in the globe is projected to rise from 880 Mn in 2011 to 2 Bn by 2050, or 22% of the world's population. The increasing degeneration of the skin is a result of aging. Therefore, it is anticipated that older people would become more interested in cosmetic operations like skin tightening and anti-wrinkle therapy.

- Nearly 204000 liposuction operations were carried out in the U.S. in 2019 on patients between the ages of 51 and 64, while 35000 treatments were carried out on patients 65 years of age and above, according to the American Society for Aesthetic Plastic surgery.

Increasing use of non-invasive and minimally invasive aesthetic treatments

- The need for minimally invasive as well as non-invasive cosmetic procedures over standard surgical procedures has increased during the last decade. Alternatives that are minimally invasive or non-surgical provide a number of benefits over more common surgical techniques, including less discomfort, less scars, and speedier healing. These methods are also less costly than customary surgical treatments.

- The market for aesthetic lasers, treatment tools, and cosmetic dermatology is all being driven by the rising demand for aesthetic operations. Such lasers are used for cosmetic operations such as skin rejuvenation, hair removal, treating psoriasis, and acne, removing tattoos, treating pigmented lesions, treating vascular lesions, and treating other skin conditions like psoriasis. The options for beauty treatments have increased thanks to lasers with lengthier wavelengths and better settings, making the aesthetic lasers market profitable.

Key Market Challenges

Clinical risks and complications associated with dermatology procedures

- Over the past 20 years, dermatology procedures have become more and more common. The market has experienced significant growth in demand for cosmetic procedures as a result of the rise in dermatologists as well as surgeons providing safe and effective treatments as well as the development of technologically advanced items for the same. However, there are a number of potential negative effects linked to dermatological operations.

- Patients receiving aesthetic procedures run the risk of infection, skin irritation, pigment changes, organ damage, and anesthesia-related problems, among other things. Red light treatment devices have been blamed for causing blisters and burns, according to reports. Few people have reported getting burned after sleeping with the unit on, while others have claimed getting burned by corroded equipment or faulty wiring. It is anticipated that these issues may hinder the use of dermatological therapies.

Key Market Opportunities

Demand for minimally invasive/non-surgical procedures is rising

- The preference for minimally invasive as well as non-invasive cosmetic procedures over traditional surgical methods has increased noticeably during the past 10 years. Compared to typical surgical techniques, minimally invasive/non-surgical therapies provide a number of benefits, such as quicker recovery and less discomfort. Additionally, these procedures are less costly than standard surgical treatments. Cosmetic dermatology, aesthetic lasers, and therapeutic devices are all being impacted by the rising demand for aesthetic procedures.

Advancements in skincare treatments

- Over the past ten years, there has been a discernible rise in the popularity of minimally invasive as well as non-cosmetic operations over standard surgical procedures. Minimally invasive/non-surgical therapies provide a variety of advantages over conventional surgical methods, including speedier healing and reduced discomfort. These methods are also less expensive than conventional surgical procedures. The growing demand for aesthetic operations has an effect on cosmetic dermatology, aesthetic lasers, and therapeutic devices.

Segment Insights

Diagnostic Devices Insights

The market for dermatology has been divided into imaging equipment, microscopes and trichoscopy, and dreamscapes based on diagnostic tools. The report categorizes imaging devices into optical coherence tomography, ultrasound, X-ray, magnetic resonance imaging, and magnetic resonance spectroscopy. Microscopes and trichoscopy are further divided into reflectance confocal microscopy, multispectral photoacoustic microscopy, Raman spectroscopy, and other categories. Additionally, there are three different types of dermatoscopes: hybrid, cross-polarized, and contact oil immersion. These include the sub-segments of imaging equipment, which had the highest revenues in 2023 and are expected to see above-average CAGR growth of 7.96% from 2026 to 2035. The imaging equipment market is booming as a consequence of its successful detection rates, real-time diagnostic picture production, and high sensitivity.

Application Class Insights

With a market share of over 15% in 2025, the hair removal therapy application sector will also have the fastest CAGR between 2026 to 2035. The treatment application segment is further divided into the following sub-segments: cellulite reduction, vascular and pigmented lesion removal, skin rejuvenation, hair removal, acne, psoriasis, and tattoo removal; wrinkle removal and skin resurfacing; removal of wrinkling and age spots; and others. Laser hair removal equipment in particular has been shown to be less uncomfortable and safer for all skin tones and hair colors, which is driving the expansion of this market.

End Use Insights

A major portion of the market, more than 54.60%, was accounted for by the hospital sector in 2025due to the widespread use of cutting-edge dermatological equipment in hospital settings. Numerous visits are made to these facilities for the diagnosis and treatment of skin diseases as a result of the availability of a variety of treatment choices, which in turn promotes the segment's expansion. The end-user category for clinics is anticipated to see the fastest CAGR between 2026 to 2035. Clinics that specialize in the diagnosis and treatment of skin diseases are called dermatology offices. Certified plastic surgeons provide both surgical and nonsurgical procedures in dermatological clinics.

According to TripleTree, the United States will have 14,000 dermatologists and 9,000 dermatology practices in 2020. 34% of all practices were single operations, while 48% of all operations had three or more physicians. Patients frequently attend specialty dermatological clinics for quick and efficient care as the need for specialized dermatology treatments increases, which fuels the segment's expansion. In addition, more people are attending dermatological clinics for treatment and care due to the global growth in skin cancer and melanoma prevalence and the expansion of clinics providing dermatology services.

Regional Insights

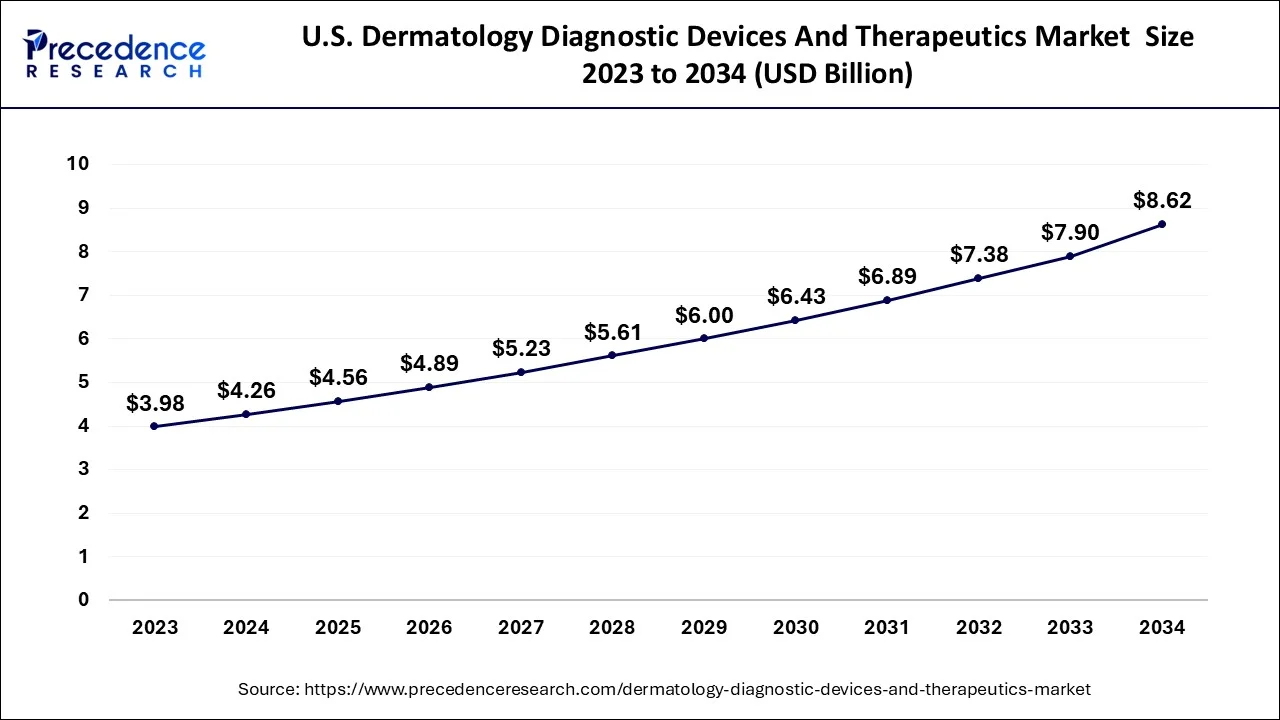

U.S. Dermatology Diagnostic Devices and Therapeutics Market Size and Growth 2026 to 2035

The U.S. dermatology diagnostic devices and therapeutics market size is estimated at USD 4.56 billion in 2025 and is expected to be worth around USD 9.21 billion by 2035, rising at a CAGR of 7.28% from 2026 to 2035.

The region with the highest revenue share in 2025, more than 45%, was North America. During the projection period, the regional market is expected to maintain its dominance and develop at a steady CAGR. The increased prevalence of skin cancer and other skin problems including eczema and rosacea, as well as the expanding usage of cosmetic procedures, are two major factors contributing to the regional market's development. 80% of Americans will encounter acne vulgaris at some time in their lives, and 20% of those people may have severe acne that might leave them permanently emotionally and physically damaged.

U.S. Dermatology Diagnostic Devices and Therapeutics Market Analysis

The market for dermatology diagnostic devices and therapeutics in the U.S. is growing due to rising rates of skin cancer, acne, and chronic skin conditions, as well as greater awareness of the importance of early detection. Expanding access to advanced imaging technologies, increasing use of AI-based diagnostic tools, and higher dermatology visit volumes also support market expansion. Additionally, consumer demand for cosmetic and aesthetic assessments continues to boost adoption.

What Makes Asia Pacific a Rapidly Growing Area in the Market?

From 2026 to 2035, the Asia Pacific regional market is anticipated to develop at the quickest rate. An increase in the number of multinational corporations engaging in R&D in the Asia Pacific has shown to be a significant driver of the regional market. Rising consumer awareness of beauty is also projected to stimulate product demand, fostering regional market expansion.

India Dermatology Diagnostic Devices and Therapeutics Market Analysis

In India, the market is expanding due to rising cases of skin disorders, worsening pollution, and greater awareness of early detection of skin diseases. Growing access to dermatology services, higher adoption of imaging and digital diagnostic tools, and demand for cosmetic procedures further fuel growth. Government healthcare initiatives and improved clinical infrastructure also support market expansion.

A Notably Growing Region

Europe is expected to grow at a notable rate in the dermatology diagnostic devices and therapeutics market. This is due to the increasing adoption of advanced optical imaging, handheld scanners, and non-invasive tools for more precise assessments. Aging populations, higher patient expectations for personalized skin evaluation, and integration of teledermatology platforms are accelerating adoption. Strong investment in dermatology research and rapid technology upgrades across EU healthcare systems also support expansion.

UK Dermatology Diagnostic Devices and Therapeutics Market Analysis

The market in the UK is expanding due to increasing rates of eczema, psoriasis, and sun-related skin damage, along with rising patient demand for faster, more accurate skin evaluations. Greater adoption of digital dermatoscopes, AI-supported analysis, and teledermatology services in NHS and private clinics also drives growth. Additionally, strong investment in clinical innovation supports broader device deployment.

Value Chain Analysis

Raw Material & Component Supply: This stage involves sourcing biocompatible materials, sensors, optical components, lasers, and chemicals used in dermatology devices and therapeutics.

- Key Players:Thermo Fisher Scientific, Merck Group, and Agilent Technologies.

Technology & R&D Development:Companies and research institutions focus on developing advanced imaging systems, laser therapies, AI-based diagnostic tools, and topical or injectable therapeutics.

- Key Players: Abbott Laboratories, Johnson & Johnson, Cutera, and Lumenis.

Device Manufacturing & Formulation:Diagnostic devices and therapeutic products are manufactured, assembled, and formulated for clinical and consumer use.

- Key Players: Canon Medical Systems, Bausch Health, Syneron Candela, and Allergan.

Top Companies in the Market & Their Offerings

- Galleria S.A.: A company supplying specialized packaging solutions and materials (e.g., tubes, blisters, containers) often used for pharmaceutical and dermatology products.

- Cetera, Inc.: Provides consulting and supply chain services for pharmaceuticals/healthcare, helping dermatology and other medical companies with regulatory support, distribution, and compliance solutions.

- Genentech: A biotech pioneer developing innovative therapies, including dermatology drugs and biologics, often addressing skin diseases, immune-related conditions, and advanced treatments.

- LEO Pharma: Focused on dermatology and skin health, offering prescription treatments and topical medications for conditions like psoriasis, eczema, acne, and other skin disorders.

- Cetera, Inc.: A service provider offering regulatory, distribution, and compliance support to pharma and dermatology product manufacturers.

Other Major Companies

- Canfield Scientific, Inc.

- Novartis International AG

- Valeant Pharmaceuticals International, Inc.

- gfa-Gevaert N.V.

- Michelson Diagnostics Ltd.

- Astellas Pharma, Inc.

- GlaxoSmithKline plc

- Dino-Lite Europe/IDCP B.V.

Recent Developments

- MyFiziq Ltd. has acquired a strategic equity stake in Triage, enabling the company to license Triage AI—a health assistant platform as a SaaS offering in December 2020 that includes the capacity to do dermatological diagnoses.

- Nikon Corporation unveiled the ECLIPSE Ci-L Plus biological microscope in September 2021. This device does not need to modify the light intensity while changing magnifications. Additionally, it boasts an ergonomic layout that eases the pressure on the body.

Segment Covered in the Report

By Diagnostic Devices

- Dermatoscopes

- Microscopes and Trichoscopes

- Imaging Equipment

By Application Class

- Diagnostic Devices

- Skin Cancer Diagnosis

- Other

- Treatment Devices

- Hair Removal

- Skin Rejuvenation

- Acne, Psoriasis, and Tattoo Removal

- Wrinkle Removal and Skin Resurfacing

- Body Contouring and Fat Removal

- Cellulite Reduction

- Vascular and Pigmented Lesion Removal

- Others

By End Use

- Hospitals

- Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting