What is Digital Ad Spending Market Size?

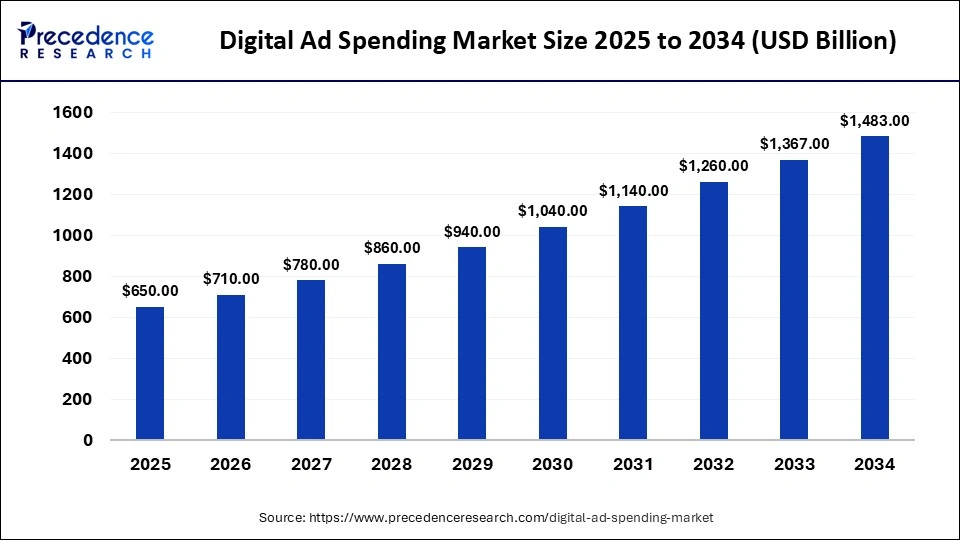

The global digital ad spending market size accounted for USD 650.00 billion in 2025 and is expected to exceed around USD 1,593 billion by 2035, growing at a CAGR of 9.38% from 2026 to 2035. It refers to the expenditure on advertising related to the Internet on devices like computers, mobile devices, and smart devices. The digital ad spending market has improved during and posts COVID. The pandemic has actually accelerated the shift to visual advertising. People are spending a lot more time at home consuming a lot of Internet and therefore the market has grown.

Market Highlights

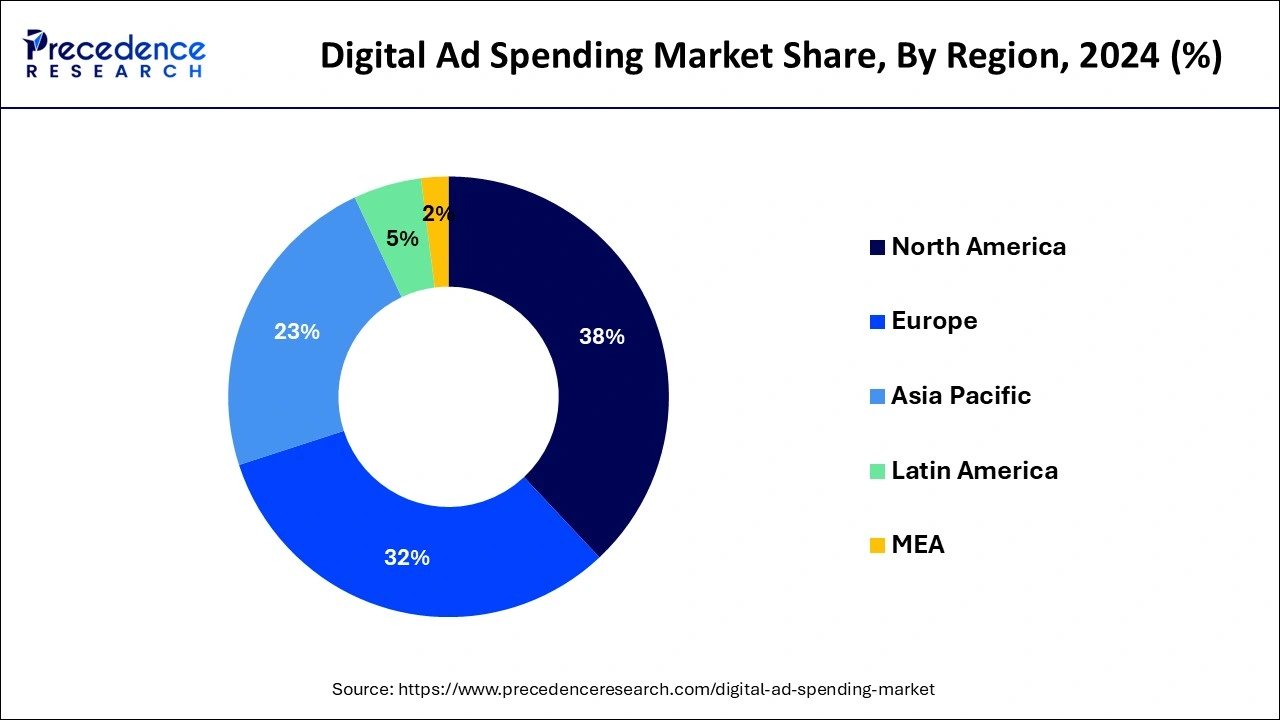

- North America is projected to have the highest market share of 37.15% during the forecast period.

- By add format, the video format segment is expected to capture the biggest revenue share over the forecast period.

- By end user, the retail segment is expected to capture the maximum market share during the forecast period.

Market Overview

- Market Growth Overview: The digital ad spending market is growing rapidly due to increased internet penetration, widespread smartphone usage, and the shift of businesses toward data-driven and performance-based marketing. The rise of social media, video advertising, e-commerce, and AI-powered ad targeting continues to fuel market expansion.

- Global Expansion:The market is expanding worldwide, driven by advertisers reallocating budgets from traditional media to digital platforms to reach targeted and measurable audiences. Emerging regions such as Asia-Pacific, Latin America, the Middle East, and Africa offer strong opportunities due to expanding digital infrastructure, growing online populations, and rising adoption of e-commerce and social media platforms.

- Major Investors: Major investors include global technology companies, digital platforms, media conglomerates, and venture capital firms. These players contribute by investing in advanced ad technologies, AI-driven analytics, programmatic advertising, and expanding digital ecosystems that support advertisers and publishers.

Digital Ad Spending Market Growth Factors

The digital ad spending market has seen a good growth during the pandemic. As there were numerous lockdowns and work from home scenarios, people did not get out of their houses. Which increased the demand for Internet and therefore the online advertising market has grown. The social networking sites and the online portals were attractive and it has resulted in an increase of online population and streaming as there was an uncertainty of the pandemic ending. As there's an increase in digital spending by the enterprises and advancements in the technology the market is expected to grow during the forecast. According to new research by the Advertising Research Foundation, the shorter ads which are six second ads are able to capture 10% to 11% more attention per second than the ads that are longer in duration.

The increasing number of Internet users worldwide have brought about an evolution on the online advertising and given rise to different forms of digital advertising. As the digital world is growing there are entries of new market players and new market levels. Various devices have various types of advertisements but consumers prefer smartphone devices over laptops or desktops as they are convenient and easy to carry. The digital ad spend on mobile platforms is expected to grow well during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 650 Billion |

| Market Size in 2026 | USD 710 Billion |

| Market Size by 2035 | USD 1,593 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.38% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Add Format, Platform Used, and End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Add Format Insights

On the basis of the format of the ad, the video format is expected to grow during the forecast.In the recent years, the spending on traditional television advertisement has declined and the digital video marketing spending has increased and it is expected to rise during the forecast. Maximum investments are done for the mobile and desktop advertising amounting to almost 2/3 of the total advertising budget. Photo video ads are used bymost of the companies as this is the main trend in the recent years as shown by many studies. Visual ads provide a better understanding and involvement in the product.

Platform Used Insights

There is a maximum amount invested on the platforms like smartphones that is mobile phones or the desktops. Most of the video ads, ranging from 6 seconds to 15 seconds are viewed maximum on the smartphones or the desktops.

End User Insights

On the basis of the end user, the retail segment is forecasted to show a good growth amongst all the nations across the world. The pharmacy and the Health Care segment is expected to grow, but at a slow rate. Retail segment is the largest category in the digital ad spends market followed by the automotive sector, financial services, telecom, consumer products, media, entertainment, healthcare and others.

Regional Insights

U.S. Digital Ad Spending Market Size and Growth 2026 to 2035

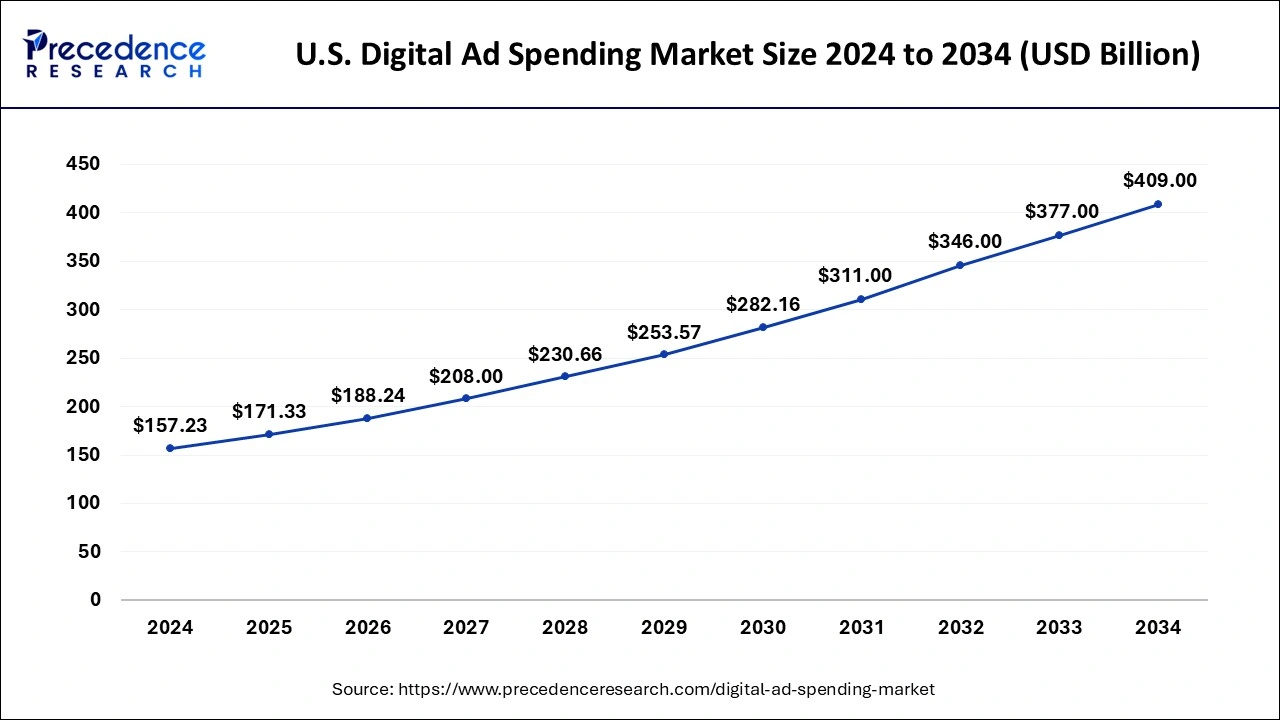

The U.S. digital ad spending market size is evaluated at USD 171.33 billion in 2025 and is projected to be worth around USD 440.3 billion by 2035, growing at a CAGR of 9.9% from 2026 to 2035.

North America occupies the largest market share, as this area is well aware about the use of smartphones and the various online activities. As some of the key market players are located in US. It has got a strong foothold in online advertising. The three prominent global ad agencies, Zenith, Group M and Magna issued their forecast for the marketplace stating that the digital marketplace was driven by digital media, specifically social media apps, Video and search. The countries like UK, US and France top the digital growth chart and they're spending more rapidly on this platform.

The digital spend of Europe is expected to grow by 27.4% and that of North America will grow at 37.5%. The top company, Google, is expected to capture 38.1% global growth. The ad spend on social media is expected to overtake the TV next year. Due to a trend of shopping online during pandemic there were a lot options of ecommerce websites. Businesses are investing in their technology, infrastructure and advertisement. Investment in the e-commerce channels has grown because people are shopping online from their comfort zone. The fastest growth is expected to come from Central and Eastern Europe.

United States Digital Ad Spending Market Trends

The United States is the primary player in North America for digital ad spending, aided by the developed digital ecosystem and the land of size. Other factors, including the presence of major corporations such as Google, Meta (previously Facebook), and Amazon, coupled with a mature e-commerce space, definitely support high levels of digital ad investments across the digital constructs of search, video, and social media.U.S. Census Bureau and IAB reports indicate brands are moving more budgets into programmatic and AI-driven advertising for targeting and possible better return on investment. When one considers the growth of streaming audio and video, as well as travel and influencer-led marketing, it is easy to see why digital ad revenues are expected to hold stout in the U.S.

UK Digital Ad Spending Market Trends

The United Kingdom is a different beast when one evaluates digital ad spending trends in Europe and other markets. With the highest levels of internet penetration in Europe, and a population with a digital device in hand, not to mention an e-commerce culture that continues to thrive, spending more on digital than traditional media is the new norm. Ofcom and the U.K. government's Digital Economy Council highlighted that brands in Britain have digital (especially social, video, and paid search) the top media buy over all other forms of advertising. Despite the challenges arising from the pandemic, London is a tech and media hub and continues to influence decisions of global firms to curate increasingly advanced digital campaigns primarily in the digital media sector. With the rise of AI-based advertising technology and the U.K. government's push to digital transformations in sectors like tourism, health (e.g. NHS apps), and care, it is evident that the U.K. will likely continue to lead the way in Europe.

What Drives the Market in the Middle East & Africa?

The digital ad spending market in the Middle East & Africa is expanding as digital adoption rises, particularly through widespread smartphone usage. Rapid growth in social media engagement and video streaming is driving brands to increase online advertising spend, supported by government and corporate investments in digital infrastructure. Advertisers are increasingly targeting younger, tech-savvy audiences through social and influencer marketing, while programmatic advertising is gaining traction in major urban centers. Despite infrastructure challenges in some areas, the region is positioned for sustained long-term growth.

Saudi Arabia stands out as a regional leader, driven by a strong digital transformation agenda and significant investments under Vision 2030. The UAE follows closely with advanced digital infrastructure and high brand spending on premium digital content. In Africa, South Africa leads due to its mature advertising ecosystem and well-established agencies, while Nigeria is rapidly emerging, supported by its large population, growing internet penetration, and rapid expansion of mobile advertising.

What Potentiates the Market in Latin America?

Latin America's digital ad spending market is growing rapidly as high social media engagement and widespread mobile internet usage push brands to shift away from traditional advertising. Video and social platforms are leading growth, while local influencers and content creators are reshaping brand engagement. The rise of programmatic advertising, economic recovery, and continued expansion of e-commerce are further driving increases in digital ad budgets across the region.

Brazil leads the regional market, supported by its large population, high social media engagement, and a well-developed advertising industry. Argentina is seeing steady gains due to widespread internet access and strong online content consumption. Chile benefits from tech-savvy consumers and high mobile advertising adoption, and Colombia is rapidly emerging as more users come online and advertisers increase focus. Smaller markets across the region are also gradually expanding as digital behaviors continue to spread.

Digital Ad Spending Market Value Chain Analysis

- Advertisers/Brands & Agencies

This stage involves the advertisers and their agencies who initiate the value chain by creating ads, defining target audiences, and setting a budget.

- Ad Tech Platforms (DSPs, SSPs, Exchanges)

The core technology layer of the value chain involves a variety of Ad Tech companies. Demand-Side Platforms (DSPs) like The Trade Desk and Google Ads help advertisers buy ad inventory programmatically, while Supply-Side Platforms (SSPs) like Magnite help publishers sell their inventory.

- Data Providers & Analytics

This crucial stage involves companies that provide data to help advertisers better target their audiences and measure campaign effectiveness.

Key Players of Digital Ad Spend Market and Their Offerings

- Alibaba Group Holdings Limited: Alibaba operates a massive e-commerce and media ecosystem, deriving significant ad revenue by connecting brands with its vast user base across platforms like Taobao and Tmall.

- Google LLC:As a subsidiary of Alphabet Inc., Google dominates the digital ad market through its powerful search advertising platform (Google Search Ads) and extensive network of publishers and video platforms (AdSense, YouTube).

- Baidu Inc:Often called the "Google of China," Baidu is China's largest search engine and a primary platform for search-based advertising in the region.

- Amazon Web Services, Inc:While primarily a cloud computing giant, AWS supports the digital ad market indirectly by providing the essential cloud infrastructure and data analytics capabilities that power numerous ad tech platforms, publishers, and advertisers.

- International Business Machines Corp (IBM):IBM contributes to the digital ad market through its marketing clouds and data analytics solutions, helping businesses manage customer data, optimize campaigns, and ensure compliance with privacy regulations. Their focus is on enterprise-level software solutions that aid in data-driven decision-making and ad performance measurement.

- Verizon Communications Inc:Verizon contributes through its media division (formerly Oath, now Verizon Media/Yahoo), offering a wide range of advertising platforms across its owned properties like Yahoo, TechCrunch, and HuffPost. They leverage their media reach and data insights to provide targeted ad solutions to various advertisers.

- Facebook Inc (Meta Platforms, Inc.):Facebook is a dominant force in social media advertising, providing highly effective targeting tools based on extensive user data across Facebook, Instagram, and WhatsApp. Their advertising platforms are crucial for brands aiming to build awareness, engage with a large global audience, and drive direct sales through social commerce.

- Twitter Inc (X Corp.):Twitter is a unique platform for real-time advertising, offering opportunities for brands to engage with trending topics and public conversations. They contribute to the market by providing advertising formats like promoted tweets, which allow businesses to increase visibility and engagement during significant cultural moments.

- Hulu LLC:Hulu contributes to the digital ad spending market as a major player in the streaming video space, offering premium, ad-supported content. They provide advertisers with targeted opportunities to reach engaged audiences through video ads, leveraging data to deliver relevant and high-impact campaigns.

- Microsoft Corporation:Microsoft contributes to the digital ad market primarily through its search engine (Bing, now Microsoft Bing), its professional networking platform (LinkedIn), and its owned media properties. They provide unique targeting opportunities through platforms like LinkedIn, which is ideal for B2B advertising, and search ads across the Microsoft Advertising network.

Recent Developments

Google launched new features which are aiming at helping the advertisers in using the company services. In order to make their products stand out in the search results on all the platforms which was launched in July 2020? Another feature developed by Google, is to configure the ads in a manner that Google can get related images from the advertiser's online material and include those images in the search results. As there is an increased application of diverse crypto currencies in many industries and many associated regulations that are in place for smooth functioning, Google, who had banned the advertisements of crypto currency, had to reverse the ban in United States. D.A Consortium Inc announced that it shall be newly certified as the Spotify advertising partner by Spotify AB, in order to sell reservation-based ads with the help of its DSP MarketOne.

Microsoft advertising introduced the multifactor authentication on October 2020. Which is now extending the rollout of multifactor authentication for all the users who sign in through a third party application and use the API?

Infectious advertisement, which was appointed by the Advertising Standards Council of India on May 2020, will provide BTL, ATL and digital creative services to ASCI and support for Strategic campaign development and reaching programs for the audience. Facebook has collaborated with L'Oreal, Motorola, Stanley Black and Decker for helping the companies in retail, in wholesale, in manufacturing, in the groceries, in the Consumer Packaged Goods and other verticals to sell more and operate in an efficient manner to seamlessly scale and deliver good customer experience.

Microsoft Advertisement has integrated new features which helped in indicating the dedication to their customers, it helps in aligning the brand values with the values of the customers and how the brand is inclusive of the values of the customers. This feature helps to communicate quickly and it helps in creating a liking for that brand. It increases the authenticity of the brand and builds trust among the customers. This initiative by Microsoft advertisement is exclusive.

Segments Covered in the Report

By Add Format

- Social media

- Video

- Search engine

By Platform Used

- Mobile

- Laptop

- Desktop

By End User

- Retail

- Health care

- Automotive

- Media and entertainment

- Education

- Transport and tourism

- IT and telecom

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting