Digital Commerce Market Size and Forecast 2025 to 2034

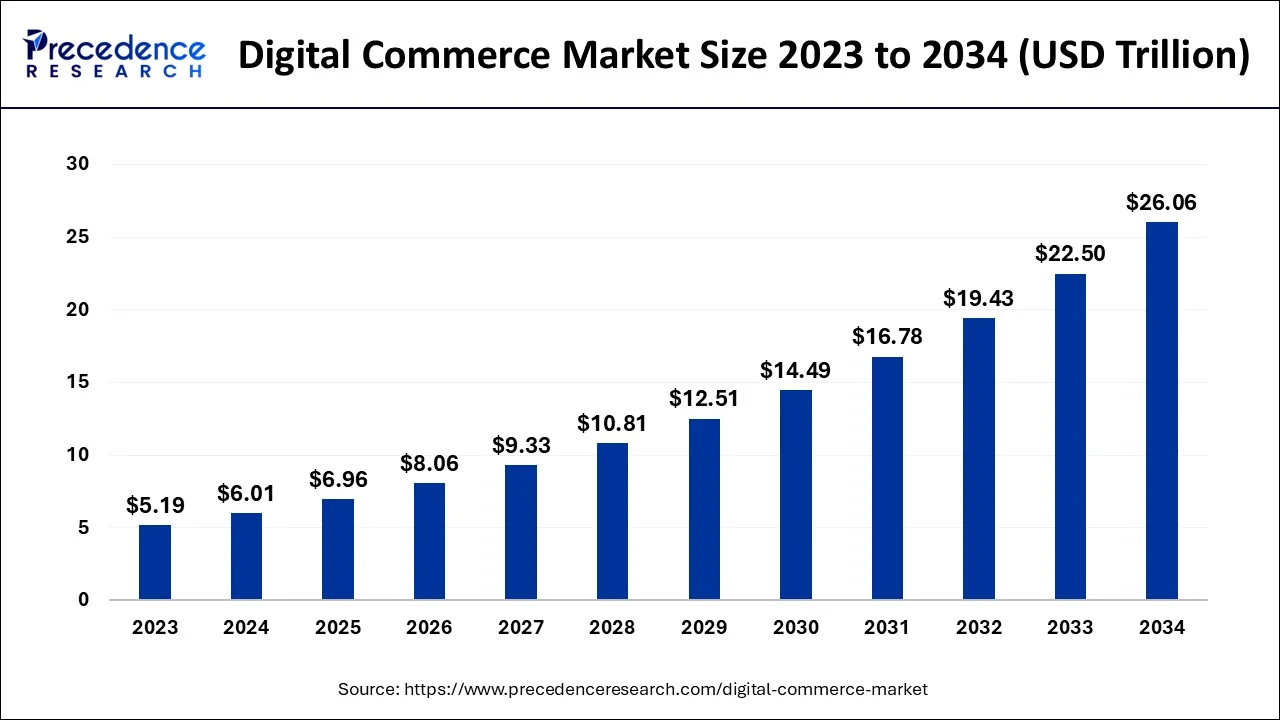

The global digital commerce market size is accounted for USD 6.01 trillion in 2024 and is anticipated to reach around USD 26.06 trillion by 2034, growing at a CAGR of 15.80% from 2025 to 2034.

Digital Commerce Market Key Takeaways

- By component, the solution segment generated the highest revenue share of 62% in 2024.

- By browsing method, the mobile/tablet segment contributed a revenue share of 65% in 2024.

- By business type, the B2B segment hit a revenue share of over 59.6% in 2024.

- By industry vertical, the automotive segment has garnered the highest revenue share of 31% in 2024.

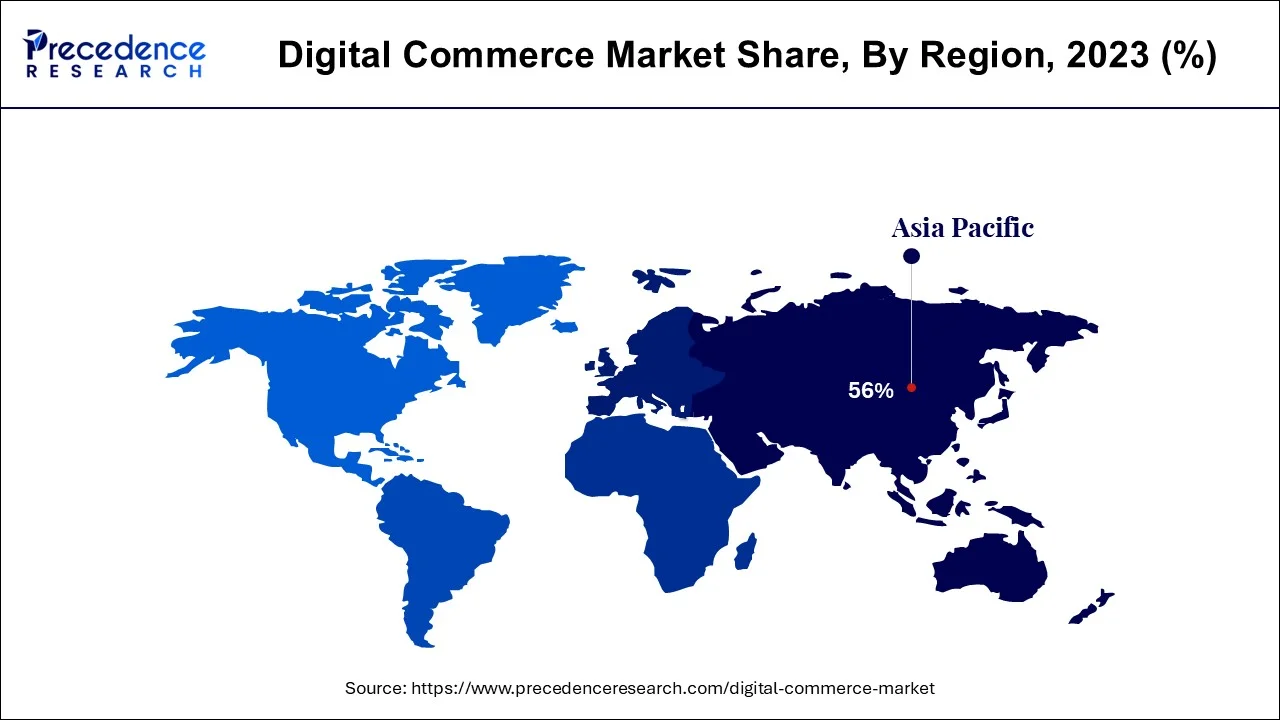

- By region, the Asia-Pacific region dominated the market with a 56% revenue share in 2024.

Asia Pacific Digital Commerce Market Size and Growth 2025 to 2034

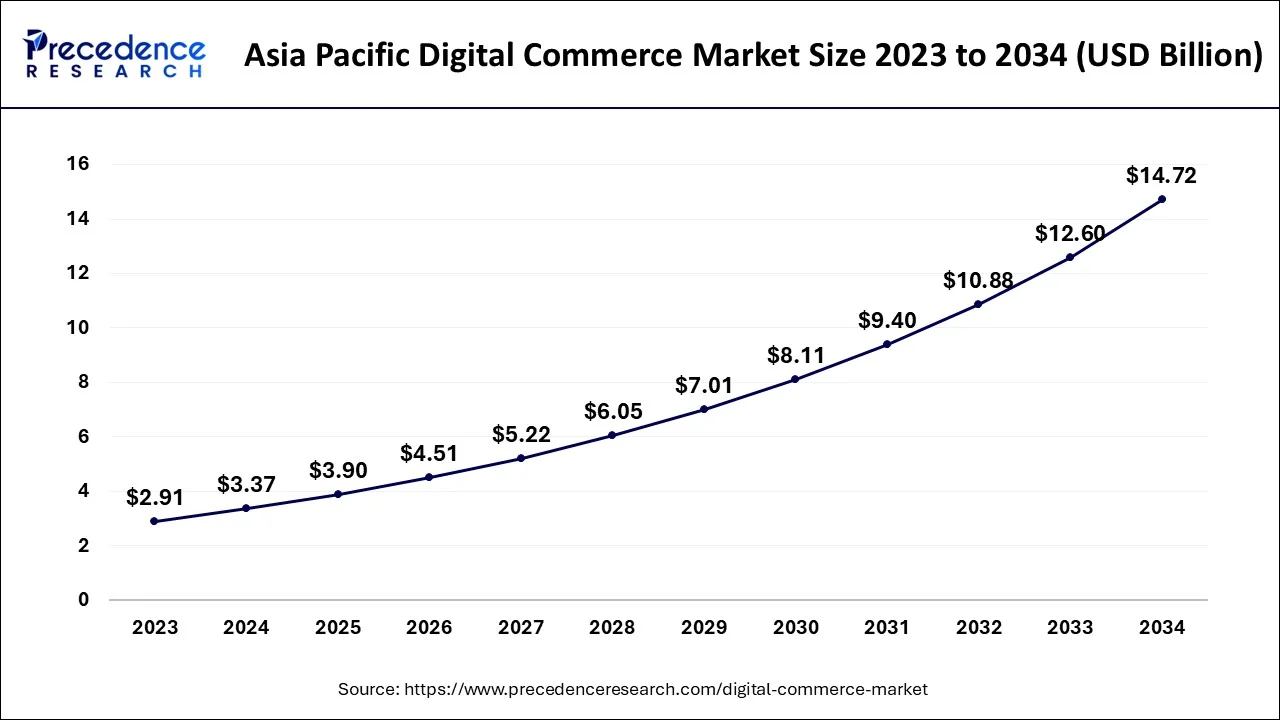

The Asia Pacific digital commerce market size is evaluated at USD 3.37 trillion in 2024 and is predicted to be worth around USD 14.72 trillion by 2034, rising at a CAGR of 15.88% from 2025 to 2034.

With a share of 56% in the digital commerce market in 2024, Asia Pacific led the way and is predicted to expand at the quickest rate between 2025 and 2034. This might be linked to enterprises' increasing propensity for doing transactions through B2B digital commerce platforms. Additionally, expanding infrastructural facilities and an increase in internet users are anticipated to boost regional market expansion.

In addition, the area is anticipated to see an increase in the demand for B2B digital commerce adoption, which can be ascribed to the widespread use of smartphones. A consumer revolution is also taking place in the Chinese market, where foreign goods are utilizing cutting-edge marketing, research, and advertising strategies. Brand awareness is becoming more significant in luring Chinese consumers. In China, the market for luxury products and services is expanding significantly.

North America and Europe are expected to see consistent growth. The American public is receptive to foreign companies and goods. They are increasingly conscious of environmental issues and overconsumption. Consumers are quite particular about the product's content, price, and quality. One of the greatest levels of internet penetration is seen in North America. A burgeoning young population and the fast-developing internet retail industry are likely to drive considerable growth across the Middle East, Africa, and Latin America in the next years.

Market Overview

The exchange of products and services, or the transfer of money or data, through an electronic network basically the internet is known as digital commerce. The internet is the driving force behind digital commerce, allowing customers to explore an online store, order goods or services using their own devices, and pay for their purchases. These commercial exchanges take place between businesses and consumers (B2C), businesses and businesses, consumers and consumers, or consumers and businesses. E-business and digital commerce are frequently used interchangeably. The transactional procedures that make up online retail shopping are commonly referred to as e-tail.

The estimated market share for digital commerce in 2021 is expected to surpass pre-COVID-19 projections. This is a result of the supply chain disruptions brought on by the COVID-19 epidemic, which have caused a sharp increase in demand for digital commerce. Additionally, there is a significant amount of demand for online buying across many industries, which forces the food and beverage, industrial, and logistics industries to expand their investments in robotics, including supply chain automation, which in turn propels the market's expansion. Due to the fact that many businesses were impacted by this epidemic and found it challenging to maintain their intricate trading networks, the need for digital commerce increased.

Digital Commerce Market Growth factor

One of the main reasons fueling the market's expansion is the rapid urbanization of the world. Additionally, rising internet usage and the use of gadgets like smartphones, laptops, and tablet to use digital commerce portals are boosting industry expansion. Through digital commerce, companies may conduct transactions without having a physical presence, which lowers their infrastructure, communication, and administrative expenses. The industry is also fueled by the rising popularity of online shopping, particularly among women, and the expanding impact of social networking sites on purchasing decisions. Online retail channels provide consumers a hassle-free buying experience while offering a large selection of goods to pick from, all at reasonable price points. Additionally, the emergence of direct-to-consumer and private-label business models is fostering optimism for market expansion. This makes it possible for businesses to gather and use consumer data in order to offer customers customized goods and services. As a result of lockdown and social isolation measures, the spread of the coronavirus illness (COVID-19) has given digital commerce operations an additional boost. Customers are turning to online platforms to acquire necessary supplies.

- Internet and smartphone use are becoming more and more prevalent

- Increasing social media and social commerce use

- Advancement of multiple payment mode options

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.06 trillion |

| Market Size in 2025 | USD 6.96 trillion |

| Market Size in 2024 | USD 6.01 trillion |

| Growth Rate from 2024 to 2034 | CAGR of 15.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Payment, Component, Browsing Medium, Business Type, Industry Vertical and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

- Rise in the amount of small and medium-sized Enterprises (SMEs) - Over the projection period, it is also anticipated that the demand would increase as the number of SMEs rises. Particularly in India, Africa, and Russia, small and medium-sized firms are expanding quickly. Indian Make-in-India and Start-up India initiatives have expanded the number of start-ups in the nation, which have adopted the internet marketplace for commerce and are driving market expansion. Additionally, throughout the course of the projected period, rising consumer affluence is anticipated to fuel market expansion.

- Growing adoption of technology - Technology has improved the effectiveness and accessibility of the digital commerce industry. Companies engaged in digital commerce are aiming to combine their technology stacks and build an integrated ecosystem that offers a full spectrum of capability for digital commerce operations. Legacy systems that are become harder to maintain will be replaced with optimized content management, simple campaign orchestration, and constant experimentation from a single digital experience platform (DXP). Modern SaaS platforms will quickly replace out-of-date technology stacks since they offer all the interfaces and functions anyone require. Anyone can maintain the agility in a market that is becoming more competitive thanks to these solutions.

Key Market Challenges

- Consumers' top concern is still security, despite the sophistication of online fraud - This concern is slowing the brisk expansion of digital commerce transactions. To increase client confidence in digital commerce, security risks such as data destruction, disclosure, and alteration, denial of service, fraud, resource misuse, and waste must be addressed. Cyber fraud and identity theft are the key obstacles to the expansion of digital commerce. Since hackers are the ones who commit cybercrime, e-rapid commerce's expansion depends on resolving the underlying problem of inadequate security on digital commerce web servers and computer usage.

Key Market Opportunities

- A rise in corporate and government efforts - The government of many developing countries and many corporations are stepping up their attempts to encourage digital commerce sales, which is a key development in the field of digital commerce. The Union Ministry of India revealed plans to build Bharat Craft, an digital commerce web modelled after Alibaba, an digital commerce platform in China, in August 2019, according to news from Entracker. This software is anticipated to give MSMEs a platform to promote and sell their goods, which is anticipated to accelerate the sector's growth in the nation.

- Growing usage of smartphones - The adoption of 4G and 5G technologies for connection is anticipated to positively affect market growth since it gives users a continuous, seamless experience. Additionally, the use of smartphones is growing quickly, boosting the customer's exposure to online buying. Therefore, it is anticipated that increasing smartphone usage will fuel market expansion over the upcoming years.

Payment Insights

In terms of payment methods, the digital wallets market category accounted for around two-fifths of the worldwide market for digital commerce in 2024, and it is anticipated that it will continue to lead the pack throughout the forecast period. From 2025 to 2034, the digital wallets category is predicted to have the fastest CAGR, at 17.98%. The market for card payments is anticipated to be the greatest portion of all digital commerce in 2024. Because of its widespread acceptance, popularity, and discounts and rewards provided by digital commerce platforms for card payments, this market has a sizable presence in both developed and developing nations. The digital commerce portal's support of the usage of digital wallets, together with convenience and security aspects, is expected to provide considerable development potential for the category of digital wallets over the next years.

On 7 February 2025, the Reserve Bank of India (RBI) announced plans to introduce domain names ending with ‘bank.in' for regulated banking institutions and ‘fin.in' for fintechs and NBFCs. This move aims to curb digital fraud by ensuring consumers can easily verify the authenticity of financial platforms. With increasing cases of phishing and domain spoofing, the RBI's initiative is expected to build greater trust in India's digital payment landscape. The domains will be exclusive and monitored under strict guidelines.

Browsing Medium Insights

In terms of browsing media, the mobile/tablet category accounted for more than three-fifths of the global market in 2024. The mobile/tablet sector is predicted to experience the fastest CAGR of 16.6% between 2025 and 2034.

The desktop/laptop sector is anticipated to hold the biggest market share for global digital commerce in 2024. The significant market share of this sector is partly because to the rise in desktop and laptop sales during the COVID-19 epidemic as a result of the culture of working from home.

Business Type Insights

Due to increased adoption of digital commerce software, which is anticipated to integrate with current software and inventory control solutions to provide useful insights for the growth of the digital commerce market, the business to enterprise segment dominated the worldwide market in 2024 and is anticipated to maintain this trend during the forecast period.

However, the business to consumer category is anticipated to see the greatest CAGR over the projected period due to the rapid uptake of digital commerce and digital commerce among consumers, which offers retail customers a convenient and efficient method of purchasing.

Industry Vertical Insights

According to digital commerce market trends by industry vertical, the automotive segment generated the most revenue in 2024 and is expected to continue to lead during the forecast period. This is because more automotive manufacturers are implementing digital commerce solutions to gain a competitive edge, which is due to increased competition between digital commerce and omni-channel players. But throughout the anticipated period, the retail and consumer goods industry is anticipated to develop at the fastest rate. It is a result of the use of digital technology in product sales and marketing. Moreover, the market is growing as more people use smartphones.

Digital Commerce Market Key market players

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Best Buy

- eBay, Inc.

- JD.com, Inc.

- Otto GmbH & Co

- Rakuten, Inc.

- Shopify, Inc.

- The Home Depot

- Walmart, Inc.

Recent Developments

- On 27 March 2025, Axis Bank and J.P. Morgan launched a pioneering 24x7 USD cross-border payment solution using blockchain. This service is designed to benefit Indian exporters and tech companies by reducing settlement delays and improving cash flow. By offering instant dollar transfers across time zones, Axis becomes one of the few Indian banks offering such global financial infrastructure. It positions India favorably in the global digital trade ecosystem.

- In March 2025, UK-based fintech Revolut announced its official India entry in 2025, aiming to tap into the country's rising affluent and digital-first consumer base. The company plans to offer multi-currency forex cards, investment options, and intuitive personal finance tools via its mobile app. With an India-specific product roadmap and local hiring, Revolut's entry is expected to raise the bar for neo-banking services. The launch aligns with the growing demand for globalized digital finance solutions in India.

- On 29 April 2025, in a bid to make UPI more financially sustainable, the Indian government and RBI proposed an MDR (Merchant Discount Rate) of 0.2–0.3% for large merchants. While small businesses will remain exempt, this move could help compensate payment service providers and banks for infrastructure costs. It reflects the government's strategy to balance innovation with long-term operational viability. Consultations with stakeholders are ongoing before the final policy rollout.

- In December 2019, the Italian company Safilo Group S.p.A. announced the purchase of a 70% stake in Blenders Eyewear LLC, a digitally native retailer, for an undisclosed sum. Safilo Group S.p.A. designs, manufactures, and distributes frames, sports eyewear, sunglasses, ski goggles and helmets, and related products. With this acquisition, Safilo Group S.p.A. hopes to advance its omnichannel and digital commerce strategy and increase its global reach. Blenders Eyeglasses LLC is a California-based business that sells premium athletic and lifestyle eyewear online at reasonable costs together with interesting brand content.

Segments covered in the report

By Payment

- Card Payments

- Digital Wallets

- Bank Transfers

- Cash Payments

- Crypto Currency

By Component

- Solution

- Services

By Browsing Medium

- Desktop/laptop

- Mobile and Tablets

By Business Type

- Business to Business (B2B)

- Business to Consumer (B2C)

By Industry Vertical

- BFSI

- Manufacturing

- Automotive

- Healthcare and pharmaceuticals

- Retail Household goods

- Media & entertainment

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting