Digital Waste Management Solution Market Size and Forecast 2025 to 2034

The global digital waste management solution market size accounted for USD 2.97 billion in 2024 and is predicted to increase from USD 3.36 billion in 2025 to approximately USD 10.12 billion by 2034, expanding at a CAGR of 13.04% from 2025 to 2034. The digital waste management solution market is growing due to its significant advantages, including enhanced efficiency, cost savings, improved recycling, and improved data-driven decision-making. It helps reducing environmental impact, conserving resources, and progress public health.

Digital Waste Management Solution MarketKey Takeaways

- In terms of revenue, the global digital waste management solution market was valued at USD 2.97 billion in 2024.

- It is projected to reach USD 10.12 billion by 2034.

- The market is expected to grow at a CAGR of 13.04% from 2025 to 2034.

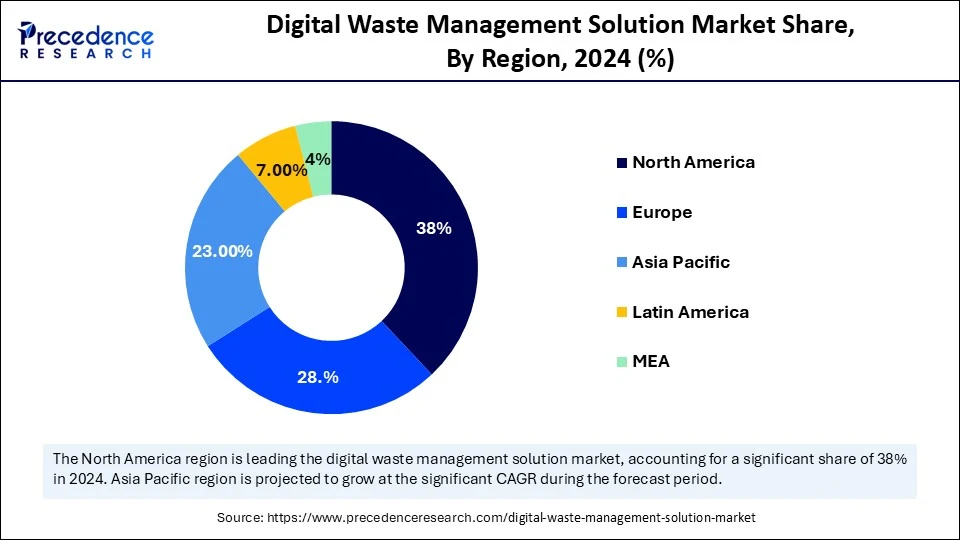

- North America dominated the digital waste management solution market with the largest market share of 38% in 2024.

- By region, Asia Pacific is expected to grow at the fastest CAGR in the upcoming period.

- By component, the hardware segment captured the biggest market share in 2024.

- By component, the software and services segment is expected to grow at the fastest CAGR during the forecast period.

- By waste type, the recyclable segment held the highest market share in 2024.

- By waste type, the non-recyclable segment is the fastest growing during the forecast period.

- By application, the commercial establishments segment contributed the major market share in 2024.

- By application, the smart cities segment is expected to grow at the fastest CAGR in the coming years.

How is Artificial Intelligence Transforming the Digital Waste Management Solution Market?

AI integration drives the digital waste management market by transforming waste processing, handling, and recycling for sustainability, efficiency, and cost-effectiveness. Machine learning classifies and sorts waste, reducing contamination. AI-driven IoT sensors optimize waste collection. These innovations boost recycling rates, reduce pollution, and support a circular economy. AI improves recycling, classifies materials, and enables smarter, energy-efficient strategies, thus fostering market growth.

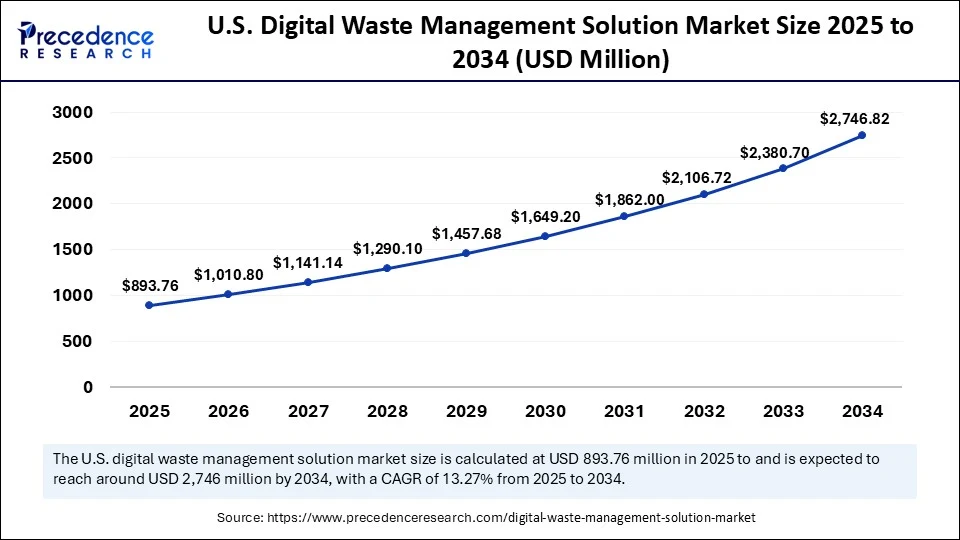

U.S. Digital Waste Management Solution Market Size and Growth 2025 to 2034

The U.S. digital waste management solution market size was exhibited at USD 790.02 million in 2024 and is projected to be worth around USD 2,746.82 million by 2034, growing at a CAGR of 13.27% from 2025 to 2034.

What Factors Support North America's Dominance in the Digital Waste Management Solution Market?

North America dominated the digital waste management solution market and accounted for the largest share in 2024. This growth is primarily fueled by the advancements in technologies and the development of digital solutions for managing digital waste. North America's digital ecosystem continues to mature and adapt to technological changes and evolving citizen expectations for government services. Increased investment in comprehensive digital infrastructure, including mobile connectivity and high-speed internet, is also a factor. Furthermore, cloud computing in North America offers a fast and cost-effective approach to IT infrastructure as an internet service.

The U.S. is a major player in the regional market. This is mainly due to the rising government initiatives, incentives, and funding for waste management projects. There is also increasing support for sustainable technologies focused on recycling and upcycling precious metals from digital waste. Various technologies, such as pyrometallurgy, have been developed for the selective and efficient extraction of valuable metals from digital waste, contributing to market growth.

Why is the Asia Pacific Emerging as the Fastest-Growing Market for Digital Waste Management Solutions?

Asia Pacific is expected to experience the fastest growth during the forecast period due to rapid urbanization, which leads to more waste generation, creating a need for efficient management solutions. Progressive digital-waste recycling methodology comprises device investment, operating expenses, technology development, and advancement, which contributes to the growth of the market. Growing awareness of sustainability and circular economy principles is boosting the demand for digital waste management. Moreover, governments around the region have imposed stricter regulations on waste management, encouraging businesses to invest in digital waste management solutions.

China is the world's largest producer and importer of electronic waste, accounting for approximately 70% of global digital waste. It is projected to generate around 28.4 million tonnes of digital waste by 2030. Major Chinese companies, such as Xiao Huang Gou, have developed AI-driven smart trash bins that can identify and sort waste into different categories. These bins use machine learning algorithms to accurately differentiate between recyclables, non-recyclables, and compostables.

India faces significant waste management challenges due to its large population and high waste generation. The technology used should be scalable to accommodate future increases in waste production. As populations and urbanization grow, waste generation is expected to rise. India's digital landscape presents a significant opportunity, with an estimated addition of US$ 900 billion by 2030. Major companies are digitizing and automating their waste management processes, leading to increased efficiency, cost reduction, and the ability to convert waste into marketable recyclables.

Market Overview

The digital waste management market is growing rapidly, fueled by its role in raising customer awareness and creating social impact. As awareness of digital waste reprocessing options grows, so does public sensitivity to the issue. Digital waste management companies actively work at the grassroots level to educate people about digital waste processing and handling. Community outreach programs are increasing rural awareness of health hazards and safe recycling practices. The system reduces fuel waste and improves air quality by lowering greenhouse gas emissions. Various solutions manage digital waste, including software solutions (route optimization, waste fee systems, real-time tracking, and data analysis) and hardware/sensor solutions (smart bin sensors, RFID chips, access control, and IoT-powered hardware). Stricter environmental regulations and policies globally drive the adoption of digital solutions to monitor and manage waste.

Which Factors are Driving the Growth of the Digital Waste Management Solution Market?

- Smart City Initiative: Smart waste management systems are integral to smart city development, where various systems communicate and interact. This interconnectivity ensures that urban environments adapt efficiently to changing environmental conditions and population dynamics, which drives market growth.

- Sustainability Goals: Smart waste management systems improve ESG by aiming to reduce waste and divert more from landfills. Powered by technology, smart waste management supports ESG goals while enhancing operations and cost-effectiveness, which contributes to market growth. Growing awareness of sustainability and circular economy principles boosts the demand for digital waste management

- Increasing Awareness: The increasing focus on spreading awareness about the benefits of digital waste by incorporating e-waste education into school curricula supports market expansion. This helps to educate young people about the importance of digital waste recycling and encourages them to adopt environmentally responsible behaviors. Also, conducting community outreach programs is effective in increasing digital waste awareness by organizing workshops and events to educate the public about digital waste recycling, which contributes to the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.12 Billion |

| Market Size in 2025 | USD 3.36 Billion |

| Market Size in 2024 | USD 2.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Waste Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Regulatory Frameworks

Government regulations significantly drive the digital revolution in waste management by implementing sustainable practices across the entire electronic product lifecycle. Key policies like the WEEE Directive (EU), the Resource Conservation and Recovery Act (RCRA) in the U.S., and the Basel Convention globally mandate strict guidelines for e-waste collection, transportation, recycling, and disposal. These regulations compel manufacturers, waste handlers, and recyclers to adopt digitally traceable, environmentally compliant processes, mitigating soil, water, and air contamination. Regulatory compliance drives innovation and investment in tech-enabled digital waste management solutions as environmental and public health concerns grow.

Restraint

Technological Challenges

A major challenge in the digital waste management market is the widening gap between the rapid evolution of electronic products and the lagging capabilities of existing collection and recycling systems. As modern devices become more compact, material-intensive, and complex, outdated infrastructure struggles to adapt, resulting in inadequacies and missed recovery opportunities, which limits market growth. Integrating digital solutions with existing waste management infrastructure can be complex and time-consuming. Moreover, limited access to technology and digital literacy in some regions may restrict the adoption of digital solutions.

Opportunity

Emerging Technological Innovations

Advancements in recycling and product design technologies create significant opportunities for businesses in the digital waste management solution market. Innovations like automated sorting, robotic disassembly systems, and advanced material recovery techniques improve the profitability and efficiency of e-waste processing. Blockchain-based tracking and traceability solutions provide end-to-end visibility, ensuring compliance and transparency across the e-waste value chain. The rise of modular electronics design, allowing for easier repair, component upgrades, and disassembly, aligns with circular economy principles and reduces e-waste volumes. Furthermore, the development of biodegradable electronic components and materials creates opportunities for sustainable product manufacturing, positioning companies to capitalize on increasing consumer and regulatory demand for green technology solutions.

Component Insights

Why Did the Hardware Segment Dominate the Market?

The hardware segment dominated the digital waste management solutions market with the largest revenue share in 2024. This is mainly due to the increased need for advanced equipment to process and recycle electronic waste efficiently. Hardware supports the recovery of valuable materials from electronic products. This conserves natural resources. It also benefits the environment by lessening the need to extract resources and lowering the potential for contamination.

The software and services segment is expected to grow at the fastest rate in the upcoming period, as digital waste management software and services offer numerous benefits, including streamlined waste collection and disposal processes, enhanced efficiency, and cost reduction. This software streamlines waste disposal and collection, allowing staff to focus on essential tasks. It minimizes disposal expenses by reducing landfill waste and encouraging recycling and reuse. It also helps mitigate fines and regulatory issues by adhering to waste management regulations. The software enables better tracking and management of digital waste, leading to more efficient recycling and disposal processes.

Waste Type Insights

How Does the Recyclable Segment Dominate the Market in 2024?

The recyclable segment dominated the digital waste management solution market with the largest share in 2024. Recycling digital waste prevents environmental contamination and leads to cleaner air and water, which directly improves well-being and community health. This is crucial for enhancing the quality of life in areas heavily affected by electronic waste. Additionally, it promotes the reuse of materials, increases resource efficiency, and fosters innovation in recycling technologies. This approach supports sustainable economic growth and helps both consumers and companies save money by reducing costs related to raw material procurement and waste management.

On the other hand, the non-recyclable segment is projected to see the most rapid growth during the forecast period. This is because digital waste, when not recycled, becomes toxic and accumulates in the air, soil, water, and living organisms. This waste contains dangerous substances that damage the environment and human health. Digital waste includes neurotoxicants like mercury and lead, which can disrupt the development of the central nervous system.

Application Insights

What Made Commercial Establishments the Dominant Segment in the Market?

The commercial establishments segment dominated the digital waste management solution market in 2024 due to the increased corporate sustainability goals. In business environments, it's crucial to prevent environmental issues, conserve resources, and protect worker safety. Recycling digital waste helps conserve energy, reduce pollution, lower greenhouse gas emissions, and preserve natural resources by using fewer raw materials. This process also prevents toxic chemicals from contaminating the soil and avoids the release of harmful gases and dust.

The smart cities segment is expected to grow at the fastest rate in the coming years. This growth is driven by the ability to efficiently sort digital waste at the source, streamlining operations and reducing costs for recycling facilities. This integration also ensures the safe and controlled disposal of hazardous materials found in some digital waste, thus mitigating environmental risks. Smart waste management systems in smart cities utilize sensors to monitor waste levels in bins, transmitting data to collection providers.

Recent Developments in the Market

- In October 2024, TOMRA acquired 80% of the shares in c-trace GmbH, a German leader in digital waste management solutions. C-trace, founded in 2005, provides advanced solutions that combine software and hardware modules to digitize and improve the process for waste management operations.

(Source: https://www.tomra.com) - In January 2025, MKS PAMP GROUP, a worldwide leader in precious metals trading, minting, refining and e-commerce, and Karo Sambhav, a leading player in India's circular economy sector, announced that the two companies are moving toward a strategic partnership to development e-waste recycling and the recovery of precious metals as well as significant raw materials in India.

(Source: https://www.tomra.com) - In April 2024, EARTHDAY.ORG and Kabadiwalla Connect launched a waste clean-up partnership model with Local Kabadiwalas. This partnership is predictable to make a momentous contribution to the waste management and clean-up initiative model by recognizing used batteries and related e-wastes for effective segregation and recycling.

(Source: https://cxotoday.com)

Digital Waste Management Solution Market Companies

- Schneider Electric (France)

- Rubicon Technologies, Inc. (U.S.)

- Veolia (France)

- c-trace GmbH (Germany)

- AMCS Group (Ireland)

- Waste Harmonics (U.S.)

- ISB Global (U.K.)

- SENSONEO (Slovakia)

- Big Belly Solar, LLC. (U.S.)

- Evreka (Turkey)

Segments Covered in the Report

By Component

- Hardware

- Software and Services

By Waste Type

- Recyclable

- Non-recyclable

- Hazardous

By Application

- Smart Cities

- Commercial Establishments

- Private Organizations

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting