What is the Diode Market Size?

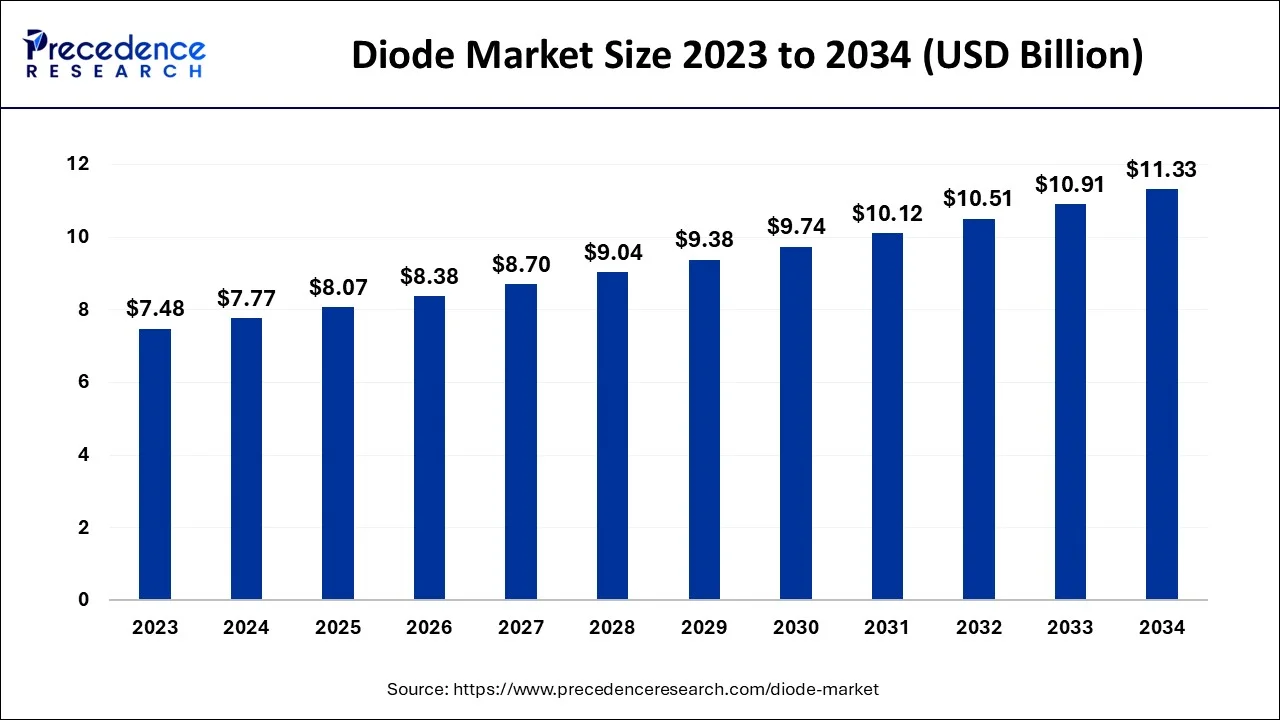

The global diode market size is accounted at USD 8.07 billion in 2025 and predicted to increase from USD 8.38 billion in 2026 to approximately USD 11.75 billion by 2035, representing a CAGR of 3.83% from 2026 to 2035.

An electrical diode is a semiconductor materials component with two terminals that, theoretically, allows current to flow through easily in one direction but blocks it in the other direction. A diode may be thought of as a switch that controls the flow of electrons via an electrical circuit.

Diode Market Growth Factors

Across all consumer electronics categories, electronic items are becoming smaller. All electronic manufacturers strive to produce products that are as small as possible, use the least amount of power, and offer the most power. As a result, there is a growing need for novel and distinctive diodes.

There is a rising desire for cell phones that can perform a variety of duties, such as FM radios, MP3 players, MP4 players, portable TVs, note recorders, cameras, and even projectors. The need for signal routing solutions has risen due to the rising quantity of signals. Mobile phone designers may continue to push for smaller form factors while still including improved functions in their designs thanks to these ideas, which call for diodes with reduced size and better functionality. The demand for diodes is increasing due to this technological requirement.

The market for diodes is expanding as there is a growing need for electric cars. Diodes of many kinds are employed in the production of EVs. The International Energy Agency (IEA) predicts that the number of electric vehicle sales will reach 6.6 million in 2021, more than doubling from 2020. In 2021, electric vehicles accounted for approximately 9% of the worldwide auto market, more than doubling their market share from the previous year.

- Over the course of the forecast period, increasing laser diode utilization across a range of end-use industries is anticipated to fuel market expansion.

- As a result of technological advancements, the use of laser diodes will increase in the aerospace and defense industries.

- The rise of the aerospace and military industries is driving the need for diodes, which is in turn being driven by favorable government laws encouraging the adoption of sophisticated technologies and technical breakthroughs.

How is AI contributing to the Diode Industry?

The diode industry is supported by AI in the areas of speeding up the designing of semiconductors, predicting the performance of semiconductors, and reducing the amount of testing done manually. With the help of machine learning, voltage, current, and thermal behavior are evaluated, thus enabling fast simulation-based optimization. The AI-driven materials discovery is accelerating the combination usage of GaN and SiC.

The automated modeling is creating the new diode layouts, and the computer vision is ensuring the quality checks are precise. Predictive analytics is reducing downtime and increasing efficiency by monitoring the equipment, while lean manufacturing is intelligently balancing the supply, production, and market response.

Market Outlook

- Industry Growth Overview:

The growth process has begun with consumer electronics and renewable energy sources pushing the mobility of electric cars and, in turn, the associated technology of diodes. - Sustainability Trends:

Eco-materials usage, energy efficiency improvements, and better end-of-life recycling practices are the areas of major concern in sustainability. - Global Expansion:

The semiconductor adoption in the Asia-Pacific region is gradually uplifting the presence of diodes worldwide, and at the same time, the expansion of the manufacturing ecosystems in the area - Major Investors:

The companies BlackRock, Vanguard, Fidelity, and State Street Corp are behind the long-term innovations and scalability in the diode industry. - Startup Ecosystem:

The startups are working on new materials for semiconductors, such as Gallium Nitride (GaN), and are thus paving the way for specialized device manufacturing and competition in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.07 Billion |

| Market Size by 2035 | USD 11.75 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.83% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Indication Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increased use across a wider range of industry sectors

Integrated circuits (ICs) using discrete diodes are used by manufacturers in the automotive, electrical, and communication sectors in place of digital circuits. Discrete components are condensed with sizes in micrometers and millimeters, which results in gains in power consumption and speed since smaller components have lower parasitic resistors, capacitances, and inductances. Producers in end markets, however, should be aware about the advantages and disadvantages of discrete diodes in order to effectively create products.

The sector is anticipated to advance due to the adoption of numerous government initiatives on modern distribution networks and generating infrastructure. By 2021, the International Energy Agency (IEA) predicts that 6.6 million electric vehicles will have been sold worldwide. 9% of all new automobiles sold worldwide were electric vehicles. The cooling fan drive in the battery management system of an electric car uses diodes. Electric cars are becoming more popular, which benefits the diode market.

Key Market Challenges

High initial investment costs in laser diode industries

The fact that laser diodes need a larger initial investment than other light-emitting diodes severely restricts the market for laser diodes as a whole. A few hundred to thousands of watts of laser power are required for diverse systems, processes, and applications. Although adopting laser goods would reduce labor expenses in the industrial and automotive industries, installing laser products is relatively expensive. Installing laser-capable items typically costs more than doing so via the conventional method.

Key Market Opportunities

The increasing usage of electronic gadgets such as television, mobile platforms, electric cars

The market for diode semiconductors is expanding rapidly as a result of low cost availability and alluring incentives that are driving up demand for consumer electronics. In addition, the leading market players are investing heavily in R&D activities to create cutting-edge consumer electronics. For instance, in a fresh round of series B fundraising announced in June 2022, Renesas disclosed their stake in Arduino, an open-source business.

According to the contract, Renesas will provide a wide range of goods for the use of the Arduino technology platforms by its global developer community. Renesas also disclosed an investment in its Kofu Factory, which is situated in Kai City, Yamanashi Prefecture, Japan, in May 2022. The investment is intended to increase the company's ability to produce power semiconductors. It is carried out in an effort to promote decarbonization.

According to its plan of action, Renesas' overall manufacturing capacity for power semiconductors will more than quadruple if the Kofu facility is successful in achieving mass production. Additionally, these elements are anticipated to fuel market growth. However, market expansion may be constrained by design and continuously rising prices. As a result, the worldwide market for diodes is being favorably impacted by all of these reasons.

Diode Market Segment Insights

Indication Type Insights

In the projected period of 2026 to 2035, the schottky diode market is anticipated to develop at a pace of 5.9%. A Schottky diode is an electrical component that may be utilized in a wide range of electronic systems, including control rectifiers, RF applications, power OR circuits, and others, particularly as a mixer to identifier diode.

One of the key reasons fueling the expansion of the schottky diode market is the worldwide increase in industrialization. The need for gadgets among customers and the preference for schottky diodes in comparison with simple diodes, which have low forward voltage drops between 0.3 & 0.5 and reduce energy waste as heat, respectively, are driving the market's expansion. Schottky diodes are increasingly being used in a variety of applications due to their important characteristics. Additionally, the schottky diode market is favorably impacted by the usage of sensitive applications, growth in demand for stationary photovoltaic (PV) cells, rise in demand from sectors such as consumer engine, communications, and automotive, urbanization, and rise in end-user awareness levels.

Application Insights

Diodes are used in vehicles because they enable electricity to flow in just one way. This important part guards the car's LED headlight against current surges. This significantly lowers the possibility of an automobile's electrical system and parts being harmed. In automotive applications, Schottky diodes can correct a current flow by enabling a quick transition from a conducting to a blocking state. At high temperatures, they have a low reverse leakage current, which lowers circuit losses and boosts protection from thermal runaway. The manufacturer of diodes is expanding its offering with cutting-edge, high-performance diodes.

Direct current electricity is produced by diodes from alternating current. Diodes can be found in the alternators and other electrical components of a car. Alternator diodes provide three crucial functions for the car charging system: converting AC power to DC power, acting as a feedback preventer, and ensuring proper polarity when charging a battery. The prevalence of electronic gadgets, batteries, and charging adaptors in autos is favorably influencing the growth of the diode market.

Major businesses are concentrating on producing cutting-edge SiC diodes to boost the battery capacity and charging rate of EVs. For instance, the first-generation silicon carbide technology from Infineon Technology has assisted EV manufacturer clients in expanding the battery range for their 800-V-based EV by 7%. The business promises that their next Cool Sic will increase that to around 10%.

Diodes are used to link solenoids in autos. The magnetic field of the coil, along with the current flow within it, decreases when the B+ is switched off. As a result, the current flows through the diode in the same direction as the arrow on the diode, which was previously blocking the B+.

The coil might collapse on itself thanks to the current flow that is created in the electric field. No spark is created, and the ECM is safeguarded. The programmable solenoid controller PT2000 was created by NXP, a top manufacturer of semiconductors, for use in automotive (12 V), truck, and industrial (24 V) power trains. Diodes are used in this system to ensure that the device operates smoothly and with flexibility.

Diode MarketRegional Insights

Due to a large number of electronics and automobile manufacturers in the Asia region as well as growing consumer buying power, the diodes industry is growing quickly.

The usage of electric cars contributes to a reduction in emissions, fleet emissions, and strict government restrictions governing vehicle emissions as a result of growing awareness. Additionally, the APAC region is predicted to see the greatest growth in the market for electric light commercial vehicles. These cars employ a variety of diodes in their electrical and electronic components. Power, small-signal, RF, and microwave diodes will see exponential growth in this region's market.

The usage of smartphones and the digitalization of industrial processes are both rising in the area. Due to the necessity of diodes in all electrical goods and the expansion of smartphones and electronics, the Asia-Pacific diodes market is also expanding. Numerous businesses are establishing manufacturing facilities in the Asia-Pacific area as a result of the rising demand for consumer electronics in nations including China, Singapore, the Republic of Korea, India, and the Republic of Korea. Large raw material supplies and low startup and labor costs are encouraging businesses to locate industrial hubs in the area.

The Asia-Pacific region is seeing the highest growth in industries like consumer electronics and smart clothing that need potent tiny diodes. For instance, the 0402-sized Schottky barrier diodes require 56 percent less mounting space while being 44 percent smaller than the conventional 0603 sizes (0.6mm 0.3mm). Due to the increase in demand for smart wearables, which they are used in, the demand in the region for these compact, potent diodes will rise.

The presence of the APAC market is enormous, the ever-expanding manufacturing, the demand for electronics, and the rapid industrial development are all together the main reasons for the increasing market of diodes. Focusing on renewable energy and the 5G ecosystem that is growing will further the need for semiconductors, their capacity in the semiconductor industry, and the integration of the automotive sector across nations.

China is the main contributor to the regional market of diodes due to its investments in optical fiber technology, the building of roads for semiconductors, and the large-scale consumption of electronics. The domestic production power, along with the investment in technology, will gradually dominate the market while the electric mobility and automation will continue to drive the adoption and innovation in the respective equipment categories.

North America is a stronghold of diode application in advanced automation, medical devices, and secured infrastructures. The strict compliance requirements of the systems push the development of specific diode technologies, while the industrial upgrading and the digital defense environments continue to broaden the applications of diodes.

The U.S. market is driven by developments in high-performance computing, the integration of electric vehicles, and the monitoring of environmental advancements. The increased usage of diodes in defense applications, investments in research, and innovations in quantum computing have all contributed to the growing demand for diodes and the accompanying technological progress, being able scaling.

Europe has a consistent diode market with automotive, smart manufacturing, and energy-efficient power solutions areas being its main contributors. Renewable inverter standards enhance the application of diodes, whereas financial aids support the implementation of energy-saving measures in the industrial and residential sectors.

Germany is moving forward due to its significant presence in semiconductor manufacturing, automotive technology, and the development of an automation-friendly infrastructure. The transition to electric mobility and the industrial management of power supply systems require more diodes, which in turn facilitates the integration of efficient devices across production and transportation technologies.

Diode Market-Value Chain Analysis

- Raw Material Procurement: Controlled material preparation of the silicon wafers and gases forming the semiconductor manufacturing foundation by sourcing and purifying them.

Key Players: Wacker Chemie, Shin-Etsu Handotai, SUMCO - Wafer Fabrication: The fabrication facilities with complex multi-step semiconductor processes are used to build microscopic electrical structures on the wafers.

Key players: TSMC, Intel, Samsung, GlobalFoundries - Photolithography and Etching: The circuit patterns are transferred by light, and the material is removed chemically to form the required device structures.

Key Players: ASML, Applied Materials, Lam Research - Doping and Layering: The impurities are introduced to control the conductivity, while the thin films used to build the p-n junctions and multilayer device architecture are deposited.

Key Players: Applied Materials, Lam Research, ASM International - Assembly and Packaging: After cutting the wafers into dies, the components are first encapsulated, and then their electrical performance is tested before distribution.

Key Players: Amkor Technology, ASE Technology Holding, JCET Group

Top Companies in the Diode Market & Their Offerings:

- NXP Semiconductors N.V.: NXP is a provider of standard power products for automotive applications and thus a great partner for efficient circuit performance and reliable system integration.

- STMicroelectronics: Microelectronics manufacturing power diodes, rectifiers, and hybrids will not only fulfill the requirements of the industrial and consumer sectors but also of the advanced technology market.

- Diodes Incorporated: Diodes, a manufacturer of power devices, provides the entire range of electronic components, including diodes, rectifiers, and protection elements that are widely accepted and demanded by the global electronic equipment industry.

Diode Market Companies

- NXP Semiconductors N.V.

- STMicroelectronics

- Diodes Incorporated

- Microchip Technology Inc.

- Renesas Electronics Corporation

- ROHM Semiconductor

- Panasonic Corporation

- Toshiba Corporation

- Skyworks Solutions, Inc.

- Analog Devices, Inc.

Recent Developments in the Diode Industry:

- In September 2025, Littelfuse, Inc., launched its 5.0 SMDJ-FB TVS Diode Series. It possesses foldback technology that enables lowering by 15% the clamping voltage for the sensitive DC power lines in Power over Ethernet, servers, and industrial power supplies to be better protected. (https://www.bisinfotech.com)

- In February 2025, CDIL Semiconductors launched the first-ever indigenous Solar Bypass Diodes in India, boosting the solar panel's performance and longevity. The diodes, which are made in Mohali, are contributing to the country's self-reliance, and they can also cater to extreme weather conditions. (https://www.tndindia.com)

Diode Market Segment Covered in the Report

By Indication Type

- Schottky

- Zener

- Rectifier

- ESD

- Others

By Application

- Consumer Electronics

- Communication

- Automotive

- Manufacturing

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting