What is the Emollients Market Size?

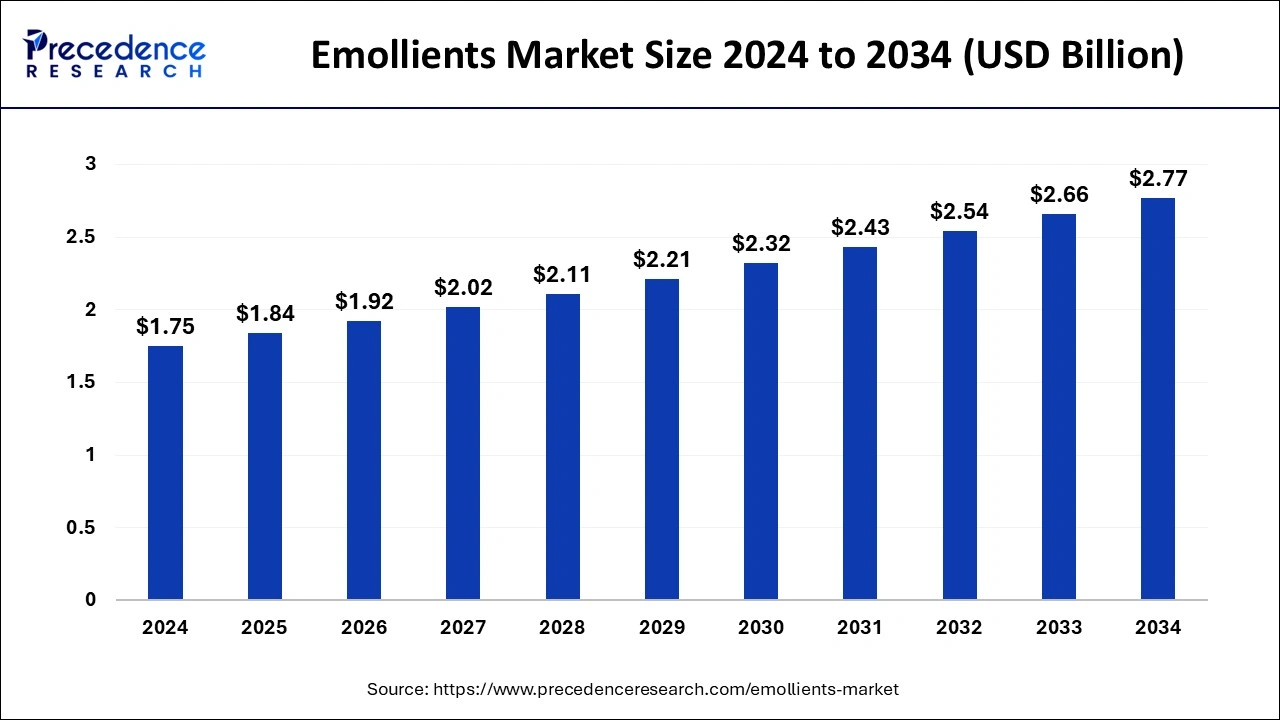

The global emollients market size is valued at USD 1.84 billion in 2025 and is predicted to increase from USD 1.92 billion in 2026 to approximately USD 2.77 billion by 2034, expanding at a CAGR of 4.70% from 2025 to 2034. The market is anticipated to be driven by globally increasing demand for cosmetics, beauty care, and personal care products.

Emollients Market Key Takeaways

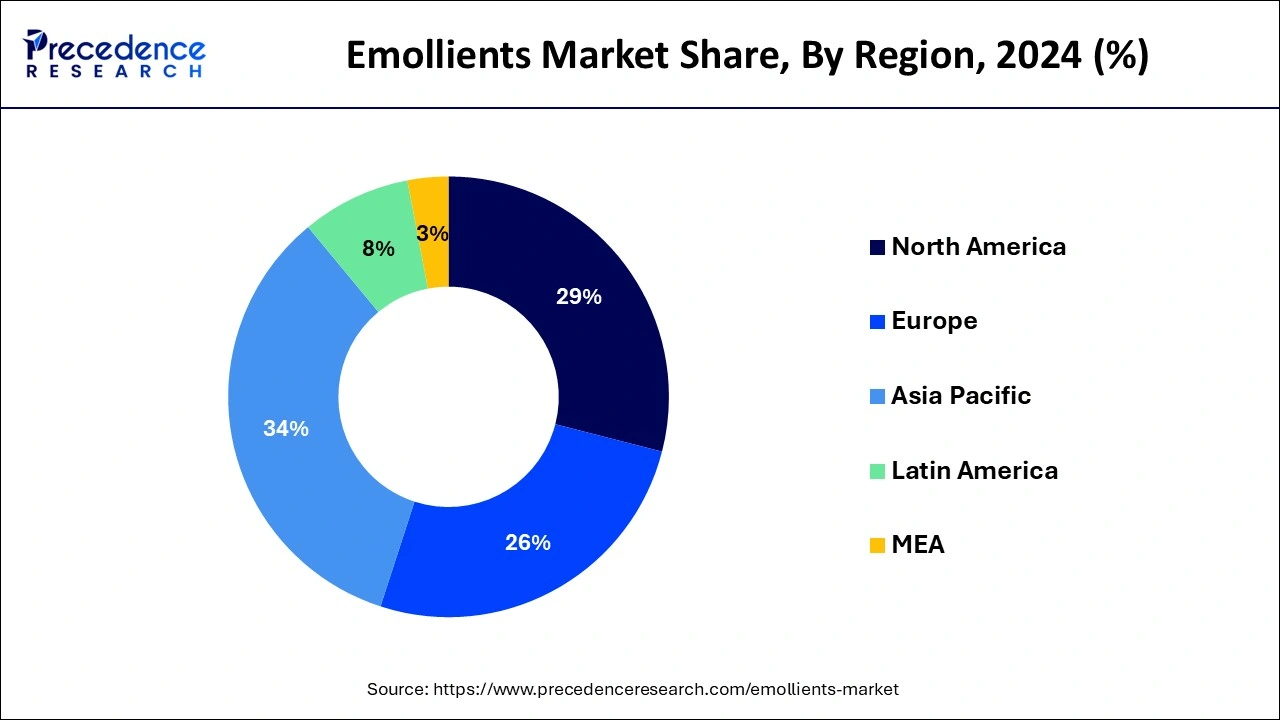

- Asia Pacific led the market with the largest market share of 34% in 2024.

- North America is expected to experience rapid CAGR of 4.84% over the forecast period.

- By form, the liquid segment has contributed more than 70% of the market share in 2024.

- By form, the solid segment is anticipated to grow at the fastest rate over the forecast period.

- By application, the skin care segment has accounted the largest market share of 39% in 2024.

- By application, the hair care segment is expected to grow at the fastest rate during the projected period.

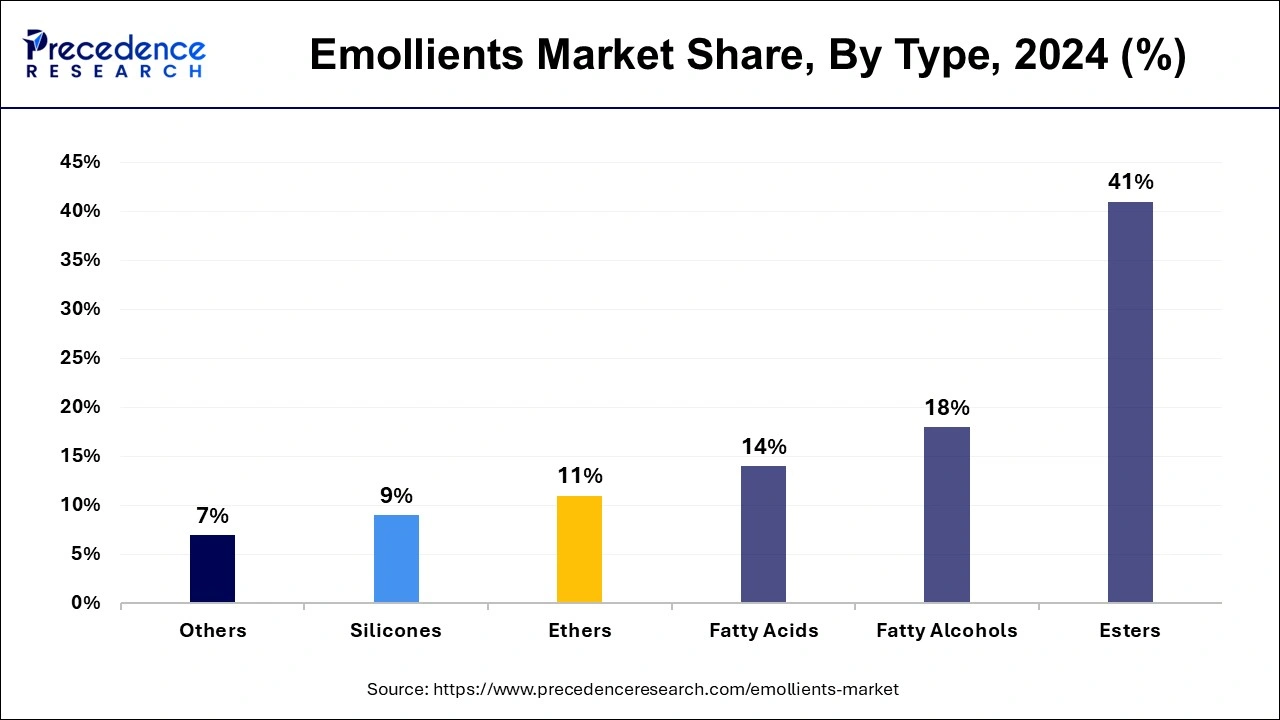

- By type, the easter segment dominated the market with the major market share of 41% in 2024.

- By type, the fatty acid segment is projected to experience the fastest growth during the forecast period.

Market Overview

Emollients are substances that help the skin to keep soft, hydrated, and calm. They come in various forms, like creams, lotions, or gels, and are used to treat skin conditions like burns, rashes, or dry and itchy skin. They can also be used to make stools softer and easier to pass, helping with constipation. Cosmetics containing emollients may also include other ingredients like antioxidants, perfumes, or preservatives. One can find emollients in products like shaving creams, hair tonics, skin cleansers, and sunscreens. The growing popularity of beauty products among young people and the increasing global population are driving the expansion of the emollients market. Emollient esters, which are long-lasting and versatile, are particularly helpful in creating various types of cosmetics.

Emollients Market Outlook

- Industry Growth Overview: From 2025 to 2034, the emollients market is projected to grow significantly, fueled by rising demand for skincare, haircare, and personal care products globally. Factors such as greater consumer awareness about skin health, the increasing prevalence of dry skin conditions, and heightened self-care pursuits are key contributors to this expansion.

- Sustainability Trends:Sustainability is transforming the emollients industry, with a clear shift toward plant-based, biodegradable, and eco-friendly ingredients. Petrochemical-derived emollients are being replaced by bio-derived oils, emollients, and waxes to meet strict environmental regulations, especially in the European Union and North America. Additionally, certifications like COSMOS and ECOCERT are gaining importance, boosting consumer confidence and market trust.

- Global Expansion:The market is expanding globally due to increasing consumer demand for skincare products that offer hydration, anti-aging, and soothing benefits, driven by growing awareness of personal care. Leading emollient manufacturers are also strategically expanding their global footprint to tap emerging markets and ensure regulatory compliance. Emerging regions present significant opportunities due to rising disposable incomes, a growing middle class, and an increasing focus on skin health and beauty, creating demand for high-quality emollient-based products.

- Major Investors:Major investors in the market include large multinational companies like Unilever, Procter & Gamble, and Johnson & Johnson, which contribute by investing in research and development of innovative, skin-friendly formulations and expanding product portfolios. These companies also drive market growth through strategic acquisitions, partnerships, and an expanding global distribution network, particularly in emerging regions.

- Startup Ecosystem:The startup ecosystem is thriving, with startups focused on developing sustainable, functional ingredients for personal care. Companies like Oleon Health and Beauty (Belgium) and Vantage Specialty Chemicals (US) are introducing bio-based, vegetal, and multi-functional emollients, utilizing advanced esterification methods and enzyme synthesis to meet evolving consumer demands while minimizing environmental impact.

Emollients Market Growth Factors

- The rise in demand for plant and animal-based oils and emollients is expected to drive the growth of the emollients market.

- An increase in skin diseases globally can raise the demand for emollients in personal care products.

- Growing demand for personal skin care products can contribute to the expansion of the emollients market.

- The young generations' increasing use of beauty products and rising population are boosting the market growth shortly.

- Increasing the use of cosmetics and personal care products worldwide can propel the growth of the emollients market over the forecast period.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.70% |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size in 2026 | USD 1.92 Billion |

| Market Size by 2034 | USD 2.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Wide range of adoption

The emollients market has experienced significant growth due to their widespread use in cosmetics, skincare, fragrances, haircare, and toiletries. Emollients, particularly those derived from natural sources like plants and animals, are becoming increasingly popular as consumers seek more natural ingredients. Industries that use emollients, such as esters and fatty acids, are experiencing high demand due to their desirable properties and easy availability. Additionally, shifting lifestyles and growing awareness of personal grooming are driving the expansion of the global emollient market.

- In November 2023, Sonneborn, LLC launched SonneNatural NXG, a plant-based emollient for use in personal care products. The ingredient enhances the formulation of lip care and personal care products due to its firmness and sensory properties, per the company. The product's naturally derived firm texture reduces the amount of thickener or wax required in the end formulation for anhydrous formulas.

Restraint

Stringent regulations

The global emollients market expansion may face challenges due to fluctuations in raw material prices and strict regulations in various countries. Laws requiring transparency about chemical ingredients and their origins can hinder the development of the emollient industry. Additionally, regulations concerning potentially toxic cosmetic ingredients may slow down market growth. Furthermore, the availability of affordable green products that serve as alternatives to emollients could also impede the expansion of the global emollient industry.

Opportunity

Benefits of offer by emollient

Emollients offer numerous sustainable benefits to personal care formulations and address complex challenges in cosmetic production. Hair care and skincare products are experiencing high demand in the personal care sector, which drives market growth. Factors such as an aging population and increased use of cosmetic products among younger generations contribute to this growth. Suppliers and chemical manufacturers are smoothly meeting the rising demand for emollient ingredients across various sectors, including dental care, hair care, and skincare. The expanding men's grooming market also significantly impacts the global emollient industry. Furthermore, the growing preference for organic and natural products in the personal care industry is expected to boost the emollients market further in the coming years.

- In April 2024, Biosynthetic Technologies, LLC announced the launch of its 100%biobased emollient for personal care applications; BioEstolide™ 250-100 at IN COSMETICS global. Biosynthetic Technologies manufactures a revolutionary new class of biobased synthetic compounds called BioEstolides for personal care and cosmetics formulations.

Segmental Insights

Form Insights

The emollients market in 2024 was mainly dominated by the liquid segment. Emollients are versatile for various personal care products, and they are commonly found in liquid form. Natural emollients, such as fatty acids, oils, and lipids, are naturally liquid. Synthetic emollients, like butylene glycol and capric/caprylic triglyceride, are also available in liquid form and are widely used in the liquid formulations of skincare products like creams, lotions, moisturizers, and shampoos. These factors contribute to the significant presence of liquid emollients in the global market.

- In April 2023, Momentive launched Harmonie, a range of natural plant and mineral-derived ingredients for the beauty and personal care industry. Harmonie soft fluid is a highly volatile emollient and solvent that enhances product spread ability and sensorial properties. It is compatible with silicones and natural oils and may be used in makeup formulations such as foundations, mascaras, eyeliners, and BB creams.

The solid segment is anticipated to grow at the fastest rate over the forecast period. Many companies in the industry are providing semi-solid, powdered, and waxy-solid emollients to personal care and cosmetics manufacturers. They are focusing on developing solid personal care products that have a longer shelf life and are easier to handle.

Application Insights

The skincare segment dominated the emollients market share in 2024. The rise in consumer demand for skincare items like moisturizers, creams, and lotions is a key factor behind this trend. Moreover, the growing popularity of plant-based emollients in the personal care sector is contributing to the market's expansion. Many manufacturers are creating innovative products using plant-derived oils to offer effective personal care solutions to consumers.

The hair care segment is expected to grow at the fastest rate during the projected period. The growth of the hair care segment in the global emollients market is driven by increasing consumer awareness of beauty and personal care. This heightened awareness is leading to greater demand for hair care products such as conditioners, shampoos, masks, creams, and hair gels.

- In February 2024, Tata Elxsi, a global leader in product engineering and innovation-led design services, introduced an innovative packaging design for the Vatika Shampoo range in the UAE market.

Type Insights

The easter segment dominated the emollients market in 2024. Esters like C12-15 alkyl benzoate, isopropyl myristate, acetyl palmitate, and myristic myristate are commonly used in making personal care emollients. The construction of this manufacturing facility was intended to cater to the growing demand in the personal care market of the Asia Pacific region.

The fatty acid segment is projected to experience the fastest growth during the forecast period. This growth is attributed to the unique properties of fatty acids as emollients, which can effectively hydrate the skin by locking in moisture and reducing moisture loss to the surrounding environment. Common fatty acids used in emollients include sterols, glycerides, and phospholipids.

Regional Insights

Asia-PacificEmollients Market Size and Growth 2025 to 2034

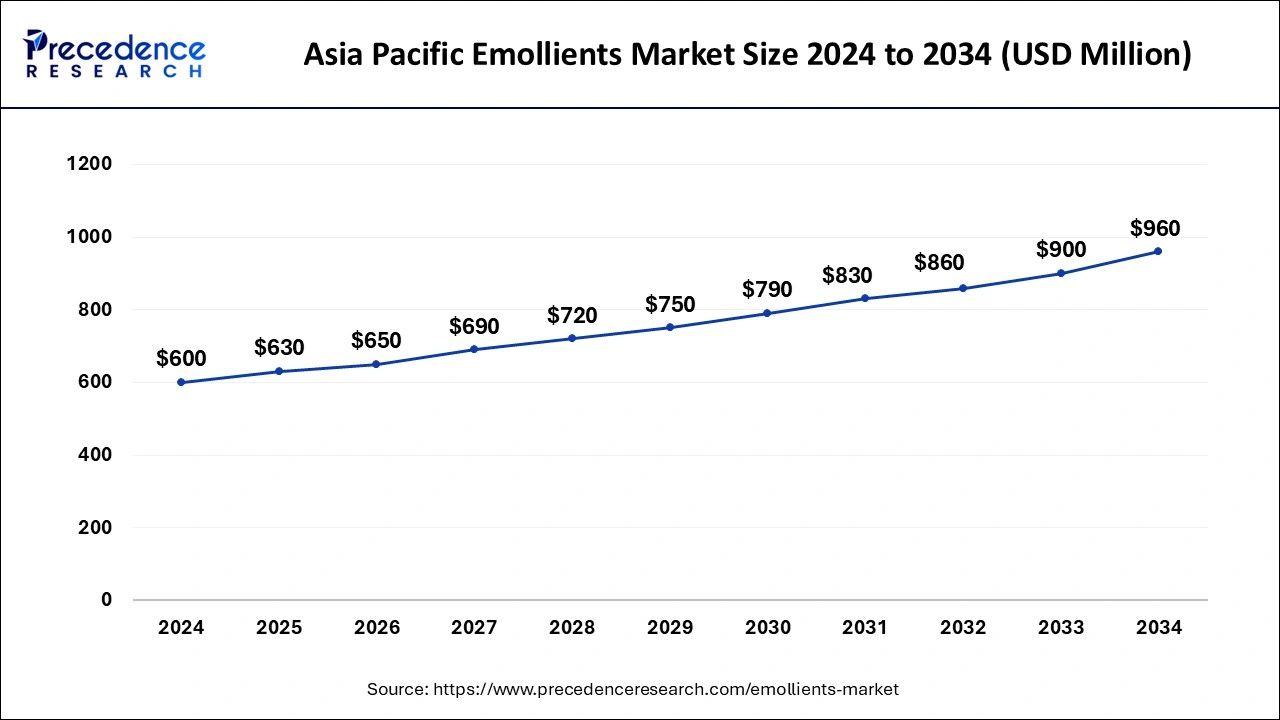

The Asia-Pacific emollients market size is exhibited at USD 630 million in 2025 and is projected to be worth around USD 960 million by 2034, growing at a CAGR of 4.81% from 2025 to 2034.

Asia Pacific dominated the global emollients market in 2024and is expected to maintain its leadership position in the coming years. The growth in this region can be attributed to evolving fashion preferences and a growing trend among people to enhance their appearance in Asian countries. Also, the presence of major product manufacturers and suppliers in the region will continue to drive market trends.

- In November 2023, American personal care brand Botanic Hearth launched in India, bringing its versatile range of face care, body care, and hair care products.

China and India are experiencing substantial growth due to rising disposable incomes and the expansion of the beauty and personal care sectors. China holds the largest portion of the market in Asia Pacific. High disposable incomes, urbanization, and the growing need to maintain skin health are driving strong demand for premium, multifunctional emollients. The presence of both local and international brands, along with the expansion of e-commerce, is increasing the availability of emollients in China.

North America is poised to experience rapid growth in the global emollients market over the forecast period. This surge is linked to the increasing demand for cosmetics and personal care products in the United States. The market's expansion in North America is driven by shifting consumer lifestyles, a growing emphasis on wellness and beauty, and changing purchasing habits. Additionally, the rising consumer expenditure on anti-aging and skincare cosmeceuticals contributes to the growth of the region's global market.

- In April 2023, MERIT, the minimalist beauty brand known for its impossible-to-mess-up makeup and skincare products, brings wearability and maturity back to color cosmetics with the introduction of Solo Shado, a long-wearing, lightweight, cream-to-powder eyeshadow.

U.S. Emollients Market Analysis

The U.S. dominates the North America's emollients market due to its large, mature personal-care industry and high consumer spending on premium skincare products. There is high demand for multifunctional emollients used in anti-aging, sun-protection, and barrier-repair preparations. The increased awareness of skin health and conditions like eczema and dry skin drives the use of clinically tested emollients.

What Makes Europe a Notably Growing Area?

Europe is expected to grow at a notable rate in the market over the forecast period due to its robust personal care and dermatology sectors, particularly in Germany, France, and the UK. The rising consumer demand for high-quality, environmentally friendly skincare products is driving the need for natural and semi-synthetic emollients. High safety and quality standards are upheld through strict regulatory frameworks, such as REACH and the EU Cosmetics Regulation, which prompt skincare manufacturers to consider renewable and bio-based raw materials, thereby contributing to market growth.

Germany Emollients Market Analysis

Germany is a leading market in Europe, driven by high per-capita consumption of skincare and cosmetic products, and a growing consumer preference for high-quality, nature-friendly formulas. Regulations such as REACH and the EU Cosmetics Regulation ensure product quality and safety, encouraging manufacturers to invest in renewable, compliant ingredients and boosting demand for semi-synthetic and natural emollients.

What Potentiates the Growth of the Emollients Market in Latin America?

The market in Latin America is potentiated by a rising middle class, increasing urbanization, and higher personal care expenditure. Customers are more attracted to affordable yet high-performing emollient-based skincare products and plant-based ingredients. Increased trade channels and the growth of e-commerce increase product availability in cities and semi-urban areas. Additionally, a growing preference for natural, sustainable, and multifunctional ingredients in cosmetics, alongside the region's increasing focus on wellness and beauty, is further boosting demand for emollients.

Brazil Emollients Market Analysis

Brazil leads the market in Latin America, driven by a growing middle class, increasing urbanization, and rising expenditures on personal care products. There is also high demand for emollient-based skincare formulations. The rising consumer preference for plant-based and natural ingredients is encouraging local manufacturers to expand the portfolio of bio-derived emollients. Moreover, increasing consumer awareness of skincare and personal care is supporting market growth.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) region offers immense opportunities for the emollients market, driven by a growing demand for skincare products due to the region's hot and dry climate. In particular, there is rising demand for sunscreens, moisturizers, and hydrating lotions, as well as multifunctional and high-performance emollients. The increasing disposable income, especially in GCC countries, and the rising trend towards luxury and natural beauty products further create opportunities for brands to introduce innovative, climate-specific, and premium emollient formulations.

UAE Emollients Market Analysis

The UAE is a major contributor to the market in the Middle East and Africa. The market growth in the UAE is driven by high demand for premium skincare, sun protection, and personal care products. The market's growth is also supported by rising disposable income, enabling consumers to invest in high-quality products. The hot and arid climate creates a consistent need for effective moisturizers, sunscreens, and hydrating lotions, while increasing consumer interest in natural, multifunctional, and high-performance emollient formulations presents an opportunity for brands to innovate.

Emollients Market – Value Chain Analysis

Raw Material Sourcing

The foundation of emollient production lies in sourcing natural and synthetic ingredients, including vegetable oils, fatty acids, esters, silicones, and butters. These raw materials determine the texture, efficacy, and safety of the final product.

- Key Players: BASF SE, Croda International PLC, Sasol, Oleon Health and Beauty, Vantage Specialty Chemicals

Intermediate Chemical Processing

Raw materials are refined and converted into functional intermediates like emollient esters, moisturizing agents, conditioning oils, and fatty alcohols suitable for cosmetic and skincare applications.

- Key Players: Evonik Industries AG, Clariant, Hallstar, Lonza, Stepan Company

Formulation & Product Development

Intermediate chemicals are blended with active ingredients, preservatives, and fragrances to create creams, lotions, ointments, balms, and other personal care formulations. R&D focuses on efficacy, sensory feel, and stability.

- Key Players: The Lubrizol Corporation, Ashland Inc., Covestro AG, Solvay

Packaging & Labeling

Formulated emollient products are packaged in tubes, jars, pumps, or sachets. Packaging innovations ensure product stability, consumer convenience, and brand differentiation.

- Key Players:Global packaging companies and in-house packaging divisions of major personal care brands

Distribution & Retail

Finished emollient products are distributed through e-commerce platforms, specialty cosmetic stores, pharmacies, and mass-market retail chains to reach end consumers worldwide.

- Key Players: L'Oréal, Johnson & Johnson, Unilever, Beiersdorf, Procter & Gamble

Top Companies in the Emollients Market

- BASF SE (Germany): Offers a broad portfolio of emollients, surfactants, and active ingredients for skincare, haircare, and cosmetic formulations.

- Clariant (Switzerland): Develops specialty chemicals and functional ingredients for personal care, including emollients, emulsifiers, and conditioners.

- Eastman Chemical Company (U.S.): Provides specialty esters, emollients, and performance additives used in skin and hair care products.

- The Lubrizol Corporation (U.S.): Supplies emollients, thickeners, and delivery systems for cosmetics and personal care applications.

- Covestro AG (Germany):Produces high-performance polymeric materials and emollient derivatives for skincare and cosmetic formulations.

- Evonik Industries AG (Germany): Offers specialty cosmetic ingredients, including emollients, surfactants, and moisturizers.Hallstar (U.S.): Focuses on emollients, skin conditioning agents, and multifunctional additives for personal care products.

- Croda International PLC (UK): Provides natural and synthetic emollients, oils, and performance ingredients for skincare and haircare.

- Ashland Inc. (U.S.):Develops specialty polymers, emollients, and delivery systems for cosmetics and personal care formulations.

- Sasol (South Africa):Supplies fatty alcohols, esters, and emollients used in skincare, soaps, and cosmetics.

- Lonza (Switzerland): Offers active ingredients and emollients for skincare and dermatological applications.

- Stepan Company (U.S.):Produces surfactants, emollients, and conditioning agents for personal care products.

- Oleon Health and Beauty (Belgium):Focuses on plant-based emollients, fatty esters, and skin-conditioning ingredients.

- Solvay (Belgium):Provides specialty ingredients, including emollients and performance chemicals, for personal care and cosmetic products.

- Vantage Specialty Chemicals (U.S.): Offers natural and synthetic emollients, esters, and functional ingredients for skin and hair care.

Recent Developments

- In November 2023, Sonneborn, LLC, introduced plant derived SonneNatural NXG emollient. Reportedly, the new product improves the formation of lip care and personal care items owing to their sensory & firmness features.

- In June 2023, Oleon is concentrating on the enzymatic esterification of ingredient development. Radia 7199ACT, an emollient and texture enhancer, and Jolee 7749ACT, a fatty ester that is good for skin and hair, are two of their most recent releases.

- In March 2023, Clariant launched Plantasens Pro LM, a novel natural emollient, in response to consumers' increasing interest in and understanding of skincare across the globe. The skin feels pampered, enriched, and opulent both during and after using this product.

- In April 2022, Seppic launched EMOGREEN™ HP 40, a new bio-based & sustainable emollient that is highly pure and sustainable.

- In November 2022, Givaudan launched Sensityl™, a cosmetic active ingredient that addresses the negative effects of stress on the skin and provides a soothing effect.

- In September 2022, BASF and L'Oréal announced a partnership to develop sustainable bio-based surfactants for personal care applications, aiming to reduce the environmental impact of formulations.

Segments Covered in the Report

By Type

- Esters

- Fatty Alcohols

- Fatty Acids

- Ethers

- Silicones

- Others

By Form

- Solid

- Liquid

By Application

- Skincare

- Hair Care

- Deodorants

- Oral Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content