What is the Explosion-Proof Lighting Market Size?

The global explosion proof lighting market size is valued at USD 422.24 million in 2025 and is predicted to increase from USD 451.17 million in 2026 to approximately USD 766.54 million by 2034, expanding at a CAGR of 6.85% from 2025 to 2034. Stringent government policies in the adoption of explosion-proof components in industries are driving the market's growth.

Explosion Proof Lighting Market Key Takeaways

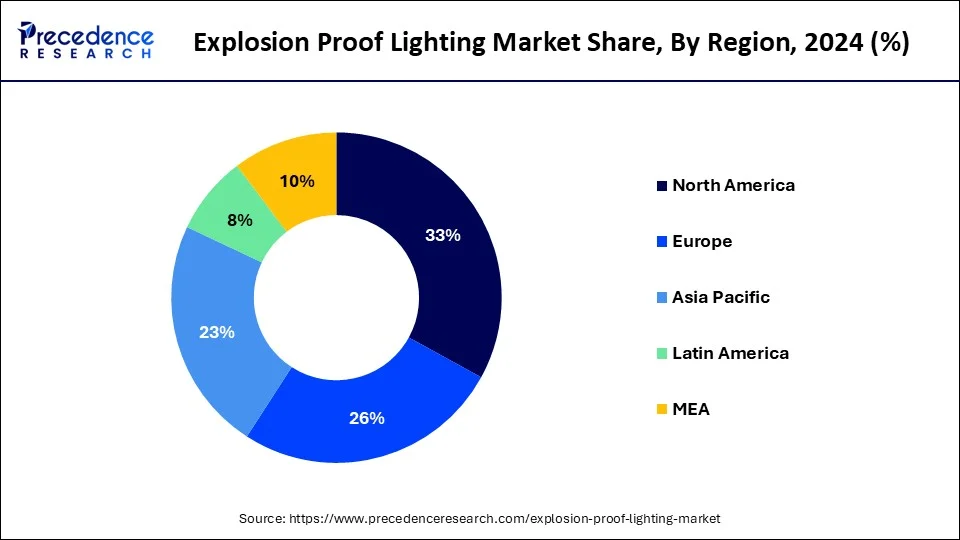

- North America dominated the explosion proof lighting market with the largest share of 33% in 2024.

- Asia Pacific is expected to be the fastest-growing market during the predicted period.

- By type, the general lighting segment dominated the market with the largest share in 2024.

- By light type, the LED segment dominated the market in 2024.

- By end-use, the oil and gas segment dominated the market in 2024.

Market Overview

Explosion-proof lighting is also considered ATEX lighting, which is an essential part of industries for ensuring safety in hazardous environments. The lighting is designed to illuminate the isolating sparks in the unit to prevent any potential explosion in the industries. The explosion-proof lighting must comply with the ATEX directive, which is required to ensure safety standards and reliability. Explosion-proof lighting plays an important role in industries such as petroleum, oil refineries, mining, food industries, and pharmaceutical companies due to the higher presence of flammable substances in the air, such as alcohol, aerosol, gasoline, dust, and others. Thus, the rising development in such industrial infrastructures is driving the growth of the explosion proof lighting market.

How Can AI Impact the Explosion Proof Lighting Market?

The integration of artificial intelligence into explosion-proof lighting is driving the capabilities and efficiency of this lighting. The integration of AI in several industrial applications, including the lighting system, enhanced the safety standards in the industrial environment. The AI algorithms can detect real-time insights into the industrial environment and adjust the power of light or brightness as per the condition; it ensures safety by predicting potential hazards and can optimize power consumption. Additionally, the AI-powered sensors offer predictive maintenance insights, minimizing downtime and providing proactive servicing, which ensures the explosion-proof lighting is reliable and secure and enhances overall safety in hazardous environments.

For Instance,

- In July 2024, Hanwha Vision, a leading vision solution provider, launched the TNO-C8083E, an AI-powered explosion-proof camera. The camera is compact and 5MP explosion-proof, and it has functions like object detection and classification with intelligent video analytics.

Explosion-Proof Lighting Market Outlook

- Industry Growth Overview: Between 2025 and 2034, this market is expected to rise significantly due to the growing demand for efficient lighting solutions from the energy sector coupled with technological advancements in the lighting systems.

- Major Investors:Numerous lighting companies are actively entering this market, drawn by partnerships, R&D and business expansions. Numerous market players such as Eaton Corporation Inc., Atomsvet LLC, NORKA Lighting and some others have started investing rapidly for developing high-quality explosion proof lights for end-user industries.

- Startup Ecosystem: Various startup companies are engaged in developing explosion proof lights for the end-user industries. The prominent startup brands dealing in manufacturing explosion proof lighting solution comprises of Explosionproof Ledlights, WorkSite Lighting, SharpEagle and some others.

Market Trends

- There are 112 fire accidents reported in India from July to December 2023. The major reason behind the fire accidents in residential and industrial areas is electrical faults, such as short circuits, which accounted for 58 incidents of fire accidents.

- According to the Emergency Medical Services, Fire & Enforcement Statistics 2023, the total number of fire incidents increased by 8.6% to 1954 cases in 2023 in Singapore.

Technology Advancement in the Explosion-Proof Lighting Market

The incorporation of LED technology has been revolutionary as it has extended its lifespan, consumed less power, and is brighter as compared to the old incandescent or fluorescent lights. Intelligent lighting systems, involving remote monitoring and control, are becoming popular as a result of which real-time diagnostics and predictive maintenance are used in the oil & gas industry, the mining industry, and the chemical processing industry. In addition, the trend of wireless communications and IoT in industrial lighting systems is transforming the management of the explosion-proof lighting.

Explosion Proof Lighting Market Growth Factors

- The rising demand for efficient lighting solutions that are safer and can be located in potentially risky places such as oil refineries, manufacturing units, and other places is driving the growth of the explosion proof lighting market.

- The explosion-proof light does not emit any harmful substances at the time of sudden accidents; it minimizes the risk of spreading explosive reactions or igniting substances in the environment, creating a safer environment in the industries.

- The increasing demand for efficient industrial infrastructure, such as lighting, safety equipment, and other assets that help reduce the potential risk associated with industrial accidents.

- Rising economic standards in several countries drive industrialization and commercial infrastructure, driving the demand for commercial lighting for installation in industrial and commercial buildings.

- The rising integration of sensors, IoT, AI, and other smart applications in infrastructure and further investments in advancements in industrial infrastructure are accelerating the growth of the explosion proof lighting market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 788.16 Million |

| Market Size in 2026 | USD 451.17 Million |

| Market Size in 2025 | USD 422.24 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.85% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Light Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The increasing awareness regarding the benefits associated with explosion-proof lighting

Explosion-proof lighting has several benefits in industrial installation other than general or conventional lighting. It ensures more safety and reliability than the conventional type of lighting, which drives the growth of the explosion proof lighting market. These lightings have several remarkable features, including robust construction, which means they are constructed with durable material that increases the lifespan of the lighting and makes it more corrosion-resistant and maintained in extreme temperatures. Its enclosed design prevents fire or sparks from escaping, making it reliable and suitable for flammable gases and dust particles in the environment. The explosion-proof lighting enhanced energy efficiency and ensured safety, durability, longevity, enhanced visibility, and regulatory compliance, which are collectively useful.

Restraint

Complexity in integration

Integrating confidential computing solutions into existing IT infrastructures can be complex and time-consuming. Organizations may face challenges in ensuring compatibility with legacy systems, leading to potential delays and increased costs during implementation. Many organizations still lack awareness or a clear understanding of what confidential computing entails and how it can benefit their operations. This knowledge gap can slow market growth as potential customers may be hesitant to invest in technologies they don't fully understand.

Opportunity

The rising adoption of explosion-proof lighting in the chemical and pharmaceutical industry

The rising installation of explosion-proof lighting in the pharmaceutical and chemical industries provides enhanced visibility and energy efficiency, optimizes power consumption, and prevents potential accidents in the unit due to the increased availability of the gaseous, alcohol, dust, and other toxic chemical materials in the environment that are more likely to capture fire in air with the exposer of heat. Thus, the higher availability of inflammable substances in the air and the stringent government policies in the implementation of fireproof components in industrial units are proving to be opportunistic.

Type Insights

The general lighting segment dominated the explosion proof lighting market with the largest share in 2024. The increasing adoption of explosion-proof lighting as the general lighting in the commercial and industrial areas to provide sufficient visibility in the industries and commercial areas is driving the explosion-proof lighting as the general lighting.

Light Type Insights

The LED segment dominated the explosion proof lighting market in 2024. The rising awareness regarding energy saving and the adoption of more wireless connectivity applications are driving the LED type of lighting in explosion-proof lighting. The adoption of LED lights in explosion-proof lighting industries is comparatively more affordable due to their lower maintenance cost than other conventional lighting. LED lighting has a longer lifespan as compared to other lighting, though it reduces the time-to-time replacement and maintenance requirements. Additionally, LED lighting is more energy efficient than other sources; it requires less power for operations due to naturally reduced power consumption. The increased adoption of LEDs is retrofitting about 60-75% of the improvement in power consumption. Other than these, LEDs have other benefits such as better performance, the fact that they can be used in a rough environment, the fact that they do not contain any toxic mercury, the fact that they have instant warm-ups during switch on and off, and others.

For Instance,

- The penetration rate of LED lighting worldwide is projected to reach 61% by 2027. It is projected that LED lighting will save approximately 348 TWh of electricity globally by 2030.

- While the global LED lighting market is expected to reach $108.99 billion by 2025. It can reduce global carbon emissions by 570 million tons annually and lasts up to 100,000 hours.

- LED lighting is projected to influence energy cost savings of $30.2 billion globally by 2030 and reduce energy consumption by 80%.

End-Use Insights

The oil and gas segment dominated the explosion proof lighting market in 2024. The rising population and the increasing demand for industrial, commercial, and residential operations in the energy sector across the world have accelerated the growth of the oil and gas sector. Thus, the rising industrial and commercial infrastructure, including oil and gas industrial development in various regions across the world, is driving the demand for explosion-proof lighting. The oil and gas industries are considered the most prevalent area for accidents, instant fires, and explosions due to the higher density of gases in the air that boosts the demand for efficient industrial infrastructure that can handle all potentially hazardous situations, which drives the adoption of the explosion proof lighting in the industrial units for maintaining proper visibility for the operations and safety of workers.

For Instance,

The lighting fixtures manufacturing industry in the United States was $13.9 billion in 2023.

- The U.S. oil refineries expanded their capacity for 2nd time during the Covid-19 pandemic. According to the Refinery Capacity Report, U.S. operable atmospheric crude oil distillation capacity and the primary measure of refinery capacity, collectively 18.4 million barrels per calendar day at the start of 2024, is 2% higher than the start of 2023. The three major oil refineries in the U.S., Marathon, Valero, and ExxonMobil, accounted for the higher capacity of distillation compared to 2023.

Regional Insights

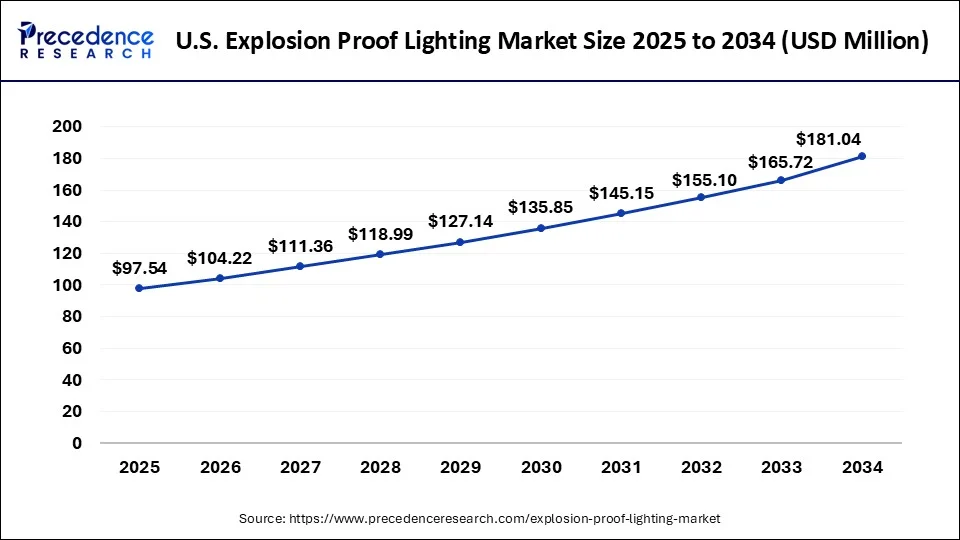

U.S. Explosion Proof Lighting Market Size and Growth 2025 to 2034

The global explosion proof lighting market size is exhibited at USD 97.54 million in 2025 and is predicted to be worth around USD 181.04 million by 2034, growing at a CAGR of 7.09% from 2025 to 2034.

North America dominated the explosion proof lighting market by holding the largest share in 2024. This is mainly due to stringent safety regulations that mandate the use of explosion-proof lighting in hazardous environments, particularly in industries such as mining, oil and gas, and pharmaceuticals. The region is known for the early adoption of explosion-proof lighting, leading to a well-established market. There has been rising development of advanced lighting technologies, supporting regional market growth. The U.S. is a major player in the market. There is a strong emphasis on workforce safety, boosting the demand for explosion-proof lighting.

Asia Pacific is estimated to show the fastest growth during the forecast period. The growth of the market is expected to increase owing to the rising demand for explosion-proof lighting from the industrial and commercial sectors, which boosts the growth of the market. The rising investment in commercial building development, such as hospitals, malls, office spaces, and others, is driving the demand for cost-efficient and less-maintenance lighting systems.

What led Europe to hold a significant share of the explosion proof lighting market?

Europe held a significant share of the market. The rapid adoption of LED lighting systems in the mining sector across numerous countries such as Germany, France, Italy, UK and some others has boosted the market expansion. Additionally, rapid investment by market players for opening up new production centers is expected to propel the growth of the explosion proof lighting market in this region.

What made Latin America to hold a considerable share of the explosion proof lighting market?

Latin America held a considerable share of the industry. The rising demand for high-quality floodlights from the football stadium in Brazil and Argentina has driven the market expansion. Also, numerous government initiatives aimed at installing fluorescent lights in the roadside areas is expected to drive the growth of the explosion proof lighting market in this region.

How did Middle East and Africa held a notable share of the explosion proof lighting market?

Middle East and Africa held a notable share of the market. The growing use of advanced lights in the oil and gas industry across numerous countries such as UAE, Saudi Arabia, South Africa, Qatar and some others has boosted the market growth. Also, partnerships among light manufacturers and AI companies to develop AI-enabled explosion proof lights is expected to foster the growth of the explosion proof lighting market in this region.

Value-Chain Analysis

Raw Material Procurement

The raw materials used for manufacturing explosion-proof lighting includes aluminum alloys or stainless steel for the housing, and tempered glass for the lenses.

- Key Companies: Rio Tinto, Alcoa, Chalco and others.

Testing and Quality Control

Testing and quality control (QC) for explosion-proof lighting involve a comprehensive suite of tests to ensure the product can withstand a hazardous environment without igniting flammable gases or dust.

- Key Companies: HQTS, TÜV, Pro QC International, and others.

Distribution Channel

The distribution channel for explosion-proof lighting typically involves a direct sales model or a channel involving distributors to reach end-users in industrial sectors such as oil and gas, chemical, and mining.

- Key Companies: Hubbell Inc, Glamox As, Cortem S.P.A. and others.

Key Players: Developing Explosion Proof Lighting Solutions For End-Users

- Hubbell Inc.: Hubbell Incorporated is a manufacturer of electrical and electronic products for non-residential and residential construction, industrial, and utility applications. Its products include a wide range of solutions for power transmission, distribution, lighting, and data communications.

- Atomsvet LLC:Atomsvet LLC is a Russian company specializing in the design and production of LED lighting systems, including explosion-proof lighting and automated lighting control systems. Atomsvet holds ISO 9001 certification and its products finds application in numerous sectors.

- Eaton Corporation Inc.:Eaton Corporation plc is a diversified power management company that develops and provides products and services for sectors including electrical, aerospace, vehicle, and eMobility. This company focuses on intelligent power management solutions that address the growing trends of electrification and digitalization.

- LDPI Inc.: LDPI Inc is a manufacturer based in Eau Claire, WI, that specializes in industrial lighting solutions for hazardous and specialized environments. This company manufactures a wide range of products, including LED, fluorescent, and incandescent lighting.

- Larson Electronics LLC: Larson Electronics LLC is a Texas-based manufacturer and distributor founded in 1973, specializing in industrial lighting and power distribution solutions for demanding sectors including military, oil and gas, and manufacturing. This brand provides a wide range of products, including explosion-proof and hazardous location lighting, along with custom design services.

- General Electric: General Electric (GE) is an American multinational conglomerate, originally founded by Thomas Edison in 1876. This company mainly focuses on energy solutions, including power generation, renewable energy, and grid solutions.

Recent Developments

- In October 2025, Shindaiwa launched EXMP range. EXMP range of lights are designed for hazardous industrial applications.

(Source: hazardexonthenet.net) - In September 2025, LEDVANCE launched a new portfolio of explosion proof lights. These lights are designed for the high-risk industrial settings across the U.S.

(Source: globenewswire.com) - In May 2025, Glamox launched wildlife-friendly marine lights. These lights are designed for operating across onshore coastal facilities.

(Source: marinelink.com) - In May 2024, FANUC America launched the CRX-10iA/L painting collaborative robot. The company launched the robot as the first explosion-proof (ex-proof) collaborative paint robot for global use and sale.

Segments Covered in the Report

By Type

- General Lighting

- Floodlights

- Compact Lights

- Others

By Light Type

- LED Lights

- Fluorescent Lights

- Incandescent Lights

- HID Lights

By End-Use

- Oil & Gas

- Chemical & Pharmaceutical

- Food & Beverage

- Mining

- Energy & Power

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting