What is the Horticulture Lighting Market Size?

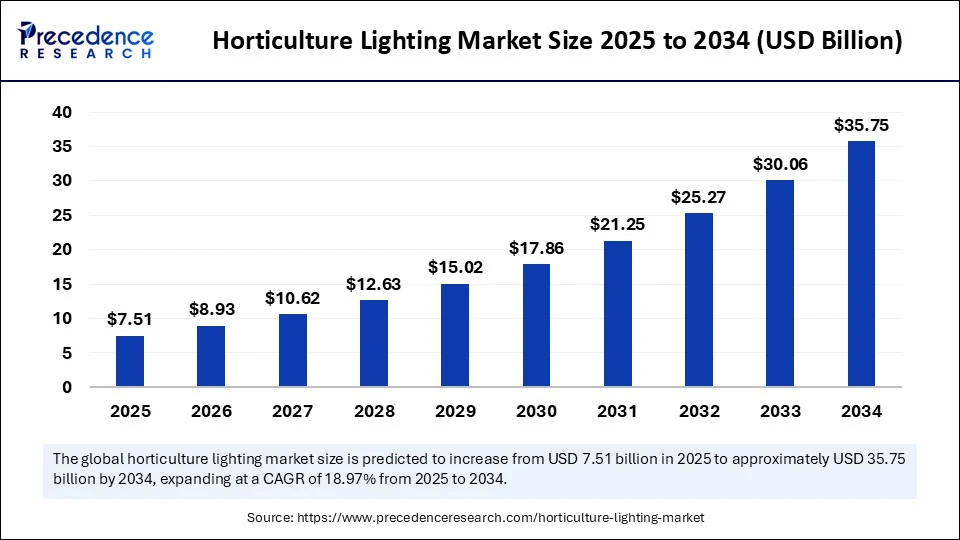

The global horticulture lighting market size is accounted at USD 7.51 billion in 2025 and predicted to increase from USD 8.93 billion in 2026 to approximately USD 35.75 billion by 2034, representing a CAGR of 18.94% from 2025 to 2034.The horticulture lighting market is a rapidly growing sector with significant projections for the coming years.

Horticulture Lighting Market Key Takeaways

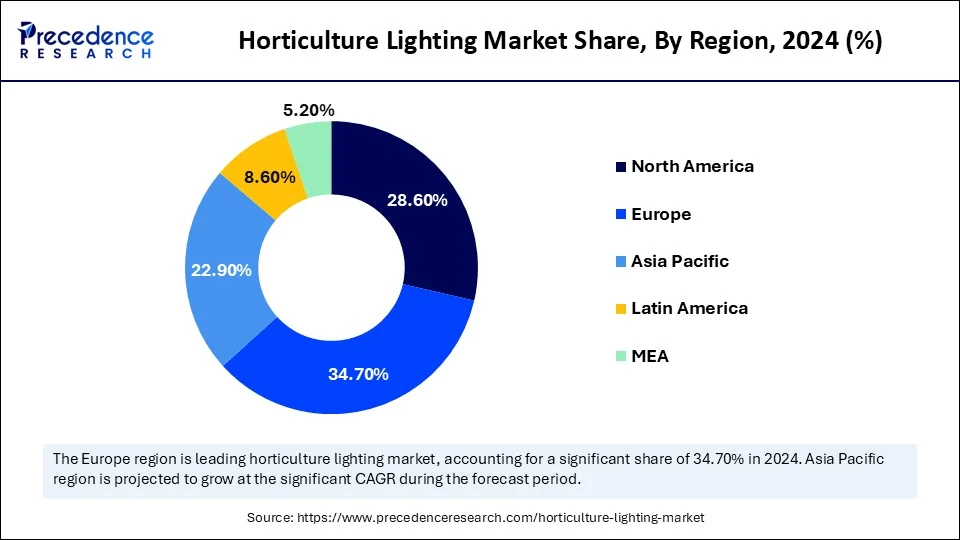

- Europe dominated the global market with the largest market share of 34.7% in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By offering, the hardware segment held the maximum revenue share of 91.4% in the market in 2024.

- By offering, the software & analytics segment is expected to witness the fastest growth over the forecast period.

- By technology, the LED segments captured the biggest market share of 80.3% in 2024 and is expected to witness the fastest growth in the market over the forecast period.

- By application / grow environment, the greenhouses segment generated the major market share of 43.2% in 2024.

- By application / grow environment, the vertical farms segment is expected to witness the fastest growth over the forecast period.

- By spectrum strategy, the broad/full-spectrum segment accounted for a significant market share of 58% in 2024.

- By spectrum strategy, the tunable/dynamic spectrum segment is expected to witness the fastest growth over the forecast period.

- By connectivity/control, the stand-alone/dimmable segment held the largest revenue share of 64% in 2024.

- By connectivity/control type, the network segment is expected to witness the fastest growth over the forecast period.

How Is AI Transforming the Horticulture Lighting Market?

Artificial Intelligence is transforming horticulture lighting from a static utility into an intelligent growth partner. AI-powered systems analyze real-time data from environmental sensors, cameras, and plant health monitors to automatically adjust light intensity, spectrum, and duration for each growth stage. This ensures optimal photosynthesis while reducing energy waste, resulting in better yields and lower operational costs. Predictive analytics allow farmers to anticipate plant needs and prevent stress before it impacts quality. By integrating AI with IoT and machine vision, growers can achieve precision farming at an unprecedented scale.

Illuminating the Future of Farming

The horticulture lighting market covers purpose-built luminaires, controls, and software that deliver photosynthetically useful light (intensity, spectrum, and photoperiod) to crops grown in controlled environment agriculture (CEA), e.g., greenhouses, indoor grow rooms, and vertical farms, to optimize growth, quality, and yield. It includes both retrofit and new build deployments across various fixture types (top/inter/intracanopy), technologies (LED, HID, fluorescent, and plasma), and control systems.

The horticulture lighting market is witnessing rapid growth as controlled environment agriculture, vertical farming, and greenhouse operations expand globally. Energy-efficient LEDs have become the cornerstone, replacing traditional lighting due to their precision, longevity, and spectrum customization. Farmers are increasingly leveraging tailored light recipes to improve crop yield, quality, and growth cycles. This sector is also being driven by urbanization, shrinking arable land, and the rising demand for fresh produce year-round. With innovations in spectrum control, the market is evolving from a simple light source to a critical crop-organization tool. The shift from outdoor dependency to tech-driven indoor farming is reshaping the very definition of agriculture.

Horticulture Lighting Market Outlook

- Industry Growth Overview: The horticulture lighting market is poised for explosive growth from 2025 to 2024, driven by increased adoption of controlled environment agriculture (CEA) for food security, the transition to energy-efficient LED technology, and the expansion of high-value crops such as cannabis and specialty produce.

- Shift Toward Energy-Efficient Technologies: There is a rapid shift toward energy-efficient technologies in the food and agriculture. This, in turn, is boosting the adoption of LED lighting, AI-enabled data analytics, and other innovations that optimize resource consumption. The focus is on reducing energy and water use in controlled environments, minimizing reliance on pesticides, and lowering the carbon footprint associated with both food transport and production, thereby promoting sustainability and environmental responsibility across the supply chain.

- Global Expansion:The market is expanding globally as the demand for indoor farming, vertical agriculture, and greenhouses increases, driven by the need for efficient lighting solutions to optimize plant growth and boost crop yields. Emerging regions like Asia-Pacific, Latin America, and Africa offer significant opportunities, driven by rising urbanization, growing food security concerns, and the adoption of sustainable agricultural practices, which are driving demand for energy-efficient horticulture lighting systems.

- Major Investors: Major investors include Signify, ams OSRAM, Current Lighting Solutions, and Heliospectra AB, who are heavily investing in R&D, acquisitions, and strategic partnerships with cloud providers and ag-tech startups. These efforts focus on integrating smart controls and AI platforms into their lighting solutions, enhancing precision farming and enabling more efficient, data-driven management of lighting for optimal plant growth.

- Startup Ecosystem: A thriving startup ecosystem is focusing on developing AI-driven lighting platforms, real-time data analytics, and specialized hardware. Emerging firms are attracting significant venture capital funding by offering innovative solutions like light-as-a-service business models and specialized light recipes for different crops.

Horticulture Lighting Market Key Trends

- Full-spectrum, tunable LEDs: These mimic natural sunlight and adapt to plant growth stages.

- Integration with IoT and AI: This helps in automated, real-time light adjustments based on crop and climate data.

- Energy-efficient and sustainable designs: Including solar-assisted lightning and recyclable materials.

- Rising adoption in vertical farming and urban agriculture: It is demanding compact, high-intensity lighting.

- Crop-specific spectrum: Personalization to maximize yield, quality, and nutritional value.

- Hybrid lighting systems: This combines artificial and natural light for optimized performance and cost savings.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.75 Billion |

| Market Size in 2026 | USD 8.93 Billion |

| Market Size in 2025 | USD 7.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.94% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Technology, Application / Grow Environment, Spectrum Strategy, Connectivity/Control, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Feeding More with Less

The primary driver for the horticulture lighting market is the surging demand for fresh, high-quality produce in urban areas with limited arable land. Controlled environment agriculture, such as vertical farming and hydroponics, requires specialized lighting to mimic natural sunlight year-round. Energy-efficient LED technology has become the preferred choice for its long lifespan, customizable spectrum, and lower heat output. Additionally, government initiatives supporting sustainable agriculture and food security are accelerating adoption. Rising population growth and climate change pressures further push the need for reliable indoor farming solutions.

Restraint

Bright Ideas, high Costs

Despite its potential, the horticulture lighting market faces barriers to mass adoption, particularly in cost-sensitive regions. High Initial investment in LED systems and AI-integrated technologies can deter small and medium-scale farmers. There is also a skill gap-many growers lack the technical expertise to fully utilize advanced lightning and AI tools. Energy infrastructure limitations in rural and developing areas further restrict the scalability of high-intensity systems. Additionally, return on investment may take time to materialize, making cautious investors hesitant to commit. These challenges highlight the need for affordable, user-friendly solutions to ensure widespread adoption.

Opportunity

The Green Gold Rush

The greatest opportunities lie in expanding horticulture lighting adoption in developing economies and non-traditional farming regions. AI-driven lightning systems open doors for specialty crops, medicinal plants, and high-value horticulture products to be grown anywhere, regardless of climate. Partnerships between lightning manufacturers and agri-tech startups can create integrated farming solutions that appeal to both large-scale operators and smallholder farmers. Emerging applications in space farming, urban rooftop gardens, and plant-based pharmaceutical production are also paving the way for new revenue streams. With food demand projected to rise sharply, innovation in smart lighting can unlock massive untapped markets.

Segmental Insights

Offering Insights

Why Hardware is Dominating the Horticulture Lighting Market?

The hardware segment captured a significant portion of the horticulture lighting market in 2024 because lighting fixtures, control gear, and installation infrastructure form the backbone of any cultivation system. Farmers rely heavily on high-performance luminaires and supporting equipment to ensure consistent light quality and durability. LEDs, drivers, reflectors, and mounting systems make up the majority of capital investment in indoor farming. The scalability of hardware solutions allows them to serve everything from small rooftop gardens to large commercial greenhouses. Advances in design have enabled better heat management and longer lifespan, making hardware a cost-effective long-term asset. The dominance of hardware is also reinforced by its irreplaceable role in delivering the physical light plants need for growth.

The hardware segment further benefits from the trend of replacing outdated lighting with more efficient, spectrum-optimized systems. Innovations in modular lighting designs allow growers to expand their systems without replacing entire setups. High-lumen output and energy efficiency continue to be the top selling points for commercial farmers. Additionally, many hardware products now integrate with IoT systems, allowing partial automation without a complete technology overhaul. The high adoption rate in established agricultural regions ensures steady market revenue. Hardware's strong market share is expected to remain stable, supported by continuous advancements in manufacturing and durability.

The software & services segment has become the fastest growing in the horticulture lighting market, as AI-powered plant monitoring and cloud-based lighting control systems gain popularity. Farmers increasingly seek solutions that automate light scheduling, spectrum adjustments, and power consumption tracking. Predictive analytics and data-driven decision-making are becoming central to yield optimization. Service offerings such as installation, maintenance, and crop-specific lighting consulting are also driving growth. Software solutions empower farmers to fine-tune lighting without constant manual intervention, improving efficiency and reducing labor costs. This segment is also benefiting from subscription-based revenue models that ensure continuous updates and support. This growth is further fueled by the shift toward remote and automated operations, where managers need visibility without being physically present. Custom dashboards provide KPIs tailored to specific industries. The rising complexity of indoorfarming has made software indispensable for maximizing returns on lighting investments. Remote monitoring capabilities allow growers to control farms from anywhere, even on mobile devices. Customizable light recipes, tailored for specific crops and growth stages, are unlocking new levels of precision farming. Services such as agronomic advisory and equipment integration help bridge the knowledge gap for small-scale farmers. This segment also benefits from partnerships between lighting manufacturers and Agri-tech firms to offer bundled solutions. With data-driven farming becoming the norm, software and services are poised to expand rapidly.

Technology Insights

How LED Segment Dominating the Horticulture Lighting Market?

The LED segment has become a dominant force in the horticulture lighting market, due to its energy efficiency, longevity, and ability to produce targeted light spectra. Compared to traditional lighting, LEDs generate less heat, reducing the need for additional cooling systems. Their customizable wavelengths can be tailored to enhance different plant growth stages, from germination to flowering. The falling cost of LEDs has further fueled their widespread adoption in greenhouses and vertical farms. Their compact design makes them suitable for high-density farming setups. The durability and low maintenance needs of LEDs make them the preferred choice for commercial growers.

LED dominance is also supported by government incentives promoting energy-efficient agricultural solutions. Advances in chip technology continue to improve light output while lowering operational costs. Multi-channel LED systems now allow growers to switch between different light spectrums without changing equipment. LED retrofits are popular in older facilities looking to improve efficiency without full infrastructure replacement. Their compatibility with automation systems makes LEDs central to smart farming. With sustainability being a priority, LED adoption is expected to stay ahead of other lighting technologies.

The fluorescent segment has become the fastest-growing in the horticulture lighting market, due to its relatively low upfront cost makes it attractive for small-scale and hobby growers. Fluorescent tubes provide broad-spectrum light suitable for seedlings and low-light crops. The technology is lightweight, easy to install, and requires minimal initial investment. Many indoor gardeners still prefer fluorescent systems for propagation stages where intense light is unnecessary. The rise of specialty plant markets is also fueling its adoption.

Fluorescents are increasingly used in combination with other light sources to balance costs and performance. They are favored for educational and research settings where budget constraints are common. Compact fluorescent lamps (CFLs) and high-output variants offer better efficiency than older models. The ease of replacing individual tubes without specialized tools adds to their appeal. While they may not match LEDs in efficiency, their affordability keeps them relevant in emerging markets. Growth in smaller urban farming operations is likely to sustain their demand.

Application / Grow Environment Insights

Why Greenhouse is Leading the Horticulture Lighting Market?

The greenhouses segment is leading in the horticulture lighting market due to its ability to combine natural sunlight with supplemental lighting. Controlled lightning ensures optimal plant growth during low-light seasons or cloudy conditions. Greenhouse operations often require high-intensity fixtures to cover large cultivation areas. The integration of lightning with heating and irrigation systems creates a highly efficient growing environment. Many large-scale vegetable and flower producers rely heavily on supplemental lighting to meet market demand year-round. This application is well-established and supported by proven ROI models.

Greenhouse dominance is further reinforced by their role in producing export-quality crops. Many facilities use hybrid lightning systems to balance energy costs with production efficiency. The adoption of LEDs in greenhouses has significantly reduced operational expenses. Advanced climate-control systems paired with adaptive lighting are boosting productivity. The segment is also benefiting from automation, allowing precise control of light schedules. As demand for sustainable farming rises, greenhouses remain at the heart of commercial horticulture.

The vertical farms segment has become the fastest-growing in the horticulture lighting market, due to their potential to produce high yields in urban spaces. They rely entirely on artificial lighting, making lighting technology central to their success. Controlled indoor environments allow year-round production regardless of weather. The demand for pesticide-free, locally grown produce in cities is fuelling investment in vertical farming projects. These setups use stacked layers of crops, maximizing output per square foot. LED lighting's spectrum control is critical for optimizing growth in confined spaces.

The expansion of vertical farming is being driven by both startups and established agricultural firms. Many facilities now integrate AI and IoT to optimize light, temperature, and humidity in real time. High-value crops like microgreens, herbs, and exotic plants are popular choices for vertical farms. Investors see them as a solution to urban food insecurity and climate challenges. Lighting manufacturers are designing compact, high-intensity systems specifically for vertical installations. This synergy between technology and market demand is propelling vertical farms forward at an exceptional pace.

Spectrum Strategy Insights

How Road/Full-Spectrum Is Dominating the Horticulture Lighting Market?

The road/full-spectrum segment has become a dominant force in the horticulture lighting market, due to its close mimicking of natural sunlight, supporting all plant growth stages. This sunlight supports all plant growth stages. This spectrum ensures balanced photosynthesis, improving both yield and crop quality. It is ideal for mixed-crop environments where multiple plant types require different wavelengths. Many growers choose full-spectrum lighting to simplify operations without needing to adjust for each crop type. Advances in LED design have made full-spectrum fixtures more energy-efficient. This strategy also supports healthier, more visually appealing crops.

Full-spectrum dominance is also tied to its versatility in both greenhouses and vertical farms. Farmers growing high-value crops prefer it for achieving consistent quality and flavor. The technology is adaptable to different growth stages without spectrum switching. Consumer demand for nutrient-rich, naturally grown produce is reinforcing adoption. Lighting companies are continuously improving spectral balance for better plant response. This all-purpose approach ensures that full-spectrum remains the most widely adopted strategy.

The tunable/dynamic spectrum segment has become the fastest-growing in the horticulture lighting market, as these systems enable real-time adjustments to wavelength output, optimizing conditions for germination, vegetative growth, and flowering. Dynamics spectrum control can enhance yield, improve taste, and speed up crop cycles. AI integration makes spectrum adjustment automated and data-driven. This strategy also enables targeted lightning for specialty crops with unique requirements. The flexibility of dynamic spectrum systems appeals to both research facilities and commercial growers.

The rise of specialty agriculture, such as medicinal plants and exotic herbs, is fueling demand for tunable lightning. Vertical farms in particular benefit from fine-tuned lightning recipes for maximum efficiency. This approach can also reduce energy waste by supplying only the wavelength needed at each stage. The ability to experiment with light profiles open opportunities for crop innovation. Manufacturers are introducing more cost-effective tunable systems to encourage wider adoption. As precision farming expands, dynamic spectrum lighting is set to become a mainstream choice.

Connectivity/Control Insights

Why is Stand-Alone/Dimmable is Dominating the Horticulture Lighting Market?

The stand-alone/dimmable segment has become a dominant force in the horticulture lighting market, due to its simplicity and cost-effectiveness. These systems allow basic manual control over light intensity without requiring complex infrastructure. They are widely used in small to mid-scale farming operations where budget constraints are a factor. Many growers appreciate their plug-and-play nature, requiring minimal training. Dimmable systems help manage energy consumption without sophisticated automation. Their reliability and low maintenance needs contribute to their widespread adoption.

The networked segment has become the fastest-growing in the horticulture lighting market, because these systems enable centralized control of multiple fixtures across large facilities. Wireless and cloud-based platforms allow remote adjustments to light intensity, spectrum, and schedules. AI integration helps optimize energy use and plant health in real time. Networked systems also facilitate predictive maintenance, reducing downtime. Their scalability makes them ideal for commercial-scale greenhouse and vertical farms.

Regional Insights

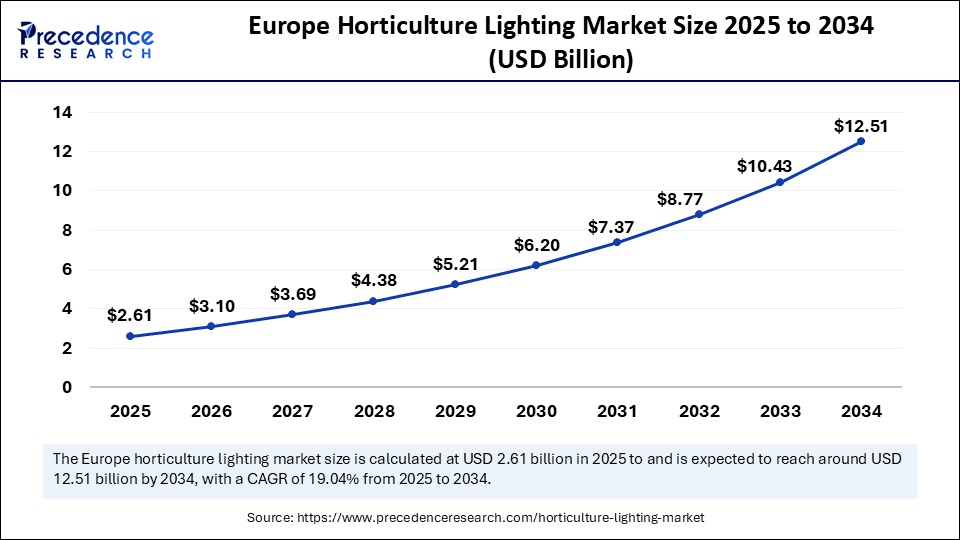

Europe Horticulture Lighting Market Size and Growth 2025 to 2034

The Europe horticulture lighting market size is evaluated at USD 2.61 billion in 2025 and is projected to be worth around USD 12.51 billion by 2034, growing at a CAGR of 19.04% from 2025 to 2034.

Why Is Europe Leading the Global Horticulture Lightning Race?

Europe continues to dominate the horticulture lighting market, due to its early adoption of advanced greenhouse technologies and strong emphasis on sustainable agriculture. The region benefits from government-backed initiatives promoting energy-efficient farming and reduced carbon footprints. Widespread use of vertical farming, controlled environment agriculture, and large-scale commercial greenhouses has cemented Europe's leadership position. LED manufacturers in the region focus heavily on spectrum optimization and climate-adaptive lighting solutions. High levels of R&D investment and collaboration between lightning companies and agricultural research institutes are further driving innovation. The demand for year-round, high-quality produce in dense urban populations adds fuel to this leadership.

The U.K. stands out in the European market with its progressive approach toward urban agriculture and smart farming. Government support for agri-tech startups, combined with a growing consumer preference for locally grown, pesticide-free produce, is accelerating adoption. The U.K. also benefits from active collaboration between universities, technology firms, and farming enterprises. LED solutions tailored for microgreens, herbs, and specialty crops are particularly in demand. Indoor vertical farms in cities like London are showcasing how lightning can boost both sustainability and profitability. The country's focus on food security and reduced import dependence is further reinforcing its agricultural lightning growth.

How Is Asia Pacific Growing Into the Brightest Spot in Horticulture Lighting?

Asia Pacific is the fastest-growing region in the horticulture lighting market, fuelled by rapid urbanization, shrinking farmland, and increasing demand for fresh produce. Countries in this region are embracing controlled-environment farming to overcome climate variability and food supply challenges. The availability of low-cost manufacturing combined with rising agri-tech investments is making advanced lighting solutions more affordable. Governments are also encouraging modern farming practices to enhance food security and reduce dependency on imports. The push for high-yield production in limited spaces is particularly driving vertical farming projects. As dietary patterns shift toward fresh vegetables, herbs, and exotic produce, the demand for smart lighting is set to surge.

India is the fastest-growing economy in the Asia Pacific, driven by its agricultural transformation agenda and rising adoption of precision farming. Urban farming startups are introducing LED-based solutions to grow vegetables and greens in rooftops, warehouses, and indoor facilities. The government's focus on sustainable agriculture and farmer training programs is increasing awareness about energy-efficient horticulture lighting. Rising disposable incomes and consumer preference for chemical-free produce are further boosting adoption. Several Indian agri-tech companies are experimenting with AI-integrated lighting to optimize yields in challenging climatic zones. With its large population and evolving farming ecosystem, India offers enormous untapped potential for market expansion.

What Makes North America a Key Force in the Horticulture Lighting Market?

North America is recognized as a key hub for innovation in the global horticulture lighting market, mainly driven by the growth of Controlled Environment Agriculture (CEA), which meets consumer demand for locally sourced, fresh produce. The region is home to leading manufacturers and ag-tech pioneers who are leading research and development in energy-efficient LED technology, AI-powered lighting analytics, and smart lighting systems. Government initiatives and utility rebates, especially in states like California and Massachusetts, motivate growers to adopt energy-efficient LED solutions, helping to offset the high initial costs of advanced systems.

The U.S. plays a key role in the global horticulture lighting market. Major U.S.-based companies like Acuity Brands and Cree, Inc. are important players in the market, focusing on developing innovative solutions for various uses. The widespread adoption of advanced farming techniques has accelerated the use of energy-efficient, full-spectrum lighting, backed by substantial private investment and R&D aimed at optimizing lighting for specific crops, thereby supporting market growth.

How is the Opportunistic Rise of Latin America in the Horticulture Lighting Market?

Latin America is emerging as a key region in the market, fueled by a growing need for food security and the adoption of controlled environment agriculture (CEA). Countries like Brazil, Argentina, and Colombia are focusing on modern lighting solutions, especially energy-efficient LEDs, to improve natural sunlight in greenhouses or support indoor farming, ensuring year-round crop production. This market also benefits from increasing consumer demand for fresh, locally sourced produce and a developing cannabis industry in some areas, though high initial investment costs remain a major obstacle.

Brazil dominates the horticulture lighting market in Latin America, driven by its large agricultural sector and increasing interest in organic and specialty crops. The market is supported by international companies like Signify and OSRAM Licht AG. However, the high cost of adopting new technologies poses a challenge for traditional farms considering LED lighting to cultivate fruits, vegetables, and flowers to meet the food needs of large populations.

What Opportunities Exist in the Middle East and Africa for the Horticulture Lighting Market?

The Middle East and Africa (MEA) region presents significant opportunities in the market, driven by a strong focus on food security and the need to combat harsh climate conditions through CEA. Major government initiatives and the increasing adoption of LED technology indicate substantial growth prospects, especially in the UAE and Saudi Arabia. Greenhouses remain the main application segment, with growing interest in vertical farming to produce high-value crops such as fruits, vegetables, and floriculture locally, thereby reducing dependence on imports.

Saudi Arabia is a key contributor to the MEA market, with growth mainly driven by substantial government investment in agricultural technology to achieve food self-sufficiency. There is a rising adoption of advanced, energy-efficient LED lighting systems with sophisticated spectrum control for greenhouses and vertical farms. This move toward technological innovation addresses issues like water scarcity and extreme heat, supporting local production while reducing dependence on imports.

Horticulture Lighting Market– Value Chain Analysis

- Raw Material Sourcing: The foundation of horticulture lightning production lies in the extraction of gallium, arsenic, and phosphide. This is used to create the semiconductor that forms the core of the LED. The sourcing of raw materials is extensively important for cost-effectiveness and a greater environmental impact.

Key Players: Osram, Lumileds, Cree LED, and Samsung

- Harvesting and Post-Harvest Handling: Harvesting and post-harvesting handling particularly contemplate carefully detaching crops at the right maturity stage, followed by a series of steps to maintain quality and minimize losses.

Storage and Cold Chain Logistics

- Post-Harvesting Storage: Once crops are harvested at optimal maturity, immediate transfer to storage is critical to slow metabolic activity and preserve freshness, thereby increasing the shelf life of the crops.

- Cold chain initiation: The cold chain begins at the moment of pre-cooling, removing field heat within 60-90 minutes after harvest. Common pre-cooling methods include forced-air cooling, vacuum cooling, and hydro-cooling.

Key Players: CEVA Logistics SA, Snowman logistics, and coldman logistics.

Top Companies in the Horticulture Lighting Market

- Signify: Signify is a leading player in the market, offering Philips Grow Lights that combine energy-efficient LED technology with smart controls and connected systems for optimized plant growth.

- ams OSRAM: ams OSRAM provides advanced LED horticulture lighting solutions, integrating smart sensor technologies and intelligent controls to optimize light intensity and spectrum for increased crop yield and energy efficiency.

- Heliospectra: Heliospectra specializes in intelligent LED lighting systems designed for greenhouses and vertical farming, offering customizable spectra and smart control systems to maximize plant performance and resource efficiency.

- Hortilux Schréder: Hortilux Schréder focuses on providing high-performance horticulture lighting solutions using LED and hybrid technologies tailored for both commercial growers and indoor farming, with an emphasis on sustainability and energy savings.

- Current Lighting:Current Lighting, a subsidiary of General Electric, offers LED grow lights and integrated smart lighting systems, optimizing energy use and supporting precision agriculture with IoT connectivity and data analytics.

- GE Lighting: GE Lighting provides energy-efficient LED horticulture lighting products for greenhouse and indoor farming applications, leveraging smart controls to optimize energy consumption and enhance crop productivity.

- Valoya:Valoya specializes in providing customizable LED lighting systems for agriculture and horticulture, offering tailored light spectra that are scientifically designed to enhance plant growth and maximize yield.

Other Key Player

- California LightWorks

- ILUMINAR Lighting

- Agrolux

- LumiGrow

- Cree LED

- Samsung Electronics

- LG Innotek

- Everlight Electronics

- Nanolux

- BLight Group

- Kind LED

- Spectrum King LED

- SANlight

Recent Developments

- In August 2025, Himachal Pradesh Education Minister Rohit Thakur announced that horticulture will be introduced as a vocational subject in schools, but only in those affiliated with the Himachal Pradesh Board of School Education. The decision was made during a review meeting attended by senior officials of the Education Department. The meeting aimed to evaluate the progress of various educational schemes and address important departmental matters.

(Source: https://www.timesnownews.com)

Segments Covered in the Report

By Offering

- Hardware

- Fixtures (toplighting, interlighting, bars, bulbs)

- Drivers/PSUs

- Wired/wireless controllers

- Software & Services

- Lighting control/recipes

- Scheduling

- Analytics

- Commissioning

- Maintenance SLAs

By Technology

- LED

- HID

- HPS

- MH

- Fluorescent

- Plasma & others

By Application / Grow Environment

- Greenhouses

- Indoor grow rooms

- Vertical farms

By Spectrum Strategy

- Broad/full-spectrum

- Narrow-band (red/blue dominant)

- Tunable/dynamic spectrum

By Connectivity/Control

- Stand-alone/dimmable

- networked (wired/wireless)

- Sensor-integrated & recipe/automation platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting