What is the Extended Warranty Market Size?

The global extended warranty market size is estimated at USD 160.83 billion in 2025 and is foreseen to reach USD 371.81 billion by the end of 2035 and poised to grow at a compound annual growth rate (CAGR) of 8.74% during the forecast period 2026 to 2035

Market Highlights

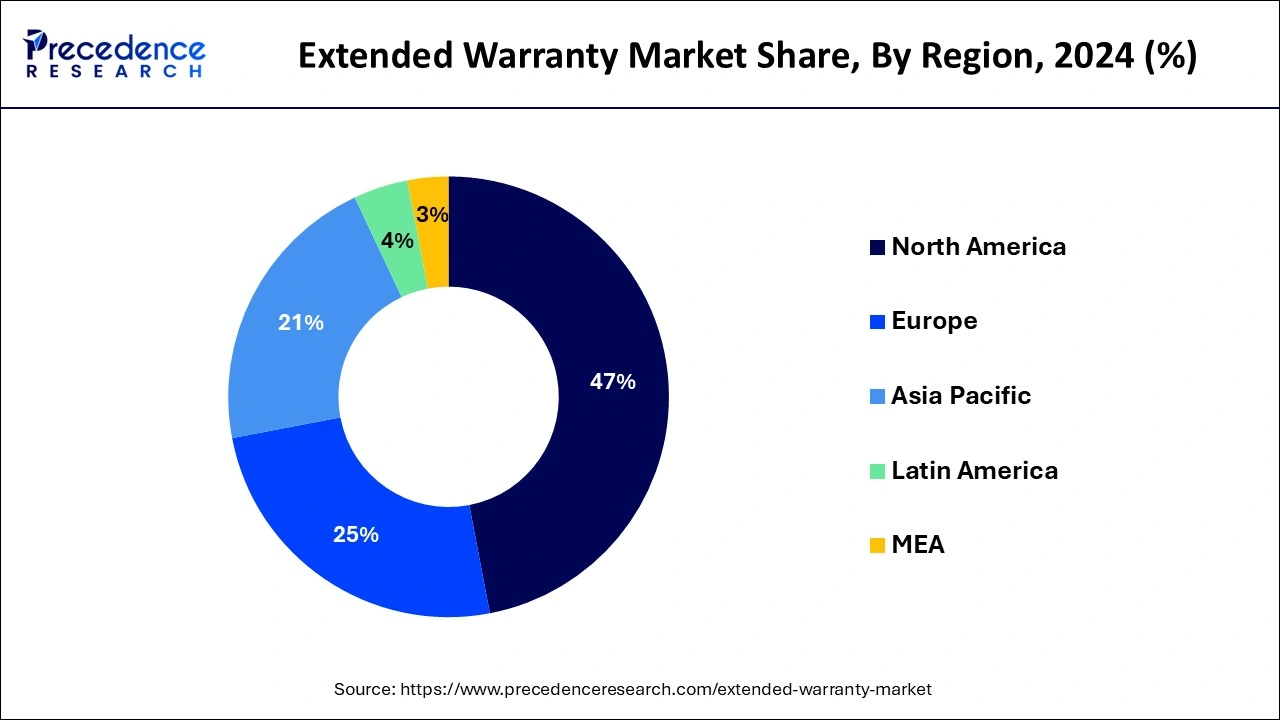

- North America region has garnered 47% of the total revenue share in 2025.

- By application, the automobile segment has reached 40.5% revenue share in 2025.

- By distribution channel, the manufacturers segment made up 59.60% of revenue share in 2025.

- By end user, the individuals segment accounted highest revenue share of around 74% in 2025.

Market Overview

Extended warranties, or service contracts, refer to an extended warranty period offered to consumers on new items. It usually covers the cost of repairing or replacing the product if the damage is due to a manufacturing defect or poor quality. It is typically provided by manufacturers, or retailers for automotive, electronics, and electrical equipment. While these products usually are covered with one-year warranty, extended warranties can provide extended coverage against various product defects after the expiration of the original warranty. Over the past few years, extended warranty services have boosted due to the cost effectiveness and its features that gives additional protections, such as mechanical and electronic failures of products not covered by the original warranty.

Extended Warranty Market Growth Factors

The extended warranty includes routine maintenance and accidental damage including liquid spills, theft or cracked screens. Therefore, the growing concern of consumers about the safety of their electronic devices after the expiration of the original warranty is the main driver for the growth of the market. Additionally, an increasing number of price sensitive customers and shift in consumer preferences to a convenient after-product sales experience is increasing the extended warranty service demand.

Additionally, strong sales of premium vehicles and consumer electronics, such as smartphones, tablets, laptops, and wearable, are driving product adoption. In addition, leading companies are providing value-added services, such as easy replacement and door to door service, while using digitalized technologies for extended warranty claims & resolution, causing the market to rise. Other factors, including growing demand to extend the life and value of goods, inflation of consumer disposable income and high repair and maintenance costs, are also fueling market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 160.83 Billion |

| Market Size in 2026 | USD 175.14 Billion |

| Market Size by 2035 | USD 371.81 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.74% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Coverage, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Increased awareness for extended warranty - With growing awareness of warranty extension over the internet or through brand stores, consumers are choosing to extend their warranty because of the benefits it offers. It starts after the manufacturer's warranty expires and can last up to three to five years, depending on the package the customer chooses. With a small investment, consumers are completely protected against unwarranted repair costs for longer after the original warranty period.

- Rising demand to extend warranty in order to minimize the maintenance cost - The increasing demand for extended product life and comfortable after-sales experience by price sensitive consumers is helping in increasing the quality of post-sales service for companies. As a result, companies are offering extended warranty solutions to retain consumers, which are contributing significantly to the growth of the market. Since extended warranties can avoid unpredictable financial losses due to high repair costs, it is increasingly being adopted by consumers to avoid worries. In addition, additional benefits such as on-site service and easy replacement offered by different companies are fueling the growth of the extended warranty market.

- Rising adoption of electronics in households - The ever-increasing requirements for regular Smartphone and home appliance maintenance and repair can cost a whopping sum of almost a fifth of the unit price. This is why consumers opt for extended warranties on electronic products to avoid unexpected financials, which is driving the growth of the market. Furthermore, the transferability of the extended warranties offered by leading companies so that the product is covered after it has been transferred to other owners is also accelerating the growth of the industry.

Key Market Challenges

- Low awareness about the extended warranty in underdeveloped regions - In underdeveloped regions mainly in the Africa and South America continent consumers are not much aware about the extended warranty about products and even when they are aware about it, they do not choose to pay more towards the extended warranty. In the regions where per capita income is less and spend capacity is also very minimum, consumers do not opt for value added services, they just buy the basic product, hence this factor may pose a critical threat for the market growth in developing regions.

- Availability of the alternative systems - For many consumers electronic products as well as automobiles, there are systems that are inbuilt in them which gives the owner warnings before any part is about the stop functioning. With early warning indications, consumers can fix the problem without letting the product damage. This system eliminates the need for extended warranty, which is a major challenge for market growth.

- High cost of replacement materials - The global extended warranty market is subject to a number of limitations, including high equipment manufacturing and shipping costs. To solve this problem, many potential companies are looking for possible solutions that can make manufacturing and shipping viable electronic devices.

Key Market Opportunities

- Increasing use of electronic devices in developing countries - The increase in the use of electronic devices is due to the increase in job opportunities, technological advancement and the digitization of the entire market. As a result, the demand for these widely used and frequently used electronic devices is increasing. With this, the pace of development and digitization worldwide is increasing at a rapid rate, which is beneficial for the global market.

- Automotive boom - Over the past few years, the automotive and transportation sectors have experienced continuous growth. With the rapid increase of auto sales, the demand for warranty extension will increase rapidly. While the automotive sector is forecast to flourish during the forecast period, the extended warranty market will also flourish in the coming years.

Segments Insights

Application Insights

In 2025, the mobile device segment dominated the global consumer electronics warranty renewal market. More than half of the market share is captured by the smartphone and tablet segment. The growing penetration of premium smartphones, especially in countries like the U.S., the U.K., Germany, France, China, India and others, is driving the growth of the mobile device segment. Furthermore, the growing use of tablets is a key factor in the explosion of the mobile device segment.

The mobile industry is expected to maintain its market leadership over the forecast period, as smartphone and tablet usage continues to grow. In addition, consumers favor high-end, expensive mobile phones accounting for a greater number in total smartphone users in Europe. These users are the forefront buyers of the relevant extended warranties, which is driving the growth of the segment.

Coverage Type Insights

Based on coverage type, the standard protection plan segment accounted for the largest market share, contributing about three-fifths of the market. However, the accident protection plan segment is estimated to have the highest CAGR from 2026 to 2035

Distribution Channel Insights

On the basis of the distribution channel, the retail segment is expected to grow with the highest CAGR while the manufacture level segment is expected to hold the largest market share.

With many consumers extending their warranty after they buy the product, the retail segment is always a go-to place for the consumers to extend their warranty and claim the added benefits.

Regional Insights

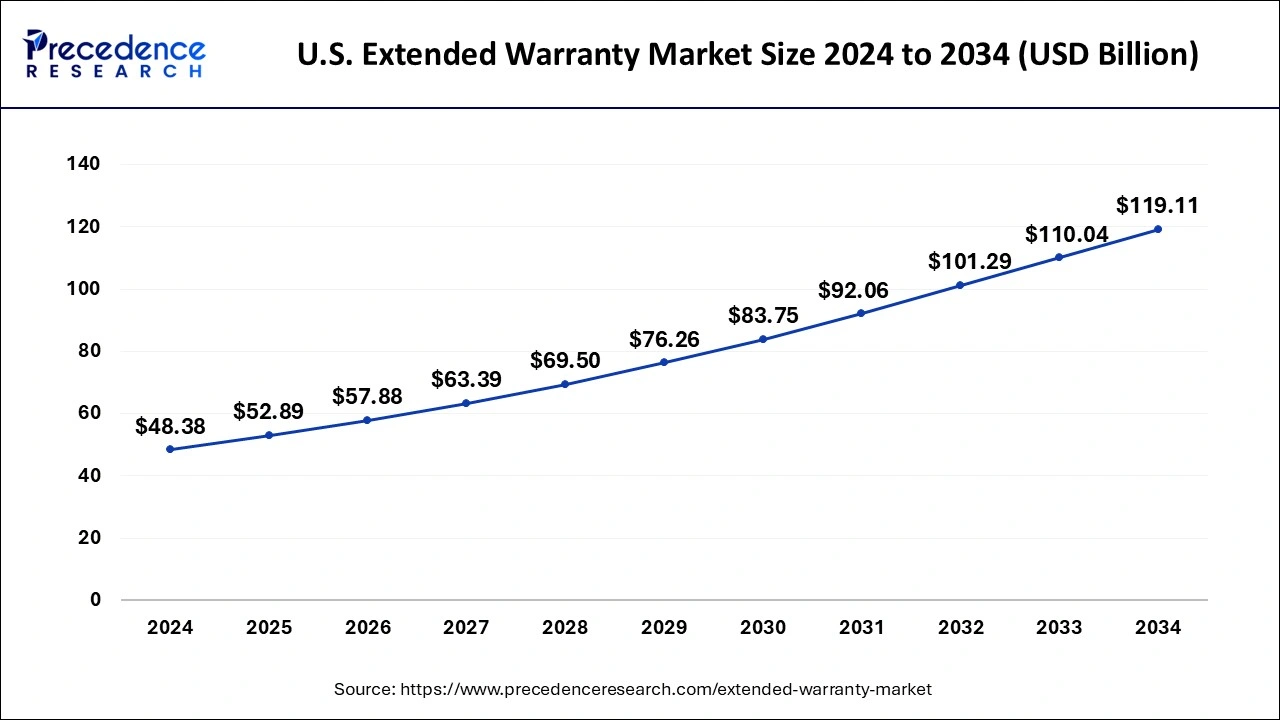

U.S. Extended Warranty Market Size and Growth 2026 to 2035

The U.S. extended warranty market size is projected to reach at USD 52.89 billion in 2025 and is anticipated to be worth around USD 127.96 billion by 2035, poised to grow at a CAGR of 9.24% from 2026 to 2035

U.S. Extended Warranty Market Trends

The U.S. market is driven by growing user awareness about protection plans, which extend product lifespan and mitigate unexpected repair expenses. The market benefits from rising product sophistication across electronics, automobiles, and home appliances, which has made extended warranties more attractive to users seeking financial protection.

Among all regions, Asia-Pacific dominates the global extended warranty market thanks to the availability of cutting-edge tools and techniques that make it possible to produce advanced and sophisticated equipment. In addition to these advantages, the global extended warranty market has several limitations, including high equipment manufacturing and shipping costs. To solve this problem, many potential companies are looking for possible solutions that can make manufacturing and shipping viable electronic devices.

Europe and North American consumers are already very aware about the benefits of extended warranty and they buy it with every product hence the growth in these regions is expected to remain steady and CAGR will also be among the slow growers.

China Market Trends

China's market is driven by the increasing need for consumer protection and the growing adoption of high-value electronics, along with automotive products. With an evolving economy and the increase in product complexity, extended warranty services provide both businesses and users a safeguard against unforeseen repairs, along with maintenance costs.

Why Extended Warranty are Gaining Momentum Across Europe

Due to growing product complexity and expenses, consumer need for financial security, stronger regulatory frameworks supporting repair, and all are driven by a demand for peace of mind along with predictable budgeting for expensive appliances, electronics, and vehicles. Modern electronics, appliances, along with especially electric or hybrid vehicles, are expensive and intricate, creating unexpected repairs expensive, thus raising the appeal of coverage.

Users seek to avoid unpredictable, high out-of-pocket repair expenses, viewing extended warranties as important financial protection and even stress reduction for relied-upon devices.

France Extended Warranty Market Trends

France's market is driven by complex electronics and even vehicles, with rising consumer knowledge about digital sales. With major trends pointing towards personalized, bundled plans, telematics, or AI integration for efficiency, along with increased competition in sectors such as consumer electronics and automobiles.

North America: The Next Growth Hub for Extended Warranty

This is driven by high consumer need for electronics and auto coverage, rising product complexity like IoT, EVs, and trends towards customizable plans, with projections stating strong revenue expansion and leading global market share by 2030. The requirement for extended warranties on electronics, household appliances, and vehicles remains strong. Users seek protection against growing repair expenses and unexpected product failures.

Extended Warranty Landscape: Latin America

Latin America's market shows notable growth during the forecast period. This is driven by the increasing consumer need for product protection, a growing reliance on technology, and a rising focus on customer satisfaction in numerous industries. An extended warranty, also known as a service contract, provides users with an additional period of coverage beyond the standard warranty of a product, primarily covering repair, replacement, and even service costs.

Brazil Extended Warranty Market Trends

Brazil's market is driven by growing usage of online platforms, AI, and even data analytics for personalized offerings, efficient management, and streamlined sales or service. Subscription-based warranties are gaining traction, working with users' purchasing habits and online sales.

MEA Extended Warranty Market

MEA's market shows a rapid growth rate during the forecast period. It is driven by increased acceptance of complex electronics and vehicles, propelling the need for protection. E-commerce and conventional retailers are major distribution channels, providing bundled options at purchase.

Kuwait Extended Warranty Market Trends

Kuwait's high GDP per capita allows users to afford premium protection for their valuable purchases. Greater user knowledge of long-term repair expenses and financial planning drives the need for predictable expenses. Digital platforms and mobile apps are enhancing customer experience by simplifying purchase, registration, and claims management, helping to boost adoption rates

Extended Warranty Market Companies

- Assurant, Inc. (U.S.)

- American International Group Inc

- AXA (France)

- AmTrust Financial Services (U.S.)

- Asurion (U.S.)

- CARCHEX, LLC (U.S.)

- CarShield LLC (U.S.)

- Endurance Warranty Services (U.S.)

- Edel Assurance, LLC (India)

- SquareTrade Inc. (U.S.)

Recent Developments

- In July 2022 – Hyundai India launched a 6th/7th year extended warranty program for all Hyundai cars. This extended warranty will also be applicable for the cars that are already in the market.

Segments Covered in the Report

By Coverage

- Standard Protection Plan

- Accidental Protection Plan

By Application

- Automobiles

- Consumer electronics

- Mobile devices & PCs

- Home appliances

- Others

By End User

- Individual

- Business

By Distribution Channel

- Manufacturers

- Retailer

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting