What is the Facial Implant Market Size?

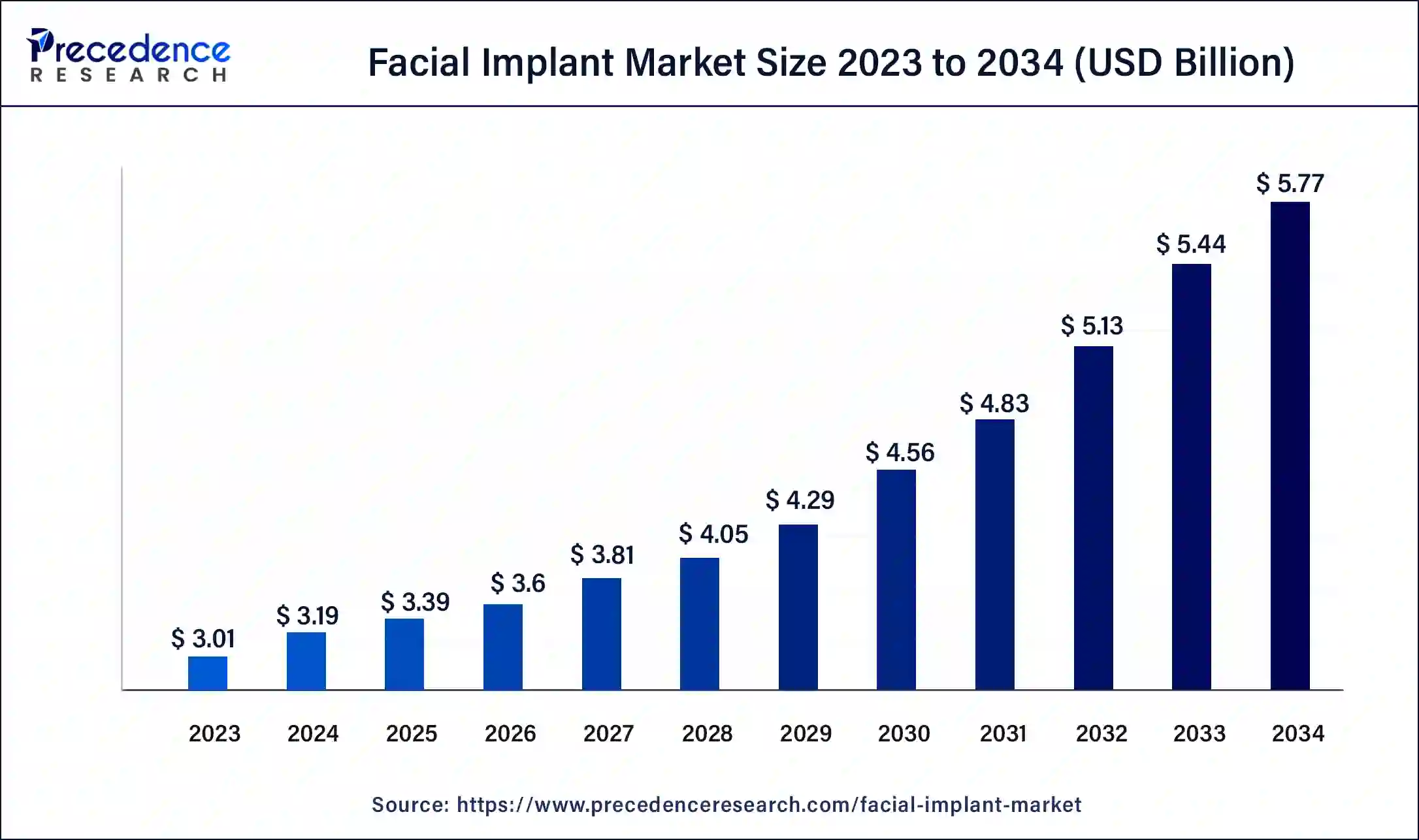

The global facial implant market size is calculated at USD 3.39 billion in 2025 and is predicted to increase from USD 3.60 billion in 2026 to approximately USD 6.09 billion by 2035, expanding at a CAGR of 6.03% from 2026 to 2035.

Facial Implant Market Key Takeaways

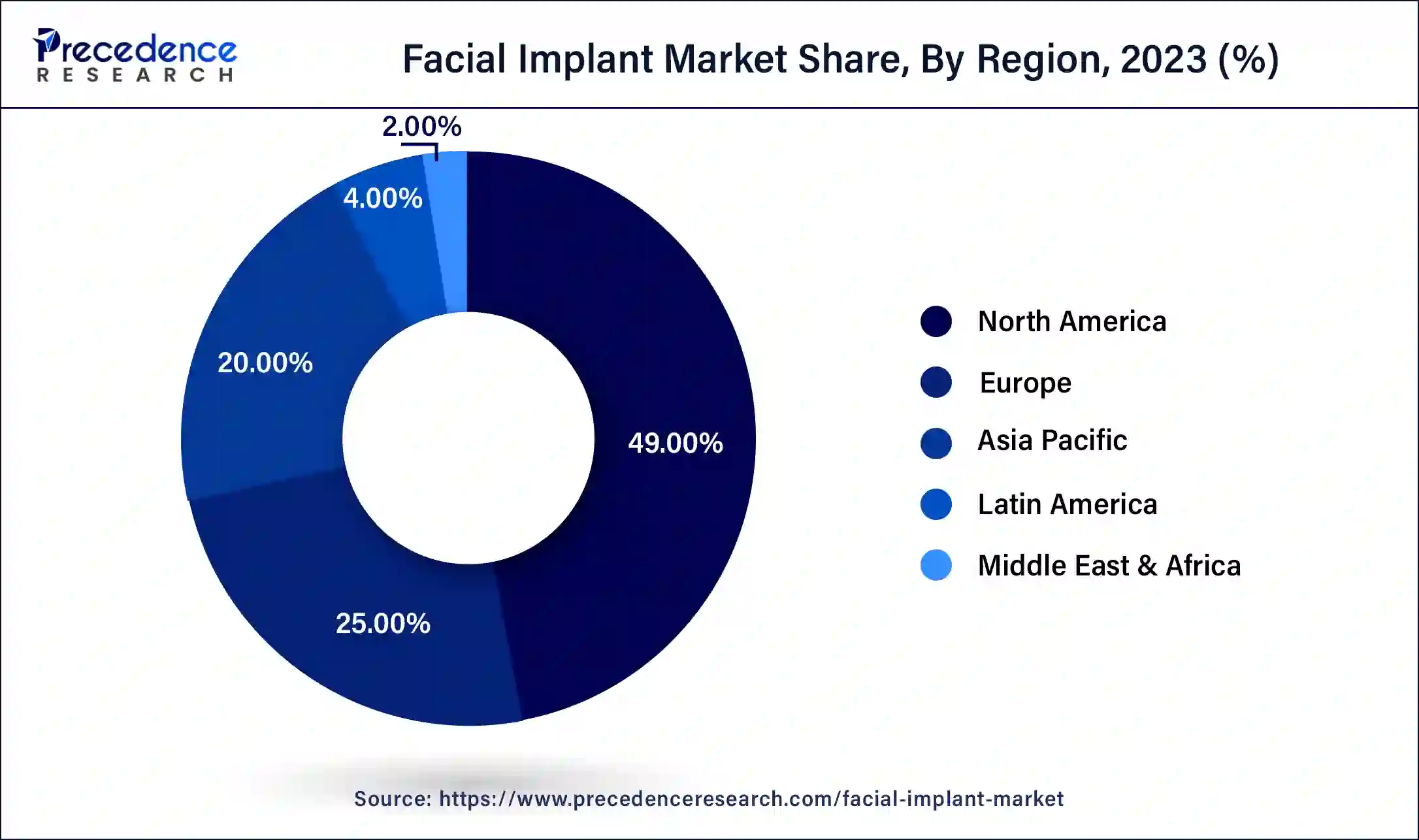

- North America held a maximum revenue share of over 49% in 2025.

- By product, the chin and mandibular segment accounted for 30.6% of revenue share in 2025.

- The fillers or injectables segment is poised to grow at a CAGR of over 8.7% in the forecast period.

- By material, the polymer segment has generated the largest revenue share of over 37.5% in 2025.

- By procedure, the eyelid segment has captured the largest revenue share of 39.4% in 2025.

- The facelift procedure segment accounted for 36.2% of revenue share in 2025.

How is AI contributing to the Facial Implant Industry?

AI is facilitating the facial implant surgery process by enhancing all three main stages: diagnosis, planning, and postoperative. It examines imaging scans for anatomical precision, and comes up with 3D models for the patient's own implant design, and predicts possible complications to help the doctors' decision-making. AI robots also assist in real-time surgical navigation to ensure the safe placement of the implant.

After the operation, the systems are capable of spotting the complications early and evaluating the results through imaging comparisons, while the mobile apps are also available for the patients to track their healing process and to get recovery guidance along with reminders.

Facial Implant Market Growth Factors

As per the Association for Safe International Road Travel, over 1.3 million people die in road accidents each year, with another 20 to 30 million becoming paralyzed and wounded. Moreover, according to the World Health Organization, road traffic injuries are the eight biggest causes of death for people of all ages. Thus, the growing number of road accidents is driving the growth of global facial implant market.

Another factor boosting the expansion of global facial implant market is growing number of face surgeries. In 2020, the International Society of Aesthetic Plastic Surgery estimates that 3,913,679 face and head cosmetic operations would be performed globally. As a result, the increase in adoption of such procedures is propelling the growth and development of worldwide facial implant market.

In addition, consumer desire to change their facial characteristics is increasing, as is the popularity of non-invasive or minimally invasive cosmetic operations. Other important factors boosting the global facial implant market are advancements in facial implant materials and the growth and development of healthcare infrastructure. The growing expenditure for facial appearance is also supporting the facial implant market growth.

Furthermore, people are spending a lot of money to improve their aesthetic appearance, due to increased disposable income, shift in consumer lifestyle, and the expansion of the fashion industry. They prefer less invasive cosmetic operations because of its numerous benefits including shorter hospital stays and higher efficacy. During the projected period, the increase in the number of these surgeries for modifying facial characteristics will continue to drive the growth and expansion of global facial implant market.

The expansion of facial implant market is also being driven by growing government initiatives such as tax benefits to the market players. Those tax benefits are categorized as tax incentives and subsidies. In addition, market players are also adopting various strategies for the development of global facial implant market. All these factors are boosting the facial implant market expansion.

Facial Implant Market Outlook

The market scope for both reconstructive and cosmetic applications is continuous; the drivers are the growing interest in facial aesthetics and the adoption of technology.

The use of biodegradable polymers and ceramics is a major support for the eco-friendly direction; the wastage reduction is through advanced manufacturing.

The market's strength comes from the widespread adoption across regions, which is supported by the growth of procedures driven by the tourism and coalescing of the technology.

Zimmer Biomet, Stryker Corp., Johnson & Johnson, Medartis AG, and Integra LifeSciences are the key players in the investment growth through their active participation.

Startups are the driving force behind the personalization trend that comes with 3D printing, making patient-specific solutions facilitating surgical adaptation and improving outcomes.

Major Trends of the Facial Implant Market

- Patient-Specific Facial Implants: Patient-specific facial implants built using digital imaging and additive manufacturing technologies are quickly gaining popularity due to their anatomical fit, surgical accuracy, and improved postoperative outcomes for the most complex cases, including reconstructive applications.

- Digital Planning for Surgical Procedures: Digital planning tools allow surgeons to plan their procedures via virtual simulations and decrease the time it takes for the surgery to be performed, and the potential risks involved with the surgical procedure, while enhancing aesthetic results.

- Reconstructive Applications are on the Rise: While facial implants are traditionally used for aesthetic purposes, as the uses of facial implants continue to expand, the potential for facial implants to be utilised for trauma reconstruction, congenital deformity correction, and post-oncological facial reconstruction enables surgeons and their patients to broaden their market potential.

- Better Materials for Longer-term Safety: Manufacturers are very focused on developing innovatively produced biomaterials that provide superior biocompatibility, reduced inflammatory response, and enhanced durability to allow for long-term implantation success.

- The Increase of Ambulatory Surgical Centres: The trend is rapidly moving facial implant surgeries from large hospitals to specialty surgical centres due to financial benefits, shortened recovery times, and the opportunity for the surgeon to specialise.

Facial Implant Market-Trade Analysis

- Global Manufacturing Concentration: The manufacturing of facial implants continues to be concentrated in technologically developed areas with robust regulatory environments, and retailers of premium facial implant systems are increasingly finding themselves dependent on importing these systems from other regions.

- Cross-Border Movement of Medical Devices: Regulations regarding the approval of medical devices and certification of the materials used to manufacture them, as well as the efficiency with which medical devices are transported around the globe, directly affect the cost and availability of medical devices.

- Localization Strategies: To decrease their dependence on imported products and the tariffs associated with them, many large global manufacturers are establishing production and assembly plants for facial implant systems in the major growth markets of the world.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.03% |

| Market Size in 2025 | USD 3.39 Billion |

| Market Size in 2026 | USD 3.60 Billion |

| Market Size by 2035 | USD 6.09 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Material, Shape, Procedure, End User, and Region |

| Regions Covered | North America,Asia Pacific,Europe, Latin America, Middle East and Africa |

Facial Implant Market Segment Insights

Product Insights

The chin and mandibular segment dominated the market in 2025 with highest revenue share. The rising adoption of facial implant is driving the growth of segment. The chin and mandibular segment are growing due to the growing chin augmentation surgeries. The growing importance of facial appearance is supporting the expansion of chin and mandibular segment. In addition, chin enhancement surgeries are adopted on a large scale, which is driving the growth and development of chin and mandibular segment.

The fillers or injectables segment is expected to witness at a CAGR of around 8.7%. The segment is growing due to rising adoption of fillers for augmentation surgeries. The fillers and injectors are cost effective and efficient in nature. As a result, the demand for fillers and injectables is growing due to this factor. The facial injectables are mostly used on the face of the female population.

Material Insights

The polymer segment accounted largest revenue share in 2025. The polymer material is largely used in deformity correction surgeries. The polymer is widely used for implants and surgeries as it is flexible and rigid in nature. In addition, solid silicone implants are used on a large scale for augmentation surgeries. In these surgeries, polymer material is utilized. This factor is boosting the growth of the polymer segment.

The biologicals segment is fastest growing segment of the facial implant market in 2025. Due to its better match to body cells and ease of adoption, the biologicals category is predicted to grow at the faster rate during the projection period. In addition, rising investments in research and development activities are expected to drive the growth of biologicals segment.

Procedure Insights

The eyelid segment accounted largest revenue share in 2025. As per the American Society of Plastic Surgeons, 352,112 eyelid surgeries will be performed in the U.S. in 2020. The eyelid surgery is quick and performed within a short period of time. The growing number of aesthetic procedures is driving the growth of eyelid segment. Due to technological developments, the eyelid surgery is performed without any kind of risk. Thus, this segment is expected to grow in near future.

The facelift segment is expected to witness fastest growth over the forecast period. As per the American Society of Plastic Surgeons, nose reshaping facelift surgery was the most popular cosmetic procedure in the U.S. in 2020. Facelift surgery is expected to rise in popularity in the coming years as people become more conscious about their appearance, particularly among baby boomers.

Facial Implant Market Regional Insights

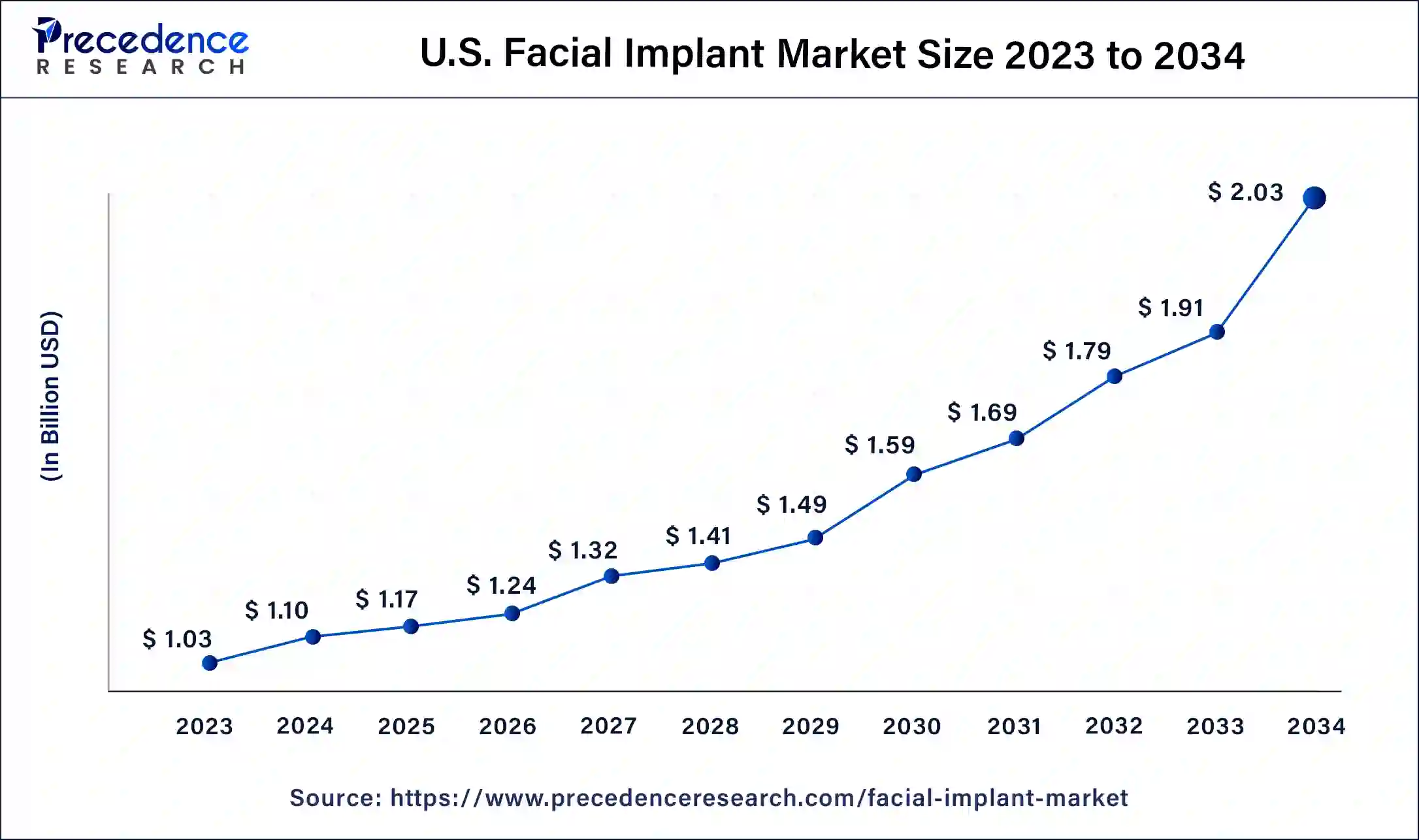

The U.S. facial implant market size is estimated at USD 1.17 billion in 2025 and is predicted to be worth around USD 2.15 billion by 2035, at a CAGR of 6.27% from 2026 to 2035.

North America dominated the market in 2025 with maximum revenue share. The U.S. dominated the facial implant market in North America region. The growth of facial implant market in North America region is due to growing prevalence of accidents and injuries. As per the American Society of Plastic Surgeons, around 15.6 million cosmetic procedures were performed in the U.S. in 2014, with the number predicted to grow at a rate of over 3.0% each year. In addition, as per the Centers for Disease Control and Prevention, around 27.6 million people were diagnosed in emergency rooms in the U.S. in 2015. Moreover, the growing demand for minimally invasive surgeries as well as technological developments is driving the growth of North America facial implant market.

North America remains on top of the market due to the increasing awareness of aesthetics, good infrastructure, and the wide acceptance of cosmetic treatments, which is further strengthened by the presence of the major manufacturers and the growing popularity of facial contouring among the old people

U.S. Facial Implant Market Trends

The U.S. is the biggest market for cosmetic and plastic surgery procedures, and that has led to more implant designs and customized solutions for jaw and chin lifting besides a more extensive use of the new implant technologies.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. India and Chinadominate the facial implant market in Asia-Pacific region. The growing awareness regarding facial implant and adoption of innovative and latest technologies are supporting the growth of facial implant market in the region. In addition, the existence of major market players is developing the facial implant market over the projected period. The other factors such as growing trend of medical tourism, expansion of healthcare industry, and growing government initiatives are propelling the growth of Asia-Pacific facial implant market. All of these aforementioned factors are contributing towards the growth of facial implant market in Asia-Pacific region.

The Asia-Pacific region is experiencing rapid growth with factors such as increased disposable income, greater acceptance of cosmetic procedures, and medical tourism, which in turn is facilitated by improved healthcare access and interest in facial aesthetics among both young and old.

India Facial Implant Market Trends

India is on the fast lane to growth, with factors like dental implants awareness, the support of medical tourism, and the demand for 3D printing of facial implants attracting materials for use in reshaping and enhancing the face

Europe is a strong market as people consume a lot of products that are high in appearance, but the regulatory frameworks that are strict help to build up to the view of product safety, clinical reliability, and structured implant adoption in the aesthetic and reconstructive fields.

Germany Facial Implant Market Trends

Germany is considered the main hub for innovations as it has exquisite surgical methods and a strong population of implant manufacturers, which opens up possibilities for the use of new materials and the application of research-driven aesthetic technology in the market.

Top Companies in the Facial Implant Market & Their Offerings

Provides ePTFE and silicone facial implants, and also patient-specific custom scanned implants for aesthetic and reconstructive purposes

Offers titanium implant systems and surgical instruments which help in craniomaxillofacial reconstruction, midface segments, mandible procedures, and repair requirements.

Supplies grade medical silicone facial implants that include malar and chin designs to be used in cosmetic and reconstructive enhancement treatments

Other Major Companies

- KLS Martin Group

- DePuy Synthes

- Zimmer Biomet

- Osteotec Ltd.

- Johnson & Johnson

- TMJ Concepts

- Stryker Corporation

Recent Developments in the Facial Implant Industry

- In April 2025, 3D Systems and University Hospital Basel collaborated to create the world's first MDR-compliant 3D-printed PEEK facial implant using point-of-care manufacturing. The solution is designed to offer the best possible care for the patients.

(Source: themanufacturer.com) - In April 2025, OSSTEC, a London start-up, is revolutionizing joint replacement implants through 3D printing technology. OSSTEC has secured 2.5 million GBP in funding led by Empirical Ventures.

(Source: med-techinsights.com) - The Center for Oral, Facial, and Implant Surgery and U.S. Oral Surgery Management, a specialized management services firm that solely supplies outstanding maxillofacial and oral experts, announced a new cooperation in November 2021.

- Allergen declared in June 2017 that they had acquired Keller Medical Inc., which included Keller Funnel in their product range.

- Bactiguard and Zimmer Biomet announced in February 2022 to expand their global license arrangement which began in 2019, to encompass a variety of implant product segments to prevent post operative infections, joint reconstruction, implants for sports medicine, thoracic, and craniomaxillofacial applications are included in the exclusive license agreement.

Segments Covered in the Report

By Product

- Chin and Mandibular

- Cheek

- Nasal

- Injectables

By Material

- Metal

- Biologicals

- Polymers

- Silicone

- Ceramic

- Others

By Procedure

- Eyelid Surgery

- Facelift

- Rhinoplasty

By Shape

- Anatomical Facial Implants

- Oval Facial Implants

- Round Facial Implants

By End User

- Hospital

- Trauma Center

- Ambulatory Surgical Centers

- Specialty Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting