Cochlear Implant Market Size and Forecast 2025 to 2034

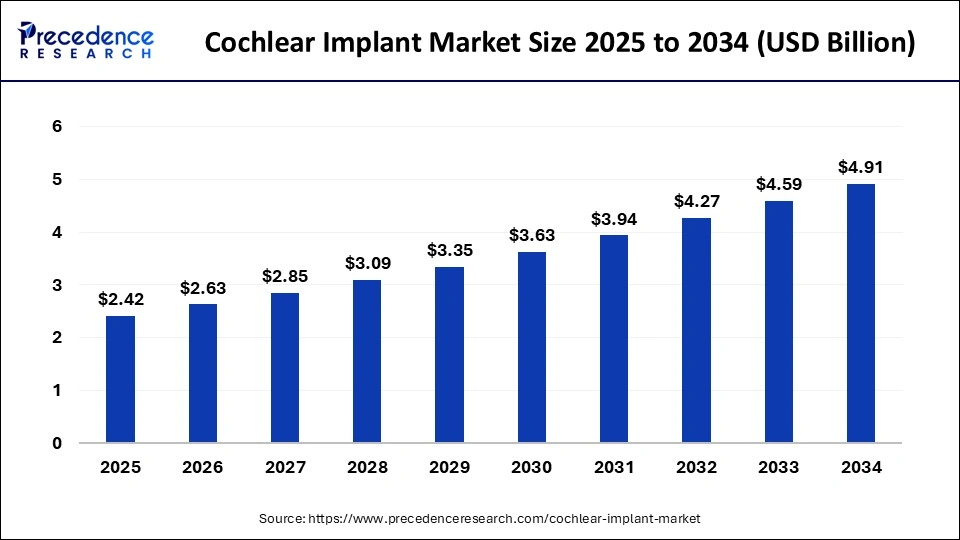

The global cochlear implant market size accounted at USD 2.23 billion in 2024 and is predicted to reach around USD 4.91 billion by 2034, growing at a CAGR of 8.21% from 2025 to 2034.

Cochlear Implant Market Key Takeaways

- In terms of revenue, the cochlear implant market is valued at $2.42 billion in 2025.

- It is projected to reach $4.91 billion by 2034.

- The cochlear implant market is expected to grow at a CAGR of 8.21% from 2025 to 2034.

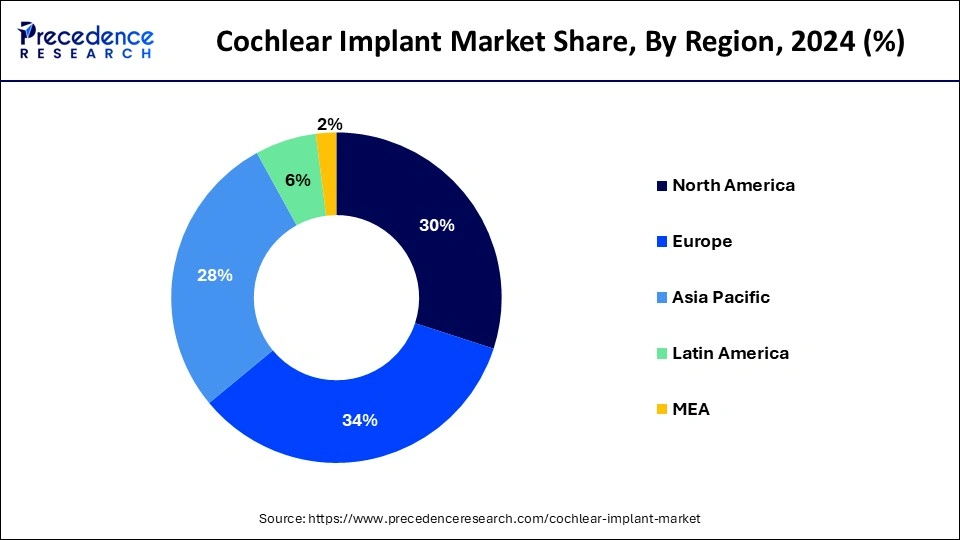

- The Europe region had the most significant revenue share 34% in 2024.

- By type of fitting, the unilateral implants segment accounted for more than 88% of revenue share in 2024.

- By age group, the adult segment generated more than 61% revenue share in 2024.

Europe Cochlear Implant Market Size and Growth 2025 to 2034

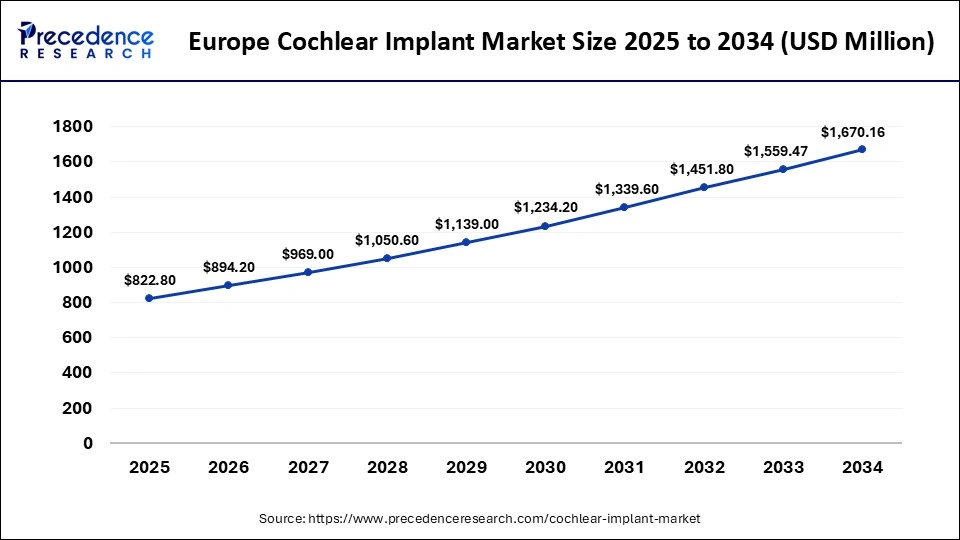

The Europe cochlear implant market size was valued at USD 758.20 billion in 2024 and is expected to be worth around USD 1,670.16 billion by 2034, at a CAGR of 8.22% from 2025 to 2034.

Due to rising hearing aid awareness, the availability of speech therapy clinics, and advantageous reimbursement rules, Europe had the most significant revenue share 34% in 2024. The development of technology and the opening of new facilities in the European Union are responsible for the market expansion in the area. For instance, MED-EL Medical Electronics became the first manufacturer of cochlear implants to acquire certification from the EuropeanMedical DeviceRegulation (MDR) in March 2020.

However, during the predicted period, Asia Pacific will likely have extraordinary growth owing to the fast-growing elderly population and growing public knowledge of hearing aids. The Asia Pacific market is expected to benefit from government initiatives that provide free healthcare to the poor. For instance, the India-based Assistance to Disabled Persons for Purchase/Fitting of Aids/Appliances (ADIP) Scheme intends to provide 500 underprivileged children with cochlear implants each year.

The European Union's highly developed healthcare system is mainly responsible for the market's expansion. Children can receive cochlear implants within a year of birth due to technological advances. For instance, the state-funded health system enables approximately 95.45% of children to have a unilateral cochlear implant, compared to the U.S.'s number of only 50.60%. Adults choose unilateral implantation in most countries; however, pediatric patients prefer bilateral implants because of their superior cost-effectiveness.

Cochlear Implant Market Overview

The market is anticipated to develop as a result of the rising prevalence of hearing loss and the rise in usage brought on by technical improvements. Four hundred thirty million individuals worldwide, or 5.0% of the population, receive rehabilitation services to help with hearing loss, according to World Health Organization (WHO) estimates from 2021. By 2050, over 2.5 billion people will likely have hearing loss.

Numerous factors, such as uterine infections, heredity, birth hypoxia, ototoxic medications, cerumen impaction, and others, have contributed to the current rise in hearing loss. Hearing aids, Cochlear implants, and other technology aids can be helpful for these patients. Cochlear implants are becoming more popular due to favorable reimbursement, minimally invasive treatments, and technological developments.

The government and numerous organizations are launching programs to encourage cochlear implant research. For instance, at the 2022 American Academy of Audiology (AAA) meeting in March 2022, the American Cochlear Implant (ACI) Alliance presented research and clinical practice to the other community members. The purpose of the conference was to facilitate networking among colleagues, keep attendees informed of new advancements in the audiological field, and stay current on knowledge that is likely to help the market for cochlear implants grow.

The market for cochlear implants is also likely to expand due to the growing elderly population. According to the Globe Health Organization (WHO) projections, there will be 1.4 billion people in the world who are 60 years of age or older by the year 2050. A rise in the population's average age is likely to assist the sector as hearing ability declines.

When COVID-19 initially surfaced, restrictions on audiology surgery and therapy services were implemented. During neurotological (a subset of ENT) procedures, there was a higher risk of viral contamination due to drilling in the mastoid cavity. As a result, patients had to undergo COVID-19 testing before the surgery, which prolonged the surgical process.

Additionally, children with cochlear implants need auditory-verbal therapy (AVT) for at least the first two years after the implantation to develop their speech-language abilities and better absorb auditory information. The post-surgery rehabilitation appointments were also postponed or canceled. However, surgery gradually recommenced at varying rates due to various countries' upliftment of COVID-19 restrictions. Telemedicine assists in the gradual recovery of audiology procedures and treatment from the negative effects of COVID-19.

Due to increasing investment and telemedicine support, the market is steadily returning. For instance, Cochlear Ltd. gained FDA certification for the Remote Check Solution in the United States in April 2020. The Nucleus 7 Sound Processor users who have cochlear implants utilize it as a tool for telemedicine patient assessment. They can use the Nucleus Smart App to perform several hearing evaluations.

Cochlear Implant Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.23 Billion |

| Market Size in 2025 | USD 2.42 Billion |

| Market Size by 2034 | USD 4.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.21% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Fitting, Age Group, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

The market for cochlear implants is likely to expand significantly owing to the increased acceptance of various cochlear implants, the incorporation of cutting-edge technology into existing products, and the number of initiatives the government and other organizations takes to support cochlear implant research.

The cochlear implants market is likely to have slow development due to several factors, including the problematic regulatory clearance process for the devices and the high cost of surgical procedures and implants.

The COVID-19 pandemic has also hindered the market's expansion for cochlear implants. Governments worldwide enacted various safety measures like lockout and strict regulations in response to the rise in COVID-19 cases, which disrupted the cochlear implant supply chain internationally. In the ear, cochlear implants are surgically implanted. Because older patients make up the bulk of those obtaining cochlear implants, the decision to postpone elective surgery in hospitals during a pandemic to prevent patient infection affected the cochlear implants industry.

Covid-19 Impact

The COVID-19 epidemic had a negative impact on the audiology industry. The pandemic hampered global logistics and supply chains, which made it more difficult for businesses to conduct their operations, including obtaining raw materials, producing goods, and distributing and selling them.

The decline in surgeries affected the demand for hearing implants as a whole. For instance, the pandemic caused the revenue of Cochlear Ltd to fall by 6.5% in 2020 compared to 2019.

As soon as COVID-19 rules were relaxed, surgical volumes increased steadily in nations including China, Spain, Germany, the United Kingdom, and the United States. So, the demand for cochlear implants returned to normal in the second half of 2022.

The factors anticipated to drive market expansion over the forecast period are technical advancement, increased R&D spending by the leading players, and telehealth audiology care.

Type of Fitting Insights

Depending on the type of fitting, the market is segmented into bilateral and unilateral implants. The market segment for unilateral implants had the largest market share in 2024, accounting for 88%. Unilateral implants are in high demand, which is the cause of the increase due to the simplicity of payment for the devices, their lower cost when compared to bilateral implants, quicker surgical times, and minimum need for anesthesia.

However, the market for bilateral implants is likely to increase profitably during the upcoming decade owing to the device's cost-effectiveness when implanted in minors because they will have it more extended than the elderly. Additionally, the ability of these gadgets to detect speech in background noise will likely fuel segment expansion.

- Additionally, the segment is likely to surge significantly due to major market players' higher research expenditures and cutting-edge product launches. For instance, in January 2022, the US FDA approved Cochlear Limited's Nucleus Implants to treat single-sided deafness (unilateral hearing loss).

End-Use Insights

The cochlear implant sector is split into adult and pediatric divisions based on end-use. Due to a more extensive patient pool of senior people, the adult category, with 61% of the market, held the largest market share in 2023. The National Institute of Deafness and Other Communication Disorder estimates that in the U.S., 2.30% of people between the ages of 45 and 54 and about 8.64% of people between the ages of 55 and 64 have hearing loss, making daily activities difficult or impossible.

However, the pediatric market will likely expand significantly throughout the projected period. The National Institute of Deafness and other Communication Disorders estimates that in the U.S., 2 to 3 children out of every 1000 have a noticeable hearing loss.

Unilateral sensorineural hearing loss affects about 1 in 1000 live births in the U.S. (UHL). Cochlear implantation received approval from the U.S. Food and Drug Administration for children aged five and older with single-sided deafness (SSD) in the U.S. in 2019. These activities will likely fuel the pediatric segment's growth during the projected period.

Leading Companies' Profiles in the Cochlear Implant Market

- A leading company named Cochlear Ltd is developing cochlear implants, bone conduction implants, and acoustic implants for commercial use. These implants can be used to treat people suffering from hearing loss due to age or other factors. The company is operating in a highly established manufacturing hub in Australia and Sweden.

- Amplifon S.p. A is one of the emerging companies in the cochlear implant market. They provide personalized hearing solutions and services through the affiliation of leading distributors. They offer this facility in corporate shops, franchises, and primarily operate in regions like Asia Pacific, Europe, the Americas, and MEA.

- Zhejiang Nuoerkan Neuroelectronic Technology Co., Ltd., based in China, has its research and development center in California. They offer medical devices and are involved in developing, designing, and commercializing neurostimulation products and systems.

- MED-EL is another well-established enterprise for the cochlear implant, which majorly focuses on research and development to build a product pipeline while developing bone conduction, middle ear, hearing, auditory brainstem, and others to help commercialize it on a large scale.

Cochlear Implant Market Companies

Several well-established businesses dominate the market, which has become more consolidated. The main strategic activities of these businesses to increase market share are product launches and research projects for the growth of product portfolios. Sennheiser electronic GmbH & Co K.G.'s consumer segment was purchased by Sonova Holding AG in March 2022, becoming the company's fourth business unit. It is projected that the rapidly growing market for audiophile headphones would offer growth opportunities for this new customer hearing category. The following companies are some of the major players in the worldwide cochlear implant market:

- So nova

- Cochlear Ltd.

- Demant A/S

- MED-EL Medical Electronics

- Oticon Medical

- Zhejiang Nurotron Biotechnology Co., Ltd.

- GAES

Recent Developments

- In May 2025, a global leader in robotic-assisted systems for cochlear implant surgery made an announcement about its first use of the system-iotaSOFT, an insertion system outside the U.S. This technology has been used in a clinical study at the University Hospital Zurich, guided by Prof. Alexander Huber.

- In July 2024, a fully internal cochlear implant was developed by a multidisciplinary team of researchers from MIT, Massachusetts Eye and Ear, in collaboration with Harvard Medical School and Columbia University. They offer a fully implantable microphone that operates and helps in external hearing. To amplify the performance of the device, the team also made a low-noise amplifier to extend the level of signal while keeping the noise at the lowest possible level.

- In March 2022, an industry leader in hearing care solutions, Sonova Holding AG, completed the previously announced acquisition of the Consumer Division of Sennheiser electronic GmbH & Co. KG. This represents the creation of a fourth business unit that will help Sonova grow its client base and channel presence while also broadening its appealing product line.

- In June 2022, Demant declared that it had acquired the remaining 80% of ShengWang's stock, gaining complete control of the largest network of hearing aid facilities in China. This comes after the 20% minority investment disclosed on March 4, 2022, and it is an important strategic move in Demant'songoing venture in hearing healthcare.

Segment Covered in the Report

By Type of Fitting

- Bilateral Implants

- Unilateral Implants

By Age Group

- Pediatric

- Adult

By End-Use

- Clinics

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting