What is the Breast Implants Market Size?

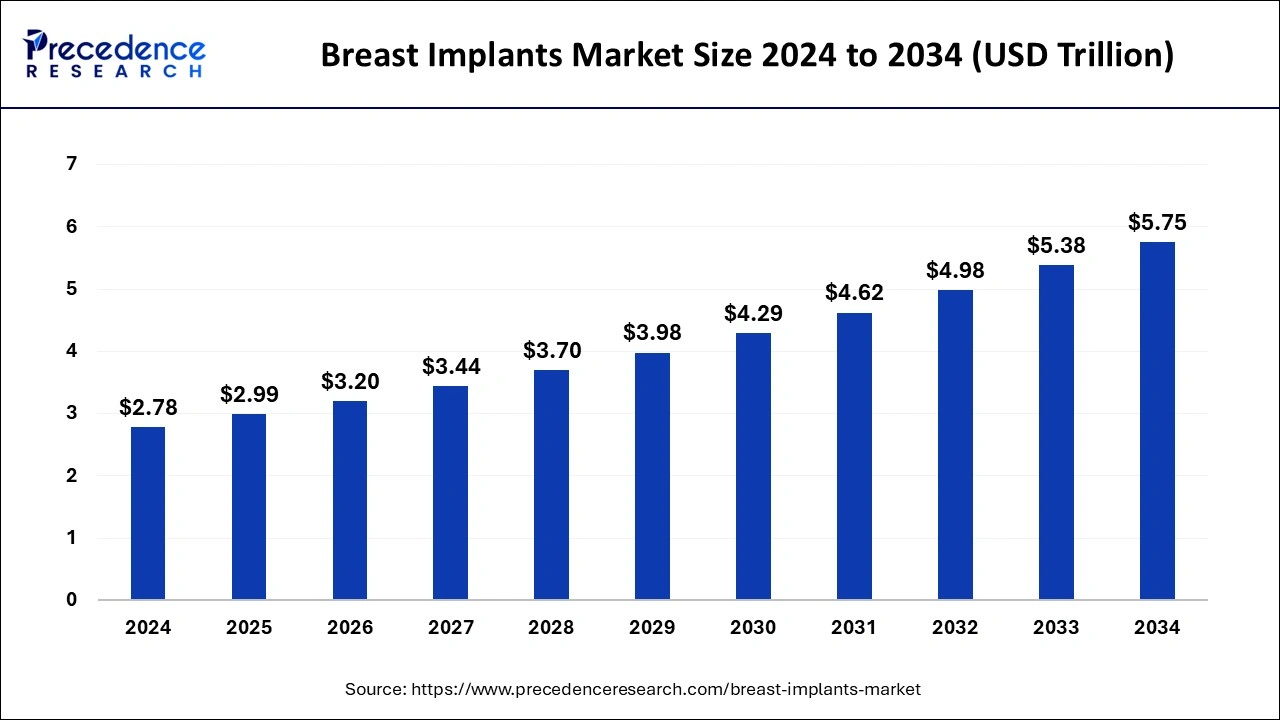

The global breast implants market size surpassed USD 2.99 billion in 2025 and is projected to hit around USD 5.75 billion by 2034, growing at a CAGR of 7.54% from 2025 to 2034. Rising demand for cosmetic surgery is the major factor expanding the breast implants market. The growing prevalence of breast cancers has increased breast implants. Advancing technologies and healthcare infrastructure fueling the breast implants market expansion.

Market Highlights

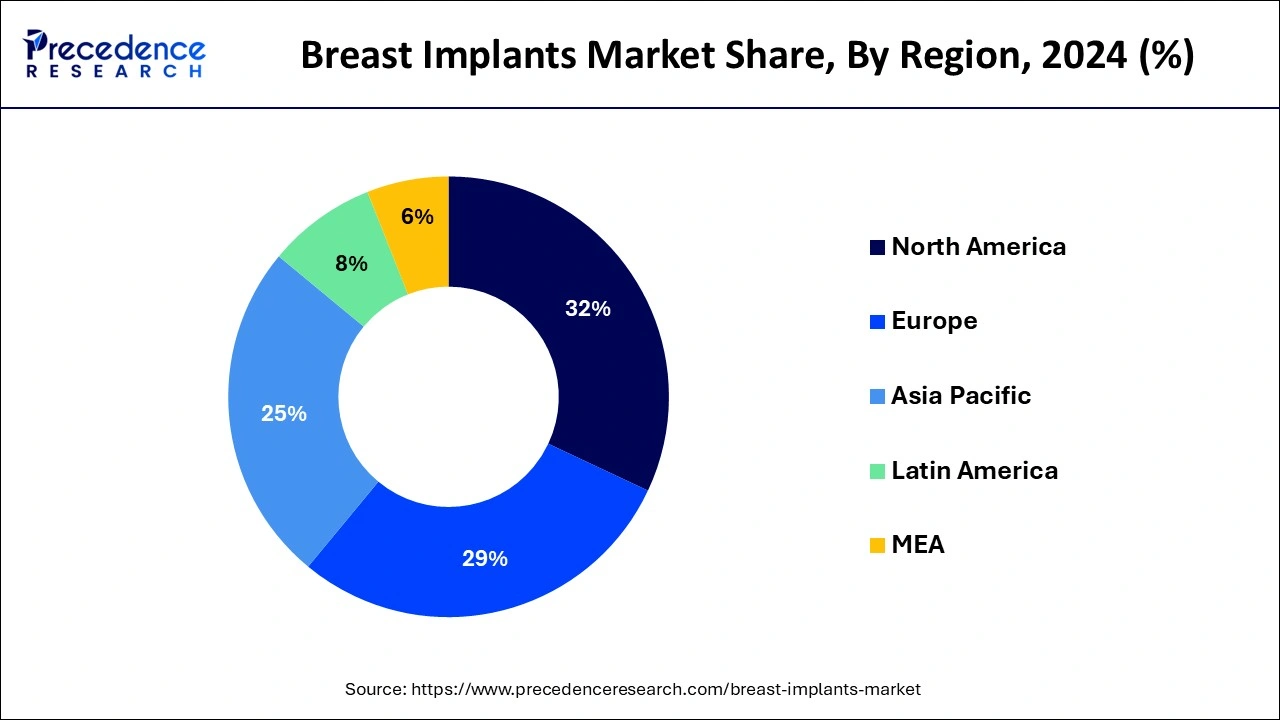

- North America dominated the market with 32% of market share in 2024.

- while Asia Pacific is expected to witness the fastest rate of growth during the forecast period.

- By product, silicone breast implants accounted for the dominating share of 83% in the year 2024.

- By product, the saline breast implants segment accounted for the considerable growth in the global breast implants market over the forecast period.

- By application, the cosmetic surgery segment held the largest share of the breast implants market in 2024.

- By application, the reconstructive surgery segment is expected to grow significantly during the forecast period.

- By end-user, the hospitals segment held the largest share of the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 2.99 Billion

- Market Size in 2026: USD 3.20 Billion

- Forecasted Market Size by 2034: USD 5.75 Billion

- CAGR (2025-2034): 7.54%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

The Market Snapshot

People who get breast implants want to enhance the size and shape of their natural breasts. Breast implants are medical devices that are surgically inserted into the breasts. In recent years, breast implants have gained attention rapidly and have made incredible progress in yielding natural-feeling results. Breast implants are the most popular type of plastic surgery prostheses. Generally, there are two types of breast implants: saline and silicone gel. Breast implants come in different shapes and sizes according to the individual's needs. The breast implants market encompasses the activities of manufacturing, selling, and distributing breast implants.

- Furthermore, the increased prevalence of breast cancer is further driving the need for breast implants and surgeries. Breast cancers are becoming more common cancer types in women, with around 2.3 million new cases every year, especially in American women.

- For instance, according to The American Cancer Society's (ACS) biennial breast cancer statistics report for 2024, it is estimated that 310,720 new cases of invasive breast cancer will be diagnosed in women in the U.S., and 56,500 new cases of non-invasive breast cancer will be diagnosed.

- 1 in 8, or approximately 13%, of women in the U.S. are likely to develop breast cancer in their lifetime.

AI integration in breast implant procedures

AI integration has become crucial for improving breast implant techniques and medical devices. AI integration in the medical field has witnessed significant positive changes. The need for advanced medical devices and procedures due to increased hospitalizations and patient demands is transforming AI adoption in the medical field. The adoption of advanced technologies, including 3D imaging, modeling, and real-time guidance, is playing a favorable role in improving guidance and plans for surgeons with critical surgery information and potential errors. With the ability of AI to provide predictive analytics, it has become an essential procedure to understand ways to improve patient outcomes and reduce complexities. The growing need for advanced breast implants and AI integration is further highlighted.

Breast Implants Market Growth Factors

- Increased demand for breast surgery: The rising awareness of physical appearance has led to increased breast implants due to cosmetic surgery, making the market grow.

- Prevalence of breast cancer: The prevalence of breast cancer has surged, which is driving the need for breast reconstruction surgeries.

- Rising geriatric population: the demand for breast implants has increased among older women in recent years; as a result, the market is seeking

- Technology advancements: The advancements in technologies, including silicone implants, micro-textured anatomical breast implants, and minimally invasive surgeries, are contributing to the number of breast surgeries.

- Regulatory initiatives: The growing regulatory approvals for novel, innovative surgical procedures and medical devices are fueling the advancements of breast implant technology and options.

- Government initiatives: The rising focus of the government and World Health Organization to reduce the prevalence of breast cancer and provide affordable diagnoses is playing a favorable role in the market expansion.

Breast Implants Market Outlook: The Future Trends

- Industry Growth Overview: The growing demand for cosmetic enhancements, post-mastectomy reconstruction surgeries, and technological advancements are driving the industrial growth in the market.

- Major Investors: The parent corporation of key manufacturers, institutional investors, and private equity firms are the major investors in the market.

- Startup Ecosystem: The development of natural, personalized, and safer alternatives to traditional silicone implants is the focus of the startup ecosystem.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.99 Billion |

| Market Size in 2026 | USD 3.20 Billion |

| Market Size by 2034 | USD 5.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of breast cancer

Breast cancer is the most common disorder. This increasing prevalence of breast cancer across the globe has increased the need for breast reconstruction procedures, which can involve the use of breast implant surgeries. Therefore, with increasing cases of breast cancer, the demand for breast implants as a treatment option is anticipated to fuel the growth of the global breast implants market in the coming years.

- According to the American Cancer Society report published in 2023, Nearly 30% of all newly diagnosed cancers in women are breast cancer in the United States. Currently, there are more than 4 million women with a history of breast cancer in the U.S., which includes women currently being treated and women who have finished treatment.

Restraint

High cost

The high cost associated with breast implant surgeries is observed to hamper the market's growth. An individual needs to invest high capital to undergo breast implant surgeries. In addition, risks associated with breast implants and post-surgery complications may restrain the market's growth during the forecast period. The side effects of breast implants include infection in the nipples, breast pain, and breast sensation, which may limit the adoption and restrict the expansion of the global breast implants market.

Opportunity

Rising demand for cosmetic procedures

The rising demand for cosmetic procedures for aesthetic appeal is projected to offer lucrative opportunities to the market during the forecast period. An individual undergoes breast implant surgeries to achieve an aesthetic appearance, which is mostly influenced by the growing hype of aesthetic appearance standards in society and social media.

Breast implants are one of the most popular cosmetic procedures for individuals seeking body transformation to be attractive. Breast implants assist in enhancing the breasts' shape, size, and symmetry according to the individual's desired aesthetic appearance, which also results in boosting their self-confidence. Therefore, increasing demand for cosmetic procedures globally is expected to spur the demand for breast implants in the coming years.

According to the report published by the International Society of Aesthetic Plastic Surgery in 2022, breast augmentation remains the most common surgical procedure for women, with 2.2 million procedures and a significant increase of 29 percent compared to 2021. All breast procedures witnessed significant growth from the previous year, with more than 4.4 million procedures on breasts and a 25 percent increase.

Segments Insights

Product Insights

The silicone breast implants segment dominated the market with the largest share in 2024. The segment is observed to grow in the coming years. Silicone breast implants offer a more natural feel than saline breast implants. Soft textured breast implants from silicone are filled with a silicone gel, and this gel is similar to natural breast tissue, which also has less risk of forming hard scar tissue around the implantation. In case of leakage, the gel may remain within the implant shell. Silicone breast implants are FDA-approved for augmentation in women aged 22 or above.

- According to the report published by the International Society of Aesthetic Plastic Surgery in 2022, breast augmentation remains the most common surgical procedure for women, with 2.2 million procedures and a significant increase of 29 percent compared to 2021. All breast procedures witnessed significant growth from the previous year, with more than 4.4 million procedures on breasts and a 25 percent increase.

The saline breast implants segment is expected to grow at a rapid CAGR rate during the forecast period. Saline breast implants are filled with sterile salt water. These implants offer a consistent shape and firmness. Saline breast implants are FDA-approved for augmentation in women aged 18 or above. In case of leakage, saline implants get absorbed naturally into the body without causing any harm.

Application Insights

Based on application, the cosmetic surgery segment dominated the global breast implant market. The segment growth is attributed to increased awareness of physical appearance. Cosmetic breast implant surgeries are becoming popular among appearance-conscious people. Additionally, the rising availability of disposable income allows for affording such surgeries. The demand for natural-looking breast results has increased among women. Furthermore, demand for fat transfer procedures is contributing to the segment expansion. Moreover, growing FDA approval for advanced and innovative breast surgeries is projected to fuel the segment growth further.

- For instance, in December 2024, the FDA gave approval for the MENTOR™ MemoryGel™ launched by Mentor Worldwide LLC, a Johnson & Johnson MedTech company, to improve breast implants by mimicking the natural shape and feel of breast tissue.

The reconstructive surgery segment is expected to witness growth in the forecast period. The segment is observed to sustain the position throughout the forecast period. Reconstructive surgery deals with the defects and deformities of the chest wall and post-mastectomy procedure. Reconstruction surgery is conducted to restore the natural look and improve physical appearance to become more aesthetic.

Advances in surgical techniques, implant designs, and materials have improved the safety, durability, and aesthetic outcomes of breast reconstruction with implants. Surgeons have access to a variety of implant options, including saline, silicone gel, and structured implants, to meet the diverse needs of patients. Overall, reconstructive surgeries with breast implants offer a viable and effective option for individuals seeking to restore breast appearance, symmetry, and confidence following mastectomy, breast deformities, or other related conditions. The popularity of these procedures underscores their significant impact on physical and emotional well-being, empowering patients to reclaim their bodies and lives.

End-User Insights

The hospitals segment dominated the breast implants market in 2024. Hospitals provide access to advanced machines for patients. Individuals seeking body transformation mostly choose hospitals to undergo breast augmentation procedures as they offer more efficient solutions. Such supportive factors are fueling the segment's dominance in the market.

Moreover, the hospital has a high volume of breast reconstruction surgeries due to the availability of advanced medical devices and healthcare professionals. The expanding advanced healthcare infrastructures are attracting the people. Moreover, the availability of government funds and medical insurance is making breast implants more affordable, leading to more demand for the surgeries. Growing government investments in hospitals are contributing to the segment expansion.

- For example, the free cosmetic surgery clinic launched by the state health department at Government Stanley Medical College and Hospital in Chennai, Tamil Nadu, in February 2018 offers a variety of cosmetic surgeries, including breast reconstruction, breast augmentation, and breast reduction.

Regional Insights

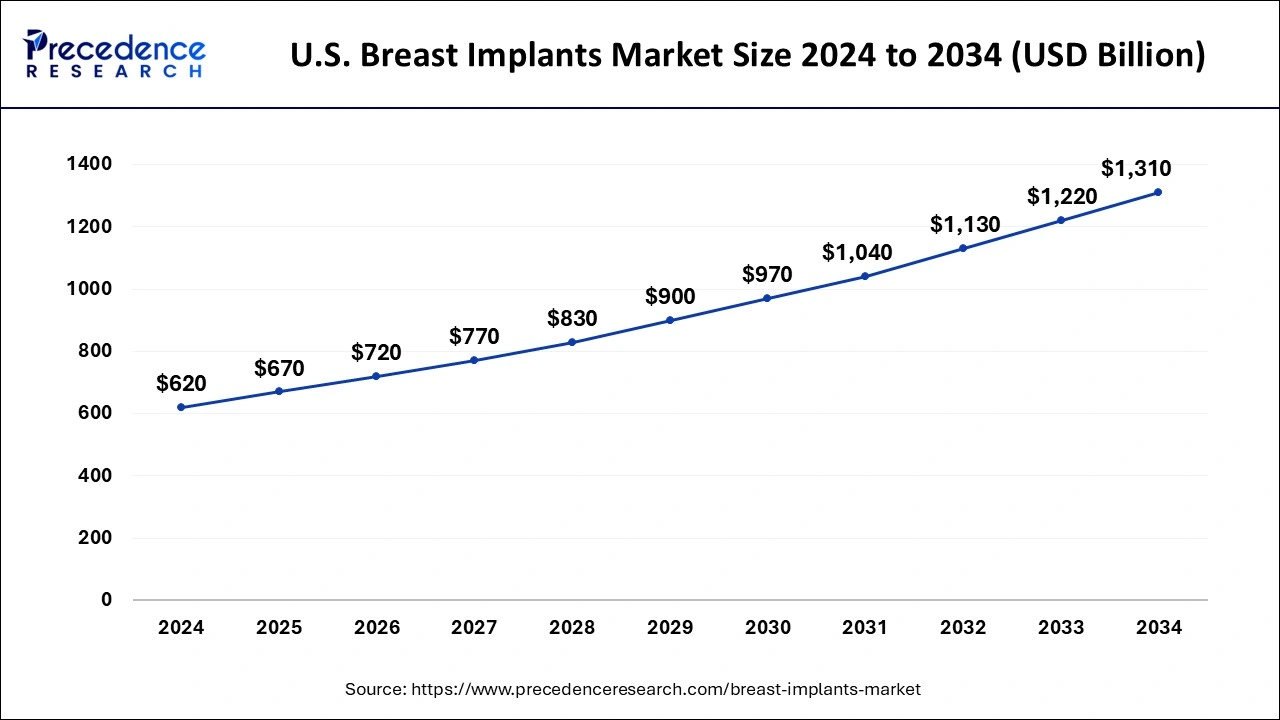

U.S. Breast Implants Market Size and Growth 2025 to 2034

The U.S. breast implants market size was estimated at USD 670 million in 2025 and is anticipated to reach around USD 1,310 million by 2034, growing at a CAGR of 7.77% from 2025 to 2034.

Advanced Healthcare Drives North America

North America held the largest share of 32% in the breast implants market in 2025. The growth of the region is attributed to the presence of the sophisticated healthcare infrastructure, increasing use of medical devices, increasing investment in the healthcare sector, rising research and development activities, technological advancement in medical devices, rising awareness campaigns regarding breast implants, and rising burden of breast cancer which results in increasing demand for breast implants surgeries in the region.

- In July 2023, Canadian plastic surgeons can now offer women the latest generation of breast implants with clinically proven low complication rates. Sientra, distributed by Clarion Medical Technologies, is the first new silicone gel breast implant manufacturer to be approved by Health Canada in nearly 20 years. Their high-strength cohesive silicone gel breast implants feature the latest generational gel technology and are backed by clinically proven data.

Growing Cosmetic Surgeries Propel U.S.

The United States is one of the major contributors to the breast implants market. The growth of the market is driven by several factors, such as the increasing number of cosmetic surgeries, increasing product approvals by various regulatory organizations, rising disposable income, risingmedical tourism, rising women's inclination toward breast augmentation and reconstruction procedures for beauty enhancement, and increasing prevalence of breast cancer.

- In November 2023, RTI Surgical, a leading global medical device organization, announced that the U.S. Food and Drug Administration (FDA) granted Investigational Device Exemption (IDE) approval for a clinical study designed to confirm the safety and effectiveness of Cortiva Allograft Dermis in implant-based breast reconstruction.

Increasing Cosmetic Procedures Boost the Asia Pacific

Asia-Pacific breast implants market is expected to grow at a significant CAGR in the coming years. The growth of the market is due to several factors, such as rising demand forcosmetic procedures, increasing prevalence of breast cancer, rising awareness campaigns, the rising potential of the healthcare sector in developing markets, and rising strategic initiatives and product innovations. The wide use of artificial devices (prostheses) coupled with rising investment in advanced technologies in the healthcare sector is increasing the demand for breast implants.

Growing Beauty Awareness Fuels India

The growing beauty consciousness is increasing the demand for breast implants in India. The expanding healthcare, technological advancements, and growing beauty standards are increasing their use. Their affordability is also driving the medical tourism, where growing breast cancer rates are also driving their demand.

Disposable Income Sparks Europe Cosmetic Trends

Europe is expected to grow significantly in the breast implants market during the forecast period, due to growing disposable income, which is increasing their use for aesthetic appeal. The growing beauty awareness through social media platforms are increasing their acceptance rates. The robust healthcare and growing medical tourism are also driving their demand.

Combination Procedures Uplift UK

The UK is experiencing a rise in the use of breast implants due to growing combination procedures. The presence of skilled personnel and growing beauty standards are increasing their acceptance rates. Additionally, increasing breast cancer and medical tourism are also enhancing their adoption rates.

Aesthetic Procedures Lead South America

South America is expected to grow significantly in the breast implants market during the forecast period, due to growth in aesthetic procedures. The increasing beauty standards, disposable income, and international patients are investing in these procedures. The growing minimally invasive techniques and reconstructive surgeries are also increasing the demand for breast implants.

Brazil's Beauty Boom Fuels Implant Market

Brazil's breast implant market is expanding robustly due to rising demand for cosmetic surgery and increased awareness of aesthetic procedures. Cultural emphasis on appearance, improving economic conditions, and a growing number of certified plastic surgeons drive this growth.

Value Chain Analysis

- R&D

The R&D of breast implants focuses on enhancing their safety, biocompatibility, and providing more natural aesthetic results.

Key players: Mentor Worldwide LLC, AbbVie Inc., GC Aesthetics. - Clinical Trials and Regulatory Approvals

The clinical trials and regulatory approvals of breast implants involve the assessment of safety and effectiveness.

Key players: Establishment Labs S.A., Mentor Worldwide LLC, AbbVie Inc. - Patient Support and Services

The patent support and services of breast implants provide warranty programs, financial assistance, and patient education resources.

Key players: Mentor Worldwide LLC, AbbVie Inc., GC Aesthetics.

The Breast Implants Market Innovators: Key Players' Offering

- Polytech Health and Aesthetics GmbH: Products like Microthane, B-Lite, and Diagon are provided by the company.

- Mentor Worldwide LLC: The company provides MemoryGel, MemoryShape, and Saline-filled implants.

- GC Aesthetics: Products like Nagor, Eurosilicone, CoGel, and EveSilk Smooth are offered by the company.

- Establishment Labs S.A.: Motiva, Erginomix, Motiva Joy, and Motiva Anatomical TrueFixation are provided by the company.

- Allergan plc: The company offers the Natrelle collection, which consists of various implant options.

Breast Implants Market Companies

- Sientra, Inc.

- Shanghai Kangning Medical Supplies Ltd.

- Sebbin

- Polytech Health and Aesthetics GmBH

- Mentor Worldwide LLC

- Laboratoires Arion

- HansBioMed

- Guangzhou Wanhe Plastic Materials Co., Ltd.

- GC Aesthetics

- Establishment Labs S.A.

- CEREPLAS

- Allergan plc

- AbbVie Inc.

Leader's announcements

- In December 2024, Alenka Brzulja, Worldwide President, Mentor Worldwide LLC, announced that “the company is prepared to launch MemoryGel™ Enhance Implants, which is a long-standing patient need for larger breast implant options.”

- In September 2024, Juan José Chacón-Quirós, founder and chief executive officer, announced that “the FDA approval for Establishment Labs Holdings Inc.'s Motiva SmoothSilk Ergonomix and Motiva SmoothSilk is a transformative step for breast aesthetics in the United States.”

Recent developments

- In September 2024, the marketing of Motiva USA, LLC's SmoothSilk Round and Round Ergonomix Silicone Gel-Filled Breast Implants, indicated for breast augmentation for patients of at least 22 years of age, announced receiving FDA approval to support it, supported by an open-label, prospective study of 560 patients followed up to three years at more than 20 U.S. and European study sites.

- In September 2024, the U.S. Food and Drug Administration (FDA) gave approval to the utilization of Motiva SmoothSilk Ergonomix and Motiva SmoothSilk Round breast implants in primary and revision breast augmentation, which were introduced by Establishment Labs Holdings Inc. (NASDAQ: ESTA), a global medical technology company dedicated to improving women's health and wellness, principally in breast aesthetics and reconstruction.

Segments Covered in the Report

By Product

- Silicone Breast Implants

- Saline Breast Implants

By Application

- Reconstructive Surgery

- Cosmetic Surgery

By End-User

- Hospitals

- Cosmetology Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting