What is the Breast Pump Market Size?

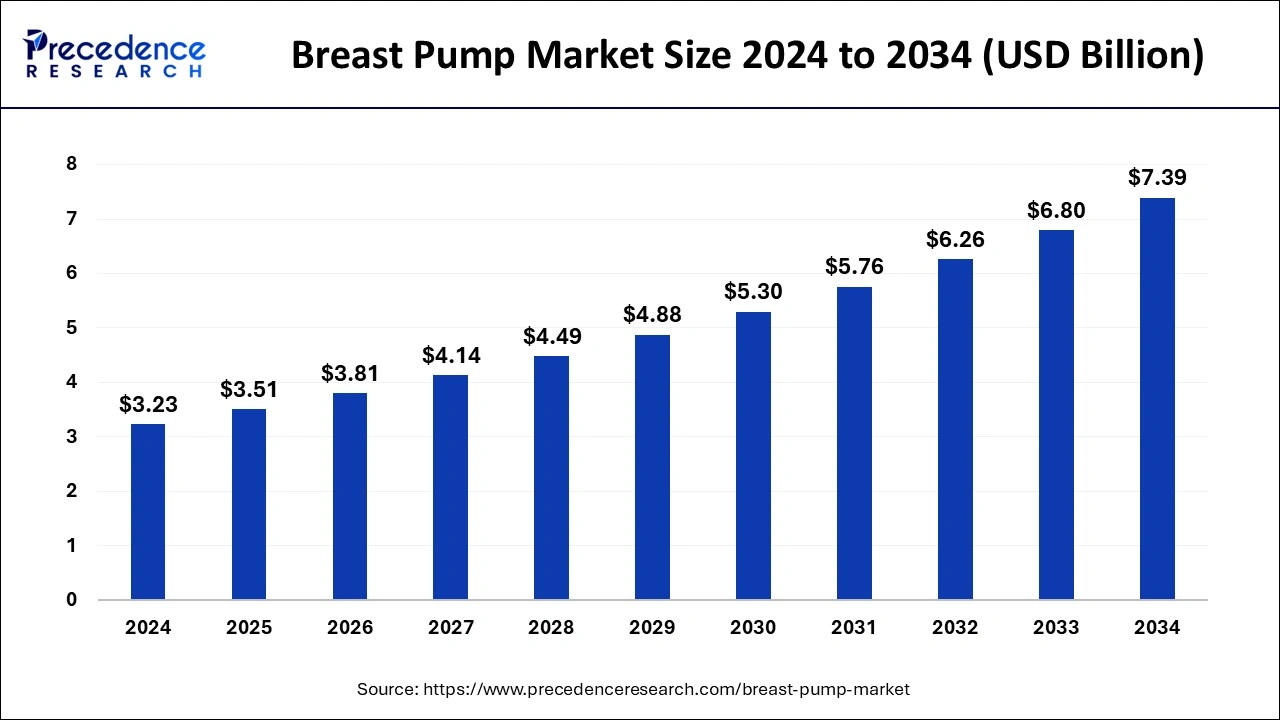

The global breast pump market size is calculated at USD 3.51 billion in 2025 and is anticipated to reach around USD 7.39 billion by 2034, growing at a CAGR of 8.64% from 2025 to 2034. The growth of the breast pump market is driven by the increasing women's employment rate and the growing awareness about the importance and benefits of breastfeeding among mothers.

Market Highlights

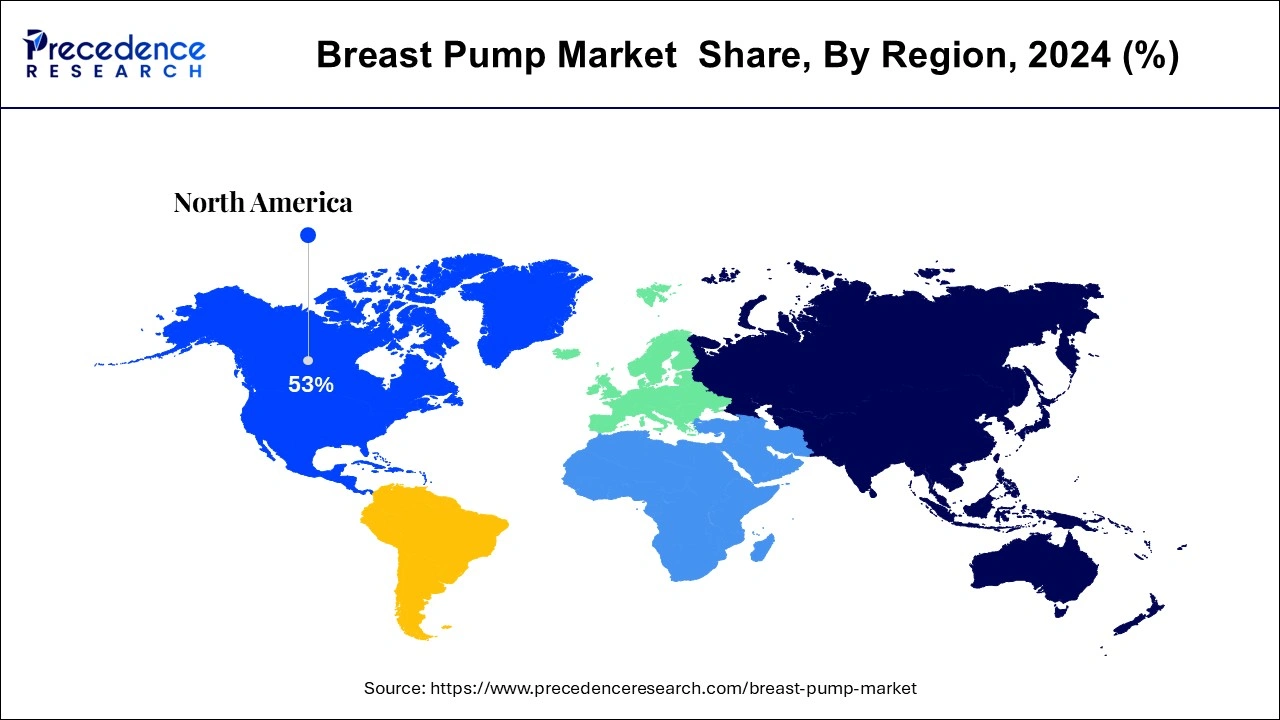

- North America led the global market with the highest market share in 2024.

- By Technology, the electric pumps segment has held the largest market share of 49% in 2024.

- By Product, the closed segment captured the biggest revenue share in 2024.

- By Application, the hospital-grade segment generated over 60% of revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 3.51 Billion

- Market Size in 2026: USD 3.81 Billion

- Forecasted Market Size by 2034: USD 7.39 Billion

- CAGR (2025-2034): 8.64%

- Largest Market in 2024: North America

What is a breast pump?

Healthcare devices used for extracting milk from the breast of lactating mothers are defined as breasts pumps. Employed women are forefront users of this device they use it to continue breastfeeding their babies while they are at work. In some instances, physicians also recommend women to use breasts pumps to activate milk supply when the child is not able to suck dairy. Breast pumps have become as an appropriate choice for the working women. The particular breast pump market is expected to witness a significant growth, mainly because of to growing technical advancements such as double breast penis pumps that assist to eliminate fat content from milk and replacement it with higher caloric value.

Throughout 2020, Covid-19 greatly impacted the overall medical devices market, with different segments of industry experiencing wide-ranging effects. The speedy initial spread of the pandemic come in healthcare systems being severely stressed, with resources and staffing being re-directed to address the surge in patients, particularly in intense care units.

Health-related device markets that are imperative to supplying hospital equipment for the management of Covid-19, such as personal defensive equipment, ventilators and general hospital items, experienced a spike in sales to fulfill the frustrating demand. However, the pandemic also come in postponements and cancellations of non-essential and elective treatments. Manufacturers centering on devices used in such elective procedures were extensively impacted fiscally during the worst-hit months of the pandemic, from Drive to April 2020. Several of these device market segments had already restored by Q2 of 2020, yet , with some even recording a surge in sales, while a few others had yet to experience such surges in 2021. Other device market segments were less influenced overall by the pandemic, particularly those found in essential treatments, such as in the heart disease place.

What are the key impacts of AI on the breast pump market?

The emergence of artificial intelligence (AI) technologies has paved the way for the development of smart medical devices. Manufacturers are developing advanced breast pumps using AI algorithms. AI-driven breast pumps analyze real-time data like milk flow and suction levels and provide personalized recommendations. This further helps mothers in their breastfeeding journey.

Breast Pump MarketGrowth Factors

- Increasing awareness among the population about the benefits of breast pumps boosts the growth of the market. The breast pump is convenient for working mothers to use.

- Rising government initiatives to spread awareness about the importance of breastfeeding contribute to market expansion.

- Social media platforms like YouTube and Facebook and e-commerce platforms have expanded the reach of breast pumps, fueling the growth of the market.

- Leading medical device companies are launching innovative and body-friendly breast pumps, which further drive market growth.

- Technological advancements led to the development of electric and battery-operated breast pumps and smart pumps, which are gaining immense traction due to their user-friendly features.

Breast Pump Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the breast pump market is anticipated to experience rapid growth, driven by the increasing number of women in the workforce and a growing awareness of infant nutrition. Innovations in technology are generating high-value, wearable/smart breast pump segments, especially in North America, Europe, and the greater Asia-Pacific.

- Sustainability Trends: Sustainability is influencing product innovation in the breast pump market as several products are currently being invented to meet increasing demand for BPA-free components, eco-friendly packaging, and energy-efficient electric pumps. Companies are innovating to ensure their products use safe, non-toxic components and develop recyclable products due to more specific global health and environmental accountability.

- Global Expansion: Key manufacturers are expanding in emerging markets such as India, Brazil, and Indonesia to meet the healthcare needs of their growing population with greater access. Medela and Philips Avent are investing in the regional manufacturing and distribution networks to establish a unified presence in the Asia-Pacific and Latin American regions.

- Key Investors: Institutional investors, in particular private equity and venture capital, are eager to invest due to predictable demand, healthcare alignment, and favorable margins. Investors have been putting their money into companies developing smart, app-connected breast pumps and inventive lactation technologies for digital native consumers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.51 Billion |

| Market Size in 2026 | USD 3.81 Billion |

| Market Size by 2034 | USD 7.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segments Insights

Technology Insights

On Technology basis the market is bifurcated into two subtypes; manual and electric. The electric pumps section held the greatest market share of over 49% in 2024 and is expected to develop further at the speediest CAGR on the forecast period. These items are powered with a motor and provide much more suction, making pumping significantly faster. The double moving model decreases the time taken when compared to the normal pump. Frequently, electric pumps can be quite heavy and noisy but manufacturers continue to use advanced technology to produce lightweight products that generate lower noise. Some key brands in this segment include Solely Yours Ultra Breasts Pump by Ameda AG and Isis iQ Duo Breasts Pump by Philips AVENT. Technological developments with the intro of lightweight devices, such as Platinum eagle electric breast pump motor by Ameda and Electric swing chest pumps by Medela, are expected to drive segment expansion over the approaching years.

Product Insights

On the basis of product type the market is segmented into open and closed system. The closed system sub segment accounted for the highest revenue in 2024 and is also likely to witness the most effective growth rate in the forecast period. This growth can be attributed to the higher consumption rates of these systems as they are more contamination-free. Closed system products include a lid which acts as a barrier between a pumping unit and variety kit, or motor that avoids the contamination of collected milk. This kind of protective layer also prevents the dairy products particles from stepping into the pump lines or motor. These products provide better safe practices, ensure maximum associated with impurities, and are super easy to clean. The introduction of convenient new products, such as AmedaHygieniKit, is expected to drive the segment expansion in the coming years.

Application Insights

On the basis of application the breast pump market is sub divided into personal use and hospital-grade pumps. The hospital-grade segment held the highest market with more than 60% revenue in 2024. This same segment is anticipated to expand with the highest CAGR over the forecast period. The increase in the use of hospital-grade chest pumps is the major factor driving the segment expansion. Several factors, such as favorable federal initiatives and a rise in can certainly employment rate, are also promoting portion growth. According to Eurostat, there has already been an increase in the employment of women from 1993 to 2016 in nearly all of the Europe; for instance, in Ireland in Europe, it has increased from ~40% in 1993 to ~65% in 2016. Such factors will increase the demand for breast pumps from working women.

Regional Insights

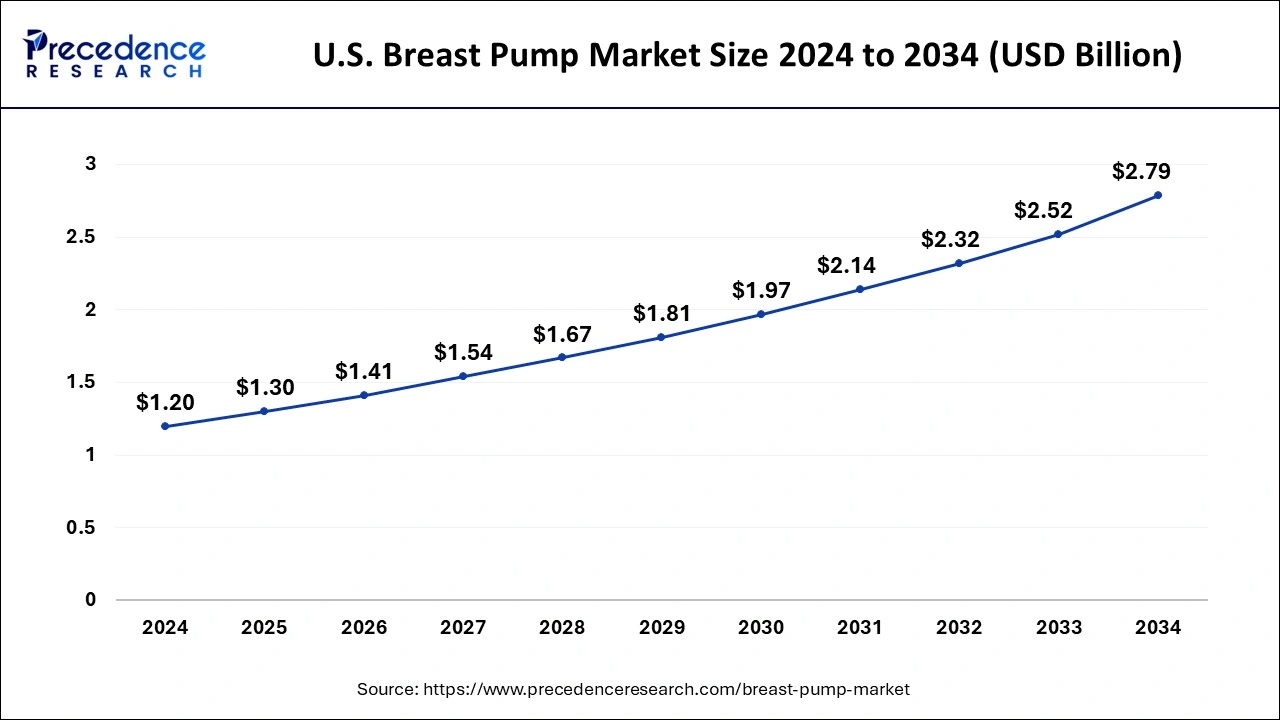

U.S. Breast Pump Market Size and Growth 2025 to 2034

The U.S. breast pump market size was exhibited at USD 1.30 billion in 2025 and is projected to be worth around USD 2.79 billion by 2034, growing at a CAGR of 8.80% from 2025 to 2034.

The North American market witnessed decent development throughout the forecast period due to high employment rate of women, embrace health care expenditure, more improved reimbursement policies. European countries contribute with considerable market share for breasts pumps industry, with Russia being the most lucrative market in Eastern European countries.

What made North America hold the dominant position in the global breast pump market in 2024?

North America held a dominant position in the global breast pump market due to high levels of awareness about breastfeeding, an established healthcare system, and the presence of several key brands. In addition, supportive government policies and a significant push towards smart breast pumps that were portable and efficient resulted in significant opportunities for producers and investors.

The U.S. was the largest market, led by a strong healthcare infrastructure, high female workforce participation, and uptake of existing technology with robust hospital programs that promoted both breastfeeding and the use of breast pumps. Leading companies in the country also produced innovative electric and wearable pumps.

The European breasts pumps market has witnessed considerable development in the recent years due to features of breast penis pumps such as permit women to keep dairy production and supply healthy feed to infants in their lack. Asia Pacific market is currently in growth stage and is expected to grow with highest market share during the analysis period.

Europe – The Fast Growing Market of Modern Motherhood

Europe expanded rapidly in the breast pump market with increased focus on maternal health, expanded health care coverage, and increased birth rates in some countries. There was strong demand for eco-friendly, hospital-grade, and portable pumps, leading to strong prospects for both local manufacturers and international entrants.

Germany led the European breast pump market, benefiting from an advanced health care system and strong public awareness of the benefits of breastfeeding. Local companies and hospitals partnered to promote the usage of safe and effective breast pumps, resulting in consistent growth for both hospital and home use.

Asia-Pacific – The Growing Powerhouse of Pumping Potential

The Asia-Pacific region experienced robust growth as a result of the increased participation of women in the workforce, improved access to healthcare, and an increase in awareness of breastfeeding benefits. Coupled with a wave of urbanization, enhanced e-commerce, and government campaigns supporting maternal health, a range of opportunities for breast pump manufacturers emerged across developing markets.

China led the Asia-Pacific breast pump market owing to rising birth rates from a relaxed family policy and an expanding middle class. Both domestic brands and global manufacturers were increasing the availability of affordable electric and smart pumps to meet the rising demand of urban working mothers.

Nurturing Growth with Every Beat in Latin America

Latin America saw consistent growth, attributed to a better healthcare system, more women joining the workforce, and increased awareness and interest in nutrition for infants. Expanding hospital networks and government sponsored breastfeeding campaigns generated new opportunities for global breast pump manufacturers to enter regional markets.

Brazil dominated the Latin American market as there was a commitment to public health policies that support breastfeeding, as well as a growing interest in modern healthcare devices. The increased availability of electric and portable pumps through both pharmacies and online platforms contributed to sales growth in urban areas.

Middle East & Africa – Emerging Voices in Maternal Wellness

The Middle East & Africa breast pump market increased moderately as maternity care improved, urbanization increased, and participation of females in the labor force increased. Awareness programs on breastfeeding and global brand entry provided good opportunities in urban and semi-urban markets.

The UAE led the regional market due to advanced healthcare facilities and high spending on maternity products. Increased consumer awareness about infant health and the availability of premium global breast pump brands encouraged the uptake of breast pumps by professional mothers and expatriate communities.

Value Chain Analysis

- Research & Development:

Focuses on designing breast pumps that are efficient, comfortable, and hygienic, with innovations such as app connectivity or wearable designs for convenience and better user experience.

Key Players: Elvie, Willow, Spectra Baby, Medela

- Clinical Trials & Regulatory Approvals:

Ensures safety and efficacy through pretesting, clinical evidence, and regulatory clearances (e.g., FDA approval), ensuring compliance and enabling trust in the device.

Key Players: Medela, Ameda, and Philips Avent.

- Formulation & Final Dosage Preparation:

This is not applicable for breast pumps since, being non-ingestible devices, they won't require chemical formulation or dosage preparation.

- Packaging & Serialization:

Developing secure glass packaging suitable for hygienic use, later adding the serialization process to authenticate, trace, and protect the products along with the supply chain itself.

Key Players: Medela, Philips Avent, and Willow Innovations

- Distribution to Hospitals & Pharmacies:

With logistics optimized for deliveries of breast pumps to hospitals and pharmacies or directly to consumers, including insurance coverage channels, accessibility, and timely availability of breast pumps are ensured.

Key Players: Amazon

- Patient Support & Services:

Lactation support would include technical assistance, warranties, and returns management to maximize customer satisfaction and the subsequent purchase of postpartum care.

Key Players Analysis

Important market players concentrate on strategies, such as mergers & acquisitions, relationships, and new product launches, to improve their foothold in the global market.

- For instance, in May 2017, Medela announced that it might conduct in-house tests to boost the precision of the comments received by the organization regarding its device. This is expected to increase patient compliance with the device.

Many companies are also trading heavily in R&D to improve their product portfolio. For example, in October 2017, Philips launched uGrow, a baby application, which helps parents monitor the baby's development.

Breast Pump Market Companies

- Ameda AG

- Bailey Medical

- Medela AG

- Philips

- Hygeia Health

- Lansinoh Laboratories

- Buettner Frank GmbH

- Linco Baby Merchandise Works Co., Ltd.

- Whittlestone, Inc.

- Koninklijke Philips N.V.

Recent Developments

- In September 2025, Willow Innovations introduces Willow Sync™, a wearable breast pump, offering high-performance technology at lower out-of-pocket costs, exclusively available through insurance providers. (Source: https://hitconsultant.net)

- In August 2025, Philips launches Philips Avent Hands-free Breast Pump in India, promoting freedom and flexibility for mothers during World Breastfeeding Week, with Masaba Gupta as the face of the campaign. (Source: https://www.tribuneindia.com)

Segments Covered in the Report

By Product

- Open System

- Closed System

By Technology

- Manual

- Electric

By Application

- Hospital-grade

- Personal Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting