What is the Smart Medical Devices Market Size?

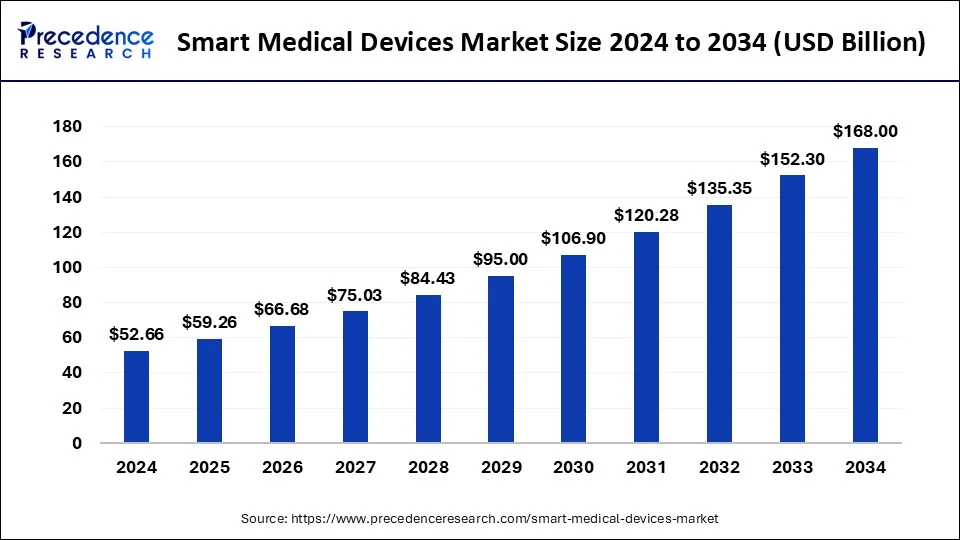

The global smart medical devices market size is accounted at USD 59.26 billion in 2025 and predicted to increase from USD 66.68 billion in 2026 to approximately USD 184.53 billion by 2035, expanding at a CAGR of 12.03% from 2026 to 2035. The rising technological integration in the medical industry drives the growth of the market.

Market Highlights

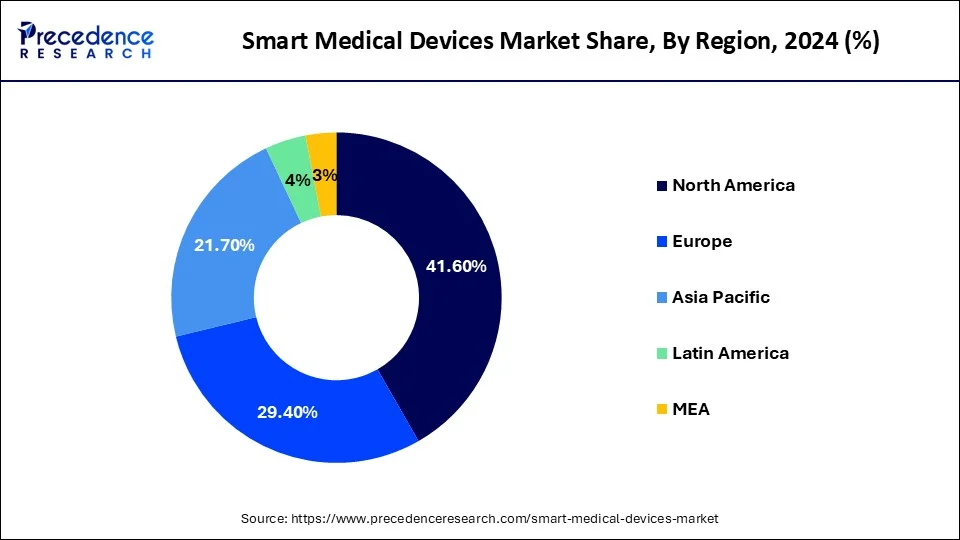

- North America dominated the global market with the largest market share of 41.6% in 2025

- Asia Pacific is observed to have the fastest CAGR of growth during the forecast period.

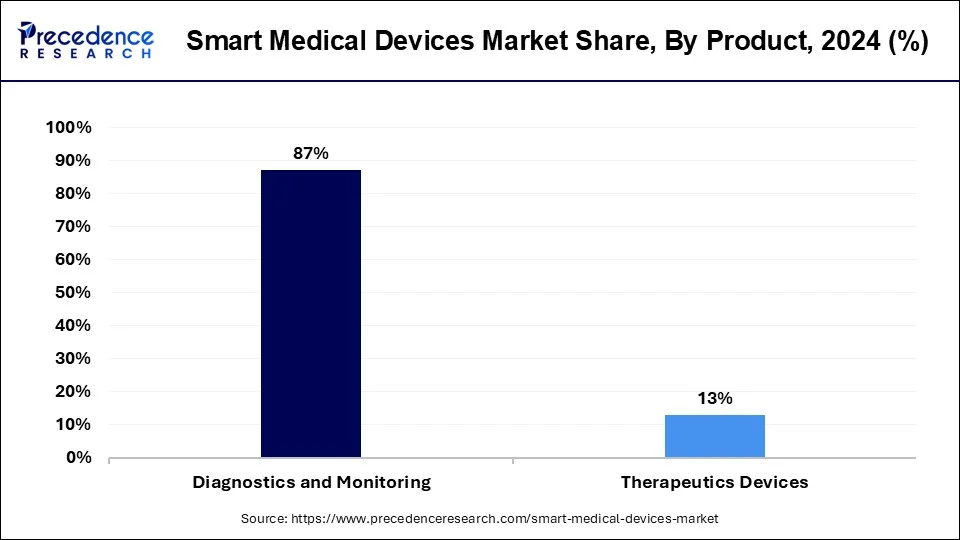

- By product, the diagnostics and monitoring segment contributed the highest market share of 87% in 2025.

- By end-use, the homecare settings segment is projected to have the highest growth in the market in 2025.

How Does RPM & eHealth Initiatives Promote the Market Progression?

Smart medical devices are automated machines, equipment, and instruments that use artificial intelligence and machine learning for the detection of the stages of diseases and give real-time insight into the patient's health condition. Smart medical devices help in the diagnosis and treatment of patients. Smart devices are an efficient device that helps in remote health monitoring by the ehealth initiatives and reduce the visit to hospital readmission and doctor visits.

The smart devices have the two categories such as automated health management, and informational management. Automated health management provides real-time insights into the health of the patients to the physicians and informational devices are designed to collect the health information and display it to the patients to make an informed decision regarding their health. The rapid adoption of the technologies in medical devices is driving the growth of the smart medical devices market.

Smart Medical Devices Market Growth Factors

- The growing prevalence of chronic diseases in the geriatric population and the rising number of infectious diseases are driving the demand for smart medical devices for the early detection and diagnosis of diseases.

- The rising awareness about health and the surging spending mentality in healthcare by the population due to the rise in disposable income and living standards are driving the expansion of the market.

- The rising awareness regarding real-time insights about health and diseases that help in early diagnosis and treatment in hospitals and other healthcare institutions is fueling the demand for the smart medical devices market.

- The rising advancement in healthcare technologies and the rising investments in the innovations of advanced and smart medical devices also accelerate the demand for the market.

- The rising government initiative for developing healthcare sectors and supporting regulations and policies that make medical facilities more reachable and affordable to the people contribute to the growth of the smart medical devices market.

Smart Medical Devices Market Outlook

- Global Expansion: The growth is driven by a rise in demand for remote patient monitoring, technological integration of AI and IoT, and a shift towards home-based care.

- Major Investor: In May 2024, StrokeDx closed a $5 million seed prime round to establish a portable, magnetism-based device for faster stroke detection and monitoring.

- Startup Ecosystem: In July 2024, The Blue Box, a Spanish startup, raised seed capital to fund clinical trials for a portable device, which escalates the detection of breast cancer from a urine sample using AI.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 59.26 Billion |

| Global Market Size in 2026 | USD 66.68 Billion |

| Global Market Size by 2035 | USD 184.53 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.03% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End-User, Modality, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for efficient healthcare operations

The integration of technologies in healthcare settings is driving the growth of the smart medical devices market. The rising prevalence of chronic diseases such as diabetes, asthma, and cardiovascular disorders which need regular monitoring drives the demand for smart medical devices. Smart devices are also known as IoT healthcare devices which include smart tools such as connectivity, sensors, and data analytics capabilities and are widely being used in the healthcare industry. Smart medical devices provide real-time data about the patient's health condition, increase patient engagement, and maintain their healthcare process. Smart devices include gadgets like smartwatches, wearable fitness trackers to remote monitoring systems.

The increasing demand for remote monitoring systems that help to monitor the condition of patients with chronic disorders at home with the integration of various devices and sensors to monitor. These tools can track the symptoms, vital signs, and medical adherence, which are sent to medical professionals for proactive interventions. Thus these factors are positively influencing the growth of the smart medical devices market.

Restraint

Lack of proper infrastructure

The insufficient amount of infrastructure and the lack of skilled professionals in technology development restrains the growth of the smart medical devices market. This factor generally acts as a hampering one in underdeveloped areas, where lack of healthcare infrastructure, absence of skilled professionals and slow pace of adoption for such devices create a major restraint for manufacturers and investors from expanding business in such areas. The challenge is observed to get addressed with government initiatives and private investments that can boost the adoption of smart medical devices in such parts.

Opportunity

Innovations in medical devices

The ongoing advancements in the medical devices and the healthcare sectors are observed to offer lucrative opportunities for the smart medical devices market. The integration of smart technologies helps healthcare professionals to make informed and strategic decisions about the health of the patients. There are some of the smart medical devices that are observed as emerging trends in the healthcare system such as wearables, medical robots, immersive technologies, 3D printing, and artificial intelligence, the internet of medical things, cybersecurity, medical waste management, minimally invasive devices, and 5G.

The rising focus and interest in automation of healthcare devices promotes the implementation of AI, medical robots, and immersive technologies in the medical devices industry. Additionally, the rising investments in the innovation of technologies in the healthcare industry also contributes to the growth of the smart medical devices market.

Segment Insights

Modality Insights

Portable medical devices segment led the market. The growing elderly population and the rise of chronic diseases worldwide, along with the need for home-based monitoring devices, are propelling market growth. The pandemic led to a marked increase in the demand for remote monitoring and patient engagement solutions, prompting manufacturers to concentrate more on boosting production to satisfy the rising need for portable monitoring devices.

Wearable segment is observed to grow at the fastest rate during the forecast period. The market is undergoing substantial expansion, fueled by the incorporation of cutting-edge technologies such as continuous glucose monitoring, individualized healthcare, and population health management. Furthermore, the increasing consciousness about physical fitness and wearable technology is a significant driver propelling market expansion. As more people globally become aware of their physical health and embrace a healthy lifestyle, the demand for wearable devices that can monitor and track their fitness and health-related insights and progress is increasing.

Product Insights

The diagnostics and monitoring segment dominated the smart medical devices market with the largest market share in 2025. The dominance of the segment is attributed to the rising demand for smart medical devices for the diagnostics and monitoring of chronic diseases such as diabetes and others. Smart medical devices give real-time information about the condition of the diseases of the patient which helps to take an informed decision regarding the diseases. The diagnostics and monitoring segment is further divided into the blood glucose, pulse, blood pressure, and heart rate monitoring.

The rising investments in technological advancements and the supportive government initiatives with subsidies and policies for the development and implementation of smart medical gadgets are driving the growth of the segment.

Among all diagnostic and monitoring tools, blood glucose monitoring tools are considered to be the most prominent ones. The rising cases of diabetes across the globe act as a major factor for the increasing utilization of blood glucose monitoring tools across the health industry. Along with this, the rising emphasis on utilizing diabetes detection tools at home by patients under the trend of home-health care settings creates a significant opportunity for the segment to grow.

Distribution Channel Insights

Pharmacies segment held the largest share of the market. Pharmacies function as an important distribution avenue for medical devices, especially for self-care and non-prescription items. Chain and independent retail pharmacies comprise a significant portion of the overall medical device market. This distribution channel is fueled by the growing demand for self-monitoring and non-invasive diagnostic tools, along with the convenience provided to consumers.

Online channel segment is seen to grow at a notable rate during the predicted timeframe. The online distribution channel segment represents a crucial and swiftly expanding portion of the medical devices market, especially concerning wearable medical devices. Although retail pharmacies presently control a greater portion of the market, online platforms are growing more rapidly due to rising e-commerce acceptance and consumers' preference for purchasing online. This trend is anticipated to persist, with digital platforms emerging as a significant factor in the distribution of medical devices.

End-User Insights

The hospitals segment held a considerable share of the smart medical devices market in 2025. Hospitals operate within a highly regulated environment, with strict requirements for patient safety, data security, and regulatory compliance. Smart medical devices that meet regulatory standards and quality certifications are preferred by hospitals, as they offer assurance of reliability, accuracy, and data integrity.

The homecare settings segment is expected to have a significant rate of growth in the smart medical devices market in 2025.

The growth of the segment is attributed to the rising number of the geriatric population having the chronic diseases and need the regular monitoring driving the demand for the high-quality medical services at their home comfort that boosts the growth of the segment. The rising adoption of telehealth, e-healthcare initiatives and smart medical devices that gives accurate results for the health condition in homecare enhances the expansion of the homecare settings segment.

Regional Insights

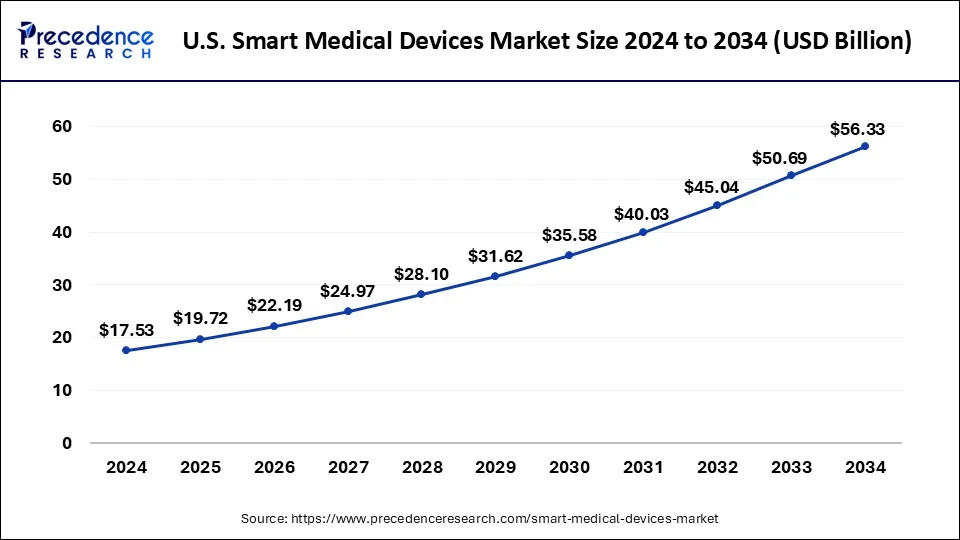

U.S. Smart Medical Devices Market Size and Growth 2026 to 2035

The U.S. smart medical devices market size is estimated at USD 19.72 billion in 2025 and is projected to surpass around USD 61.97 billion by 2035 at a CAGR of 12.13% from 2026 to 2035

North America led the smart medical devices market in 2025, the region is observed to have a sustained growth during the forecast period. The dominance of the market in the region is attributed to the early adoption of technologies in the medical sector and the higher investments in the development of healthcare in the countries like the United States and Canada are driving the expansion of the market. The higher presence of the major market players in smart medical gadgets is further propelling the growth of the market.

The rising chronic disease among the geriatric population also acts as a major factor for the higher demand for smart medical devices in the region. Additionally, North America is home to multiple manufacturers and investors for healthcare devices. This factor brings a significant opportunity for the region to sustain dominance in the smart medical devices market.

Asia Pacific is observed to witness the fastest rate of expansion in the smart medical devices market during the forecast period. The growth of the market in the region is increasing owing to the rising population and the chronic diseases in the geriatric population such as diabetes, asthma, and others that need to be regularly monitored that enhance the demand for smart medical devices. Technological integration in medical devices enhances the quality of the results and provides real-time insights into the health condition to the doctors or patients to make an informed decision.

The rising investments in the development of healthcare facilities and technological advancements are driving the growth of the market. Additionally, the rising research and development activities in innovation and the launch of new categories of smart medical devices are driving the growth of the market in the region.

- Indian Institute of Technology (IIT) Jodhpur researchers introduced the lower priced paper-based analytical devices that can monitor and detect the glucose level and it can be connected to the smartphones. The devices contain lab based biodegradable paper that change the color depend upon the glucose level.

- China Medical University Hospital (CMUH, Taiwan) Sleep Medicine Center has recently launched the iDREAM (Intelligent Detection of Respiratory Events through Automated Monitoring), with the Quanta's QOCA Portable ECG Monitoring Device, for the efficient detection of the apnea patient during the sleep at the home.

- Calcutta Salt Lake's HP Ghosh Hospital had taken the revolutionary step in by combining smart technologies in the ICUs. It is the first faculity in the eastern India that adopted this system for enhancing the patience experience and decreases mortality rates.

The U.S. smart medical devices market had the highest revenue share in 2025. The increasing use of advanced healthcare technologies, including AI and ML, fosters the creation of innovative, interconnected devices that improve patient results. Supportive government initiatives further promote the adoption and growth of smart medical devices throughout the healthcare industry. The growing focus on fitness among adults in the U.S. and the heightened attention on patient diagnosis and real-time monitoring by regional and national healthcare organizations have significantly contributed to the increased demand for wearable devices.

Key factors driving market growth in India include the surging healthcare demands, heightened government expenditures on healthcare infrastructure, improvements in medical technology, a growing elderly demographic, the rising incidence of chronic illnesses, and the integration of sophisticated diagnostic and therapeutic equipment. Increasing income levels, broader healthcare insurance access, and a surge in medical tourism are generating concurrent demand for both cost-effective and cutting-edge medical devices. The development of infrastructure in Tier 2 and 3 towns is creating new markets by expanding PM Jay insurance coverage, utilizing digital platforms such as ABDM, and implementing innovative strategies like differential pricing models.

IoT wireless technology in medical devices is transforming healthcare in Europe. Wearable smart devices now connect patients to healthcare providers, sending vital medical information instantly from hospital beds and homes, as well as mobile devices utilized at emergency locations and in transport vehicles. Implanted wireless devices in the body enable patients to undergo continuous monitoring, notifying health care providers of any changes that might demand appropriate action. Intelligent personal medical devices grant patients unparalleled mobility while delivering real-time information to clinicians to guarantee the highest quality of care for patients. Intelligent medical devices are subject to rigorous regulations and must undergo testing and certification based on specified standards like FCC in the US and RED compliance for the EU.

Germany is dedicated to enhancing its medical technology sector, focusing heavily on healthcare research and innovation. The country possesses a vast array of universities and research facilities, promoting the ongoing advancement of innovative medical equipment. Germany's older population is another major factor; as the need for treatments and devices rises, there is an increasing demand for sophisticated healthcare solutions. Moreover, favorable regulatory environments and robust government efforts motivate local firms to innovate and invest in medical device technologies. The medical device market in Germany is governed by standards, safety regulations, and directives from both Germany and the EU. Following a one-year postponement of the EU Medical Device Regulation (MDR) start date, which implemented heightened testing, certification, and compliance demands, this regulatory system was fully enacted on May 26, 2021.

Emergence of AI Integration is Surging in Latin America

The smart medical devices market in Latin America is fueled by the greater adoption of AI-assisted tools in medical equipment, such as AI for X-rays, CT scans, and MRIs. For this many startups in Argentina and Brazil, like Entelai, are pushing with AI-enabled solutions in brain imaging, chest X-rays, and mammography.

Regulatory Advances: Leveraging the Brazilian Market Growth

Specifically, recently, the Brazilian Health Regulatory Agency (ANVISA) has unveiled new regulations for simplifying market access for novel, higher-risk devices (Class III and IV). New legislation (IN 290/2024, effective April 2024) enables manufacturers to expand regulatory authorizations from authorities like the U.S. FDA, TGA, Health Canada, and MHLW, probably lowering review times by an estimated 30%.

Escalating Local Production is Supporting MEA

The smart medical devices market in MEA has been exploring with international companies, which are boosting their presence through new regional headquarters and local manufacturing alliances. For this, the UAE and Saudi Arabia are assisting local production of medical equipment to expand their global competitiveness.

Extensive AI-Powered Surgery: Fostering the Saudi Arabia Market

Day by day, Saudi Arabia is actively investing in robotic surgical solutions, in which they are increasingly integrating AI-driven navigation into these solutions for accelerating accuracy. In March 2025, Saudi Arabia rolled out the Seha Virtual Hospital (SVH) that connects over 224 facilities and uses AI and Augmented Reality (AR) for care delivery.

Smart Medical Devices Market: Value Chain Analysis

- R&D: This comprises identification of robust needs, conceptualization and design planning, detailed design and engineering, iterative prototyping and testing, and finally validating and approval from regulatory bodies.

Key Players: Medtronic, Johnson & Johnson, Siemens Healthineers, etc. - Distribution to Hospitals, Pharmacies: The market encompasses a combination of direct-to-hospital systems, partnerships with wholesalers, and online channels.

Key Players: Amazon Business, Appoint Distributor, F6S.com, etc. - Patient Support & Services: The devices usually facilitate real-time monitoring, remote consultations, and automated tasks that enhance outcomes and patient engagement.

Key Players: HealthSnap, MedTel Healthcare, Medtronic, etc.

Key Players Offering:

- Abbott- A leading company provides diverse smart and connected medical devices, especially in diabetes care, cardiovascular health, and neuromodulation.

- Apple, Inc.- Particularly offers wearables, like watches, to capture health monitoring features like ECG, blood oxygen monitoring, and fall detection.

- Fitbit, Inc.- A key player facilitates consumer wearables, like ECG and EDA sensors.

- Dexcom, Inc- It mainly emphasises continuous glucose monitoring (CGM) systems for diabetes management.

- F. Hoffmann-La Roche Ltd- A significant company provides instruments for in-vitro testing that can analyse patient samples like blood or urine.

Smart Medical Devices Market Companies

- Zephyr

- Sonova, NeuroMetrix, Inc.

- Medtronic

- Johnson & Johnson.

Recent Developments

- In February 2025, MediBuddy, India's foremost digital healthcare firm, has revealed a strategic alliance with ELECOM, a prominent Japanese electronics manufacturer, to collaboratively create and launch advanced smart health IoT devices in the Indian market. This collaboration represents an important advancement in MediBuddy's goal of providing high-quality healthcare to a billion individuals by promoting innovation in preventive health management.

- In February 2025, SpineGuard, a pioneering firm utilized its DSG (Dynamic Surgical Guidance) local conductivity sensing technology to enhance and simplify the placement of bone implants, today reveals that its commercial partner Omnia Medical has introduced their co-developed product PsiFGuard in the USA at the NANS.

- In February 2025, EssilorLuxottica obtained FDA approval for its over-the-counter Nuance Audio Glasses, which combine smart glasses with an open-ear hearing aid feature. Simultaneously, the device obtained CE marking according to the Medical Devices Regulation in the EU and achieved an ISO Quality Management System certification for Hearing Aids.

Segments Covered in the Report

By Product

- Diagnostics and Monitoring

- Blood Glucose Monitor

- Heart Rate Monitors

- Pulse Oximeters

- Blood Pressure Monitors

- Therapeutics Devices

- Portable Oxygen Concentrators and Ventilators

- Insulin Pumps

- Hearing Aids

By End-User

- Homecare Settings

- Hospitals

- Others

By Modality

- Portable

- Wearable

By Distribution Channel

- Pharmacies

- Online Channel

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting