What is the Remote Health Monitoring Market Size?

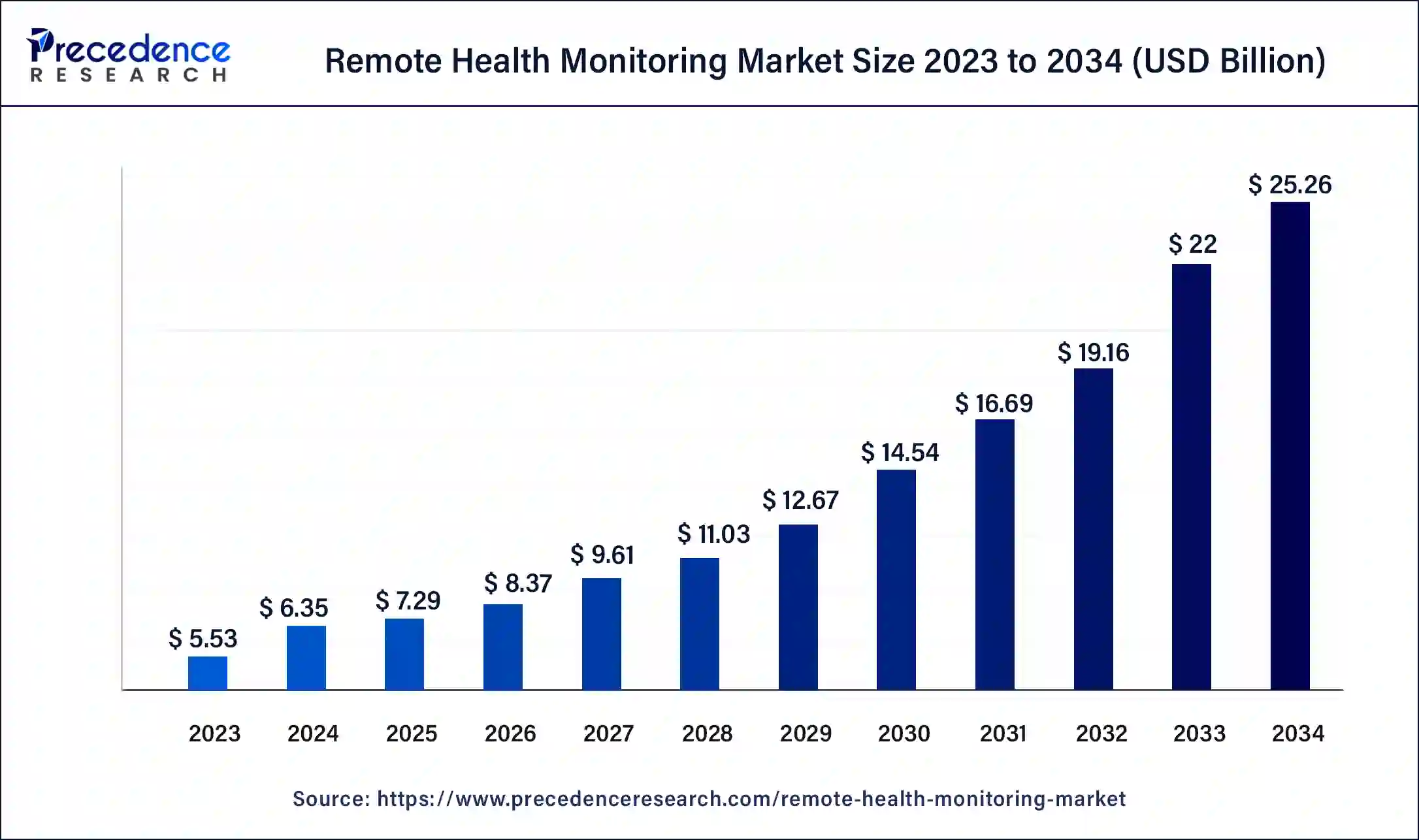

The global remote health monitoring market size is calculated at USD 7.29 billion in 2025 and is predicted to increase from USD 8.37 billion in 2026 to approximately USD 25.26 billion by 2034, expanding at a CAGR of 14.8% from 2025 to 2034.

Remote Health Monitoring Market Key Takeaways

- In terms of revenue, the market is valued at $7.29 billion in 2025.

- It is projected to reach $25.26 billion by 2034.

- The market is expected to grow at a CAGR of 14.80% from 2025 to 2034.

- North America led the global market with the highest market share of 43% in 2024.

- By device, the cardiac monitoring device segment is estimated to capture the biggest revenue share in 2024.

- By application, the cardiovascular segment predicted to register the maximum market share in 2024.

- By end-users, the hospital segment is estimated to hold the highest market share in 2024.

What is remote health monitoring?

Remote health monitoring is used to manage a patient's health from a distance to get proper and real-time data. Remote health monitoring devices can collect patients' health information, transfer it to the hospital-based system and help doctors/administration get timely updates. Remote health monitoring devices are generally used to monitor patients with chronic diseases. Moreover, it also assists in monitoring heart rhythms, stress levels, blood glucose levels, temperature, and other parameters. With the growing advent of technology in remote health monitoring devices, getting prior alarms in case of severe health issues has become possible for doctors or health providers. Thus, the utilization of remote health monitoring devices has resulted in a reduction in morbidity.

The remote health monitoring technique covers multiple medical solutions and allows the medical sector to provide excellent health care to patients not present on the hospital premises. Along with this, the technology has allowed the direct involvement of patients in their health management by providing time-to-time health-related data while sitting in the comfort of their homes. A few other benefits of remote health monitoring include the reduction of patients' visits to the hospital and convenience for hospital administration with a reduced workload.

Remote health monitoring devices have helped the health sector immensely by preventing unnecessary admissions and appointments in hospitals or clinics. The COVID-19 pandemic accelerated the utilization of remote health monitoring devices in the healthcare sector with the rapid adaptation of technology due to imposed regulations to constrain the spread of the virus. The pandemic increased investments in the invention and research & development sectors for the remote health monitoring market.

What are the technological advancements in the remote health monitoring market?

Technological advancements in the remote health monitoring market feature mobile technologies, telehealth, wearables, internet of things (IoT), wireless connectivity, and AI andmachine learning. Telehealth platform technology provides remote consultation, which enables patients and healthcare providers to connect from anywhere. The mobile technologies, such as tablets and smartphones. It enables access to track health metrics, communication, and health applications. The wireless connectivity includes advanced technologies such as Wi-fi and 5G to fasten data transmission between healthcare systems and devices.

Wearables and IoT consist of fitness trackers and smartwatches. It calculates real-time health data, which is later transmitted to healthcare providers through IoT networks. These technologies leverage the remote health monitoring market. The advancement is reshaping the future of the healthcare sector globally.

Remote Health Monitoring Market Outlook

- Industry Growth Overview: The remote health monitoring market is expected to expand rapidly from 2025 to 2030, driven by rising rates of chronic diseases, an aging population, and increased adoption of connected healthcare devices. Growth is expected to be driven by the Asia-Pacific region and North America, given the advancements of digital structure and government-assisted telehealth approaches.

- Global Expansion: Major companies are expanding into developing markets such as India, Brazil, and certain Southeast Asian countries based on increased penetration of smartphone devices in combination with demand for rural telemedicine systems. Companies have launched regional solutions to eliminate access and affordability constraints associated with remote health monitoring devices.

- Major Investors: Venture capital and healthcare funds are investing in companies that develop AI-powered remote diagnostics and care in the home, and companies, including Sequoia Capital and General Atlantic, are selecting a few scalable digital health models utilizing significant patient engagement metrics.

- Startup Ecosystem: The environment is flourishing with startups such as Biofourmis (Singapore) and Current Health (UK) creating AI-enhanced monitoring systems and previous disease management models and developing new hospitals-at-home models.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 25.26 Billion |

| Market Size in 2025 | USD 7.29 Billion |

| Market Size in 2026 | USD 8.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Devices, Application, End-Users, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

The remote health monitoring market is likely to grow in the upcoming years with increasing demand from developing countries where the healthcare infrastructure is still growing. Hospitals are adapting to remote health monitoring technology due to improved patient outcomes and cost savings. Wearable ECG monitors, Fitness tracker watches, Patch-biosensor, Smart health watches, and wearable blood pressure monitors are a few remote health monitoring devices that have gained immense importance in the remote health monitoring market.

The remote health monitoring market carries multiple drivers. Increasing cases of chronic diseases are seen as a significant driver for the growth of the remote health monitoring market. Chronic conditions include diabetes, cardiovascular diseases, cancer, and other diseases that need continuous medical attention. The utilization of remote health monitoring techniques for managing chronic illness has benefited both patients and doctors. The remote health monitoring marker is surging with the increasing awareness of self-health care. In recent years, people have started focusing on early diagnosis and remote health monitoring devices to help them get proper health care, as these devices provide early signs of uncertain health issues before minor issues turn into major ones. Another remote health monitoring market driver is raising investment in the research and development sector. Prominent companies have started investing in the remote health monitoring market, which will help in developing advanced devices. The invention of technologically advanced remote monitoring devices is seen as another driving factor for the remote health monitoring market. Prominent players in the market are focused on developing their product portfolio while launching new remote health monitoring devices. For instance, the Stasis Lab launched a new multi-parameter remote health monitoring device in the U.S. market in August 2020. Rapidly increasing adaptation of artificial intelligence is likely to fuel the growth of the remote health monitoring market.

The remote health monitoring market also carries considerable restraints along with multiple driving factors. Privacy concerns and data safety issues are seen as major restraining factors for the remote health monitoring market. The remote health monitoring device carries health-related data. At the same time, the remote health monitoring systems imposed in hospitals have patients' confidential health information along with payment-related data. The threat of cyber-attack is continuously growing for every firm in the market and losing any patient data can result in a significant loss for the hospital administration. Thus, the privacy concern associated with remote health monitoring technology hampers the market. The lack of adoption of remote health monitoring devices in low or middle-income countries is another restraining factor for the growth of the remote health monitoring market. Implementing remote health monitoring technology in the healthcare sector requires skilled professionals, significant investments, a sufficient budget, and quality maintenance. Limited availability of quality healthcare infrastructure, along with a lack of awareness, has hampered the growth of the remote health monitoring market in low- or middle-income countries.

Devices Insights

The remote health monitoring market is segmented into Respiratory monitoring, Blood glucose monitoring, Cardiac monitoring, and Multi-parameter monitoring. The cardiac monitoring device is the largest remote health monitoring market segment. The rise in heart disease has boosted the demand for cardiac monitoring devices. Blood pressure cuffs,Pulse oximeters, and wearable activity trackers are a few examples of cardiac remote health monitoring devices available in the market. Unpredictable risks caused due to chronic diseases have forced hospitals and cardiology departments to adopt remote health monitoring devices to track the real-time health conditions of patients. The rapid increase in demand for advanced healthcare technologies in intensive care units has boosted multi-parameter monitoring devices. The multi-parameter monitoring segment is predicted to propel the remote health monitoring market growth during 2024-2034, owing to its multi-beneficiary factor. Multi-parameter monitoring devices can monitor oxygen levels, blood glucose levels, cardiac activities, and temperature on one screen. Remote multi-parameter monitoring devices allow hospitals to simultaneously manage multiple patients and their real-time health data. Considering the benefits of the multi-parameter monitoring device, the demand for such devices will likely increase in the upcoming years.

Application Insights

The remote health monitoring market is segmented by application into Oncology, Cardiovascular diseases, Diabetes, and Others. Among these, the cardiovascular segment holds the largest revenue share in the market. Increasing heart attacks, heart failures, arrhythmia, and hypertension patients are considered to boost the demand for remote health monitoring devices. Cardiac remote health monitoring devices such as insertable, external monitoring devices, and wearables can monitor heart rate, heart health, pulse rate, and stress level. Cardiac remote health monitoring devices can track improper heartbeats, dizziness, fainting, dropped blood pressure, and hypertension to send alarming early warnings to the system imposed in the hospital. Cardiovascular diseases fall under the segment of chronic illnesses that require continuous medical attention. The remote health monitoring devices developed for cardiovascular detail provide reliable health care to all such requirements. Thus, the cardiovascular segment is likely to grow in the forecast period of 2025-2034.

The increasing number of diabetes patients across the globe has increased the demand for remote blood glucose monitoring devices. In contrast, increased awareness related to diabetes has forced the population to check blood glucose levels daily. This is another factor considered for the growth of the diabetes sector in the remote health monitoring market.

End-Users Insights

The remote health monitoring market is segmented into Hospitals, Home health care, and Diagnostic centers. The hospital segment holds the largest share of the remote health monitoring market. The increase in the number of hospital visits has forced hospitals to adopt remote health monitoring technology. Also, during the Covid-19 pandemic, multiple healthcare providers, hospitals, and clinics adopted remote health monitoring systems to provide better and more reliable healthcare to patients remotely by reducing the risk of virus spread.

The home healthcare segment will likely experience growth in the forecast period owing to the rising importance of self-healthcare among people. People have started preferring real-time monitoring of their health. In contrast, remote health monitoring devices allow the direct involvement of patients in managing their health. These factors will grow the home healthcare segment in the remote health monitoring market.

Regional Insights

North America: The Connected Care Revolution: North America's Remote Health Dominance

U.S. Remote Health Monitoring Market Trends

The U.S. market is growing rapidly as providers increasingly adopt remote patient monitoring (RPM) and related technologies to support home-based care and chronic disease management. One key driver is the rising prevalence of chronic conditions, such as diabetes, hypertension and heart disease, which push demand for continuous monitoring beyond the hospital setting. Technological advances in wearable sensors, cloud-based connectivity and AI analytics are making monitoring systems more accessible, user-friendly and actionable for clinicians.

Europe Title: Europe's Healthy Acceleration: Riding the Remote Health Monitoring Wave

Germany Remote Health Monitoring Market Trends

The remote health monitoring market in Germany is advancing rapidly, fueled by supportive policy frameworks and a strong digital health infrastructure. The country is expected to see its remote healthcare market grow at a compound annual growth rate of around 20% from 2025 to 2030. Key growth drivers include the aging population, rising chronic disease burden, and the widespread adoption of wearables, sensor-based health devices and connected platforms for home-based care.

Asia-Pacific: The Next-Gen Health Frontier

The Asia-Pacific region experienced notable growth in the remote health monitoring industry owing to rising population, urbanization, and government investments in digital health. Countries including China, India, and Japan made substantial efforts to advance AI-powered wearables and telehealth platforms. Increased smartphone use and internet access have led to increased demand for connected healthcare services. Growing opportunities for remote health monitoring include elderly care monitoring, mobile diagnostics, and rural telemedicine. The Asia-Pacific region presents a unique opportunity for innovation to develop scalable, low-cost digital healthcare technologies to improve the delivery of patient care.

China Remote Health Monitoring Market Trends

China has taken a lead in the regional market, driven by both connected health device adoption and national digitalization initiatives. Government policies promoting telemedicine have further fueled accessibility efforts. Businesses, like Huawei and Xiaomi, have developed wearable devices that are relatively inexpensive in comparison to other Western products, and further advance early disease detection and remote monitoring capabilities. Urbanization and demand for smart health solutions, coupled with expanded healthcare coverage, have uniquely positioned China as a major player driving the extraordinary growth of remote health monitoring in the Asia-Pacific region, owing to its strong technological innovation.

Latin America: The Connected Health Revival

Latin America exhibited significant growth in the remote health monitoring sector as a result of growing digital health engagement and supportive government policies for telemedicine utilization. In addition, the latency in chronic illnesses resulted in increased demand for wearables and application-based health tracking. Brazil and Mexico were significant players in digital health in response to recent regulations aimed at advancing digital healthcare. In general, opportunities included lower-cost IoT-based devices, mobile clinics, and partnerships between the public and private sectors in health systems to improve access and engagement in communities, including urban and rural regions.

Brazil Remote Health Monitoring Market Trends

Brazil led the Latin American market due to advanced regulations on telehealth and increased investment in health care. Government incentives fostered solutions devoted to patient monitoring and chronic disease management applications. Institutions were integrating wearables and mobile health systems to improve care quality. Coordination with private technology companies led to innovation, including mobile health uptake while improving national broadband access for telemedicine delivery.

Middle East & Africa: The Smart and Steady Health Frontier

Steady market development in the countries in the Middle East and Africa occurred due to improvements to healthcare systems and initiatives from governments and technology. Investments in eHealth and telemedicine projects supported the eventual delivery of care to populations whose physical access to services is limited. Growth in the use of wearables for chronic disease management and the development of smart hospitals opened up new avenues and opportunities for growth. Focus on the rapid integration of artificial intelligence technology, mobile clinics, and cross-border collaborations continues to position the region as a potential frontier for expansion in the remote health monitoring and digital transformation space.

The UAE Remote Health Monitoring Market Trends

The UAE leads the market with national strategies to promote telehealth patient-centred models of care and to develop smart hospital infrastructure. Support from the government at all levels to develop AI-based health technologies has supported digital transformation. With patients being well aware of or exposed to telehealth options, this, combined with good internet connectivity, supported fast adoption of wearable monitoring devices. Collaborative partnerships between healthcare providers as well as key global technology companies have supported innovation and have made the UAE the primary driver of remote health monitoring growth within the Middle East region.

Remote Health Monitoring Market Companies

- Philips

- Medtronic

- A&D Company Limited

- G.E. Healthcare

- Boston Scientific Corporation

- Nihon Kohden Corporation

- 100-Plus

- F-Hoffman-La-Roche AG

Recent Developments

- In April 2025, Validic and Tenovi announced a strategic integration to advance remote patient monitoring for broader patient access. The collaboration will be a great contribution to the remote health monitoring market.

- In October 2024, Samsung's Galaxy Ring offered a comprehensive and user-friendly health monitoring tool that can facilitate better management of chronic conditions and overall wellness.

- In March 2025, Tenovi and GenieMD announced a transformative partnership to expand access to remote care and enhance medication adherence. The transformative virtual care model has been introduced as the outcome of an enhancement for both the market and partnership.

- In October 2022, a leading clinical grade provider company, AccuKardia, announced a collaboration with Mawi, a leading medtechprovider company. The partnership aims to integrate the proprietary ECG analytics into Mawi's new monitoring watch. This wearable device will help in remote cardiac monitoring.

- In September 2021, a leading company for wearable biosensor technology, VitalConnect, announced its latest version of vista center for remote patient monitoring.

- In January 2021, Omron Healthcare introduced its first remote patient monitoring system, 'VitalSight,' which will help manage hypertension.

- In February 2021, Philips announced the acquisition of BioTelemetry company. The aim behind this acquisition is to increase the portfolio of cardiac diagnostics with remote monitoring of patients.

- In October 2022, the G.E. healthcare company and AMC Health announced a remote patient monitoring partnership.

- In July 2022, DiMe company released a toolkit to help scale wearables for remote patient monitoring. The toolkit is based on the Digital Medicine Society's Sensor Data Integrations project.

- In March 2022, Manipal Hospitals, one of the largest healthcare providers in India, announced its entry into a partnership with Singapore-based health tech provider ConnectedLife to monitor patients after surgeries remotely.

- In December 2022, the Rhythm Management Group announced the acquisition of Equis Consulting Group. This acquisition commits to providing customers with the best and most seamless remote health monitoring services.

Segments Covered in the Report

By Devices

- Respiratory monitoring

- Blood glucose monitoring

- Cardiac monitoring

- Multi-parameter monitoring

By Application

- Oncology

- Cardiovascular diseases

- Diabetes

- Others

By End-Users

- Hospitals

- Home health care

- Diagnostic centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content