Remote Cardiac Monitoring Market Size and Growth 2025 to 2034

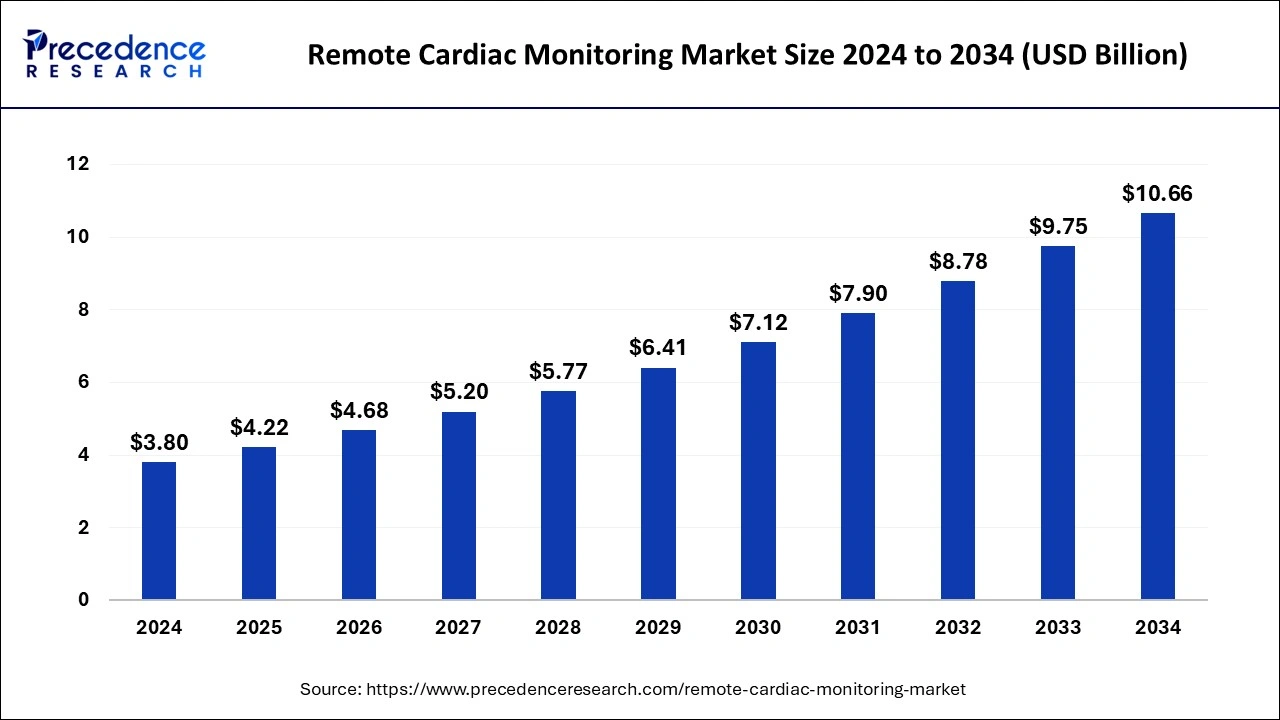

The global remote cardiac monitoring market size was estimated at USD 3.80 billion in 2024 and is predicted to increase from USD 4.22 billion in 2025 to approximately USD 10.66 billion by 2034, expanding at a CAGR of 10.87% from 2025 to 2034. Increasing prevalence of cardiovascular diseases along with advancements in technology are the driving factors of the market globally.

Remote Cardiac Monitoring Market Key Takeaways

- The global remote cardiac monitoring market was valued at USD 3.80 billion in 2024.

- It is projected to reach USD 10.66 billion by 2034.

- The market is expected to grow at a CAGR of 10.87% from 2025 to 2034.

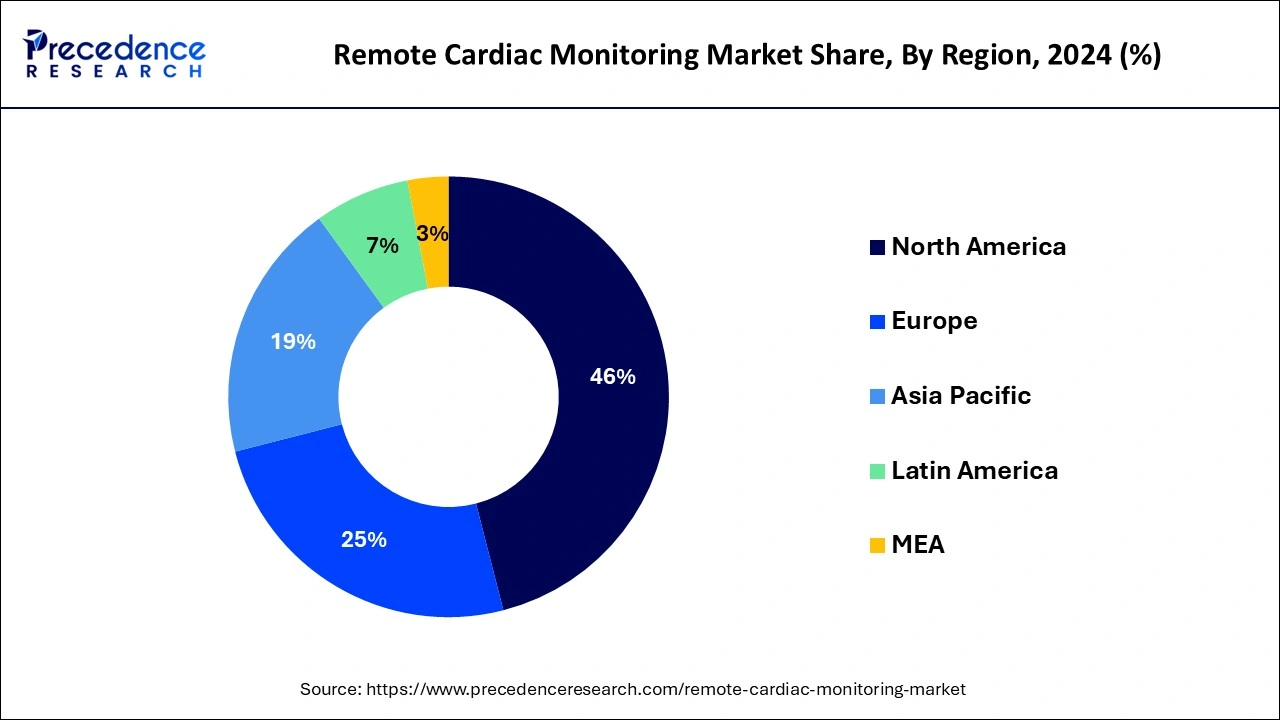

- North America led the market with the largest market share of 46% in 2024.

- Asia Pacific is emerging as the fastest-growing landscape in the global market.

- By product, the device segment held the largest share of the market in 2024.

- By product, the software segment is showcasing significant growth in the market.

- By end-use, the home care setting segment held the dominant share of the market in 2024.

- By end-use, the long-term care segment is expected to witness the fastest growth in the market.

U.S.Remote Cardiac Monitoring Market Size and Growth 2025 to 2034

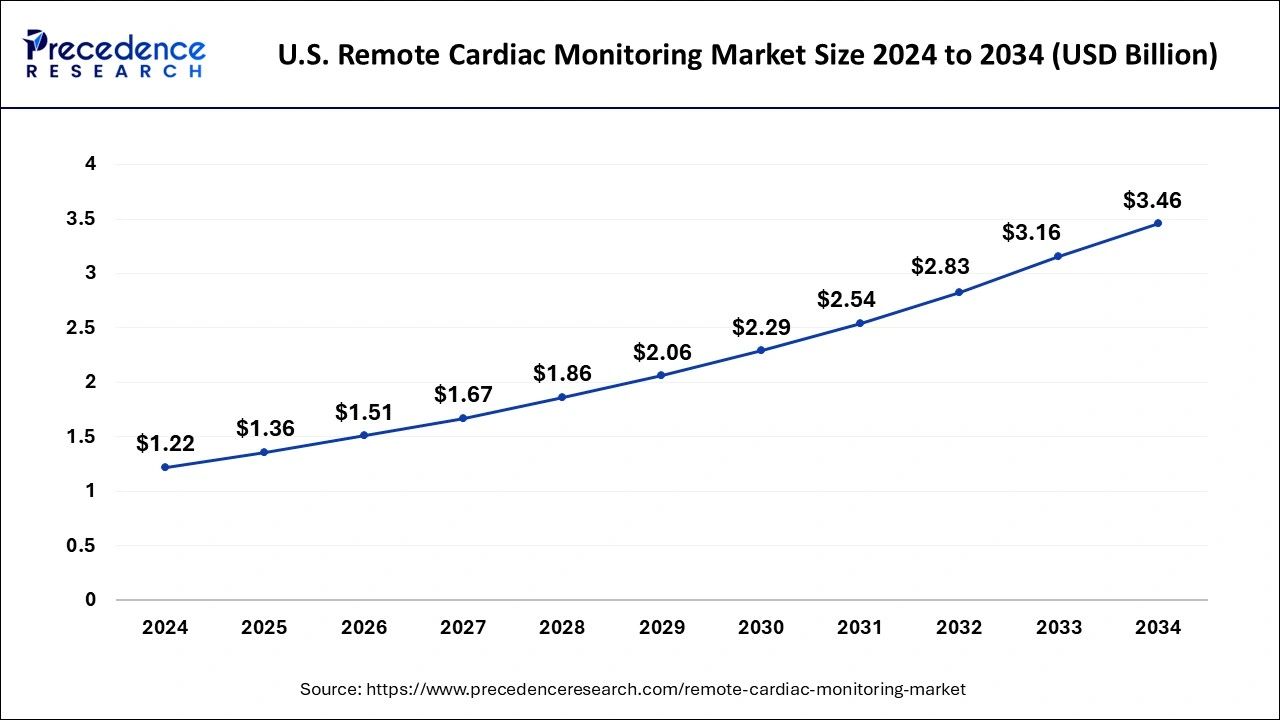

The U.S. remote cardiac monitoring market size was estimated at USD 1.22 billion in 2024 and is predicted to be worth around USD 3.46 billion by 2034, at a CAGR of 10.99% from 2025 to 2034.

North America emerges as the dominant segment within the remote cardiac monitoring market, encompassing both the United States and Canada. The region is at the forefront of technological innovation, with a robust ecosystem of healthcare startups, research institutions, and industry leaders continuously pushing the boundaries of remote monitoring technology. This is driven by a combination of technological innovation, disease prevalence, regulatory support, healthcare infrastructure, and evolving healthcare delivery models.

Both the U.S. and Canada have high rates of cardiovascular diseases, including heart disease and stroke, driving the demand for remote cardiac monitoring solutions to manage and prevent these conditions effectively. Also, the regulatory landscape in North America, particularly in the US, supports the development and adoption of digital health technologies. Hence, it provides a conducive environment for remote cardiac monitoring companies to thrive.

Moreover, the well-developed healthcare infrastructure in the region, coupled with high levels of healthcare spending, facilitates the adoption of remote monitoring solutions by healthcare providers and patients alike. The COVID-19 pandemic has accelerated the adoption of telemedicine and remote patient monitoring in North America, further fuelling the demand for remote cardiac monitoring solutions.

Asia Pacific is emerging as the fastest-growing landscape in the global remote cardiac monitoring market. Asia Pacific is witnessing a significant rise in cardiovascular diseases, attributed to changing lifestyles, urbanization, and an aging population. As a result, there is a need for effective cardiac monitoring solutions to manage and mitigate the burden of these diseases. Moreover, the COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring solutions globally, including in the Asia-Pacific region, as healthcare systems seek to minimize in-person interactions while ensuring continuous patient care.

Furthermore, advancements in healthcare infrastructure and technology adoption across countries like India, Japan, and China in the region are driving remote cardiac monitoring systems. Governments and healthcare organizations are increasingly investing in telemedicine and remote patient monitoring initiatives to improve healthcare accessibility, especially in rural and underserved areas. Additionally, the growing prevalence of chronic diseases coupled with rising healthcare expenditure is fuelling the demand for remote cardiac monitoring solutions among healthcare providers and patients alike.

Market Overview

The remote cardiac monitoring market is experiencing rapid growth driven by advancements in technology and an increasing prevalence of cardiovascular diseases. With the integration of wearable devices, smartphone connectivity, and cloud-based data analytics, remote cardiac monitoring offers patients and healthcare providers real-time access to crucial cardiac data, enabling early detection and intervention for potential cardiac issues.

The demand for remote monitoring solutions has been further accelerated by the COVID-19 pandemic, as it promotes remote patient care and reduces the need for in-person visits. Additionally, the aging population and rising awareness about preventive healthcare measures contribute to market expansion. Key players in the industry are continuously innovating to enhance the accuracy, reliability, and user-friendliness of remote cardiac monitoring devices, ensuring a competitive landscape with a focus on improving patient outcomes and quality of care.

Remote Cardiac Monitoring Market Growth Factors

- Technological advancements in remote monitoring devices, including wearable sensors and smartphone connectivity.

- Increasing prevalence of cardiovascular diseases globally.

- Rising adoption of telemedicine and remote patient monitoring solutions.

- Growing awareness about the importance of early detection and management of cardiac conditions.

- Aging population and the subsequent rise in the incidence of age-related cardiovascular ailments.

- Demand for cost-effective and efficient healthcare solutions, especially in remote or underserved areas.

- The COVID-19 pandemic is accelerating the adoption of remote monitoring as it reduces the need for in-person visits.

- Supportive government initiatives promoting the adoption of digital healthcare technologies.

- Integration of artificial intelligence and machine learning algorithms for predictive analytics and personalized healthcare solutions.

- Expansion of healthcare infrastructure in emerging markets, facilitating access to remote monitoring services.

- Increasing investments by healthcare organizations and technology companies in remote cardiac monitoring solutions.

- Shift towards value-based care models emphasizing preventive measures and patient engagement in managing chronic conditions like heart diseases.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.87% |

| Market Size in 2025 | USD 4.22 Billion |

| Market Size by 2034 | USD 10.66 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising cardiovascular diseases (CVDs)

The alarming increase in cardiovascular diseases (CVDs) serves as a significant driver for the remote cardiac monitoring market. Globally, CVDs have become the leading cause of morbidity and mortality, posing a considerable burden on healthcare systems and economies. Factors such as sedentary lifestyles, unhealthy dietary habits, rising obesity rates, and an aging population contribute to the surge in CVD cases.

Moreover, cardiovascular diseases often manifest silently, with symptoms appearing only at advanced stages. Therefore, early detection becomes crucial for effective management and prevention of complications. Remote cardiac monitoring offers a proactive approach by enabling continuous tracking of cardiac health parameters such as heart rate, rhythm, blood pressure, and ECG data, even in asymptomatic (where symptoms of the disease are not showing) individuals.

As the prevalence of CVDs continues to escalate, there is a growing recognition of the need for proactive and personalized healthcare solutions. Remote monitoring empowers patients to take charge of their cardiovascular health and provides healthcare providers with real-time insights. This approach aids in facilitating timely interventions and reducing the risk of adverse events such as heart attacks and strokes. Thus, the increase in cardiovascular diseases defines the importance and relevance of remote cardiac monitoring solutions in mitigating the impact of these conditions on individuals and healthcare systems alike.

Restraint

Data privacy and security

One significant restraint of the remote cardiac monitoring market is concerns regarding data privacy and security. As the collection and transmission of sensitive medical data become more prevalent with remote monitoring solutions, ensuring the confidentiality, integrity, and availability of patient information becomes a priority in healthcare settings. Addressing these concerns requires robust security measures, including encryption protocols, access controls, and secure data storage practices. Additionally, proactive communication and transparency regarding data handling policies are essential to build trust among patients and healthcare stakeholders.

Patients and healthcare providers may be hesitant to adopt remote cardiac monitoring technologies if they perceive a risk to the privacy and security of their data. Instances of data breaches or unauthorized access can create trust issues in these systems, leading to reluctance to utilize them for critical healthcare needs. Moreover, regulatory compliance requirements, such as HIPAA in the United States, are the privacy rule standards in the U.S. According to this, the use and disclosure of individuals' health information (known as protected health information or PHI) by entities subject to the Privacy Rule. These individuals and organizations are called “covered entities.” such rules create a barrier to unnecessary access of individuals' health data to unknown entities. Similarly, GDPR in Europe imposes strict standards for safeguarding medical data. Meeting these regulatory obligations adds complexity and cost to the development and deployment of remote monitoring solutions.

Opportunity

Integration of AI and ML

The future opportunity within the remote cardiac monitoring market lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance the efficiency and effectiveness of cardiac care. AI and ML algorithms have the potential to analyze vast amounts of cardiac data collected through remote monitoring devices, enabling more accurate and timely detection of cardiac abnormalities and trends.

These technologies can help identify patterns and biomarkers indicative of cardiovascular diseases, allowing for early intervention and personalized treatment strategies. By continuously learning from new data inputs, AI-powered remote monitoring systems can refine their predictive capabilities, improving patient outcomes and reducing healthcare costs associated with preventable cardiac events. Furthermore, AI-driven remote monitoring platforms can assist healthcare providers in optimizing care pathways and resource allocation by prioritizing patients at higher risk of adverse cardiac events. This proactive approach not only enhances patient safety but also streamlines healthcare workflows, leading to greater operational efficiency and resource utilization.

Moreover, the integration of AI and ML can facilitate the evolution of remote monitoring solutions towards more proactive and preventive models of care. By leveraging predictive analytics, these systems can identify individuals at risk of developing cardiovascular diseases based on various risk factors, enabling targeted interventions and lifestyle modifications to mitigate these risks before they escalate into clinical conditions. This preventive approach aligns with the broader healthcare industry's shift towards value-based care and population health management, presenting a compelling opportunity for innovation and growth within the remote cardiac monitoring market.

Product Insights

The device segment held the largest share of the remote cardiac monitoring market in 2023. Wearable devices such as smartwatches, fitness trackers, and patch-based monitors are particularly prominent within this segment. These devices offer convenience and ease of use, allowing individuals to track their heart rate, rhythm, and activity levels in real time. Furthermore, advancements in sensor technology and miniaturization have enabled the development of highly accurate and comfortable wearable monitors, enhancing user experience and compliance.

Additionally, the integration of wireless connectivity features enables seamless data transmission to healthcare providers for remote analysis and interpretation. Moreover, implantable cardiac devices such as implantable loop recorders (ILRs) and implantable cardioverter-defibrillators (ICDs) represent another significant component of the device segment. These devices provide continuous monitoring and intervention capabilities for individuals with complex cardiac conditions, further driving the segment's dominance in the remote cardiac monitoring market.

The software segment is showcasing significant growth in the remote cardiac monitoring market. As technological innovation continues to advance, software solutions play a pivotal role in enhancing the efficiency and effectiveness of remote monitoring systems. These software platforms facilitate seamless data collection, analysis, and transmission of vital cardiac information from patients to healthcare providers in real time. Features such as predictive analytics, machine learning algorithms, and cloud-based storage enable healthcare professionals to make informed decisions promptly and optimize patient care.

Moreover, the integration of software with wearable monitoring devices further enhances accessibility and usability for both patients and caregivers. With the increasing emphasis on telehealth and remote patient monitoring, the demand for sophisticated software solutions in the remote cardiac monitoring market is expected to continue its rapid growth trajectory, revolutionizing the way cardiac care is delivered and managed.

- In 2022, GE Healthcare launched a new Edison platform for healthcare organizations. The digital health platform aims to bring the flexibility of hundreds of apps but with the simplicity of working with one vendor.

End-use Insights

The home care setting segment held the dominant share of the remote cardiac monitoring market in 2024. This is reflecting the growing trend towards patient-centric healthcare delivery and the increasing adoption of telemedicine and remote patient monitoring solutions. Home care settings offer several advantages, including higher convenience, comfort, and cost-effectiveness, making them particularly appealing for individuals with chronic cardiac conditions, where long-term treatment is appealed. Remote cardiac monitoring devices designed for home use, such as wearable monitors and portable ECG devices, enable patients to track their cardiac health parameters from the comfort of their homes. This empowers individuals to take an active role in managing their conditions while minimizing the need for frequent visits to healthcare facilities.

Furthermore, the COVID-19 pandemic has accelerated the shift towards home-based care, as it reduces the risk of exposure to infectious diseases. Telemedicine platforms and remote monitoring solutions enable healthcare providers to remotely assess patients' cardiac health status, provide timely interventions, and offer ongoing support and education, further driving the dominance of the home care setting within the remote cardiac monitoring market.

The long-term care segment is expected to witness the fastest growth in the remote cardiac monitoring market. With an aging population and increasing prevalence of cardiovascular diseases, the demand for continuous monitoring in long-term care facilities has surged. Remote cardiac monitoring provides real-time data on patients' heart health, enabling timely intervention and personalized care plans. This growth is fuelled by advancements in technology, making monitoring devices more accessible and user-friendly for both patients and healthcare providers. As healthcare systems prioritize preventive care and remote patient monitoring, the long-term care segment is poised for significant expansion, contributing to improved patient outcomes and cost-effective healthcare delivery.

Remote Cardiac Monitoring Market Companies

- OSI Systems, Inc.

- GE Healthcare

- Biotronik se

- Nihon kohden corp.

- Abbott laboratories

- Boston Scientific

- Koninlijke Philips N.V

- Honeywell International, Inc

- AMC Health

Recent Developments

- In April 2023, GE HealthCare introduced a new asset management and network supervision solution, ReadySee. ReadySee is designed to transform data into actionable insights about devices and infrastructure and, provide risk scoring, and help protect sensitive patient health information (PHI). In addition, ReadySee profiles behaviors and risks for networked & non-networked devices so they can be found and investigated without disrupting the patient care experience.

- In April 2023, the Portrait Mobile Monitoring Solution was launched by GE Healthcare, which addresses the needs of wireless and wearable monitoring with a state-of-the-art platform that leverages innovative technologies that are easily deployed on a hospital's IT infrastructure. By utilizing the medical body area network (MBAN) architecture and the proprietary protocol, designed so the wireless signal is as reliable as a wired connection, Portrait Mobile patients have the autonomy to recover without the burden of being wired to a traditional monitoring device.

Segments Covered in the Report

By Product

- Devices

- Software

- Services

By End user

- Hospitals and Clinics

- Emergency Settings

- Homecare Settings

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting