What is the Remote Patient Monitoring Software and Services Market Size?

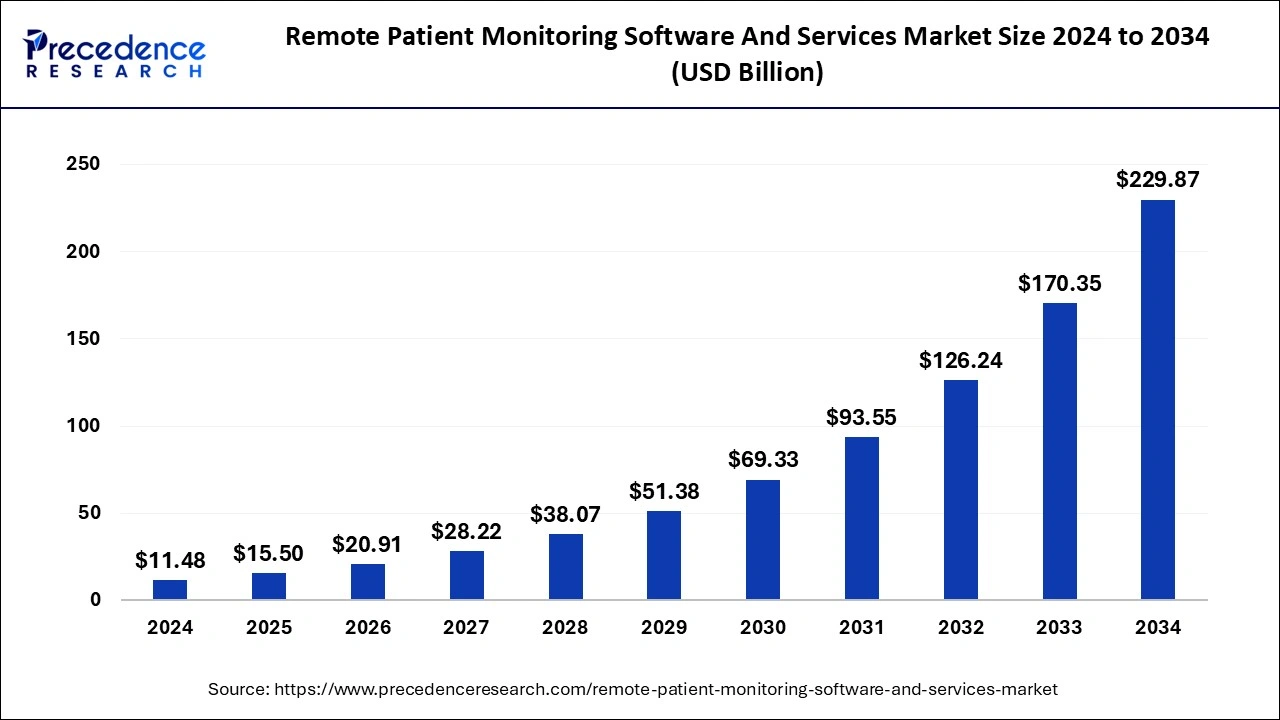

The global remote patient monitoring software and services market size was worth around USD 11.48 billion in 2025 and is predicted to increase from USD 20.91 billion in 2026 to approximately USD 229.87 billion by 2035, growing at a CAGR of 34.94% from 2026 to 2035. The growing need for healthcare in rural and remote areas is driving the remote patient monitoring software and services market.

Remote patient monitoring software and services collect medical and other types of health data like clinical data, patient registry, and patient current health status is transmitted to a healthcare provider using digital technologies. In order to save money on treatment and hospitalization, the information might be collected at the patient's home.

Remote Patient Monitoring Software and Services Market Key Takeaways

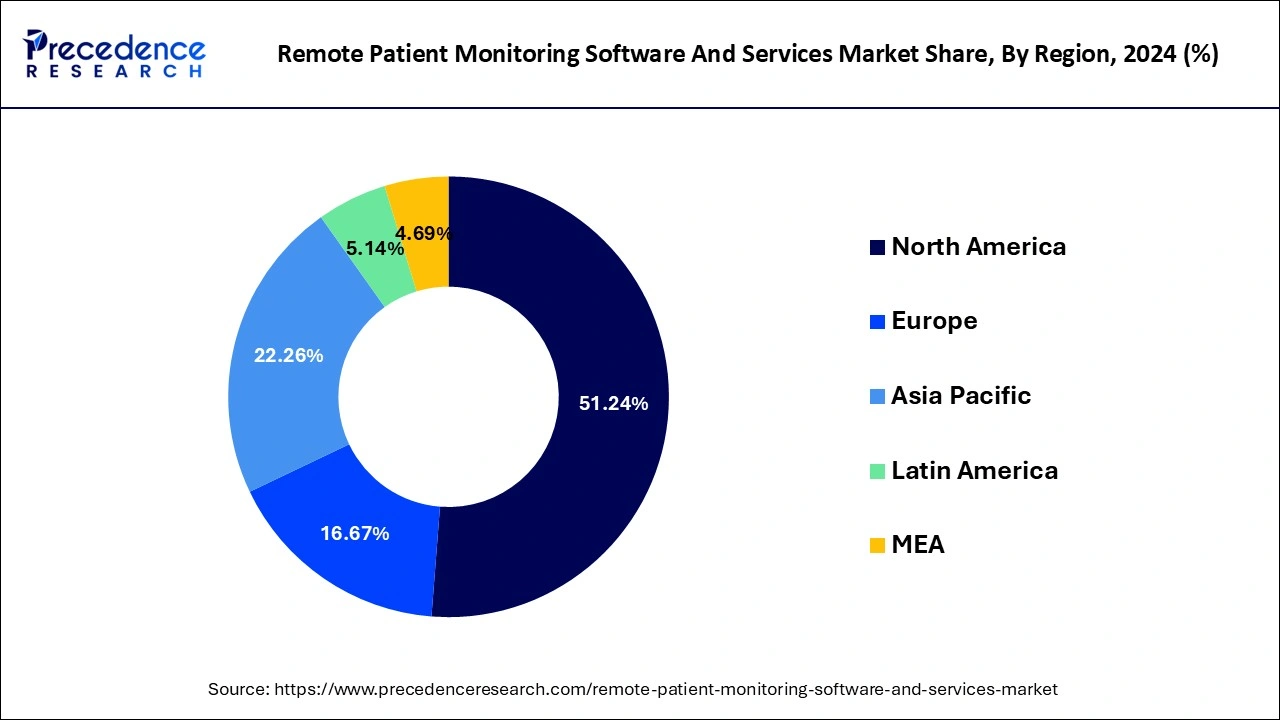

- North America dominated the global market with the largest market share of 51.24% in 2025.

- Asia pacific is projected to expand at the notable CAGR during the forecast period.

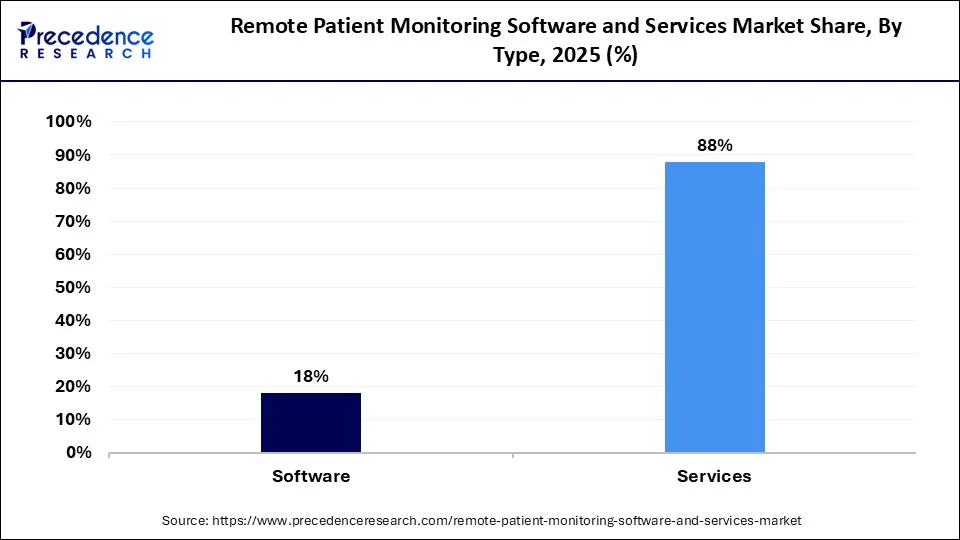

- By type, the services segment contributed the highest market share in 2025.

- By type, the software segments is estimated to be the fastest-growing segment during the forecast period.

- By end use, the provider segment captured the biggest market share in 2025.

- By end use, the patients segment is expected to grow at a significant CAGR from 2026 to 2035.

- By application, the other segment has held the largest market share in 2025.

- By application, the diabetes segments is predicted to be the fastest-growing segment during the forecast period.

How is the integration of AI impacting the market?

AI in remote patient monitoring has ushered in a new era of customized healthcare. Through the analysis of extensive patient data, such as vital signs, medical history, and lifestyle decisions, AI algorithms are able to provide personalized treatment plans and patient care. These care plans take into account the individual features of each patient, allowing medical professionals to give individualized interventions and treatments. Better chronic care management and increased patient satisfaction are the outcomes. AI has the ability to completely transform remote patient monitoring as it develops, breaking down barriers and guaranteeing that everyone has access to effective, patient-centered healthcare.

Remote Patient Monitoring Software and Services Market Growth Factor

- Remote Monitoring: Healthcare workers may monitor and treat patients outside of hospitals with the use of remote patient monitoring software and services. This is expected to fuel the industry's expansion.

- Needed by Old and Disabled People: RPM software enables patients to communicate with medical staff members around-the-clock from distant places, which boosts patient engagement and leads to improved results. Particularly those individuals who struggle with movement owing to advancing age or certain illnesses like paralysis might benefit from these solutions.

- Increased Use of Internet: During the projection period, it is predicted that increasing Internet usage in both developed and developing countries would accelerate the uptake of RPM software among patients and physicians.

- Increasing Prevalence of Chronic Conditions: The use of RPM software is anticipated to be fueled by the increasing prevalence of chronic diseases, including arthritis, diabetes, Alzheimer's, and cardiovascular diseases. With 58.5 million Americans suffering from arthritis, it is the most common cause of job incapacity, and it is expected that this will contribute to a rise in the usage of RPM software and services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.50 Billion |

| Market Size by 2035 | USD 279.12Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 33.52% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Remote Patient Monitoring Software and Services Market Dynamics:

Key Market Drivers

One factor is the rise of wearable patient monitoring devices

- Continual glucose monitoring, temperature monitoring, blood pressure monitoringdevice , and pulse oximetry are just a few of the many uses for wearable patient monitoring devices, biosensors, and smart implants. Internet of things technology is incorporated into next-generation wearables. Vital indicators including blood pressure, weight, blood sugar, and electrocardiography (ECG) are collected by wearable biosensors and sent to a central server using mobile wireless networks. These specific elements are what propels the market's expansion.

Key Market Challenges

Shortages of experts in the healthcare sector

- The absence of adequate reimbursement, tight regulatory requirements, a lack of qualified personnel in the healthcare sector, and unfavorable reimbursement rules will all slow the market's expansion.

Key Market Opportunities

The emphasis has changed due to rising healthcare expenses

- Recent years have seen an increase in interest in alternative treatment modalities including home healthcare due to rising healthcare expenditures, particularly in hospital settings. Therefore, there is a significant need for efficient home-use equipment including thermometers, weight scales, pulse oximeters, electrocardiograph (ECG) monitors, event monitors, EEG recorders, and foetus monitors. For governments all across the world, the viability of the existing healthcare system is a key cause of worry.

Segment Insights

Type Insights

The services type segment was the highest revenue holder in 2025. The greater implementation of RPM software and services to lower hospital admissions is responsible for the large share of this market. The utilization of emergency response systems, medication management, and data-driven patient engagement solutions are a few of the services offered. Reduced response times and proper hospital allocation are made possible by emergency response systems, which benefit patients by enabling them to get better care.

On the other hand, the projected period is expected to see the fastest increase in the software category. Smartphone and internet usage are becoming more widespread, which is helping the category develop. For instance, according to information made public by bankmycell, there were 6.05 billion cell phones worldwide in 2020 and 6.37 billion in 2021. This is expected to accelerate the uptake of RPM solutions. During the projected period, it is predicted that recent advancements in 4G and 5G networks and video conferencing systems would propel the segment's growth.

End Use Insights

The provider segment has held the largest revenue share in 2025. Hospitals, clinics, doctors, and clinicians are some of the providers. The providers' increased use of remote patient monitoring services is one factor that is projected to fuel the segment's expansion. For instance, 53% of doctors expressed interest in employing remote monitoring services to care for their patients in 2021, according to a poll by the American Medical Association.

During the projection period, this is likely to provide the category a significant boost. During the projection period, the patients' sector is predicted to see the quickest CAGR. During the projected period, it is predicted that factors like more usage of the services to cut healthcare expenses and improved doctor interaction would fuel segment expansion. Industry surveys predict that in 2021, 4 out of 5 Americans would support using remote monitoring to provide medical care. According to the research, 85% of those who employed remote patient monitoring for medical purposes were between the ages of 18 and 34.

Application Insights

By application, the other segment led the market in 2025. The segment is expected to be driven by the usage of RPM software and solutions for remote monitoring of chronic illnesses, such as Alzheimer's, arthritis, hypertension, and paralysis. Key elements that are projected to fuel sector expansion during the forecast period include the rising prevalence of these illnesses globally and the growing geriatric population. Patients with ailments including arthritis and paralysis experience mobility challenges, which is predicted to increase demand for these services and support the segment's expansion.

During the projected period, the diabetes category is expected to increase at the quickest rate. Blood glucose levels must be continuously monitored for diabetes, which can be done remotely. The functioning of the liver, eyes, heart, and kidneys can all be impacted by diabetes. In the next years, this is expected to fuel category expansion. Partnerships between public and commercial companies to offer remote diabetes monitoring are predicted to further fuel the industry.

For instance, the University of Mississippi Medical Center and North Mississippi Primary Health Treatment collaborated to expand access to remote monitoring for diabetic care. In eight American cities, including Corinth, Ashland, Booneville, Oxford, New Albany, Ripley, Tishomingo, and Walnut, the initiative hopes to engage at least 1,000 individuals.

Regional Insights

What is the U.S. Remote Patient Monitoring Software and Services Market Size?

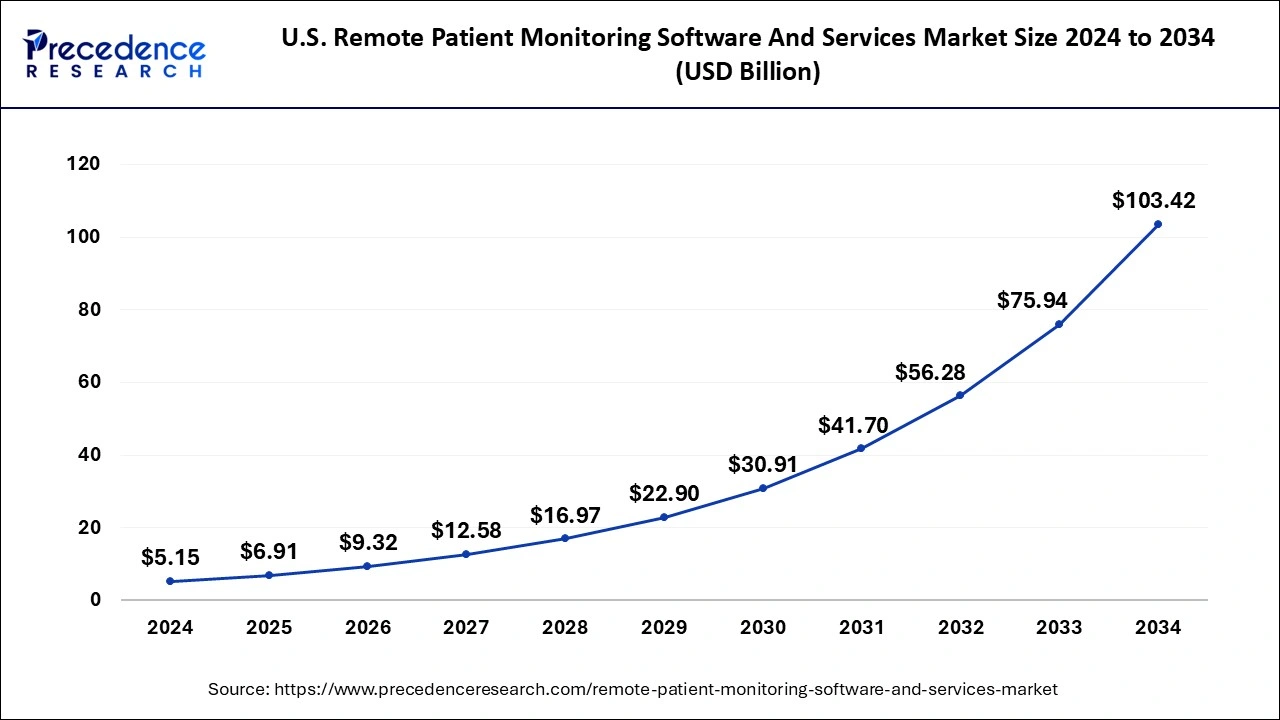

The U.S. remote patient monitoring software and services market size was evaluated at USD 6.91 billion in 2025 and is predicted to be worth around USD 125.69 billion by 2035, rising at a CAGR of 33.65% from 2026 to 2035.

How is the Revolutionary Growth of North America in the Remote Patient Monitoring Software and Services Market in 2025?

North America dominated the market globally with the highest revenue share in 2025. The region's market is expected to increase as a result of factors including the use of remote patient monitoring services and the accessibility of digital infrastructure. The regional government's initiatives are also anticipated to accelerate the use of RPM solutions.

For instance, the Rural Remote Monitoring Patient Act was presented by U.S. lawmakers in June 2021; it is anticipated that the measure would establish a virtual health pilot program to assist in the provision of remote patient monitoring software and services in rural regions of the U.S. The law will aid in enhancing patient access to remote patient monitoring and assisting healthcare professionals in providing better patient care.

The USAID Digital Health Position Paper 2024-2029 is a new policy paper that outlines the organization's initiatives in digital health. The four goals outlined in the Digital Health Vision are reaffirmed in this document, which also identifies six evidence-based strategies to help USAID operationalize these priorities. Last but not least, USAID plays a significant role in building the ability required to organize and oversee telemedicine and other digital health systems at the national level. The Digital Health program is still being developed and delivered by USAID.

As healthcare expenses rise and the frequency of chronic illnesses like type II diabetes and hypertension rises, the Middle East and Africa area is expected to experience considerable increase throughout the projection period. Additionally, it is projected that the use of RPM to lighten the load on healthcare institutions together with rising expenditures by public and private entities to develop the digital healthcare system would accelerate industry growth in the area. For instance, 30% of hospital spending in the Middle East and North Africa would go toward virtual care, artificial intelligence, and remote patient monitoring, according to a Healthcare IT News story from June 2022.

How does Asia Pacific Expand Rapidly in the Remote Patient Monitoring Software and Services Market?

The Asia Pacific market is growing rapidly due to rising healthcare digitization, increasing prevalence of chronic diseases, and expanding demand for home-based and remote patient care solutions. Countries like China, Japan, India, and South Korea are leading adoption, supported by large populations, growing smartphone penetration, and government initiatives promoting telemedicine and digital health infrastructure.

India Remote Patient Monitoring Software and Services Market Analysis

India is witnessing a rapid growth in the market due to the rising burden of chronic diseases, the rise of affordable wearable devices, and the government's healthcare policies. Government initiatives promoting telemedicine, digital health, and smart healthcare infrastructure are further supporting market expansion. MyBenefits.ai launched an AI platform to support Indian healthcare and advance post-surgical care.

What will be the Noteworthy Growth of Europe in the Remote Patient Monitoring Software and Services Market?

Europe is expected to grow at a notable rate in the market in 2025, owing to the government funding and policies that support telehealth and remote patient monitoring in European countries like Spain and Italy. In December 2025, the European Commission introduced new projects under the ‘2024 EU4Health Work Programme' to advance digital healthcare across the European Union.

Germany Remote Patient Monitoring Software and Services Market Trends

The German market is expanding steadily, driven by the country's aging population, rising prevalence of chronic diseases, and increasing demand for efficient remote healthcare solutions. Technological advancements, including wearable health devices, IoT-enabled monitoring systems, and AI-powered analytics, are enabling real-time tracking and predictive patient care.

How is the Lucrative Growth of the Remote Patient Monitoring Software and Services Market within South America?

South America is expected to experience lucrative growth during the forecast period, driven by digital transformation and innovation, including AI and IoT integration, enhanced connectivity, and home-based and cost-effective care. The South American market for remote patient monitoring software and services is driven by major government programs and projects, such as Argentina's mandatory electronic prescriptions and Brazil's COP30 integrated care initiative.

Remote Patient Monitoring Software and Services Market Companies

- Teladoc Health, Inc.

- Medtronic Plc.

- GE Healthcare

- Siemens Healthineers AG

- Philips Healthcare

- Caretaker Medical

- OMRON Healthcare

- BioIntelliSense

- Shenzhen Mindray

- Bio-Medical Electronics Co., Ltd.

- Nihon Kohden Corporation

- F. Hoffmann-La Roche Ltd

- Welch Allyn

- Smiths Medical

- Abbott

- Boston Scientific Corporation

- Honeywell

- Johnson & Johnson

- LifeWatch, Medtronic.

Latest Announcements by Industry Leaders

- In January 2024, as part of its dedication to digital transformation, Apollo Hospital Seshadripuram will keep incorporating the most recent LifeSigns technologies into its core business processes and make them accessible to all patients going forward. This cutting-edge device tracks vital indicators, including blood pressure, SPO2, ECG, and more, continually using biosensors that patients wear. The business claimed in a statement that real-time data is safely sent to a platform that medical experts may access, enabling ongoing monitoring and early detection of possible issues.

Recent Developments

- In July 2024, the first cellular-connected, multi-cuff blood pressure monitor created especially for RPM and chronic care management (CCM) was released by Smart Meter, the industry leader in Cellular Remote Patient Monitoring (RPM)TM solutions.

- In June 2024, the Pylo GL1-LTE, the company's first remote blood glucose monitoring device, was introduced by Prevounce Health, a top supplier of remote care management software, tools, and services.

Segments Covered in the Report

By Type

- Software

- Services

By Application

- Cancer

- Cardiovascular Disease

- Diabetes

- Sleep Disorder

- Others

By End User

- Payers

- Patients

- Providers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting