Audiology Devices Market Size and Forecast 2025 to 2034

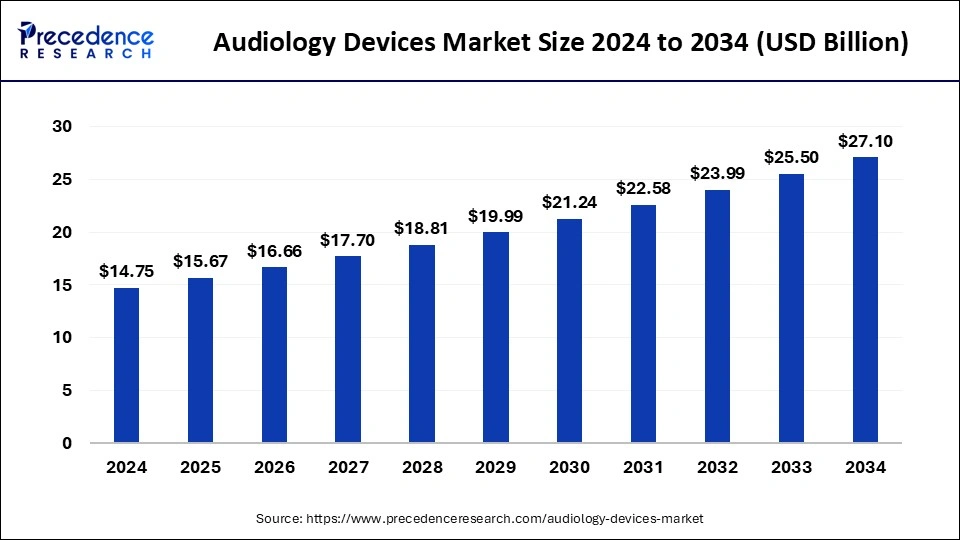

The global audiology devices market size was calculated at USD 14.75 billion in 2024 and is predicted to increase from USD 15.67 billion in 2025 to approximately USD 27.10 billion by 2034, expanding at a CAGR of 6.27% from 2025 to 2034. The audiology devices market is driven by the rising incidence of hearing loss in the world.

Audiology Devices Market Key Takeaways

- In terms of revenue, the global audiology devices market was valued at USD 14.75 billion in 2024.

- It is projected to reach USD 27.10 billion by 2034.

- The market is expected to grow at a CAGR of 6.27% from 2025 to 2034.

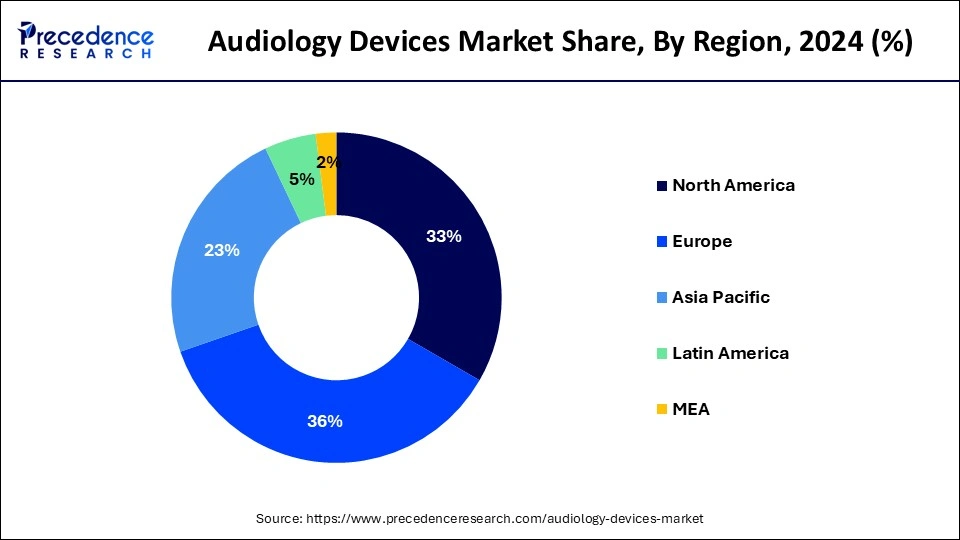

- Europe dominated the audiology devices market with a revenue share of 36% in 2024.

- By product, the hearing aids segment dominated the market with the largest share in 2024.

- By technology, the digital segment dominated the market with a revenue share in 2023.

- By sales channel, the retail sales segment has accounted for revenue share in 2024.

- By age group channel, the adult segment dominated the market with the largest share in 2024.

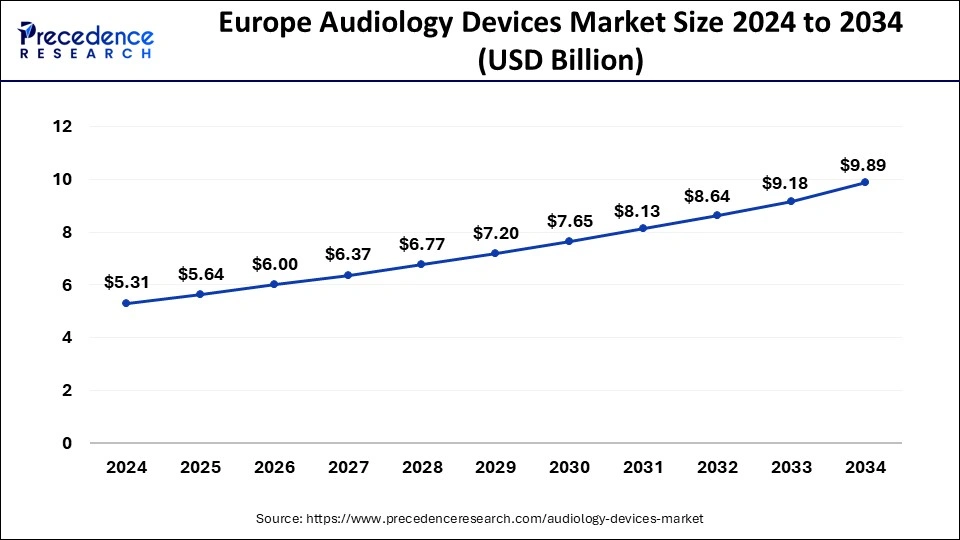

Europe Audiology Devices Market Size and Growth 2025 to 2034

The Europe audiology devices market size was exhibited at USD 5.31 billion in 2024 and is projected to be worth around USD 9.89 billion by 2034, growing at a CAGR of 6.42%.

In 2024, Europe led the audiology devices market due to advanced healthcare infrastructure, increasing awareness of hearing loss, and a rising aging population. Strong government initiatives and significant investments in research and development also contributed to the growth, making Europe the dominant region in the global audiology devices market. Europe's focus on advanced technology and innovation, with continuous investments in R&D, improved product quality and functionality. Collaborations between healthcare providers and audiology device manufacturers also played a key role in shaping the market's growth trajectory, positioning Europe as the market leader.

North America is observed to be the fastest growing marketplace in the audiology devices market, the region is observed to sustain the dominance throughout the forecast period. Audiology evaluations, treatments, and equipment are frequently partially or fully reimbursed byhealth insurance policies and government-funded healthcare programs, increasing accessibility and affordability for a wider audience. This encourages people to get audiology equipment. Its manufacturing, marketing, and distribution of medical devices, including audiology- are subject to strict rules.

Laws protect product safety and quality standards but also make it harder for new competitors to enter the market, giving established businesses who can afford to comply with laws a more significant portion of the market.

- According to the company, in November 2023, The TrueEQ, the business's debut product, is a robust update of the finest technologies from the analog period. A plethora of benefits distinguishes TrueEQ from digital hearing aids.

Asia-Pacific is seen to witness a notable rate of growth in the audiology devices market during the forecast period. The market environment has changed due to the quick technological advancement in audiology equipment, which has improved the efficacy, stealth, and usability of hearing aids and other supportive devices. Manufacturers always introduce state-of-the-art technologies like wireless connectivity, noise cancellation, and personalization possibilities to accommodate many customer preferences. The accessibility of cutting-edge audiology equipment draws on a broader customer base. Throughout Asia-Pacific, campaigns, educational programs, and lobbying efforts have increased public awareness of hearing health issues.

Governments, non-profit groups, and healthcare facilities have extensively promoted early detection, interventions, and hearing screenings. The demand for audiology devices is growing due to people becoming more aware of the need for professional assistance and the availability of audiology services.

Market Overview

A variety of medical devices intended for the diagnosis, management, and treatment of hearing and balance issues are included in the market for audiology devices. These technologies are used by ENT specialists, audiologists, and hearing healthcare providers to evaluate patients' hearing capacities, offer therapies, and enhance their auditory health.

Audiologists use these tools to evaluate and treat individuals with balance and hearing issues in clinics and hospitals. Producers of audiology equipment are always coming up with new ideas to advance current technologies and create fresh approaches to enhance hearing healthcare. Rehabilitation programs use devices like cochlear implants and hearing aids to help people with hearing loss improve their quality of life and communication skills. Audiological equipment can assess and assist pupils with hearing difficulties in educational contexts.

- In June 2023, Sonova introduced an "In-Clinic Care Package" option with their first over-the-counter hearing aid. All day, its goal is abundantly evident.

Audiology Devices Market Growth Factors

- The number of people with hearing loss is rising, and so is the demand for hearing aids and other solutions. These factors include the aging population, noise pollution, and medical problems.

- Access to devices is becoming more affordable and accessible thanks to programs like the US's Over-the-Counter Hearing Aid Act and rising public awareness of hearing loss and treatment choices, promoting the growth of the audiology devices market.

- Creating more advanced, discrete, and user-friendly gadgets with AI-powered capabilities draws in more customers and expands the market.

- Several governments are implementing policies to promote hearing health, such as subsidies and reimbursement plans, which may encourage market expansion.

- Beyond conventional hearing aids, the market includes cochlear implants, bone-anchored hearing aids, and other specialty products that meet various demands.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.27% |

| Market Size in 2025 | USD 15.67 Billion |

| Market Size by 2034 | USD 27.10 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Sales Channel, and Age Group Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of hearing loss

A growing number of people worldwide are experiencing age-related hearing loss. More people now use audiology equipment like cochlear implants and hearing aids due to improvements in healthcare and longer life expectancies. More people seek diagnosis and treatment for hearing loss due to increased knowledge about hearing health and the availability of screening programs. Furthermore, many people now have easier access to healthcare services and health insurance for audiology devices. Thereby, the rising prevalence of such issues creates a significant driver for the audiology devices market.

Restraint

Limited access to qualified professionals

There is a shortage of audiologists and other skilled workers who can test, fit, and care for people with hearing impairments in many places, particularly in rural or underdeveloped nations. As a result, fewer people can use audiology services, and devices are adopted. Some areas may have inadequate healthcare infrastructure, which could worsen the competent experts' shortage. The issue can be exacerbated by a lack of funding for audiology services, limited resources for training programs, and difficulties setting up clinics or other facilities with the required technology. Thereby, the limited access to skilled professionals acts as a restraint for the audiology devices market.

Opportunity

Increased awareness and education

The need for audiology devices is projected to increase as more individuals become aware of the value of maintaining good hearing health and the various options for treating hearing loss. Various educational activities, such as public awareness campaigns, instructive seminars, and internet resources, might be utilized to capitalize on this opportunity. The industry can grow and reach unexplored segments by informing consumers and medical professionals about the most recent developments in audiology technology.

Product Insights

The hearing aids segment dominated the audiology devices market with the largest share.Significant progress has been made in hearing aid technology during the last few decades. These developments include the creation of digital signal processing, component miniaturization, wireless networking, and advanced sound processing techniques. The effectiveness and usability of hearing aids have been significantly enhanced by these developments, making them the recommended option for those with hearing loss.

Government initiatives and favorable reimbursement regulations have also facilitated the market dominance of hearing aids. Many people can now afford and obtain hearing aids because they are covered by healthcare systems in many nations.

The BAHA/BAHS segment shows a notable growth in the audiology devices market during the forecast period. Technological developments have resulted in enhanced BAHA/BAHS devices, improving their usefulness and efficacy for those with hearing loss. These devices are helpful for people with single-sided deafness and conductive or mixed hearing loss because they use bone conduction to send sound straight to the inner ear. Furthermore, the market for BAHA/BAHS devices may be more significant now that more people are aware of the importance of hearing health and that creative solutions are readily available. The need for these implantable systems has increased as more people look for alternatives to conventional hearing aids.

Technology Insights

The digital segment dominated the audiology devices market with the largest in 2024. When it comes to sound quality, clarity, and customization, digital audiology equipment surpasses its analog predecessors. Their enhanced ability to analyze sound information results in better user experiences with hearing. Advanced features that improve speech understanding and general hearing performance in noisy surroundings, including feedback cancellation, directional microphones, and noise reduction, are often included in digital devices.

The analog segment is the fastest growing in the audiology devices market during the forecast period. Regarding hearing aids, analog models are frequently less expensive than digital ones. Because of their affordability, a more comprehensive range of people can use them, particularly in areas with scarce healthcare facilities or where people do not have the money to purchase more expensive digital gadgets. Consequently, consumers concerned about cost are increasingly interested in analog gadgets. Analog hearing aids can still be somewhat tailored to fit specific hearing needs, even with their basic features.

Audiologists can customize the gadget to fit each user's specific hearing profile by adjusting characteristics like frequency responsiveness and amplification settings. This degree of personalization guarantees a tailored listening experience, increasing user comfort and happiness.

Sales Channel Insights

The retail sales segment dominated the audiology devices market in 2024. Customers can now purchase hearing aids and related products directly from retail channels without a prescription or expert assistance, giving them wider accessibility to audiology devices. The rise in retail chains and online platforms has led to increased competition in pricing, decreasing consumer costs, and increasing accessibility to audiology devices.

It significantly increased customer awareness and stimulated demand for their products by educating them about hearing health and the advantages of audiology devices. The e-commerce segment is the fastest growing in the audiology devices market during the forecast period.

These provide customers with unmatched accessibility and convenience. Buying audiology devices in physical stores may be difficult for people with hearing difficulties, especially the elderly or those with mobility issues. With only a few clicks, customers can browse and purchase things from the comfort of their homes at any time or place, removing this barrier. To offer individualized purchasing experiences, many e-commerce platforms use cutting-edge technology like artificial intelligence and machine learning.

Online retailers can customize relevant product recommendations to meet everyone's needs by using algorithms that examine customer preferences and browsing history. This degree of personalization raises the possibility that customers will be satisfied and improves the entire purchasing experience.

Age Group Channel Insights

The adult segment dominated the audiology devices market with the largest share in 2024. Adults are more inclined to experience hearing loss due to aging, noise exposure, and specific medical disorders. As a result, the market for adult-oriented audiology devices is bigger. Compared to other demographic groups, adults frequently have more purchasing power, which enables them to acquire audiology products such as assistive listening devices or hearing aids.

Many adults seek audiology equipment to help with age-related hearing loss or gradual degradation. Technology developments in audiology, such as digital cochlear implants and hearing aids, have significantly increased the efficacy of adult hearing aids.

The pediatrics segment shows significant growth in the audiology devices market during the forecast period. Healthcare spending has increased in tandem with the growing emphasis on the health and well-being of children, including purchases of audiology equipment for pediatric use. Around the world, the frequency of hearing impairments in children is rising due to several causes, including infections, genetics, and loud noise exposure. The increasing number of children with hearing problems requires audiology devices for diagnosis and therapy.

Recent Developments

- In October 2022, the debut of Sony Electronics' first over the counter (OTC) hearing aids for the US market was announced. Sony is redefining the market for hearing aids with an emphasis on customization, accessibility, and innovation.

Audiology Devices Market Companies

- Demant A/S

- GN Store Nord A/S

- Sonova

- Starkey Laboratories, Inc.

- MAICO Diagnostics GmbH

- Oticon Medical

- INVENTIS srl

- MED-EL Medical Electronics

- Cochlear Ltd.

- WS Audiology A/S

Segments Covered in the Report

By Product

- Hearing Aids

- Cochlear Implants

- BAHA/BAHS

- Diagnostic Devices

By Technology

- Digital

- Analog

By Sales Channel

- Retail Sales

- E-commerce

- Government Purchases

By Age Group Channel

- Adults

- Pediatrics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting